Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

A unique business name is important for branding, but it’s easy to get lost in all the Connecticut business name rules.

This page will teach you how to look up your LLC name and make sure it’s available to use.

Connecticut LLC name

If you file your Connecticut LLC paperwork with a name that is already used by another Connecticut business entity – or that doesn’t meet the Connecticut name rules – your filing may be rejected.

The first step to checking if your LLC name passes is to make sure your name is not already taken by another business.

You can do this using the Business Records Search. And you need to do this because two business entities in the state can’t have the same name or be too similar.

The second step is to make sure your LLC name follows the Connecticut Secretary of State’s rules, which we’ve broken down below.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

How do I search the Connecticut business entity name database?

You can use the business entity search to search your business name against the existing business entities registered in Connecticut.

Note: This tool is sometimes called the Connecticut Business Records Search, Connecticut Business Name Search or the Connecticut Business Entity Search. They all refer to the same website and get you the same search records.

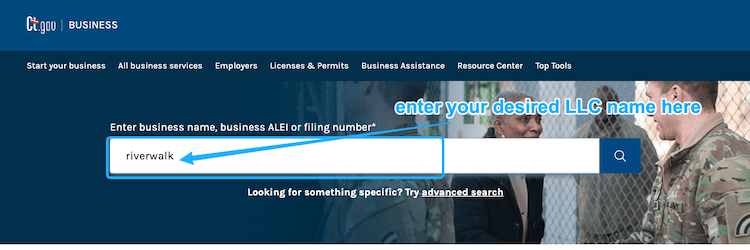

Visit the Connecticut Business Records Search page:

Connecticut Secretary of State: Business Records Search

It’s simple: enter your desired LLC name in the search bar.

Search tips:

- Leave out “LLC”, “L.L.C.”, “Limited Liability Company”, etc., when doing your searches.

- Leave out any commas, periods, apostrophes, etc.

- You can search using uppercase or lowercase letters.

Tip: It’s best to enter only the main part of your desired Connecticut LLC name in the search bar. For example, if your desired LLC name is Riverwalk Studios LLC, first do a search for the words “Riverwalk Studio”. And then do a search for “Riverwalk”. This helps make sure that you see everything that is potentially similar.

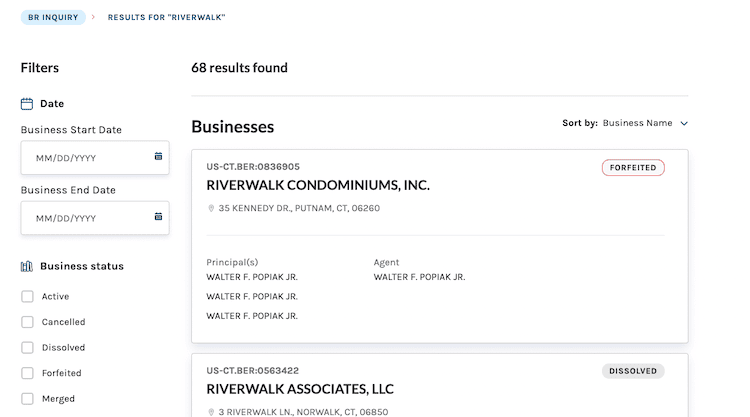

How to interpret the Connecticut LLC search results

If the results show names that are not too similar to yours (meaning yours is distinguishable), then your Limited Liability Company name is available for use.

- Let’s keep using the example above. If your desired name is Riverwalk Studios LLC, and the only similar names you saw were “Riverwalk Rentals” and “Riverwalk Studio Starters”, then your name should be available.

If no results show up, that means your LLC name is unique and it should be available for use. To be safe, run your search again using only part of your LLC name (to double-check that there are no similar names).

- For example, search just the word “Riverwalk” instead of Riverwalk Studios.

If your exact LLC name appears in the list of search records, your LLC name is not available for use because another Connecticut business entity is already using it.

If the results show a name that is very similar to yours, your LLC name may not be available for use.

- If your desired name is Riverwalk Studios LLC, and the search results show a “Riverwalk Studio”, then your name is not available.

What if my desired LLC name isn’t available?

If your name is not unique, you’ll need to come up with a variation or a different name for your LLC.

Tip: Wait until your LLC is approved before you apply for your LLC EIN Number or purchase any other marketing materials. This way you don’t spend money on business supplies you can’t use because your business name isn’t available.

Connecticut Secretary of State Contact Information

You can call the Connecticut Secretary of State to ask questions about whether your LLC name is available.

Representatives at the Connecticut Secretary of State can help you use the Connecticut Business Records Search. They can’t guarantee that your LLC name will be available when you file, however.

The Business Services Division phone number is 860-509-6002. Their hours are 8:30am to 4pm Eastern Time, Monday through Friday.

Connecticut Limited Liability Company Name Requirements

As per Section 32-243k of the Connecticut LLC Act, there are a few rules and requirements for naming a Connecticut business entity that you need to know.

Do I have to use a comma in my LLC name?

No, you don’t have to. You can file your LLC name with or without a comma. Both versions are accepted by the Secretary of State.

For example: If your desired business name is Grandpa Joe’s, you can file it as:

- Grandpa Joe’s LLC

- Grandpa Joe’s, LLC

Or, instead of having “LLC” as your designator (ending), there are a few other options in Connecticut.

What designators (endings) can I use in my LLC name?

Your Connecticut LLC name must contain one of the following designators at the end:

- LLC

- L.L.C.

- Limited Liability Co.

- Limited Liability Company

- Ltd. Liability Co.

- Ltd. Liability Company

Note: Most people choose “LLC”.

The following designators are not allowed

Your Connecticut LLC can’t make itself sound like a Connecticut Corporation or any other business entity besides an LLC.

The following words and designators can’t be used anywhere in your LLC name:

- Inc.

- Corp.

- Incorporated

- Corporation

What words are not allowed in my Connecticut LLC name?

Your Connecticut LLC name can’t contain words and abbreviations that are restricted by law.

For example, you can’t make your LLC name sound like it’s a bank, part of the government or a government agency, or anything else that misleads the public.

You also can’t use words that are reserved for licensed professionals. These vary by state, but some common examples are accountants, architects, attorneys, dentists, and engineers.

Your Connecticut business name must be distinguishable (unique)

When you search the Connecticut Secretary of State Business Records Search, you will compare your desired LLC name to existing businesses in the state.

If your name is not unique, you’ll need to come up with a variation or a different business name.

Below are rules and examples of LLC names that are not distinguishable.

General Rules Only – Call to Check!

The Connecticut Secretary of State doesn’t publish their rules for what does or doesn’t make a business name distinguishable. The rules below are general guidelines that will help you make sure your name is unique.

After you read this lesson and use the Business Records Search, you may want to call the Business Services Division. They can check whether your name is available before you file your LLC paperwork.

Designators

Differences in designators (endings) don’t create distinguishability.

If your desired LLC name is Jake’s Fishing Company LLC, it’s not available to use if any of the following are found in the Connecticut Business Name Search results:

- Jake’s Fishing Company, Inc.

- Jake’s Fishing Company, Corp.

- Jake’s Fishing Company, L.L.C.

Filler Words

Adding non-meaningful or filler words (the, a, an, and, &, of, or) won’t create distinguishability.

If your desired LLC name is Pleasant Farms LLC, it’s not available to use if any of the following are found:

- The Pleasant Farms LLC

- A Pleasant Farm Inc.

- Pleasant and Farms L.L.C.

- Pleasant & Farms Corp

Plural or Singular Words and Possessive Words

Adding a letter “s” to make a word plural or possessive doesn’t create distinguishability.

If your desired LLC name is Paulo’s Balloons LLC, it’s not available to use if any of the following are found:

- Paulos Balloons LLC

- Paulo’s Balloon Inc.

- Paulos Balloon, L.L.C.

What if my Connecticut business name is rejected?

If you file your Connecticut Certificate of Organization (the document that creates your Connecticut LLC) and the business name is not available, don’t panic. The state will notify you and tell you why your filing was rejected.

You will just need to file again with a variation of your LLC name or a different LLC name.

Connecticut Business Name FAQs

Do I need a name reservation in Connecticut?

No, a name reservation isn’t required to form an LLC in Connecticut. It’s an unnecessary step and a waste of money.

You can just file your LLC’s Certificate of Organization with your desired LLC name.

Does Connecticut require LLC in the name?

Yes. Your Connecticut LLC name must contain one of the allowable designators at the end. The most commonly used designators are:

- LLC

- Limited Liability Company

- Ltd. Liability Co.

Does my Connecticut LLC need a DBA?

No, you’re not required to file a DBA (“Doing Business As”) for your business entity in Connecticut.

A DBA (known as a Trade Name in Connecticut) lets your LLC conduct business under a name which is different from its true and legal name (the name on your Certificate of Organization).

If you want your LLC to do business under a name that’s different from its true and legal name, you have to file a Trade Name Registration with the town clerk where you do business. The fees vary depending on which town you register in (and how many towns you register in).

Check out the Secretary of State Trade Names page for more information on this process.

There is no limit to the number of Trade Names an LLC can have.

For more information, please see Does my LLC need a DBA?

When would my LLC use a DBA?

Let’s say you form an LLC called White Oak Tours and Services LLC, but you also want to use a friendlier, catchy name, like White Oak Tours. In this case, your LLC would need to file a Trade Name Registration to use the name White Oak Tours.

If you don’t file a Trade Name Registration for a different name, you can only use your legal entity name of White Oak Tours and Services LLC.

Similarly, if you want to do business under the name White Oak Tours and Services, just without the letters “LLC” in the name, you will need to file a Trade Name Registration for White Oak Tours and Services.

How do I get a business domain name?

Once you’ve found a business name that you like, it’s a good idea to check if your domain name is available before forming your LLC.

You can search for available domain names with GoDaddy:

Find a domain name

What does “distinguishability” mean?

Each business entity name must be “distinguishable upon the records” of the Secretary of State.

This means that no two businesses can operate with the same exact name. Said another way, if a business already exists with your desired LLC name, you can’t register your LLC with that name.

For example, let’s say you want to form an LLC called Robin Landscapers LLC. But there is already a business in another town called Robin Landscapers, Inc. Because your desired LLC name is the same as that existing Connecticut Corporation, it is not distinguishable. You can’t use it and must choose another name.

How do I come up with a business name?

Business names are important for branding and recognition. The name of your Connecticut LLC can be your company’s brand name, but it doesn’t have to be (please see the FAQ about DBAs above). Either way, picking a good LLC name is an important decision.

Here are some quick tips for coming up with business names:

- First, write down the features of your company and things that you want to be associated with.

- Then list out as many business names as you can think of. Don’t edit or analyze them. Just get as many names on the page as you can.

- Now go back and read through them. Write down any variations that come to mind.

- Next, set the list aside. Do something else, like go for a walk or get groceries, or sleep on it for the night. Then come back and review the list of names. As you go through it, write down additional ideas and variations.

- Read the whole list out loud. If you want, get input from friends, business partners, and family.

- Repeat the process: sleep on the ideas, write down new variations, read them out loud again.

- The best business name will often “rise off the page” and present itself. If it doesn’t, you can try this trick: Close your eyes and count to 10. When you get to 10, you must choose a name. When you open your eyes, force yourself to make a decision. Sometimes we know the best name deep in our subconscious, and this trick can help it come out. Trust yourself and go with what feels best.

For more tips, please see How to Choose a Business Name or check out TRUIC’s Business Name Generator.

Can I use the name of another Connecticut entity?

No. You can’t use the same name as another Connecticut business.

And it doesn’t matter what entity type it is – your LLC can’t have the same entity name as another corporation, LLC, or any other entity type.

You can’t use another business’s name even if the entity is in “delinquent” status on the Connecticut Secretary of State website.

But if the business entity is dissolved, they no longer have rights to that name. This means you can form an LLC with the same name.

How do I change my LLC name?

You can change your LLC’s name later by filing an Amendment form with the Secretary of State.

We have step-by-step instructions on how to change an LLC name in Connecticut.

How to start an LLC in Connecticut?

Here are the steps to starting an LLC in Connecticut:

- Choose an LLC name and make sure it’s available

- Choose who will be your Connecticut Registered Agent

- File the Connecticut LLC Certificate of Organization

- Complete and sign an LLC Operating Agreement

- Get a Tax ID Number (EIN) from the IRS

- Open an LLC bank account

- Check whether you need a business or sales tax license in Connecticut

References

Connecticut Secretary of State: Trade Names

Connecticut Secretary of State: Business Name Test

Connecticut LLC Act: Section 243k (permitted name)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Connecticut LLC Guide

Looking for an overview? See Connecticut LLC

Hello, I have had a sales & use tax id# for some years . My business is growing and i now am getting a llc. Do i HAVE to use the exact same name or can i shorten it up a bit? Will it matter?

Hello, if you’re creating an LLC, its name doesn’t have to be similar to a name of a prior DBA (for your Sole Proprietorship). You can name your new LLC whatever you want. There may be a way to “transfer” your sales & use Tax ID Number, but you’d need to contact the Connecticut Department of Revenue Services about that (we’re not sure… and typically that’s not the case). Usually, an LLC (after it’s approved) would get an EIN Number from the IRS and then get its own sales & use Tax ID Number. Hope that helps.