Northwest Registered Agent is the 2nd largest Registered Agent business. They offer LLC formation service and Registered Agent service in every state. Read our review to find out if you should hire them.

Let’s get right to it:

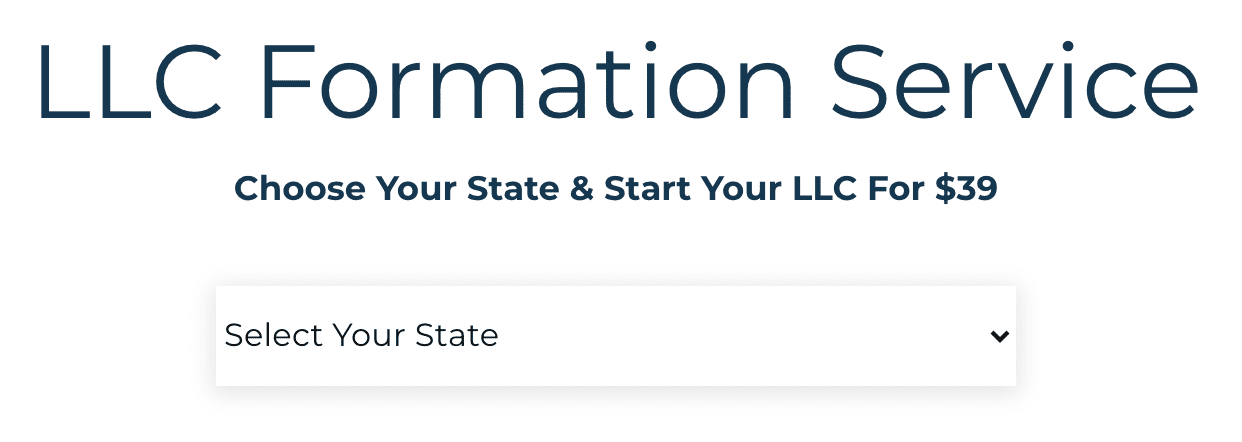

Should you hire Northwest to form your LLC?

If you’re looking for premium customer service and the best price, yes, we recommend hiring Northwest Registered Agent. They charge $39 plus state fees to form your Limited Liability Company.

Northwest offers discounted pricing to LLC University® readers (60% off).

About Northwest Registered Agent LLC

Northwest Registered Agent is headquartered in Spokane, Washington. However, they also have offices in all 50 states.

They are a well-established business and have been in operation for over 20 years.

Core Services

Northwest Registered Agent offers the following core services:

- LLC formation service

- Registered Agent service

- Address privacy (keeps your address off public record)

- Lifetime customer support

- Annual Report reminders

- Online document dashboard

Additional Services

Northwest offers the following extra services:

- EIN Number

- Annual Report service

- Operating Agreements

- Virtual office service

- S-Corp Election

- Mail forwarding service

- Foreign qualification

- Legal forms

- Legal services (in Utah)

- Incorporation services

Northwest Registered Agent reviews

| Rating | Number of Reviews | Source | |

|---|---|---|---|

| Google: | 4.6 stars | 339 reviews | Google reviews |

| Better Business Bureau: | 4.33 stars | 90 reviews | BBB reviews |

| Birdeye: | 4.4 stars | 443 reviews | Birdeye reviews |

| Yelp: | 4 stars | 49 reviews | Yelp reviews |

Here’s a few of our favorite customer reviews:

“These guys are real. They do LLCs. They do just as good a job as LegalZoom. They do it for much cheaper. And they do it with 1 or 2 day turnaround, for FREE, whereas Legal Zoom charges HUNDREDS of dollars for that. They also have great people available on the phone. I paid. I received service. It was not a scam. Legit business. I’m very, very happy I found these guys. LegalZoom would’ve taken a month and cost much more.”

Carlos Augusto, California

(source: Google reviews)

“Northwest Registered Agent is one of the more seamless companies to work with in regards to company formation and registered agents. Paul (the rep who helped me) is a beast. I rapid fired so many questions at him, all of which were answered patiently with specificity and experience. Within 30 minutes, I went from being someone who knew little to nothing about company formation, to being someone who was able to move things forward with certainty.”

Dylan P, New York

(source: Yelp reviews)

“Down-to-earth pricing with no hidden gotchas. Fast turnaround, responsive customer service, and an all-round pleasurable company to work with.”

Ozan B.

(source: Better Business Bureau reviews)

How much does Northwest Registered Agent charge to form an LLC?

| LLC formation: | $39 + state fee |

| Registered Agent service: | Free the 1st year (then $125 per year) |

| Address privacy: | Free |

Pros of Northwest Registered Agent

These are the pros of Northwest Registered Agent:

- Keep your address off public record (no other company offers this)

- Great customer support (call and ask any question – you’ll be impressed!)

- Very reasonable prices (use the LLCU discount)

- Been in business 20+ years

- They don’t sell your customer data (unlike most other companies in the space)

- They have offices in strategic locations (to help you save money on states where there’s a publication requirement: Arizona, New York, and Nebraska)

Cons of Northwest Registered Agent

Northwest Registered Agent is not the cheapest company. Other companies are cheaper, however, we think the saying holds true: you get what you pay for.

We don’t believe there are any cons to Northwest. We’ve compared Northwest with all other LLC filing companies. We haven’t found a single situation in which Northwest didn’t come out on top.

Northwest Registered Agent Guarantee

Northwest has a 100% Error-Free Guarantee:

“We form hundreds of LLCs every day, and each filing is backed by our 100% error-free guarantee. Although extremely rare, in the 20 years we’ve been in business, we’ve learned that mistakes do happen. Should an error occur, we’ll file every amendment required to make sure your company information is accurate (at no cost to you).”

Alternatives to Northwest Registered Agent

Alternatives to Northwest Registered Agent are:

- BizFilings

- CorpNet

- Harbor Compliance

- InCorp

- Incorporate.com

- IncFile

- LegalZoom

- MyCorporation

- My Company Works

- ZenBusiness

If you go with another company, we recommend looking into the following:

- Do they have hidden fees?

- Do they have lots of upsells?

- Do they charge extra to scan your mail?

- Do they have good reviews?

- Do they keep your address off public records?

Northwest Registered Agent vs competitors

Check out the table below for pricing and reviews of the top LLC formation services.

| Price | Address privacy | Reviews | Free Registered Agent 1st year? | |

|---|---|---|---|---|

| Northwest Registered Agent | $39 + state fee (complete package) | Yes, the only company to offer this. | 4.6 stars Google rating | Yes |

| LegalZoom | $0 + state fee (basic package) | No | 3.6 stars Google rating | No, $299 per year |

| ZenBusiness | $49 + state fee (starter package) | No | 4.8 stars Google rating | Yes |

| IncFile | $0 + state fee (started package) | No | 3.4 stars on Trustpilot | Yes |

| Rocket Lawyer | $100 + state fee (non-subscriber price) | No | 4.7 stars on Trustpilot | No, $150 per year |

Northwest Registered Agent vs LegalZoom

Winner → Northwest Registered Agent

Why? Northwest Registered Agent has better customer support and better pricing. LegalZoom has misleading pricing and can be hard to cancel.

For more information, check out Northwest Registered Agent vs LegalZoom.

Here is LegalZoom compared to Northwest Registered Agent:

| LegalZoom | Northwest Registered Agent | Notes | |

|---|---|---|---|

| LLC price: | $0 + state fee | $39 + state fee | Northwest's filing fees are $110 cheaper. |

| Registered Agent price: | $249 per year | Free for 1st year, then $125 per year | Many LegalZoom customers say this service is hard to cancel. |

| Upsells: | 7 upsells | No upsells | LegalZoom upsells totaled $1,688. |

| Approval time: | 30 business days (unless you pay extra) | 3-5 business days (in most states) | Northwest is on average 3 weeks faster |

| Google reviews: | LegalZoom is 3.7 stars | Northwest is 4.7 stars | Northwest has better reviews. |

| Customer support: | Not easy to contact. Sometimes they try to sell you more products. | Industry experts who share knowledge. Friendly. No sales pitches. | Northwest has better customer support. And no "pushy" salespeople. |

| Data privacy: | LegalZoom sells customer info. | Northwest never sells any customer info. |

Northwest Registered Agent vs IncFile

Winner → Northwest Registered Agent

Why? While IncFile has cheaper filing fees, Northwest Registered Agent has much better support. And Northwest doesn’t sell any of your customer data.

For more information, check out IncFile vs Northwest Registered Agent.

Here is IncFile compared to Northwest Registered Agent:

| IncFile | Northwest Registered Agent | Notes | |

|---|---|---|---|

| LLC price: | $0 + state fee | $39 + state fee | While IncFile is cheaper up front, most people pay a lot more with the upsells. |

| Registered Agent price: | Free for 1st year, then $119 per year | Free for 1st year, then $125 per year | |

| Upsells: | 8 upsells | No upsells | IncFile upsells totaled $343. |

| Approval time: | 1-3 weeks (depends on the state) | 3-5 business days (in most states) | |

| Google reviews: | IncFile is 1.5 stars | Northwest is 4.5 stars | Northwest has better reviews. |

| Customer support: | This is where IncFile gets a bad reputation. Support can be hard to reach or not helpful. | Industry experts who share knowledge. Friendly. No sales pitches. | Northwest has better customer support. And no "pushy" salespeople. |

| Data privacy: | If you choose certain upsells, IncFile does sell your data. | Northwest never sells your data. |

Services provided by Northwest Registered Agent

In addition to LLC formation and Registered Agent service, Northwest also offers other products and services.

LLC formation

Northwest Registered Agent charges $39 + state fee. This includes free Registered Agent service for the 1st year.

Northwest will check your LLC name availability and then file the Articles of Organization with the state government. Once this document is approved, your LLC is officially created.

Note: In some states, the Articles of Organization is called the Certificate of Organization or Certificate of Formation.

With every order, Northwest includes the following for free: Annual Report reminders, mail scanning and uploading, and lifetime customer support.

Registered Agent service

Northwest will include Registered Agent service for free for the 1st year (if you hire them to form your LLC). After that, service renews at $125 per year.

What is a Registered Agent? A Registered Agent is a person or company who agrees to accept legal mail (called Service of Process) and state notices on behalf of your LLC.

Federal Tax ID Number (EIN)

Northwest will get your EIN Number from the IRS for $50 (if you have an SSN or ITIN).

If you’re a non-US resident, and don’t have an SSN or ITIN, Northwest can still get your EIN Number from the IRS. The price is $200.

LLC Operating Agreement

An LLC Operating Agreement is an agreement between the LLC owners (called “Members”). It spells out certain things, such as how much of the LLC everyone owns and how the LLC is managed.

You can purchase an Operating Agreement from Northwest for $50.

Other items

Certificate of Good Standing for $50. This is needed if you are registering your LLC as a Foreign LLC in another state.

Certified Copy for $60. This is needed in only certain states if you are registering your LLC as a Foreign LLC in another state.

Phone service. Northwest offers a free trial for a business phone number. If you like the service, it renews at $9/month.

Credit card processing. If you’d like to receive credit card payments for your business, Northwest can help you set up a merchant account. Prices will vary based on volume.

Top 5 reasons Northwest Registered Agent is the best

We compared Northwest Registered Agent to all the other companies. These are our top 5 favorite things about Northwest.

1) No Hidden Fees. No Upsells. No Confusing Packages.

With Northwest Registered Agent, what you see is what you get.

Their tagline is “We’re just not annoying.” What they mean by that is they offer a great service at a great price. They don’t have confusing LLC packages, they don’t upsell you, and there are no hidden fees.

They offer LLC formation packages and Registered Agent services at the best price.

Unfortunately, most other companies take advantage of you. They make their packages confusing and trick you into paying more (often for things you don’t even need).

2) They don’t sell your personal information

Northwest doesn’t sell your personal information to make more money (unlike many competitors)

Instead, they protect their customers’ information at all costs. The data that you provide stays with them. They don’t sell your information to other companies and disguise it as an “Accounting Consultation” (which is really your information being sold to a company with aggressive sales tactics).

This is one of the biggest reasons I personally use Northwest for my own LLCs. I trust that my information is safe and I’m not going to get unwanted spam or marketing solicitations.

3) You can use their address for privacy (keep yours off public records)

The address you put on your LLC filing (your Articles of Organization, Certificate of Organization, or Certificate of Formation) gets listed on public records with the Secretary of State.

From there, it may begin appearing on Google searches (since the state databases are publicly available), and even on other websites that copy the public records.

This used to drive me crazy. I’d get so much junk mail and I didn’t like it when my information was so readily available via a quick search.

So instead of using your home address (which is what most filers do), if you hire Northwest Registered Agent, you can use their business address throughout your LLC filing and keep your address off public records.

This also eliminates some junk mail, which I think is a great bonus!

4) Free Registered Agent Service for 365 Days

If you hire Northwest ($39 + state fee) to form your LLC, they will include Registered Agent service free for the 1st year.

That’s a $125 discount. After that, Northwest’s Registered Agent service is $125 per year.

This renews automatically every year, but you can cancel this at any time in your personalized dashboard.

If you cancel services with Northwest, nothing happens to your LLC. It doesn’t change status or do anything scary like that. Instead, you’ll just need to file a change of Registered Agent filing with the state and appoint the new Registered Agent.

5) They are LLC experts

If you call most other companies in this industry, you will probably speak to some sales rep who barely understands what a Registered Agent is or how to form an LLC.

On the other hand, I really like that Northwest doesn’t have any sales reps. Everyone in their company does customer support. There’s no dedicated “sales team.” So when you call, you speak with a friendly person who knows what they’re talking about.

Go ahead and give their customer service team a call right now: 509-435-9053. Their hours are Monday to Friday, from 9am to 8pm Eastern (6am to 5pm Pacific).

Ask any question you want. I think you’ll be impressed when the phone is answered right away (no phone prompts or extensions), the person you speak with is very friendly, and, most importantly, they are experts at what they do.

Is Northwest Registered Agent a good choice for your LLC?

Northwest Registered Agent has excellent customer service and they are industry experts.

They keep your address off public records and don’t sell your data to 3rd parties.

Northwest Registered Agent is our favorite company and they’re also a great option if you’re on a tight budget.

We’ve been using them for our own LLCs for many years and we highly recommend them.

I hope this Northwest Registered Agent review has been helpful!

Northwest Registered Agent FAQ

What happens after I hire Northwest?

Northwest will confirm that your LLC name is available. Then they’ll file your Articles of Organization with the state. Once your LLC is approved, you will get an email notification.

Then, you can log into your personalized dashboard and download your LLC forms. This will include the approved Articles of Organization (formation papers), your LLC Operating Agreement, and any other services you ordered.

Does Northwest offer a discount?

Yes, Northwest Registered Agent offers a 60% discount for LLC University readers. To learn more, see Northwest Registered Agent discount.

What are the turnaround times?

The turnaround time depends on the state where you form your LLC. Please see How long does it take to get an LLC for state approval times. Please add a few days to the state approval time to account for Northwest’s processing time.

Can you be your own Registered Agent for an LLC?

Yes, you can be your own Registered Agent for your LLC. In most states, you need to be a resident of the state where you’re forming the LLC. Being your own Registered Agent will save you money.

However, your name and address will be listed in the Articles of Organization, which goes on public record. If you’d like to avoid that, you should hire Northwest and let them be your Registered Agent. This will keep your address off public records. Not only does Northwest let you use their address for the Registered Agent section, but they’ll use their address for the LLC principal office address and the LLC mailing address.

What is Service of Process?

Service of Process for an LLC is the delivery of legal documents, like a notice of a lawsuit.

Other documents that are delivered by Service of Process include subpoenas, summons, complaints, and writs. Service of Process is delivered to your LLC’s Registered Agent.

Receiving Service of Process is the main purpose of a Registered Agent. However, the Secretary of State may also send state notices to your Registered Agent. Any mail sent to your Registered Agent will be forwarded to you.

Is a Registered Agent really necessary?

Yes, a Registered Agent is required for forming an LLC in every state (except for New York and West Virginia).

However, we still recommend hiring a Registered Agent in New York to save money on the New York LLC Publication Requirement.

How much does Northwest Registered Agent cost?

If you use Northwest’s Registered Agent service, it costs $125 per year. People choose this standalone service if they are forming their LLC themselves.

However, if you hire Northwest to form your LLC ($39 + state fee), they’ll include Registered Agent service free for the 1st year.

Is Northwest Registered Agent legit?

Yes. They’ve been in business for 20+ years, and have an excellent BBB Business Profile.

They have the best customer service and we use them for our own LLCs. They don’t sell customer data and they keep your address off public records.

How to cancel Northwest Registered Agent?

You can cancel services with Northwest Registered Agent at any time by logging into your online account.

Click on “Services” at the top. Then click on your company name. Then check the box to the left of “Registered Agent service”. Then click the “Cancel services” button.

There is no fee to cancel Northwest Registered Agent. However, keep in mind that you’ll need to file a change of Registered Agent with the state to add your new Registered Agent.

How long to get an EIN with Northwest Registered Agent?

If you hired Northwest Registered Agent to form your LLC, they can also get your EIN from the Internal Revenue Service (IRS).

Once the IRS approves your EIN, they’ll issue an EIN Confirmation Letter (CP 575). Northwest will provide the EIN Confirmation Letter along with your other LLC approval documents and they’ll give them to you at the same time. So it depends on what state you form your LLC in.

However, Northwest can usually get an EIN within a few business days if you have a Social Security Number (SSN) or Individual Taxpayer ID Number (ITIN). If you don’t have an SSN or ITIN, it can take a few months.

What does enabling compliance mean Northwest Registered Agent?

Enabling compliance with Northwest Registered Agent means they will file your LLC Annual Report for you every year.

Northwest does charge a service fee for this. And you’ll need to pay the state fees as well. Northwest Registered Agent will send you reminder notices by email before your LLC’s Annual Report due date.

Note: This service doesn’t apply for states where there are no LLC Annual Reports.

Which companies use Northwest Registered Agent?

Companies that use Northwest Registered Agent are usually small and medium sized businesses. Northwest Registered Agent offers services for businesses of all sizes, whether you’re a brand new entrepreneur or your business is expanding into multiple states.

Where is Northwest Registered Agent located?

Northwest Registered Agent is headquartered in Spokane, Washington. However, they have offices in all 50 states. So no matter where you need an LLC formed, or where you need Registered Agent services, Northwest can assist you.

What does Northwest Registered Agent do?

Northwest Registered Agent specializes in LLC formation and Registered Agent services.

A Registered Agent is a person or company who agrees to receive legal mail (called Service of Process) and state notices on behalf of your LLC.

What is the Northwest customer support phone number and email?

Northwest’s customer support phone number is 509-435-9053. Their hours are Monday to Friday, 6am to 5pm Pacific (9am to 8pm Eastern).

Their email is support@northwestregisteredagent.com

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi, I’m trying to determine the best business structure for my business. I’m working with several nonprofit organizations in Africa and South America. The focus of these are Forest habitat protection and wildlife conservation and protection.

I would like to establish a business to fund raise for the above. We would also provide program guidance for projects. Projects could include Ecotourism programs (nonprofit) where revenues are allocated to conservation and local community benefit projects.

How would be the best way to structure this ie nonprofit LLC, social benefit corporation, nonprofit s-corporation…?

Do you offer business addresses along with the business phone offer?

I want to form a NON-PROFIT LLC in Georgia for a chaplain. I would be the sole member, so no need for an Agent. Are the rules different for non-profits?

Hello

I am looking for a reliable agent to set up an LLC, be able to organise, prepare and send

“Apostled Articles of Organization” to me (in Europe) as quickly as possible and organise the EIN for the LLC; Subsequently looking after us, in as much as filing annual reports as and when necessary.

I’m reaching out because my wife and I are gearing up to purchase an apartment complex in Connecticut and are considering Northwest LLC formation for its reputed privacy protections.

To give you a quick rundown, both my wife and I will be owners and property managers, making privacy a top concern for us. Northwest’s services seem to align with our needs, but we wanted to hear from you about any specific advantages or features that could benefit us in this scenario.

Additionally, I wanted to mention that we’ve already drafted a pretty detailed Operating Agreement for our LLC. However, we’re still open to any guidance or insights you might have regarding its structure or content.

Lastly, as we’re mindful of our budget, we were wondering if there are any discount codes available that could help with the initial setup costs.

Your insights would be greatly appreciated as we navigate this new venture. Looking forward to your response!

THanks!!!

Hi Jerin, if you have financing lined up, make sure to speak to the lender re: taking title in an LLC name. Also, Connecticut’s filing form – the Certificate of Organization – doesn’t make privacy easy. For #5, they want a Member or Manger listed. The Connecticut LLC Annual Report also asks for the same information. Here are a couple of options to explore (might also be helpful to speak to Northwest by phone and/or a few local real estate attorneys):

A. Hold title directly in an out-of-state LLC. However, if that LLC needs to be registered as a Foreign LLC (since the LLC is “transacting business” in CT), then you’re back around to the same issue (see #11 on the Foreign Registration Statement; and there’s the same LLC Annual Report too). Foreign LLC rules are in place, but aren’t always strictly enforced, so a bit of a gray area.

B. Set up a “parent” LLC out of state (say, in Wyoming). Then have the Wyoming LLC own the Connecticut LLC (the “child” LLC). The Connecticut LLC would be managed by the Wyoming LLC, so you can list the Wyoming LLC, and its address, in #5 of the Certificate of Organization, and in the Annual Report too. This also has some “future proofing” in place. For example, if you buy more buildings in the future, you could set up additional CT LLCs, all owned by your Wyoming LLC. This offers additional asset protection and also consolidates your tax return. Reason being is that each child LLC wouldn’t have to file its own return since they would be Single-Member LLCs (aka Disregarded Entities). So all the child LLCs would be reported on the parent LLC’s tax return.

Regarding the Operating Agreement, we don’t offer custom services or review. But it sounds like what you have is solid. Also, keep in mind that you can always change your Operating Agreement if your operations expand or get more complex. The document isn’t “set it stone”. And as far as a discount code, there isn’t one for Northwest, since they already offer their best pricing through our referral links on this page. Hope that helps a bit and gives you a few things to look into!

Thank you in advance for answering my queries

I work as a W2 and recently been getting offers for contract work on 1099 too. This requires me to have an LLC (Both W2 as well as 1099 jobs are for “IT program manager”, currently remote working but may travel to offices too)

What would be the best kind of LLC to set up for tax purposes (deductions, Car purchase, travel, vacations with family) as well as less complexity?

Secondly, need your suggestion.

In addition, Im starting off some bit of investing on Robinhood and trading (say 4-6 trades a week). If successful, I may do more. I spent some money for Trading software and need to spend more on computers, monitors and WIFI etc.

what kind of LLC would help me deduct my expenses and losses? or should i continue to do this in my individual name?

Hi Jay, you actually don’t need an LLC for tax purposes. This is because a Single-Member LLC is taxed like a Sole Proprietorship. Meaning, you can get all the tax benefits by simply operating as a Sole Proprietorship. Having said that, if you want to form an LLC, a traditional LLC in your home state is likely a solid route. I’d say for the trading, an LLC isn’t needed, especially if you’re just starting out. In terms of deducting expenses for investing, this falls under the “investor” vs “trader” status, as defined by the IRS. You’re likely not consider a “trader” by the IRS, unless this is your full-time/main source of income. So deducting expenses on this front may be more challenging, with or without an LLC. Having said that, you can likely deduct these expenses under your IT work, since computers and accessories could fall under that use case.

Does Northwest offer a discount for first year as a registered agent for military veterans forming an LLC in Texas on their own, using the Senate Bill 938 Exempt filing fee for veterans?

If so, send me the link to lock that in for my RA.

Thanks,

Hi Ken, unfortunately, they don’t. They only offer the discount for someone hiring them to form an LLC.

does LLCs have categories? If I need an LLC for my SaaS business online will it be considered different from my Amazon business LLC. Or can I use 1 LLC for both businesses online if the name is same. For example I can have a website that sells services and with same name I can have a store on Amazon to sell my products? It’s like a brand doing different things, like Google have different services and products. Is it possible to have one LLC for different businesses that are owned by same person?

Hi Ameer, it’s better to think of things in two categories: business entities and business activities (not “businesses”; it’s too vague and ambiguous).

So yes, an LLC can engage in multiple business activities (like being a SaaS business and selling on Amazon). Hope that helps. We have more information here: Can you have multiple businesses under one LLC.

Have you accepted my payment and began the process?

Hi Elizabeth, we are not Northwest Registered Agent. This is LLC University, and we recommend Northwest. You’ll need to contact Northwest Registered Agent to check on the status of your order.

Hi Matt, I am interested in an LLC in CA and I would be the only member. Is that permitted? Does it need to have a minimum amount of cash to start? For the most part, it will be an online business that publishes books, creates an online courses, and have a community platform for classes, etc. Would it be a good idea to create a dba for the different business lines? If yes, how much does it cost to create a dba? Thanks!

Hi Lisa, yes, Single-Member LLCs are permitted in California (and in every state!). And no, there is no minimum cash requirement to start an LLC. I don’t think you need (or would want) that many DBAs. It could be an administrative headaches, cause confusion, and honestly, it just doesn’t sound necessary. I’d start really simple, with just the LLC and I’d focus on acquiring customers :) Also, on the topic of California LLC costs, there is an $800 annual LLC tax, due by all California LLCs every year; FYI.

Do you offer also extra (paid)service on top of being the registered Agent such as “worry free compliance” or “annual compliance service” like companies such a Zenbusiness do? and if yes what are the prices for those extra services?

Thank you

Hi Marco, “worry free compliance” is a bit of a vague term. I see most companies using it to mean Registered Agent renewal (which isn’t really a service lol) and the filing of the LLC Annual Report. Northwest does offer an Annual Report service. This costs $100 per year (assuming your state has an Annual Report and not a Biennial Report) + the state filing fee. Hope that helps.

HI Matt, i am about to start the process of creating an llc with Northwest. i read above that readers of Llcuniversity get an additional discount, is that correct, or still apply ? what do I need to gain access to it ?

Many thanks, by the way, very useful site – thank you for all the help provided!

Hi JM, you’re very welcome! Yes, the Northwest Registered Agent discount will apply if you click on any of the links above on this page. Hope that helps.

Definitely great company, one thing to keep in mind though. Even though their website says “EVERY LLC we create comes with a FREE year of Registered Agent service”, they only do that for the first. Also the $39 price is only for the first formation, it is $100 for any other filing you may have. The way I had understood was that it would be for any LLC and would renew for the $100 fee and Registered Agent service would be included for the first year. However, they do not do that. After a bit of pushback and showing them where their website says that, they said they would give me the first year of RA service free for one more LLC, but I was in the process of creating several. Now my upfront investment is much higher than initially calculated.

Also, their operating agreement is pretty basic. You get a template to be able to print them, then fill it out yourself, and sign.

Hi Gonzalo, thank you for your detailed comment :) I think it will be very helpful for other readers.

Great Info I like this

Hi Matt,

How do I set the effective date to Jan 1, 2023 when creating an LLC using Northwest as the registered agent? My LLC is in Georgia.

I started the LLC formation process but paused because I didn’t see anywhere I can input the effective date while I was signing up. Their public customer service number is not currently functioning.

Hi Chloe, you’ll need to contact them before submitting the order.

i have made by myself an llc in florida and i have the statement number already (i don`t really know if it is relevant) and now i am looking to obtain the EIN, can you please tell me the costs associated with that thru the NW. And since it takes a while to get it can you recommand some acountants services that work with non us citizens in order to have the company up and running without any issues please!

Hi Cosmin, the cost for Northwest to get an EIN for US citizens/US residents is $50 (service link). However, the cost for Northwest to get an EIN for non-US resident is $200 (service link). This is because the process requires more paperwork and more time.

And for accountants for non-US residents, check out O & G Accounting or GW Carter. Hope that helps!

Hey Matt,

This is Alex Oware, CPA and CEO of O&G accounting. I’d like to take this opportunity to express my excitement and gratitude for the huge mention up there. Your website is one of the best out there in terms of All things LLC.

Thanks again!

Hey Alex, you’re very welcome. You do great work! Thanks for the kind words :)

Hey Matt,

Loving the content so far!

Quick question, I noticed that with the CA Assembly Bill 85 that I would not be required to pay the CA $800 fee the first year of LLC formation. So my question is: do you know if Northwest would still have me on the hook for the state filing fee (assuming I formed by December 31st, 2023)? Or would I only be expected to pay the $39 fee?

Thanks in advance!

Thanks Lainey! No, you wouldn’t be on the hook for the $70 state filing fee. That is because California waived LLC fees until June 30, 2023. So if you form an LLC with Northwest, you just pay $39 for the Northwest service fee and a $20 state fee. The $20 is for the initial Statement of Information, which they file for you (it’s due within 90 days of the LLC being formed). Hope that helps!

Oh great, thanks so much for clarifying that, Matt! And thanks for the quick reply!!

I’m so excited- I filed my FBN and started my business in March of this year and am hoping to transition to LLC by January of next year. I just can’t wait!! 👍 Thanks again and thank you for the work you do! ☺️

You’re very welcome Lainey! And thank you for the kind words :) Heck yeah, go get ’em! Best wishes with the business!

Hi Matt:

I plan to set up a LLC with my friend. But we haven’t thought what business we will do. Does it mean we don’t know what exactly legal transactions will take place. So we can not decide which state to set up LLC, is it correct? In additional, I checked Northwest, I didn’t quite understand the choice of additional items: EIN, operate agreements…., Can I do it by myself after the company set up? How does Northwest can make our multi members LLC legally without hiring an attorney?

Thank you!

Hi Vivien, while you can hire an attorney to form an LLC, that is not a legal requirement. You could also form the LLC yourself or hire an LLC filing company. By completing an LLC Operating Agreement and creating the LLC with 2 or more Members, the LLC will automatically be a Multi-Member LLC. Northwest does offer an Operating Agreement and they’ll get your EIN, but you don’t have to hire them for those things if you’d prefer to get them yourself. As far as which state, where are you guys located? Do you have any ideas about what the business might do?