Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Franchise Tax and Public Report Filings for Texas LLCs

While nearly all entities in Texas need to file a franchise tax report, this page is strictly about an LLC in Texas.

90% of Texas LLCs don’t owe any franchise tax since most LLCs have annualized total revenue less than $1,230,000.

However, your LLC still must file a No Tax Due Report (Form 05-163) and a Public Information Report (Form 05-102). These forms are combined together when filing online via WebFile.

Table of contents:

(click a link to skip to its section)

Major parts:

Part 1: What is Texas franchise tax, and who has to file?

Part 2: How things happen, and Franchise tax questionnaire

Part 3: How to complete the franchise tax reports

Part 4: Frequently Asked Questions

Specific sections:

• What is Texas franchise tax?

• What is the tax rate?

• Most LLCs don’t pay, but file

• 2 most common scenarios

• What’s annualized total revenue?

• When are tax reports due?

• Due in advance, not in arrears

• Reminder notices

• Penalties for not filing

• SIC code and NAICS code

• Welcome Letter

• WebFile and XT numbers

• Creating a WebFile account

• Franchise tax questionnaire

• How to calculate total revenue

• No Tax Due Report

• Veteran-owned Texas LLC

• Public Information Report

• Franchise tax extension

• Long Form

• EZ Computation Report

• PIR for Long Form or EZ

Part 1: Overview

Note: This page contains a lot of information. If you’re already familiar with Texas franchise tax, know your LLC’s annualized total revenue is less than $1,230,000, and just want to file your No Tax Due Report (and PIR), you can find simpler instructions here: How to file a Texas LLC No Tax Due Report and PIR

What is the Texas Franchise Tax?

Texas franchise tax is a “privilege tax” for doing business in Texas. Part of this privilege includes liability protections provided by state law. The franchise tax is administered by the Texas Comptroller of Public Accounts.

A Franchise Tax Report must be filed by all Texas LLCs, regardless of activity, revenue, or how they are taxed by the IRS.

(Want a mini history lesson? Check out the history of the Texas franchise tax.)

What is the franchise tax rate?

As per the Texas Tax Code: Section 171.002, the franchise tax rate is either:

- 0.375% of taxable margin for wholesalers and retailers,

- 0.75% of taxable margin for all other companies,

- or 0.331% of total revenue for companies using the EZ computation method

Most LLCs don’t pay franchise tax, but still have to file

Again, about 90% of Texas LLCs don’t have to pay franchise tax.

Your Texas LLC won’t have to pay franchise tax if either of the following are true:

- your LLC’s annualized total revenue for the tax year is below the “No Tax Due Threshold“, or

- your LLC’s calculated tax liability is less than $1,000

For the 2022 and 2023 Report Year, the No Tax Due Threshold is $1,230,000.

Remember, even if your LLC owes no tax, you still must file a No Tax Due Report (Form 05-163) and a Public Information Report (Form 05-102).

Veteran LLCs:

If you have a veteran-owned Texas LLC, you are exempt from your first 5 years of franchise tax. However, you still have to file a No Tax Due Report (Form 05-163) every year. More information will be provided below.

Here are the 2 most common scenarios for Texas LLCs

Most LLCs fall into this 1st category:

Their annualized total revenue is less than $1,230,000. In this case, they don’t pay any tax, but they still have to file the following 2 reports:

- Public Information Report (Form 05-102)

- No Tax Due Report (Form 05-163)

Note: These forms are combined together when you file online via WebFile.

“Established” LLCs fall into this 2nd category:

Their annualized total revenue is greater than $1,230,000. In this case, they have to file the reports below (and pay franchise tax):

- Public Information Report (Form 05-102)

- EZ Computation Report (Form 05-169) or a Long Form (Form 05-158-A & Form 05-158-B)

- Additionally, supporting documentation may be required

For more information on how to file the forms listed above, please see the Long Form or EZ Computation section below.

What is annualized total revenue?

Annualized total revenue is a term used when an LLC didn’t have a complete 12-month tax year. This will apply for nearly all Texas LLCs’ first franchise tax reporting year.

For example, let’s say it’s 2024 and you’re looking over last year’s numbers. Your LLC was formed on June 15th 2023, and between June 15th and December 31st of that same year, your LLC’s total revenue was $105,000.

To “annualize” that number, you would divide $105,000 by 199 days ($527.64) and then multiply it by 365. You’d come up with $192,589 in annualized total revenue.

(tip: just google search “how many days between 2 dates” to find a calculator)

For more information, please see the how to calculate total revenue section below.

When are franchise tax reports due?

Your Texas LLC’s Annual Franchise Tax Report (and the Public Information Report) are due on or before May 15th every year.

Your Texas LLC’s Annual Franchise Tax Report (and the Public Information Report) are due on or before May 15th every year.

Your LLC’s first reports are due in the year following the year that your LLC was approved.

For example:

- If your Texas LLC is approved on August 5th 2023, then you have to file by May 15th 2024

- If your Texas LLC is approved on January 10th 2024, then you have to file by May 15th 2025

Texas franchise tax reports are due in advance, not in arrears

This is easier explained with an example. Let’s say your Texas LLC is approved on August 5th 2023. So your LLC franchise tax reports are due the following year, by May 15th 2024.

- your LLC’s report year will be 2024

- but your LLC’s accounting year will be 8/5/2023 – 12/31/2023

Unlike federal taxes, which are due in arrears (being filed for the prior year), Texas franchise tax reports are due in advance (being filed for the current year).

Reminder notices for Texas franchise tax

Effective 2021: If the Texas Comptroller already has an email address on file for your LLC, you will receive an email reminder instead of a physical mail reminder (the Comptroller is going more and more digital).

If the Texas Comptroller doesn’t have an email address on file for your LLC (or your LLC’s never filed anything with the Comptroller), then you’ll get a Franchise Tax “Reminder Notice” mailed to your LLC. It will arrive between January and March.

However, both email and mail reminders are just “courtesy” reminders. Even if you don’t receive a reminder notice, it’s still your responsibility to file your Texas Franchise Tax Report every year.

For this reason, we recommend putting a (repeating) calendar reminder on your phone and/or computer.

This video shows how you can use Google Calendar to create free LLC reminders:

Penalties for not filing Texas franchise tax reports

If your Texas LLC fails to file its franchise tax reports:

- your LLC will be charged with penalties and interest,

- the Comptroller has the power to forfeit the right of your LLC to transact business in this state (as per section 171.251 and section section 171.252 of the Texas Tax Code),

- your LLC being denied the right to sue or defend itself in a Texas court,

- each LLC Member and/or Manager becomes personally liable for the LLC’s debts and taxes owed to the state (as per section section 171.255),

- your LLC won’t be awarded a contract by any state agency, and

- your LLC won’t be granted a permit or license from any state agency.

For more information, please see penalties for past due franchise taxes.

45-day grace period:

Texas law requires that the Comptroller’s Office gives your LLC at least 45 days grace period. That 45-day grace period starts after you receive the “Notice of Pending Forfeiture”.

If your LLC doesn’t take care of its franchise tax obligation within that 45-day grace period, your LLC will forfeit its right to do business in the state and the above penalties will apply.

SIC code & NAICS code

When completing your Franchise Tax Reports, you’ll need to enter your Texas LLC’s:

- SIC code (Standard Industrial Classification)

- and NAICS code (North American Industry Classification System)

These numbers help identify your LLC’s industry and business activity.

This is especially important for retailers and wholesalers. If you owe franchise tax and you leave your SIC code blank, you won’t get a reduced tax rate of 0.375%; instead you’ll be charged the 0.75% rate.

Part 2: The order of how things happen

(this is what happens after you form an LLC in Texas and it’s approved by the Secretary of State)

1. Franchise Tax Responsibility Letter from the Comptroller

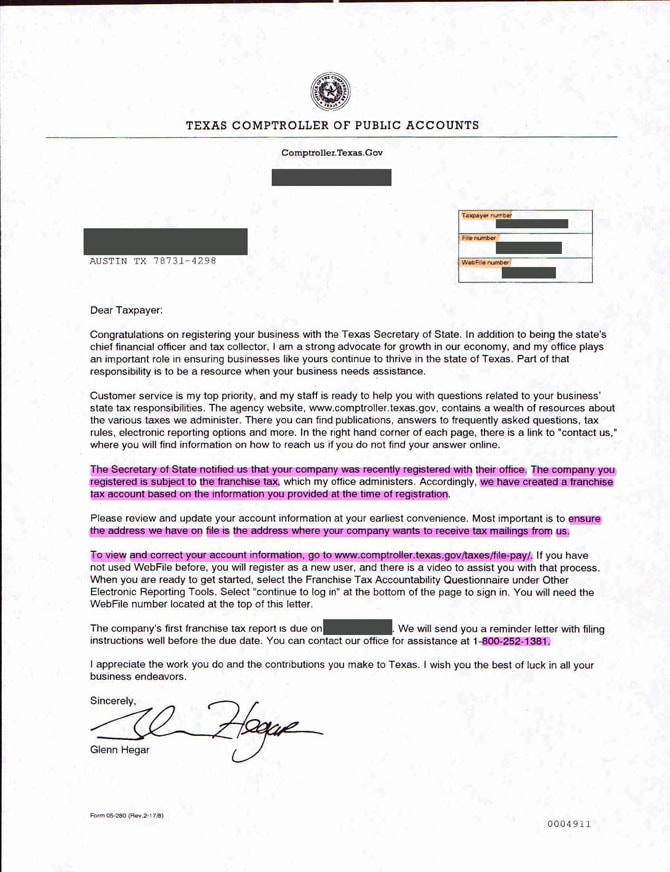

Within about 2-3 weeks, you’ll receive a “Welcome Letter” from the Texas Comptroller. This is what it will look like:

It will be mailed to your Registered Agent’s address. If you hired Northwest Registered Agent, they will scan this letter into your online account and you’ll receive an email notification. If you hired a different Registered Agent company, you’ll need to check whether this will be mailed or emailed to you.

The “Welcome Letter” is technically called the Franchise Tax Responsibility Letter (Form 05-280).

Within this letter, you’ll find a bunch of different numbers. At first, it can be a little overwhelming and hard to figure out what each of them mean. We’ve explained them below.

Taxpayer Number (11-digits):

Your LLC’s Taxpayer Number is an 11-digit number that is issued by the Texas Comptroller. This number is used to identify your LLC for state tax obligations and filings. If you ever call the Comptroller’s Office, they’ll use your Taxpayer Number to lookup your LLC. Also, when you use WebFile (the online filing system) you’ll need this number.

Important: Make sure not to confuse your Taxpayer Number with your Federal Tax ID Number (aka EIN). They are different numbers. Your Taxpayer Number is a Texas number. And your Federal Tax ID Number (EIN) is issued by the IRS.

File Number:

This number comes from the Secretary of State (SOS). The File Number is what the SOS uses to identify your LLC. The SOS creates and administers LLCs, while the Comptroller taxes them. While your LLC’s File Number is on this letter, you won’t really use it when dealing with the Comptroller.

WebFile Number(s):

The Comptroller’s online filing system is called WebFile.

The first WebFile Number you’ll get will start with “FQ”. This stands for your Franchise Tax Questionnaire.

You need to complete a Franchise Tax Questionnaire so the Texas Comptroller knows what taxes and filings your LLC is responsible for.

After your Franchise Tax Questionnaire is complete, the Comptroller will issue you one (or multiple) additional WebFile Number(s).

For example:

XT Number (ex: XT000000)

- An XT Number is for franchise tax.

- All LLCs will be given an XT Number at the end of the Questionnaire (since all LLCs are responsible for filing Franchise Tax Reports). You’ll use this XT Number on all Franchise Tax Reports.

RT Number(s) (ex: RT000000)

- An RT Number is used for Texas sales and use tax

- Additionally, an RT Number is also used for:

• crude oil tax,

• hotel tax,

• mixed beverage tax,

• motor fuel tax,

• tobacco tax,

• and more (see all taxes in Texas)

2. Create a WebFile account

(you need to create a WebFile account in order to complete the Franchise Tax Questionnaire)

- Visit the WebFile login page (aka “Texas Comptroller eSystems”)

- Click “Sign up”

- Create a User ID and click “check availability”

- Enter your email address and contact information

- Create a password and click “Continue” (make sure to save your User ID and password)

- Create a security question

- Agree to the terms and click “Create User Profile”

- You’ll see a success message: click “Continue” and you’ll be on the WebFile homepage

Your WebFile account is now created!

3. Complete the Franchise Tax Questionnaire

- Make sure you’re logged into WebFile

- Click on “Franchise Accountability Questionnaire”

- Enter your 11-digit Taxpayer Number (not your Federal Tax ID Number, aka EIN)

- Enter your WebFile Number that starts with “FQ” (ex: FQ000000) and click “Continue”

- You’ll be going through a number of questions about your LLC

- Additionally, you’ll be providing more contact information to the Comptroller’s Office

- After you submit your Questionnaire, the Comptroller’s Office will send you one (or multiple) new WebFile Numbers as previously mentioned

Mailing Address:

- You’ll see the option to change your LLC’s “mailing address”.

- The mailing address is the address where the Comptroller will send you notices and correspondence.

- Initially, the Comptroller uses the address of your Texas Registered Agent (they get that info from the Secretary of State).

- If you would like your tax mail sent to a different address (besides your Registered Agent’s address), you can update your mailing address. Note: this just changes your address with the Comptroller, not the Secretary of State. And this address doesn’t have to be an address from your Certificate of Formation. Furthermore, the address can be in any state or in any country.

4. File your Franchise Tax Reports (due by May 15th)

- Remember, your Franchise Tax Reports are due by May 15th every year

- Your first Franchise Tax Report is not due until the year after your LLC is approved (ex: LLC was approved in 2023; return not due until May 15th, 2024)

- At the end of the year, calculate your LLC’s annualized total revenue to determine if you have a franchise tax liability

- If you don’t have a franchise tax liability, you still have to file, but not pay

- If you do have to pay, determine whether you want your LLC to be taxed on margin or taxed using the EZ Computation method (if your LLC qualifies)

- We recommend working with an accountant in Texas to calculate total revenue, taxable margin, and determining if your LLC should use a deduction (cost of goods sold, compensation, less $1 million, or 30% of total revenue)

Part 3: The details

All Texas LLCs must file one of the following franchise tax reports:

- No Tax Due Report

- Long Form

- EZ Computation Form

Additionally, all* LLCs must file a Public Information Report (PIR) to report ownership to the Comptroller.

(*Veteran-owned LLCs don’t have to file a PIR. This will be explained below in the No Tax Due section.)

Your LLC’s annualized Total Revenue will help you determine which type of franchise tax report your LLC must file.

Before we talk about the forms themselves, let’s discuss how to calculate your Texas LLC’s Total Revenue.

How to calculate Total Revenue for a Texas LLC?

Total Revenue comes from your LLC’s federal income tax return. While there are more details and exceptions, the information below is a simplified approach, extracted from the Texas Tax Code: Section 171.1011.

- Related article: How is my LLC taxed?

Note: The information below is subject to change. Again, we recommend calculating Total Revenue with an accountant in Texas.

Note: Calculating an LLC’s Total Revenue for Combined Reporting and Tiered Partnerships are different. These are discussed below in the FAQ section.

Single-Member LLC:

Most Single-Member LLCs are taxed as Sole Proprietorships. Their business activity is reported on IRS Schedule C.

Total Revenue is usually on line 3.

- If a Single-Member LLC owns rental properties, then the business activity is reported on IRS Schedule E. In this case, Total Revenue is usually on line 3 (total rents).

- If the Single-Member LLC sells a rental property, then line 17 from IRS Form 4797 is also added to the Total Revenue.

Keep in mind: A husband and wife Texas LLC can be taxed as a Single-Member LLC, aka a Qualified Joint Venture LLC.

Multi-Member LLC:

Most Multi-Member LLCs are taxed as Partnerships. Their business activity is reported on IRS Form 1065.

Total Revenue is the sum of lines 1c, 4, 5, 6, and 7 from page 1 plus lines 3a and 5 from page 4 (the “Schedule K” section)

- If the Multi-Member LLC owns rental properties, add line 17 from IRS Form 8825 to the amount above to get the Total Revenue.

Alternatively:

Alternatively, an LLC can elect to be treated as a corporation for federal tax purposes. The two types of corporate taxation are:

LLC taxed as an S-Corporation:

An LLC taxed as an S-Corp reports its business activities on IRS Form 1120S.

Total Revenue is the sum of lines 1c, 4, and 5 from page 1 plus lines 3a and 4 through 10 from page 3 (the “Schedule K” section).

- If your LLC taxed as an S-Corp owns rental properties, add line 17 from IRS Form 8825 to the Total Revenue.

LLC taxed as a C-Corporation:

An LLC taxed as a C-Corporation reports its business activities on IRS Form 1120.

Total Revenue is line 1c plus lines 4 through 10.

Statutory exclusions

After a Texas LLC determines its Total Revenue, it can deduct certain exclusions:

- dividends and interest from federal obligations;

- Schedule C dividends;

- foreign royalties and dividends under Internal Revenue Code Section 78 and Sections 951-964;

- certain flow-through funds; and

- other industry-specific exclusions.

For more information, please see the Texas Tax Code: Section 171.1011 and the Texas Administrative Code: Rule 3.587.

No Tax Due Report and Public Information Report

Again, 90% of LLCs in Texas file the No Tax Due Report since their annualized total revenue is less than $1,230,000.

Since 2016, the Comptroller’s Office wants all No Tax Due Reports filed online via WebFile (instead of being filed by mail).

They also took things a step further and combined the No Tax Due Report and the Public Information Report (PIR) into one online filing via WebFile.

Get started:

- Go to WebFile and login with your username and password.

- Select “WebFile/Pay Franchise Tax”.

- Enter the 11-digit Taxpayer Number for your Texas LLC (if your LLC is not listed, you must add it to your account).

- Select “File a No Tax Due Information Report”.

- Select the report year. If you receive a “no obligation” message, you’ll need to call the Comptroller’s Office. Their number is 1-800-531-5441, extension 34402.

- Answer the questions about a Combined Group and a Tiered Partnership. Most LLCs don’t file as a Combined Group or Tiered Partnership, but you should check with an accountant if you’re not sure.

- Enter your LLC’s SIC code and NAICS code.

- Enter your accounting year: begin date and end date. If you have questions, please see report year vs. accounting year for more information.

- Answer the qualification questions. If your LLC’s annualized total revenue is below $1,230,000, you will be selecting “yes” for the “Is the entity’s annualized total revenue below the no tax due threshold” question. Or, if your Texas LLC made $0, you can select “yes” for the “Does this entity have zero Texas Gross Receipts” question. Note: If you formed a 100% veteran-owned Texas LLC, and your LLC is in the Comptroller’s system, you don’t have to complete the Public Information Report portion. WebFile will automatically exclude this from your filing.

- Enter your LLC’s annualized total revenue.

- We’ll explain the rest of the steps in paragraph-format below. These are technically the Public Information Report sections.

A note about 100% veteran-owned Texas LLC:

Your Texas veteran LLC must have been formed on or after 1/1/2022 and before 12/31/2025 and qualified with the Texas Secretary of State and the Texas Comptroller’s office. As per the Texas Administrative Code: Section 3.574, qualifying veteran LLCs:

- are exempt from paying any franchise tax for 5 years (from the date of formation),

- still have to file a No Tax Due Report,

- but don’t have to file a Public Information Report (PIR)

Public Information Report (PIR)

A note about the PIR, privacy, and public records:

Take a look at the Comptroller’s Taxable Entity Search page. Go ahead and just do an example search. Enter “ABCD” in the “Entity Name” box. Click on any LLC in the list, then click the “Public Information Report” tab at the top. You’ll notice that the LLC Members or Managers’ names and addresses are there. Unless your LLC is owned by another entity (such as an LLC, Corporation, Trust, etc.), the individual LLC Members or Managers’ names will be listed. However, if you’d like the address(es) to be private, you don’t have to use their home address. You can use a PO box address, a mailbox rental, or the address of your Texas Registered Agent (see our recommendations).

Mailing Address:

Review your LLC’s mailing address. You can leave it as-is or make changes if needed.

This mailing address doesn’t have to match any of the addresses on your LLC’s Certificate of Formation. This address can be located in any state or in any country. The Comptroller just wants a reliable mailing address to send notices and correspondence.

Note: Changing this address doesn’t change your address with the Secretary of State. There are different steps to that. This address is only for the Comptroller’s office.

Principal Office:

Enter your LLC’s principal office and principal place of business. For the majority of readers, these will both be in Texas. The address doesn’t have to be an actual office either. If applicable, it can be a home address.

Officers, Directors, Managers

In this section, you will enter all of the LLC owners (Members) and any LLC Managers. Most filers will leave the “Term expiration date” box blank as it usually doesn’t apply.

- Related article: LLC Member vs Manager

Owned Entity(ies)

If your Texas LLC is the owner of any “child/subsidiary” companies, enter those companies here. If those companies are registered to do business in Texas, enter their Texas SOS File Number.

Owned by

If your Texas LLC is owned by a “parent” company, enter that company’s information here. If that company is registered to do business in Texas, enter its Texas SOS File Number.

Registered Agent & Office

Your LLC’s Texas Registered Agent information can only be changed through the Secretary of State. While the system asks you if you need forms, we’ve included them below for you.

You can change your Registered Agent in Texas by mail or online. The fee is $15 in both cases.

- the paper form is Change of Registered Agent/Office (Form 401)

- or you can file online via SOSDirect

Declaration Statement, Review and Submit

Declare the information is true and correct and then click “Continue”. Then review your information for accuracy and check for typos. Click the edit buttons to go back or click “Submit” to finalize.

Congratulations! You have filed your Texas LLC No Tax Due franchise tax report. You’ll see a Confirmation Page. You can print/save this page for your records if you’d like. It’ll also be saved in your WebFile account’s history.

No Tax Due Report instructional video (by the TX Comptroller):

My LLC doesn’t qualify for No Tax Due. What form should I file?

If your LLC doesn’t fall under the No Tax Due Threshold of $1,230,000 in annualized total revenue, you will need to file either:

- Long Form

- or EZ Computation Form

Additionally, you’ll have to file a Public Information Report.

(Note: Of the businesses in Texas that owe a franchise tax payment, 80% use the Long Form and take the cost of goods sold deductions, while 20% use the EZ Computation method.)

The state allows you to run your calculations using both the Long Form and EZ computation method (if your LLC qualifies) and pick whichever one has the smallest tax bill. It’s recommended that you work with an accountant in order to calculate your franchise tax liability and determine which filing method is best.

Before we discuss the forms, let’s talk about requesting an extension, if needed.

How do I request a franchise tax extension?

You can file a Franchise Tax Extension Request (Form 05-164) by mail or online via WebFile.

The Request must be filed and received by the Comptroller on or before May 15th (so be sure to file early). If the request is granted, the deadline to file the Franchise Tax Report will be extended to November 15th.

As a general rule, the Comptroller grants the request only if you make an extension payment.

For more information, please see the Texas Comptroller’s franchise tax extensions page.

Note: The rule above applies only to LLCs that don’t have to pay Franchise Tax by Electronic Fund Transfers (EFT).

Long Form (Forms 05-158-A + Form 05-158-B)

Full Name: Texas Franchise Tax – Long Form (Form 05-158-A & Form 05-158-B)

- The Long Form report is needed by LLCs that don’t qualify for the EZ Computation Report; LLCs with more than $20 million in annualized total revenue

- This report can be filed online or by mail

- Additional reports may be required; please speak with your accountant

- A Public Information Report (05-102) must also be completed (online or by mail)

The franchise tax formula when using the Long Form:

1. Total Revenue minus the highest of the 4 allowable deductions:

- cost of goods sold

- compensation

- $1 million

- 30% of Total Revenue

This equals your Gross Margin.

(Note: It’s important to know that the Texas Tax Code definition is not the same as the IRS’ definition. You will want to work with an accountant to properly calculate and use the COGS deduction. The Comptroller provides more information here: Cost of Goods Sold deduction)

(more info: Texas Comptroller: FAQs on compensation)

2. You then take your Gross Margin and multiply it by the percent of your business that is in Texas (“apportionment”). This equals your Taxable Margin.

(more info: Texas Comptroller: FAQs on apportionment)

3. You then take your Taxable Margin and multiply it by your Tax Rate. Currently, those are 0.375% for wholesalers and retailers, and 0.75% for all other businesses.

That’s how you calculate your franchise tax payment.

For example: ABC Consulting LLC has $4,500,000 in annualized Total Revenue and will be using the cost of goods sold (COGS) deduction. The company’s accountant determines the COGS deduction to be $1,875,000, resulting in a Gross Margin of $2,625,000. The Gross Margin is then apportioned to the percentage of business done in Texas. For this company, 100% of their revenue come from Texas, so it’s not applicable. Their Taxable Margin is $2,625,000. This company isn’t a wholesaler or retailer, so they take $2,625,000 and multiply it by 0.75%. Their resulting franchise tax bill is $19,687.50.

Texas franchise tax formula:

| Begin with: | Texas Tax Code: | |

|---|---|---|

| Total Revenue | 171.1011 | |

| Minus the greater of: | ||

| Cost of Good Sold | 171.1012 | |

| Compensation | 171.1013 | |

| $1 million | 171.101(a)(1)(B)(i) | |

| 30% of total revenue | 171.101(a)(1)(A)(i) | |

| Equals: | ||

| Gross Margin | ||

| Multiplied by: | ||

| Percent of Business in Texas, which is: | 171.106 | |

| - Receipts from Texas business divided by | 171.103 | |

| - Receipts from Business Everywhere | 171.105 | |

| Equals: | ||

| Taxable Margin | 171.101 | |

| Multiplied by: | ||

| Tax Rate: | 171.002 | |

| - 0.375% for wholesalers and retailers | ||

| - 0.75% for all other businesses | ||

| Equals: | ||

| Tax Due |

Methods of filing the Long Form:

- Online via WebFile

- By mail

Download the Long Form (05-158-A & 05-158-B):

- Visit the Texas Franchise Tax Forms page

- Click on the report year

- Click “Long Form”

- Look for “05-158-A and 05-158-B, Franchise Tax Report” and download the PDF

- Additional forms may be required (depending on your situation)

Mailing address: (send original signatures)

Texas Comptroller

PO Box 149348

Austin, TX 78714-9348

Notes about mail filing:

- If filing by mail, make sure to send the Comptroller an original Long Form with original signatures (as well as any required additional reports)

- The mailing address is subject to change. Please double-check this mailing address with the address listed on the Long Form.

EZ Computation – an alternative method:

As an alternative to the Long Form, if your Texas LLC qualifies, you can file the EZ Computation Report instead.

EZ Computation Report (05-169)

Full name: Texas Franchise Tax – EZ Computation Report (Form 05-169)

- The EZ Computation Report is an alternative option (as opposed to the Long Form) for LLCs that are above the No Tax Due Threshold, but their annualized total revenue is $20 million or less

- The EZ Computation Report can be filed online or by mail

- Additional reports may be required; please speak with an accountant

- A Public Information Report (05-102) must also be completed

House Bill 32: The EZ Computation Report was originally used by companies with up to $10 million in Total Revenue, however due to House Bill 32 being passed in 2015, that amount was increased to $20 million.

The EZ Computation Report offers a simpler approach to calculating a Texas LLC’s franchise tax liability. Instead of using the deductions mentioned above (and filing a Long Form), the EZ Computation Report offers a reduced tax rate of:

- 0.331% of an LLC’s Total Revenue in Texas

Note: This reduced tax rate is based on the LLC’s annualized Total Revenue, and is not a tax based on margin.

According to the Texas Taxpayers and Research Association:

- 20% percent of LLCs that owe Franchise Tax use the EZ Computation Report

- the EZ Computation Report is the 2nd most popular method to calculate the franchise tax, behind using the Long Form and COGS deduction

If the EZ Computation Report is chosen:

- your LLC is not eligible to take any credits, including the temporary credit for business loss carryforwards (and it can’t be carried over to a future period)

- your LLC is not eligible to take any margin deduction (COGS, compensation, 70% of revenue, or $1 million)

Combined Group:

If a Combined Group uses the EZ Computation Report, the reporting LLC must also provide a Texas Franchise Tax Affiliate Schedule (Form 05-166) for each member of the Combined Group.

Tiered Partnership:

If your LLC makes the Tiered Partnership election, upper-tier and lower-tier entities can only qualify for EZ Computation before Total Revenue is passed to the upper-tier entities.

Note: Please see below in the FAQ section for more information on Combined Groups and Tiered Partnerships.

Methods of filing the EZ Computation Report:

- Online via WebFile

- By mail

Download the EZ Computation Report (Form 05-169):

- Visit the Texas Franchise Tax Forms page

- Click on the report year

- Click “EZ Computation”

- Look for “05-169, EZ Computation Report” and download the PDF

Mailing address: (send original signatures)

Texas Comptroller

PO Box 149348

Austin, TX 78714-9348

Notes about mail filing:

- If filing by mail, make sure to send the Comptroller an original EZ Computation Report with original signatures

- The mailing address is subject to change. Please double-check this mailing address with the address listed on your EZ Computation Report.

Public Information Report (for Long Form or EZ Computation filers)

Full Name: Texas Franchise Tax Public Information Report (Form 05-102), aka PIR

Note: If you filed a No Tax Due Report, you already submitted the Public Information Report. So this section doesn’t apply to you.

If your LLC filed the Long Form or EZ Computation Report, you still need to to submit your Public Information Report (PIR).

Some notes about the Public Information Report (PIR):

- The PIR must be filed every year with your franchise tax report

- The PIR is due at the same time as your franchise tax report

- The PIR keeps your LLC’s contact info updated with the Comptroller

- This includes the LLC’s address as well as the LLC’s members, managers, officers, and/or directors name and address(es) information in your PIR will appear on the Texas Taxable Entity Search page

- This includes LLC member/manager information and their address

- If you don’t want your home address on public record, you can use a PO box, a mailbox rental, or the address of your Texas Registered Agent (see our recommendations)

How to file a Public Information Report (Form 05-102)

You can file your LLC Public Information Report online via WebFile or by mail.

Filing via WebFile is quicker and easier. To do so:

- login to WebFile

- click “WebFile/Pay Franchise Tax”

- select your LLC’s Taxpayer Number

- click ” File a Public/Ownership Information Report” to begin

- please see the Public Information Report instructions listed above

To file by mail, visit the Texas Franchise Tax Forms page, click on the report year, click “EZ Computation” or “Long Form”, then click “05-102, Public Information Report” to download the form. Once complete, mail it to:

Comptroller of Public Accounts

Open Records Section

PO Box 13528

Austin, TX 78711-3528

Note: The mailing address is subject to change. Please double-check this mailing address with the address listed on the Public Information Report.

Texas Franchise Tax – Frequently Asked Questions

Is this the Texas LLC annual report?

Sort of. In most states, an LLC files an Annual Report with the Secretary of State’s office. However, in Texas, that type of “annual report” doesn’t exist, meaning, there are no annual filing requirements with the Texas Secretary of State.

Instead, the annual requirement for Texas LLCs is to remain compliant with the Texas Comptroller by filing annual franchise tax reports (and other taxes, if applicable).

Having said all that, the Comptroller (and other professionals) may loosely refer to the franchise tax reports as “annual reports”. Most often though, they’re just called annual franchise tax reports.

How do I find my Texas Webfile number?

The Texas Comptroller’s office will mail your LLC a “Welcome Letter” within a few weeks of your LLC being approved. It will be sent to your Registered Agent’s address.

If you didn’t receive a “Welcome Letter” (which includes your WebFile Number), you can call the Texas Comptroller’s office at 800-442-3453. Their hours are 8am to 5pm Central Time, Monday through Friday.

You will need your Texas Taxpayer ID Number though. That can be found by searching your LLC name on the Texas Taxable Entity Search page.

What is the No Tax Due Threshold for Texas franchise tax?

The “No Tax Due Threshold” states that if your LLC’s annualized total revenue is below a certain amount, you don’t have to pay franchise tax. You still have to file a No Tax Due Report (Form 05-163).

As per the Texas Tax Code: Section 171.006, the “No Tax Due Threshold” is adjusted every 2 years (in even-numbered years).

The most current “No Tax Due Threshold” is $1,230,000 in annualized total revenue.

(per 12-month period on which the margin is based)

For more information, please see the Comptroller’s franchise tax overview page.

Does my LLC have to file estimated taxes in Texas?

No. Texas doesn’t require that your LLC file estimated tax reports or payments.

What’s the difference between an SOS File Number, a Taxpayer ID, and a Federal Tax ID Number?

Your SOS (Secretary of State) File Number will be on your LLC’s stamped and approved Certificate of Formation. This is a number that the Secretary of State’s office uses to identify your LLC.

Your Taxpayer ID Number is an 11-digit number assigned to your LLC by the Texas Comptroller’s office for tax and reporting purposes. You can find this number by doing a Texas Taxable Entity Search.

A Federal Tax ID Number is issued by the IRS after you apply. You’ll want to wait for your LLC to be approved. Your Federal Tax ID Number can be obtained online, by mail, or by fax. A Federal Tax ID Number is also known as:

- EIN (Employer Identification Number)

- FEIN (Federal Employer Identification Number)

What is a Texas passive entity?

You may see notes about Texas passive entities not having to file any “No Tax Due” returns.

While most LLCs are “pass through” entities for federal taxation, the term “passive entity” has a different meaning in Texas.

The term “passive entity” doesn’t apply to LLCs in Texas.

It only applies to Sole Proprietorships and Partnerships (not LLCs taxed like Sole Proprietorships or Partnerships).

What is Combined Reporting?

If your Texas LLC is part of an affiliate group (which includes LLCs and other entities) engaged in a unitary business, then it doesn’t need to file a separate Annual Franchise Tax Report. Instead, the group can file a Combined Group Report.

Note: A newly-formed veteran-owned LLC cannot file as part of a Combined Group.

For more information, please see the Comptroller’s FAQs on Combined Reporting.

What is a Tiered Partnership?

A Tiered Partnership election (for Texas franchise tax purposes) applies to an LLC that is in a parent/child relationship, also referred to as parent/subsidiary relationship.

A Tiered Partnership election is not mandatory (it’s optional) and it reflects IRS rules: it allows a child (or subsidiary LLC) to “pass” its total revenue up to the parent entity. Then the parent entity combines the child/subsidiary revenue with its revenue and reports it all together to the Comptroller.

Texas refers to parent entities as “upper tier” entities and child/subsidiary entities as “lower tier” entities.

This Tiered Partnership election only applies to LLCs that either:

- owns another taxable entity which is treated as a Partnership or an S Corporation; or

- is a Multi-Member LLC that is owned by another taxable entity

Notes:

- in a Tiered Partnership election, the lower-tier entity can’t pass its margin deduction (COGS, compensation, 70% of revenue, or $1 million) to the upper-tier entity

- a newly-formed Veteran-owned LLC cannot elect Tiered Partnership treatment

For more information, please see the Comptroller’s FAQs on Tiered Partnerships.

Do I send the Texas Comptroller my federal tax return?

No. The Texas Comptroller doesn’t require a copy of your federal tax return.

Does my LLC need to file an Ownership Information Report (05-167)?

No. Form 05-167 is not for LLCs. It’s for other entities.

Texas LLCs file a Public Information Report (Form 05-102) instead.

Do I need to file a Texas franchise tax report?

If you have a Texas LLC (or a foreign LLC registered in Texas), yes, you do.

All Texas LLCs must file a Franchise Tax Report. Which report you file will depend on your LLC’s annualized Total Revenue.

If your LLC’s Total Revenue is under the “No Tax Due Threshold” of $1,230,000, then yes, you need to file a Texas Franchise Tax Report, but you don’t have to pay a tax.

Does a single-member LLC need to file a Texas franchise tax report?

Yes. All Texas LLCs must file a Franchise Tax Report. It doesn’t matter if your LLC is a Single-Member LLC or a Multi-Member LLC.

However, as mentioned above, your LLC most likely only needs to file a Franchise Tax Report, but doesn’t have to pay any tax.

The reason many people get confused about this is they see information on the Comptroller’s website (or somewhere else online) that says “Sole Proprietorships don’t have to file franchise tax reports“.

And while that statement is true, your LLC is not a Sole Proprietorship. A Single-Member LLC is taxed like a Sole Proprietorship (big difference).

Texas Tax Code: Section 171.0002 (d) states: “An entity that can file as a sole proprietorship for federal tax purposes is not a sole proprietorship for [Texas franchise tax] purposes…”

Does my disregarded entity LLC need to file a franchise tax report?

Yes. A Disregarded Entity LLC is an IRS term. The Texas Comptroller doesn’t care how your LLC is taxed by the IRS.

All LLCs formed in Texas (or doing business in Texas) are subject to the franchise tax.

How does a Series LLC file Franchise Tax?

Although a Texas Series LLC has multiple “series”, the Series LLC is treated as one legal entity for franchise tax purposes.

Therefore, it has to file only one annual franchise tax report:

- No Tax Due

- EZ Computation

- Long Form

The Texas Series LLC also has to file a Public Information Report.

Are veterans exempt from franchise tax?

If you properly formed a Texas veteran LLC, and it’s in the Secretary of State and Comptroller’s system, you are exempt from paying any franchise tax for the first 5 years. Your veteran LLC must have been formed on or after 1/1/2022 and before 12/13/2025.

While you are exempt from paying any franchise tax, you still have to file a No Tax Due Report every year. Veteran LLCs, however, don’t have to file a Public Information Report, as we’ve explained above.

What businesses are exempt from Texas franchise tax?

The following businesses are exempt from franchise tax:

How is an LLC taxed in Texas?

A Texas LLC doesn’t pay state income tax, but instead, has to file a Franchise Tax Report, as mentioned above. You’ll have to pay a tax if your LLC’s Total Revenue is over the “No Tax Due Threshold” of $1,230,000.

Your Texas LLC may also be responsible for other state taxes, such as sales tax and other taxes.

For more information, please see our Texas LLC taxes page.

Questions? Texas Comptroller Contact Info

If you have any questions, you can contact the Texas Comptroller at 800-252-1381. Their hours are Monday through Friday, from 8am to 5pm Central Time. If you call early, their hold times are very short (1-5 minutes).

Texas Comptroller of Public Accounts

800-252-1381 (franchise tax)

Texas Comptroller: locations and hours

Texas Comptroller: calling tips and peak schedule

Texas Comptroller: contact the Comptroller’s Office

References

Texas Tax Code: Chapter 171

Texas TX Comptroller: Franchise Tax

Texas Comptroller: Tax publications

Texas Comptroller: Franchise Tax overview

Texas Comptroller: FAQs on Taxable Entities

Texas Comptroller: How to add WebFile access

Texas Comptroller: Getting started with WebFile

Texas Comptroller: Certificate of Account Status

Texas Comptroller: FAQs on Combined Reporting

Texas Comptroller: FAQs on compensation deduction

Texas Comptroller: FAQs on calculating Total Revenue

Texas Comptroller: FAQs on cost of goods sold deduction

Texas Administrative Code: Subchapter V (Franchise Tax)

Texas Administrative Code: Subchapter A (General Rules)

Texas Comptroller: Reasons for courtesy or statutory notices

Texas Comptroller: Transparency, where state revenue comes from

Texas Comptroller: FAQs on Franchise Tax reports and payments

Texas Comptroller: requirements for reporting and paying Franchise Tax electronically

Texas Department of Banking: Proof of Good Standing with the Texas Comptroller

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi,

I have filed texas franchise return. However, I have received a letter from the IRS.

It is mentioned that I have to file “Complete Franchise Accountability Questionnaire” from the comptroller site.

Here’s a screenshot for your clearification:

Screenshot of Letter:

https://ibb.co/m6dxZ96

Screenshot from the website:

https://ibb.co/k13hnm9

so, My question is, Is it necessary to fill it Questionnaire? Is there any penalty for it? Also, Do you have any guide/reference on how to fill this?

Looking forward to your response.

Thanks

Hi Malik, to clarify, that letter is from the Texas Comptroller, not the IRS. And yes, you should fill out the questionnaire for the Comptroller. The page you’re on here has some information about the questionnaire above.

Hi,

Thanks for your response.

My question is, Is it necessary to fill it out? Is there any penalty if I just ignore this..

Yes, it’s necessary to fill out. You need to submit it so the Texas Comptroller knows what taxes and filings your LLC is responsible for. And so they can issue your LLC one (or multiple) WebFile Number(s). I haven’t been asked before about the penalty, but I’d image there is a penalty, as filing the report is a state requirement. Hope that helps.

What is the start date for Texas franchise taxes.

The due date is may 15.

I’m guessing you’re asking about the “Accounting Year Begin Date”. And I’m going to assume your tax year is the calendar year (January – December), as this is the most common. If those are both correct and this is the first time you’re filing the Texas Franchise Tax Report, this will be the date your LLC was approved. If this isn’t your first filing, then it’ll be 01/01/2022 to 12/31/2022 (assuming your filing in the 2023 report year for the 2022 calendar year).

How do I find the correct SIC and NAICS code for my business?

Hi Morgan, you get to select which NAICS code and SIC code you’d like to use for your Texas LLC. We have some more information here: NAICS code for LLC. Hope that helps.