Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Annual Report filings for Washington LLCs

After you form a Washington LLC, and file your Initial Report, you then must file an Annual Report every year.

You need to file an Annual Report in order to keep your Washington LLC in compliance and in good standing.

Washington LLC Annual Report Fee:

$60 per year

Due date:

Your Washington LLC Annual Report is due every year by the end of your LLC’s anniversary month. Your LLC’s anniversary month is the month your LLC was approved.

You can find this date in the upper right corner of your stamped and approved Certificate of Formation. You can also use the advanced business search on the state’s website to search for your LLC name, then look for the “formation/registration” date.

You can find this date in the upper right corner of your stamped and approved Certificate of Formation. You can also use the advanced business search on the state’s website to search for your LLC name, then look for the “formation/registration” date.

For example, if your Washington LLC was approved on August 5th 2025, your first Annual Report will be due by August 31st 2026. Then every year going forward it will be due by August 31st.

Please keep in mind that these anniversary month due dates are for your Annual Reports, not your Initial Report. The Initial Report is due within 120 days of your LLC being formed. Then the Annual Reports are due every year by the end of the LLC’s anniversary month. This can be a little bit confusing because the Initial Report is sometimes referred to as the “first” Annual Report.

For more information on Initial Reports, please see Washington LLC Initial Report.

Penalty:

Once your LLC misses the due date, the Secretary of State will add a $25 penalty onto the filing fee. Instead of the total being $60, it will be $85.

If your LLC Annual Report is still not filed within 90 days of the due date, the Secretary of State will administratively dissolve your Washington LLC. Said another way, they will shut it down.

Reminders:

The Secretary of State will mail a courtesy reminder to your LLC’s Registered Agent address. This is sent approximately 45 days before the Annual Report due date.

However, even if you don’t receive the courtesy reminder from the Secretary of State, it is still your responsibility to file your LLC Annual Report on time. As mentioned above, failure to do so will result in your LLC being shut down by the state.

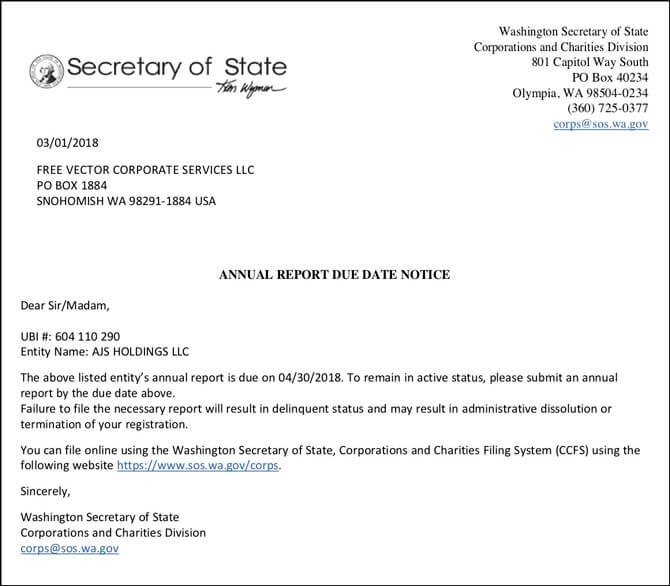

Here’s what the LLC Annual Report Reminder will look like:

Annual Report filing methods & processing times:

You can file a Washington LLC Annual Report by mail or online, however the state prefers that you file online. We also recommend the online filing as it’s much easier, and the Annual Report will be approved instantly.

On the other hand, if you file your LLC Annual Report by mail, the processing time is 10 to 12 business days.

The filing fee for both the online filing and the mail filing is $60.

Important: The step-by-step information below is only for the online filing method. If you prefer to file by mail, please download the Paper Annual Report and mail it to the state with a check or money order for $60 (payable to “Secretary of State”). The mailing address is WA Corporation & Charities Division, PO Box 40234, Olympia, WA 98504-0234.

Important:

The #1 reason that LLCs are shut down by the Washington Secretary of State is for failure to file an Annual Report.

Even if you do not receive any of the reminders (from the state or from your Registered Agent), it is still your responsibility to file your Washington LLC’s Annual Report every year.

For that reason, we strongly recommend putting a repeating reminder on your phone and computer, as well as writing it out and putting it in some place where you’ll see it every year.

Washington LLC Annual Report (Online)

If you haven’t done so already, you’ll need to create an online account with the state. This is called the Corporations & Charities Filing System (CCFS).

You can create a CCFS account here.

Get Started:

– In the left navigation menu, click “Business Maintenance Filings”.

– Then click “Annual Report”.

Business Search:

Search for your Washington LLC using either its UBI Number or its name. Select your LLC from the list below and then click “Continue”.

Note: Most of your LLC’s information will be pulled in from your Certificate of Formation so for the most part you’ll be verifying/confirming information. However, if something needs to be changed, you can update that in your LLC’s Annual Report. There will also be some new sections that need your LLC’s information.

Business Information:

There’s nothing you need to do here. It just shows your Washington LLC information.

Registered Agent:

If you need to edit your LLC’s existing Registered Agent information, click the pencil icon to the right.

If you need to add a new Registered Agent, you first must delete the existing Registered Agent and then add a new one.

In Washington state you have 3 options for who can be your LLC’s Registered Agent. For more information please see our prior lesson: Washington LLC Registered Agent.

Principal Office:

Review your Principal Office address information and make any changes or updates (if needed).

If you haven’t yet entered an email address, you must do so now. Entering a phone number is optional.

Don’t check off the Address Confidentiality Program box unless you are actually a part of the program. The ACP offers privacy for people who have been the victim of a crime.

Governors:

In Washington state the term “Governor” means any LLC Member or Manager.

You should see your existing LLC Governor information already in place. If you need to edit or delete a Governor you can do so by clicking the icons to the right. If you need to add any additional Governors click the “Add Governor” button.

For more information on the difference between an LLC Member and an LLC Manager please see the following article: Member-Managed LLC vs Manager-Managed LLC.

For more information on the state’s definition of an LLC Governor, please see #12 of RCW 23.95.105.

Nature of Business:

If this field is blank, you’ll need to select the type of business (or the type of businesses, if multiple) that your Washington LLC will engage in.

If you can’t find something that fits the nature of your LLC business from the drop-down menu, you can check off the “Other” box below and enter the business activities that your LLC will engage in.

For example, it can be just a few words like “buying and selling real estate”, “bookstore”, “e-commerce”, or it can be a longer explanation or sentence if needed.

Washington state also allows for a general purpose, which means your LLC can engage in any and all legal activity. If you prefer to file your Washington LLC with a general purpose, you can select “Any Lawful Purpose” from the drop-down menu.

If you’re not 100% sure about what type of activity your Washington LLC will engage in, or you’re worried that the state will always force you to do the same thing, that’s not the case. You can always update your LLC’s business purpose in next year’s Annual Report. Or you can just select a general purpose LLC, which is what most filers do.

Effective Date:

Select “Date of Filing” since you’ll want this Annual Report to be effective as soon as possible.

Controlling Interest:

Does your company own real property (including leasehold interests) in Washington?

Select “Yes” or “No” depending on whether or not your LLC owns any real estate, including leasehold interests in Washington State.

If you answer “Yes”, additional questions will appear below. You will likely need to notify the Washington Department of Revenue.

For more information on an LLC’s Controlling Interest, you can call the Department of Revenue at 360-534-1503 or visit their website.

Return Address for this Filing:

This section is optional and can be used if you would like your LLC Annual Report approval mailed and/or emailed somewhere besides the default option.

By default, the state mails a stamped and approved copy of your Annual Report to your LLC Registered Agent’s address. They’ll also send you an email with your approval document attached (the email you used when creating your CCFS account).

If instead you’d like the stamped and approved copy of your Annual Report mailed to an address different than your LLC Registered Agent’s address, you can enter that here.

Do keep in mind that whatever information is entered in this section will become a part of your LLC filing and will be listed on the state’s website (this information isn’t private).

Most filers are okay with the default and leave this section blank.

Upload Additional Documents:

This section can be used if you’d like to include any additional attachments with your LLC Annual Report.

Most filers don’t upload any additional attachments.

Email Opt-in:

By default, the Washington Secretary of State sends Annual Report reminders (by mail) to your LLC’s Registered Agent.

If instead you’d like to receive these reminders by email only, you can check off this box.

If you’re not sure yet, you can also leave this box unchecked, and then you can select this option at a later date, during a future Annual Report filing.

If you’re not super tech-comfortable and/or don’t use your computer all the time, we recommend leaving this box unchecked. This way, If you are your LLC’s Registered Agent, you will be sure to see your Annual Report reminder when it is sent to you by mail.

However, if you hired a Registered Agent service and you leave this box unchecked, then they’ll receive your Annual Report reminder by mail, and then they’ll likely scan and email it to you. So it’s pretty much the same thing.

If you keep an eye on your inbox and you’re prepared to get email reminders from the state, you can check off the Email Opt-in box. It’s kind of like “paperless statements” that come from the bank, but instead of it being statements, it’s reminder notices.

Authorized Person:

An Authorized Person is the person or company who has the authority to sign your LLC Annual Report.

Most filers are the Members (owners) of their LLC as well as the Authorized Person.

If that’s the case for you, check off the box that says “I am an authorized person”, select “Individual”, enter your first and last name, and then check off the box in the bottom section that the information listed in your LLC Annual Report is true and correct.

Once finished, click the “Continue” button to go to the next step.

Review:

On the next page, you will see a preview of your Washington LLC Annual Report. Please review this page carefully and look for any errors or typos.

If you need to make any changes, click the “Back” button at the bottom.

If everything looks good, click the “Add to Cart” button to proceed.

Shopping Cart:

Select the checkbox to the left of your LLC Annual Report filing and then click the “Check Out” button.

On the next page, click “Proceed to Checkout”.

Enter your first and last name, then enter your credit or debit card information, and click the “Place Your Order” button.

Congratulations, your Washington LLC Annual Report has been filed for processing!

Now you just need to wait for your Annual Report to be approved.

Washington LLC Annual Report Approval

If you file your Washington LLC Annual Report online, it will be approved instantly. Your approval will come in the form of a stamped and approved copy of your Annual Report.

You’ll find it in your CCFS dashboard or you can do a business search for your LLC, click on your LLC name, click on “Filing History” at the bottom, look for “Annual Report” and click “View Documents”. Then click the small icon to the right of “Annual Report – Fulfilled” to download and save the PDF file.

If you file your Washington LLC Annual Report by mail, it will be processed within 10 to 12 business days and then the approval will be mailed to your LLC’s Registered Agent.

You can also do a business search after 10-12 business days to download a copy of your approved Annual Report as well.

We recommend keeping the copies of your LLC’s approved Annual Reports in a safe place.

And don’t forget that calendar reminder – or writing a note in a place where you can easily see it – for filing your Annual Report next year.

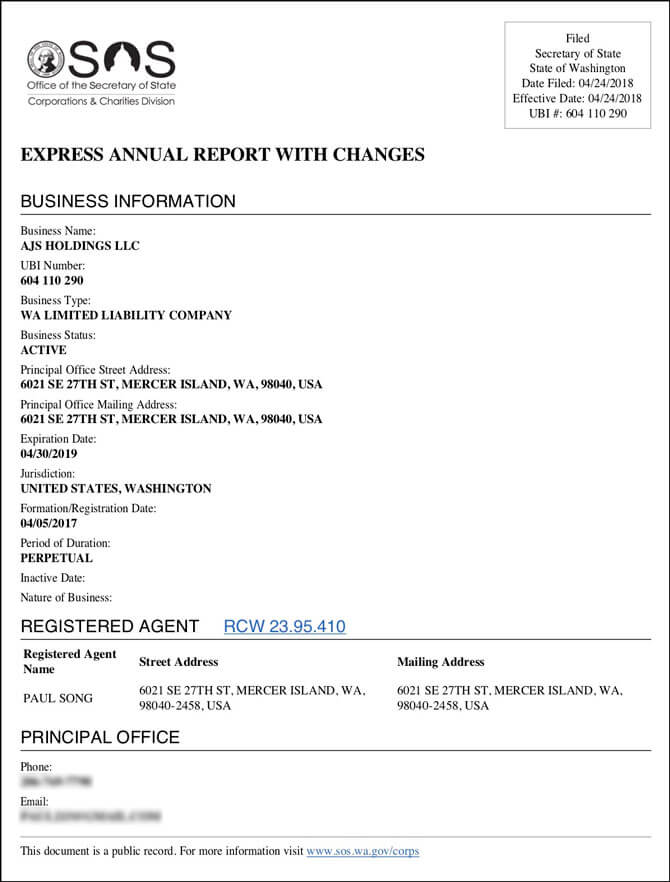

Here’s an example of what the Annual Report approval will look like:

Washington Secretary of State Contact Info

If you have any questions, you can contact the Washington Secretary of State at 360-725-0377. Their hours are Monday through Friday from 8am to 5pm Pacific Time.

References

Revised Code of Washington: Section 23.95.255

Revised Code of Washington: Section 25.15.106

Washington Secretary of State: Annual Report FAQs

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Washington LLC Guide

Looking for an overview? See Washington LLC

My extended family and I started an LLC to acquire a secondary home (6 LLC members in total) that we may or may not turn into a vacation rental. It still needs a lot of work before we can rent it out. I have been filing $0 income on our WA LLC annual report. Is there a term limit or any penalities if we do not generate income on this property?

Hi B, great question. And good news, the answer is no. There is no rush or pressure or penalty for a non-income earning LLC. So take your time :)

If I’ve dissolved the LLC with WA State, do I still need to submit an annual report?

Hi Buck, no. Once the LLC is dissolved, you don’t have to file an Annual Report anymore.

Hello, I have already filed my annual report for this year and hadn’t realized I needed to change the owners/governors on the annual report in order to remove one of them from ownership. Is there a way to amend this or am I required to continue with them for an additional year, until my next filing date? Thank you for your time!

Hi CJ, no you are not stuck with them. You can file an amended Annual Report. After you login to Corporations & Charities Filing System (CCFS), click “Business Maintenance Filings” and then select “Amended Annual Report”.

You should also document the transfer of the Member’s membership interest via a sale or assignment of LLC membership interest (we don’t provide this form at this time) as well as amending the LLC’s Operating Agreement.

You also need to update the Washington Department of Licensing. Please see Form 700 306: Change in Governing People, Percentage Owned

and/or Stock/Unit Ownership Form.

How many Members are now left in the LLC?

Our LLC owns a commercial building and acts as landlord. I used to manage the LLC from the building when my husband was a tenant. Now he has retired and I have moved the office for the LLC to our home, which is in a different city from the commercial building the LLC owns and manages. I have tried to change the official address of the LLC but the old address still appears on the “File annual report with changes” e-form and this section is not editable. Where do I change the official address of the LLC?

Hi Annie, Washington LLCs have a number of addresses attached to them. And different state agencies (ex: Secretary of State and Department of Revenue) may have different addresses on file. Would you mind sharing your LLC name?

Our nonprofit Way Back Inn files an annual report and charity renewal each year. Our UBI is 601368930. If we are an LLC, is there a separate renewal for an LLC Annual Report that is different than the one we have been currently filing. We are all volunteers and don’t know if we are an LLC or not. Can you please advise us of our requirements as we want to do things correctly?

Hello, according to the Washington Corporations Division website, the Way Back Inn is a Non-profit Corporation (not an LLC). Non-profit Corporations do have an Annual Report to file each year. The annual fee is $10. The Annual Report is due every year by the last day of the anniversary month. The Way Back Inn’s anniversary month is February, so the Annual Report is due before the last day of February each year. You can file the Annual Report by mail or online. Please see here: Washington Corporations Division: Annual Reports. If you any questions, you can contact the Washington Division of Corporations at 360-725-0377. Hope that helps.

Thank you very much Matt for your very quick response. We appreciate it very much.

You’re very welcome :)

I am a Governor of an LLC registered in the State of Washington. When I think of an annual report, I think of a report containing financial information related to sales, investments and business relevant information. Our CEO has repeatedly failed or refused to meet that standard if that is what is required in an LLC annual report. What is required in an annual report for an LLC registered in WA?

Hi Richard, the information requested from the state in a Washington LLC Annual Report is actually listed on this page. Hope that helps.

thank you so much

You’re welcome Maria!

Thank you so much! This is the first time I had to file an annual report and I could have not done it without the help of this article. Appreciate it!

Hey Nidhi, you’re very welcome! Thanks for the nice comment :)