Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Certificate of Formation filing for Washington LLCs

In this lesson, you’ll learn how to form a Washington LLC. We will walk you through filing the Certificate of Formation and Initial Report with the Washington Secretary of State.

In this lesson, you’ll learn how to form a Washington LLC. We will walk you through filing the Certificate of Formation and Initial Report with the Washington Secretary of State.

The Certificate of Formation is the form that officially creates your LLC in Washington state.

Washington State LLC Filing Fee:

The Washington state LLC filing is $200.

This is a one-time filing fee.

Note: The “LLC filing fee” (the fee to create a Washington State LLC) is the same thing as the “Certificate of Formation fee”. The Certificate of Formation is the document, that once approved by the Secretary of State’s office, creates your Washington State LLC.

How much is an LLC in Washington explains all the fees you’ll pay, including the Certificate of Formation filing fee.

Washington State LLC Approval:

By Mail:

If you form your Washington LLC by mail, it will take 5-6 weeks (plus mail time) to be approved.

Keep in mind that it will take a little longer for your documents to arrive at the Secretary of State’s office, and to return to you in the mail after the state approves them.

Online:

If you form your Washington LLC online, it will take 5-6 weeks (plus mail time) to be approved.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Washington.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Washington LLC Initial Report:

An Initial Report can be thought of as your LLC’s “first” Annual Report. We’ll be discussing Annual Reports in greater detail in another lesson, but for now, the important thing to know is that your LLC’s Initial Report is due within 120 days after your LLC is approved. After that, your Annual Reports are due just once every year.

If you were to form your Washington LLC by mail, the Certificate of Formation would be one filing that costs $200, and your Initial Report would be a separate filing that costs $30.

However, if you form your Washington LLC online, not only is the approval time much faster, but your Initial Report is included for free ($0).

Our team at LLC University® recommends filing your Washington LLC online. Not only is your LLC approved faster and the whole process is much easier, but you also save $30 by filing your Initial Report at the same time.

The instructions that you’ll find below are for the online filing only.

If you’d like to file by mail instead, the instructions below can be referred to, however you need to download the Certificate of Formation and send your $200 filing fee in with a check or money order made payable to the “Secretary of State”.

Alternatively, if you want to hire a company to form your LLC, check out Best LLC Services in Washington.

Before you continue: Make sure you searched to check that your Washington LLC Name is available, and you’ve chosen a Washington LLC Registered Agent.

Washington State LLC Certificate of Formation (Online Filing)

Before filing your Certificate of Formation online, you need to create an account with the Washington Secretary of State.

This account is known as the Corporations & Charities Filing System (CCFS) and it just takes a few minutes to create one.

Create an Account with the Corporations & Charities Filing System (CCFS)

- Visit this page: Washington Corporations and Charities Filing System Login

- On the right side of the page, click the “Create a User Account” button.

- Under “User Account” click “Continue”.

- For User Type, select “Individual” and click “Continue”.

- Create a User ID and a password, then click “Continue”. Make sure to keep your login information in a safe place. We like using 1Password.

- Enter your contact information and then click “Continue”. We recommend entering the email address which you check most often.

- The address information isn’t required at this step (and this isn’t your LLC filing), so we recommend leaving it blank since it’s optional and can cause confusion. We’ll be entering the LLC address information in a few steps ahead.

- Click “Register” to complete your account setup.

- There’s one last step. You need to go to your email inbox and click the confirmation link that the state sent you. The link should say something like “Activate your account”. Click that link and then login.

- Your account is successfully verified and you’re now inside your online dashboard and ready to begin!

Corporations & Charities Filing System (CCFS) – Online Dashboard

To get started forming your LLC in Washington state:

Look in the left sidebar navigation and click on “Create or Register a Business”.

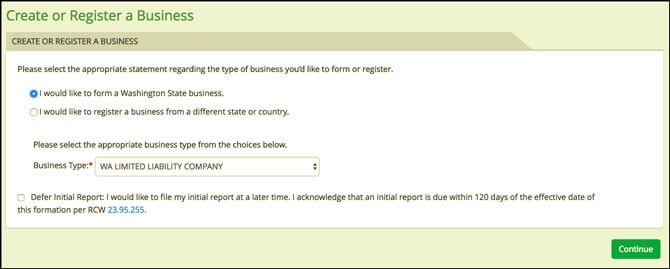

Domestic Washington LLC vs. Foreign LLC:

A Domestic LLC in Washington is an LLC that was formed in Washington.

A Foreign LLC is an LLC that was formed outside of Washington and then registers to do business in the state. This is also known as “foreign qualification“.

Since most of our readers live in Washington state and will be doing business in Washington, they’ll be forming a Domestic LLC.

If that’s the case for you, select “I would like to form a Washington state business.”

- Related article: Domestic LLC vs Foreign LLC

Business Type:

Select “WA Limited Liability Company”.

Defer Initial Report:

We don’t recommend checking this box off. Instead, leave it unchecked.

All LLCs in Washington must regularly file an Annual Report in order to remain in good standing with the Washington Secretary of State.

The first Annual Report is called the “Initial Report” (aka “Initial Annual Report”) and this is due within 120 days of your Washington LLC being approved.

So while you could file this Initial Report later, we recommend filing it now to save time and get everything done in one go.

Additionally, if you choose to file your LLC Initial Report at a future date it will cost you $30, but if you file it now along with your Certificate of Formation, the cost is $0.

Then click the “Continue” button to proceed.

Here’s a screenshot of an example filing:

UBI Number:

UBI stands for “Unified Business Identifier“, it’s unique to your Washington LLC, and it will be used across multiple state registrations.

Most filers don’t have a UBI, so they check off “No”. The state will issue your Washington LLC a UBI after it’s approved.

Business Name:

Note: Make sure you have read our Washington LLC name lesson before proceeding.

Do you already have a name reserved with this office?

A name reservation is not required in order to form a Washington state LLC. Most filers select “No” since they did not reserve a name. If you reserved a name ahead of time check off “Yes” and enter your Name Reservation Number.

Submit a name for review:

Enter your desired Washington LLC name including the designator and click the “Look Up” button.

You’ll see a list of businesses that exist in the state that are similar to your desired LLC name.

If your desired Washington LLC name is available, you will see the word “Available”:

If your desired Washington LLC name is not available, you will see the words “Not Available” and you’ll usually see the name that caused the conflict either above or below your desired LLC name:

If your desired LLC name is not available, you will need to think of a unique variation or a completely new LLC name.

Note: Although you can change your LLC name in the future by filing an amendment, if you’re not sure about what your LLC name should be, we recommend sleeping on it for a few nights because changing your LLC name at a later date is a major pain in the neck. Not only do you have to file an amendment and pay a state filing fee, but you also need to update the IRS, the Washington Department of Revenue, your bank, any place where you do business, and all online registrations.

Registered Agent Consent:

Reminder: You have 3 options for who can be your LLC Registered Agent in Washington state and there may be pros and cons depending on which option you choose. Please make sure you have read our Washington Registered Agent lesson before proceeding. You can learn more in Is a Registered Agent a Member of an LLC?

If you’re going to be the Registered Agent for your Washington LLC, select the 1st option, “I am the Registered Agent. Use my Contact Information.” You’ll see the “Registered Agent” field expand below and your name will be added. Then enter your street address in Washington state. You only need to enter a mailing address if you prefer to receive mail at a location different than your street address.

If a friend or family member is going to be the Registered Agent for your Washington LLC, select the 2nd option.

If you hired a Washington Registered Agent Service (aka Commercial Registered Agent), you’ll also select the 2nd option.

As per RCW 23.95.415 (#2), “A registered agent shall not be appointed without having given prior consent in a record to the appointment.”

Plain English: The person or company serving as your LLC Registered Agent should sign a consent form agreeing to be your LLC Registered Agent in Washington state.

If you, a friend, or a family member are going to be your Washington LLC’s Registered Agent, you/they should sign a Registered Agent Consent Form. This form does not need to be sent to the Washington Secretary of State, the Department of Revenue, or the IRS. Just keep a few copies with your LLC’s business records.

If you hired a Washington Registered Agent Service (such as Northwest Registered Agent), they should have provided you with a signed Consent Form after you registered for their services. If you have not received that form yet, you will need to call or email them and request it.

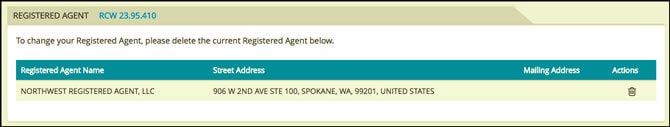

Registered Agent:

If your Washington LLC’s Registered Agent will be a friend or a family member, select “Non-Commercial Registered Agent”, select “Individual”, enter their first name and last name, and then click “Search”. Obviously, they’re not going to appear in any search results, but in the pop-up menu you’re going to click “Add New Agent”. Then enter their email address and their street address in Washington below. You only need to enter a mailing address if they prefer to receive mail at a location different than the street address.

If you hired a Washington Registered Agent service, select “Commercial Registered Agent”. Then select “Entity”, enter the company name, and then click “Search”. A pop-up will appear with their business name. Click the radio button underneath “Select” and then click “Select Agent”.

For our example filing, we’ve hired Northwest Registered Agent and our filing looks like:

(yours may look slightly different depending on who you choose as your LLC registered agent)

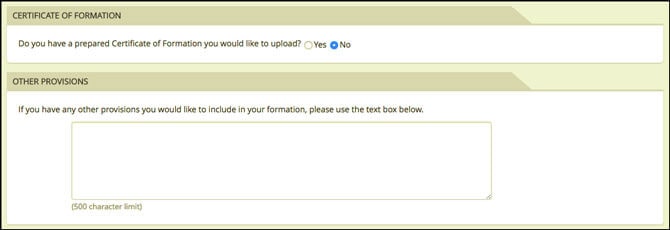

Certificate of Formation:

“Do you have a prepared Certificate of Formation you would like to upload?”

You can select “No” since you’ll be entering all of the information electronically in the online LLC filing.

Other Provisions:

If you have any other provisions you’d like to add to your LLC’s filing (besides the default provisions), you can do so in this section.

Most filers leave this section blank unless they’ve been instructed otherwise by their attorney.

Here’s what our example filing looks like:

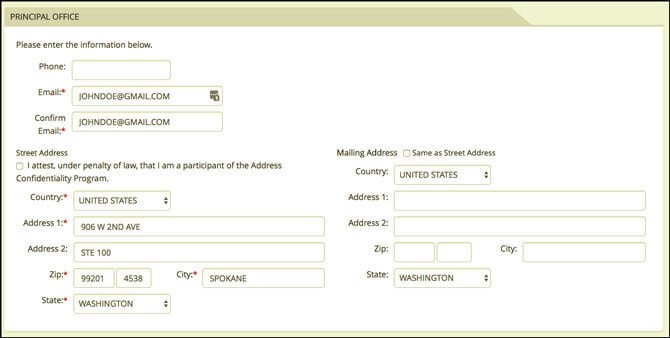

Principal Office:

Email address:

Enter your e-mail address twice.

Address Confidentiality Program:

“I attest, under penalty of law, that I am a participant of the Address Confidentiality Program.”

Don’t check this box off unless you are a part of the Washington Address Confidentiality Program (ACP), as per Chapter 40.24 RCW. The ACP program offers privacy for people who have been the victim of a crime.

Street Address (of Principal Office):

As per #13 of RCW 25.15.006, enter the street address of your Washington LLC’s Principal Office.

This address is the location where the primary business activities take place and/or the place where business records are kept.

The street address of your LLC’s Principal Office can’t be a PO Box address. It also can’t be a PMB (Private Mailbox) or CMRA (Commercial Mail Receiving Agency), such as The UPS Store.

Your LLC’s Principal Office location must be a street address, however this street address does not need to be located in Washington state, or within the United States for that matter. This address can be located within Washington state, outside of Washington state, or in any country.

For many filers this address will be their actual office address or their home address.

If you would like to keep your address private and off of public records, as we’ve mentioned in the prior lesson you can hire a Registered Agent service and use their address as your Principal Office address. The company we recommend is Northwest Registered Agent ($125 per year).

Special offer: Hire Northwest to form your LLC ($39 + state fee), and you'll get a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

Mailing Address (of Principal Office):

You can leave the mailing address section blank unless you prefer to receive mail at an address that is different than the street address you entered to the left.

Here’s what our example filing looks like:

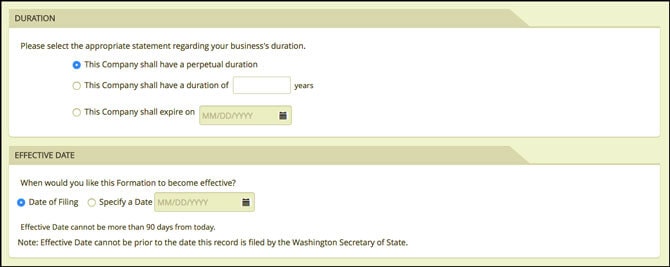

Duration:

The duration of a Washington LLC is how long the LLC will remain in existence.

Most filers choose the first option “This company shall have a perpetual duration“. This means the Washington LLC will remain open and in existence until it is shut down by the LLC members or administratively shut down by the state (usually for failure to file an Annual Report).

If you prefer for your Washington LLC to automatically shut down on a future date you can select the second or the third option.

Effective Date:

Think of the LLC effective date as the date your LLC is “born”. This is the official date that your Washington LLC goes into existence.

Most filers choose the first option, which means their LLC will go into existence on the date it is approved by the Washington Secretary of State.

However, if you’re forming your Washington LLC later in the year, such as October, November, or December, it may be a good idea to forward-date your filing to January 1st of next year. This will save you the hassle of filing taxes for those few months.

For more information on effective dates, please see LLC effective date.

Here’s what our example filing looks like:

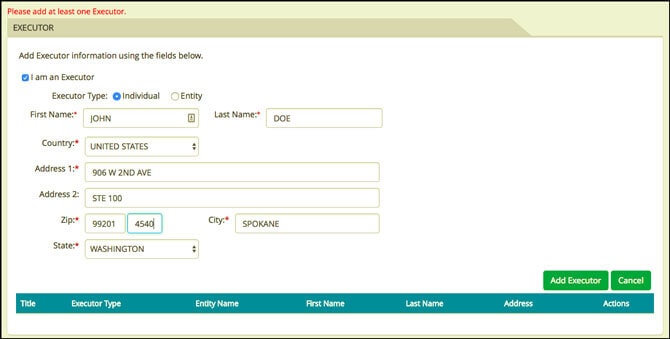

LLC Executor:

An LLC Executor (usually referred to as an LLC Organizer in most states) is the person or company who is filing the Certificate of Formation with the Washington Secretary of State.

Learn more about an LLC Executor by reading these articles about the role of an LLC Organizer: Organizer vs Member and Registered Agent vs Organizer.

An LLC Executor is not automatically a member of the LLC; however, for most filers they are both a Member of the LLC as well as the Executor of the LLC’s Certificate of Formation.

Note: Your LLC cannot organize itself, so if you are filing your LLC Certificate of Formation you will select “Individual”, then enter your name and your address (not the name of your LLC).

Once finished, click the “Add Executor” button.

Here’s what our example filing looks like:

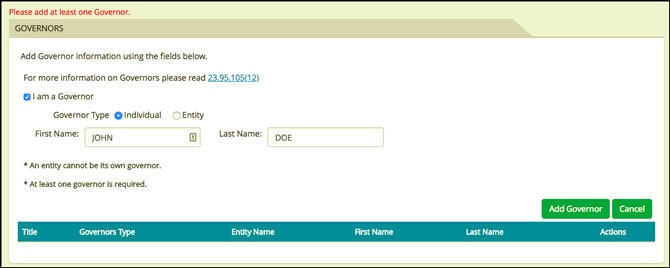

LLC Governors:

In Washington state, the term “Governor” means an LLC Member or LLC Manager.

You are required to list at least one LLC Governor; however, if your LLC has more than one Governor (Member or Manager), you can also list them as well.

Click the “Add Governor” button to save each LLC Governor that is added.

When opening an LLC bank account, the bank representatives will likely be looking for all the LLC Members to be listed as Governors in the Certificate of Formation; however, you are not required by law to do this. Of course if you don’t mind all LLC Members being on record, then you should add them.

If you’d only like to list 1 Governor you can do so. Then, to make your documentation and paper trail better for the bank, show them your LLC Operating Agreement (which lists all LLC Members). Additionally, you can also have the Executor (aka Organizer) sign a Statement of Organizer. This document shows the Executor creating the LLC and then appointing all of the LLC Governors. The Statement of Organizer form is an internal document and does not need to be filed with the Secretary of State. The bank should have no issue opening your LLC bank account with an Operating Agreement and Statement of Organizer.

Member-Managed vs. Manager-Managed LLC:

Although you don’t need to tell the Washington Secretary of State whether or not your LLC will be Member-Managed or Manager-Managed (or whether the Governor is a Member or a Manager), we think the following articles will be helpful for you to understand how LLCs are managed.

LLC University® related articles:

For more information on LLC Governors in Washington state, please see #12 of RCW 23.95.105.

Here’s what our example filing looks like:

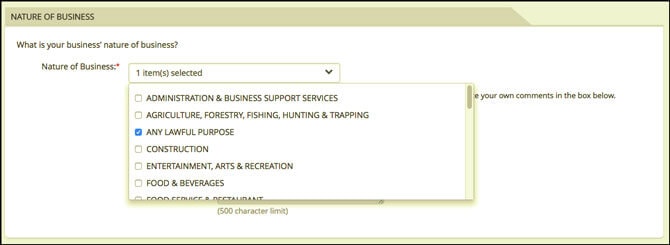

Nature of Business:

Select the type of business (or the type of businesses, if multiple) that your Washington LLC will engage in.

If you can’t find something that fits the nature of your LLC business from the drop-down menu, you can check off the “Other” box below and enter the business activities your LLC will engage in.

For example, it can just be a few words like “real estate investing”, “coffee shop”, “online retail”, or it can be a longer explanation or sentence if needed.

Washington state also allows for a general purpose, which means your LLC can engage in any and all legal activity. If you prefer to file your Washington LLC with a general purpose, you can select “Any Lawful Purpose” from the drop-down menu.

If you’re not 100% sure about what your Washington LLC will engage in, or you’re worried that the state will always force you to do the same thing, that’s not the case. You can always update your LLC’s business purpose in your ongoing Annual Report. Or you can just select a general purpose LLC, which is what most filers do.

Here’s what our example filing looks like:

Return Address for this Filing:

This section is optional and can be used if you would like your LLC approval documents to be mailed and/or emailed somewhere besides the default address.

By default, the state mails a stamped and approved copy of your Certificate of Formation to your LLC’s Registered Agent’s address. They’ll also send you an email with your approval documents attached (the email you used when creating your CCFS account for online filing).

If instead you’d like the stamped and approved copy of your Certificate of Formation mailed to an address different than your LLC Registered Agent’s address, you can enter that here.

Do keep in mind that whatever information is entered in this section will become a part of your LLC filing and will therefore be listed on the state’s website (this information isn’t private).

For our example filing, we left this blank. Reason why is that we hired Northwest Registered Agent in order to keep our address off public records. That means the Washington Secretary of State will mail our approved Certificate of Formation to our Registered Agent and then our Registered Agent will scan and email that document to us.

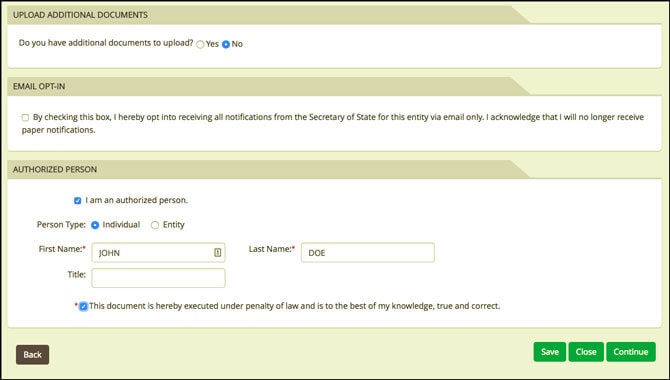

Upload Additional Documents:

This section can be used if you’d like to include any additional attachments with your Certificate of Formation.

Most filers don’t upload any additional attachments.

Email Opt-in:

By default, the Washington Secretary of State sends Annual Report reminders (by mail) to your LLC’s Registered Agent.

If instead you’d like to receive these reminders by email only, you can check off this box.

If you’re not sure yet, you can also leave this box unchecked, and then you can select this option at a later date (inside of your online account).

If you’re not super tech-comfortable and don’t use your computer all the time, we recommend leaving this box unchecked. This way, If you are your LLC Registered Agent, you will be sure to see your Annual Report reminder when it is sent to you by mail.

If you hired a Registered Agent service and you leave this box unchecked, then they’ll receive your Annual Report reminder by mail, and then they’ll scan and email it to you. So it’s pretty much the same thing.

If you keep an eye on your inbox and you’re prepared to get email reminders from the state, you can check off the Email Opt-in box.

Authorized Person:

An Authorized Person is the person or company who has the authority to sign your LLC Certificate of Formation.

Most filers are the Members (owners) of their LLC as well as the Authorized Person. If that’s the case, check off the box that says “I am an authorized person”, select “Individual”, enter your first and last name, and then check off the box in the bottom section that the information listed in your LLC Certificate of Formation is true and correct.

Once finished, click the “Continue” button.

Here’s what our example filing looks like:

Review:

On the next page, you will see a preview of your Washington LLC Certificate of Formation. Please review this page carefully and look for any errors or typos.

If you need to make any changes, click the “Back” button at the bottom.

If everything looks good, Click the “Add to Cart” button to proceed.

Shopping Cart:

Select the checkbox to the left of your LLC filing and then click the “Check Out” button.

The “online rapid processing fee” of $20 is mandatory and is automatically added to the $180 when filing your Washington LLC online ($200 total).

Next, click “Proceed to Checkout”.

Enter your first and last name, then enter your credit or debit card information, and click the “Place Your Order” button.

Congratulations, your Washington LLC filing has been submitted to the Secretary of State!

Now you just need to wait for your LLC to be approved.

Washington State LLC Approval

After submitting your Washington LLC Certificate of Formation online, the Secretary of State will approve your LLC within 5-6 weeks (plus mail time).

Your Washington LLC approval documents will be mailed to your Registered Agent’s address, as well as sent to you by email.

You can also download your approval documents in your LLC’s online Filing History. Just search for your LLC name on the state’s Business Search page. Click “Filing History”, click on the name of the form, then click the document icon to download and save.

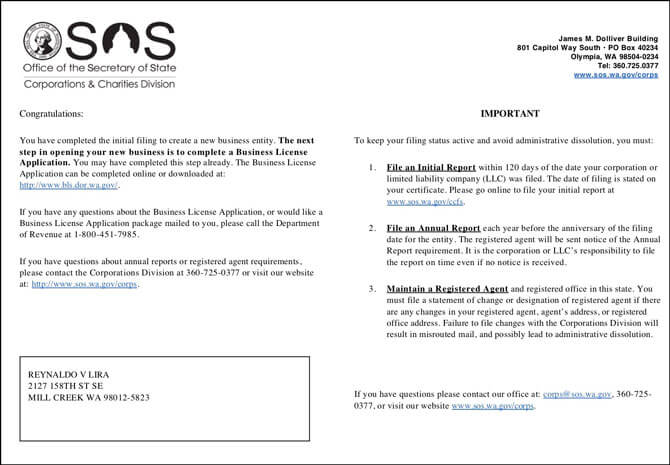

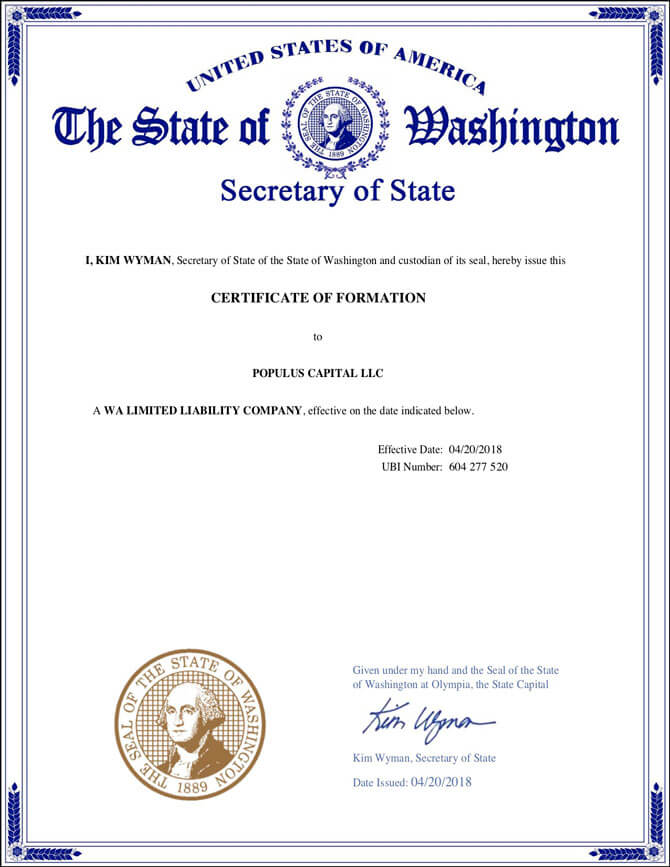

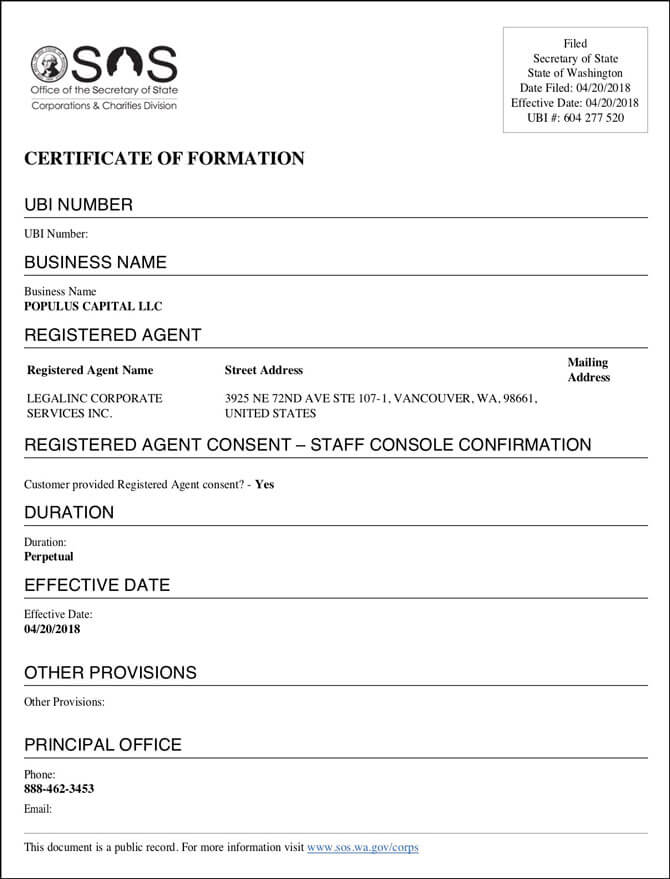

There are 3 documents that make up your Washington LLC approval:

- Congratulation Letter

- Certificate of Filing (called “Certificate of Formation” in your Filing History)

- Certificate of Formation with Initial Report – Fulfilled (this is the stamped and approved Certificate of Formation)

Here is what the Congratulation Letter looks like:

Here is what the Certificate of Filing (“Certificate of Formation“) looks like:

Here is what the Fulfilled Certificate of Formation will look like. Notice the stamped approval in the upper right:

Washington Secretary of State Contact Info

If you have any questions, you can contact the Washington Secretary of State at 360-725-0377. Their hours are Monday through Friday from 8am to 5pm Pacific Time.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

References

Washington LLC Act

Washington LLC Certificate of Formation

Revised Code of Washington, Section 25.15.071

Washington Secretary of State: What Addresses to Use When Filing

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Washington LLC Guide

Looking for an overview? See Washington LLC

If I am applying for the LLC and there will be no one else in the business, can I be the personal agent, executer and governor?

Hi Lily, yes, absolutely. You can be all of those roles.

This is the most helpful, easy to understand information and I cannot thank you enough! Question: Do you have a step by step guide on how to change from a “General Partnership” to an LLC? Our EIN says “General Partnership” but our business license says “Association” and I am unsure as to why, is this going to be an issue? Also, since we’re already a partnership, should we choose LLP instead of LLC? Does it matter? Thanks!

Hi Lynn, thanks so much! And apologies for the slow reply. I wouldn’t go LLP (LLC is a much better route). And in terms of how to convert from a General Partnership to an LLC, the easiest thing to do is just form a new Multi-Member LLC (there isn’t a formal “conversion” process from GP to LLC). Once the LLC is approved, get a new EIN, and get a new business license. Hope that helps :)

Hi Matt,

I started an individual registered agent job. I did my first client, LLC, yesterday. He will start Uber Black Driver, and I chose the Nature of Business “Transportation/Warehouse” option. I am a little bit worried. Is this correct, or if not, how can I fix it?

Thank you so much.

Hi Julie, that’s fine for the Nature of Business section. I wouldn’t be concerned.

Hi Matt,

I’m trying to set up an LLC that is going to be owned by my Roth IRA. I received direction from my Roth managing company for setting up the LLC but when attempting to complete these steps on the website I don’t understand how to do it. The directions are below.

o Please be sure to have the member/owner of the LLC listed as: “IRA management company. FBO Client Name IRA #XXXXXXX”.

o Please be sure to have the manager listed as yourself.

o Please be sure to have the LLC set up as “Manager Managed”.

I see different places to add information, but I just am not sure how to do this correctly as there is no specific field in the electronic form that talks to this. Any help you could provide would be appreciated.

Hi Brad, in the Washington Certificate of Formation, there is just a field for Governors (which can be Managers and/or Members). The state doesn’t ask you to clarify, and they don’t ask for how the LLC will be managed (Member-managed vs Manager-managed).

My guess is the Roth IRA management company isn’t familiar with every single state’s LLC documentation, however, you can ask them if they just want themselves listed as Governor (on the Certificate of Formation) or they want both themselves as well as you listed as Governors. If they’re not sure, it could be interpreted as being slightly more accurate to have yourself as the Governor, and the management company, FBO of your IRA listed as the Member in your Operating Agreement (a Manager-managed Operating Agreement that is).

Either way, what they are really asking for (without knowing these details) is they want to see a Manager-managed Operating Agreement (this is how a Washington LLC becomes Manager-managed). Within this Washington LLC Operating Agreement, it would list “IRA Management Company, FBO Client Name IRA #XXXXXXX” as the 100% Member and it would list you as the Manager of the LLC.

Hey there,

I followed the process as outlined above and just filed my LLC. I am a little confused about the initial report. As suggested I didn’t check the box to defer filing the initial report but then I did not see any option for how to file the initial report with the certificate of formation. I am wondering now if there was an extra step that I missed. Thanks!

P.

Hi P, it sounds like you did it correctly and filed the Initial Report, however, we recommend calling the Washington Secretary of State to confirm.

Hey Matt,

This is a remarkably well laid out resource for navigating the application process. KUDOs to you, and THANKS!

Russ

Thank you very much Russ! You’re very welcome :)

Hi Matt,

I am setting up a revocable trust and wanted to know if all liability protections afforded by the LLC are intact even when the LLC is owned by a revocable trust.

Thanks!

-Ellen

Hi Ellen, the Trustee of the Revokable Trust would be an LLC Member, just like anyone else would be. And yes, the LLC still offers the same liability protection.

Hi Matt, great article, this was extremely actionable and helpful!

I filed my LLC Monday afternoon and haven’t gotten approval yet (5:40pm Thursday).

I know you said usually it takes 2-3 business days and up to 5 during “peak filing seasons”. When exactly are “peak filing seasons”?

Is there any suggested action to take if there are no updates after a certain number of days?

Thanks very much!

Hi Ben, awesome to hear! You’re very welcome. Things are delayed longer than usual. We recommend just being patient. It’ll arrive :) I hope that helps.

Here’s my question I tried to sign up as an LLC but accidentally signed up as limited How am I able to correct this problem any help you can give me would be very much appreciated. Is there a way to do it without spending another $200?

Hi Steve, can you clarify what you mean by “signed up as limited”? Did you form a legal entity, one besides an LLC? Or did you form an LLC, but not name your LLC correctly? And what approval forms did you receive back from the state?

Thanks and this was super helpful to confirm many of my guesses!

Hi Adam, you’re very welcome!

THANK YOU for this information. Navigating the state requirements has been a little difficult. You made it so much easier, and I appreciate it!

You’re very welcome Carrie! We’re glad we could help :)