Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

This page will explain what LLC Distributions are and how they’re used.

LLC Distributions may also be called:

- LLC Capital Distributions

- LLC Profit Distributions

- LLC Distribution of Profits

These all mean the same thing.

What is an LLC Distribution?

An LLC Distribution is when Members (owners) of an LLC take money out of the LLC bank account and issue profits to themselves.

Instead of receiving income in the form of a W2 salary (aka wages), the LLC Members “pay themselves” via LLC Distributions.

How does an LLC make Distributions?

An LLC makes distributions by transferring money from the LLC bank account to an individual Member.

You can make an LLC Distribution in any of these ways:

- Check

- Internal transfer

- Electronic funds transfer (EFT)

- Wire transfer (including SWIFT)

- Cash withdrawal (including ATM)

- Transfer from an online account (like PayPal, Venmo, Stripe, Zelle, etc.)

The most common methods are writing checks and bank transfers.

How much and how often should Members take LLC Distributions?

It’s important not to distribute too much profit to the owners. Business expenses should be paid first and money should be set aside for taxes. After that, the Members can take some or all of the remaining profit.

How much profit gets distributed to each Member is determined by how much of the LLC each person owns (their “Membership Interest”). This is called a “proportionate distribution”.

Single-Member LLC example:

Ashwini owns 100% of her Single-Member LLC and she wants to distribute $1,000 of profit. Because she owns 100%, Ashwini receives $1,000. So Ashwini transfers the $1,000 from her business bank account to her personal bank account.

Multi-Member LLC example:

Dev and Albert each own 50% of their Multi-Member LLC and they want to distribute $1,000 of profit. Because Dev and Albert each own 50%, they each receive a $500 Distribution. Dev writes two checks from the LLC bank account. One for $500 payable to Albert, and another for $500 payable to himself.

Notes: The rules about proportionate distributions come from Federal Law (Regulation Q). An LLC Operating Agreement can also provide for non-proportionate distributions. This is rare. If you want to do this, you should consult a business attorney for a customized Operating Agreement. You should also tell your accountant since this affects tax calculations.

Multi-Member LLCs must make Distributions to all Members

If a Member in a Multi-Member LLC wants to take a Distribution, then all Members must take a Distribution.

Keep in mind that Distributions are proportional to how much of the LLC each Member owns.

How does a proportionate Distribution work?

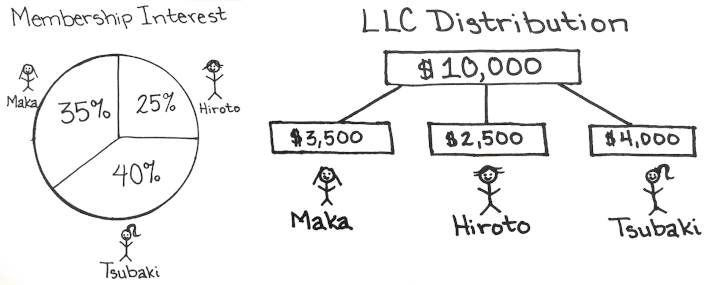

Maka, Hiroto, and Tsubaki own Soulful Cinnamon LLC, a Multi-Member LLC. Maka owns 35% of Soulful Cinnamon LLC, Hiroto owns 25%, and Tsubaki owns 40%.

Hiroto wants to make sure he gets $2,500 in the next Distribution so he can put a down payment on a car.

Hiroto calls a meeting of the LLC Members and asks them to vote on a total Distribution of $10,000. So they all get on a group video call, and review the LLC bank account. Since there’s about $32,400 in the LLC’s bank account, everyone agrees to the Distribution.

Maka then receives a $3,500 Distribution, Hiroto receives $2,500, and Tsubaki receives $4,000. That leaves more than $20,000 in Soulful Cinnamon LLC’s bank account, which is more than enough to pay their expenses.

Your LLC Operating Agreement sets Distribution rules

The LLC Operating Agreement controls how and when LLC Distributions are made.

Typically, the Operating Agreement provides that LLC Distributions are made when the Members or Managers decide to make a Distribution. Members or Managers “decide” this by voting at a meeting.

Tip: A meeting can be a simple phone call, group text message, or email with all the LLC Members or Managers.

Related article: Member-managed vs. Manager-managed LLC

The LLC Operating Agreement template we provide at LLC University allows you to specify how many Members must vote to make an LLC Distribution.

For example, you could require a simple majority (like 3 Members for an LLC with 5 Members), or a unanimous vote (both members of a 2 Member LLC).

Keeping track of LLC Distributions

Make sure you keep a record of each Distribution. For example, make a copy of the check or save a printout of the wire transfer. Alternatively, you can review your bank statements and identify the Distribution(s).

Your accountant will need this information at tax time.

If you have a Multi-Member LLC, there should be a separate record for each Member’s Distributions.

How do LLC Distributions affect my taxes?

- Related article: How is my LLC taxed?

LLC Distributions aren’t taxed. Instead, LLC profit is taxed.

Because you owe taxes on the LLC’s profit, you don’t have to pay taxes again when you distribute that profit. Keep in mind, Distributions are derived from the LLC’s profit.

Said another way, tax is owed regardless of whether money is kept in the LLC bank account or distributed to the Members.

Single-Member LLC example:

Janine owns 100% of her Single-Member LLC. Her LLC made $9,000 in profit this year. Janine took a total of $4,000 in LLC Distributions. Janine will be taxed on the $9,000 profit. She doesn’t also pay taxes on the $4,000 of Distributions (because that comes from the $9,000 in profit).

Multi-Member LLC example:

Wayne and Darryl each own 50% of a Multi-Member LLC. Their LLC made $2,000 in profit. Wayne took a $700 Distribution and Darryl also took a $700 Distribution.

Wayne will be taxed on $1,000, which is his 50% share of the total profit. He doesn’t also pay taxes on his $700 Distribution (because that comes from his $1,000 share of the profit).

Likewise, Darryl will be taxed on $1,000, which is his 50% share of the total profit. Darryl doesn’t also pay taxes on his $700 Distribution (because that comes out of his $1,000 share of the profit).

Remember, Wayne and Darryl owe tax on that profit regardless of how much or how little they take in distributions.

Do I need an accountant?

The short answer is Yes. We strongly recommend hiring an accountant to help with your taxes. And we suggest you hire a bookkeeper if your business has a large volume of transactions, or has employees.

There are lots of other issues connected to LLC Distributions, especially at tax time, that only a qualified accountant can help you address.

You can also talk to an accountant about these more sophisticated distribution set-ups that we don’t discuss here:

- Preferred Membership Interest. This means if you make a larger Capital Contribution – not proportionate to your Membership Interest – you will get money distributed to you before the LLC distributes money to the other Members on a proportionate basis.

- Guaranteed Payments. This is a type of Operating Agreement provision that requires the LLC to pay the Members on a set schedule. Unlike LLC Distributions, Guaranteed Payments are taxed as income for the Members.

References

Uniform LLC Act, Sections 404-405 – Distribution Rules and Insolvency Test

Regulation Q: Section 501 – Proportionate Distributions

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

I am a partner in an LLC that owns 6 duplexes. The current LLC is comprised of myself and two friends as members, with no employees. Each member has a 33.3% share. I’ve been considering taking my ownership in that LLC’s (basically 2 of the duplexes) and moving it to a new LLC, comprised of me and my son, hopefully without triggering any tax consequences. I would simply get new mortgages in the name of the new LLC to pay off my share of our current loan debt. Also, I would like to also take a third of the cash in our checking account and the corresponding tenant security deposits for the properties. What is the best and simplest way to accomplish my goal? Thanks for any definitive insight you can provide!

Hi Mark, I’m not sure on the best approach here, and would recommend speaking with an accountant or two. Thanks for your understanding.

“Except as expressly provided in this Agreement, no Unit Holder shall have priority over any other Unit Holder, either as to the return of Capital Contributions or as to Net Profits, Net Losses or distributions.”

In light of this, can a majority decision be made in a multimember LLC to make a cash distribution to one member to the exclusion of another, as long as the equity accounts are adjusted accordingly?

Or does this mean if one member gets a distribution the same distribution would need to be made available to any other member who would also like to receive the same regardless of a majority decision?

Hi James, unfortunately we can’t interpret language like this, and one would need to review the Operating Agreement to see how distributions are handled for that LLC. Thank you for your understanding.

2 member LLC. We are a real estate company with a lot of deductions and depreciation schedules. We take out distributions monthly but on our taxes we have yet to make a profit due to depreciation. Do we need to pay taxes on those distributions?

Hi Jacob, I’d run it by an account in case there’s anything special regarding your situation. Generally, Multi-Member LLCs pay (technically the Members pay) tax on net income, not on amount distributed.

My wife and I have 50/50 ownership of our “investment LLC” that holds our stocks and bonds. We have never taken any money out, and pay taxes yearly on the pass through dividends and capital gains reported on the K-1. If we take out cash this year for our living expenses is this a distribution and will we have to report it o the IRS or pay Self employment taxes on it?

How does the IRS tell this is not equivalent to a salary?

Hello F, because your Multi-Member LLC is taxed like a Partnership (this is the default treatment for Multi-Member LLCs), taxes are just paid on the net income. There are not taxes paid on distributions to partners. The distributions do still get reported though (on the K-1), but they aren’t taxable. Hope that helps.

We are a small freight broker, and trucking company, Set up as an LLC, filing as an S Corp, and issue K1’s to all members , The LLC consists of two Managing members, and a family trust that due to the death of their father, are Economic Interest only. they have no decision making abilities. but their share is 73% one Managing member has just over 20 % and the other about 7%

We recently applied for and received an ERC credit. for 315,500.00 , We had to correct our 2021 taxes to reveal the profit, and we issued a distribution to each of the managing members, for their additional taxes , in 2023 and asked the family trust what they needed for the additional tax amounts. but they have not replied. My question is, if we issue the managing members then as i understand it, We are obligated to issue the family trust a distribution . But if we simply run the amounts through payroll, although it would be a large expense in payroll. We would not be obligated to issue the family trust a distribution. It isn’t that i am trying to get out of paying them a distribution, I am wondering about why they haven’t answered our requests, which may have something to do with the fact that they are an agricultural family , that have already filed and received both ERC and PPP monies, from that business , which may confuse the whole issue. Any thoughts?

Hi Kathy, this is a bit outside our wheelhouse, and we’re not sure. I’d look to the Operating Agreement and I’d also run this by an accountant or two.

Can a multi-member LLC makes distribution to only one member? If so, how does it affect the ownership of other members? Does it have tax consequences to any member?

Hi Steve, you can make disproportionate distributions if the Operating Agreement allows. For tax details, please speak with an accountant, however, generally speaking there won’t be a tax consequence to any Member. To be more detailed, the LLC Members will pay taxes on the profit in the business (regardless of the distributions). And your accountant would update the capital account of any and all Members that receive distributions. So I guess in a way, if all Members share the taxes based on their share of ownership (which would proportionate), but one person gets a larger distribution, then in a way, they are affected financially (aka, indirectly, they paid some portion of your taxes).

We are a multi member LLC (husband and wife). We are set up on a biweekly payroll and often change the amount depending on our business. There are times we are hit with huge taxes because of that. Are we better off keeping our payroll low and just taking out distributions? Or will that effect our yearly taxes? Thank you

Hi Brenda, there are a lot of variables to this, so it’s challenging to give a direct answer. It’s honestly a conversation best had with an accountant. Thanks for your understanding.

50-50 partnership

We take regular bi- weekly distributions

We used to be on payroll. For tax and money purposes what is the best way to get the most for out money?

Thank you

Hi Elaine, I’m not sure what you mean by “what is the best way to get the most for our money”. Can you ask the question another way with some additional context? Thanks.

If a small 5 member LLC pays a bill that benefits all 5 members of the LLC and the bill is NOT related to the LLC, would that be considered a distribution if the amount attributed to each member is less than the profit allocated to each member that year?

Hi Lorie, it’s best to not have the LLC pay for personal/non-business expenses, even if it benefits the LLC Members.