If a person or company has paid your LLC $600 or more for services during a single calendar year, you’ll need to provide them with IRS Form W-9.

What is Form W-9 (Request for Taxpayer Identification)?

Form W-9 is an IRS form used for federal tax purposes when a person or company pays your LLC for services.

It gives that person or company the information they need to report payments to the Internal Revenue Service (IRS), including your:

- Taxpayer Identification Number (like your EIN or SSN)

- Business name

- Entity type

- Address

They need this business information (including your taxpayer identification number) in order to create a 1099 form for your business.

After you give the person or company your W-9, they’ll give a copy of the 1099 to you, and another copy of the 1099 to the IRS.

Note: Form W-9 is also called “Request for Taxpayer Identification and Certification”.

When do I need to fill out Form W-9?

Form W-9 is usually requested when a US person (or US company) pays your LLC $600 or more in a calendar year for services.

Where can I get Form W-9?

If you need to download IRS Form W-9, use this link: IRS: About Form W-9.

How is Form W-9 filled out?

You’ll fill out Form W9 differently depending on your federal tax classification.

What is a Federal Tax Classification?

A federal tax classification is a method of taxing your business that is used by the IRS.

And there are 7 tax classification options listed on form W-9:

- Individual/Sole Proprietorship

- C-Corporation

- S-Corporation

- Partnership

- LLC

- Trust/Estate

- Other

In this lesson, we’re going to focus on LLCs tax classifications, and provide step-by-step instructions for filling out Form W-9 for them.

Note: Form W-9 was most recently revised by the IRS in March 2024. They added line 3b in this revision, and it has specific implications for entities like a real estate investment trust with foreign partners, owners, or beneficiaries.

This lesson doesn’t cover instructions for completing Form W-9 for a real estate investment trust, any other type of trust, regulated investment company, or for real estate transactions.

We recommend speaking with an accountant if you fall into these categories.

How are LLCs Taxed for Federal Tax Purposes?

There are 4 common ways Limited Liability Companies can be taxed by the IRS:

- LLC taxed as a Sole Proprietorship

- LLC taxed as a Partnership

- LLC taxed as a C-Corporation

- LLC taxed as an S-Corporation

Note: Husband and wife LLCs can sometimes be taxed as a Qualified Joint Venture LLC. To do this, the LLC must be formed in a community property state.

LLC taxed as a Sole Proprietorship

By default, an LLC with 1 owner (a Single-Member LLC) is taxed the same way as a Sole Proprietorship for federal income tax purposes.

This is because the IRS considers a Single-Member LLC to be a disregarded entity. Meaning, as far as the IRS is concerned, an LLC isn’t a separate legal entity (for tax purposes) from the individual who owns the LLC.

So when it’s time to report income taxes, the owner of a Single-Member LLC reports and pays taxes on the LLC income using their personal tax return (Form 1040).

LLC taxed as a Partnership

By default, an LLC with 2 or more owners (a Multi-Member LLC) is taxed the same way as a Partnership for federal income tax purposes.

And when it’s time to pay income taxes, a Multi-Member LLC reports taxes to the IRS on Form 1065 (the Partnership Return).

However, a Multi-Member LLC doesn’t pay taxes to the IRS. Instead, the owners of the LLC pay taxes on the LLC income using their personal tax returns (Form 1040).

That said, Single-Member and Multi-Member LLCs can elect to be taxed as a C-Corporation or S-Corporation instead.

Note: We recommend that most LLC Members keep their LLC taxed in the default status unless your accountant recommends otherwise.

LLC Taxed as a C-Corporation

An LLC taxed as a C-Corporation means that the IRS taxes your LLC using the rules in Subchapter C of the Internal Revenue Code.

If you choose to have your LLC taxed as a C-Corporation, your LLC will be taxed twice: once at the business level, and again at the individual level.

This is known as double taxation, and it’s one of the downsides of electing C-Corporation tax classification.

LLC Taxed as an S-Corporation

An LLC taxed as an S-Corporation means that the IRS taxes your LLC using the rules in Subchapter S of the Internal Revenue Code.

Having your LLC taxed as an S-Corporation is a much more popular choice than having your LLC taxed as a C-Corporation. And it can help you save money on self-employment taxes.

Choosing S-Corporation taxation makes sense once your LLC generates about $70,000 in net income per year (per Member).

That said, we recommend speaking with your accountant before changing your tax classification with the IRS.

For more information on how Limited Liability Companies are taxed, please see How are LLCs Taxed.

Below are instructions for how to complete the W-9 form depending on your LLC’s federal tax classification.

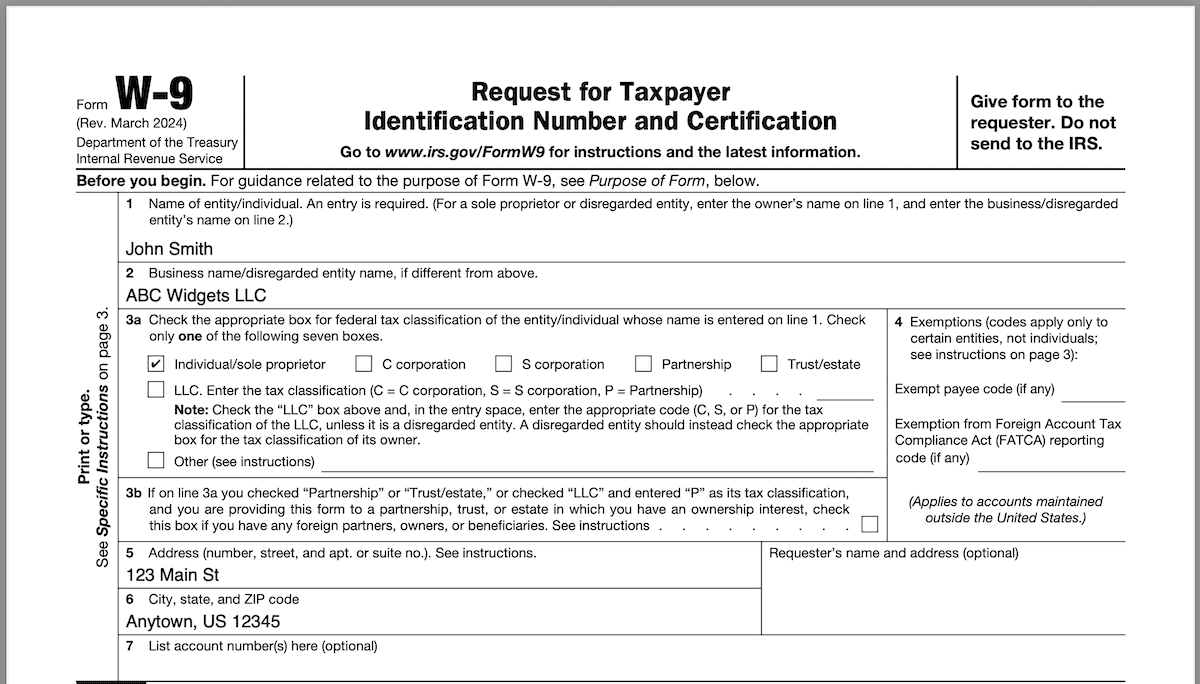

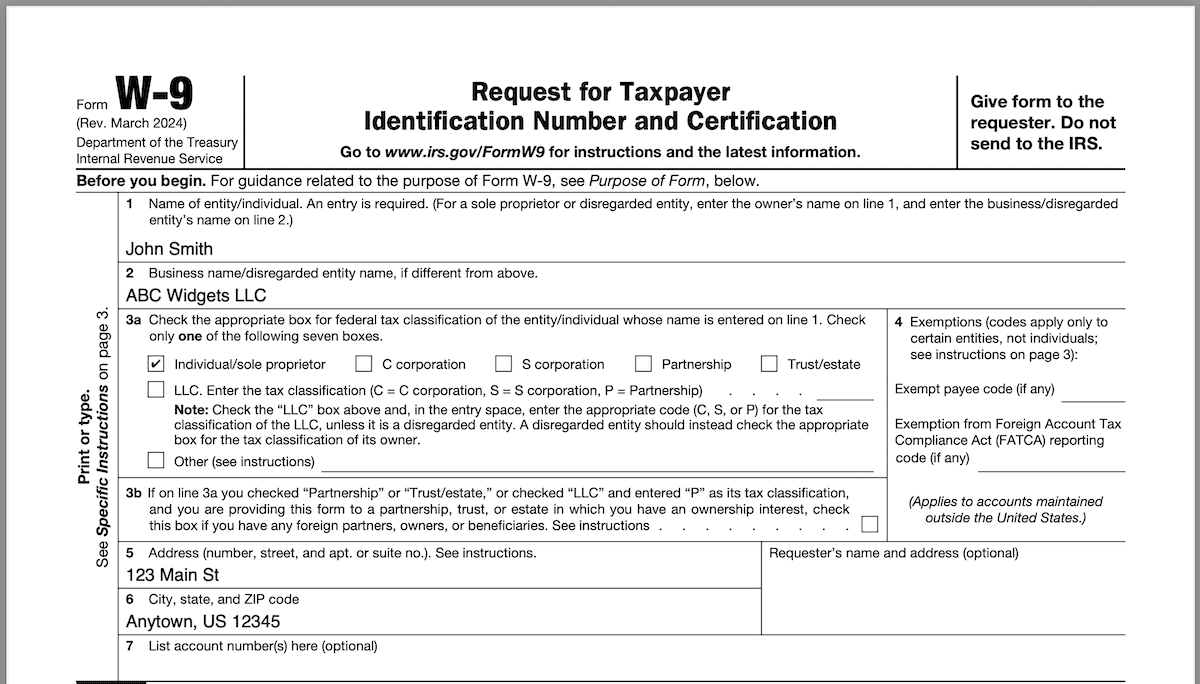

How to fill out W-9 for a Single-Member LLC (taxed as Sole Proprietorship)

Note: By default, all Single-Member LLCs are taxed like a Sole Proprietorship.

1. Name of entity/individual

Enter your own name.

Don’t enter the name of your LLC.

2. Business name/disregarded entity name, if different from above:

Enter your LLC’s name.

3a. Check the appropriate box for federal tax classification:

Check off “Individual/sole proprietor”

Don’t check off the “LLC” box.

3b. Foreign partners

Leave this blank.

It doesn’t apply to Single-Member Limited Liability Companies.

4. Exemptions

Leave this blank.

5, 6, and 7 – Address

Enter your LLC’s mailing address.

This address can be:

- your home address

- office address

- mailbox address

Part I – Taxpayer Identification Number (TIN)

Enter your LLC’s EIN Number.

Leave “Social Security Number” blank.

Pro Tip: I recommend listing your LLC’s Employer Identification Number (EIN), and not your Social Security Number (SSN). This is for privacy and identity theft reasons. Many companies requesting IRS Form W-9 don’t have robust security practices.

Part II – Certification

Sign your name. And date the form.

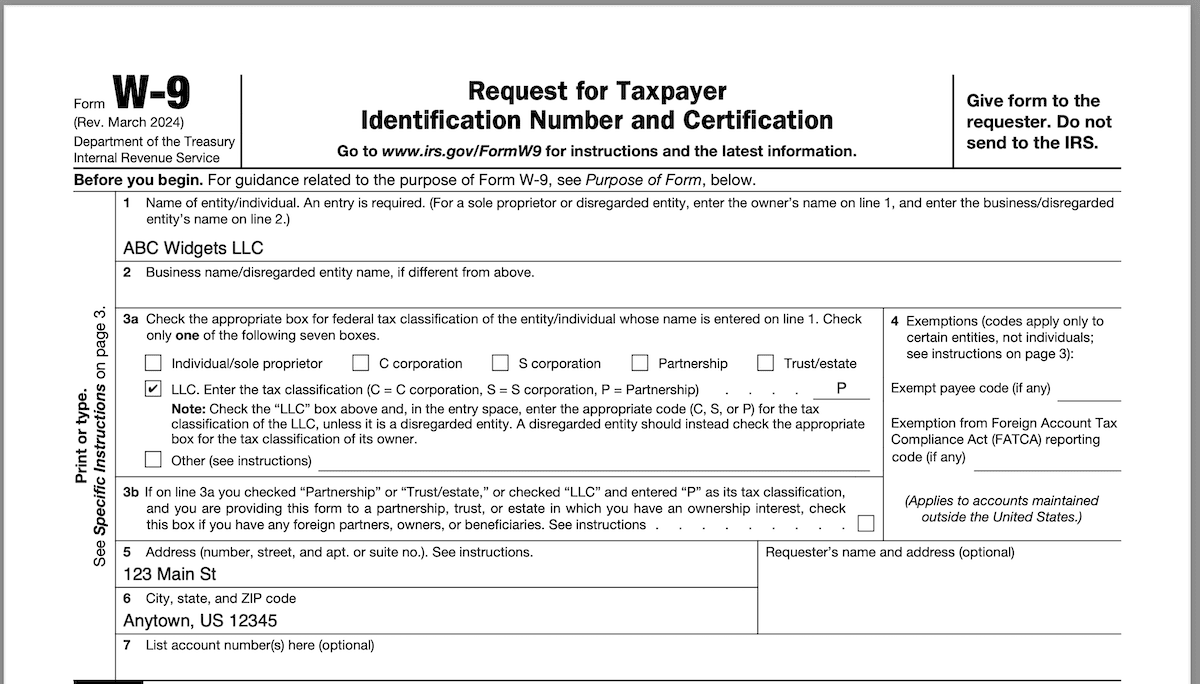

How to fill out a W-9 form for a Multi-Member LLC (taxed as Partnership)

Note: By default, all Multi-Member LLCs are taxed like a Partnership.

1. Name of entity/individual

Enter your LLC’s name.

Don’t enter your individual name.

2. Business name/disregarded entity name, if different from above:

Leave this blank.

This doesn’t apply to Multi-Member Limited Liability Companies.

3a. Check the appropriate box for federal tax classification:

Check off the “LLC” box.

Then write “P” to the right.

3b. Foreign partners

Most people leave this blank.

Only check this box if all of the following apply:

- You selected “LLC” and entered “P” (for Partnership) as the tax classification.

- You are providing this W-9 to an LLC/Partnership that you own.

- There are foreign partners, owners, or beneficiaries associated with your LLC.

4. Exemptions

Leave this blank.

5, 6, and 7 – Address

Enter your LLC’s mailing address.

This address can be:

- your home address

- office address

- mailbox address

Part I – Taxpayer Identification Number (TIN)

Enter your LLC’s EIN Number.

Part II – Certification

Sign your name. And date the form.

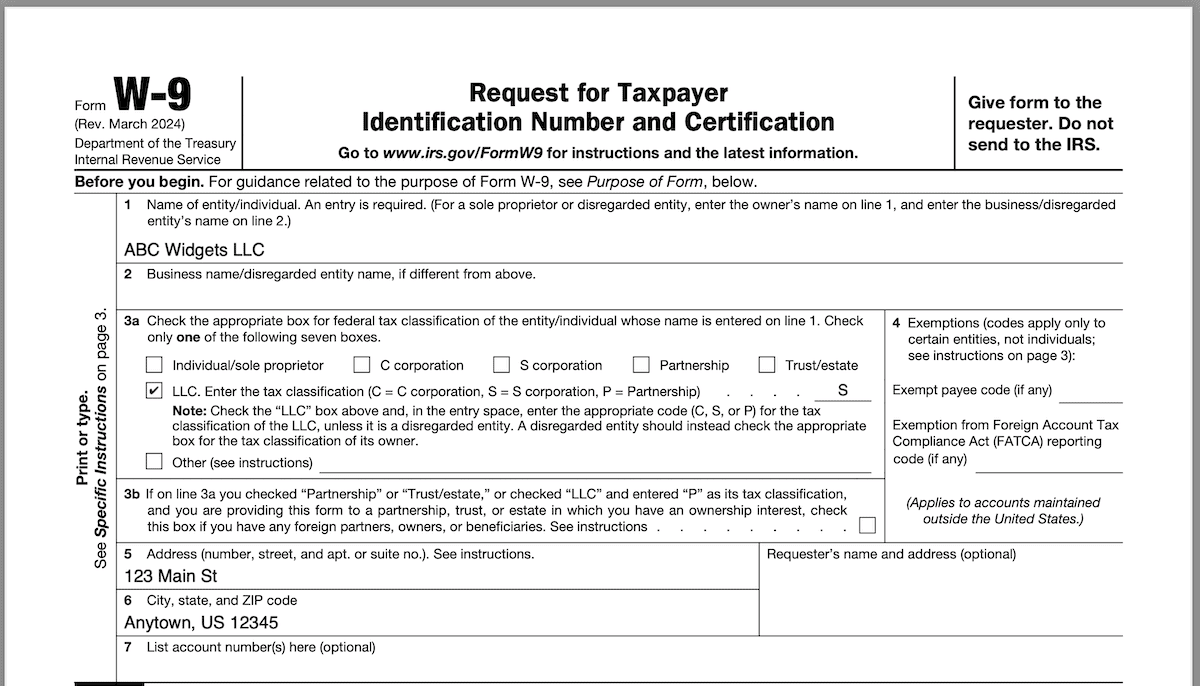

How to fill out a W-9 form for an LLC taxed as an S-Corp (Single-Member or Multi-Member)

Note: Instead of being taxed in their default tax classification, both Single-Member LLCs and Multi-Member LLCs can choose to have their LLC taxed as an S-Corp.

1. Name of entity/individual

Enter your LLC’s name.

Don’t enter your individual name.

2. Business name/disregarded entity name, if different from above:

Leave this blank.

3a. Check the appropriate box for federal tax classification:

Check off the “LLC” box.

Then write “S” to the right.

3b. Foreign partners

Leave this blank.

This doesn’t apply to Limited Liability Companies taxed as S-Corporations.

4. Exemptions

Leave this blank.

5, 6, and 7 – Address

Enter your LLC’s mailing address.

This address can be:

- your home address

- office address

- mailbox address

Part I – Taxpayer Identification Number (TIN)

Enter your LLC’s EIN Number.

Part II – Certification

Sign your name. And date the form.

W-9 for an LLC taxed as an C-Corp (Single-Member or Multi-Member)

Note: Instead of default tax elections, both Single-Member LLCs and Multi-Member LLCs can elect to have their LLC taxed as a C-Corp.

Fill the form out using the same information as an LLC taxed as an S-Corporation (see above).

The only change is on 3a:

Check off the “LLC” box.

And then enter “C” to its right.

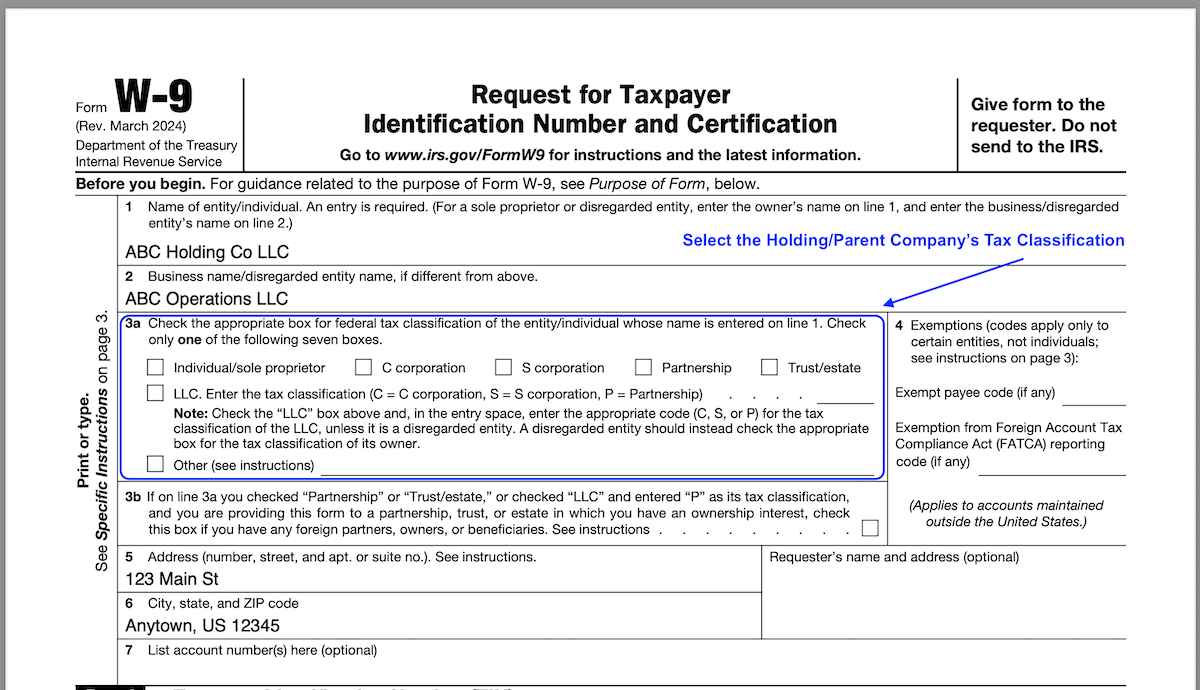

How to fill out a W-9 form for an LLC owned by another LLC

Note: An LLC can own another LLC. This is often referred to as a Holding Company LLC and Subsidiary LLC(s). Or as a Parent LLC and Child LLC(s). They all mean the same thing.

In the example below, ABC Holding Co LLC is the Parent LLC, and ABC Operations LLC is the Child LLC.

1. Name of entity/individual

Enter the name of the Holding/Parent LLC.

Don’t enter the name of the Subsidiary/Child LLC.

Why? The Child LLC is a disregarded entity (aka an LLC with 1 owner). It doesn’t file its own return. It’s income/losses/credits/deductions all “flow up” to the Parent LLC. Said another way, the Parent LLC is the one that files the income tax return.

2. Business name/disregarded entity name, if different from above:

Enter the name of the Subsidiary/Child LLC.

3a. Check the appropriate box for federal tax classification:

This will depend on how the Parent LLC is taxed.

However the Parent LLC is taxed, please reflect that in 3a.

(See other LLC examples above)

3b. Foreign partners

Most people leave this blank.

Only check this box if all of the following apply:

- Your Parent company is an LLC taxed as a Partnership.

- You are providing this W-9 to an LLC/Partnership that you own.

- There are foreign partners, owners, or beneficiaries associated with your LLC.

4. Exemptions

Leave this blank.

5, 6, and 7 – Address

Enter your LLC’s mailing address.

This address can be:

- your home address

- office address

- mailbox address

Part I – Taxpayer Identification Number (TIN)

Enter your LLC’s EIN Number.

Part II – Certification

Sign your name. And date the form.

Other examples

Husband and Wife Single-Member LLC

For a Husband and wife LLC (Qualified Joint Venture), complete the form as if you were a Single-Member LLC.

Note: Only one of the spouses names will be on line 1.

Any more examples you’re looking for?

Please make your request (and include full details and context) in the comments below.

W9s for Limited Liability Companies – Frequently Asked Questions

Does my LLC need to fill out a W-9 form?

Yes, if someone is paying your LLC and needs to report it to the IRS, they’ll ask you for a W-9 form.

This is super common if you’re doing freelance work, client services, or getting paid rent or commissions.

The W-9 form gives them the info they need to send you a 1099 form later.

What if my LLC is taxed as an S-Corp or C-Corp—do I still use Form W-9?

Yes, you do. Limited Liability Companies taxed as an S-Corp or C-Corp still use Form W-9.

Please see above for examples on both.

Do I need to give someone a W-9 form if they paid my LLC less than $600?

Technically, no, you don’t.

The IRS only requires 1099 reporting for payments of $600 or more (for services, not goods), so if you’re under that amount, there’s no legal requirement to provide a W-9.

If a company persists and still wants one, there’s no harm in sending one though.

Should I use my SSN or my EIN on Form W-9 for my LLC?

If you have a Single-Member LLC, you can use either one, but I recommend using your LLC’s Employer Identification Number (EIN) for privacy.

This helps protect your Social Security Number (SSN).

Can I send the same W-9 to multiple clients, or do I need a new one each time?

Yes, you can certainly reuse your W-9 form. There’s no rule that says you have to fill out a fresh one every time.

As long as your information hasn’t changed and you’re using the correct taxpayer identification number, it’s perfectly fine to send the same W-9 form to anyone who asks.

Just make sure that it’s signed and dated.

Do I need to submit the W-9 to the IRS?

No, you don’t send the W-9 to the IRS.

You send your W-9 to the person or company that asked for it. And in return, they use that information to issue your LLC a 1099.

Said another way, the IRS never sees your W-9 directly.

What happens if I don’t fill out a W-9 when someone asks?

If you ignore a W-9 request, the person or business paying you might have to withhold 24% of your payment and send it to the IRS. That’s called backup withholding. So instead of getting paid the full amount, you might get the amount, minus 24%.

Having said that, backup withholding isn’t all that common.

It’s still best to provide the W-9 to avoid any headaches later.

Should I use my personal name or my LLC name on the W-9?

It depends on your tax classification.

If you’re a Single-Member LLC (taxed as a Sole Proprietorship), put your name on Line 1 and your LLC name on Line 2.

If your LLC is taxed as a Partnership, S-Corp, or C-Corp, put your LLC name on Line 1. Line 2 will most often be left blank.

What tax classification do I enter for my LLC on Line 3a?

Single-Member Limited Liability Companies: Check “Individual/sole proprietor”

Multi-Member Limited Liability Companies: Check “LLC“, and then enter “P” (for Partnership) to the right.

Limited Liability Companies taxed as an S-Corp: Check “LLC“, and then enter “S” to the right.

Limited Liability Companies taxed as a C-Corp: Check “LLC“, and then enter “C” to the right.

Do I need to check the box on Line 3b of the W-9?

In almost all cases, no. Line 3b only applies to Limited Liability Companies if all of the following apply:

- You selected “LLC” and entered “P” (for Partnership) as the tax classification.

- You are providing this W-9 to an LLC/Partnership that you own.

- There are foreign partners, owners, or beneficiaries associated with your LLC.

What if I made a mistake on the W-9 I already sent?

It’s not a big deal. Just fill out a new one with the correct info and send it to whoever requested it.

There’s no penalty for correcting a W-9.

Tip: Always double-check your Employer Identification Number (EIN) before sending the form.

This is false. You are incorrect about putting the SMLLC’s EIN on a W-9. There is absolutely nothing in the IRS language provided in the instructions for this form that suggests using a SMLLC’s EIN on the face of the form. In fact, the IRS explicitly specifically states “If you are a sole proprietor and you have an EIN, you may enter either your SSN or EIN. If you are a single-member LLC that is disregarded as an entity

separate from its owner, enter the owner’s SSN (or EIN, if the owner has

one).”

An individual can obtain an EIN using the individual’s credentials (without creating a SMLLC) and use that EIN on the form. But to recommend using a SMLLC’s EIN on this form is flies in the face of what the IRS is asking for. Further it is at best misleading and at worst borders on malpractice.

Hi Michael, I know the instructions state SSN, but there are thousands and thousands of W9s used every year with the LLC’s EIN. Meaning, in practice, EINs are used all the time and it’s a non-issue. You can of course your SSN. It’s just a tip that if someone is concerned about their data, to use the EIN instead. Since often, many unsophisticated businesses (those with low/no security practices) are requesting W9s and storing them in non-secure ways. This can lead to SSN numbers getting in the wrong hands.

In the IRS W9 form:

“If you are a single-member LLC that is disregarded as an entity separate from its owner, enter the owner’s SSN (or EIN, if the owner has one). Do not enter the disregarded entity’s EIN”

Is it OK to enter your LLC’s EIN Number?

or should we enter our own EIN (Apply an new EIN as a Sole Proprietor)

Hi Chris, I know the instructions say that, but you can just enter the LLC’s EIN Number. This is much better for privacy and identity theft reasons.