Can a husband and wife LLC be a Single-Member LLC or a Multi-Member LLC?

Disclaimer: There are legal and tax considerations that will be unique to your situation and your state of residency. This article is simply an educational overview and is not legal, financial, or tax advice. We recommend speaking with your accountant and lawyer before making any final decisions.

As another “disclaimer”, this article is specifically about a husband and wife LLC making the Qualified Joint Venture election as per IRS Revenue Procedure 2002-69. Other husband and wife businesses may also qualify for the Qualified Joint Venture election, however, we won’t be discussing that here.

A Qualified Joint Venture (LLC) is an election made with the IRS for husband and wife LLCs allowing them not to be taxed as a Partnership (and therefore being taxed as a disregarded entity).

By default, multi-member LLCs are taxed as a Partnership with the IRS, however, the IRS allows for husband and wife LLCs (which meet the requirements below) to be treated as “one unit”.

This allows the husband and wife to file one tax return instead of two, reduce accounting fees, reduce paperwork, and save time regarding record keeping.

Married Couple Single-Member LLC

Another way to imply the term Qualified Joint Venture is by using the term “married couple single-member LLC” or “husband and wife single-member LLC”.

But the term “single-member LLC” makes it sound like there is only one person, correct?

That is the case, except for husband and wife-owned LLCs in community property states. In community property states the husband and wife are treated as one “unit” for federal tax purposes.

In the husband and wife’s LLC Operating Agreement (the document which lists who owns the LLC, among other things), instead of listing the membership interests as “John Doe, 50%” and “Mary Doe, 50%”, it’ll be listed as “John and Mary Doe 100%”.

Can a gay married couple or same sex marriage also be treated as a Qualified Joint Venture LLC?

Yes, “husband” and “wife” can be replaced with “spouse”, so long as the marriage was legal (as per state law).

As per the IRS Publication 555 (Community Property) and Answers to Frequently Asked Questions for Individuals of the Same Sex Who Are Married Under State Law, same sex marriages are treated the same as an opposite sex marriage. And the term “spouse” means a person who is legally married to another person, as per state law.

However, if the same sex couple has a civil union, registered domestic partnership, or any other relationship that isn’t considered “marriage” by state law, they are not considered spouses and are not considered a married couple for federal tax purposes.

So anytime you see “husband” or “wife” on this page, you can replace those terms with the broader definition of “spouse”.

Requirements of a Qualified Joint Venture LLC

If a married couple forms an LLC in a non-community property state (known as a “common law property state”), they can’t qualify for the Qualified Joint Venture election.

If a married couple forms an LLC in a community property state, they can qualify for the Qualified Joint Venture election, as long as they meet the following requirements (as per Revenue Procedure 2002-69):

- The LLC is formed/created in a community property state

- The married couple are the only LLC owners (there are no other persons or companies that own the LLC)

- Both spouses materially participate in and operate the business

- The married couple files a joint federal income tax return (Form 1040)

- The LLC has not elected to be taxed as a Corporation under 26 CFR 301.7701-2

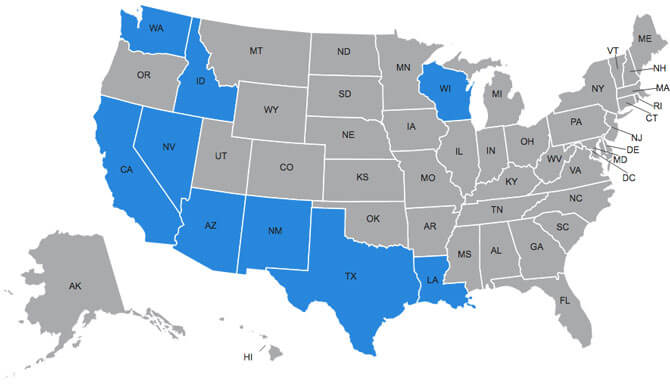

Community Property States:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Note: In California, an LLC owned by Registered Domestic Partners is not allowed to use a Qualified Joint Venture. Instead, the LLC must be taxed as a Partnership.

Advantages of Husband and Wife Qualified Joint Venture LLC?

The advantages of a Qualified Joint Venture LLC are:

1. Save time: The married couple eliminates the extra paperwork and record-keeping requirements of a Partnership.

2. Save money: The married couple saves money on accounting and tax preparation. Instead of the need to file a Partnership 1065 return, K-1s, and then a separate 1040 for each spouse, the married couple’s accountant will just file a Schedule C along with Form 1040 for just one spouse.

3. Social security and Medicare: The married couple can get additional credit for paying Social Security and Medicare taxes (without actually having to pay more in taxes).

How Can a Married Couple Form a Single-Member LLC?

Here are the step to forming a husband and wife single-member LLC:

1. LLC Name

Select your desired LLC name.

2. Registered Agent

Designate your LLC’s Registered Agent.

3. Articles of Organization (or similar form)

File your LLC filing forms with the Secretary of State’s office. This document is usually called the Articles of Organization, but in a few states it may be called Certificate of Organization or Certificate of Formation.

If your state’s Articles of Organization asks for the LLC members, do not list “John Doe” and “Mary Doe” on two lines. Instead, list “John and Mary Doe” on one line.

Tip: If your state rejects your LLC filing forms with “John and Mary Doe” on one line, just re-file with “John Doe” and “Mary Doe” on two lines. You can later designate the single ownership unit in your LLC’s Operating Agreement and when obtaining your EIN from the IRS.

4. LLC Operating Agreement

Draft your LLC’s Operating Agreement. List the LLC member as “John and Mary Doe” and later when the Operating Agreement asks for the capital contributions, list that financial amount alongside the ownership percentage as “John and Mary Doe, 100%”.

5. Federal Tax ID Number (aka EIN)

Obtain your Federal Tax ID Number (also called EIN) from the IRS. Use the IRS EIN online application. After you select your state, the IRS will ask if you are a husband and wife company. Select yes. Then on the next page, the IRS will ask if you’d like to be taxed as a multi-member LLC (Partnership taxation) or a single-member LLC (Qualified Joint Venture taxation). You’ll select single-member LLC.

Note: After your EIN is issued by the IRS, they will provide you with an EIN Confirmation Letter. At the top of the letter you will only see one of the spouses’ names and the abbreviation “SOLE MBR”. Don’t be alarmed though, your Qualified Joint Venture election has been noted by the IRS. Further, you aren’t technically “making the election” by obtaining your EIN. As stated in Revenue Procedure 2002-69 (section 4), however you choose to file your taxes (whether as a Partnership or a Qualified Joint Venture), the IRS will accept.

How to Change Husband Wife Partnership LLC to a Qualified Joint Venture?

Do you have an existing husband and wife LLC taxed as a Partnership and want to change it to a Qualified Joint Venture?

Here are the steps:

1. Make sure the LLC is formed in a community property state and you meet the requirements listed above.

2. Download this Qualified Joint Venture notification letter.

3. Mail your letter to the IRS.

Depending on the state where your LLC is located, you’ll mail your letter to either Kansas City, Missouri or Ogden, Utah:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

OR

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

Note: There is no street address needed.

To determine which address you should use, please reference this page:

IRS: Where to File Your Taxes (for Form 8832)

(Note: You don’t have to send 8832 to the IRS. You’re just using it to find the mailing address.)

4. Wait 30-45 days for an IRS Confirmation Letter. The letter confirms that the IRS will now recognize your husband and wife LLC as a Qualified Joint Venture.

References

US Code: Title 26 Section 761

Wikipedia: Community property

IRS: Married Couples in Business

IRS: Frequently Asked Questions – Entities

IRS: Publication 555 – Community Property (PDF)

IRS: Publication 555 – Community Property (HTML)

IRS: About Publication 555 – Community Property

IRS: Election for Married Couples Unincorporated Businesses

IRS: 26 CFR 301.7701-3 – Classification of certain business entities

Berkeley Law: Federal taxation of community property

US Government Publishing Office: Public Law 110–28 at 110th Congress

Library of Congress: Senate Bill 349 – Small Business and Work Opportunity Act of 2007

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi Matt,

Thank you very much for your informative web site. Here is my scenario:

1/ My wife and I, we live in California and we own a rental property in Florida. We have formed a multi-member LLC in Florida with just my wife and myself as members, and each of us has 50% interest. We have started to transfer a rental property in Florida to the newly formed Florida LLC via quit claim deed.

2/ In the past 5 years, we have filed joint federal tax returned and schedule E to report rental income. Could we file an operating agreement to list the LLC member as “John and Mary Doe” and “John and Mary Doe, 100%”, then send a Qualified Joint Venture letter to the IRS to our Florida LLC as Qualified Joint Venture for Federal tax purposes since we live in California?

3/ If not, could we transfer our rental property in Florida into a Florida Community Property Trust and be classified as Qualified Joint Venture?

Hope to get some guidance from you.

As per the IRS rules, the LLC in question should be formed in a community property state. What you can do is form a California LLC (to be your holding company). This will owned by you and your wife (John and Mary Doe, 100%). When you get the EIN for this LLC, you’ll tell the IRS there are 2 Members. On the next page, the EIN application will ask you if you’re in a community property state. Select yes. And then select that you’d like Qualified Joint Venture/Single-Member LLC treatment. So now your holding company (your California LLC) will be taxed like a QJV.

Next, you can both assign your LLC Membership Interest of your Florida LLC from yourselves to your California LLC. In this manner, the California LLC (holding company) owns the Florida LLC (subsidiary company). And under this setup, the Florida LLC will be taxed like a disregarded entity. And because it’s owned by another company, it’ll be taxed like a branch/division of the parent company. Said another way, all activity of the Florida LLC will be reported on your California LLC tax filings.

This page is an instant bookmark. Thank you so much for the great information. No other page I’ve visited has explained all of this as clearly as I see here. I have a couple questions:

My wife and I are in California and started an LLC. We had no idea what we were doing when we filed for our EIN. Our EIN confirmation letter Only has my wife’s name on it with “MBR” behind it not “SOLE MBR”. In your experience does this mean that we filed as a Multi-Member LLC instead of a sole member LLC and need to file a a 1065 and include our K1s in our 1040?

It appears that if we filed our EIN application wrong we will not be able to file as a Qualified Joint Venture LLC this year and would need to file a 1065 as a partnership for this year. Then, we need to send the letter to the IRS in order to get reclassified as a single member Qualified Joint Venture and file as that next year. Does that sound correct?

Thanks Jesse. You’re very welcome! Yes, that all sounds correct to me. The “MBR” abbreviation on the CP 575 (EIN Confirmation Letter) means the IRS will be expecting a 1065 Partnership Return (you’ll also see that in the body of the letter). And yes, I’d file the 1065 Return this year and also make the request for your LLC to be taxed as a SMLL/QJV for the 2023 tax year. Hope that helps :)

Matt, we are in the exact same position as Jesse was, except we learnt about this distinction in the EIN confirmation letter 3 years after forming the company. My wife and I have been filing joint tax returns with the assumption that we are a single member LLC. We have never filed a 1065 since inception and have been reporting tax returns only through 1040 schedule C. We have not received any notices from the IRS about not filing a 1065 or any penalties. I’m reaching out to our lawyer/registered agent to find out if this was an oversight while applying for the EIN and if any corrections need to be made to ensure we are treated as a single member LLC. Meanwhile, would be great to know your thoughts on this scenario. I’m really hoping we aren’t liable for penalties!

Hi Vivek, I just reviewed an Internal Revenue Manual (IRM) from the IRS. Here’s my guess: You’re likely fine. There’s a chance your “Business Master File” (BMF) was updated so the IRS agents know not to look for a 1065 Partnership return. However, even if it’s not, I don’t think it’s a big deal. Reason why is because you and your wife meet the conditions under Section 761(f). Said another way, often times with the IRS, it’s about whether or not you actually meet the requirements (not whether or not you filed something that says you do… or filed something that asks to be treated in a way in which you already are). Hopefully that makes sense. Here’s one more way to think about: because you technically are a Qualified Joint Venture, the IRS should honor that and not penalize you.

To double check on all this, I’d simply call the IRS (use the phone prompt instructions on our 147C page to speak to a rep the fastest) and ask if your Business Master File (BMF) says the IRS is looking for “1065” or “1040”. And if it happens to say “1065”, I also wouldn’t stress. I’d just tell the IRS you’ll mail in a letter stating that you are, and have been a QJV, and you wish for the IRS to update their records (see above on this page for a template you can model). And as as per the IRS, if you send them something in writing, they have to reply in writing within 30 days (although it can sometimes take 60-90 days for a response… the IRS is still behind from the pandemic days). Hope that helps!

I see this post is 2 years old, I’m hoping you can still answer my question.

My husband and I own a rental property under an LLC in MA. We are both listed as members of the LLC. We purchased this in 2020.

For the last 3 years, we have used Schedule E to list all of our expenses related to running the rental property.

How do I confirm that we filed all forms required to avoid getting a fine for failing to list we are a partnership? Does this only matter if using Schedule C?

On another note, next year I will qualify for Real Estate Professional Status. Can you claim that status and still report expenses on Schedule E or will I need to use Schedule C and also pay self-employment taxes? We do not offer services to tenants, this is a multi-family rental with long term leases.

We have used TurboTax and next year we will work with someone specializing in real estate to avoid making errors when filing.

Thank you!

Hi Kristen, I’m not 100% sure on your questions. I recommend working with an accountant on this. Thank you for your understanding.

What a great When information, thank you very much. We own a LLC the IRS qualifies us as a partnership, this was last year (2022) now we are looking to change to a qualified joint venture with this information that you have given us. But we would like to know if the change would only be for this year onwards or if we can file our 2022 taxes as a qualified joint venture? thank you.

Thank you Annie! It would only be from the date they recognize the Qualified Joint Venture.

I am confused about the ability for husband and wife to file as sole proprieters in a community property state. Does the LLC need to be FORMED in the community property state? Or do the husband and wife need to LIVE in a community property state?

For instance, we wish to form

An llc to to purchase real estate in Ohio, and we live in Oregon. If we form

The llc in a community property state like idaho or nevada, will we be able to file our income taxes in Oregon as a sole proprietorship disregarded for taxes? Thank you.

Hi Mark, as to our understanding, the LLC must be formed in a community property state. And we’re only familiar with the IRS’s treatment of a Qualified Joint Venture LLC, not state taxes.

Here’s a scenerio … I currently have a single-member LLC registered in AZ. I’m considering bringing my wife in as a partner. I have a legal address in AZ. However, my wife and I are current residents in Portugal. She is Dutch. She is a non-resident of the US with no VISA. We were married in Mexico. Could we still be treated as a single member LLC?

Hi Eric, I’m not sure if you and your wife are filing US taxes as “married filing jointly”, but that is one of the requirements of being a Qualified Joint Venture. Assuming that were the case, regarding the marriage, and whether or not the IRS will recognize it, you’ll need to call the IRS – or check with an accountant – to confirm. I’m not sure.

If you end up adding your wife to your LLC, you can amend your LLC Operating Agreement to add her as a 50% Member. Thanks for your understanding. And hope that helps.

Hi Matt,

Thank you so much for all your valuable information.

In the portion: How to Change Husband Wife Partnership LLC to a Qualified Joint Venture? You mention that the husband and wife do NOT need to send the form 8832 to the IRS. Why is that? Is there any benefit to sending the form anyway?

Hi AJ, you’re very welcome. You don’t need to send Form 8832 because there is no box to check for “qualified joint venture”. Hope that helps.

Hi Matt, Your website has been very informational and straight to the point. Can you do a section on husband and wife with two separate LLCs and how that affects taxes in non-community property states?

Thanks Shannelle! In this example you’re referring to, is each LLC only owned by one spouse, or is each LLC owned by both spouses?

Each LLC is owned by one spouse. Example, Husband has ABC llc and wife has XYZ llc.

Hi Shannelle, in that case, both ABC LLC and XYZ LLC are going to be taxed like Sole Proprietorships. Hope that helps.

Happy new year Matt. Thank you so much for offering this service…it is truly a blessing! I am a language interpreter who lives in the state of California and and was caught up in the whole AB5 hoopla last year. At the request of one of the companies I contracted with, I elected an s-corp taxation. However, the amount I spent on payroll doesn’t make it worth my while and I would like to revert back to the default LLC taxation, which in my case is a partnership since I set the company up with my husband. Including my husband as a co-owner was just a formality, in reality the company is my business. I recently heard about the Qualified Joint Venture taxation which would simplify things even more than a Partnership taxation. My question is the following; Would I first have to file a revocation of S-corp election, then file a Qualified Joint Venture taxation election? Or can I do it all at once? I’m afraid if I do the first I will the be stuck with a partnership taxation for 5 years. And lastly, would we qualify for Joint Venture if my husband is more of a silent partner who has very little involvement other than occasionally helping with bookkeeping and taxes? I realize that’s more than one question and I appreciate your feedback!

Hi Adriana, I recommend calling the IRS to check, however, I would imagine they’ll want the LLC’s S-Corp revocation filed first. You could send a Qualified Joint Venture request letter along with the S-Corp revocation though, so that both “moves” are done back-to-back. For a Qualified Joint Venture, the IRS does require “material participation”. We can’t comment on exactly how that is interpreted though as we don’t have direct experience. If you dial the IRS at 800-829-4933, press option 1 > option 1 > option 3 to get to someone. And if you call between 7-9am, you’ll have the shortest hold time. Feel free to let me know what you find out.

My employer operates a husband/wife LLC (S Corp) called ADG Architecture. For minority purposes, ADG wants to change the ownership from 50/50 to 51%/49%. How is this best accomplished? Also, no stock was ever issued. Does anything need to be done with the stock? Thank you!

Hi Joni, that is typically handled via an Assignment of Membership Interest as well as a bookkeeping entry to adjust the S-Corp stock.

Yes, tax purposes is my main concern, but it sounds like maybe that was an overreaction on my part if the taxes are the same either way. So my understanding would be that I can just add her as a Member on my Business Entity Report and it would automatically turn the sole proprietorship/single member LLC into a partnership/multi member?

Hi William, to be clear, the same amount of tax is paid between a Single-Member LLC and a Multi-Member LLC (taxed in their default status). However, a Multi-Member LLC (which is taxed like a Partnership) does have to file Form 1065. So there is extra form that needs to be filed.

And no, you wouldn’t just list your wife on the Business Entity Report. You’d first need to assign some of your LLC membership interest to your wife. This can be done via an Assignment of LLC Membership Interest form (we don’t provide this currently, but will in the future). Then you’ll amend the LLC’s Operating Agreement to reflect the change.

Then, if LLC Members are listed in your state filing (either the Articles of Organization, Certificate of Organization, or Certificate of Formation), you’ll need to file an Amendment to add your wife. The state filing reflects the reality of the situation: that you assigned LLC membership interest to your wife. Said another way, it’s the assignment that makes your wife an LLC Member (not the state filing). The state filing just reflects the internal affairs of the LLC.

You’ll also then need to file Form 8832 with the IRS to change the LLC’s tax classification. By adding a 2nd Member to the LLC, the LLC will now be taxed as a Partnership instead of a Disregarded Entity/Sole Proprietorship. You may need to update your state Department of Revenue (or equivalent agency) and add your wife to the LLC’s bank account. I know, it’s a lot. Hope that helps though.

Hi Matt,

Very helpful information! I’m wondering if there is any breakdown in income to where a husband & wife LLC needs to declare itself as a partnership. I started a single member LLC a few years ago, and this year my wife has started her own service as a side project to bring in more income. She has only brought in around $500 so far. Since that is such a small sum, does that mean I should include her as a partner or can I continue to file as single member since that’s such a small slice of the overall revenues?

Hi William, thank you! Are you looking to “wrap in” your wife’s business activities into your LLC (which is, or you want to be, qualified as a Qualified Joint Venture)? If that’s the case, it’s not about income, but it’s about participation. If you look above on this page under the “can qualify” section: “Both spouses materially participate in and operate the business“. So it’s more so a question of is there 1 LLC (with multiple business activities inside of it) being ran/managed by husband and wife? Or is there 1 LLC here (your business) where your wife doesn’t materially participate and your wife has a growing Sole Proprietorship (or a soon-to-be-formed LLC). I’m not sure if I directly answered your question (as I don’t fully understand the question). However, I hope that helps ;)

Matt,

Thanks for the quick response. Yeah it helps, it’s just confusing on how to proceed. I think our situation would fit into a combined business as her work is related (meaning I would need to add her as a member I assume?), but it’s just such a small percentage of the total revenues, so I wasn’t sure if there were other options such as labeling her work as 1099 or something. We don’t live in a Community Property state so a joint venture isn’t an option. I suppose I’m just worried about the tax ramifications of such a small sliver of revenue being worthwhile in the end.

Hi William, I see. So why are you concerned about whether or not to add your wife as a Member to your LLC? For tax purposes? The same tax will be paid whether it’s a Multi-Member LLC taxed as Partnership or she just files a Schedule C as a Sole Proprietorship. If there is a liability concern for her business activities, you could add her as a Member of your LLC (not sure if that’s ideal). Or she could form her own LLC to keep those business activities separate from your business activities (and vice versa).

I filed our Arizona business as a multi-member LLC in 2019, but I plan to change it to a QJV using the letter you provided here. Do you know if I have to file our 2019 taxes as a partnership? Or can I file two two Schedule Cs if I get this QJV letter approved before the April deadline? Thank you in advance!

Hi Morgan, we’re not able to comment on specifics regarding tax filings. You’ll need to check with an accountant familiar with Qualified Joint Ventures. Thanks for your understanding.

Hey Matt, thank you for the concise explanation. My wife and I are currently own an LLC (Ohio – Common Law State) . Since we do not qualify to file as QJV, would it make sense for me to remove her from the LLC, so that we do not have to file as a partnership? Last year we filed two schedule C’s (which I assume was incorrect) , do we need to amend it? Looking back at my IRS EIN statement it states I needed to file a 1065. We didn’t claim any income as our first year had losses. Any help would be appreciated.

Thank you.

Hey Matt, you’re very welcome. This would be a conversation to have with an accountant. Thanks for your understanding.

I do have a question. I am starting a business up as a woman in a mans industry and though I would like to show my husband on the LLC, if I file as a Qualified Joint Venture would this affect my status as a woman owned business? Originally he was going to show a 10% ownership on the Operating Agreement. Any insight would be appreciated.

Hi Kelli, that’s a great question. We’re not sure. You’ll want to contact the agency that would qualify your business. They likely have a set of requirements. Hope that helps.

Hi Matt.

Thank you so much for your easy to understand information.

I do have a question for you though. I saw where if a husband and wife are going to be the only ones and file as single that on the member area we are to put both our names on one line….ex. John and Mary Doe…instead of filling out two separate names and addresses. Do we still put Partnership at the bottom of page 2 or do we put single member there. We live in Texas. I was unsure of that area on the form.

Matt, thank you so much for this resource and all the other articles that has made forming a new LLC and opening our new business a little easier.

You’re very welcome Jin! Thank you for the nice comment.

By the way – thank you for all the great advice and free letter templates. You provide a wonderful service! I will certainly send in a donation!

Thank you so much Polly! And you’re very welcome!

We live in the State of Washington, and our LLC is registered in Washington – is the Qualifying Joint Venture notification letter for our LLC mailed to Cincinnati, OH, or should we mail it to Ogden, UT?

Hi Polly, while both addresses will work, you should send to Odgen, UT for the fastest response. We’ve updated this page to make the mailing address section more clear. Thank you.

Hey Matt! Great site. Thanks for all the help. Are there any disadvantages or reasons that you can think of that a married couple in a community-property state might choose to organize their LLC as a standard partnership LLC rather than a Qualified Joint Venture?

Hey Jeff, there may be some slight pros and cons, but I’m not sure on this as it would really dig deeper in taxes. I recommend running that questions by a few accountants and seeing what they think. If you’d like, feel free to share any findings :) Thank you for your understanding.

You state that “The married couple can get additional credit for paying Social Security and Medicare taxes (without actually having to pay more in taxes).” What do you mean by this?

Hi Shawn, we don’t cover that level of granularity regarding taxes. You’ll need to speak with an accountant. Thank you for your understanding.

Hi,

If I understand correct we with my husband can’t form “Husband and Wife Qualified Joint Venture LLC” if we live in Illinois. Before now we filled one tax declaration. When we will register LLC as Partnership, we have to fill taxes separatelly. Is it correct?

Thanks in sdvance for answer.

Alla

Sort of. It’s more semantics. You will still be filing taxes on your personal married joint tax return, however, rather than two Schedule Cs, it’ll be a 1065 Partnership return and K-1s will need to be issued. Also, you don’t have to “register” your LLC as a Partnership. The IRS automatically treats an LLC with 2 or more Members as a Partnership for federal tax purposes. Hope that helps :)

Is there a way to have a spousal QJV in Alaska?

Hi Jen, unfortunately no. This is because Alaska isn’t a community property state.

Appreciate the CLEAR explanation. Being in AZ we will divide the income and expenses on separate schedule c forms! This is nice because we can’t claim the additional child tax deductions like daycare etc. if one spouse doesn’t have income listed on the 1040. Not to mention the soc sec. being applied to both spouses instead of just one. The only “election” required is just to make to schedule c forms I think?

Hey Matt, thanks for the nice comment. Speaking of comments, we can’t comment on how a return is structured. We definitely recommend speaking with an accountant before making this election and afterward. Thanks for your understanding :)

Amazing helpful, I have been searching and reading from the Secretary of State and the IRS. You teach in easy to understand language.

One other thing I need to know is how to write and Article of Consolidation for Iowa. I can’t find a for, only a filed one from a company that has done it. Help, it is lengthy and very confusing. We need to have an official meeting of the board of the S corp to have everything on record. We are consolidating our S Corp to an LLC. Iowa requires that we file a Certificate of Organization. Then I understand the IRS will accept a late return and effective date of the LLC for 2017 if the returns have not been filed yet.

This is long but I do hope you can give me some guidance.

Hi Judy, thanks for the kind words and I’m happy to hear things are easy to understand! I apologize, but this is above my current understanding as we don’t work with converting S-Corporations to LLCs yet. I’d advise giving our “knights of the roundtable” strategy a try (details here) and calling a few lawyers. I hope you can get to the bottom of things!

This is the first time in 12 years that I have been able to find any clear explanation of how to deal with a qualified joint venture LLC. Thank you.

Hi Fayne, thank you for the nice comment! I’m glad to hear the explanation was easy to read and understand :)