Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

All North Dakota LLCs must file an Annual Report

Know what you’re doing? Jump to the instructions ↓

Ever North Dakota LLC that does business in the state must file an Annual Report every year.

Ever North Dakota LLC that does business in the state must file an Annual Report every year.

This is required in order to keep your LLC in compliance and in good standing with the North Dakota Secretary of State.

If you don’t file your LLC’s Annual Report on time, there are late fees.

If you continue to ignore the Annual Report filing requirement, the Secretary of State will shut down your North Dakota LLC.

All Annual Reports for LLCs must be filed online via FirstStop.

If you formed your North Dakota LLC online via FirstStop:

You’ll be able to login and begin filing your Annual Report.

If you didn’t form your North Dakota LLC online via FirstStop (you filed by mail, fax, or walk-in):

You’ll need to create a FirstStop account.

You should have also received a PIN in the mail from the Secretary of State. These PINs are sent to your LLC’s Principal Executive Office. You need the PIN in order to “connect” your LLC to your FirstStop account.

If you don’t have a PIN, you’ll need to request one from the Secretary of State before you can file your LLC Annual Report online. We have more details on this further below.

North Dakota LLC Annual Report fee

The North Dakota LLC Annual Report fee is $50.

This $50 fee is due every year by the Annual Report due date.

Annual Report due date

Your LLC Annual Report is due by November 15th every year.

When is my first North Dakota LLC Annual Report due?

Your first Annual Report is due the year after your LLC is approved.

You can find your LLC’s approval date by looking at your approval documents or by finding your LLC’s “filing date” on the North Dakota Business Search page.

Some examples:

- If your LLC was approved on March 10th 2025, your first Annual Report will be due by November 15th 2026.

- If your LLC was approved on December 1st 2025, your first Annual Report will be due by November 15th 2026.

Exception for Farm/Ranch LLCs

If you formed a Farm/Ranch LLC, as per Section 10-06.1-15 of the ND Century Code, you must file an Initial Farm Report along with your Articles of Organization. Luckily, those two forms will be grouped together in your FirstStop account.

Once logged into First Stop, click on “Forms”. In the “Limited Liability Company” Section you will see “Farm/Ranch Limited Liability Company Articles of Organization and Initial Farm Report“.

After your Articles of Organization and Initial Farm Report are filed and approved, you then must file an Annual Report every year. The Annual Report for Farm/Ranch LLCs is due by April 15th every year (instead of November 15th like “regular” LLCs).

Your Farm/Ranch LLC’s first Annual Report will be due in the year after your LLC is approved. For example, if your Farm/Ranch LLC was approved anytime in 2025, then your first Annual Report will be due by April 15th, 2026.

What’s the purpose of the Annual Report?

The purpose of the Annual Report is to keep your LLC’s contact information up to date with the North Dakota Secretary of State.

What’s the penalty for not filing an Annual Report (or filing late)?

If your North Dakota LLC Annual Report is filed after the due date, there is a $50 late fee. This $50 late fee is in addition to the Annual Report filing fee of $50, so it’s $100 total.

You have 6 months to file a late Annual Report (and pay the $100).

If you don’t file within the 6-month window, by law, the Secretary of State’s office will shut down your LLC. This is called revoking your LLC’s charter (existence), or revocation.

If your North Dakota LLC has been revoked, you can file a Reinstatement to bring your LLC “back to life”. The Reinstatement fee is $135. You must also file a past-due Annual Report and pay the $100 fee ($50 Annual Report fee + $50 penalty). You can file a Reinstatement with the Secretary of State up to 1 year after your LLC was revoked.

(Note: A North Dakota LLC that has been revoked for more than 1 year can only be reinstated by a court order.)

If your LLC has been revoked and you want to file a Reinstatement, it’s best to call the North Dakota Secretary of State for instructions and fees specific to your LLC. You’ll find the Secretary of State’s contact information toward the bottom of this page.

Note: The above penalties also apply to Farm/Ranch LLCs.

How to file an Annual Report in North Dakota

You can only file your North Dakota LLC Annual Report online.

The online filing system is called FirstStop.

Mail filings

If you don’t have a credit or debit card, you still have to start the Annual Report filing inside of FirstStop, and then at the end of the filing, you can print out your Annual Report and mail it to the Secretary of State with a check or money order.

By default, when filing by mail, the Secretary of State doesn’t send back any proof of the filing. If you would like proof that your LLC Annual Report has been filed, you can mail a “Cover Letter for Annual Report” along with your Annual Report and payment. This way, after your Annual Report has been processed, the Secretary of State’s office will mail you back proof of filing.

Note: This “mail filings” section is only applicable to a small percentage of readers. Most of our readers just file the Annual Report online. If you’re filing your LLC Annual Report online, you don’t need to worry about this “Mail filings” paragraph.

Processing Time for the Annual Report

After you submit your North Dakota LLC Annual Report online (via FirstStop), it will be processed and filed instantly. You’ll be able to download your approval documents right after the payment goes through.

Although rare, there is a small chance that your LLC’s Annual Report goes into “worker review”. This usually happens if you make substantial changes to your LLC’s Annual Report. Don’t worry though, it just means a staff member at the Secretary of State’s office needs to review your filing and make sure they update your records correctly. In that case, it could take 2-4 weeks for your LLC’s Annual Report to be processed.

A “worker review” will not cause your Annual Report to be late. Your Annual Report is considered “filed” on the date it is received by the Secretary of State. Don’t worry though, if this occurs, you’ll receive a message about it so there’s no surprises.

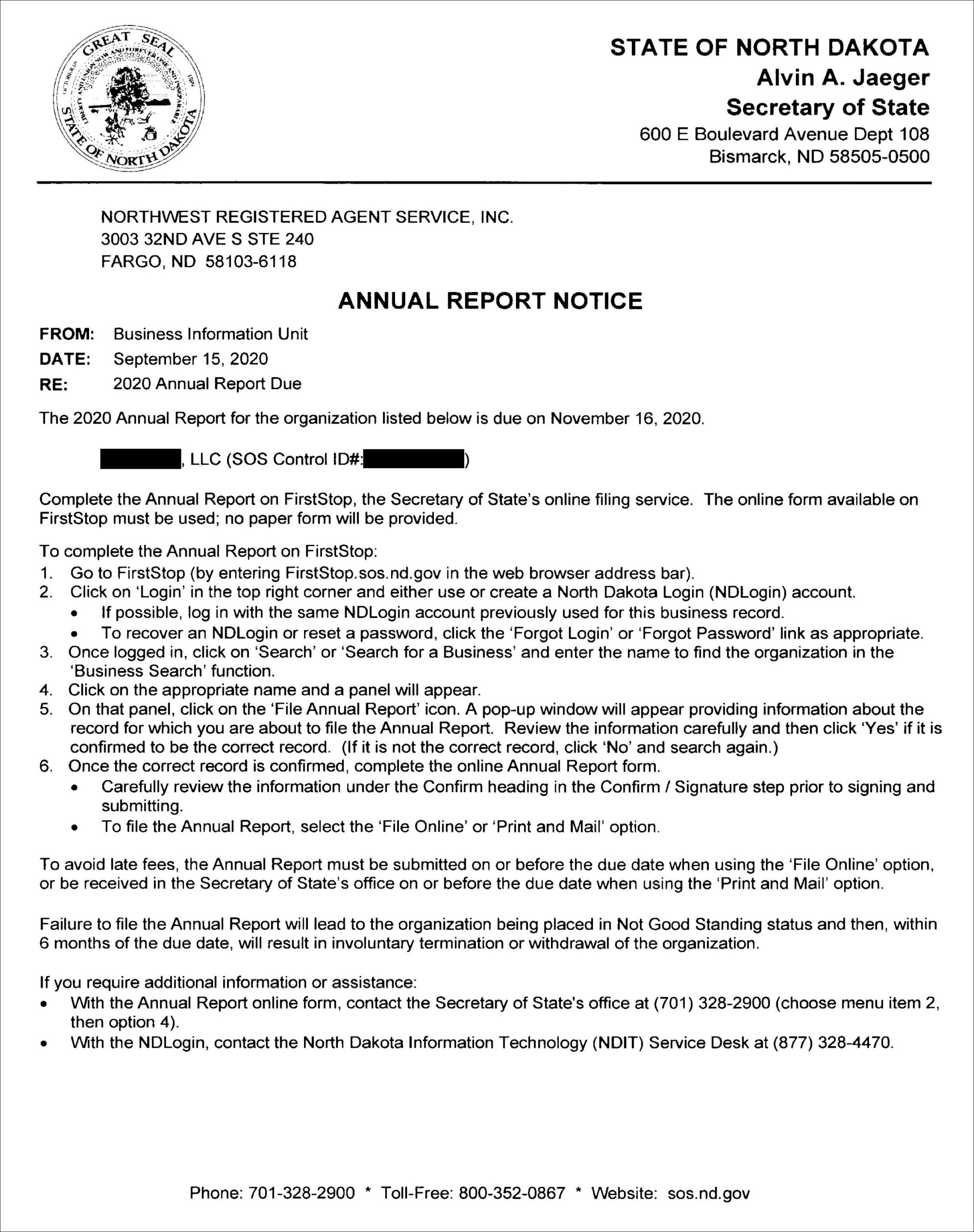

Annual Report reminder

An LLC Annual Report reminder is mailed to the address of your North Dakota Registered Agent about 60 days prior to the due date.

Here’s what it looks like:

(Currently, the state doesn’t send any reminders by email.)

However, even if you don’t receive an Annual Report reminder, it’s still your responsibility to file your North Dakota LLC Annual Report on time every year.

For this reason, we recommend putting a repeating reminder on your calendar, phone, and/or computer.

This will help avoid getting your LLC shut down.

How early can I file my LLC’s Annual Report?

You can file your North Dakota LLC Annual Report as soon as you receive the reminder from the Secretary of State’s office.

This will be approximately 60 days before the due date, or sometime in mid-September.

PIN numbers, requesting access, and FirstStop

FirstStop is the only way to file an Annual Report (and it’s the preferred method for LLC registrations, too).

However, the North Dakota Secretary of State takes your security very seriously. They don’t have an “open database”, where anyone can file anything on behalf of any LLC.

So in order for someone to access an LLC record, and make changes or filings on behalf of that LLC (such as filing an Annual Report), they need to be authorized to do so.

You can find your PIN in a letter called “Welcome to FirstStop” that the Secretary of State sent to your Principal Office address.

If you don’t have this notice, or you’re not sure where it is, then you’ll need to “Request Access” (and get a PIN) to “connect” your LLC to your FirstStop account. You’ll find instructions on this below.

If you formed your LLC online (via FirstStop):

If you formed your LLC online via FirstStop, then you don’t need to worry about a PIN or “Requesting Access”.

The reason is that your LLC is already connected to your FirstStop account. You can skip ahead to the filing instructions.

If you didn’t form your LLC online via FirstStop, don’t have a PIN, or hired a company to form your LLC:

You first need to create a FirstStop account and then connect it (or request access) to your LLC.

Here’s how to create a FirstStop account:

- Go to the North Dakota FirstStop page.

- Click “Login“.

- Click “Personal Account“.

- Create a username and password and enter the rest of your information.

- Agree to the terms and click “Create Account“.

- You’ll see a note telling you to “confirm your account“. Go to your email and find the email from the state.

- Copy (or write down) your activation code.

- Go back to the FirstStop browser tab, enter your activation code, and click “Confirm“.

- Click “Return to Online Service“.

- Click “Login” again.

- Enter your login information and click “Login“. The page will not refresh, but you should see your username in the upper right (this means you’re logged in).

Now that you have a FirstStop account, you need to request a PIN and then “connect” it to your LLC.

Here’s how to do that:

- Search your LLC name on the North Dakota Business Search page.

- Click on your LLC name and look to the right.

- You should see a “Request Access” button. Click that.

- You should see this message: “Click Request PIN to have a new PIN sent to the record’s mailing address on file”.

- Click the “Request PIN” button.

- The Secretary of State will mail you a PIN. It will be sent to your LLC’s Principal Executive Office (aka Principal Office). It will take about 1 week to arrive in the mail.

- Once you have your PIN, log back into FirstStop, search your LLC name again, click “Request Access” and enter your PIN.

- Once that’s completed, your FirstStop account is now connected to your LLC. You can now file your Annual Report online.

Important: A new PIN is only issued once. So it’s very important you know what your LLC’s Principal Executive Office address is and that you’re able to receive mail there. If you have issues with receiving your PIN, you must call the Secretary of State’s office (contact information towards the bottom of the page) and get assistance with connecting your FirstStop account to your LLC.

If your LLC has a Commercial Registered Agent, you may see a different message:

(Note: This doesn’t apply to all LLCs with a Commercial Registered Agent, just some.)

- A large number of Commercial Registered Agents were granted access to FirstStop (by the Secretary of State) for all the LLCs they provide services to.

- If your LLC has a Commercial Registered Agent, after clicking “Request Access”, you may see this message: “To become an owner of this record, a current owner will need to grant you access. To request access, click Request Access below.”

We just wanted to let you know about this since some people get scared when they read that there is already a current “owner” for their LLC. Don’t worry, it’s just your Commercial Registered Agent. Again, the North Dakota Secretary of State grants large Registered Agent companies access to LLCs they provide services to. It’s nothing to worry about. - Small potential issue: Some Commercial Registered Agents manage tens of thousands of LLCs. So if you request access from them, there is a chance they could be slow to reply to the email from the state that grants you access. If you don’t hear back from the FirstStop system (which hasn’t heard back from your Commercial Registered Agent) after requesting access, you’ll need to call the Secretary of State (contact info towards bottom of page) for assistance requesting a PIN and connecting your LLC to your FirstStop account.

If your LLC is already connected to another FirstStop user:

- Your LLC may already have an “owner” if there are multiple LLC Members (each with their own FirstStop account).

- This isn’t very common, but there is a chance it could occur. If that’s the case, you just need to request access from the first “owner”.

- After searching your LLC name and clicking “Request Access“, the current “owner” will receive an email from FirstStop.

- The current owner will then login to FirstStop where they’ll see a “Manage User Access” section. Then the current owner can accept your request and connect the LLC to your FirstStop account as well (and you’ll also become an “owner”).

How to Complete the North Dakota LLC Annual Report

Get started:

- Visit FirstStop and login.

- Visit the Business Search page and search your LLC name. Just enter the first word or two of your LLC name. Don’t include “LLC” in your search.

- Click on your LLC name in the results below.

- A pop-up will appear on the right. Click “File Annual Report“.

- Another pop-up will appear asking you to confirm the LLC. Click “Yes” to proceed.

Instructions

There is nothing to do on this page except click “Next Step“.

Entity Information

Annual Report Due Date:

There is nothing to do in this section.

Limited Liability Company Name:

There is nothing to do in this section. You cannot change your LLC name via the Annual Report.

(Tip: You need to file an Articles of Amendment if you want to change your LLC name. You can follow our step-by-step instructions in North Dakota LLC Name Change.)

Principal Executive Office Address:

Make sure your LLC’s Principal Executive Office Address is correct and up-to-date. If it’s not, please make changes here.

What is the Principal Executive Office Address?

The Principal Executive Office Address is where business activities take place and/or where business, legal, and financial documents are kept for your LLC.

This address cannot be a PO Box address. It must be a physical street address.

The Principal Executive Office Address can be:

- a home address,

- an office address,

- or the address of your Registered Agent (if they allow).

Mailing Address:

Make sure your LLC’s Mailing Address is correct and up-to-date. If it’s not, please make changes here.

What is the Mailing Address?

This is where you prefer mail to be sent for your LLC.

This address can be different from your LLC’s Principal Executive Office Address.

If you don’t have a separate mailing address, you can just list the Principal Executive Office Address again here.

Registered Agent

There is nothing to do in this section. You can’t change your LLC’s Registered Agent via the Annual Report.

(Tip: You need to file a Statement of Change of Registered Agent to change your Registered Agent. Or, if you hired a new Registered Agent company, they can file this change for you.)

Character of Business (be specific)

- Related article: LLC statement of business purpose

Add or update the activities or purpose of your LLC.

Tip: Don’t worry, you’re not going to be forced to do this forever. You can always change the purpose of your LLC in future Annual Reports.

You must be specific

You can’t use a generic statement here, like “any lawful business”, or “general business purpose” (or anything similar). This will cause your North Dakota LLC Annual Report to be rejected.

Instead, you must be specific.

Here are a few examples:

- This business owns and runs a pizza shop in Jamestown.

- This business is created for the purposes of buying and selling real estate.

- This business will provide landscaping services.

- This business will provide online coaching and digital products to families who homeschool their children.

Tip: If you’re not sure how specific or vague to be, it’s better to be more specific.

Management

In North Dakota, there are 3 ways an LLC can be managed:

- Member-Managed

- Manager-Managed

- Board-Managed

Depending on how your North Dakota LLC is managed, you’ll need to click “Add” and then enter the name, address, and title of either:

- the LLC Member(s), with titles “Member” or “Managing Member”

- the LLC Manager(s), with titles “Manager”

- the LLC Governor(s) with titles “Chief Executive Officer”, “CEO”, “Chief Manager” “President”, “Vice President”, “Chief Financial Officer”, “CFO”, or any other applicable title

Member-Managed LLC

A Member-Managed LLC is where all of the LLC Members (owners) have the ability to bind the LLC into contracts and agreements. They also take part in the day-to-day operations and business decisions.

Note: Most LLCs in North Dakota are Member-Managed.

Manager-Managed LLC

A Manager-Managed LLC is where the LLC Members appoint one (or more) Managers, who are then the only one(s) who have the ability to bind the LLC into contracts and agreements. They are also the ones who take part in the day-to-day operations and business decisions. The Members take more of a “back seat”/investor role.

To learn more, please see:

Board-Managed LLC

A Board-Managed LLC is a newer concept (allowed by the North Dakota statutes) where an LLC can be managed by a “Board of Governors”, similar to a Board of Directors in a traditional Corporation.

The Board of Governors can have one Governor or multiple Governors.

The specific language in the Operating Agreement will determine the details of how a Board-Managed LLC is run.

Because Board-Managed LLCs are quite new, and there are a number of legal considerations (and potential issues), we recommend getting legal advice and working with an attorney if this is something you are considering.

Note: Most LLCs in North Dakota aren’t Board-Managed.

Confirm/Signature

Confirm:

Review the information you submitted for accuracy. Check for any typos.

If you need to make any changes, click “Previous Step“.

If all looks good, scroll to the bottom of the page.

Signature:

Check off the box, enter your name, and enter today’s date.

Click “Next Step” to proceed.

Submit

Select your submission method.

You can submit your Annual Report online (and pay online) or you can print it out and submit it by mail (and pay by check or money order).

Print and mail:

Click “Print and Mail” at the bottom.

Send your signed Annual Report to the state along with the $50 filing fee. Your check or money order should be made payable to the “Secretary of State”. Send your form and payment to:

ND Secretary of State

PO Box 5513

Bismarck, ND 58506-5513

Late filing? If your Annual Report will be received by the Secretary of State after November 16th, it’s considered late. So if you think your Annual Report will arrive after that date, your filing fee is $100 (and not $50).

File online:

Click “File Online” at the bottom. A pop-up will appear on the right showing the filing fee.

Click “Pay with Credit Card“.

Enter your payment and billing information and then click “Pay Now“.

You will be redirected back to FirstStop and you’ll see a “payment processing” message.

Approval for your Annual Report

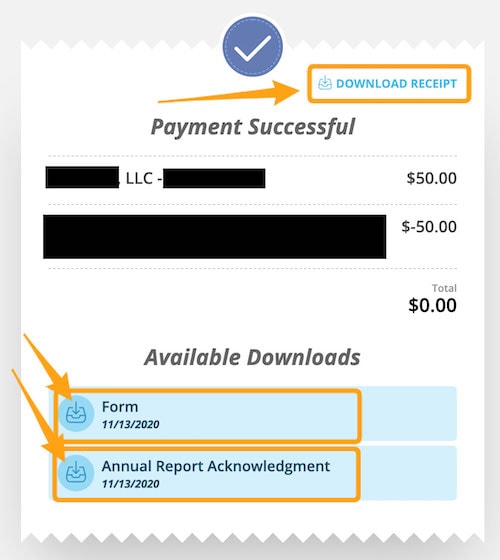

The approval time for filing the Annual Report is instant. Once your payment goes through, you’ll see a “Payment Successful” message. It will look something like this:

Downloads

After your Annual Report is approved, there are 3 documents you can download (see the orange boxes in the above image).

The 3 document links are:

- “Download Receipt” (This is your payment receipt.)

- “Annual Report Acknowledgment” (This is an informational receipt.)

- “Form” (This is a copy of the completed Annual Report form you just filed.)

Just download these documents and keep a copy of them with your business records.

Once you download your forms, you’re all set! You can close the webpage.

And don’t forget: Make sure to file your LLC Annual Report on time next year. :)

North Dakota Secretary of State Contact Info

If you have any questions, you can contact the North Dakota Secretary of State.

Their phone number is 701-328-4284. This is the phone number to reach the department that handles Annual Reports. You can also call them on their main line at 701-328-2900.

Their hours are Monday through Friday, from 8am – 5pm Central Time.

References

North Dakota Century Code: Section 10-32.1-89

North Dakota Century Code: Section 10.32.1-90

North Dakota Century Code: Section 10.32.1-91

North Dakota Century Code: Section 10.32.1-92

North Dakota Secretary of State: LLC Annual Reports

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

North Dakota LLC Guide

Looking for an overview? See North Dakota LLC