Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

LLC filing form (Articles of Organization) in South Carolina

In this lesson, we will walk you through filing your Articles of Organization with the South Carolina Secretary of State. This is the document that officially forms your South Carolina LLC.

In this lesson, we will walk you through filing your Articles of Organization with the South Carolina Secretary of State. This is the document that officially forms your South Carolina LLC.

You can submit your South Carolina LLC’s Articles of Organization to the state online or by mail. Or, you can hire a company to form your LLC instead. Check out Best LLC Services in South Carolina for our recommendations.

Important: Before acting on this lesson and filing your Articles of Organization, make sure you have searched your South Carolina LLC name and selected your LLC’s Registered Agent.

How long does it take to get an LLC in South Carolina?

If you file online, the LLC filing fee is $125 and your LLC will be approved in 1-2 business days, however, most filings are approved the same business day.

If you file by mail, the LLC filing fee is $110 and your LLC will be approved in 3-4 business days (plus mail time).

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in South Carolina.

We recommend online filing because it’s much easier to complete, and the approval time is much faster. However, if you want to save $15 and don’t mind the wait, then you can file by mail.

We’ve written you step-by-step instructions below for both the mail and online filing.

Scroll down or skip ahead to the applicable section:

Note: The “LLC filing fee” (the fee to create a South Carolina LLC) is the same thing as the “Articles of Organization fee”. The Articles of Organization is the document, that once approved by the Secretary of State’s office, creates your South Carolina LLC.

How much is an LLC in South Carolina explains all the fees you’ll pay to start and maintain an LLC.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

How to file South Carolina LLC Articles of Organization Online

Create your Online Account:

1. Visit the South Carolina Online Business Filing System.

2. Enter your email address, create a password, and click “Continue”. Make sure to keep this information in a safe place.

3. Go check your inbox and look for the email the state has sent you. Click the “Complete your registration” link to verify your email address. You’ll then be redirected to a confirmation page. Click the “Login” button to proceed.

4. Login with your email and password.

5. Create 2 security questions and then click “Continue”.

File your LLC’s Articles of Organization Online:

Get Started:

To the right of “New Business”, click “Start a New Business Filing“.

Select “Begins With“, enter your desired LLC name, and click “Search“.

Make sure to enter your desired LLC name exactly as you’d like it, including your desired capitalization and your preferred designator.

Remember: If you haven’t read our LLC name search lesson, please do so first before proceeding. It will explain the naming rules for South Carolina LLCs to help your LLC get approved on the first try.

When you find an LLC name that gives the result of “This name is available”, click the “Add New Entity” button to begin your filing.

1. Is the organization a South Carolina entity?

Most filers are forming LLCs in South Carolina. These are called “Domestic LLCs”.

If that’s the case for you, then click the “Yes Domestic Entity” button.

If you already formed an LLC in another state, and you are registering that LLC to do business in South Carolina, then click the “No Foreign Entity” button.

2. Choose a business type to see a list of forms:

Select “Limited Liability Company” from the drop down menu. “Available Forms” boxes will appear below. To the right of “Articles of Organization”, click the “Start Filing” button.

3. Contact Information:

Please enter your contact information and then click “Continue“.

4. New Entity Name:

Make sure your desired LLC is capitalized the way you want it. And make sure your LLC name has the appropriate designator at the end (“LLC”, “L.L.C.”, “L.C.”, or “LC”).

Most people choose the designator “LLC”.

5. Agent Information:

Enter the name and street address of your LLC’s Registered Agent. The address can’t be a PO Box, and the address must be located in South Carolina.

Your LLC’s Registered Agent is a person or company who agrees to accept legal mail and court documents (known as “service of process”) on behalf of your LLC if your business is sued. You have 3 options for who can be listed as your LLC’s Registered Agent.

Important: If you haven’t read our South Carolina Registered Agent guide yet, please do so first before acting on this lesson.

6. Initial Designated Office:

Enter your LLC’s office address here.

This doesn’t have to be an actual office address. It just needs to be a South Carolina street address where the LLC is “located”.

You can use:

- your home address,

- the address of a friend or family member, or

- an actual office address if you have one.

7. Managers:

In this section, you’ll let the the state know whether your business will be a Member-managed vs. Manager-managed LLC.

Most LLCs are Member-managed, where all the owners run the business and day-to-day operations.

An LLC can also be Manager-managed. This is where one, or a few designated people, run the business and day-to-day operations. The rest of the members play more of a passive/investor role.

If your LLC is Member-managed, leave this section blank (don’t check off the box).

If your LLC is Manager-managed, check off the “LLC has managers” box and add their contact information in the box that appears below.

8. Member(s) Liable for its debts? (not required):

Only check this box if one or more of the LLC’s members are going to be held liable for the business’ debts and obligations (as per section 33-44-303). Most filers choose to leave this blank.

9. Company Term:

If you’d like your South Carolina LLC to have a perpetual existence, leave this section blank (don’t check the box).

This is what most filers choose and this gives them the freedom to have their LLC remain in existence until they choose to close it down (if ever).

If you’d prefer your LLC to automatically be shut down on a specific date in the future, check this box off and enter your LLC’s future date of dissolution.

10. Delayed Effective Date:

If you’d like your LLC to go into existence on the date it is approved by the South Carolina Secretary of State, then leave this section blank (don’t check the box). If want your LLC to go into existence on a future date, enter that date in the box. The date cannot be more than 90 days ahead.

Important notes:

You cannot back-date your filing.

If you’re forming your LLC in October, November, or December, and you don’t need your LLC open right away, you can forward date your filing to January 1st of the following year. This will save you the hassle of unnecessary filing and/or reporting on your personal tax return for those few months. For more information, please see LLC effective date.

11. Organizers:

Enter the name and address of each person filing this form with the state. There only needs to be one Organizer, but you can have multiple Organizers if you’d like.

From the “Who is signing this form” drop down, select “Organizer”. Check off the box that appears below (agreeing to the terms) and enter your full name in the box. This serves as your digital signature.

Note: An Organizer is not automatically made a member of the LLC by signing this form (although they can be a member; but that’s done with a different form). Members are set in your Operating Agreement, which we’ll discuss later on. F0r more information on the role of an Organizer, read these articles: Organizer vs. Member and Registered Agent vs Organizer.

12. Next Step:

Click the “Continue” button at the bottom to proceed to the next step.

13. Summary of Forms & CL-1:

Since an LLC does not have it’s own tax classification with the IRS, your LLC can be taxed in 1 of 4 ways:

- like a Sole Proprietorship (the default status for single-member LLCs)

- like a Partnership (the default status for multi-member LLCs)

- like a C-Corporation

- like an S-Corporation

If your LLC will be taxed in its default status by the IRS (Sole Proprietorship or Partnership), you can just click “Continue” to proceed.

If your LLC will be taxed as a S-Corporation or an C-Corporation, click “Start Filing” to the right of CL-1.

Note: If your LLC will elect S-Corp tax status or C-Corporation tax status with the IRS, you also need to file Form CL-1 with the South Carolina Department of Revenue.

If you’re not sure how your LLC should be taxed, we recommend speaking with your accountant. And if you don’t have an accountant, we’ve researched and made accountant recommendations for you in every state.

14. Filing Summary:

There is nothing to do on this page but click “Checkout”.

15. Payment:

Enter your credit or debit card information and click “Next”.

Congratulations, your South Carolina LLC has been filed online for processing!

Now you just need to wait for approval. The state will email you in 1-2 business days after they review your filing.

South Carolina LLC Online Approval:

Within 1-2 business days, the state will send you an email.

If your LLC was rejected, they will explain why and tell you what you need to do to properly re-file.

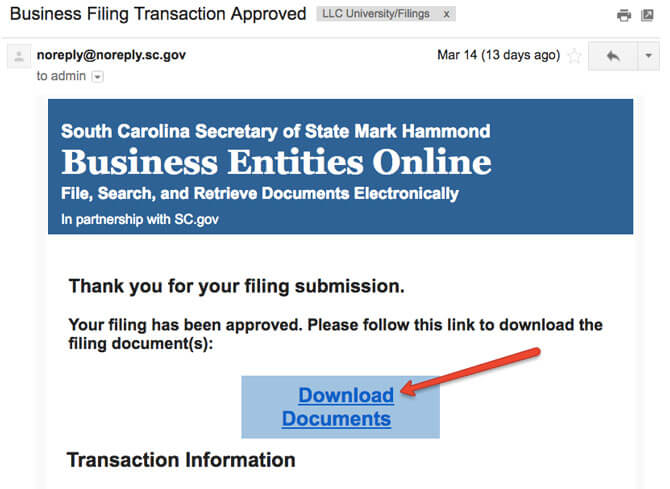

If your LLC was approved, you’ll receive an email from the state and inside will be a link called “Download Documents”:

After you click the “Download Documents” link, you’ll be taken to the download page.

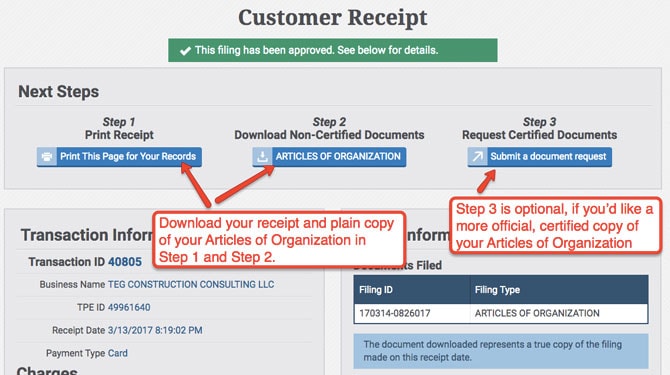

Click the button under “Step 1 Print Receipt” and the button under “Step 2 Download Non-Certified Documents” to download your receipt and stamped and approved Articles of Organization:

Certified Copy (optional):

Step 3 (Request Certified Documents) is optional, but if you’d like a certified copy of your Articles of Organization, click this button as well. There is a small fee to pay. You’ll be able to download a certified copy of your Articles of Organization right after making payment.

You’re finished. There are no more steps in forming a South Carolina LLC online. Please proceed to the next step.

How to File South Carolina LLC Articles of Organization by Mail

Download South Carolina Articles of Organization:

South Carolina Secretary of State: Downloadable paper forms

(look for “Limited Liability Company – Domestic”)

Instructions:

Please follow the instructions above for the online filing. The steps are exactly the same. The only difference is that you are entering the information into the paper form instead.

2 Copies:

When filing your LLC by mail, you need to send 2 copies of your Articles of Organization. Make sure both are completed exactly the same and that they have the signature(s) of the Organizer(s).

Filing Fee: $110

Accepted Forms of Payment: Check or Money Order

Make Payable To: “South Carolina Secretary of State”

Mailing Instructions: Send your $110 filing fee, along with 2 copies of your Articles of Organization and a self-addressed stamped envelope to:

Secretary of State

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201

Tip: you may need to use a medium-sized envelope if the above items do not fit in a regular #10 envelope.

South Carolina LLC Approval for Filing by Mail:

After South Carolina processes and approves your LLC, they will send the following items back in the mail: a stamped and approved copy of your Articles of Organization and a Filing Receipt.

South Carolina Secretary of State Contact Info

If you have any questions, you can contact the South Carolina Secretary of State at 803-734-2158.

Next Step

Once you file your Articles of Organization and it is approved by the state, you can then proceed to the next lesson: LLC Operating Agreement.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

References

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

South Carolina LLC Guide

Looking for an overview? See South Carolina LLC

Do I need to choose “Certificate of Existence” and “Articles of Organization”?

Hi Tam, apologies for the slow reply. We got backed up on support tickets. You just need to file the Articles of Organization to form an LLC in South Carolina. A Certificate of Existence won’t hurt to get, but it’s not required.

Hello, I was wanting to open an LLC and then have multiple DBA’s under that. I found that South Carolina does not require you to file DBA’s. So can I just have multiple businesses under my one LLC with no issues? Example: Gwen’s LLC and then Gwen’s Candles, Gwen’s Photography, Gwen’s Soaps

Thanks in Advance

Hi Gwen, there is no state-level DBA (usually called an Assumed Name in South Carolina) filing in South Carolina, however, you’ll want to check with the city and county where you’re doing business to see if they have a registration requirement. If not, your LLC can simply use the DBA names as you wish.

I have 2 LLCs, and my husband has one. When the were formed a couple of years ago, we were not aware of an annual renewal fee. I checked and the LLCs are in good standing. How to I pay the annual renewal? Thank you!

Hi Patricia, South Carolina LLCs (taxed in their default status) don’t have an Annual Report to file with the Secretary of State. Please see here for more information: No South Carolina LLC Annual Report.