Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Tennessee LLC name

Once you’ve chosen a Tennessee LLC name, you need to compare it against existing businesses in the state.

Once you’ve chosen a Tennessee LLC name, you need to compare it against existing businesses in the state.

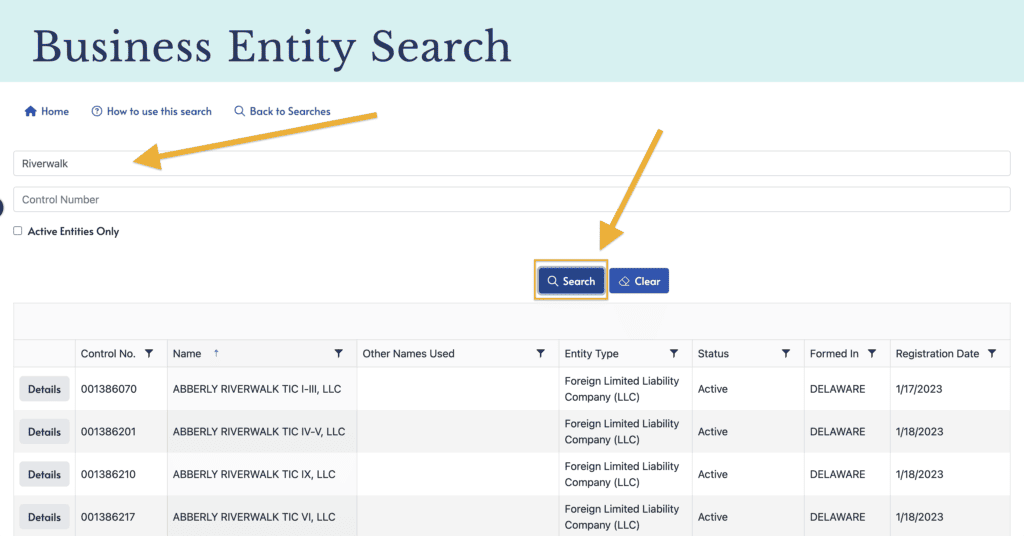

This is done using the Tennessee Business Entity Search tool.

And this is necessary because business names in the same state:

- can’t be the same

- can’t be too similar

If you file your LLC paperwork with a name that’s not available, your LLC filing will be rejected.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Tennessee business entity search

Search tips:

- Enter your desired LLC name in the box

- You can use uppercase or lowercase letters (it doesn’t matter)

- Leave out punctuation (commas, periods, apostrophes, etc.)

- Don’t enter a designator (like “LLC”) during the search

Then click “Search“.

Note: It’s best to only enter the main part of your desired LLC name in the search bar. For example, if your desired LLC name is Riverwalk Studios LLC, first do a search for the words “Riverwalk Studio“. And then do a search for “Riverwalk“. This helps you see everything that is potentially similar.

How to search the database (and understand the results)

Pro Tip: State databases aren’t very intelligent, so you need to search your LLC in multiple ways. This is very important for 2 reasons.

- If you choose an LLC name that’s already taken, your LLC filing will get rejected.

- If you choose an LLC name that’s very similar to an existing business, this may cause issues with branding, marketing, and potential customer confusion.

We’ll show you how to search your LLC in multiple ways.

Let’s use our example company, Riverwalk Studios LLC.

1. Do an exact search first

Why? Checking if your exact name is already taken will save you time.

Action: Search for “Riverwalk Studios“.

Results:

🔴If you see Riverwalk Studios LLC (or Riverwalk Studios Inc), then your LLC name isn’t available. You’ll need to come up with a new name.

🟡If you don’t see a Riverwalk Studios LLC (or Riverwalk Studios Inc), then you “passed the first test”. But next, you need to broaden your searches (to see any potential conflicts).

2. Broaden your searches

Why? While the exact name may not populate in the search results, there may be other names that are very similar. And the state can reject names that are too similar. Or you might not want an LLC name that is too similar to an existing business.

Actions: Remove a word or two. For example, search “Riverwalk S” and then “Riverwalk“.

Results:

🟡If you see “Riverwalk Studio Sounds” or “Riverwalk Productions” or “Riverwalk Recording“, then your LLC name is available, but it may be too similar in that it can cause branding, marketing, and customer confusion. It’s up to you though. You could still use Riverwalk Studios LLC (it’s distinguishable), or you may want to choose a different LLC name.

🟢If you don’t see any names that are too similar to your name (for example you see “Riverwalk Rentals” or “Riverwalk Bistro” or you don’t see anything with the name “Riverwalk“), then your LLC name is good to go!

What if my desired LLC name isn’t available?

If your name is not unique, you’ll need to come up with a variation or a different name for your LLC.

Tip: Wait until your LLC is approved before you apply for your EIN Number or purchase any other marketing materials. This way you don’t spend money on business supplies you can’t use because your business name isn’t available.

When in doubt, call the Secretary of State

You can call the Tennessee Secretary of State to confirm that your LLC name is available.

The Business Services phone number is 615-741-2286. Their hours are Monday through Friday, from 8am to 4:30pm Central Time.

Tennessee Limited Liability Company Name Requirements

As per Section 48-207-101 of the Tennessee LLC Act, there are a few rules and requirements for naming a Tennessee business entity that you need to know.

Do I have to use a comma in my LLC name?

No, you don’t have to. You can file your LLC name with or without a comma. Both versions are accepted by the Secretary of State.

For example: If your desired business name is Grandpa Joe’s, you can file it as:

- Grandpa Joe’s LLC

- Grandpa Joe’s, LLC

Or, instead of having “LLC” as your designator (ending), there are a few other options in Tennessee.

What designators (endings) can I use in my LLC name?

Your Tennessee LLC name must contain one of the following designators at the end:

- LLC

- L.L.C.

- Limited Liability Co.

- Limited Liability Company

- Ltd. Liability Co.

- Ltd. Liability Company

Note: Most people choose “LLC”.

The following designators aren’t allowed

Your Tennessee LLC can’t make itself sound like a Tennessee Corporation or any other business entity besides an LLC.

The following words and designators can’t be used anywhere in your LLC name:

- Inc.

- Corp.

- Incorporated

- Corporation

What words aren’t allowed in my Tennessee LLC name?

Your Tennessee LLC name can’t contain words and abbreviations that are restricted by law.

For example, you can’t make your LLC name sound like it’s a bank, part of the government or a government agency, or anything else that misleads the public.

You also can’t use words that are reserved for licensed professionals. These vary by state, but some common examples are accountants, architects, attorneys, dentists, and engineers.

For more information about restricted words for a Tennessee business entity, please see this PDF from the Tennessee Secretary of State: Business Name Availability Guidelines.

Your Tennessee business name must be distinguishable (unique)

When you use the Tennessee Secretary of State Business Entity Search, you will compare your desired LLC name to existing businesses in the state.

If your name is not unique, you’ll need to come up with a variation or a different business name.

Below are rules and examples of LLC names that are not distinguishable.

Designators

Differences in designators (endings) don’t create distinguishability.

If your desired LLC name is River Pearls LLC, it’s not available to use if any of the following are found in the Tennessee Business Name Search results:

- River Pearls, Inc.

- River Pearls, Corp.

- River Pearls, L.L.C.

Filler Words

Adding non-meaningful or filler words won’t create distinguishability. In Tennessee, the following words and symbols are considered “filler words”:

- the

- a

- an

- and

- &

- plus

- +

- at

- @

- of

- or

If your desired LLC name is Tomato Farms LLC, it’s not available to use if any of the following are found:

- The Tomato Farms LLC

- Of Tomato Farms Inc.

- @ Tomato Farms Incorporated

- Tomato & Farms Corp

Capitalization

Differences in capitalization don’t create distinguishability.

If your desired LLC name is Walking Horses LLC, it’s not available to use if any of the following are found:

- Walking HORSES Inc.

- walking horses LP

- WaLKiNg HoRsEs LLC

Said another way, you’re allowed to use any capitalization you want. It just doesn’t make your name distinguishable from an existing company with the same name.

Punctuation and Spaces

Adding punctuation or spaces won’t create distinguishability.

If your desired LLC name is Iris Nail Salon LLC, it’s not available to use if any of the following are found:

- IrisNailSalon Inc.

- “Iris” Nail Salon Limited Liability Co.

- Iris-Nail-Salon Inc.

- Iris Salon LLC

What if my Tennessee business name is rejected?

If you file your Tennessee Articles of Organization (the document that creates your Tennessee LLC) and the business name is not available, don’t worry.

The state will notify you and tell you why your filing was rejected.

You will just need to file again with a variation of your LLC name or a different LLC name.

Tennessee Business Name FAQs

Do I need a name reservation in Tennessee?

No, a name reservation isn’t required to form an LLC in Tennessee. It’s an unnecessary step and a waste of money.

You can just file your Articles of Organization with your desired LLC name.

Does Tennessee require LLC in the name?

Yes. Your Tennessee LLC name must contain one of the allowable designators at the end:

- LLC (this is the most common)

- Limited Liability Company

- Ltd. Liability Co.

Does my Tennessee LLC need a DBA?

No, you aren’t required to file a DBA (“Doing Business As”) for your LLC in Tennessee.

A DBA (known as an Assumed Name in Tennessee) lets your LLC conduct business under a name which is different from its true and legal name (the name on your Articles of Organization).

If you want your LLC to do business under a name that’s different from its true and legal name, you have to apply to register an Assumed Name online through the TNCaB portal (or print the online application and mail it). You’ll also pay an additional $20 fee to the Secretary of State.

If you are going to file an Assumed Name for your Tennessee LLC, it must also be distinguishable from existing business names in the state.

There is no limit to the number of Assumed Names an LLC can have.

For more information, please see Does my LLC need a DBA?

When would my LLC use a DBA?

Let’s say you form an LLC called Channel Catfish Boat Tours LLC, but you also want to use a friendlier, catchy name, like Catfish Tours. In this case, your LLC would need to file an Assumed Name Registration to use the name Catfish Tours.

If you don’t file an Assumed Name Registration for a different name, you can only use your legal entity name of Channel Catfish Boat Tours LLC.

Similarly, if you want to do business under the name Channel Catfish Boat Tours, just without the letters “LLC” in the name, you will need to file an Assumed Name for Channel Catfish Boat Tours.

How do I get a business domain name?

Once you’ve found a business name that you like, it’s a good idea to check if your domain name is available.

You can search for available domain names with GoDaddy:

Find a domain name

What does “distinguishability” mean?

Each business entity name must be “distinguishable upon the records” of the Secretary of State.

This means that no two businesses can operate with the same exact name (or names that are “deceptively similar“).

Said another way, if a business already exists with your desired LLC name (or one that’s very similar), you can’t register your LLC with that name.

For example, let’s say you want to form an LLC called Mockingbird Landscapers LLC. But there is already a business in another town called Mockingbird Landscapers, Inc (or The Mockingbird Landscapers LLC).

Because your desired LLC name is the same as (or too similar to) an existing Tennessee business, it is not distinguishable. You can’t use it and must choose another name.

How do I come up with a business name?

Business names are important for branding and recognition. The name of your Tennessee LLC can be your company’s brand name, but it doesn’t have to be (please see the FAQ about DBAs above). Either way, picking a good LLC name is an important decision.

Here are some quick tips for coming up with business names:

- First, write down the features of your company and things that you want to be associated with.

- Then list out as many business names as you can think of. Don’t edit or analyze them. Just get as many names on the page as you can.

- Now go back and read through them. Write down any variations that come to mind.

- Next, set the list aside. Do something else, like go for a walk or get groceries, or sleep on it for the night. Then come back and review the list of names. As you go through it, write down additional ideas and variations.

- Read the whole list out loud. If you want, get input from friends and family.

- Repeat the process: sleep on the ideas, write down new variations, read them out loud again.

- The best business name will often “rise off the page” and present itself. If it doesn’t, you can try this trick: Close your eyes and count to 10. When you get to 10, you must choose a name. When you open your eyes, force yourself to make a decision. Sometimes we know the best name deep in our subconscious, and this trick can help it come out. Trust yourself and go with what feels best.

For more tips, please see How to Choose an LLC Name.

Can I use the name of another Tennessee entity?

No. You can’t use the same name as another Tennessee business.

And it doesn’t matter what entity type it is – your LLC can’t have the same entity name as another corporation, LLC, or any other entity type.

You can’t use another business’s name even if the entity is in “delinquent” status on the Tennessee Secretary of State website.

But if a business is dissolved, they no longer have rights to that name. This means you can form an LLC with the same name.

How do I change my LLC name?

You can change your LLC’s name later by filing an Amendment form with the Secretary of State.

We have step-by-step instructions on how to change an LLC name in Tennessee.

References

Tennessee LLC Act – Section 48-207-101

Tennessee Revised LLC Act – Section 48-249-106

Tennessee Secretary of State: Business Name Availability Guidelines

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Tennessee LLC Guide

Looking for an overview? See Tennessee LLC

Greetings,

I am trying to setup LLC, but its purpose is to tie to self directed IRA so that I can do some real estate investing, the custodian company saying legal zoom sets them up wrong and at the end it costs more to fix the mess, so they are advising to start fresh with CPA, do you have procedure you can share on how to setup LLC where IRA is member.

Thanks

RP

This is all i have

Form an IRA LLC with the professional assistance of either a seasoned tax attorney or experienced IRA LLC facilitator who specializes in setting up IRA LLC regularly, and can ensure the entity is set up to meet your specific investment needs.

Hi RP, IRA/LLCs are on our list, but we don’t have an information published on them yet. We recommend working with an attorney or professional who specializes in IRA/LLCs. Thanks.