Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

After your Texas LLC is approved, you need to do the following with the Texas Comptroller:

- Wait for your Welcome Letter

- Create a WebFile account

- Complete the Franchise Tax Questionnaire

Welcome Letter

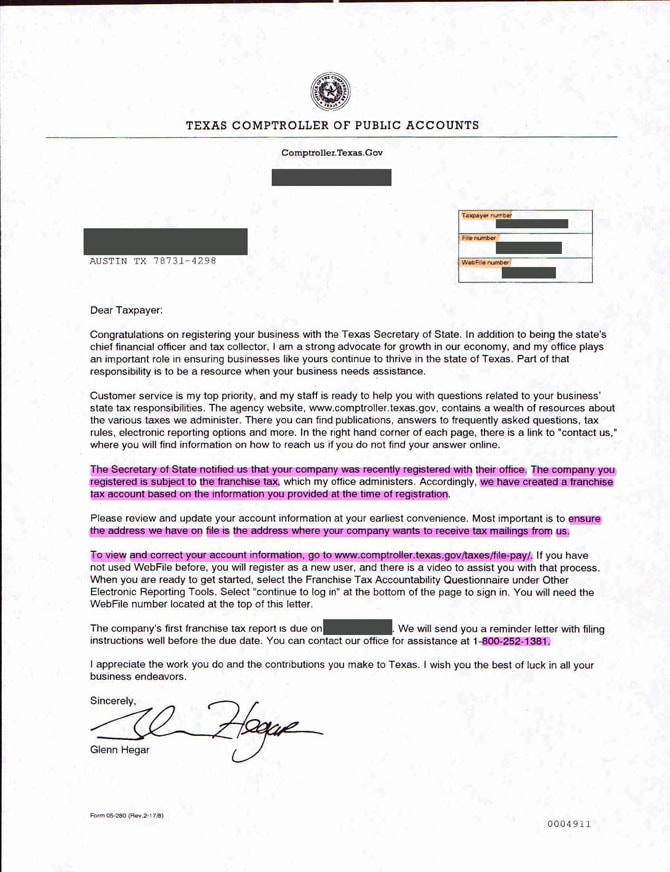

Within 2-3 weeks of your LLC being approved, you’ll receive a Welcome Letter from the Texas Comptroller.

Pro Tip: This is a very important document. Make a copy and keep it with your business records.

This letter will be sent to your LLC’s Mailing Address, and it includes 3 important numbers:

Taxpayer number

- This is your 11-digit Texas taxpayer number.

- Note: This is not the same thing as your EIN Number from the IRS.

File number

- This is the number that identifies your LLC with the Secretary of State.

- Note: You won’t need this number for most filings with the Comptroller’s office.

WebFile number (FQ number)

- This is your “initial” WebFile number.

- You’ll use the FQ number to complete the Franchise Tax Questionnaire, which we’ll discuss below.

(Note: Your LLC actually has multiple WebFile numbers, and things can be a little confusing. But we explain it all in Texas WebFile Numbers.)

This is what the Welcome Letter looks like:

Pro Tip: If you didn’t receive a Welcome Letter (or you can’t find yours), call the Texas Comptroller at 512-463-4402. Press option 5. Then press the star sign. Then press option 5 again. Then after the pre-recorded message, they’ll forward you to a representative.

How to Create a WebFile Account

What is a WebFile account? WebFile (aka “Texas Comptroller eSystems”) is where Texas LLCs file Annual Reports and pay taxes.

- Visit the WebFile login page.

- Click on “Create Profile“.

- Complete the registration information.

- Enter a few security questions.

- Then check your email and click the verification link.

How to complete the Texas Franchise Tax Questionnaire

What is the Franchise Tax Questionnaire? It’s a series of online questions you must complete in order to get your XT number (which you’ll need to file Texas Annual Reports).

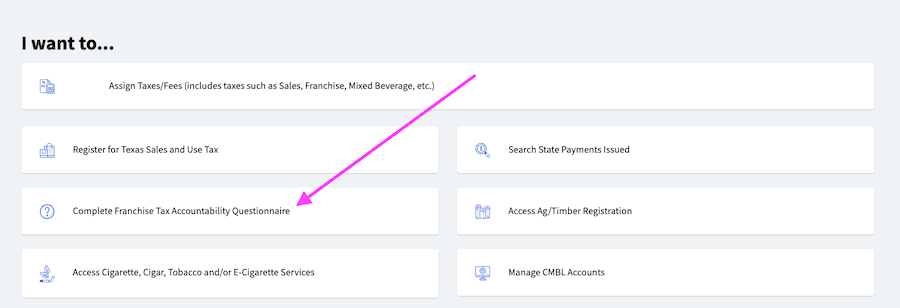

To get started, login to Texas eSystem here: WebFile Login page.

Enter your new User ID and password, and click “Login“.

This will take you to your eSystem Dashboard.

Under “I want to…“, click on “Complete Franchise Tax Accountability Questionnaire“.

Franchise Tax Accountability Questionnaire

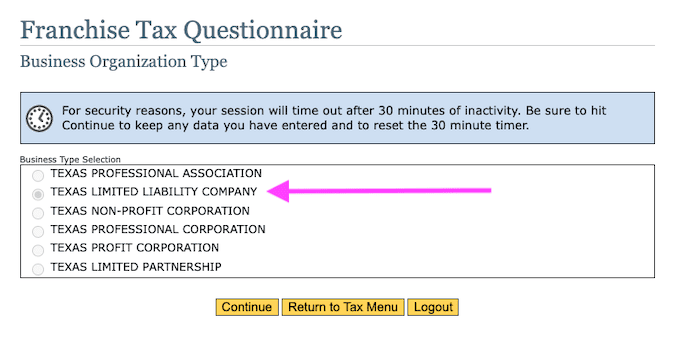

Enter your 11-digit Taxpayer Number (found on your Welcome Letter).

Then enter the WebFile Number (also found on your Welcome Letter). It will start with “FQ“.

On the next page, select “Texas Limited Liability Company” and click “Continue“.

Organization Type, Business Mailing Address, Contact Information

Organization Information

You can enter your LLC’s EIN number issued by the IRS here.

That said, don’t worry if you don’t have an EIN for your LLC yet. You can leave this section blank, as it’s not required.

Mailing Address

Look in the upper left of the screen. Here, you’ll see your LLC’s current mailing address.

- If this address is good, then leave the “Mailing Address” section blank.

- If you’d like to update or change this address, then complete the “Mailing Address” section.

Contact Information

The only required fields here are your first and last name, email, and phone number.

You’ll also need to check “Yes” or “No” next to the International Phone field.

Click “Continue“.

NAICS Filter

An NAICS Code is used by government agencies to identify your LLC’s line of business and activities.

If you know your NAICS code, enter it here.

Alternatively, select the best match to your business from the list. Then on the next page(s), you’ll drill down a step further and choose the best match again. It’s okay if your selections are fairly broad. NAICS codes don’t have to be precise, and to be honest, aren’t that important.

Pro Tip: If you use ChatGPT, just tell it what your business does and then ask it for your NAICS code. Or you can search using the NAICS Code Identification Tool.

Click “Continue“.

Permits, Licenses, and Tax Accounts

List any tax permits, licences, or other tax accounts your LLC has already gotten from the Texas Comptroller.

Tip: If you’re creating an account for the first time (and/or you just recently started your LLC), it’s likely that nothing here will apply. In that case, it’s okay to leave everything blank and continue to the next step.

Click “Continue“.

Confirm Set-up (Review)

Review the information you’ve entered. If you need to make any edits, click “Edit” in that section.

Then click “Submit Questionnaire“.

Congratulations

You’ve completed your Franchise Tax Questionnaire with the Texas Comptroller.

They will use this information to further set up your account, and to generate an XT number for your LLC.

You’ll use your XT number in the future when you file your Texas LLC Annual Report.

Texas LLC Annual Reports

A Texas Annual Report is a required filing that keeps your LLC in good standing with the state.

There are 2 types of Annual Report filings in Texas:

- the Public Information Report (PIR), and

- the Franchise Tax Report.

All LLCs are required to file a Public Information Report every year, regardless of how much money your business makes.

And if your LLC makes more than $2.47 million in revenue per year, then you also have to file a Franchise Tax Report.

Said another way:

If your LLC makes less than $2.47 million per year in revenue, you’ll only file a Public Information Report.

If your LLC makes more than $2.47 million per year in revenue, you’ll file a Public Information Report (PIR) and a Franchise Tax Report.

When are the Texas Annual Reports due?

Your first PIR (and Franchise Tax return, if applicable) are due by May 15th, starting the year after your LLC is approved.

For example, if your LLC was approved in February 2025, then you first PIR (and Franchise Tax return, if applicable) will be due by May 15, 2026.

Then, they will be due May 15th, every year after that.

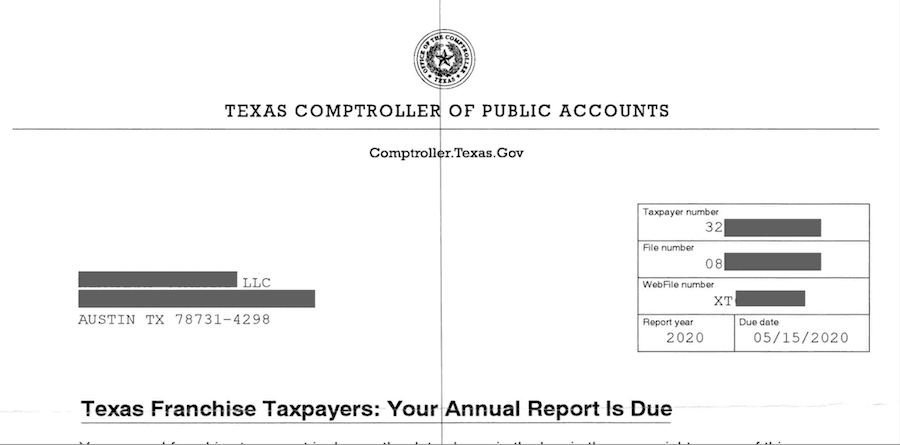

How do I get my XT number?

6 weeks before your first Texas Annual Report is due (sometime in late March or early April), you’ll receive an Annual Report Reminder Notice.

(Keep in mind that if you formed your LLC in 2025, you won’t get this Annual Report Reminder until spring of 2026.)

At the top of the Annual Report Reminder, you’ll see your XT number (in the “WebFile number” box).

Contacting the Texas Comptroller

If you didn’t receive any of these documents or numbers, you can call the Texas Comptroller’s office at 512-463-4402.

And you can find more Texas Comptroller contact information in their Contacts Directory.

References

Texas Comptroller: Franchise Tax Overview

Texas Comptroller: Getting Started with WebFile

Texas Comptroller: Texas Franchise Tax Report Forms for 2024

Texas Comptroller: Changes to No Tax Due Reporting for 2024 Reports

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.