You may have heard veteran owned businesses are free to form in Texas. Well it’s true! And in this guide, we’ll walk you through how to create a Texas LLC for $0.

Free Texas LLC for Veterans

Dear Veteran,

Thank you for your service!

And good news, Texas LLCs are free for veterans.

And after your LLC is formed, you are exempt from paying Texas Franchise Tax for 5 years, and from filing a Public Information Report.

Said another way, veterans forming a Texas LLC:

- don’t have to pay the $300 LLC filing fee

- don’t have to pay Franchise Tax for 5 years

- don’t have to file a Public Information Report for 5 years

Read more to learn about the rules for this fee waiver program. And then follow the instructions on this page to form your free Texas LLC.

Senate Bill 1049 replaced by Senate Bill 938

The initial bill that made Texas LLCs free for veterans was Senate Bill 1049. This bill applied to Texas companies formed between 1/1/2016 through 12/31/2019.

Folks weren’t sure if the free Veteran LLC was going to continue after 2021, but luckily the Texas legislature decided to keep the program alive. Senate Bill 938 was passed just before New Year 2022. And this means that LLCs are still free for veterans (who meet the requirements below) for LLCs formed between 1/1/2022 and 12/31/2025.

Requirements for the SB 938 Exemption

In order to form your LLC for free (and be exempt from Franchise Tax and the Public Information Report for 5 years):

- Veterans must own 100% of the LLC (no non-veteran Members allowed)

- Every LLC Members must be an honorably discharged veteran

- You must certify that every LLC Member is a veteran of a branch of the US Armed Forces

- Your LLC must be approved between 1/1/2022 and 12/31/2025

In the next section, we’ll tell you how to get proof of your veteran status and file the form to create your LLC.

SB 938 Exemption FAQs

What if I’m still Active Duty?

If you’re still Active Duty in the United States Military you can’t use the SB 938 fee waiver.

You must have completed your service and be honorably discharged to qualify for the veteran fee waiver.

What if I don’t have an Honorable Discharge designation?

As per the Texas Veterans Commission, the fee waiver only applies to veterans with:

- Honorable Discharge

- General Under Honorable Conditions Discharge

If you have any other character of service on your discharge papers, you don’t qualify for the waiver.

What if I’m a veteran of the Texas National Guard?

If you are a veteran of the Texas National Guard, you do qualify for the veteran fee waiver as long as you have a DD-214 or NBG-22.

As per the Texas Veterans Commission, the fee waiver applies to veterans of:

- US Army

- US Navy

- US Marine Corps

- US Air Force

- US Coast Guard

- Texas Army National Guard

- Texas Air National Guard

Unfortunately, veterans of the Texas State Guard don’t qualify for the fee waiver. And veterans of other state National Guards aren’t eligible, either.

Do I have to live in Texas?

No – you don’t have to live in Texas in order to form free veteran owned businesses in Texas. You can live in another state, or even be living overseas. Your company (your LLC) must be created in Texas and its “headquarters” must be in Texas. That means your company needs a Texas address.

As long as you get a Veteran Verification Letter from the Texas Veteran’s Commission you are eligible for the fee waiver.

How many Members have to be in my LLC?

You can form a Veteran-owned LLC in Texas with just 1 Member or as many Members as you’d like. But all Members must be honorably discharged veterans.

How to form a Texas Veteran LLC ($0)

To form a Texas Veteran LLC for free, follow the steps below.

- Get a copy of your DD-214

- Request a Verification Letter from the Texas Veterans Commission

- Fill out the Form 05-904 from the Texas Comptroller

- Fill out the Texas LLC Certificate of Formation from the Secretary of State

- Upload the Verification Letter, Form 05-904, and Certificate of Formation via SOSUpload

1. Get a Copy of your DD-214

You must send a copy of your DD-214 (or another proof of honorable discharge, like NBG-22) to the Texas Veterans Commission in order to get the Letter of Verification.

If you don’t have your DD-214 handy, you can request a copy through:

- milConnect

- or the National Archives

We recommend making a copy of your DD-214 and blacking out your Social Security Number. Make sure you don’t black out your date of birth, however.

Scan your DD-214 into your computer as a PDF so you can send it to the Texas Veterans Commission.

2. Get a Letter of Verification of Veteran’s Honorable Discharge

Use the Texas Veterans Commission’s Veteran Entrepreneur Program contact form and provide the following information:

- Full name (First, Middle, Last Names)

- Mailing address (including the County)

- Date of birth

- Telephone number

- Email address

Attach a PDF copy of your DD-214 (or NBG-22) if you have it.

Note: Make sure you’re attaching the Member 4 or Service 2 copy of your DD-214, because the TVC needs to see the character of service.

If your current name is different from the name on your DD-214 (because of marriage, divorce, or other reasons), you should also attach a PDF of the Marriage Certificate, Court Order, or other document that caused the name change.

Verification Letter Processing Time

Please allow the Texas Veterans Commission 30 business days to return your Letter of Verification of Veteran’s Honorable Discharge.

You will get back the following by email:

- Letter of Verification

- Unique ID (which you’ll enter in Form 05-904, explained below)

Since SB 938 was made into law, the TVC has gotten a lot of requests for Verification Letters. Hopefully this processing time will go back down to the usual 7-10 business days soon. But for now, please be patient with them and don’t send multiple requests.

3. Complete the Certification of New Veteran-Owned Business

After you have your Letter of Verification from the TVC, the next step is to complete the Certification of New Veteran-owned Business (Form 05-904) from the Texas Comptroller’s Office.

First, download the Certification of New Veteran-owned Business Form.

Form 05-904 Instructions

Enter your LLC Name at the top in “Entity Name“.

- Before filing out the form, make sure you checked that your Texas LLC name is available.

- You should also double check the Texas Veteran Business Name Rules below.

List each Member’s name in “Owner’s Printed Name“, along with their Unique ID (from the TVC Verification Letter), and how much of the LLC they own as a percentage.

- Tip: If you have a Single-Member LLC, your ownership percentage is 100%

Every LLC Member that is listed must sign Form 05-904 under their name.

4. Complete your Texas LLC Certificate of Formation (Form 205)

Download Form 205 (Domestic LLC Certificate of Formation). This is the form that officially creates your LLC.

Note: Before filing out the form, make sure you have selected a Texas Registered Agent.

We have instructions for completing the Texas Certificate of Formation. However, our instructions are for online filing. But because the online filing asks the same questions you’ll see on Form 205, you can read our instructions to figure out how to complete the form. Just don’t use the SOSDirect online filing described on that page.

The Texas Secretary of State actually has 2 online filing methods: SOSDirect and SOSUpload. You can’t form a Texas Veteran LLC online via SOSDirect. Your Texas Veteran LLC Certificate of Formation must be filed via SOSUpload, which we’ll explain in the next section.

5. Submit your forms via SOSUpload to the Texas Secretary of State

Gather your documents:

- Letter of Verification of Veteran’s Honorable Discharge for each Veteran Business Owner (each LLC Member)

- Form 05-904 (Certification of New Veteran-owned Business)

- Form 205 (Certificate of Formation)

Make sure you have scanned these into your computer as individual PDF files.

We’ll now walk you through how to submit your documents via SOSUpload.

Get started:

Note: While you won’t be using the SOSDirect filing method, you’ll need to create an SOSDirect login in order to use SOSUpload.

- Create an SOSDirect account.

- Wait for the email with your user ID to arrive. Your user ID will be a 13-digit number.

- Login to SOSUpload with your user ID and password.

Payment Information

Confirm your Name and Email Address.

How will you be paying for the filing?

Click the box for “By Credit Card” and enter your credit card information.

Don’t worry, your card won’t be charged – the system just requires you to enter credit card information to prevent fraudulent or spam filings.

Entity Information

Is this filing for a new entity?

Click the box for Yes.

Entity Name

Enter your LLC name, including the designator (Example: “LLC”).

Entity Type

Select “Domestic Limited Liability Company (LLC)” from the dropdown menu.

Filing Type

Select “Certificate of Formation” from the dropdown menu.

Important: Check the box to indicate that you are filing as a Veteran-owned business.

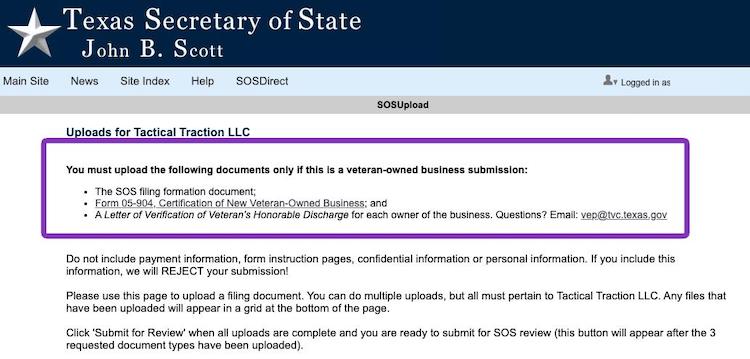

Uploads

First: Confirm that you’re on the right upload page. Look for the message about Veteran-owned Businesses Submissions (see purple box below).

If you don’t see this message, go back a step and make sure you checked the box to indicate your filing is for a Veteran-owned Business.

This is important, because the system won’t let you upload all of the veteran verification documents otherwise.

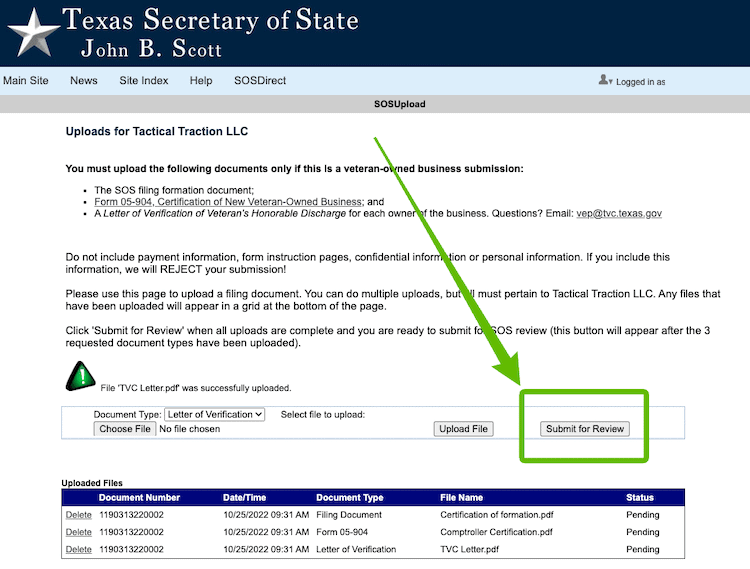

Upload your Certificate of Formation (Form 502):

- For Document Type, choose “Filing Document“

- Upload your Certificate of Formation

- Click “Upload File”

- You should see your document listed below

Upload Certification of New Veteran-owned Business (Form 05-904):

- For Document Type, choose “Form 05-904“

- Upload your Certification of New Veteran-owned Business

- Click “Upload File”

- You should see your document listed below

Upload your Letter of Verification of Veteran’s Honorable Discharge:

- For Document Type, choose “Letter of Verification“

- Upload the Letter of Verification

- Remember: You must upload a Letter of Verification for each LLC Member

- Click “Upload File”

- You should see your document(s) listed below

Before you submit the filing, double-check that you uploaded the correct document for each category.

Finally, click “Submit for Review” to send your documents to the Secretary of State.

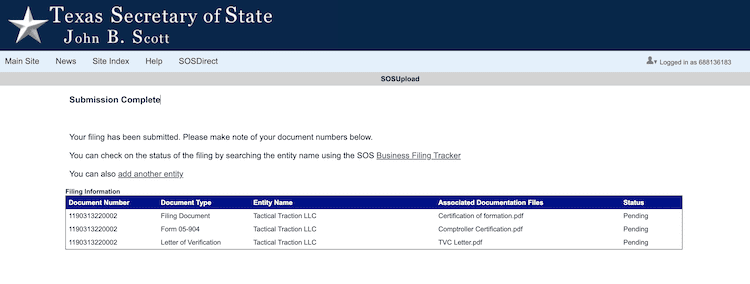

Submission Complete

You’ll see this Submission Complete screen after your submit your filing:

Texas Veteran LLC Approval

Your Texas Veteran LLC will be approved in 8-10 business days.

You’ll receive back the following documents by email:

- Welcome Letter

- Certificate of Filing

- Certificate of Formation (stamped and approved)

Click the links above if you’d like to see an example of the document.

You can check the status of your LLC filing on the Secretary of State’s website: Texas Business Filing Tracker

Good news, Veteran-owned Businesses approved in Texas between 1/1/2022 and 12/31/2025:

- don’t have to pay Texas LLC Franchise Tax for their first 5 years, and

- don’t have to file a Public Information Report for their first 5 years.

(Optional) 6. Get a Veteran-owned Business Logo from TVC

After your Texas LLC is approved, email a copy of your Certificate of Filing, Certificate of Formation, and Form 05-904 to the Texas Veterans Commission at vep@tvc.texas.gov

The TVC will create a Veteran-owned Business Logo for you that you can use in your marketing materials. This is a special service only available through the Texas Veterans Commission for small businesses owned by veterans, and it’s completely free ($0).

Important LLC name rules for Veteran-owned businesses

As per Section 5.062 of the Texas Business Organization Code:

Unless you get approval from an official Veterans Organization (like the American Legion or VFW), your LLC name cannot:

- imply that the LLC is created by or for the benefit of war veterans, and

- contain the following words (or abbreviations):

- Veteran

- Legion

- Foreign

- Spanish

- Disabled

- War

- World War

Said another way, you can use any of the words in the list as long as your business name isn’t implying that your LLC is set up for the benefit of veterans.

Or, if you want to create a company to benefit veterans that uses these words, you need to get permission from a congressionally recognized Veterans Organization.

Questions? State Contact Info

Texas Secretary of State

You can contact the Texas Secretary of State at 512-463-5555. Their hours are Monday through Friday from 8am to 5pm, Central Time.

Texas Veterans Commission

You can contact the Texas Veteran Commission at 512-463-6564. Press 4 for the Veteran Entrepreneur Program.

Their hours are Monday through Friday from 7:30am to 5:30pm, Central Time.

Texas Comptroller

You can contact the Texas Comptroller at 800-252-1381. Their hours are Monday through Friday from 8am to 5pm, Central Time.

Texas Veteran Fee Waiver FAQs

How long does it take for my Texas Veteran LLC to be approved?

Once the Secretary of State receives your Texas veteran LLC filing, it will be approved within 8-10 business days.

This is a little longer than the typical Texas LLC approval time of 4-5 days, because the new veteran owned businesses must use SOSUpload to file.

For more detailed information about processing times for Texas LLCs, check out How long does it take to get an LLC in Texas?

What if I’m a veteran and I already paid?

If you paid $300 and formed any new veteran owned businesses (anytime after 1/1/2022), you can get a refund.

You’ll need to send the following to the Secretary of State:

- Cover letter asking for a refund (include your name, your contact info, LLC name, and LLC file number)

- Your Letter of Verification of Veteran’s Honorable Discharge from the TVC

- Form 05-904 (Certification of New Veteran-owned Business) from the Comptroller

Once the Secretary of State determines your Texas LLC is qualified for exemption, they will:

- refund your filing fee

- and will reclassify your LLC as a Veteran-owned Business

How do I get the money? If you paid for your LLC with a debit or credit card, the refund will go back onto your card within 30 days. If you paid by check or money order, you’ll receive a check in the mail within 30-35 days.

References

Texas Legislature: SB 938

Texas Comptroller: New Veteran-owned Businesses

Texas Secretary of State: Business Information for Veterans

Texas Veterans Commission: Veteran Entrepreneur Program

Texas Veterans Commission: What is a Veteran Verification Letter?

Texas Veterans Commission: A Veteran’s Guide to Launching a Business (PDF)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

The Senate Bill 938 really caught my eye, offering free LLCs for veterans. It’s like a displaytest https://displaytest.org for how Texas supports its heroes. While sipping coffee, I wondered, could this change the game for small businesses? And no installation needed, it’s just so user-friendly!

Hello, I created one LLC using this method and I was wondering how many LLCs can I form and is it possible to use the Veterans letter for each?

Hi Reginal, as many as you’d like :) There is no limit.

If I use a service like Legal Zoom or Zen to start my LLC, can I get a refund from the State for the filing fee as a veteran and still register it as a new veteran owned business.

Hi Richard, yes, you still can. The instructions are above on this page. Hope that helps.

Hi Matt,

After completing this process for a Veteran LLC, does it actually form the LLC or are there any additional steps needed?

Hi Lin, once the Texas Secretary of State approves the Veteran LLC, there are no other steps.

Hello Matt. Would my spouse be able to form a veteran owned business? Any info will be greatly appreciated.

Hi Julio, if she is a Veteran and will be the only Member, then yes.

How many LLC’s can the veteran apply for under SB 983?

Hi Adrien, there is no limit.

Can we add a non veteran to the LLC after it’s formed?

I guess technically you could. At that point, you’ve already received the LLC fee waiver. And while you’d no longer be able to get the Texas Franchise Tax waiver for veterans, it likely doesn’t matter… since most LLCs fall under the tax threshold (currently ~$1.2 million) and only file a Texas LLC No Tax Due Report (and PIR). Having said that, it’s important to think about the ethics here. I’d ask myself, is this in the spirit of the law. Or more importantly, is this stolen valor. Would I be taking advantage of something and would I feel comfortable doing that.

once the LLC is formed how can I add a non-veteran to the LLC?

Hi Omar, this is the process of adding an LLC Member. In essence, you take some of your (and others, if applicable) LLC ownership (called LLC Membership Interest) and transfer it to the new Member. Here’s the overview:

Hello! Thank you so much for this information! I submitted the documents for a filing fee refund, and see now that the filing fee has been removed from my account. But how would the refund be sent? Is it sent by mail or a credit to the account? I haven’t been able to find any information on it.

Hi Tianna! If you originally paid with a debit or credit card, the refund will be sent back to the card within 30 days. If you paid by check or money order, they’ll mail a check and it should arrive in about 30-35 days. Hope that helps.

Is the free veteran Llc still Available in Texas?

Hi Miguel, yes, Texas LLCs are still free for for veterans.

Hello, my question is. Can a veteran use their unique identifier code that’s on their veteran verification letter to form more than one single member LLC?

Hi Efrem, that is a great question. And I’m not sure (first time being asked). I recommend calling the Texas Secretary of State (their phone number is above) and asking. Feel free to keep us updated if you’d like. I’m curious what you find out.

was this question ever solved?

Yes. You can use the verification letter ass many times as you’d like until 31 December 2025.

Thank you Mrs. Martin!

Hello,

I’m a veteran, but I’m confused about what it means for every member needs to be a Veteran

does this mean that when forming the company all members need to be a veteran, does this means that I cannot add a non veteran member later on?

If I elect to form the company as manager managed and have a non veteran as one of the members, does this mean that the application would not be approved?

Yes, when forming the LLC, all Members need to be veterans (to get the filing fee waived). You can add a non-veteran Member at a later date though. It doesn’t matter how the LLC is managed; if there’s a Member who’s a non-veteran at the time of formation, you won’t get the fee waiver.

If I’m still currently active duty am i considered a veteran or i have to wait until i get my DD214?

Hi Ty, thank you for your service. The free Veteran LLC is no longer available in Texas. Please see the opening paragraph on this page for an explanation.

I aware what’s going on currently but if they vote to reinstate it I’m wondering if qualify. Is it worth me waiting?

Ah, I see. No, active service members didn’t qualify when it was in place. They must have finished with service and been honorably discharged. The free LLC for veterans ended a year ago and we don’t have any update that it will be reinstated.

Matt,

I appreciate your site and the work you are doing. I sent the email noted below to my TX state senator and a similar one to my state representative.

“Dear Senator Campbell,

I recently started the process for creating a Texas LLC, taking advantage of the Veteran’s Exemption for the associated fees. I received verification of veteran status and have just been informed the Texas Legislature has cancelled this program. It would have been simple to give a heads-up to applicants that the program was in jeopardy. As a U.S. Navy veteran, which included a tour of duty on riverboats in Vietnam, I am deeply disappointed in our State Legislature and you especially, as Chair of the State Veteran’s Affairs Committee, in your decision to cancel this program. As a business Broker and member of TABB (Texas Association of Business Brokers) I am currently dealing with two companies, one on CA and the other in VA, who are considering moving their manufacturing to South Texas. I have promoted Texas as “business friendly” but now am not so sure, especially when it comes to veteran-owned businesses. I can’t imagine the loss of revenue to the state is worth the loss of good will and appreciation from Texas Veterans.

Sincerely, Ken Scott”

Matt, I have also reached out to local veteran-owned businesses via email to advise them of this situation and will push or TX legislature to reinstate this veteran’s benefit in the next session.

Again, thanks for your good work.

Best regards,

Ken Scott

Hi Ken, you are very welcome. Thank you for your comment. Inspired by your message, we updated the notification at the top of this page, making it easier for Veterans to contact their state senator regarding the renewal of Senate Bill 1049. Thank you!

We submitted the paperwork to the secretary of the state and it was dated 12/20/19. On December 31st it was rejected. If we resubmit will they back date to the original submission

Hi Tonya, LLC formations cannot be back-dated. And at this time, Senate Bill 1049 has not been renewed, so if you want to form a Texas LLC, you’ll need to file a regular one and pay the state filing fee. Hope that helps.

My friend and I want to start a business. She will receive her DD-214 on Friday.

I am still in the military until November, can I be a member of the company?

Does her credit score effect the LLC?

I have better credit, but won’t receive my DD-214 until November.

Can she own 100% now then later transfer it to me?

Hi Laura, active service members cannot be LLC Members in a Veteran-owned LLC. And credit score doesn’t affect the formation of an LLC. Hope that helps.

We are setting up our LLC. My husband is DV and we are looking into using the Texas Veteran LLC. Understand that he will need to 100% own and I would most likely be the registered agent and an employee. However we’re still confused about Member-Managed vs Manager-Managed. He will be providing the service while I will be running all the accounting, orders, payroll and deductions, contracts, filing taxes, bookings, travel and expenses, etc. He just wants to do his thing and and have me handle the business (he’ll still be working a full time job). I’m thinking manager-managed, as I’ll be running it. As he would be the only Member, if he doesn’t like the way I’m doing things, I suppose he could fire me!

Hi Carol, while either you or he can be the Registered Agent, you don’t have to be. It can be any Texas resident or any Texas company. That’s explained further on the Texas LLC Registered Agent page. Also, please see how can an LLC be managed for more information. We’re unable to say “this is how your LLC should be managed”, however, your understanding of a Manager-Manager LLC with you being the Manager and your husband being the Member is correct. Hope that helps :)

hi

does the register agent need to be a veteran as well?

Hi Artemio, great question. No, the Registered Agent doesn’t have to be a veteran. The requirements is that all LLC Members (owners) need to be a veteran who was honorably discharged. Keep in mind though, that an LLC Member can also be the Registered Agent for the LLC. Hope that helps.