Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Disregarded Entity is a term used by the IRS for Single-Member LLCs, meaning that the LLC is “ignored” for tax purposes. The IRS simply treats the LLC and its owner as the same person.

This is just for federal taxes though. For legal purposes, the LLC and its owner are still separate and the LLC still protects the personal assets of its owner.

We know there are a lot of confusing articles about the LLC Disregarded Entity, and you often see language like, “the LLC is disregarded as being separate from its owner“, however, we think that’s a bit difficult to understand and we’ve come up with some easier ways to think about it.

In the eyes of the IRS:

- The LLC is ignored

- The LLC and the owner are the same person

- The LLC is not a separate entity from the person

Disregarded Entity Defined

A Disregarded Entity has to do with tax-filing responsibility. Meaning, whether or not a company needs to file an information return.

(An information return is a form that gives the IRS information about your business income, losses, and who the owners are. It does not have an “amount due” to the IRS.)

If the LLC is disregarded, it means the LLC itself doesn’t file an information return. Instead, only the owner files a personal tax return (Form 1040). The owner’s personal tax return contains information about the LLC’s business activities (on a Schedule C, for example).

Non-disregarded LLCs must file an entity-level information return in addition to the owner also filing a personal tax return (Form 1040).

Single-Member LLCs are Disregarded Entities

By default, Single-Member LLC are Disregarded Entities.

Specifically:

- If a Single-Member LLC is owned by an individual, it will be taxed as a Sole Proprietorship.

- If a Single-Member LLC is owned by a company, it will be taxed as a branch or division of the parent company.

When is a Single-Member LLC NOT a Disregarded Entity?

If a Single-Member LLC has made a special election with the IRS to be taxed as a Corporation, the Single-Member LLC is not a Disregarded Entity.

If a Single-Member LLC has not made an election to be taxed as a Corporation, it is automatically a Disregarded Entity and the IRS “looks through” the LLC and taxes it the same way its owner is taxed.

The History of the Disregarded Entity LLC

An LLC is created by state law.

LLCs are not created by federal (national) law.

However, LLCs are taxed under federal law (and state law)

This created a bit of a problem because when LLCs first went into existence, the IRS wasn’t sure how they should be taxed.

The first state to pass an LLC statute was Wyoming in 1977 and in the early 1980s, the IRS made an official statement that they would tax an LLC like a Corporation. This wasn’t the greatest news, so the other states were a bit slow to adopt LLC statutes as part of their state law.

The first step in the right direction was in the late 1980s when the IRS released Revenue Ruling 88-76, allowing an LLC to be taxed as a Partnership. This was more favorable than Corporate taxation, so by the early 1990s, many states began passing LLC statutes and the formation of LLCs began to grow across the nation. By 1996, all 50 states and Washington D.C. had LLC statutes.

But the really big moment for LLCs came shortly before Christmas that same year. The U.S. Department of the Treasury released final regulations that would become effective on January 1st of 1997.

Under Title 26 of the Code of Federal Regulations (CFR), Sections 301.7701-1 through 301.7701-3, the government created what are known as “Check the Box” regulations, allowing an LLC to choose how it would like to be taxed. The new law also gave birth to the concept of a Disregarded Entity LLC.

Section 301.7701-1(a)(4) states:

“… certain organizations that have a single owner can choose to be recognized or disregarded as entities separate from their owners.”

Section 301.7701-2(c)(2)(ii) states:

“… a business entity that has a single owner and is not a corporation under paragraph (b) of this section is disregarded as an entity separate from its owner.”

This means that a Single-Member LLC will be treated as a Disregarded Entity (unless it made an election to be taxed as a Corporation).

More specifically, a Single-Member LLC would be taxed as a Sole Proprietorship. This meant tax savings and a simpler tax return for Single-Member LLCs.

Additionally, the IRS allowed Multi-Member LLCs to choose whether they would like to be taxed as either a Partnership or a Corporation.

Once the industry got wind of the changes through the late 1990s and early 2000s, the growth of LLC formations began to explode!

And that’s how we arrived at the Disregarded Entity LLC!

What about the LLC’s asset protection?

A lot of people ask:

“If my LLC is ‘disregarded’, then won’t I lose my LLC’s asset protection?”

No, you won’t. Having a Single-Member LLC that is a Disregarded Entity (ignored by the IRS) has nothing to do with how the state looks at your LLC.

In the eyes of the state, your LLC (whether single-member or multi-member) is separate from you and your personal assets are protected.

However, in the eyes of the IRS, they don’t really care about that. They just want to collect taxes. So in turn, they disregard (“ignore”) a Single-Member LLC and ask for you to report and pay the tax yourself. It’s really as simple as that.

However, if you’ve knowingly defrauded the IRS or evaded taxes, the IRS may go after your personal assets in court. Having an LLC won’t protect you in that case.

Is a Single-Member LLC a Disregarded Entity?

Yes, a Single-Member LLC is the only type of LLC that can be a Disregarded Entity.

Furthermore, a Single-Member LLC is automatically considered a Disregarded Entity unless it makes a special election with the IRS to be taxed as a Corporation.

Is a Multi-Member LLC a Disregarded Entity?

The short answer is no, a Multi-Member LLC isn’t a Disregarded Entity.

By default, a Multi-Member LLC will be taxed as a Partnership.

If the Multi-Member LLC wants to be taxed as a Corporation instead, it needs to make a special election with the IRS. This election can be made when the LLC is formed or at any time in the future.

Exception #1:

Some husband and wife LLCs are Disregarded Entities.

A husband and wife LLC can elect to be treated as 1 person (and be taxed as a Sole Proprietorship) if all of these are true:

- your LLC has only 2 Members

- and those Members are husband and wife

- and the LLC is located in a community property state

This is also called a Qualified Joint Venture LLC. This type of LLC is a Disregarded Entity.

Exception #2:

The rarer exception is when there is a Multi-Member LLC with 2 owners, and one of the owners is a Disregarded Entity of the other owner.

Think of it like this:

Shruti already owns a Single-Member LLC called Destiny Entertaining LLC. Shruti then forms a new LLC with 2 Members called Ganeshugar LLC.

The 1st Member of Ganeshugar LLC is Shruti, and she owns 50% of Ganeshugar LLC. The 2nd Member is Destiny Entertaining LLC and it owns the other 50% of Ganeshugar LLC.

Because Destiny Entertaining LLC is treated as a Disregarded Entity, the IRS sees both of the owners (Shruti and Destiny Entertaining LLC) of Ganeshugar LLC as being the same person. Therefore, Ganeshugar LLC is treated as a Disregarded Entity instead of a Partnership, even though it is technically a Multi-Member LLC.

The fact that on rare occasions a Multi-Member LLC can be treated as a Disregarded Entity was confirmed by IRS Revenue Ruling 2004-77. Andrew Mitchel, an International Tax Attorney, has made a helpful video which you can find on Youtube and is also embedded below:

Is a C-Corporation a Disregarded Entity?

No, a C-Corporation is not a Disregarded Entity.

A C-Corporation is a separate entity from its owner(s).

Is an S-Corporation a Disregarded Entity?

No, an S-Corporation is not a Disregarded Entity.

An S-Corporation is a separate entity from its owner(s).

Whether or not an entity is Disregarded doesn’t have anything to do with pass-through taxation though. The S-Corporation’s profits still flow through to the owner(s), aka shareholder(s).

Note: An LLC (multi-member or single-member) can elect to be taxed as an S-Corp, which typically makes sense once the LLC earns $70,000 to $100,000 in net income per member, per year.

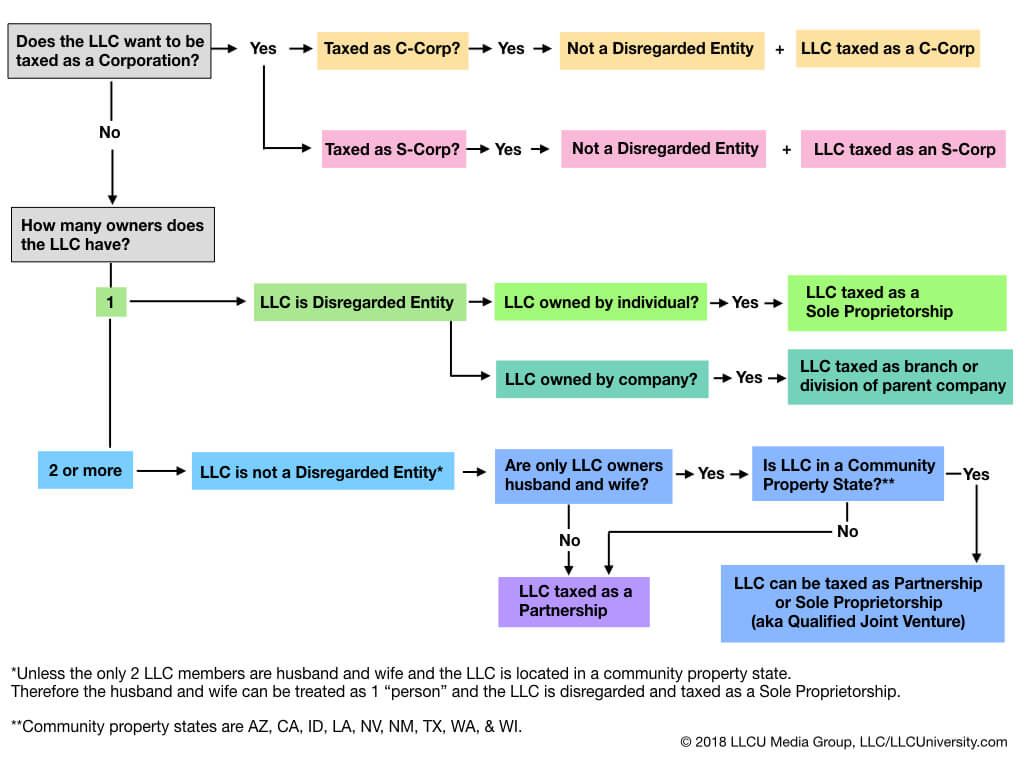

LLC Disregarded Entity Chart

To summarize the above, here is a visual chart explaining LLCs and whether or not they are Disregarded Entities:

Is my LLC a Disregarded Entity LLC in my state, too?

Yes, most states tax your Disregarded Single-Member LLC the same way the IRS does, meaning the LLC is taxed as a Sole Proprietorship and your LLC’s profits are reported on your state income tax return.

There are some exceptions to this rule though, and it varies by state. We’re not tax advisors so you’ll need to speak with an accountant regarding the specifics of your LLC.

However, we do know that New Hampshire doesn’t treat a Single-Member LLC as a Disregarded Entity for the purposes of collecting taxes. For more information, please see how the NH Department of Revenue taxes Single-Member LLCs.

Is a Pass-through Entity the same as a Disregarded Entity?

No, these are two different things.

What’s a Pass-through Entity?

A Pass-through Entity means the tax-paying responsibility flows through to the owners of the LLC. And the LLC itself doesn’t pay taxes.

Remember that a Disregarded Entity has to do with tax-filing responsibility. Meaning, whether or not a company needs to file an information return.

Think of it this way:

Your LLC can have certain properties. Like: Single-Member, Multi-Member, Member-Managed, and Manager-Managed. You can also think of “Disregarded Entity” and “Pass-through Entity” of properties your company can have.

So, Disregarded Entity is a property that deals with whether a company must file a tax return. Whereas Pass-through Entity is a property that deals with whether a company must pay taxes directly to the IRS.

Some companies are both Disregarded Entities and Pass-through Entities, and some companies are not Disregarded, but are still Pass-Through Entities.

Disregarded Entity vs Pass-through Entity

| Tax Classification | Disregarded Entity? | Pass-through Entity? |

|---|---|---|

| LLC taxed as Sole Proprietorship | Yes, the LLC doesn't file an information return | Yes, taxes flow through businesses to the owner |

| LLC taxed as Partnership | No, the LLC files an information return (Form 1065) | Yes, taxes flow through businesses to the owners |

| LLC taxed as S-Corp | No, the LLC files an information return (Form 1120S) | Yes, taxes flow through businesses to the owner(s) |

| LLC taxed as C-Corp | No, the LLC files an information return (Form 1020) | No, the LLC pays corporate income tax |

Is a Disregarded Entity a Pass-through Entity?

When talking about LLCs: Yes, a Disregarded Entity is always a Pass-through Entity.

Being a Disregarded Entity means the company doesn’t file its own tax return. Having pass-through taxation means the company doesn’t pay its own tax (the owner pays the tax instead).

If the company doesn’t file its own tax return, this automatically means it doesn’t pay its own tax. The company cannot pay taxes to the IRS without a tax return. So if a company is a Disregarded Entity it must also be a Pass-through Entity.

Thought of another way: If you have the property “Disregarded Entity”, you automatically also get the property “Pass-through Entity”.

Work with an Accountant

Regardless of how your LLC is taxed with the IRS, most people pay incomes taxes on 3 levels:

- federal

state

local

And this is just income tax. There is also sales tax, excise tax, franchise tax, and more.

The tax reports you and your LLC must file and the taxes it must pay depend on where your LLC was formed, what type of business you’re in, how your money is made, and more.

Please speak with an accountant/CPA regarding the specific details of your situation. You can use our list of accountant recommendations in all 50 states. We recommend phoning a few to see which one you feel most comfortable with, and who understands your business fully.

References

IRS: 26 CFR Part 301

Wikipedia: Limited Liability Company

Wikipedia: Entity classification election

IRS: LLC Filing as a Corporation or Partnership

IRS: Single Member Limited Liability Companies

Code of Federal Regulations: Title 26 Section 301.7701-1

Code of Federal Regulations: Title 26 Section 301.7701-2

Code of Federal Regulations: Title 26 Section 301.7701-3

IRS: Publication 3402 – Taxation of Limited Liability Companies

American Bar Association: The Single-Member Limited Liability Company as Disregarded Entity

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Great article. Thank you.

“and the LLC is located in a community property state”

Husband and wife in California (comm prop) own LLC formed in Florida (not).

Which state’s laws determine whether it’s a SMLLC?

Hi Dan, thank you. We’re glad you enjoyed it. The laws pertaining to husband and wife Single-Member LLCs (aka Qualified Joint Venture LLC) are determined by the state where the LLC is formed, and not by the state where the owners are a resident. So in your case, you can’t have a Qualified Joint Venture LLC in Florida because it isn’t a community property state. If you and your wife form a Florida LLC, it would be Multi-Member LLC.

Thanks Matt. Very timely for me. My wife and I own 2 rentals in WA state (community property). As part of rental I am going to move the ownership under saparate LLCs. Now it will be disregarded from IRS perspective. Guessing this is by default. Your comment: The IRS simply treats the LLC and its owner as the same person. Does that mean –> Question – Am I doing anything different on my 1040? Do I have to report anywhere the name of the LLCs and EINs or ignore this change and nothing changes on my individual taxes (filing jointly) since those LLCs will be disregarded. Thanks so much for your help.

Hi Rajiv, if you’re going to continue acquiring property, you may want to consider the following. You could have an LLC holding company (aka parent LLC). This would be owned by you and your wife and taxed as a Qualified Joint Venture LLC. Then this parent LLC would own child LLCs. And the child LLCs would own individual properties, or multiple properties. Then… thinking long term. If you get into estate planning, you could have a Trust own your parent LLC. This basically “packages” your LLCs and your assets for longevity.

Good explanation Matt! I have a question for you….I work for a disregarded entity in which the single member is a company. The only signor on the bank account has been terminated, but prior to the termination he wrote a letter asking the bank to remove him and put me on for everything. This was 3 years ago. It just came to light yesterday that our banker said it was done (3 years ago) but it was not. Now, I have to bring paperwork to the bank evidencing I am a member of the LLC. I tried to explain that I am not a member and what else I could bring. They wouldn’t have it. Any ideas?

Hi Sean, if you work for a Single-Member LLC (owned by another company), are you wanting to be added as a Member so that the LLC will then become a Multi-Member LLC? Or do you just need access to the bank account? If you just need access, I’d speak to the branch manager and ask specifically what they need. It might be an Operating Agreement or it might a Resolution.

I just need to regain access to the bank account. So I printed out the company articles that show I am the director. Hopefully, that will clear this up. Interestingly enough, the bank sees “LLC” and immediately thinks a person when I tried to explain the member of the LLC is a company in my case. So the bank was insistent that I bring a human to add me to the account! I’ll let you know how it goes.

Yes, I’m curious to know. Again, best bet to speak with branch manager first, or someone who is highly knowledge with business account and entity structures.

Well, it turns out that my account manager for the State she represents and where I am located saw my name everywhere on the system and simply sent me a signature card to fill out (which I believe I did years ago) I sent it back and now I am back in business. Who knew. Thank you Matt.

Wow, that worked out well! Thanks for the update.

THANK YOU! THIS IS ONE OF THE BEST INSTRUCTION AND INFORMATION SOURCE ON NET! THANK YOU FOR YOUR EFFORTS!

You’re very welcome! Thank you so much for the kind words! We’re happy to help :)