Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Every North Carolina LLC needs to file an Annual Report each year to renew their LLC.

Every North Carolina LLC needs to file an Annual Report each year to renew their LLC.

If you just started your Limited Liability Company in NC, you won’t have to file an Annual Report until next year (just bookmark this page for later).

If you need to file your North Carolina LLC Annual Report, this page will walk you through the filing instructions.

(Use the following link to jump to the filing instructions.)

We have been teaching LLC formation since 2010, and we also own North Carolina LLCs. We’ve filed numerous Annual Reports in North Carolina, so we’ll walk you through the filing step-by-step and provide helpful tips along the way.

What is an Annual Report for an LLC?

The Annual Report is a filing that keeps your LLC’s contact information up to date with the North Carolina Secretary of State.

It can be filed online or by mail.

Does North Carolina require an LLC Annual Report?

Yes. Every North Carolina LLC (Limited Liability Company) must file an Annual Report every year. This keeps your LLC in compliance and in good standing.

This is due regardless of business activity or income. Meaning, even if your LLC does nothing and makes no money, you still have to file this paperwork every year.

How much does it cost to file this report in North Carolina?

The North Carolina Annual Report costs $200 each year for LLCs.

This filing fee is paid every year for the life of your LLC.

When is the North Carolina due date?

The North Carolina Annual Report is due on April 15th every year.

When is my first report due?

Your first Annual Report is due the year after your LLC was approved.

For example:

- If your LLC was approved anytime in 2024, your first report’s due date is April 15th, 2025.

- If your LLC was approved anytime in 2025, your first report’s due date is April 15th, 2026.

After that, your North Carolina Annual Report is due every year (by April 15th).

Does North Carolina send reminders to LLCs?

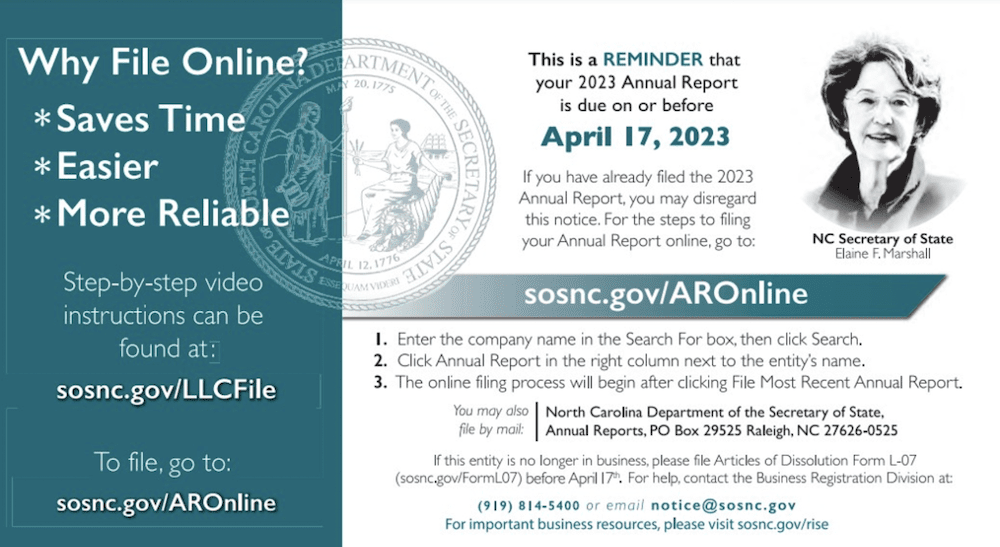

Yes, the North Carolina Secretary of State will send out reminder notices in March every year.

- If the state has an email address on file for your LLC, they’ll email the reminder.

- If the state doesn’t have an email address on file, they’ll mail the reminder notice to your Registered Agent.

Calendar reminder

Even if you don’t receive a reminder notice, it’s still your responsibility to file your North Carolina Annual Report on time every year.

For that reason, we also recommend putting a repeating reminder on your phone, computer, and/or calendar.

Here’s a video on how to use Google Calendar to create reminders:

How early can I file my report?

You can file your North Carolina LLC Annual Report as early as January 1st.

For example, you can file your 2025 report (which is due by April 15, 2025) as early as January 1, 2025.

What happens if I don’t file?

If you don’t file your report on time, your LLC will fall out of “good standing” status.

However, this isn’t a big deal because there isn’t a financial penalty.

But if you continue to ignore this requirement, the Secretary of State will eventually shut down your LLC (this is called Administrative Dissolution).

And here’s how it would work:

If you miss the April 15th deadline:

You can still file a late Annual Report. There is no financial penalty. You’ll still pay $200 (the usual Annual Report fee).

You can file a late report (with no penalty) until you receive a “Notice of Grounds for Administrative Dissolution“. And after you receive this notice, you have 60 more days to file with no penalty.

If you don’t file by the 4th quarter:

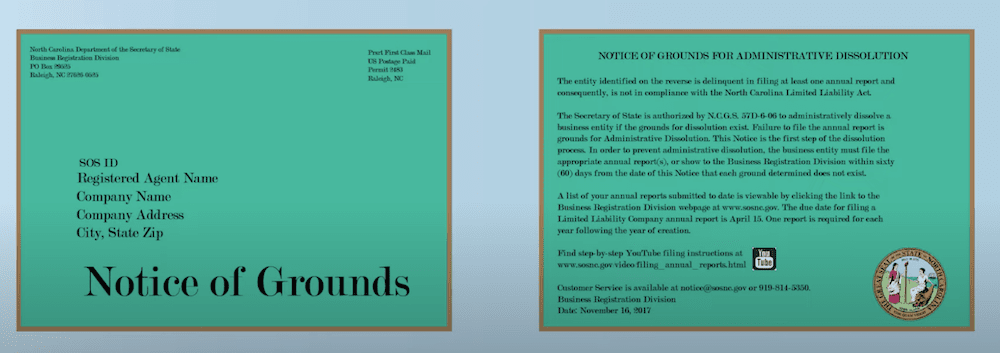

During the 4th quarter of every year (between October and December), the state will send out a Notice of Grounds for Administrative Dissolution to any LLC which hasn’t filed an Annual Report.

- If there is an email address on file for your LLC, the state will email you this notice.

- If there isn’t an email address on file for your LLC, the state will mail this notice to your Registered Agent.

You now have 60 days:

You will find a date on your notice. You have 60 days (from the date on your notice) to file a late North Carolina Annual Report.

For example, if your Notice is dated October 14, 2025, you have until December 13, 2025 to file your late Report before your LLC is dissolved.

If you don’t file within 60 days:

If you don’t file within the 60 days, the North Carolina Secretary of State will administratively dissolve your LLC.

You will receive a Certificate of Administrative Dissolution as confirmation that your LLC has been dissolved by the state. This Certificate will arrive within a month after the deadline on the Notice.

What if I already received a Certificate of Administrative Dissolution?

If you wanted to close your LLC, then there’s nothing you need to do. Said another way, you don’t have to pay any money to close your LLC, since the state’s done it for you. Just make sure to talk to an accountant about how to file a final tax return.

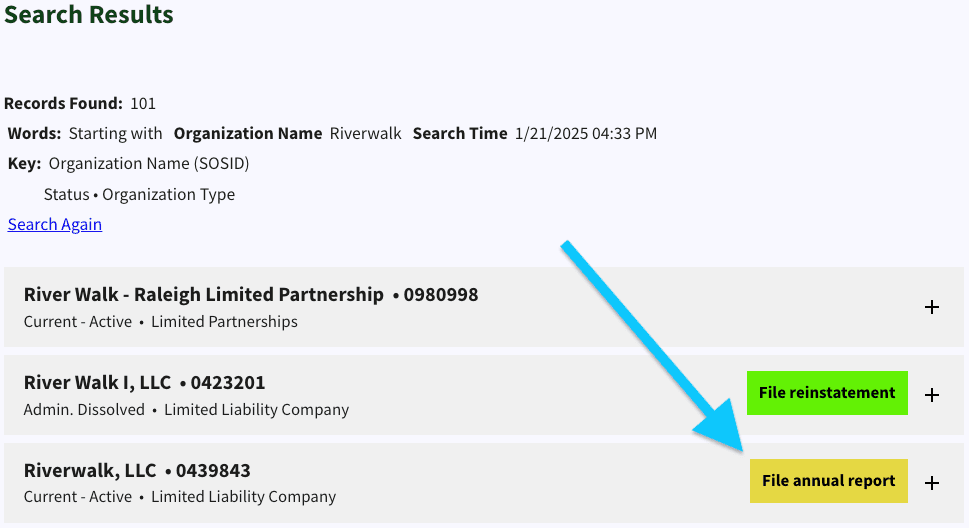

If you want to keep your LLC open, you can file a reinstatement (to bring your LLC “back to life”). The form to use is called the Application for Reinstatement Following Administrative Dissolution. The filing fee is $100.

How to file a North Carolina LLC Annual Report

You can file your North Carolina Annual Report online or by mail.

Online: We recommend filing your LLC Annual Report online, since it’s easier and you’re allowed to make updates.

By Mail: While you can technically file your LLC Annual Report by mail, it’s a complicated and confusing process. And we don’t recommend it – it’s much easier to file online. If you really want to file by mail, call the Secretary of State for instructions.

Get started:

Visit the North Carolina Business Search page.

Enter the first word or two of your LLC name in the box labeled “Organizational name”. Then click “Search”.

Find your LLC name in the search results. And then click the “File annual report” button.

On the next page, click “File Current Annual Report Due”.

Check the certification boxes, then click “Next“.

Report(s) for the year(s):

Select the report year. Most people will select the current year.

For example: if you’re filing an on-time Annual Report in 2025, select 2025.

Then click “Next”.

Tip: If you have late reports to file, file those first, before filing for the current year.

Veteran question

There is a short survey question regarding US Military Veterans. Answer this and then go to the next step.

Select the Registered Agent

On this page, you’ll either confirm your North Carolina Registered Agent hasn’t changed (by selecting “Current Registered Agent”), or you can change your Registered Agent.

To keep your current Registered Agent:

- Select “Current Registered Agent”.

- Click “Next”.

- On the next page, review your Registered Agent’s address and make sure it’s correct (most people also check the box for “This address is also the Registered Mailing Address”).

- Click “Next”.

To change your current Registered Agent to a Registered Agent Service:

- Select “An entity on this list has given consent to be the registered agent”

- Click “Next”.

- On the next page, review your Registered Agent’s address and make sure it’s correct (most people also check “This address is also the Registered Mailing Address”).

- Click “Next”.

To change your Registered Agent to yourself or someone you know (like a friend or family member):

- Select “An entity or person not on the above list has given consent to be the registered agent or I need to correct the spelling of the current registered agent”.

- Click “Next”.

- Enter their email address.

- For the question “Is the registered agent a commercial entity?” select “No”.

- Enter their first and last name.

- Click “Next”.

- Enter their address (most people also check “This address is also the Registered Mailing Address”).

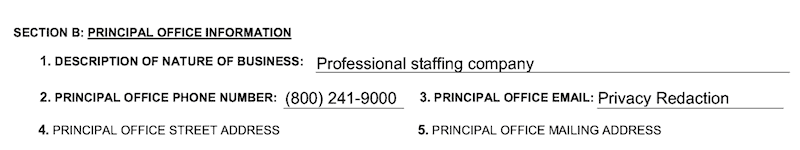

Briefly Describe The Nature of Business

Enter a few words or a sentence about what your LLC does. This is known as your LLC purpose.

Phone Number

You must enter a phone number here. This can be a cell phone, office phone, or home phone number.

Note: your phone number will be publicly available on your report:

Pro Tip: I’m not sure why the state requires a phone number. They never call. And unlike the email address below (which is kept private), your phone number goes on public records. This just leads to more spam phone calls, which I can’t stand!

If you want to keep your phone number off public records, you can enter one of our NC phone numbers in your Annual Report: 919-746-8010. Hope that helps!

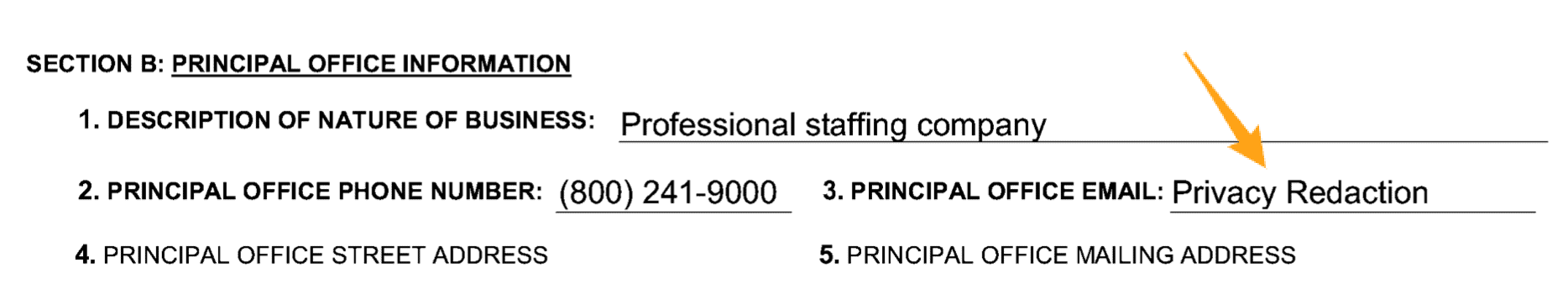

Principal Office Email

Enter your email address. The state will use this email address to notify you anytime documents are filed for your LLC. It’s like an extra security measure.

We recommend entering an email address here. This information will not go on public record. The state keeps it private. It’ll look like this on your filed report:

Annual Report Receipt Return Email

Enter your email address again. The state will use the email address to mail you a receipt for your filing. This email address will also be kept private.

Principal Office Street Address

Enter your LLC’s Principal Office Street Address. This address can be in North Carolina, or it can be located in any state.

Most people also check off “This address is also the Principal Office Mailing Address”. If your LLC’s mailing address isn’t the same as the Principal Office Street Address, you can enter a different mailing address.

Company Officials

The state requires you to list all LLC Members or all LLC Managers (depending on how your LLC is managed) and their address(es).

If this is your first report, click “Add Official” to add LLC Member(s) or LLC Manager(s).

To learn more about LLC Members and LLC Managers, please see Member-managed vs Manager-managed LLC.

If this isn’t your first report, you can edit the existing Official(s), delete them, and/or add additional Official(s).

When your list of Officials looks complete, click “Next”.

Official’s Title

When you’re adding or editing an Official, you’ll need to choose the correct title.

If you have a Member-managed LLC:

- The Official(s) should use the title “Managing Member“

If you have a Manager-managed LLC:

- If the Official is only a Manager and not a Member (they don’t own any of the LLC), select “Manager“.

- If the Official is both a Manager and a Member (they own some or all of the LLC), select “Managing Member“.

- If the Official is only a Member and not a Manager (they don’t run the business), select “Member“.

Is the Official a commercial entity?

- If the LLC Member or Manager is a person, select “No”.

- If the LLC Member or Manager is another company, select “Yes”.

Select the Entity that is executing the Annual Report

Select the Official who will be signing the report.

Note:

- In a Member-managed LLC, this can be any Member.

- In a Manager-managed LLC, this can be any Manager.

Then click “Next”.

Preview Filing

Review your filing in this section. Double-check that the info is correct and look for any typos.

If you need to make any changes, use the “Back” button.

If all looks good, click “Go to Checkout” to proceed.

Fees & Payment

There’s nothing to do or select on this page. You’ll notice the state charges a few extra dollars as a transaction fee.

Payment Details

Select your payment method. Enter your billing and payment information.

Then click “Pay and Submit” to complete your filing.

Approval

Congratulations. You’ve successfully filed your North Carolina Annual Report, and it will be processed within a few minutes.

Once your Annual Report is processed, you will receive an email confirmation from the state.

Set a calendar reminder to file your Annual Report every year

To make sure you file your Annual Report on time (and so you don’t have to worry about late fees or filing a Reinstatement), we recommend putting a repeating reminder on your phone, computer, and/or calendar.

North Carolina Secretary of State Contact Info

If you have any questions, you can contact the North Carolina Secretary of State at 919-814-5400.

Their hours are Monday through Friday, 8am – 5pm Eastern Time.

North Carolina Annual Reports FAQs

Do I have to file Annual Reports for my LLC in NC?

Yes, every LLC in North Carolina has to file Annual Reports. The Annual Reports are due regardless of LLC business activity or income.

Said another way, if your LLC does nothing and makes no money, you still need to file the report every year to keep your LLC active.

How do I file an Annual Report for an LLC in North Carolina?

You can file the LLC Annual Reports in NC online or by mail. We recommend filing online as it’s faster and easier. We have instructions above on this page.

Does NC have an Annual Report fee?

Yes, the North Carolina Annual Report fee for an LLC is $200 per year.

How do I check the status of my LLC in NC?

You can check the status of your LLC in NC by doing an Entity Search on the North Carolina Secretary of State’s website.

After you click on your LLC name, you’ll see a “Status” section. There is also a small icon you can hover over to learn more about what your status means.

And depending on the status of your LLC and what you’re trying to do, you might need to call the Secretary of State to check on the next steps.

What happens if you don’t file an LLC Annual Report in NC?

If you file an NC LLC report late, there is no penalty. Meaning, if you file by the end of the year, you’re generally safe.

However, if you don’t file by the end of the year, the state will mail you a “Notice of Grounds for Administrative Dissolution”. You have 60 days from the date of this notice to file your LLC’s report.

If you don’t file within those 60 days, the state will administratively dissolve (shut down) your NC LLC.

How much is the late fee for an LLC Annual Report in NC?

There is no late fee. It’s still $200 to file a “late” NC LLC Annual Report.

However, if you wait too long to file, the state will eventually shut down your LLC and you will have to pay a filing fee for the Reinstatement form, plus the Annual Report fee.

The Reinstatement form brings your LLC “back to life” after it’s been dissolved by the state.

Can I deduct the Annual Report fee for my LLC?

Yes, you can deduct the Annual Report fee on your tax return. You can also deduct all North Carolina LLC costs.

Where do I mail my NC LLC Annual Report?

If you want to file your report by mail (instead of online), send it to:

Secretary of State

Corporations Division

PO Box 29525

Raleigh, NC 27626-0525

Make sure to sign the pre-populated Annual Report form and include a check or money order for $200 (made payable to the “North Carolina Secretary of State”).

If you have any questions about how to get the pre-populated form or how to complete it, please contact the Secretary of State.

How do I get a copy of my NC Annual Report?

You can get a copy of your Annual Report by visiting the NC Secretary of State’s Business Search page, and searching for your North Carolina LLC by name.

Then click on your LLC name in the search results, and click “View Filings”.

You can download any filed report or document from this page, including a copy of your past Annual Reports.

Does an LLC file a tax return in North Carolina?

For most people, their LLC doesn’t need to file a separate tax return with the North Carolina Department of Revenue. However, the LLC Member(s) still need to file a North Carolina tax return. Please see Directive CD-02-1.

This includes:

However, if your LLC is taxed in either of the following formats, a separate tax return is due:

For more information, please see How are LLCs taxed.

References

North Carolina Secretary of State: Annual Report Due Dates

North Carolina Secretary of State: Frequently Asked Questions

North Carolina Secretary of State: Annual Report Filing Manual

North Carolina Secretary of State: What is a Notice of Grounds?

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

North Carolina LLC Guide

Looking for an overview? See North Carolina LLC

Your website saved me! I have been getting “renewal notices” since March from what legitimately looked like were from the NC Sec. of State, BUT the charge to file is $399.98. Because of your website, I took a closer look and discovered it was a 3rd party disguised as the NC Sec. of State website- a scam! Thank you for providing accurate information.

Hey Shelby, so glad you found us. You’re very welcome :) I freakin’ hate those crappy, spammy businesses that send out those “disguised” notices. They make me furious 😠!

Hi,

My LLC got admin dissolved due to the non-filing of annual reports for the last three years. Can I file them now and would that be only paper filing? Should I send separate cheques with each report if online filing is not possible? I understand that there is a form for a $100 fee that can be sent through mail only but what about the annual reports?

How long does it take NC to reinstate the LLC after all the forms are submitted and fees are paid?

Hi Fiashk, you can file them all online. No need for mail filings. I’m not exactly sure on the timeline of reinstatement, but you can call the North Carolina Secretary of State to check.

Hi I am closing my LLC in Feb 2021 and will file articles of dissolution with the NC SOS. 2 part question: is the annual report due Apr 2021 for the 2020 year and do I have to file it even though I would have already filed articles of dissolution? Second, would I need to file annual report in 2022 for 2021 year if I filed articles of dissolution in 2021? Thanks in advance.

Hi Art, the Annual Reports pay for the current year. So if the LLC were to remain open for 2021, the report due by April 15 2021, would be paying for the 2021 year. There is an interesting quirk in North Carolina regarding dissolution. If your LLC has a status of “Current/Active”, you can file Articles of Dissolution even if you have outstanding Annual Reports due. This is because it sometimes takes the Secretary of State a few years before they change the status of the LLC. Said another way, if you file an Articles of Dissolution and your LLC is “Current/Active”, they LLC will be dissolved even if it owes an Annual Report or two. It sounds like that’s not the case for you, but just an FYI. You can file for dissolution in February without filing a 2021 Annual Report. And you don’t need to file an Annual Report in 2022. Hope that helps :)

Is this a written report supported with documentation.What exactly do I include in this report? Does it need to be notarized? Is it a financial report?

Thank’s for your help,Stephen Cordery

Hi Stephen, the details of what go in the North Carolina LLC Annual Report are described in the video on this page. The Annual Report doesn’t need to be notarized. And it isn’t a financial report. It’s just informational in nature, making sure your LLC’s contact information is kept up to date with the North Carolina Secretary of State. Hope that helps!

I have a corporation that has changed from a fiscal year of 10/31 to a calendar year. We prepared a short period income tax return for 10/31/16 – 12/31/16. The last annual report was filed on paper for 10/31/15. Do we need to have them file for 10/31/16 AND 12/31/16 or just for 12/31/16 and going forward?

Hi Debbie, not sure on this. We only cover LLCs. You’ll want to check with the Secretary of State on that.

I noticed that you didn’t focus on privacy in any of your presentations (with the exception of the registered agent having a “privacy feature” Is there any way you can file these without your birth name hitting the public records, or do you need to go through added trouble of forming a revokable/anonymous trust and use that to fill in where you’re instructing us to put “our name”?

Hey Danny, it’s challenging to go into the same level of details regarding privacy as the variance is quite wide and sometimes that type of content “gets in the way” of the main lesson. So we look for balance in trying not to overwhelm the majority while helping the minority. Said another way, we have on our to-do list the creation new and separate lessons regarding privacy, however, it’s in the near future. While you could make a living revokable trust the LLC Member, you could also use a Parent/Child LLC setup. For example, form an LLC in Wyoming (hire a Registered Agent and a filing company to sign as Organizer) and then they Wyoming LLC is the Member of the North Carolina LLC. And you’d also want to use a filing company to submit your North Carolina Annual Report. Hope that helps and thank you for your understanding.

When I file an annual report for the deadline of April 17th 2018 – do I file it for 2017 or 2018? I think I just filed it incorrectly and filed it under 2017 year.

Hey Tiffany, great question. In this case, the report due 4/17/2018 is the “2018 Annual Report”, so you should select 2018 from the drop down menu. Did you file 2017’s report last year? That drop down menu can be quite confusing, right?!

Hello, if the date formed for my business is 1/1/2018 will the 2018 annual reporting requirement remain or will I file in 2019? The business was registered in October with the articles effective date documented as 1/1/2018.

Hi Shanese, since your LLC’s effective date was 1/1/2018, your first Annual Report isn’t due until 2019. It doesn’t matter that the Articles of Organization was filed in October, since you marked it effective 1/1/2018. Hope that helps!

I registered a Software Company in December 2017. Since then company is inactive. Do I still need to file annual report now?

Hi Sridhar, yes, a North Carolina LLC Annual Report needs to be filed regardless of income or activity. Since your LLC went into existence in 2017, your Annual Report is due by April 15th 2018. Hope that helps.

My Company was registered (LLC) 4 months ago, late year December 2017. Do i need to file annual return now or wait till my First year anniversary ?

If your LLC went into existence on a date in 2017 then your first LLC Annual Report will be due by April 15th, 2018. Hope that helps.

I am trying to download annual reports, unable to do so

Hi Byron, please try again. The link was changed and we have it updated now. Thank you.