Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Every West Virginia LLC needs to file a Annual Report each year to keep their LLC in good standing.

Every West Virginia LLC needs to file a Annual Report each year to keep their LLC in good standing.

If you just started your Limited Liability Company, you won’t have to file this until next year (just bookmark this page for later).

If it’s time to file your West Virginia Annual Report now, this page will walk you through the filing instructions.

What is a West Virginia Annual Report for an LLC?

The West Virginia Annual Report is a filing that keeps your LLC’s contact information up to date with the West Virginia Secretary of State.

You can file it online and it keeps your LLC in compliance and in good standing. Your business entity must be in good standing in order to legally conduct business in West Virginia.

Does West Virginia require Annual Reports?

Yes. All LLCs (Limited Liability Companies) must file West Virginia Annual Reports every year. It is a state requirement in order to keep your LLC in good standing.

This is required regardless of business activity or income. Meaning, even if your LLC does nothing and makes no money, you still have to file this paperwork every year.

How much does it cost to file West Virginia Annual Reports?

The West Virginia Annual Report fee is $25 each year. These annual filing fees are paid every year for the life of your LLC.

Pro Tip: Good news, Veterans! If you start an LLC in West Virginia, your first 4 consecutive Annual Report fees are waived by the Secretary of State. You must still file the Annual Reports, though. Only the fees are waived. Your filing may also look a little bit different from the instructions on this page.

West Virginia LLC Annual Report due date

All West Virginia Annual Reports are due between January 1 and June 30 every year.

When is my first Annual Report due?

Your first Annual Report is due the year after your LLC was approved. The due date is anytime between January 1 and June 30.

For example, let’s say your LLC was approved on March 12, 2025. Your first West Virginia Annual Report is due by June 30, 2026. Then your Annual Report is due by June 30 every year after that.

How early can I file my Annual Report?

You can file your Annual Report any time between January 1 and June 30.

For example, let’s say your LLC was approved on July 12, 2025. You can file your Annual Report anytime between January 1 and June 30 every year starting in 2026.

What happens if I don’t file my Annual Report?

If you don’t file your Annual Report at all, the state will charge you a $50 late fee for each year your Annual Report isn’t filed. This late fee is in addition to the normal $25 fee for each Annual Report filing.

If you don’t file any Annual Reports for 4 years in a row, the state can cancel your LLC’s registration. This is called “administrative dissolution”.

If your LLC is administratively dissolved, you will have to call the state and file paperwork to reinstate your LLC.

Note: You can Reinstate your LLC within 2 years after it’s been dissolved. However, if your LLC name was taken by another business while yours was dissolved, you’ll need to find a new business name. And if you don’t Reinstate your LLC within the 2 year reinstatement period, you’ll have to start a new LLC.

West Virginia LLC Annual Report Reminders

We recommend putting a repeating reminder on your phone, computer, and/or calendar for your West Virginia Annual Report deadline. The deadline is the same every calendar year: June 30th is the last day to file the Annual Report on time.

Here’s a video on how to use Google Calendar to create reminders:

Note: If you want help filing your paperwork, you can hire a company that offers Annual Report service. Check out our review of the best LLC services for our recommendations on companies that file annual reports for your LLC.

How to file a West Virginia Annual Report online

West Virginia allows you to file your Annual Report online.

Get started:

Go to the West Virginia One Stop Business Portal page.

Instructions for Filing Your LLC Annual Report

Log into the One Stop Business Portal.

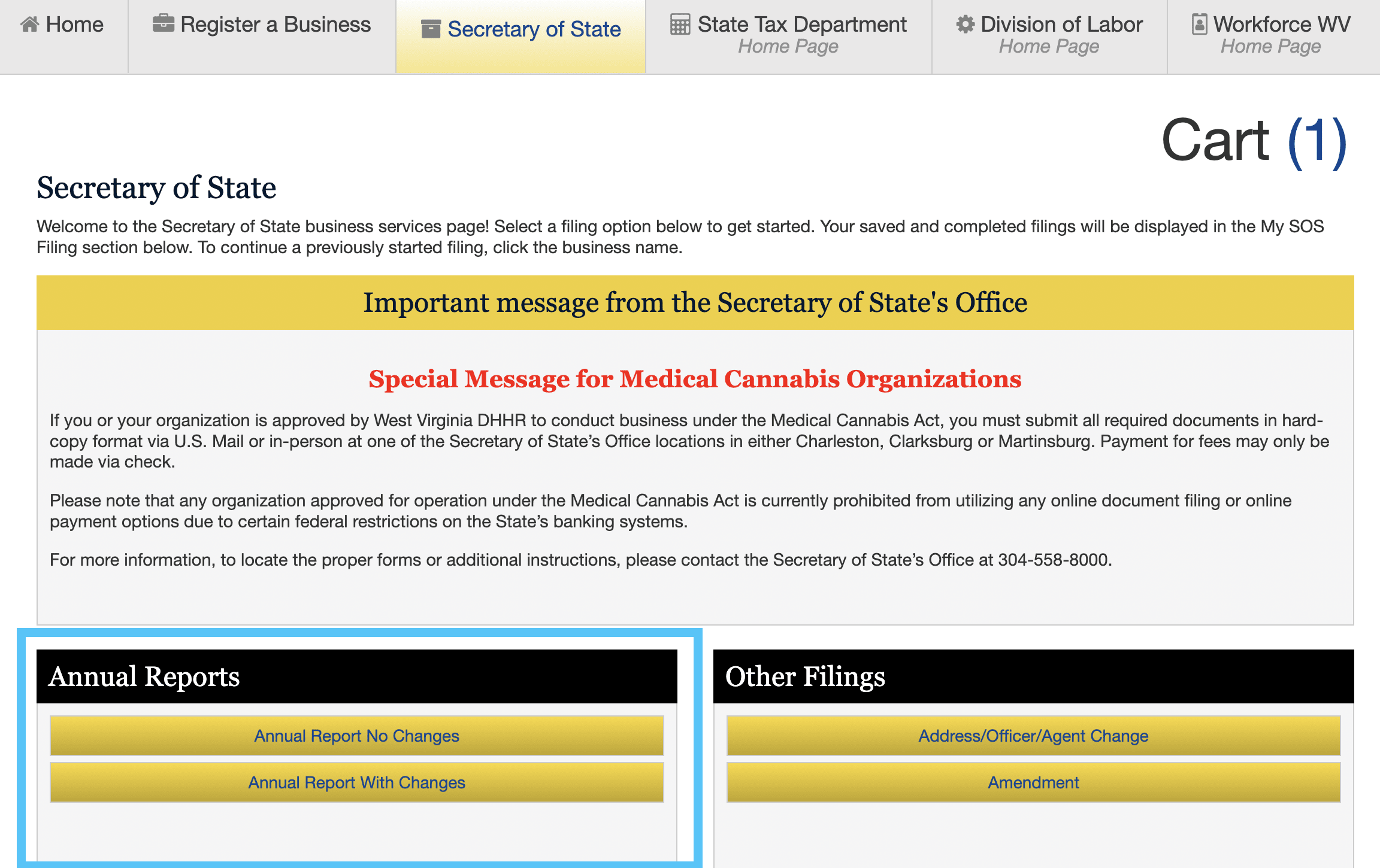

Click the Secretary of State tab. The Secretary of State will update any changes you make in your Annual Report when the filing is approved.

Scroll down to the Annual Reports section.

The blue box indicates where to find your Annual Report filing in the Secretary of State tab within West Virginia’s One Stop Business Portal.

- If you won’t be updating any information, click Annual Report No Changes.

- If you plan to make changes to the information on file with the Secretary of State, click Annual Report with Changes (jump to instructions below).

Tip: If you’re not sure whether you need to make changes to your LLC’s information, it’s best to click Annual Report with Changes and review all the information in the Annual Report.

Annual Report No Changes (Step-by-step)

Access Your Company Record

Enter the name of your LLC in the Name Search box and click Search.

Select your business name from the list.

Secretary of State annual filing status

This page just lets you know the filing will cost $25 and that updates to any information in the online workflow will be processed after your Annual Report is approved by the state.

Click Continue.

Annual Filing – Data on File at the Secretary of State

Review the information you have on file and click Continue.

Annual Filing Summary

This page is certifying that all of the information in your Annual Report is correct.

Enter your first and last name.

Then select your Capacity in the drop-down:

- If your LLC is Manager-managed, you should select the title “Manager“.

- If your LLC is Member-managed, you should select the title “Member“.

Enter your phone number and click Checkout.

Select Payment

Select how you’d like to pay for your Annual Report and review the fees. Then click Checkout.

Checkout/Submit Filing

Enter your payment information and submit your filing by clicking Checkout/Submit.

Congratulations! You’ve completed your Annual Report Without Changes! You should receive a confirmation email within a few minutes.

Annual Report with Changes (Step-by-step)

Access Your Company Record

Enter the name of your LLC in the Name Search box and click Search.

Select your business name from the list.

Secretary of State annual filing status

This page just lets you know the filing will cost $25 and that updates to any information in the online workflow will be processed after your Annual Report is approved by the state.

Click Continue.

LLC – Data on File at the Secretary of State

This page shows the information you have on file. There’s nothing to do on this page, just click Continue.

LLC – Updating Information

There’s nothing to do on this page – it’s giving you instructions for the following pages.

Some pages are already filled-in with the existing information about your business. If you don’t need to change that information, you can just click Continue. If you need to update information, make the changes on the page.

However, some pages are not pre-filled and you must complete the fields before you click Continue.

LLC – General Business Detail

Select the business purpose that best fits your business. If you can’t find a purpose that fits your exact business, you can just choose the one that’s closest.

Then select your WV County from the next dropdown list.

If your LLC isn’t located in West Virginia, scroll to the bottom of the dropdown and select Out of State (if your business is in a different state) or Out of Country (if your business is not in the U.S.).

Click Continue.

LLC – Principal Office

Update your principal office address if needed. Click Continue.

LLC – Mailing Address

Update your mailing office address if needed. Click Continue.

LLC – Designated Office

Update your designated office address if needed. Click Continue.

LLC – Agent of Process

Update the name and address for your Agent of Process if needed. Click Continue.

Note: You don’t have to list an Agent of Process (aka Registered Agent) for a West Virginia LLC – learn more about West Virginia Registered Agent Requirements.

LLC – Company Email

Enter your best business email address in case the state needs to contact your business about your filing. This email address won’t be on public record.

You can also enter your company’s website here, but it’s optional.

Click Continue.

LLC – Number of Employees

Enter the number of your LLC employees who live or work in West Virginia in the first field.

Then enter the total number of employees your LLC employs (in any state or country).

Remember: If you are an LLC Owner (LLC Member), you aren’t an employee.

LLC – Member or Manager Information

- If your LLC is Member-managed, you’ll see a screen listing the Members on file.

- If your LLC is Manager-managed, you’ll see a screen with the Managers on file.

If you’d like to change the Member or Manager on record, click the small pen icon to the right of their name. Then update the name and address on the next screen.

If you’d like to add a second Member or Manager, click Add Record and enter their name and address on the next screen.

Note: Your LLC must have at least one Member or Manager on record with the West Virginia Secretary of State.

If you don’t need to make changes, click Continue.

Scrap Metal Information

If your business is a scrap metal dealer or is a scrap metal recycler, click Yes and enter your business information on the next screen. Otherwise, click No.

Most people click No.

Click Continue.

Export Information

If your business exports anything, enter the names of the top 3 countries you export to.

If your business doesn’t export anything, click No and select whether you would like to receive information from the state about exporting your LLC’s goods or services.

Click Continue.

LLC – Minority and/or Women Owned Business Information

Is this a minority owned business?

If your LLC is minority-owned, click Yes. If not, click No.

If you don’t want to disclose that information to the state, you can also Decline to answer.

Is this a woman owned business?

If your LLC is woman-owned, click Yes. If not, click No.

If you don’t want to disclose that information to the state, you can also Decline to answer.

Do you own or operate more than one business in West Virginia?

If you own or operate more than one business in West Virginia, click Yes. Then tell the state how many businesses and the number of counties those businesses are located or operated in.

If you don’t operate other businesses, click No.

Click Continue.

LLC – Active/Retired Military Information

Does your organization employ individual(s) who currently serve or someone who has served as a member of the United States Armed Forces?

If your business employs any veterans or active military personnel, click Yes and enter the amount employed.

If your business doesn’t employ any veterans or active military personnel, click No.

Remember: If you are an LLC Owner (LLC Member), you aren’t an employee.

Does the owner of the organization currently serve or has served as a member of the United States Armed Forces?

If the owner of your LLC (LLC Member) is a veteran or active military personnel, click Yes. Otherwise, click No. You can also Decline to answer.

Click Continue.

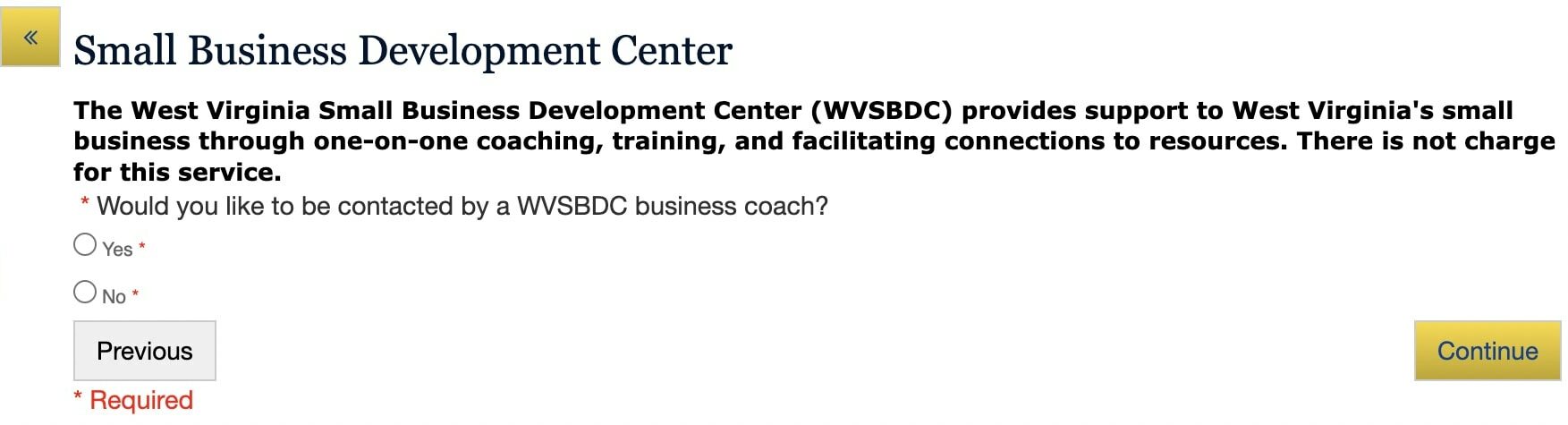

Small Business Development Center

This isn’t a sales pitch. The Small Business Development Center (SBDC) is a government-funded organization that helps small business owners by answering questions about running a business and providing resources.

If you would like a business coach from the SBDC to reach out to you (for free), click Yes. Otherwise, click No.

LLC – Annual Filing Summary

This page allows you to review all of the information you’ve entered for your Annual Report before signing to certify that it’s all correct.

Review the information you’ve submitted for your filing. Click Show to the right of each heading to expand the details for each section.

Once you’ve verified the information is all correct, enter your first and last name. Then select your Capacity in the drop-down.

If your LLC is Member-managed, you’ll select the title “Member“.

If your LLC is Manager-managed, you’ll select the title “Manager“.

Enter your phone number and click Checkout.

Select Payment

Select how you’d like to pay for your Annual Report and review the fees. Then click Checkout.

Checkout/Submit Filing

Enter your payment information and submit your filing by clicking Checkout/Submit.

Congratulations

Your West Virginia Annual Report was filed online and will be processed within a few minutes. You can download a copy of your Annual Report to save for your records on this page.

A confirmation email of your Annual Report approval will be sent to the email address on file.

Note: If you don’t get that email within a few minutes, please check your spam folder.

West Virginia Secretary of State Contact Info

If you have any questions, you can contact the West Virginia Secretary of State’s office.

Their phone number is 304-558-8000. And their regular business hours are Monday through Friday, 8:30am to 5pm Eastern Time.

West Virginia Annual Report Filing FAQs

Do I need to file an Annual Report for my LLC in West Virginia?

Yes. Every West Virginia LLC must file an Annual Report. This requirement begins the year after you start your LLC, and continues every year for the life of your LLC.

West Virginia charges a $50 late fee if you fail to file your Annual Report on time. If you don’t file your Annual Report for 4 years in a row, the state can administratively dissolve your LLC. So we recommend filing on time every year.

You can set up Google Calendar reminders to help notify you.

How much does it cost to file an Annual Report in West Virginia?

The West Virginia Annual Report for LLCs costs $25 per year. This is paid every year for the life of your LLC. The Annual Report fee is paid to the West Virginia Secretary of State.

Note: Veteran owned registered entities (including LLCs) don’t have to pay the Annual Report filing fees for the first 4 years.

How do I file my Annual Report in West Virginia?

You can file your West Virginia LLC Annual Report forms online.

Look up your LLC on the West Virginia One Stop Business Portal. Enter all the information requested and submit your payment. We have more detailed instructions on how to file your Annual Report above.

If you don’t want to file yourself, you can also hire a company that offers Annual Report Service.

What is the processing time for a West Virginia Annual Report?

The One Stop Business Portal processes Annual Reports immediately. If you don’t receive a confirmation email within a few minutes of submitting the form, we recommend checking your spam folder.

Will I be charged a late fee if I don’t file a West Virginia Annual Report?

Yes. West Virginia charges a $50 late fee each year if you file your Annual Report late or don’t file one at all.

Said another way, if you miss one Annual Report, you will pay $25 for the missing Annual Report, plus the $50 late fee.

If you miss 3 years of Annual Reports, you will pay a total of $225 including all late fees.

If you don’t file for 4 years in a row, the Secretary of State can shut down your LLC. This is called administrative dissolution. Then you’ll have to pay a fee and file paperwork in order to restore your LLC, or you’ll have to start a new LLC.

What happens if an Annual Report is not filed?

West Virginia charges a $50 late fee per each Annual Report that isn’t filed before July 1st.

Said another way, if you miss filing Annual Reports, you will pay the $25 for each missing Annual Report, plus a $50 late fee per Annual Report.

If you don’t file for 4 years in a row, the state will administratively dissolve your LLC instead of just charging a fee.

Once the state administratively dissolves an LLC, you have 2 years to reinstate it and pay the fees. If you wait longer than that, you have to start a new LLC.

How to reinstate an LLC

To reinstate your LLC, you’ll need to call the West Virginia Secretary of State’s office at 304-558-8000 to get the Articles of Reinstatement.

You must file the Articles of Reinstatement by mail. They can’t be filed online.

It will cost $200 to file for reinstatement. This is $25 for the reinstatement application, the maximum late fees of $150, and $25 to file a current Annual Report to get your LLC up-to-date.

Include the following with your filing:

- Letter of Good Standing from the West Virginia State Tax Department

- Completed Annual Report for the current year

- Check or money order for $200, payable to “West Virginia Secretary of State”

Mail the payment with your paperwork to the state.

How to get a copy of a West Virginia LLC Annual Report

Most people don’t need a copy of their Annual Report. However, if you need a copy of your Annual Report for any reason, there are a few ways to get them from the state depending on your filing method.

If you logged in to your account when you filed your Annual Report, go to the Secretary of State tab. Scroll down to “My SOS Filings” and download your Annual Reports for free.

If you did the guest Annual Report filing or can’t find your login information, you can call the Secretary of State to ask for a request form. Then you’ll pay a few dollars for a copy of your Annual Report and the state will deliver it by email.

You can also print or download a copy of your Annual Report for free on the confirmation page when you file each year.

Is the LLC Annual Report the same as the West Virginia Business Tax Registration?

No, they are not the same thing.

The West Virginia Business Tax Registration (aka Business Registration Certificate) is a business license that lets you operate your LLC in West Virginia. It’s filed with the State Tax Department.

The Annual Report (aka SOS Annual Report) is filed with the Secretary of State and is required to keep your LLC’s information up to date and in good standing.

- Learn more about West Virginia LLC Business Licenses

How do I file an Article of Organization in WV?

You can file the Articles of Organization in WV online or by mail.

The filing fee is still $100 and approval takes 5-10 business days for both filing methods.

However, we recommend the online filing (via One Stop Business Portal) since this will also handle your LLC’s Business Registration Certificate (aka Business License).

We have instructions on how to file West Virginia LLC Articles of Organization.

How much does an LLC cost in West Virginia?

It costs $100 to register your West Virginia LLC with the Secretary of State. This is a one-time fee paid to form your LLC.

In West Virginia, you will also need a $30 Business Registration Certificate from the State Tax Department.

And you must file an Annual Report for $25 each year.

There may be other business licenses, permits, and costs to start your LLC in West Virginia depending on your industry and occupation.

References

West Virginia State Tax Department

West Virginia Code: Section 59-1-2a

West Virginia One Stop Business Portal: Login

West Virginia One Stop Business Portal: Annual Reporting

West Virginia Secretary of State: Limited Liability Companies

West Virginia One Stop Business Portal – Annual Report Filing Instructions

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

West Virginia LLC Guide

Looking for an overview? See West Virginia LLC