Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

If you googled how to form an LLC in the state of West Virginia, and are feeling confused, don’t worry! At LLC University, we specialize in researching the LLC formation process and turning it into step-by-step instructions.

If you googled how to form an LLC in the state of West Virginia, and are feeling confused, don’t worry! At LLC University, we specialize in researching the LLC formation process and turning it into step-by-step instructions.

File Articles of Organization to form an LLC in West Virginia

In this lesson, we will walk you through filing the West Virginia LLC Articles of Organization form with the Secretary of State.

Your West Virginia Articles of Organization is the legal document that officially forms your Limited Liability Company. You can file this form online or by mail.

The form asks for basic information like your business name, your LLC address, and your business’s industry or activities.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

West Virginia LLC Articles of Organization filing fee

It costs $100 to file the West Virginia Articles of Organization.

You’ll also pay $30 for the Business Registration Certificate.

These fees are the same whether you file your LLC online or by mail. And they are both one-time fees paid to the state.

How much is an LLC in West Virginia explains all the fees you’ll pay, including the LLC filing fee for the Articles of Organization.

LLC approval times

The approval time for an LLC in West Virginia takes 5-10 business days when you file online or by mail.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in West Virginia.

Online vs Paper (LLC University® Recommendation)

While you can file West Virginia’s Articles of Organization online or by mail, we recommend filing online because it’s easier and it includes all the required steps.

West Virginia requires all LLCs to apply for a Business Registration Certificate after filing their Articles of Organization:

- If you file your Articles of Organization online, the system includes the application for your Business Registration Certificate.

- If you file your Articles of Organization by mail, you’ll have to separately apply for your Business Registration Certificate by mail after your LLC is approved.

Alternatively, you can hire a company to form your LLC. Make sure the company you choose can also file the Business Registration Certificate application for you. Check out Best LLC Services in West Virginia for our recommendations.

How to File a West Virginia LLC by Mail

If you prefer to file by mail (instead of online), you’ll need to:

- Download and complete the West Virginia LLC Articles of Organization (Form LLD-1)

- Fill out the Articles of Organization and Customer Order Request form.

- You can ignore the e-Payment Authorization form.

- Prepare a check or money order for $100 and make it payable to “West Virginia Secretary of State“

- Send your payment and the completed forms to one of the three Business Service Centers listed on the form. It doesn’t matter which address you choose (they all work), so many people choose the location closest to them.

Note: If you choose to have your LLC approval documents returned via email, just send 1 signed and completed copy of your Articles of Organization. However, if you choose to have your LLC approval documents returned via regular mail, you’ll need to send 2 signed and completed copies of your Articles of Organization to the state.

Once your LLC is approved, you can then apply for your Business License (aka Business Registration Certificate). The fee for this is $30.

How to File a West Virginia LLC Online

To file your LLC online, you’ll need to use West Virginia’s One Stop Business Portal.

One Stop will take care of your LLC formation and your Business Registration Certificate.

And because One Stop is a multi-agency filing system, it will also register your LLC for Unemployment Compensation and Workers’ Compensation.

What if I don’t have any employees? You’ll still need to answer the questions in One Stop. The system automatically submits everyone’s business information to these programs, to keep accurate state records. But you don’t need to pay anything extra.

We’ll walk you through all of this in our step-by-step instructions below.

Let’s get started:

- Visit One Stop Business Portal to create an account.

- Click on Create an account here.

- Enter your information and click Register (you’ll be automatically logged in).

- Click the New Business Registration button in the middle.

Note: If you’ve already formed your LLC and are wanting to apply for your Business Registration Certificate you shouldn’t use One Stop for this purpose. Instead please use the instructions in West Virginia Business Registration Certificate to file the application by mail.

Business Class

Note: You’ll see a warning in red text. Don’t worry. You can ignore this and continue your filing.

Select “For Profit“.

Remember: The instructions on this page are for For Profit Limited Liability Companies only.

Activity Category and Primary Activity (NAICS Code)

The next sections ask for your NAICS code. An NAICS code for an LLC will help the state determine your West Virginia business license requirements.

Click through the drop down menus to narrow down your selection.

Here’s a video showing some examples:

Tip: If you can’t find your exact type of business, don’t worry. That’s pretty common. Just pick something that generally describes your primary business activity.

Public Information

Select Yes if you would like information about your primary business activity category to be made available to the public.

If privacy is important to you, click No.

Primary Activity Only

If your LLC will engage in one primary business activity, click Yes.

If your LLC will engage in multiple business activities, click No. Then on the next pages, select your secondary business activity.

For example:

1. If your business will be carpentry and goat yoga, that would be two different business activities. Click No and go through the Secondary Activity workflow to select another NAICS code for your secondary business activity.

2. If your business will be hardscaping, landscaping, and planting, that could all be grouped under one Primary Activity. So click Yes, because you don’t need to select a Secondary Activity in this case.

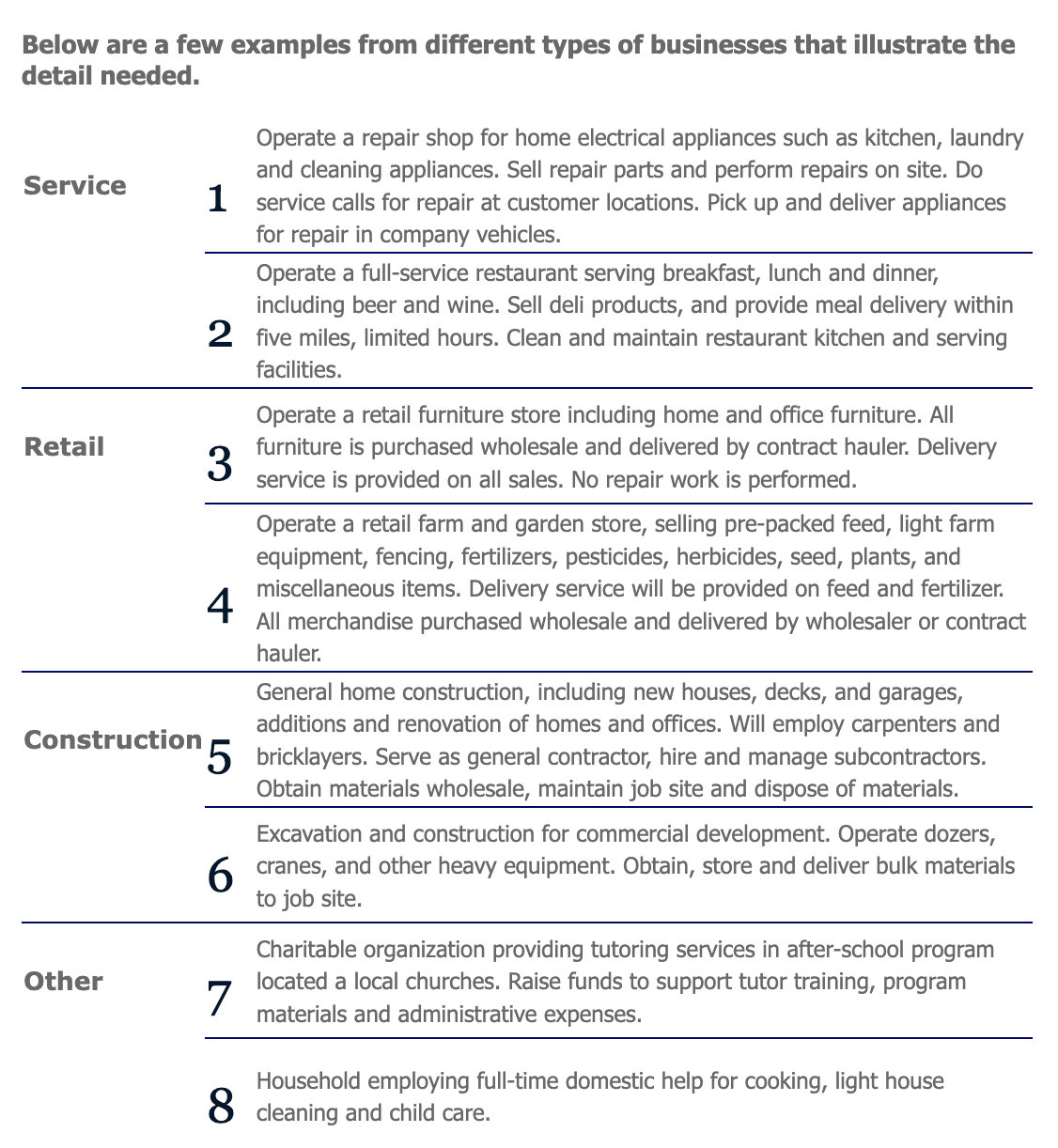

Business Activity Description

You now need to explain what your business does, in sentence-format.

The state wants you to enter a few sentences about what your business does and they prefer details.

Here are some examples:

Starting Point

If you are forming a new LLC in West Virginia, select “A business formed in West Virginia.”

Note: If you already formed an LLC for this business in another state, but need to register to do business in West Virginia, select from one of the bottom four options. On the next page, you’ll need to upload a Certificate of Good Standing.

Check Exemptions

This page asks if your business is exempt from getting a Business License (aka Business Registration Certificate).

Most businesses aren’t exempt. So most people just click No and proceed to the next step.

Note: If you think your business might be exempt from the Business Registration Certificate, you can click Yes to see if you meet the requirements. If you think you meet the exemption requirements, you then need to explain why to the state on the next step. If you’re not sure – or have any questions, you can call the State Tax Department.

Business Structure Information

There’s nothing you need to do on this page. Just click Continue.

Ownership/Control

Select how many owners (LLC Members) your business will have.

Business/Organization Structure

Select Limited Liability Company.

LLC Management Type

Choose your LLC’s management structure (said another way, choose whether you want a Member-managed vs Manager-managed LLC).

Tip: If you’re not sure what to select, most businesses owned by individuals choose to be a Member-managed LLC.

Employees

If you will have employees working in West Virginia, click Yes.

If you won’t have employees working in West Virginia, click No.

Summary of The Basics

Review the information you entered on this page.

The fine print at the bottom just lists what the next few sections will be about. But don’t worry if it sounds confusing. We’ll explain them below.

Business Name

Important: It’s very important to make sure your name is available and meets state requirements at this point in the formation process. You’ll be using it in the next few steps to get an EIN online from the IRS.

First, read our West Virginia LLC Name guide and come up with your LLC name (plus a backup name) to make sure your business name meets the state requirements.

Then call the West Virginia Secretary of State at 304-558-8000 for a preliminary check on name availability. Their hours are 8:30am to 5pm Eastern time.

After you have this informal approval, enter your LLC name exactly as you would like it. Include your preferred capitalization and the designator. Most people use “LLC”.

Register Trade Names

If you’d like to register a DBA name for your LLC (known as a Trade Name in West Virginia), you can do so here.

- If your LLC will do business under its full name, you don’t need to file a DBA.

- If your LLC will do business under a name that’s different from its full name, you need to get a DBA.

Note: Your LLC can have multiple Trade Names and each Trade Name you register costs $25.

Existing Business Identification Number

Note: In the next few steps, you’re going to go get a Federal Employer Identification Number (FEIN) from the IRS online, then come back to complete this process. Getting an FEIN for an LLC can be done for free online in about 15 minutes.

If you’re forming a new LLC, you should select “No number has been assigned“.

Tip: If you’re converting from a Sole Proprietorship to an LLC, or from a General Partnership to an LLC, you shouldn’t use your existing FEIN number. You should get a new FEIN number. So you should also select “No number has been assigned“.

Request Business Identification Number

Note: If your business is a Multi-Member LLC or an LLC with employees, don’t worry; you won’t see this screen or this message.

If you’re a Single-Member LLC with no employees, you’ll see a message that you’re not required to get an FEIN. While this is technically accurate, it’s really bad advice. We recommend getting an FEIN since you’ll need it when you open business bank accounts later.

There’s nothing to do on this page. Just click Continue.

Request Business Identification Number (cont.)

If you’re a Single-Member LLC, you’ll see an additional screen with two options. Click “Apply online and use an FEIN“.

Federal Employer Identification Number

At this point, you’re ready to head over to the IRS website and get your FEIN online.

We recommend clicking Save/Continue Later in the left navigation menu to save your progress. This will return you to the One Stop Dashboard.

Action Item: Alright, now go get your FEIN. Here’s a link to the IRS application. And here’s our step-by-step instructions. Make sure you save your EIN Confirmation Letter (CP 575) and make a few copies to keep with your business records.

After you have your FEIN, go back to One Stop. Click the Register a Business tab. Then click your LLC name.

Click the name of your LLC to resume your filing and enter your FEIN on this page.

You’ll enter the first 2 digits in the first box and the remaining 7 digits in the second box.

Actual Physical Location (no P.O. Boxes) in WV

Enter the physical location where your business operates or where you run your business from.

This address can be a home address or an office address, but it must be a physical address (no PO boxes).

Additionally, this address can be in Wisconsin, in any other state, or it can be an international address.

Then enter a phone number.

In the WV County dropdown, select your West Virginia county if the address you entered is in West Virginia.

If the address you entered is in another state or country, scroll down to the bottom of the dropdown and select Out of State or Out of Country.

Mailing Address for Tax Returns

Enter the address where you’d like to receive tax documents.

This address can be the address used in the previous step, or a:

- home address

- office address

- PO Box address

- mailbox rental address

- virtual office address

This address can be in West Virginia or in any state, or it can be an international address.

Designated Office (optional)

(Wow, West Virginia’s filing asks for a lot of addresses!)

The Designated Office address is not required (and it’s unnecessary). Because this is optional, we recommend leaving this blank.

Principal Office

Enter your LLC’s Principal Office address. (I know, another address field!)

This is the address where you keep your LLC business records, legal documents, and/or the address where you run your business from. This address can be in West Virginia or this can be in any state.

This address can be a:

- physical address (like a home or office address)

- mailbox rental address

- virtual office address

This address can be in West Virginia or in any state, or it can be an international address.

Agent of Process

Note: An Agent of Process is the same thing as a Registered Agent.

You may have read that every LLC in West Virginia needs a Registered Agent.

However, this isn’t true. West Virginia is unique in that it doesn’t require an LLC to have a Registered Agent.

You can learn more about this in our West Virginia Registered Agent article, and by exploring Is a Registered Agent a Member of an LLC?

However, we recommend that if you’re forming your LLC yourself, to just leave this blank and not enter a Registered Agent.

Organizer Information

- Learn More: LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer

Click Add Record to add the contact information for your LLC’s Organizer.

Note: You only need to list one person as the Organizer.

Signature Authority Member Information (or Manager Information)

Click Add Record to add the contact information for your LLC’s Members or Managers (depending on your management structure).

If your LLC is Member-managed, then add all of the Members’ contact information.

If your LLC is Manager-managed, then add all of the Managers’ contact information.

Note: You’ll need to enter the Social Security Number (SSN) or ITIN for every person added because this information gets submitted to the State Tax Department.

Legal Purpose of LLC

Enter a few words or a sentence about your LLC business purpose (what your business does).

You can enter just a few words. For example: “pizza shop”, “real estate investing”, “landscaping”, etc.

Or you can enter a short sentence. For example: “We restore old cars”, “I offer life coaching services”, etc.

Charter Information for LLC

Are the members liable in their capacity as members?

Most people click No here.

Why? An LLC is used to provide personal asset protection. This means it keeps your personal assets separate from your business assets in case of a lawsuit, and separate from the LLC’s debts. Clicking yes here would defeat the purpose of having an LLC.

What is the effective date of the statement of registration?

The LLC Effective Date is the date your LLC goes into existence. Think of it like the day your LLC is “born”.

If you want your LLC to become effective on the day it’s approved by the state, select the first option.

If you want your LLC to go into existence on a future date, click “A future date and time” and enter that date on the next screen. This date can’t be more than 90 days ahead. And you can’t back-date your filing.

Most people choose to have their LLC go into existence on the date it’s approved by the state.

Pro tip: If you’re forming your LLC later in the year (October, November, December) and you won’t be doing business right away, you can give your LLC an effective date of January 1st of the following year. This can save you the hassle of filing taxes for those few months with no business activity. And you won’t have to file an Annual Report for 2 years (saving you $25).

Charter Information for WV LLC

This section is optional and typically used for “additional rules”.

For example, your attorney might give you specific instructions to include here. But that’s uncommon and most people just leave this blank.

LLC Term Type (LLC Duration)

This section lets the state know how long your LLC will remain in existence (the LLC duration).

If you prefer for your LLC to be “open-ended” with no set end date, click “An at-will company, for an indefinite period“. Most people choose this option.

If you prefer for your LLC to be automatically shut down after a certain period of time, click “A term company, for a specific number of years“. Then enter that amount of time in years on the next screen.

Domestic Business Background

If any of the LLC members have ever owned a business before in West Virginia, click Yes. If not, click No.

Domestic Business Background (cont.)

Select a phrase that best describes your LLC. Most people select “ALL NEW“.

Start of Operations

Choose the date your business will start.

If you chose for your LLC to have an Effective Date on the day it’s approved by the state, enter today’s date.

If you chose for your LLC to have an Effective Date in the future, enter that same date here.

Gross Revenue

This page may look confusing with the multi-colored messages. But don’t worry. It’s pretty simple.

The state is just asking you how much money you estimate you’ll make. They’re also technically asking you about the prior year, but for most people, this is not applicable.

What is your estimate of the annual gross income from this location?

Let the state know if you think your LLC will make more or less than $20,000.

Counting all business income for the previous year at any location, has this business grossed over $4,000?

Since most people are starting a new LLC, this question is not applicable, so they just click No.

Retail Sales or Service

If your business will be making retail sales, or doing any service or maintenance work at this West Virginia location, click Yes. Otherwise, click No.

Special Products Sales

If your business will sell or consume any item listed, please check that box.

If none apply, check None of the above.

Special Business Activities

Check any business categories that apply to what your business will be doing.

If none apply, check None of the above.

Specialized Services

Check any services or functions that your business will provide.

If none apply, check This business does not engage in any of these specific activities.

Other Special Questions (Businesses With Operations in WV)

If your business will use commercial scales or measuring devices (like gas pumps) at this West Virginia location, click Yes. Otherwise, click No.

If your business will make purchases from outside of West Virginia for use in West Virginia, (other than for resale), click Yes. If not, click No.

Tax Year End

Select the month you’d like to be the end of your business’s tax year. Most people select December.

Election of Tax Status with IRS

If you plan to change your tax classification with the IRS so your LLC will be taxed as a Corporation, click Yes. If not, click No.

Most people choose to have their LLCs taxed in their default status and select No.

Default status means that if you have a Single-Member LLC, you’ll have an LLC taxed as a Sole Proprietorship. And if you have a Multi-Member LLC, you’ll have an LLC taxed as a Partnership.

However, if you choose to be taxed as a Corporation with the IRS, click Yes. You have two options: an LLC taxed as an S-Corporation or an LLC taxed as a C-Corporation.

S-Corporation taxation can save you money on self-employment taxes. However, it only makes sense once your business has established revenue and you’re making at least $70,000 in net income per LLC Member.

And C-Corporation taxation is rarely used by small business owners.

Make your selection and continue.

Requirements for Payroll Insurance

There’s nothing to do on this page. Just click Continue.

Owner/Employer Responsibilities

On a previous page, you told the state whether your LLC will have employees.

If your LLC won’t have employees:

Then confirm that selection on this page.

If your LLC will have employees:

You’ll need to answer a series of questions about your employees. This includes how many you’ll have, where they’ll be physically located, the date they’ll start work, etc.

Payroll & Reporting

One Stop can be weird at times and may ask you questions that aren’t relevant to your business. Like this payroll question (and the next one). A lot of LLCs don’t have payroll because they don’t have employees.

But you’ll need to answer this question regardless of whether you have payroll responsibilities. Just choose the address where you’ll keep your business records.

If you want to enter a new address, select “At a different location“. Then enter that address and phone number on the next screen.

Unemployment Compensation Payroll Reports

Select your best mailing address.

If you would like to enter a new address, select, “At a different location“. Then enter that address and phone number on the next screen.

Scrap Metal Information

If your business makes money dealing in or recycling scrap metal, click Yes and enter your business information on the next screen. Otherwise, click No.

Most people click No.

Veteran Owned Business Information

Note: This section is for businesses that are owned by veterans, active military personnel, or their spouses. If none of these apply to you, you can just click No and skip to the next section.

Veterans, active military personnel, and the spouses of either can start an LLC for free.

Note: Only the LLC formation fee ($100) is waived in this process. You will still pay $30 for the Business Registration Certificate.

To qualify, your business must be 51% owned by one or more veterans (or active military personnel, or their spouses). And veterans must have been discharged under honorable conditions.

If you don’t meet the requirements or aren’t interested in the waiver, select No.

If you do meet the criteria and you’d like to apply for the veteran-owned business waiver, select Yes and upload your documents.

Document Upload

If you meet the fee waiver requirements, upload the appropriate documents:

If you’re a veteran (or the spouse of a veteran), you’ll need to get a copy of the veteran’s DD214 and upload that file here.

If you’re an active military personnel, you can upload a copy of your military ID.

If you’re the spouse of active military personnel, you can upload your military ID or your spouse’s military ID.

Company Website

Listing your business website is optional and you can skip this section if you want.

Small Business Development Center

This isn’t a sales pitch. The Small Business Development Center (SBDC) is a government-funded organization that helps small business owners by answering questions about running a business and providing resources.

If you would like a business coach from the SBDC to reach out to you (for free), click Yes. Otherwise, click No.

Young Entrepreneurs Act Waiver

Good news! If you’re under the age of 30, you can form an LLC for free.

This is because of the Young Entrepreneur Reinvestment Act. This West Virginia statute allows West Virginia residents, aged 18-29, to form an LLC for free.

Note: Only the LLC formation fee ($100) is waived in this process. You will still pay $30 for the Business Registration Certificate.

In order to claim the waiver, click Yes and then prove your age and verify your residential address by uploading the required documents listed on this screen.

If you don’t meet the requirements (or would rather not claim this discount), click No.

Warning! The site is a little finicky, and after you click Continue on this screen, you can no longer hit Previous as the Previous buttons aren’t available on future pages. If you want to go back after this point, you’ll need to click on some of the headings in the left navigation menu until one actually opens that has a Previous button.

Next Steps (signatures)

WV State Tax Department

An LLC Member (owner) must sign this section on the LLC’s behalf.

Enter their first and last name, the date, and the title “Member“.

WV Secretary of State

Enter the Organizer’s first and last name, best email address, and phone number.

In the Capacity dropdown, select “Organizer“.

WV Unemployment Compensation Division

An LLC Member (owner) must sign this section.

Enter their first and last name, the date, and the title “Member” in the Capacity field.

Click Review Registration.

Registration Review

Review the information you submitted throughout this lengthy application. Click Show to the right of each heading to expand the details for each section.

When you’ve verified the information is all correct, click Select payment option.

SOS Expedite Service Processing Option

Select how fast you want your LLC approved.

Select Standard Processing (no additional fees) if you’d like your LLC approved in 5-10 business days.

If you want your LLC approved faster, we recommend choosing 24-Hour Expedite for $25 extra.

Note: To get your LLC approved the next day, you’ll need to choose this option between Monday and Thursday. If you file on Friday (or over the weekend), you won’t get your expedited approval until Monday next week.

Select Payment

Select whether you want to pay by credit card or electronic check.

Click Calculate Fees/Deposits.

Itemized Summary of Fees and Deposits for WV Business Registration

Review the fees to make sure everything looks right and then click Checkout.

Checkout/Submit Filing

Enter your billing information and click Checkout/Submit.

Finalize Payment

Enter the name of your LLC, your first and last name, your address information, phone number, and best email address.

Check the box marked “I understand that my billing statement will say B4WV“.

Once you’ve checked the box, payment fields will appear at the bottom of the screen.

Enter your payment information and click Pay.

CONGRATULATIONS!!!! YOU SURVIVED!!!

Just kidding, we mean to say Congratulations! Your West Virginia Limited Liability Company Articles of Organization form has been submitted for processing.

LLC approval (online filing)

Once you submit your Articles of Organization, the state will approve it in 5-10 business days.

Once approved, the state will then email you a stamped and approved Articles of Organization as well as a Certificate of Organization.

Then 2-4 weeks later, the state will mail you the Business Registration Certificate. You’ll need to post this at your business location where people can see it. If you’re running your business from home, just keep it with your business records.

We recommend making a few copies of your West Virginia LLC Articles of Organization and your Business Registration Certificate to keep with other records like your LLC’s Operating Agreement.

West Virginia Secretary of State Contact Info

If you have any questions, you can contact the WV Secretary of State’s office.

Their phone number is 304-558-8000. And their regular business hours are Monday through Friday, 8:30am to 5pm Eastern Time.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

West Virginia LLC FAQs

How much does it cost to open an LLC in West Virginia?

The filing fee for the LLC Articles of Organization is a one-time fee paid to the West Virginia Secretary of State.

It costs $100 to file by mail or online using West Virginia’s One Stop

Business Portal.

And every LLC in WV must pay $30 for a Business Registration Certificate.

How much does an LLC cost per year in West Virginia?

Your LLC must file a West Virginia LLC Annual Report and pay the $25 fee every year.

This fee is paid to the West Virginia Secretary of State between January 1 and June 30. Filing the Annual Report keeps your LLC in good standing.

How do I file an Article of Organization in WV?

You can file the West Virginia Articles of Organization online or by mail.

The filing fee is still $100 and approval takes 5-10 business days for both filing methods.

However, we recommend the online filing (via One Stop Business Portal) since this will also handle your LLC’s Business Registration Certificate (aka Business License). We have instructions above on how to use One Stop to create a business entity.

How do I get a copy of my West Virginia Articles of Organization?

If you’re looking for a copy of the West Virginia Articles of Organization that you already filed for your LLC, you can call the state at 304-558-8000 and they’ll email it to you.

Source: West Virginia Secretary of State: Copies and Certificates

What should I do if my LLC is rejected?

If your LLC is rejected, there’s no need to panic. You can correct the issue and re-submit your Articles of Organization to the state.

We cover this in more detail in West Virginia LLC Name Rejected.

How long does it take to get an LLC approved in West Virginia?

All LLCs formed in West Virginia are approved in 5-10 business days. This is true whether you filed online or by mail.

If you file by mail, make sure you consider the turnaround time while the documents are in the mail.

Does my LLC need a West Virginia business license?

Yes, every LLC in the state of West Virginia needs a Business License (aka Business Registration Certificate).

The government agency responsible for this license is the State Tax Department, however, if you follow the instructions above and file through One Stop, your business license is included in that filing.

If you already have an LLC, but haven’t obtained your Business License, you can follow our instructions.

How do I set up an LLC in West Virginia?

Here are the steps on how to start an LLC in West Virginia:

- Choose an LLC name and make sure it’s available

- Choose who will be your West Virginia Registered Agent

- Get a Tax ID Number (EIN) from the IRS

- File the West Virginia LLC Articles of Organization

- Get your Business Registration Certificate

- Complete and sign an LLC Operating Agreement

- Open an LLC bank account

References

West Virginia Code: Section 59-1-2

West Virginia Code: Section 31B-1-101

WV One Stop: Get Startup Help

WV One Stop Business Portal: Forms

WV One Stop Business Registration Instructions

WV One Stop Business Portal: Register Your Business

West Virginia Secretary of State: Expedite Service

West Virginia Secretary of State: Business Division

West Virginia Secretary of State: Articles of Organization

West Virginia Secretary of State: Young Entrepreneur Waiver

West Virginia Secretary of State: Register a New WV Business

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

West Virginia LLC Guide

Looking for an overview? See West Virginia LLC

Leave a comment or questionComments are temporarily disabled.