Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

If you googled how to form an LLC in Wisconsin, and are feeling confused, don’t worry! At LLC University®, we specialize in researching the LLC formation process and turning it into step-by-step instructions.

If you googled how to form an LLC in Wisconsin, and are feeling confused, don’t worry! At LLC University®, we specialize in researching the LLC formation process and turning it into step-by-step instructions.

File Articles of Organization to form an LLC in Wisconsin

In this lesson, we will walk you through filing the Wisconsin LLC Articles of Organization form with the Wisconsin Department of Financial Institutions (DFI).

Your Articles of Organization is the legal document that officially forms your Wisconsin LLC. You can file this document online or by mail.

The form asks for basic information like your business name, your LLC address, and your company’s Registered Agent information.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Wisconsin LLC Articles of Organization filing fee

The filing fee for a Wisconsin LLC varies depending on how you file:

- If you file by mail, the fee is $170

- If you file online, the fee is $130

How much is an LLC in Wisconsin explains all the fees you’ll pay, including the Articles of Organization LLC filing fee.

LLC approval times

The approval time for an LLC in Wisconsin varies depending on how you file:

- If you file by mail, your LLC will be approved in 5 business days (plus mail time)

- If you file online, your LLC will be approved immediately

LLC University® recommendation: We recommend filing your Wisconsin Articles of Organization online as it’s cheaper and has a faster approval time. Instructions for online filing are below.

However, if you aren’t very tech-comfortable, you can still file by mail.

Alternatively, you can hire a company to form your LLC instead. Check out Best LLC Services in Wisconsin for our suggestions.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Wisconsin.

How to File a Wisconsin LLC by Mail

If you want to file by mail (instead of online), you need to:

- Download and complete the Wisconsin LLC Articles of Organization

- Enter the information about your LLC on page 1

- If you want your approved Wisconsin Articles of Organization returned by email, enter your email address on page 2. If you want your Articles of Organization returned by regular mail, enter your mailing address on page 2.

- Print out the form and sign it

- When printing, use regular white paper (8.5″ x 11″)

- Prepare a check or money order for $170

- Make payable to “State of Wisconsin“

- Put your LLC Name on the memo line

- Send your payment and the completed form to:

- State of WI – Dept. of Financial Institutions

PO Box 93348

Milwaukee, WI 53293-0348

- State of WI – Dept. of Financial Institutions

How to File a Wisconsin LLC Online

These instructions will walk you through filing Wisconsin Articles of Organization using the QuickStart LLC system from the Wisconsin Department of Financial Institutions.

You don’t need to create an account to use the QuickStart LLC system. The first page lists the information you’ll need to form your LLC.

Simply click the button at the bottom to start your filing.

Wisconsin Articles of Organization Instructions

Name of Domestic Limited Liability Company

First, make sure your business name follows Wisconsin naming guidelines: Wisconsin LLC Name Search.

Article 1: Name of Domestic Limited Liability Company

Enter your desired business name. Make sure to include the designator at the end.

The designator can be any of these:

- LLC

- L.L.C.

- Limited Liability Co.

- Limited Liability Company

- LC

- L.C.

- Limited Company

- Limited Co.

- Ltd. Liability Co.

- Ltd. Liability Company

Tip: Most people choose LLC.

Click Next to continue.

Registered Agent and Office Address

If your Registered Agent is a person:

Article 3 (Registered Agent Name):

Enter their first and last name.

Article 4 (Registered Office Address):

Enter their physical address. This Registered Office address must be in Wisconsin and must be a street address. It can’t be a PO Box.

If you hired a Registered Agent Service:

Tip: If you want to hire a Registered Agent Service, we recommend Northwest Registered Agent. After you’ve hired a Registered Agent Service, you can complete the Articles of Organization as follows.

Article 3 (Registered Agent Name):

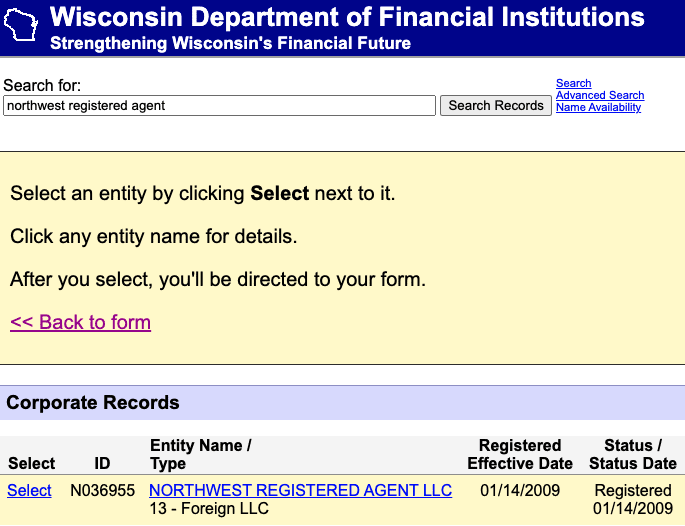

Click Select Entity. This will take you to the Corporate Records Search page. From here, search the name of the Registered Agent Service.

Click the name of the Registered Agent Service you hired. Scroll down and find their Registered Agent Office address (the one in Wisconsin). Write this address down because you’ll need to enter it in the next step.

Click “Select this Entity” at the top of this page to return to the form.

Article 4 (Registered Office Address): Enter the physical address of your Wisconsin Registered Agent.

Management

- Learn More: Member-managed vs Manager-managed LLC

Article 5: Management

Choose whether your LLC will be Member-managed or Manager-managed.

Wisconsin doesn’t require you to list any specific Members or Managers. You just need to identify which management structure your LLC will use.

Organizer

- Learn More: LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer

Article 6: Name and complete address of each organizer

Enter your first and last name and your address. This address can be an address that’s already on the Articles of Organization, or a:

- street address

- PO Box address

- mailbox rental address

- virtual office address

This address can be in Wisconsin or in any state, or it can be an international address.

Click Save Organizer to confirm. Then click Next to continue.

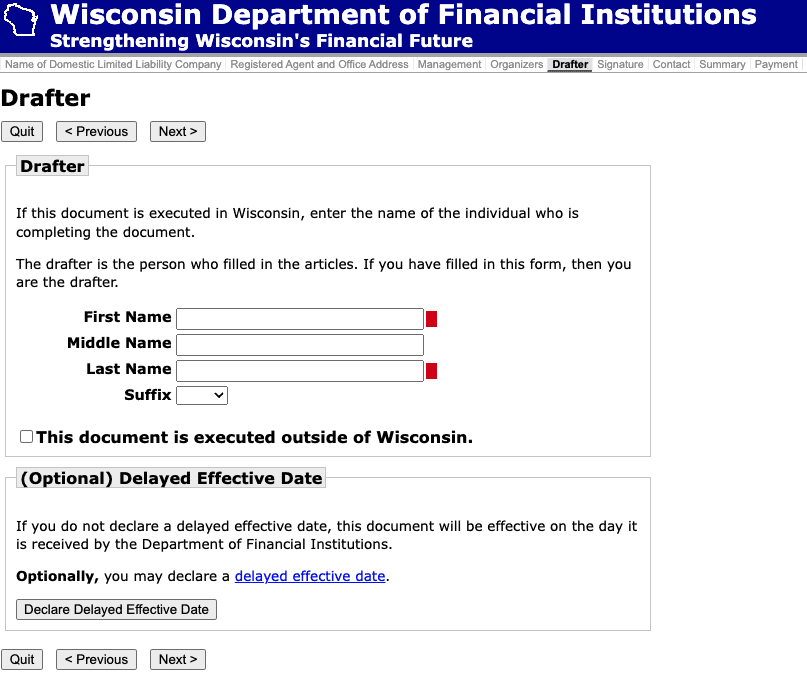

Drafter

If you’re in Wisconsin, enter your first and last name. And leave the “This document is executed outside of Wisconsin” box unchecked.

If you’re outside of Wisconsin, you can check the “This document is executed outside of Wisconsin” box and you don’t need to enter your name.

(Optional) Delayed Effective Date

- Learn More: What is the LLC Effective Date?

The LLC Effective Date is the date your LLC goes into existence. Think of it like the day your LLC is “born”.

If you don’t declare a Delayed Effective Date, your LLC will become effective the day it is approved by Wisconsin’s Department of Financial Institutions.

If you want your LLC to go into existence on the date it’s approved by the state:

Then you don’t need to do anything here. Most people choose this option.

If you want your LLC to go into existence on a future date:

Click “Declare a Delayed Effective Date” and enter that date (ex: MM/DD/YYYY). This date can’t be more than 90 days ahead. And you can’t back-date your filing.

Tip: You’ll see a note about including a time. This is not necessary or important. So you can just ignore this note.

Pro tip: If you’re forming your Wisconsin LLC later in the year (October, November, December) and you don’t need your LLC open right away, you can give your LLC an effective date of January 1st of the following year. This can save you the hassle of filing taxes for those few months with no business activity.

Signature

Check the box next to the Organizer’s name. That’s all you need to do on this screen.

Click Next to proceed.

Contact

This is the person the Department of Financial Institutions will contact with any questions about the filing information. This person can be the Drafter, the Organizer, or someone else at the LLC.

The Department of Financial Institutions communicates by email, so make sure the email address you enter is monitored.

Enter the Contact Person’s mailing address, email address, and phone number. This address can be an address that’s already on the Articles of Organization, or a:

- street address

- PO Box address

- mailbox rental address

- virtual office address

This address can be in Wisconsin or in any state, or it can be an international address.

Summary

Review the information you entered by scrolling through the page.

You can click the “Edit” button on any of the sections to make changes, if needed.

Optional Expedited Service

Because most LLC filings in Wisconsin are approved immediately, you don’t need to pay extra for Expedited Service. Most people leave this box unchecked.

Click Next to continue.

Payment Details – Wisconsin Department of Financial Institutions

The fee for a Wisconsin LLC through QuickStart LLC is $130. There’s nothing to do on the first screen, so click Continue.

On the next screen, you will submit your payment to the state. You can pay this fee with a credit card or debit card.

Congratulations! Your Wisconsin LLC Articles of Organization form has been submitted for processing.

LLC approval time (online filing)

When you file with QuickStart LLC, your LLC is approved immediately.

The state will email you a stamped and approved copy of your Articles of Organization. This email will be sent to the Contact Person you entered in the last step.

We recommend making a few copies of your Wisconsin LLC Articles of Organization and keeping them with your business records.

What if I didn’t get an email approval?

- If you don’t get the email approval within a few minutes, please check your spam folder.

- If you don’t get an email within 30 minutes, there might be an issue with your filing (ex: an incomplete address). If that’s the case, please wait one day for a new email from the state. This new email will explain what was wrong with your filing and how to fix it.

- If you have any questions about your LLC approval, you can call the state.

Wisconsin Department of Financial Institutions Contact Info

If you have any questions, you can contact the Corporation Section of the Wisconsin Department of Financial Institutions (DFI).

Their phone number is 608-261-7577. And their regular business hours are Monday through Friday, 8am to 5pm Central Time.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Wisconsin LLC FAQs

How much does it cost to register an LLC in Wisconsin?

The filing fee for the Wisconsin LLC Articles of Organization is a one-time fee paid to the Wisconsin DFI.

It costs $170 to file by mail or by using Wisconsin’s One Stop business portal.

However, if you file online using the DFI’s QuickStart LLC system, you get a $40 discount and the fee is only $130.

How much does an LLC cost per year in Wisconsin?

Your Wisconsin LLC must file an Annual Report and pay the $25 fee every year.

This fee is paid to the Wisconsin Department of Financial Institutions. Filing the Annual Report keeps your LLC in good standing.

What are the Articles of Organization for an LLC in Wisconsin?

The Wisconsin Articles of Organization is a form that tells the Department of Financial Institutions important information about your LLC. Once the DFI approves your Articles of Organization, your LLC officially exists.

The Articles of Organization form asks for your LLC name, business address, Registered Agent, and other information.

How do I get Articles of Organization in Wisconsin?

You can get the Wisconsin Articles of Organization from the state’s website.

The DFI provides a template Wisconsin Articles of Organization for you to use. You can download the PDF of Form 502 for free. You can also complete this form online instead.

How do I get a copy of my Wisconsin Articles of Organization?

If you’re looking for a copy of an Articles of Organization that you already filed for your LLC, you can get one for $5 online.

Here’s how to do that:

- Go to the Wisconsin Department of Financial Institutions: Search Corporate Records page.

- Type the name of your LLC in the search box and click the Search Records button.

- Find your LLC in the list and click on it.

- Scroll to the bottom of your LLC’s Corporate Records page under the Chronology section and click “Order a Document Copy“.

- The next page provides instructions for completing your order. Click the Start an Order button to continue.

- Select “Copy-Articles of Incorporation/Organization“.

- Fill out the name of the entity (your LLC’s name), and your contact information.

- Select how to get the copy: by mail, by email, or pick it up at the DFI office. (Most people choose email).

- Choose whether you want your copy request expedited for $25. This will get your copy sent to you on the next business day after you submit your request. Otherwise, you’ll receive your copy within 7-10 business days.

Do you have to put LLC in your business name in Wisconsin?

Yes, you have to put “LLC” (or another allowable ending) in your business name if you are forming an LLC. Wisconsin allows the following endings:

- LLC

- L.L.C.

- Limited Liability Co.

- Limited Liability Company

- LC

- L.C.

- Limited Company

- Limited Co.

- Ltd. Liability Co.

- Ltd. Liability Company

Tip: Most people choose “LLC”.

Your complete LLC name gets listed in your Wisconsin Articles of Organization.

How long does it take to get an LLC approved in Wisconsin?

If you form a Wisconsin LLC online, it will be approved immediately.

If you form a Wisconsin LLC by mail, it’ll take 5 business days (plus mail time) for the state to process your Articles of Organization filing.

Does Wisconsin have Expedited LLC Filings?

Yes, the Wisconsin DFI offers Expedited Filing for mail or online filings for an additional $25.

Expedited filings are processed in 1 business day. Said another way, if you pay for expedited filing, your LLC will be approved by the close of business on the business day after the state receives your filing.

For example, if your filing arrives at the DFI at 10am Monday, it will be approved by 5pm Tuesday.

Expedited filing by mail: If you want to request an expedited filing, check the box on the top of the form and make sure your check is for $195 (to include the $25 expedited filing fee). Make sure to use the correct address for overnight mail, which is listed on Form 502.

Expedited filing online: Since most LLCs filed online are approved immediately, you don’t need to pay extra for expedited filing.

Does my LLC need a Wisconsin business license?

It depends on what your business does.

Wisconsin doesn’t have a state-wide general business license requirement.

However, the Wisconsin Department of Revenue requires certain types of businesses to have a license. You should also check with your city or county about any local business license requirements for your LLC.

And you may need to register with the Wisconsin Department of Revenue in order to collect sales tax or register for other taxes.

What is Wisconsin OneStop Filing?

Wisconsin has two filing systems for LLC formation online: QuickStart LLC and OneStop.

QuickStart LLC is an easy-to-use online filing system built by the DFI.

OneStop is a multi-department registration process used by the DFI and the Department of Revenue. While it was built with good intentions, it’s really complicated and has disadvantages.

Why we don’t recommend OneStop:

- You have to enter a lot of private information (including your date of birth and Social Security Number).

- You have to answer a lot of extra questions (which can be really confusing).

- And QuickStart LLC is so much easier (and cheaper).

Instead of using OneStop, we recommend filing online through the Wisconsin DFI QuickStart LLC instead to save $40 on the filing fee.

Can I use the instructions above for filing a Foreign LLC?

No, the instructions on this page are specifically for filing a Domestic LLC in Wisconsin.

If you want to register a Foreign LLC, you can find the forms and fees in Foreign LLC Fees by State.

How do I form an LLC in Wisconsin?

Here are the steps to forming an LLC in Wisconsin:

- Select a business name for your Wisconsin LLC

- Choose your Registered Agent

- File the LLC Articles of Organization with the state

- Complete and sign an LLC Operating Agreement

- Get an Employer Identification Number (EIN) from the Internal Revenue Service (IRS)

- Open an LLC bank account to protect your personal assets

- Check whether you need a business or sales tax license in Wisconsin

References

Wisconsin Uniform LLC Act

Wisconsin Articles of Organization (Form 502)

Wisconsin DFI: Business Entity Types

Wisconsin DFI: QuickStart LLC Directions

Wisconsin DFI: Business Creation Resources

Wisconsin DFI: Corporations Section Filing Fees

Wisconsin DFI: Corporations Section Filing Forms

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Wisconsin LLC Guide

Looking for an overview? See Wisconsin LLC

Just want an outline of Wiscosnin state requirements. For a handyman or someone who do Renovations to a home. ARE they supposed to get certified or where can I find this information and to get permits and licenses. Stuff like that. Thanks

Hi Cynthia, this page (and our other Wisconsin LLC lessons) shows the process of forming an LLC. Assuming you’ll use an LLC for your business, once your LLC is approved, you’ll need both a Dwelling Contractor License (Business License) and a Dwelling Contractor Qualifier License (Individual License). Hope that helps.