Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Every Wisconsin LLC needs to file an Annual Report each year to renew their LLC.

Every Wisconsin LLC needs to file an Annual Report each year to renew their LLC.

If you just started your Limited Liability Company, you won’t have to file this until next year (just bookmark this page for later).

If it’s time to file your Wisconsin Annual Report now, this page will walk you through the filing instructions.

What is an Annual Report for an LLC?

The Wisconsin LLC Annual Report is a filing that keeps your LLC’s contact information up to date with the Wisconsin Department of Financial Institutions (DFI).

It can be filed online or by mail and it keeps your LLC in compliance and in good standing.

Does Wisconsin require an Annual Report?

Yes. Every Wisconsin LLC (Limited Liability Company) must file an Annual Report every year. It is a state requirement in order to keep your LLC in good standing.

This is required regardless of business activity or income. Meaning, even if your LLC does nothing and makes no money, you still have to file this paperwork every year.

Having said that, it’s okay if your Annual Report is late in Wisconsin. The penalty is not that serious.

How much does it cost to file an Annual Report in Wisconsin?

The Wisconsin Annual Report costs $25 each year. This filing fee is paid every year for the life of your LLC.

Wisconsin LLC Annual Report due date

Wisconsin uses a quarterly system for Annual Report deadlines. Wisconsin uses your LLC’s Effective Date to determine when your first Annual Report is due.

Your Effective Date is the date your LLC was approved by the Wisconsin DFI. You can find this information on your approved Articles of Organization or through the Wisconsin OneStop Business Portal.

For example, let’s say the Wisconsin Department of Financial Institutions approved your LLC on February 12, 2025. So February 12 is your LLC approval date. Your Annual Report deadline is March 31 every year after that.

| LLC Approval Date | Annual Report Due Date |

|---|---|

| January 1 - March 31 | March 31 |

| April 1 - June 30 | June 30 |

| July 1 - September 30 | September 30 |

| October 1 - December 31 | December 31 |

You can find your LLC’s approval date on your Articles of Organization, or by searching for your LLC name on the OneStop Business Portal.

When is my first Annual Report due?

Your first Annual Report is due the year after your LLC was approved. The due date is the last day of the quarter your LLC was approved.

For example, let’s say your LLC was approved on March 12, 2025. Your first Wisconsin Annual Report is due by March 31, 2026. Then your Annual Report is due by March 31 every year after that.

Wisconsin Annual Reports due dates

| Date of Organization | First Annual Report Due Date | Second Annual Report Due Date |

|---|---|---|

| January 1 - March 31, 2025 | March 31, 2026 | March 31, 2027 |

| April 1 - June 30, 2025 | June 30, 2026 | June 30, 2027 |

| July 1 - September 30, 2025 | September 30, 2026 | September 30, 2027 |

| October 1 - December 31, 2025 | December 31, 2026 | December 31, 2027 |

How early can I file my Annual Report?

You can file your Wisconsin Annual Report any time during the quarter it’s due.

For example, let’s say your LLC was approved on July 12, 2025. You can file your Annual Report anytime between July 1 and September 30 every year starting in 2026.

What happens if I don’t file my Annual Report?

If you didn’t file your Annual Report on time, don’t panic. Wisconsin doesn’t impose any fees for filing a late Annual Report. However, if you don’t file an Annual Report for 3 years in a row, your LLC will be administratively dissolved.

If your Annual Report is 1 to 2 years late:

You can just pay the missing Annual Report fees and complete the unfiled reports. This will get your LLC out of “delinquency” and back in “good standing”.

If your Annual Report is 3 years late:

Your LLC can be canceled by the Department of Financial Institutions. This is called “administrative dissolution”. If your LLC is administratively dissolved, you will have to file paperwork to reinstate your LLC.

What should I do if my LLC is administratively dissolved?

If you want to shut down your LLC, you can just let the state close your LLC for you. There’s no penalty for doing this and you don’t need to file anything else with the Department of Financial Institutions to dissolve your LLC. You can then file a final tax return to complete the closure of your LLC.

If you want to keep using your LLC, you need to “bring it back to life” by filing an Application for Reinstatement.

How do I reinstate my LLC?

To reinstate your LLC, you’ll need to call the Wisconsin DFI Corporations Division at 608-261-7577 to get the Application for Reinstatement.

Then you’ll file your Application for Reinstatement along with one Annual Report. It will cost $100 to file the Reinstatement document and $25 for each Annual Report that wasn’t paid.

These documents can only be filed by mail. They can’t be filed online.

Make a check or money order payable to “Wisconsin Department of Financial Institutions” and mail the payment with your paperwork to the state.

Note: You can Reinstate your LLC anytime after it’s been dissolved. However, if your LLC name was taken by another business while yours was dissolved, you’ll need to find a new business name.

Wisconsin LLC Annual Report Reminders

Reminder postcards are mailed to your Registered Agent 2 weeks after the first date you can file.

So if your Annual Report is due in Q1 (January 1 to March 31), your Registered Agent should receive a postcard in mid-January. If it’s due in Q3 (July 1 to September 30), your Registered Agent should receive a postcard in mid-July.

We recommend putting a repeating reminder on your phone, computer, and/or calendar just in case.

Here’s a video on how to use Google Calendar to create reminders:

Note: If you want help filing your paperwork, you can hire a company that offers Annual Report service. Check out our review of the best LLC services for our recommendations.

How to file a Wisconsin Annual Report online

Wisconsin allows you to file your Annual Report forms online or by mail. We recommend using the online filing method because it’s fast and easy.

(If you prefer to file by mail, please see the FAQs below.)

Get started:

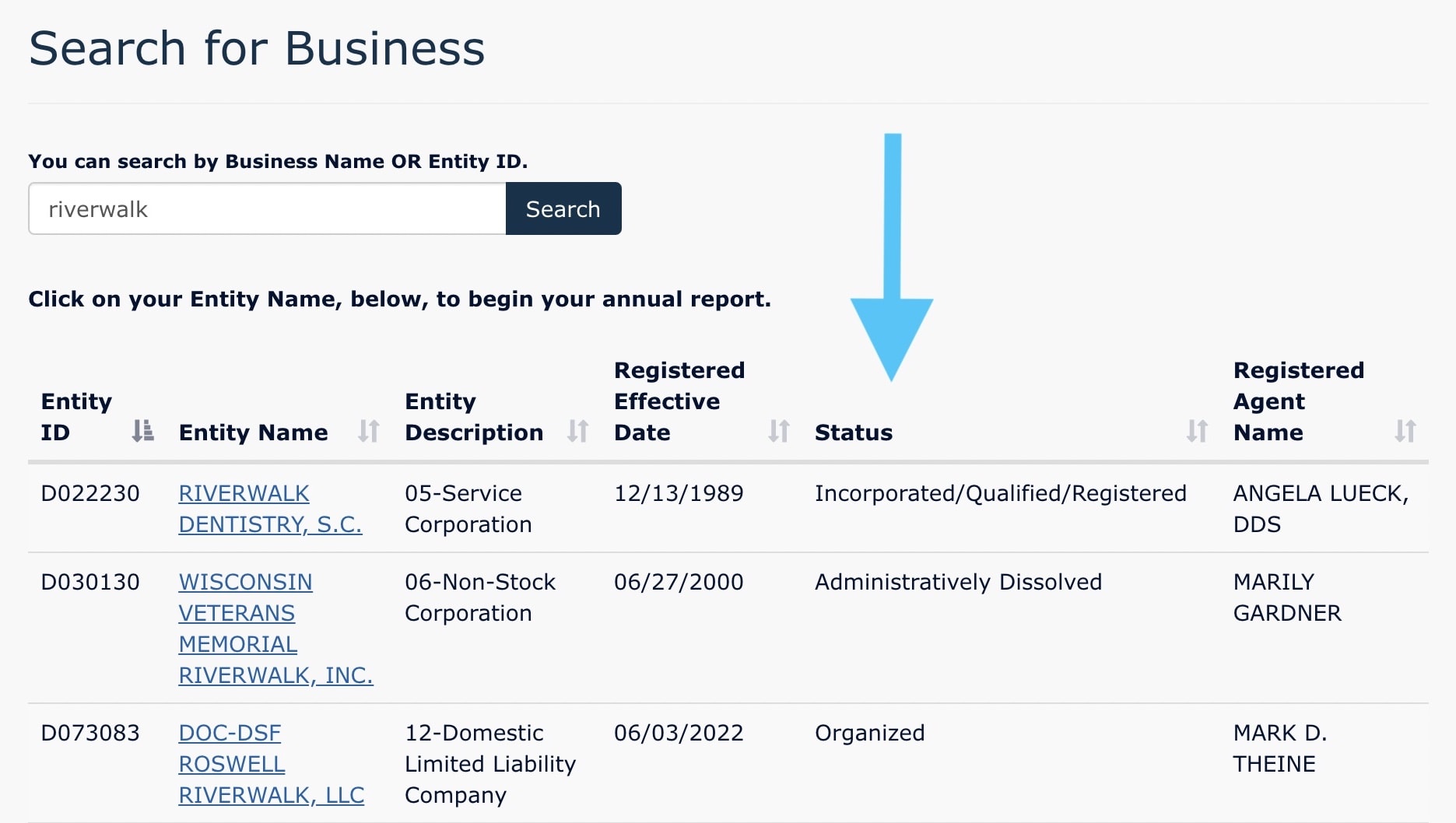

Go to the Wisconsin OneStop Business Portal page.

Find your LLC

Enter your LLC name and click Search.

Click on your LLC in the search results.

Business Details

Confirm your LLC name is listed on this page and click Next.

The next page is just a list of basic information about Annual Report filings. Just click Next again.

Registered Agent

Review your LLC’s Wisconsin Registered Agent information.

If you don’t need to make any changes:

- Select “Use current registered agent and registered office address“.

- Click “Next“.

If you want to update your current Registered Agent’s address:

- Select “Use current registered agent and registered office address” and update the address.

- Then click “Next“.

If you want to change your Registered Agent:

- If your new Registered Agent will be an individual person (like you, a friend, or family member), select “Change Registered Agent (Individual as Agent)“.

- If you hired a Registered Agent Service, select “Change Registered Agent (Entity as Agent, Search DFI records)“.

Principal Office

Make sure your Principal Office information is up to date. This is the main address for your LLC and does not have to be in Wisconsin.

If you need to make any changes to your Principal Office, you can do so here.

Management (Member or Manager)

Select whether your LLC is Member-managed or Manager-managed using the dropdown list.

Then click Next.

If your LLC is Manager-managed, enter the information for your Manager(s). If your LLC is Member-managed, you don’t need to enter any information.

Tip: If you can’t remember which management structure your business uses, you can find that information in your Articles of Organization.

- Learn More: Please read Member-managed vs. Manager-managed LLC

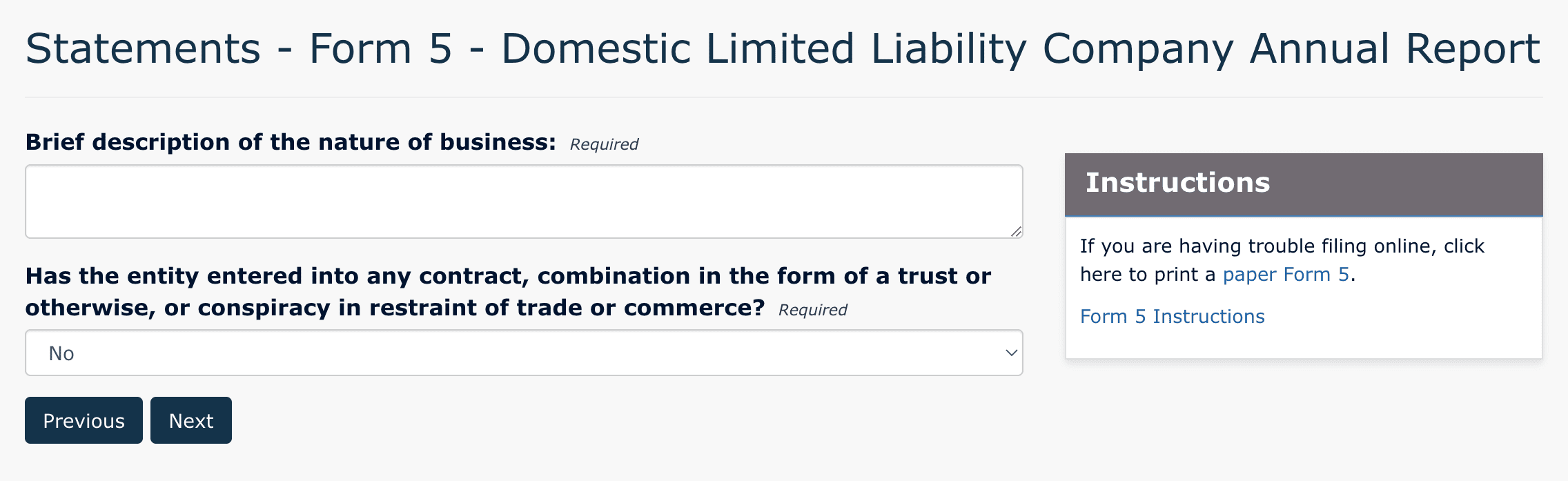

Statements

Enter a brief description of what your business does. This can be a few words (ex: “website design”) or a full sentence (“Borders Jewelry LLC makes custom jewelry and sells it online.”).

Then select Yes or No from the dropdown to indicate whether your business has entered into any contracts, combinations, or conspiracies in restraint of trade or commerce.

Tip: Most non-criminal organizations select No ;-)

Click Next to continue.

Contact Information

This section is for the “point of contact” for your LLC Annual Report. The state will contact this person if they have any questions about your filing. And this point of contact will also receive your approved Annual Report filing.

Enter the name, address, phone number, and email for the person you want to receive your approved Annual Report.

Click Next.

Summary

Confirm the information you’ve entered is correct. If you need to make any changes, you can do so by clicking “Edit” next to each field.

When everything looks correct, click Next.

Signature

Enter the title of the person signing this Annual Report. If your LLC is Manager-managed, the Manager must sign. If your LLC is Member-managed, a Member must sign.

Select the date and click the box to agree to the terms.

Enter the Member or Manager’s name, then click Next.

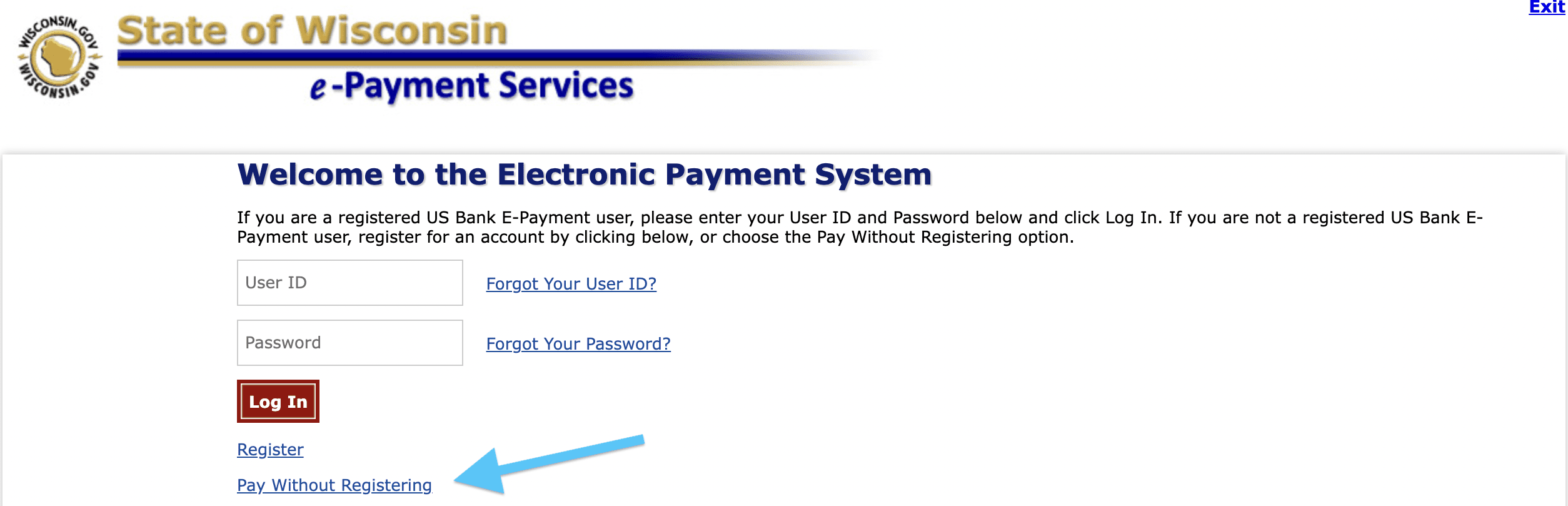

Payment

Review the charges and then click Make Payment.

Pro tip: You’ll be redirected to the Wisconsin e-Payment Services page. We know this might be a little confusing, but don’t worry. Just click “Pay Without Registering“.

(If you already have an e-payment account, you can log in, but most people don’t have an account.)

On the next page, complete your billing information and then submit the $25 fee using a debit or credit card.

Congratulations

Your Annual Report was filed online and will be processed within a few minutes. A copy of your approved Annual Report will be sent to the email address entered in the Contact Information section.

Note: If you don’t get the email within a few minutes, please check your spam folder.

Wisconsin Department of Financial Institutions Contact Info

If you have any questions, you can contact the Division of Corporate & Consumer Services at the Wisconsin Department of Financial Institutions.

Their phone number is 608-261-7577. And their hours are Monday through Friday, 8am to 5pm Central Time.

Wisconsin Annual Report Filing FAQs

Do I need to file an Annual Report for my LLC in Wisconsin?

Yes. Every Wisconsin LLC must file an Annual Report. This requirement begins the year after you start your LLC, and continues every year for the life of your LLC.

Although there are no late fees, if you fail to file for 3 years in a row, the state can administratively dissolve your LLC. So we recommend filing on time every year.

You can set up Google Calendar reminders to help notify you.

How much does it cost to file an Annual Report in Wisconsin?

The Wisconsin Annual Report for LLCs costs $25 per year. This is paid every year for the life of your LLC.

How do I file my Annual Report in Wisconsin?

You can file your Wisconsin LLC Annual Report forms online or by mail.

Online: Look up your LLC on the Wisconsin OneStop Business Portal. Enter all the information requested and submit your payment. We have more detailed instructions on how to file your Annual Report above.

By Mail: Complete the information on the Annual Report form. Then send the form, and a check or money order for $25, back to the DFI.

How do I check the status of my LLC in Wisconsin?

You can check the status of your LLC in the Wisconsin OneStop Business Portal.

Enter your LLC’s name in the Business Name search box and click Search.

Find your LLC in the list of businesses and check the Status column for your LLC.

What is the processing time for a Wisconsin Annual Report?

If you file online, it’s processed immediately. If you file by mail, the DFI will process it within 5 business days of receiving your Annual Report.

Will I be charged a late fee if I don’t file a Wisconsin Annual Report?

No, there are no late fees for Wisconsin LLCs that fail to file this paperwork. However, if you don’t file an Annual Report for three years in a row, the state can shut down your LLC. Then you’ll have to pay a fee and file paperwork in order to restore your LLC.

How to get a copy of a Wisconsin LLC Annual Report

Most people don’t need a copy of their Annual Report. This is because you can just look up your LLC on the state’s records to confirm that your Annual Report has been filed.

However, if you need a copy of your Annual Report for any reasons, you can download a copy online for $5:

- Go to the Wisconsin DFI’s Annual Report ID Lookup page

- Search for your LLC name and click on it

- Scroll down to the Annual Reports section

- Click on “Order a Document Copy“

- Click on “Copy of a Single-year Annual Report“

- Select how to get the copy: by mail, by email, or pick it up at the DFI office. (Most people choose email).

- Choose whether you want your copy request expedited ($25 extra). This will get your copy sent to you on the next business day after you submit your request. Otherwise, you’ll receive your copy within 7-10 business days.

Can I file Wisconsin LLC Annual Reports by mail?

Yes, you can file by mail (instead of online).

- Download the Wisconsin LLC Annual Report (Form 5)

- Enter the details on your Wisconsin LLC Annual Report.

- Sign and date the form.

- Include a check or money order for the $25 filing fee.

- Mail your payment and the form to the address on the form.

Alternatively, you can file online.

How do I find my LLC Effective Date?

You can find your Wisconsin LLC’s Effective Date via the Wisconsin DFI Business Search page.

Search for your LLC name and select it from the list. Look for “Registered Effective Date” to find out the date your LLC was approved by the DFI.

Is the LLC Annual Report the same as the Wisconsin Annual Franchise Tax?

No, they are not the same thing. And the Wisconsin Annual Franchise Tax doesn’t apply to most LLCs.

The Wisconsin Annual Franchise Tax is only paid by Corporations, LLCs taxed as C-Corporations, and LLCs taxed as S-Corporations. You can learn more under the general information FAQs on the Wisconsin Department of Revenue website.

And likewise, if you have employees, the LLC Annual Report does not pay employer taxes or any other withholding taxes.

- Learn more about Wisconsin LLC Taxes

References

Wisconsin LLC Act: Section 183.0122

Wisconsin LLC Act: Section 183.0212

Wisconsin LLC Annual Report (Form 5)

Wisconsin DFI: Administrative Dissolutions

Wisconsin DFI: Corporation Section Filing Fees

Wisconsin OneStop Business Portal Business Search

Wisconsin LLC Annual Report Information and Instructions (Form 5-I)

Wisconsin Legislative Fiscal Bureau: Corporate Income/Franchise Tax

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Wisconsin LLC Guide

Looking for an overview? See Wisconsin LLC