Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

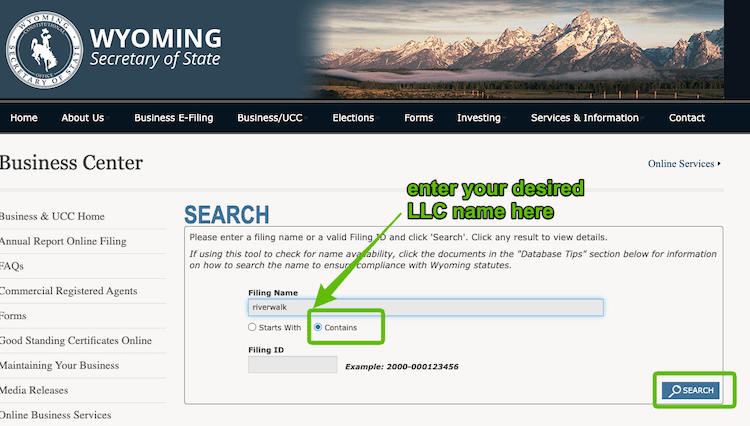

Once you’ve chosen a Wyoming LLC name, you need to compare it against existing businesses in the state.

This is done using the Wyoming Business Filings Search tool.

And this is necessary because business names in the same state:

- can’t be the same

- can’t be too similar

If you file your LLC paperwork with a name that’s not available, your LLC filing will be rejected.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

How do I search the Wyoming business entity name database?

Note: This tool is sometimes called the Wyoming Business Name Search or the Wyoming Business Entity Search. They both refer to the same website and get you the same search records.

Visit the Wyoming Business Filings Search page:

Wyoming Secretary of State: Business Filings Search

It’s simple to use:

- Enter your desired LLC name in the Filing Name bar.

- Click Contains for the search type.

- Click Search.

Why use “Contains”? If you select “Starts With” you might miss a similar name which adds a filler word. For example, if you searched “GumGum Guy” using the “Starts With” setting, you’d miss the existing business called The GumGum Guy Inc. You can’t name your company “GumGum Guy LLC” if The GumGum Guy Inc. already exists.

Search tips:

- Leave out “LLC”, “L.L.C.”, “Limited Liability Company”, etc., when doing your searches.

- Leave out any commas, periods, apostrophes, etc.

- You can search using uppercase or lowercase letters.

Tip: It’s best to enter only the main part of your desired Wyoming LLC name in the search bar. For example, if your desired LLC name is Riverwalk Studios LLC, first do a search for the words “Riverwalk Studio”. And then do a search for “Riverwalk”. This helps make sure that you see everything that is potentially similar.

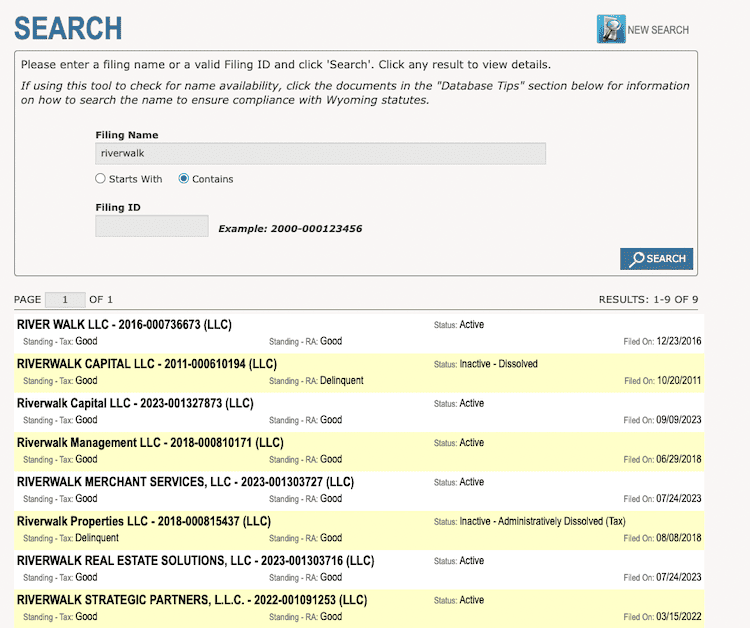

How to interpret the Wyoming LLC search results

If the results show names that are not too similar to yours (meaning yours is distinguishable), then your Limited Liability Company name is available for use.

- Let’s keep using the example above. If your desired name is Riverwalk Studios LLC, and the only similar names you saw were “Riverwalk Rentals” and “Riverwalk Studio Starters”, then your name should be available.

If no results show up, that means your LLC name is unique and it should be available for use. To be safe, run your search again using only part of your LLC name (to double-check that there are no similar names).

- For example, search just the word “Riverwalk” instead of Riverwalk Studios.

If your exact LLC name appears in the list of search records, your LLC name is not available for use because another Wyoming business entity is already using it.

If the results show a name that is very similar to yours, your LLC name may not be available for use.

- If your desired name is Riverwalk Studios LLC, and the search results show a “Riverwalk Studio”, then your name is not available.

What if my desired LLC name isn’t available?

If your name is not unique, you’ll need to come up with a variation or a different name for your LLC.

Tip: Wait until your LLC is approved before you apply for your LLC EIN Number or purchase any other marketing materials. This way you don’t spend money on business supplies you can’t use because your business name isn’t available.

When in doubt, call the Secretary of State

You can call the Wyoming Secretary of State to confirm that your LLC name is available.

Not all states offer this service, but the representatives in Wyoming will help you use the Wyoming Business Name Search and Name Availability Search to figure out whether your business name is available.

The Business Division phone number is 307-777-7311. Their hours are Monday through Friday, from 8am to 5pm Mountain Time. You can also submit name availability questions via email at business@wyo.gov.

Wyoming Limited Liability Company Name Requirements

As per Section 17-28-108 of the Wyoming LLC Act, there are a few rules and requirements for naming a Wyoming business entity that you need to know.

Note: Certain Wyoming LLC names cannot be filed online and must be filed by mail.

If your Wyoming LLC name meets any one of these rules, you’ll need to file it by mail:

- starts with “A” or “a” followed by a space

- like: A Calm Tree LLC

- includes “the”, “an”, “and” or “&”

- like: Wilma and Grace LLC

- includes special charactrers/symbols (anything other than periods, commas, and apostrophes)

- like: Dollar$ LLC

- or like: Quik–E–Mart LLC

We explain more about how this rule works in our lesson on how to file the Wyoming Articles of Organization.

Do I have to use a comma in my LLC name?

No, you don’t have to. You can file your LLC name with or without a comma. Both versions are accepted by the Secretary of State.

For example: If your desired business name is Grandpa Joe’s, you can file it as:

- Grandpa Joe’s LLC

- Grandpa Joe’s, LLC

Or, instead of having “LLC” as your designator (ending), there are a few other options in Wyoming.

What designators (endings) can I use in my LLC name?

Your Wyoming LLC name must contain one of the following designators at the end:

- LLC

- L.L.C.

- Limited Liability Company

- LC

- L.C.

- Limited Company

- Ltd. Liability Company

- Limited Liability Co.

Note: Most people choose “LLC”.

The following designators are not allowed

Your Wyoming LLC can’t make itself sound like a Wyoming Corporation or any other business entity besides an LLC.

The following words and designators can’t be used anywhere in your LLC name:

- Inc.

- Corp.

- Incorporated

- Corporation

- Trust

What words are not allowed in my Wyoming LLC name?

Your Wyoming LLC name can’t contain words and abbreviations that are restricted by law.

For example, you can’t make your LLC name sound like it’s a bank, part of the government or a government agency, or anything else that misleads the public.

If you want to use these words in your Wyoming LLC name, you’ll need permission from the Division of Banking:

- Bank

- Banker

- Banc

- Banque

- Banquers

- Banco

- Banca

- Trust

And if you want to use these words in your Wyoming LLC name, you’ll need permission from the Department of Education:

- College

- Educate

- Education

- Educational

- Institute

- Institution

- University

You also can’t use words that are reserved for licensed professionals. These vary by state, but some common examples are accountants, architects, attorneys, dentists, and engineers.

For more information about restricted words for a Wyoming business entity, contact the Secretary of State.

Your Wyoming business name must be distinguishable (unique)

When you search the Wyoming Secretary of State Business Filing Search, you will compare your desired LLC name to existing businesses in the state.

If your name is not unique, you’ll need to come up with a variation or a different business name.

Below are rules and examples of LLC names that are not distinguishable.

Designators

Differences in designators (endings) don’t create distinguishability.

If your desired LLC name is Indian Paintbrush LLC, it’s not available to use if any of the following are found in the Wyoming Business Name Search results:

- Indian Paintbrush, Inc.

- Indian Paintbrush, Corp.

- Indian Paintbrush, Limited Liability Co.

Filler Words

Adding non-meaningful or filler words (the, a, an, and, &) won’t create distinguishability.

If your desired LLC name is Bison Farms LLC, it’s not available to use if any of the following are found:

- The Bison Farms LLC

- A Bison Farm Inc.

- Bison and Farms L.L.C.

- Bison & Farms Corp

Note: If you use these filler words in your LLC name, we recommend filing your Wyoming LLC by mail (not online).

Plural or Singular Words and Possessive Words

Adding a letter “s” to make a word plural or possessive doesn’t create distinguishability.

If your desired LLC name is Paula’s Jade LLC, it’s not available to use if any of the following are found:

- Paulas Jades LLC

- Paula’s Jade Inc.

- Paulas Jade, L.L.C.

Punctuation, Symbols, Spaces

Adding or removing punctuation, symbols and spaces doesn’t create distinguishability.

If your desired LLC name is Wheatgrass Soapstore LLC, it’s not available to use if any of the following are found:

- Wheat-Grass-Soap-Store Inc.

- Wheatgrass/Soapstore, Limited Liability Co.

- Wheat Grass Soap Store, L.L.C.

- Wheat Grass “Soap” Store Corp.

- (Wheat) Grass Soapstore LLC

Note: If you use special characters (like $, %, etc.) in your LLC name, we recommend filing your Wyoming LLC by mail (not online).

What if my Wyoming business name is rejected?

If you file your Wyoming Articles of Organization (the document that creates your Wyoming LLC) and the business name is not available, don’t panic. The state will notify you and tell you why your filing was rejected.

Unfortunately, your Wyoming LLC filing fee is non-refundable. This means you can’t re-file with a new name for free. You must pay the $100 Articles of Organization fee again and file with a different name.

That’s why we recommend contacting the Wyoming Secretary of State (307-777-7311 or business@wyo.gov) to check whether your desired LLC name is available before you file. They offer this service for free.

Wyoming Business Name FAQs

Do I need a name reservation in Wyoming?

No, a name reservation isn’t required to form an LLC in Wyoming. It’s an unnecessary step and a waste of money.

You can just file your LLC’s Articles of Organization with your desired LLC name.

Does Wyoming require LLC in the name?

Yes. Your Wyoming LLC name must contain one of the allowable designators at the end. The most commonly used designators are:

- LLC

- Limited Liability Company

- Ltd. Liability Co.

Does my Wyoming LLC need a DBA?

No, you’re not required to file a DBA (“Doing Business As”) for your business entity in Wyoming.

A DBA (known as a Trade Name in Wyoming) lets your LLC conduct business under a name which is different from its true and legal name (the name on your Articles of Organization).

If you want your LLC to do business under a name that’s different from its true and legal name, you have to file an Application for Registration of Trade Name and pay an additional fee of $100 to the Secretary of State. The first page of the Application form has more information on this process.

If you are going to file a Trade Name for your Wyoming LLC, it must also be distinguishable from existing business names in the state.

There is no limit to the number of Trade Names an LLC can have.

For more information, please see Does my LLC need a DBA?

When would my LLC use a DBA?

Let’s say you form an LLC called Skytree Cruise Lines LLC, but you also want to use a friendlier, catchy name, like Sky Cruises. In this case, your LLC would need to file an Application for Registration of Trade Name to use the name Sky Cruises.

If you don’t file a Trade Name Registration for a different name, you can only use your legal entity name of Skytree Cruise Lines LLC.

Similarly, if you want to do business under the name Skytree Cruise Lines, just without the letters “LLC” in the name, you will need to file a Trade Name for Skytree Cruise Lines.

How do I get a business domain name?

Once you’ve found a business name that you like, it’s a good idea to check if your domain name is available before forming your LLC.

You can search for available domain names with GoDaddy:

Find a domain name

What does “distinguishability” mean?

Each business entity name must be “distinguishable upon the records” of the Secretary of State.

This means that no two businesses can operate with the same exact name. Said another way, if a business already exists with your desired LLC name, you can’t register your LLC with that name.

For example, let’s say you want to form an LLC called Meadowlark Landscapers LLC. But there is already a business in another town called Meadowlark Landscapers, Inc. Because your desired LLC name is the same as that existing Wyoming Corporation, it is not distinguishable. You can’t use it and must choose another name.

How do I come up with a business name?

Business names are important for branding and recognition. The name of your Wyoming LLC can be your company’s brand name, but it doesn’t have to be (please see the FAQ about DBAs above). Either way, picking a good LLC name is an important decision.

Here are some quick tips for coming up with business names:

- First, write down the features of your company and things that you want to be associated with.

- Then list out as many business names as you can think of. Don’t edit or analyze them. Just get as many names on the page as you can.

- Now go back and read through them. Write down any variations that come to mind.

- Next, set the list aside. Do something else, like go for a walk or get groceries, or sleep on it for the night. Then come back and review the list of names. As you go through it, write down additional ideas and variations.

- Read the whole list out loud. If you want, get input from friends, business partners, and family.

- Repeat the process: sleep on the ideas, write down new variations, read them out loud again.

- The best business name will often “rise off the page” and present itself. If it doesn’t, you can try this trick: Close your eyes and count to 10. When you get to 10, you must choose a name. When you open your eyes, force yourself to make a decision. Sometimes we know the best name deep in our subconscious, and this trick can help it come out. Trust yourself and go with what feels best.

For more tips, please see How to Choose an LLC Name.

Can I use the name of another Wyoming entity?

No. You can’t use the same name as another Wyoming business.

And it doesn’t matter what entity type it is – your LLC can’t have the same entity name as another corporation, LLC, or any other entity type.

What if the business is closed?

You can’t use the same name as another “Active” business.

But if the business entity is marked “Inactive” on the Business Entity Search site, you might be able to use that name.

If the existing company is marked as “Inactive – Archived”, then you can use the name.

If the existing company is marked as “Inactive – Administratively Dissolved” or “Inactive – Revoked”, you can use the name only if it’s been 2 years or more since the Inactive Date. Click on the company’s record in the Business Filings Search to find the “Inactive Date”.

Note: Make sure you look at the “Status” field next to the company’s name. The “Standing – Tax” and “Standing – RA” fields don’t affect whether a name is available.

How do I change my LLC name?

You can change your LLC’s name later by filing an Amendment form with the Secretary of State.

We have step-by-step instructions on how to change an LLC name in Wyoming.

How to start an LLC in Wyoming?

Here are the steps to starting an LLC in Wyoming:

- Choose an LLC name and make sure it’s available

- Choose who will be your Wyoming Registered Agent

- File the Wyoming LLC Articles of Organization

- Complete and sign an LLC Operating Agreement

- Get a Tax ID Number (EIN) from the IRS

- Open an LLC bank account

- Check whether you need a business or sales tax license in Wyoming

References

Wyoming LLC Act – Section 17-29-108

Wyoming Business Corporation Act – Section 17-16-401

Wyoming Secretary of State: How to Choose a Company Name

Wyoming Secretary of State: Business Entity Name Search Tips

Wyoming Secretary of State: How to Create a Wyoming Company

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hello Matt,

firstly absolutely fantastic source of information, thanks for sharing your wealth of knowledge my friend.

If it’s cool with you, I’d like to ask a few short questions:

But first a quick overview:

I have worked up until last year as an artist living as commissions came in.

For a few years working on a side passion-project called The Karma Kids which has just been picked up by an IP Development company (happy days), so I will finally need to behave in an adult and responsible manner and set up a company to pay taxes.

So to be clear I will be paying the IP Dev company to produce my project for a TV show- they will be raising money from VCs – creating deals with animation house, paying writers, etc, etc- WHEN the show is “optioned” by a distributor I will receive an advance/salary too, I want to put all these expenses through the LLC I create.

I understand through my little research there are huge benefits in doing this as opposed to being an individual paying taxes, therefore I am at this stage going to set up a LLC in either Vegas (as moving back there soon too) or Wyoming.

So here are my questions:

A: As I presently reside in NYC – is it possible to set up the LLC in either state?

B: I presently do side gigs as a voice-over actor- can I put this income & related expenses through the LLC?

C: Lastly, do need BOTH a CPA and a tax attorney or just one or the other?

Then how is a good way to find a COMPETENT one?

I thank you in advance for your help

All the best Simon

Hi Simon, thank you! And you’re very welcome :) There aren’t any tax benefits between a Sole Proprietorship and an LLC (taxed in default status). Reason why, is a Single-Member LLC is taxed like a Sole Proprietorship. Meaning, the LLC files no federal return. All LLC revenue, expenses, credits, and deductions flow through to your personal 1040 tax return.

If it made sense (aka tax savings), you could elect for your LLC to be taxed as an S-Corp, however, you need some net income to make the administrative + payroll costs worth the potential tax savings. You could also elect to have the LLC taxed as a C-Corp, but that it not used very often.

A. While you can technically form an LLC in any state, the LLC should be registered where you’re transacting business. Check out best state to form an LLC.

B. Yes, your LLC can include multiple business activities. More details here: can I have two businesses in my LLC?

C. While you could speak with both, a CPA will likely be hired to handle your tax filings. A tax attorney knows taxes and business law, but based on what you said, it seems a tax attorney could be used for a consultation. Check out our accountant recommendations page. And I like Avvo for finding tax attorneys.

Hope that helps!