Did you get an error when applying for an EIN? We explain the most common EIN reference numbers (errors) below and how to resolve your EIN application.

IRS Phone Number & Contact Information

If you receive an EIN reference number that is not listed below, please call the IRS at 800-829-4933. Their hours of operation are 7am to 7pm, Monday through Friday. If you find information about a reference number not listed below, please feel free to share your findings in the comment section below.

Tip: Press option 1, then 1, then 3 to speak to an IRS operator.

Don't have an LLC yet? Hire Northwest to form your LLC for $39 + state fee (then add EIN to your order).

Have an LLC, but no EIN? Hire Northwest to get your EIN:

I have an SSN | I don't have an SSN

EIN Application via Form SS-4

You’ll notice a lot of the solutions below reference mailing or faxing Form SS-4 to the IRS. This is due to the fact that your EIN application requires a manual review process by the IRS.

We have instructions on how to apply for an EIN via Form SS-4. Please see this lesson if needed: Apply for EIN for LLC with Form SS-4.

EIN Reference Number 101 (name conflict/duplicate):

IRS EIN Reference Number 101 is the most common error message that people experience while applying for an EIN online.

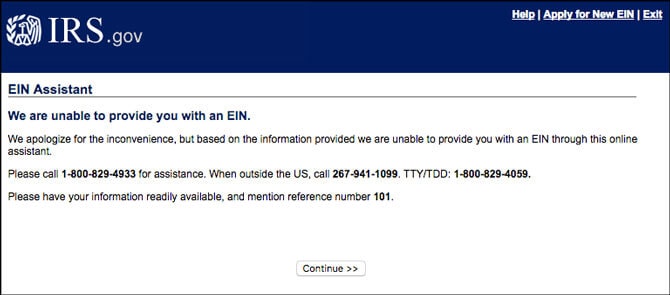

You’ll see a message that states “We are unable to provide you with an EIN. We apologize for the inconvenience, but based on the information provided we are unable to provide you with an EIN through this online assistant.”

And you’ll see this image:

Reference number 101 means the IRS has found a business entity name that is too similar to the name of your LLC. Although it may be unique in the state where you formed your LLC, the name likely conflicts with the name of a business from another state. This isn’t a big deal for concern though, it just means the IRS needs to manually review your filing and you have to apply with Form SS-4.

Solution: File Form SS-4 by mail or by fax (to fax number 855-641-6935) as the IRS will need to manually review your EIN application. If you formed an LLC, make sure to include your approved LLC filing form (Articles of Organization, Certificate of Organization, or Certificate of Formation) along with Form SS-4.

EIN Reference Number 102 (SSN/ITIN error):

Reference number 102 means there is either a mismatch or an error with the Responsible Party’s name and their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Solution: Try the EIN Online Application once more and make sure to enter the SSN or ITIN correctly. If you still see reference number 102, then we recommend filing Form SS-4 by mail or fax (to fax number 855-641-6935).

EIN Reference Number 103 (existing EIN error):

Reference number 103 means you’ve entered an existing company as the EIN Responsible Party and their records do not match. There is an EIN number and company name mismatch.

Solution: Try the EIN Online Application once more and make sure to enter the EIN correctly. If you still get the error/reference number 103, then we recommend filing Form SS-4 by mail or fax (855-641-6935).

EIN Reference Number 104 (Third Party Designee conflict):

Reference number 104 means that a Third Party Designee (a person or company who assists in obtaining an EIN), has entered conflicting contact information. The IRS does not allow a Third Party Designee to have the same contact information as the LLC, specifically an address (either physical or mailing) and a phone number.

Solution: Try the EIN Online Application again, making sure the Third Party Designee’s contact information is their own and is not the same as the LLC’s.

EIN Reference Number 105 (too many attempts):

Reference number 105 means that you’ve made too many attempts online to obtain the EIN (using the same SSN, ITIN, or EIN), each leading to an error reference/code.

Solution: Wait 24 hours and try the EIN Online Application again. If you still receive an error message, then we recommend filing Form SS-4 by mail or fax (855-641-6935).

EIN Reference Number 106 (single-member LLC with no EIN):

Reference Number 106 means that your Single-Member LLC (which has employees) does not have a Sole Proprietorship EIN yet.

Solution: Please contact the IRS as we’re not sure what the next best step is. If you run into this problem and would like to share your solution, please leave a comment below.

EIN Reference Number 107 (single-member LLC with too many EINs):

Reference Number 107 means that your Single-Member LLC (which has employees) has more than one Sole Proprietorship EIN.

Solution: Please contact the IRS as we’re not sure what the solution is for reference number 107. If you find the solution and would like to share, please leave your experience below in the comments.

EIN Reference Number 109 (technical):

Reference number 109 means that there are technical issues with the EIN Online Application. It doesn’t mean that you can’t get an EIN online though (like other reference numbers).

Solution: Wait 24 hours and then try the Online Application again. If you still get the error message, you should contact the IRS or apply for an EIN using Form SS-4.

EIN Reference Number 110 (technical):

Reference number 110 means that there are technical issues with the EIN Online Application. It doesn’t mean that you can’t get an EIN online though (like other reference numbers).

Solution: Wait 24 hours and then try the Online Application again. If you still get the error message, you should contact the IRS or apply for an EIN using Form SS-4.

EIN Reference Number 112 (technical):

Reference number 112 means that there are technical issues with the EIN Online Application. There are a number of reasons this message can appear, but a common one is that their systems have a large amount of users and it’s better to try at another time.

Solution: Try the Online Application again or wait 24 hours. If you still get the error message, you should contact the IRS or apply using Form SS-4.

EIN Reference Number 113 (technical):

Reference number 113 means that there are technical issues with the EIN Online Application. There are a number of reasons this message can appear, but a common one is that their systems have a large amount of users and it’s better to try at another time.

Solution: Try the Online Application again or wait 24 hours. If you still get the error message, you should contact the IRS or apply using Form SS-4.

EIN Reference Number 114 (max EINs per day):

Reference number 114 means that the Responsible Party has already been granted an EIN for the day. An IRS Responsible Party can only be assigned one EIN per day.

Solution: Wait 24 hours and then apply again online.

EIN Reference Number 115 (Date of Death shows for Responsible Party):

Reference number 115 is when the system runs a date of death inquiry on the Responsible Party and it comes back showing that party as deceased.

Solution: Contact the IRS if the Responsible Party is not deceased. They may require further documentation to prove this, or they may request filing Form SS-4 by mail or fax instead. (You can fax Form SS-4 to 855-641-6935).

Technical Note: IRS Internal Revenue Manual (21.7.13)

As per IRS IRM 21.7.13 (Assigning Employer Identification Numbers) [Removed from public view], Section 21.7.13.3.4.1 (10-01-2024):

(3) Callers contacting the IRS regarding the message shown in paragraph 2 above are routed based on their specific reference number. Reference numbers 101 or 115 are directed to a CSR [Customer Service Representative] for assistance. All other reference numbers are routed to an automated message which provides instructions to correct invalid information and resubmit the application.

(4) Before resolving issues for reference numbers in paragraphs 9 and 10 below, you must use the table below to:

- Determine if the caller’s relationship/position with the entity authorizes them to receive information and

- Authenticate the caller by asking specific information as shown in the chart below and validating that information on IDRS.

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi, good afternoon.

When trying to obtain my EIN an Error 101 occurs, complete the SS4 form.

What email or fax should you send it to?

Hi Norka, you can use this number: 855-641-6935. We’ll also go ahead and update the page above to include it. Thank you.

Hi ,

I am buying a small business with a active EIN . Would it be a problem Appling for a new EIN for myself, 3 month in advice. I will need it to start the process of the purchase. the effective date is Jan 2025.

Hi Samie, you don’t need a new EIN when purchasing an LLC. You can just update the EIN Responsible Party. Hope that helps.

This is an excellent reference. Thank you!

You’re welcome Jud!

Hello,

I am trying to obtain EIN number by using EIN number of my friend and it shows error of 115,105,104 in different attempt.

Do I am eligible to obtain Ein number by using another EIN number (trying to obtain EIN without SSN/ITIN).

If it is possible to get EIN by another EIN kindly correct me that on field of Name should we have to fill out the name of entity or the director of the entity.

Thanks

You can’t get an EIN using an existing EIN. The IRS stopped accepted this years ago.

Great list and very well done! Thank you for taking the time to do this.

Thanks. You’re very welcome!

I have been trying to apply for an EIN for a trust and code 109 comes up. Over the last 3 weeks I have tried over 700 times. What is the problem

Hi Debbie, EIN reference code 109 doesn’t provide details. Wait 24 hours and then try online again. If you still get the error message, you can file Form SS-4 by mail or fax. However, if you file by mail or fax, it’ll take 2-3 months before you get back the EIN Confirmation Letter due to current delays.

I need a TIN for a closing at the end of the month. I received error code 101 when I applied online for the LLC’s TIN. I called the IRS because I assumed they would then ask me to fax the filed Articles to distinguish my filing from the filing/conflict with the similar name and then provide me with the TIN over the telephone. The agent informed me that my request for the TIN would have to be done by fax with a 45 day turn around for a TIN. Is there any way around waiting this long to receive a TIN? I cannot control the fact that another entity has a similar name to my LLC, it would seem there should be some system in place in this regard.

Hi Dee, unfortunately, there is no other way. If you get the 101 error code (reference number), the online system will continue to issue the error if you keep trying. You have to submit Form SS-4 to the IRS. There are only two submission methods: by mail or by fax. Fax is faster, however, the information you received is correct: it can take 45-60 business days (approximately 2.5 months) before you receive back the EIN number. Thousands and thousands of people are dealing with this exact same issue right now. Due to work-from-home and other new issues, the IRS has been backed up. Maybe the title company can make an exception or hold a little bit of money in escrow. I would speak with them to see what your options are (or even try another title company or real estate attorney). There aren’t any other options with the IRS, so maybe seeing what you can work out with a title company or real estate attorney may be your best bet. Hope that helps.

I get this message. What does this mean, and how should I respond?

Error from: https%3A//sa.www4.irs.gov/modiein/notices/CP575_1609775183980.pdf

Reference ID: Javascript is required to generate the reference ID.

Hi Michelle, please try applying for an EIN again using a different web browser (Chrome, Firefox, Safari, etc.)

I solved this by fully closing the web browser I was using (Chrome). Normally these turn-it-off-and-on again solutions don’t work, but in this case it did for me.

That’s great to know. Thanks Brian!

Is there another way to quickly get an EIN besides the EIN ASSISTANT? Fax is taking months. I have a client who needs to access money from an estate immediately and we dont have time to wait for this – – any other options?

Hi PKM, the only methods are online, fax, or mail. If your client can’t obtain the EIN online, they’ll need to mail or fax Form SS-4 to the IRS. After 45 business days have passed, your client can call the IRS and request an EIN Verification Letter (147C). The EIN Confirmation Letter (CP 575) will still eventually arrive, but the 147C will serve the same purpose in the meantime. Hope that helps.

I’ve been trying to apply for an EIN number for the past 3 days and keep getting this message: Planned Outage, This service will be unavailable due to system maintenance. You mentioned in an earlier reply that the system would be down until January 4th. Has the downtime been extended? Do you know when the site will be up?

Hi Ben, the maintenance is taking longer than originally expected. We recommend trying early next week. It should be up by then.

Hello, I went online to apply for an EIN and the website appeared to be the IRS website. I did not realize until I got to the end of the application that it was a 3rd party company trying to charge me $245. I then went to IRS.gov to apply and got the reference code 101. Does this mean the third party company has my EIN?

Hi Leigh, we can’t say for sure if the 3rd party company applied for the EIN. We recommend contacting them to see if the order went through. If not, and you’re still getting Reference Code 101, you’ll need to mail or fax Form SS-4 to the IRS (you can’t apply online). We have instructions here: How to apply for EIN for your LLC using Form SS-4.

If you have mailed or faxed the SS-4 but have not had any response can you try again electronically now that the system is up?

Hi Shawn, no, you shouldn’t file for the EIN a 2nd time without hearing back from the 1st application. However, you can call the IRS to check the status of the 1st application and request an EIN Verification Letter (147) (if it has been 45 business days since the 1st application). Hope that helps.

This is helpful. One question though. What if we need to get 12 EINs in one day?

My father is diverting each property he owns in an LLC and we need each LLC to have an EIN number. How can we get this done without having to wait 12 business days to do each one per day?

Any help would be appreciate.

Roger

Unfortunately, you can’t. You will have to apply for one number each day over a period of 12 days. Also, the EIN Website will be down until January 4th.

Hi Roger, Kristen is correct. You simply cannot. You can only get 5 EINs per week since the EIN online application is only open Monday through Friday. Said another way, there is no way around it taking 12 business days to get 12 EINs.

I received Reference #18.2d5dda17.1605732513.bece49b, which is not included in any of the above error codes. It doesn’t appear to be an error code as it says “Access Denied You don’t have permission to access “thhp://sa.www4.irs.gov/modiein/IndividualEINClientServlet Reference #18.2d5dda17.1605732513.bece49b”.

I obtained an EIN just yesterday but today I cannot. What does this reference mean?

Hi Judy, we’ve never heard of such an error code. You are allowed to get one EIN per day. We recommend trying again tomorrow.

THANKS THANKS THANKS VERY HELPFUL !!!

You’re very welcome Tina! Glad it was helpful :)