When you first get an EIN Number, the IRS sends you an EIN Confirmation Letter (CP 575).

- If you got your EIN Number online, you can download the CP 575 online

- If you got your EIN Number by mail or fax, the IRS will mail you a CP 575 (it’s mailed to the address you listed on 4a and 4b of Form SS-4; takes 4-6 weeks to arrive)

Note: If you are a Third Party Designee, you cannot download the CP 575 if applying online. The CP 575 will be mailed to the EIN Responsible Party.

Some people lose the CP 575 EIN Confirmation Letter and need an official copy of their LLC’s EIN Number for things like opening an LLC bank account.

The IRS only issues the EIN Confirmation Letter (CP 575) one time. You can’t get this letter again. In fact, “CP” means the letter was auto-generated by a computer. So even if you call the IRS, no one there can recreate the CP 575.

However, there is good news. You can still get an official “EIN Letter” from the IRS. It’s just not called an EIN Confirmation Letter (CP 575).

Instead, it’s called an EIN Verification Letter (147C).

Note: The full name of the 147C is actually EIN Verification Letter 147C, EIN Previously Assigned.

The CP 575 and 147C are technically different letters, however, they are both official letters from the IRS and can be used for all business matters.

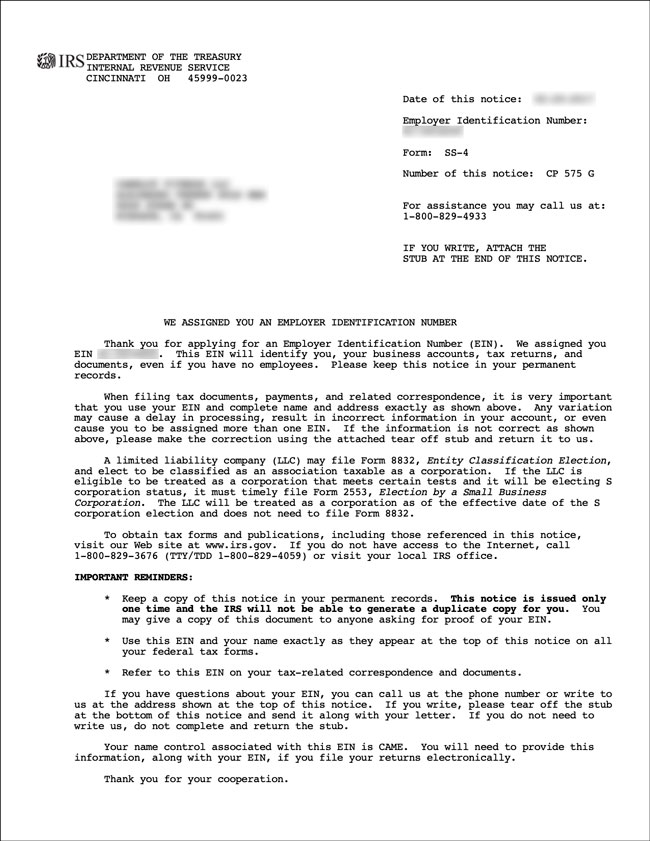

Here is what an EIN Confirmation Letter (CP 575) looks like:

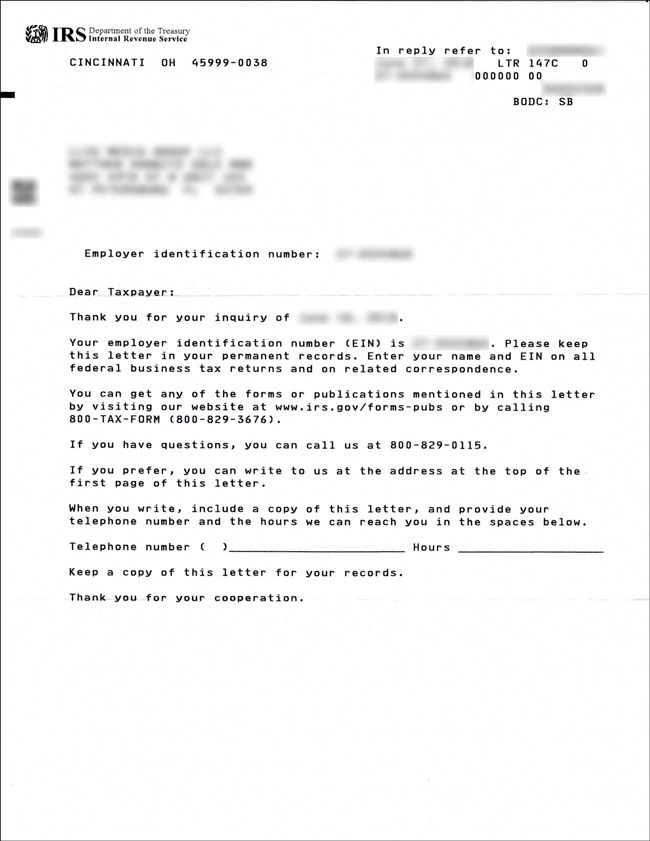

Here is what an EIN Verification Letter (147C) looks like:

How to get a 147C EIN Verification Letter from the IRS

The only two ways to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933, or to mail the IRS a written request.

Recommendation: We recommend calling the IRS between 7am and 10am or between 3pm and 7pm. And don’t call on Monday (the busiest day).

An EIN Verification Letter 147C can be requested by phone or by mail. But you can’t request it by fax.

It’s also important to note that requesting this letter by mail takes longer than requesting it by phone. Said another way, requesting 147C by mail may take 4-6 weeks to arrive. If you’d like to get your EIN verification letter faster, we recommend requesting the letter by phone.

Here’s how to call the IRS and get a 147C Letter

- Call the IRS at 1-800-829-4933 (the “business and specialty tax line”).

- Press option 1 for English.

- Press option 1 for Employer Identification Numbers.

- Press option 3 for “If you already have an EIN, but you can’t remember it, etc.”

- Tell the IRS agent that you have an LLC and need an EIN Verification Letter (147C).

- The IRS agent will ask a few security questions to confirm you own your LLC.

- Tell the IRS agent whether you’d like to receive the 147C Letter by mail or fax.

Tip: Only an owner of your LLC can request a 147C Letter. No one else can call for you, unless they have a Power of Attorney on file with the IRS. If you have a Single-Member LLC, refer to yourself as the “owner” (instead of Member). If you have a Multi-Member LLC, refer to yourself as a “partner” (instead of a Member).

Here’s how to write to the IRS and get a 147C Letter

You can also request an EIN verification letter 147C by mail.

What should I include in my IRS 147C request?

To request IRS Form 147C by mail, you’ll need to write the IRS a letter that contains:

- the date,

- your LLC’s name,

- your LLC’s EIN number, and

- a general request for Form 147C.

We’ve created a letter for you, so all you have to do is fill in the blanks with your LLC information.

Downloads

IRS – Request for EIN Verification Letter (147C) (Word)

IRS – Request for EIN Verification Letter (147C) (PDF)

IRS – Request for EIN Verification Letter (147C) (Google Doc)

As long as the information you submit in the letter is correct, the IRS will fulfill your written request.

Where do I mail my written request for an EIN verification letter?

The address you mail your written request to is state-dependent. Said another way, the address you submit your letter to depends on where your LLC is located.

That said, you’ll need to mail your request to 1 of 2 addresses:

Internal Revenue Service

333 West Pershing Rd.

Mail Stop 6055 S-2

Kansas City, MO 64108

Internal Revenue Service

Stop 6273

Ogden, UT 84201

Which address should I use to request my 147C by mail?

You should mail your written request to the Kansas City, Missouri office if your LLC is located in and does business in any of the following states:

Connecticut

Delaware

District of Columbia

Florida

Georgia

Illinois

Indiana

Kentucky

Maine

Maryland

Massachusetts

Michigan

New Hampshire

New Jersey

New York

North Carolina

Ohio

Pennsylvania

Rhode Island

South Carolina

Tennessee

Vermont

Virginia

West Virginia

Wisconsin

You should mail your written request to the Ogden, Utah office if your LLC is located in and does business in any of the following states (or anywhere outside of the US):

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Hawaii

Idaho

Iowa

Kansas

Louisiana

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Mexico

North Dakota

Oklahoma

Oregon

South Dakota

Texas

Utah

Washington

Wyoming

How will the IRS send me EIN Verification Letter 147C?

For security reasons, the IRS will never send you anything by email. Instead, the IRS will send you an EIN Verification Letter (147C) two ways:

- by mail

- by fax (you can use an actual fax or a digital/online fax)

147C by mail

If you choose to receive your 147C by mail, it can take 4-6 weeks before your EIN Verification Letter (147C) arrives.

The IRS will mail your 147C Letter to the mailing address they have on file for your LLC. You’ll be able to confirm this address when you’re on the phone with the IRS agent.

147C by fax

If you choose fax, the IRS will fax you the 147C Letter while you’re on the phone.

Tip: The IRS agent will ask, “Do you have a private and secure fax next to you?” If you are using a digital/online fax, say yes.

Congratulations! You have successfully requested a 147C, EIN Verification Letter for your LLC. We recommend making a few copies and keeping them with your business records.

References

IRS: Employer Identification Number FAQs

IRS: Telephone Assistance Contacts for Business Customers

IRS: About Form SS-4, Application for Employer Identification Number (EIN)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

A Big Help, thank you, Matt. We all appreciate you and your hard work in making things so easy for us, especially the call flow you mentioned, which was super, easy & fast. Keep up the good work. Thanks again.

You’re very welcome Amit! Thank for your nice comment. I really appreciate it.

Great help that page. Had to call IRS for 147C letter… got through and the lady was very patient and helpful. Thanks for that advice Matt 🫶

Hey Jeff, that’s what we like to hear! Awesome. You’re very welcome :)

Our EIN was established over 25 years ago. There has been a change in leadership since then and I’m now the General Manager. My name is NOT listed on the original application for an EIN number. Will I be able to get a copy of our EIN confirmation if I’m not listed on there?

I’ve got the same question. The original document is long gone as are the founding owners.

Hi Erica, please see my reply above to Marcie.

Hi Marcie, I’d still call the IRS and see if they can authenticate you. If you’re on the tax return, that’ll be sufficient. You don’t have to be on the original EIN Application. If that doesn’t’ work, you can Change the EIN Responsible Party, wait for that to be processed, and then call for a copy of 147C. Hope that helps.

So 2 days ago I got the EIN issued through the Phone, Today, One of my Payment processors required a “IRS letter confirming EIN.” So I called The IRS, the lady said she cannot Send me that 147C form and I have to wait 10-14 days because the Letter is already on it’s way.

It’s been 8 days since I faxed the IRS the SS-4 form, I think I shall wait. What do you say?

Hi Shahla, apologies for the slow reply. I think that’s a good idea. Hopefully you got it resolved by now.

Thank you for this very thorough step by step guide. It was VERY helpful and cut down on the time I would have needed to spend on solving my problem. I’m grateful to you.

Hey Jack, you are very welcome! So great to hear that. We appreciate the kind words :)

What happens if my session timed out before I could select the “confirmation letter” option?

You’ll get the EIN Confirmation Letter (CP 575) in the mail (I’d allow 6-8 weeks). If you need some “proof” sooner than that, then you can call the IRS (instructions above on this page) and request an EIN Verification Letter (147C).

WHAT IF I CAN’T REMEMBER THE ADDRESS I USED WHEN I APPLIED FOR EIN OR TELEPHONE NUMBER? I JUST CALLED THEM AND THEY SAID THEY COULDN’T AUNTHENTICATE MY IDENTITY BECAUSE IT’S BEEN SEVERAL YEARS AND I DID NOT HAVE A PERMANENT ADDRESS AT THAT TIME. I GAVE THEM MY SSN, DOB, I MEAN THAT’S PERSONAL INFO NO ONE ELSE SHOULD KNOW. I DON’T SEE ANY OTHER WAY TO GET MY REPLACEMENT EIN CERTIFICATION.

Hi Abel, I’m not sure. You could try calling again and asking if maybe you sending in a letter containing certain information could help. Otherwise, maybe try digging up old records to find that info. I’m really not sure.

Hi Matt… hope you are doing great.. Was wondering how do i get CP 575 notice if i am a Non Usa resident and dont have an SSN or ITIN…i received the EIN when i called the IRS. When i asked for the Cp575 notice they said they would send it to my mailing address which would typically take around 20 days. But previously i had taken a service from someone for EIN…he gave me the EIN and cp575notice PDF in 2 days… how is this possible? How did he manage to get the PDF of CP575 notice in 2 days?

Hi Cheryl, I’m doing well, thanks :) You were told correctly by the IRS. Even though non-US residents get the EIN number over fax, they later get the EIN Confirmation Letter (CP 575) by mail. There is a chance the person who got your EIN in 2 days likely didn’t list you as the EIN Responsible Party.

Said another way, the only way to get an EIN that fast is to apply online. And you can’t apply online if the EIN Responsible Party doesn’t have an SSN or ITIN. So what we sometimes see is someone (that person hired) lists themselves as the EIN Responsible Party. And while you can change the EIN Responsible Party for an LLC, we recommend just doing it correctly from the start. Hope that helps.

Hi Matt ,

I hope you are Doing Great . I want Ask you how i Apply for EIN Verification Letter if i a non -Us Resident . I Have My EIN number already but I Nedd Only EIN Verifaction Number now my LLC Adress is Virtual Address what can i Do now ? Is There Any Way That I Get EIN Confirmation Letter in PDF File Through my E-mail . ? Means CP575 ?

Hi Atif, no, the IRS doesn’t email anything. And CP575 is only generated once. Unfortunately, the only way to get a 147C is to call the IRS. The instructions are above on this page.

Hello Matt, I have my small business as a DBA and have had my EIN for a couple of years. In March I applied in the state of Texas for an LLC with the same company name. I was certified and I sent the SS-4 application for my LLC to the IRS. 3 months passed and I did not receive anything. I made the application by fax. I called and they said my DBA EIN was the same for my LLC. Is this correct?

Hi Yadira, that doesn’t sound correct to me. First, DBAs themselves don’t have EINs. It’s the owner “behind” the DBA that has the EIN. Aka, you, or your LLC. So the first EIN you have is for your Sole Proprietorship. You want a new LLC, owned by your LLC.

Hello Matt, I received my Ein number by fax six weeks ago. CP 575 letter not received. I called the IRS number. After 20 days they sent a 147C letter. My LLC name was misspelled. I’m trying to call customer service, but there’s no answer.

I checked my SS4 form, I sent my LLC name correctly.

Should I write them a letter? What can I do in this case?

Hi Silvia, I’d mail the IRS a letter and let them know they made a mistake. Please see change LLC name with IRS. We have a template letter on that page you can use.

I called the number listed here for the business and specialty tax line and waited for 45 minutes to be told it was the wrong department to call for a 147C. The correct department is at 1800-829-4933. Thanks for wasting my time.

I apologize, the number was correct. The IRS is just the worst.

Thanks Kaitlyn, totally cool. The IRS can be really frustrating to deal with. Glad you got it sorted though :)

Hi, many people are saying that you can get an EIN for your DBA, calling to IRS.

Have you already heard anything about that? Or, is it just for LLC or INC?

Because, i faxed an SS4 form to IRS 3 weeks ago, and then, I’ve called them this week and they are saying that they don’t have anything in the system about my DBA!

I talked to 3 differents representatives and all of them were saying the same thing, i guess, they don’t know how to explain what’s going on. If you ask them something, they never know, actually. Thanks for your help!

Hi Emerson, let me back up a step first. A DBA is simply “nickname” for a business entity (like an LLC or Corporation) or a person(s). If you don’t have an LLC, then your DBA is for yourself (aka your Sole Proprietorship). If you had a business partner, the DBA would be for your General Partnership.

So… no, you can’t get an EIN for a DBA. But you can get an EIN for a Sole Proprietorship (that has a DBA). Which is what I’m guessing you have. In that case, you should wait longer than 3 weeks and then call again. It’s likely not in the system yet. I wouldn’t apply again as that can cause issues. Hope that helps.

Thanks for helping. Yes, I’m gonna wait for sure. I already have my Sole Proprietorship registered with the County Clerk and the next step I’d like to get an EIN from the IRS. But, unfortunately, they are taking too long to issue that number. They say, “we are so busy, sorry but, you can’t solve it in person, you have to wait and that’s it”. It’s ridiculous to expect a basic EIN within a month or two. It should be easy and fast!

I know, it’s really frustrating. Many people are dealing with the same issue.

Do you know what questions, they ask you to get a new copy of the cover letter?

I forget exactly, but they are just confirming you are who you say you are, and that that matches their records.

Hi. I need help, i want to verify someone else’s EIN number. How can I do it? Other than calling or Visiting IRS. Are there any possibility to do it online?

There is no such service that we’re aware of.

Legal zoom did not include my suite #, and my original EIN cert letter reflects this. I can’t open a bank account until it is rectified.I’ve been trying since October. Is there any other way to get this done? Can I go to an office?

Hi Robert, sorry to hear that. You’ll need to keep trying. This is the only way to get a 147C EIN Verification Letter. There is no office to go to.

Hi Matt,

I am a foreign national, I created an LLC on 11/09/2022 and got my EIN approved, and received it in the Fax form IRS stating EIN on the Form SS-4. its been 6 weeks and i have been waiting on CP575. can you shed a light why is it taking so long from IRS to mail the document

The IRS has been really backed up. It will eventually arrive, but for many foreign nationals, it can take 2-4 months. Hope that helps!

Hi Matt

I am a foreign national, I created an LLC on 11/22/2022 and got same day approval. Then I applied for EIN using SS-4 and followed the method you stated for foreigners. Today I got my EIN approved and I received a fax from IRS stating EIN on the form SS-4. The quality of the document is not good (EIN is visible but most of the form is unreadable) How can I get Letter 147C and CP575? Should I follow the process listed in this blog or should I wait a few days?

By the way you are doing an extraordinary job of educating ordinary people like us. Thanks

Hi Waseem, you’re very welcome! The IRS should have mailed you a CP575, which should much more clear. Those faxes can sometimes be really hard to read lol!

Is it the same process when trying to get a verification letter for an estate?

Hi Nina, yes, it is.

We need a 147C from IRS.

We’ve callled this number 1-800-829-4933 many, many times, and after choosing 1, 1 and 3 options, we always got a voice mail saying they are busy and call back at different time.

After several weeks of not being able to contact IRS by phone, the only option left is to request it by mail, even if it takes 4 to 6 weeks.

My questin is which department of IRS and which location of IRS should we send our request for 147C letter. The IRS.gov website does not have this info.

Thank you very much for your help.

Hi Justin, I feel you on this. Thousands of people are dealing with the same issue. The IRS is extremely back up right now. Some readers are getting through by trying multiple times per day and multiple days per week (sounds like you’ve been doing the same though). As of right now, we only know about obtaining a 147C via phone, however, we’ll see if we can find anything out. If so, I’ll reply back here (and we’ll update this page). It may take us a couple weeks if we do find something. Thank you for your understanding. We’re hoping things return to normal soon.

Hi Justin, we just got through to the IRS (after trying for a few days). We added a new note at the top of this page. But in short, a 147C can only be requested by phone. It can’t be requested by mail or fax. And 1-800-829-4933 is the only number to request a 147C. So you’ll need to just keep trying. I know it’s super annoying. But check the note at the top of this page for some additional tips.

Cannot get thru to them by phone. Can I request via faxing to them? what #?

Hi James, not that we’re aware of. The IRS is extremely back up right now, however, readers are getting through by calling multiple times per day and multiple days per week. Hopefully things return to normal shortly.

Hi Whenever i call it hangs up because there arent any people to answer. ANy advice on how to go about it now?

Hi Mary, the IRS is still a bit backed up. We recommend calling shortly after they open in order to get through. Hope that helps!

No that doesn’t work either. I called at 7am and then again at 7:01 am and was hung up on. The instructions are accurate. Just no one is wanting to do their job or they refuse to take calls for 2 weeks now. I DID get to an agent on the “Forms” option. She told me to try between 5 and 5:30pm however that proven to be fruitless.

I am going on week 3 now. This is a government department that just got approved to hire over 85k workers and they cannot answer the bloody phone. America’s finest.

Oh my! That is really bad. I totally hear you. Thanks for the update and letting us know. I hope things get better in the coming months :)

Thank you so much for the easy to follow instruction on how to get 147C.

You’re very welcome Maribel :)

Thank you for sharing! This was very helpful!

You’re very welcome Rebecca :)

Thanks for your article. It is very helpful. I tried to obtain an EIN verification letter on behalf a client by calling in and faxing them a Form 2848. On line 3 of the form, I listed “EIN and EIN Verification Letter” “SS-4 and 147C” and “2021”. They rejected the form (after an hour and half hold to get to them and advised that line 3 needs to be totally blank when checking line 4 (specific use not recorded on CAF). Does this sound right? When I read the Instructions, I am even more confused. The person I spoke with was stuttering and referring to incorrect line numbers at first, so I worry that if I send blank line 3, I’m going to get rejected again.

Hi Jeff, we are not sure as we don’t deal with Form 2848 filings. However, anytime we get “unconfident” information from an IRS representative, we always call back a few more times and ask the exact same question to someone else. The phones are busy right now, so calling between 7am and 8am is best. Hope that helps.

Hey Matt AT LAST I GOT MY EIN. :)

It was mailed CP575.

But now I have few question that I want to clear it up.

1. The first SS4 form was sent on 5th of November. When I tried to talk to representative from IRS after 45 business days I still had no EIN assigned and they told me to resend SS4 form again. So than I found Third Party Designee. They faxed it for me few times.

Now, can i find out from IRS which SS4 form did they use? Mine or my Third Party Designee?

2. It appress that the Name of my LLC is correct

My business address is correct

My first name is correct and written in full

My Last Name is correct and written in full

However, my middle name has only “One alphabet letter”. I can’t find an information if it is ok for middle name or not.

When I faxed them I had everything written in full.

I need help on this, please?

Hey Rocky, that is wonderful news :) You can call the IRS to check, or you can just do this: Use the current EIN you have. If you get another EIN in the future, just cancel/deactivate the EIN. If your name is Rocky John Smith and it’s entered as Rocky J Smith, that is totally okay. Hope that helps.

I’ve had my EIN for 20 years and just need a copy of the letter… it seems someone applying for a new EIN has the convenience of downloading theirs after the application but I have to call the IRS and then try to find one of these FAX machines to receive it. (we aren’t in the 90’s anymore so my oversized phone-printer isn’t here anymore). Why does acquiring a new letter need to be so difficult for those who already have an EIN?

Enter my EIN, something personal and download.. ??

Hi Herbert, we don’t disagree ;) However, this (or sending in a written request) is the only way to get a copy of your EIN.

Hi,

Good Day,

My EIN Number was received by phone on November 2nd but up to this moment, CP575 Letter not yet received in my USA LLC Mail address.

1- Do You know if clients in similar situations have already received their letter?

2- To get 147C by fax, is it required to send to IRS a consent letter asking IRS to send to You mentioned letter via fax? (is there a template for that?).

Tks and have a nice weekend.

Ps. You have no idea how Your Videos and messages have already helped me in my journey!! Thanks a lot!! You rock!!

Hello

After getting EIN what else we have to do for IRS like for taxes. Do you have any idea.

thanks

Hi Giren, unfortunately, there isn’t a simple and short answer to this. Taxes depend on how the money is made, where the business makes money, where actives are, and what the tax status is of the LLC owner(s). We recommend working with an accountant.

Hi Daniel, thanks so much! You’re very welcome :) If you are the owner of the LLC, you can just call the IRS. You don’t need a consent form. Yes, the CP 575 can take a while to arrive due to the current situation. Sometimes it’s taking 3 months. You can call the IRS and request an EIN Confirmation Letter 147C in the meantime. Hope that helps.

I was issued my EIN on Dec. 15, 2020 by computer and as I opened it my system crashed. I managed to get the number before it went blue. My problem is I have been calling every single business day since then and get a recording that they are busy and to call back later or try again tomorrow. I cannot set the woocommerce portion of my ecommerce site up without verification and cannot get verification. I am running out of money while trying to get the one piece of paper I need from the IRS to allow me to open my business. I have customers waiting but they won’t wait forever…

Hi Stephen, I feel you man. Thousands and thousands of people are in the same situation. The IRS opens at 7am (local time; based off the incoming phone number’s area code). We recommend calling at 7am or 8am, or as early as you can. We’ve called the IRS ourselves about 5 times this week. We’ve had to wait each time, but we’ve gotten through each time. When calling, please follow the prompts/option number as mentioned above on this page to speak to a representative. Hope that helps :)

I got the EIN number only but my agent is saying that foreigners dont get CP 575 is that true?

My question is after EIN approval do IRS send EIN verification letter or CP 575 letter to the respective mailing address or not(agent address)?

Hi Giren, if the SS-4 application was faxed, the first approval from the IRS is the SS-4 returned with the EIN written on it. Then the CP 575 arrives in the mail. Usually that is a few weeks after the EIN is issued, however, due to current delays, that can take a couple months. The CP 575 is sent to the mailing address that was listed on the SS-4. However, if you get an EIN Verification Letter (147C) it does the same thing and has the same power as the EIN Confirmation Letter (CP 575).

Thank you for your reply

After the EIN approval through fax will IRS send EIN verification letter automatically to the mailing address or we have to inform IRS for the mail.

Hi Giren, the EIN Confirmation Letter (CP 575) is automatically mailed after your EIN number is faxed back to you. You don’t have to contact the IRS to request it.

If I apply for an EIN online (https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online), it provides me with the EIN instantly. Where do I then go to download my CP575 instantly?

Hi Emily, the CP 575 (EIN Confirmation Letter) is provided in the very last step of the EIN online application. It’s a PDF form that you can download. If you didn’t download it and closed out of the EIN online application, you can call the IRS to get an EIN Verification Letter (147C) in the meantime. The CP 575 will eventually arrive in the mail, but that can take a few weeks to a couple months due to the delays the IRS is currently facing. Hope that helps.

Is that Step 5. EIN Confirmation? I don’t see where to download. It says “Congratulations! The EIN has been successfully assigned.” Then, under the EIN, it says “The confirmation letter will be mailed to the applicant.” The only links/buttons from this page is a “Continue” button to get additional information about using the new EIN, and a Help Topic link “Can the EIN be used before the confirmation letter is received?”

Hi Emily, yes, that is Step 5. EIN Confirmation. There should be a link that says “CLICK HERE for Your EIN Confirmation Letter”. We’ve never heard of that link not being there. That’s very strange. While the EIN Confirmation Letter (CP 575) will be mailed to you, we recommend calling the IRS for an EIN Verification Letter (147C) in the meantime. We recommend calling early in the morning for the shortest hold time.

You only have the option to print the CP 575 if you the responsible party. Third party registers obtaining an EIN on behalf of another entity do not have the option to print the CP 575 and it will be mailed to the client.

You may want to update the article so everyone knows.

Hi Hugh, this is very helpful, thank you. We’ve updated the page.

I figured out why the link was not there. I usually put in that I am a Third Party applying for the EIN on behalf of the entity (as I am). To get the link to the letter, you have to click you are one of the owners, members, etc. of the entity. I was instructed to try it that way, and sure enough, the link comes up on Step 5. Thanks!!

Hi Emily, that makes sense. While that works, you don’t want to submit false information if you’re not an LLC Member or LLC Manager. The EIN Confirmation Letter (CP 575) will be mailed to the EIN Responsible Party if you’re applying as a Third Party Designee.

Thanks a lot, Matt, super helpful.

One question remains, I already got a CP 575 but my name on it wasn’t full when I registered and this causes me trouble while registering as an Amazon seller.

Is it possible to amend, extend my name while asking for the (147C) ?

Thanks a lot

Antoine

Hi Antoine, you can ask while you call (I’m not 100% sure). If it doesn’t work, you can change the EIN Responsible Party for an LLC via Form 8822-B

Matt, buenos días

Conoce algún número para pedir el 147Co ver si se ha emitido mi EIN que atiendan en inglés? Dado que sólo el titular puede llamar, es dificil comunicarse cuando sólo dan la opción en inglés en el número que mencionas. Llevo 9 semanas desde que envié mi SS-4 por FAX

Gracias

Hola Nata, puedes llamar al 1-800-829-4933 y presionar la opción 2 para español.

Gracias Matt. Te cuento que intenté eso en Diciembre pero al parecer ese tipo de información sólo la brindan en inglés y te piden que vuelvas a comunicarte con un intérprete.

Sin embargo, hoy llamé y la contestadora dice que el IRS se encuentra cerrado. Tienes idea a qué se debe este cierre o cuánto podría durar?

Llevo 9 semanas de enviado el SS-4 por fax, sin ningún tipo de novedades aún.

Gracias eternas por tu ayuda.

Hola Nata, el IRS está abierto de lunes a viernes. A qué día y a qué hora llamaste? Intente llamarlos nuevamente esta semana y avíseme.

Hi,

Thanks for your very informative documents. I have already received 147C but I changed my business name in that period and Should I change EIN number? How I can change my EIN number for changed business name company?

regards

Hi Ersin, you’re very welcome. No, you would not change the EIN number if you change your LLC name (it’s still the same LLC). Instead, you just update the IRS with the new LLC name. We have instructions here: How to change my LLC name with the IRS. Hope that helps.

Can I apply for a new EIN # if I misplaced the one that I applied for recently?

Hi Christina, yes, you can do that. If you go that route, you can cancel the first EIN (see how to cancel an EIN with the IRS). Alternatively, you can call the IRS and request an EIN Verification Letter (147C) as mentioned above on this page.

Hi,

I received my EIN number by phone, 1 month ago, but up to this moment, I have not received the confirmation letter…

Do you know if due to Corona Virus, is it taking longer than 4 to 6 weeks??

Tks and have a wonderful week ahead!!

Hi Daniel, yes, it’s taking much longer than 4-6 weeks right now. Sometimes 2 months or a bit longer. The EIN Verification Letter (147C) can serve as the official EIN approval though, in place of the EIN Confirmation Letter (CP 575)… or until it arrives by mail.

Thank you for this post. Exactly what I needed to know.

You’re welcome Lisa!

I received my EIN but I can’t find the letter I Know my number but I need the letter to open a bank account t what can I do? Please help me

Hi Efraín, the instructions on how to get your EIN Verification Letter (147C) are above on this page :) If you can’t find your EIN Confirmation Letter, the 147C is the only kind of “proof” you can get from the IRS. You can also call the bank and see if they’ll just take your word on the EIN, however, most banks want a copy of the EIN Confirmation Letter (CP 575) or EIN Verification Letter (147C). Hope that helps.

They didn’t accept, they want a copy. Thank you so much for your help I really appreciate.🙏🏼🙏🏼

I figured that was the case ;) You’re welcome Efraín!

Do foreign application having EIN can request for CP 575. (Non US citizen nor resident)

Hi Giren, yes, non-US residents/foreigners can get an EIN for an LLC. We have instructions here: How non-US residents can get EIN for LLC.

Hi Matt, I have been trying to get through to the IRS using option 1-1-3. It keeps telling saying they are experiencing higher than normal call volume and to try back. This has gone on for weeks. Any suggestions?

Hi Jennifer, the IRS has been horrible with phone support recently. Many people are having a hard time getting through. We recommend calling early in the morning, and if that doesn’t work, try multiple times per day. Some readers have gotten through, but only after trying for multiple days. Apologies, I wish there was something we could do or another way to solve this, but all we’ve been told by the IRS when we inquired was “keep trying”. Hopefully this doesn’t last too long and things soon return to normal. Thanks for your understanding.

Thanks for the article! It helped me a lot!.

Btw, I faxed my EIN application 2 months ago. Now I still has not received any EIN/response from IRS? What should I do now?

Hi Thanh, it’s best to wait. The IRS has been delayed due to covid. You can call the IRS though at the number on this page to see if your EIN has been issued.

Thanks for the article!

How long after receiving my EIN can I call the IRS to request a verification letter by fax?

Hi Momen, you don’t have to wait at all. You can request an EIN Verification Letter right after your EIN is issued.

Hello Matt, just wanted to see if you knew how to get my EIN letter because SWYFT Fillings sent it to the wrong address on file? I have tried calling the number but it keeps saying the office is closed. I started my business last August 2022 and i cant even do payroll or open a business account or anything without this letter..

Hi William, we posted an update at the top of this page. You’ll need to keep trying until you get through. There’s no other way to get the 147C letter.