Also known as: How to Apply for a Federal Tax ID Number for an LLC.

This lesson is about how to get an EIN for an LLC, not another type of business or trust. Also, you can only apply for an EIN online if you have a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

Don't have an LLC yet? Hire Northwest to form your LLC for $39 + state fee (then add EIN to your order).

Have an LLC, but no EIN? Hire Northwest to get your EIN:

I have an SSN | I don't have an SSN

Skip ahead: If you’ve already read what is an EIN, feel free to skip ahead to 4:10.

Note: The video above shows obtaining an EIN for an LLC in Florida, however, the steps will be similar regardless of which state you formed your LLC in. Also, this video is a few years old and a few things have changed with the online EIN Application. Please read this entire lesson before applying for an EIN for your LLC.

Online EIN Application for LLC

Hours: The EIN Online Application is only available Monday through Friday, from 7:00am to 10:00pm Eastern Time.

Reminder: The instructions below are only for people who have an SSN or an ITIN. If you are a foreigner and don’t have an SSN or ITIN, you can still get an EIN for your LLC. Please see the instructions here: How to get an EIN without an SSN or ITIN.

Get started:

Visit the EIN for LLC Online Application:

IRS: Apply for an Employer Identification Number (EIN) Online

Click the blue “Apply Online Now” button in the middle of the page.

Read through the important information and then click “Begin Application“.

1. Identify

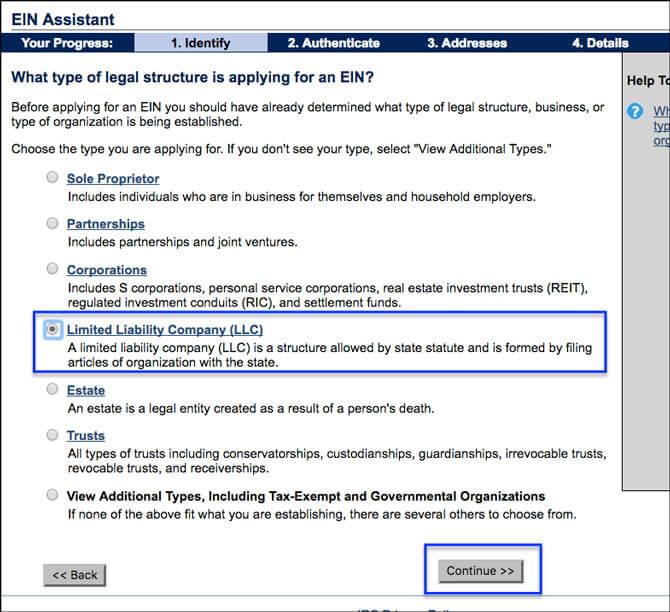

What type of legal structure is applying for an EIN?

Select “Limited Liability Company” and then click “Continue“.

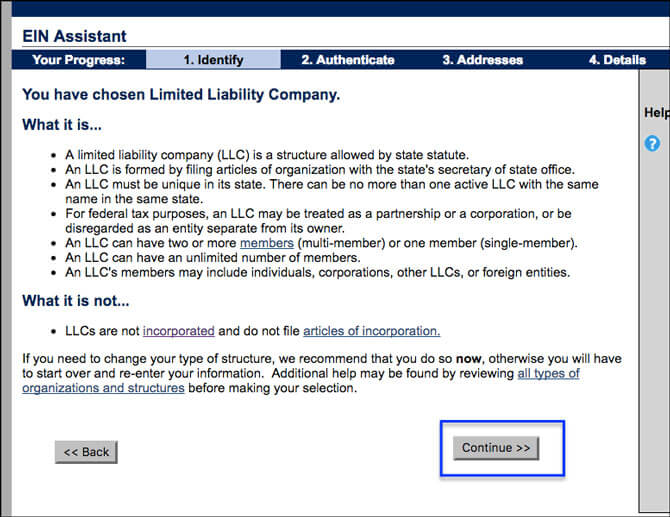

You have chosen Limited Liability Company.

This page explains what an LLC is and what an LLC is not. Please read over the information and then click “Continue“.

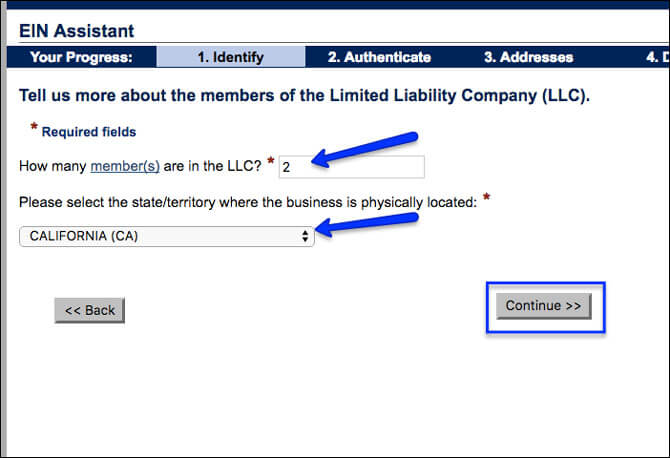

Tell us more about the members of the Limited Liability Company (LLC).

Enter the total number of LLC Members. Then select the state where your LLC was formed and click “Continue“.

Note: LLCs can be taxed by the IRS a few different ways. By default, LLCs with 1 member will be taxed like a Sole Proprietorship. And by default, LLCs with 2 or more members will be taxed like a Partnership. If you want your LLC to be taxed like a C-Corporation or an S-Corporation, you’ll do that with a separate form after the EIN is approved (we’ll discuss this later on). Additionally, how your LLC is taxed by the IRS has nothing to do with your LLC’s liability protection. Your personal assets will still be protected regardless of how your LLC is taxed by the IRS.

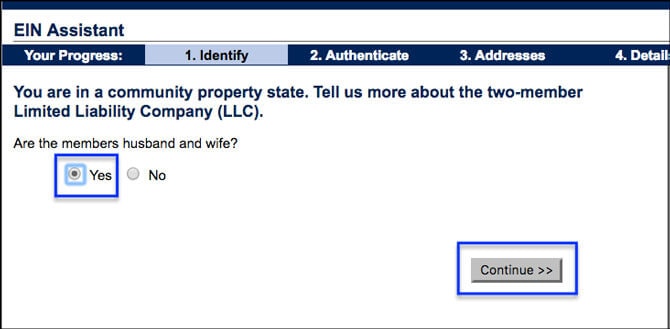

Husband & Wife LLCs in Community Property States

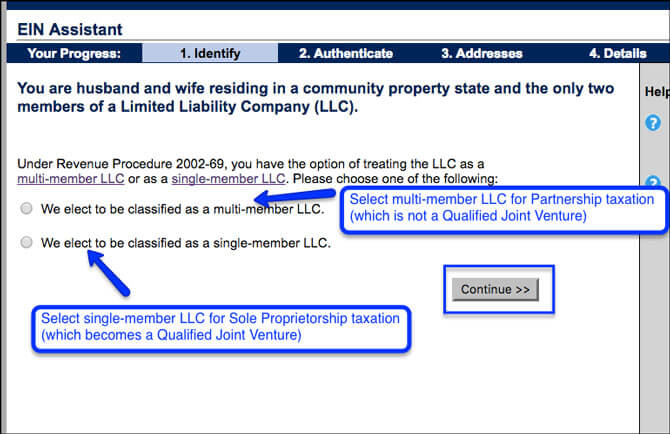

If you select 2 members and are forming an LLC in a community property state, the IRS will then ask you how you’d like to be taxed and whether or not you want to be a Qualified Joint Venture LLC.

A Qualified Joint Venture LLC is when an LLC is formed in a community property state, the only owners are the husband and wife, and they file a joint tax return, they may elect to treat the LLC as being owned as one “legal unit”, meaning the LLC can choose to be taxed as a Sole Proprietorship (instead of a Partnership). So by making this election, the married couple will not be required to file a 1065 Partnership Return, but will instead report income, losses, credits, and deductions directly on their joint tax return.

You’ll see the following:

If you select “multi-member LLC“, your husband and wife LLC will be taxed as a Partnership, which is not a Qualified Joint Venture.

If you select “single-member LLC“, your husband and wife LLC will be taxed as a Sole Proprietorship, which is a Qualified Joint Venture.

Please confirm your selection:

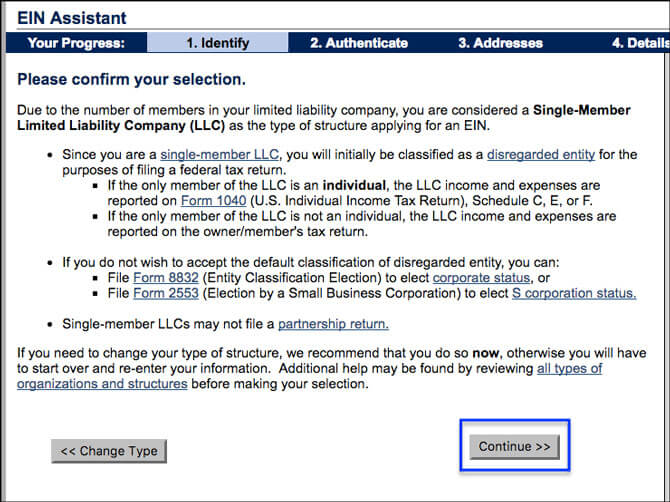

This page will confirm and explain the IRS tax classification for your LLC.

If you have a Single-Member LLC, the IRS will treat your LLC as a “disregarded entity” and the LLC will be taxed like a Sole Proprietorship. Keep in mind, this has nothing to do with your liability protection. You are still operating as an LLC and have its full personal liability protection. The IRS is just taxing it like a Sole Proprietorship.

Your LLC’s income will “pass through” to your personal tax return, known as Form 1040, and your income will be reported on a Schedule C, E, or F. You’ll see the following message:

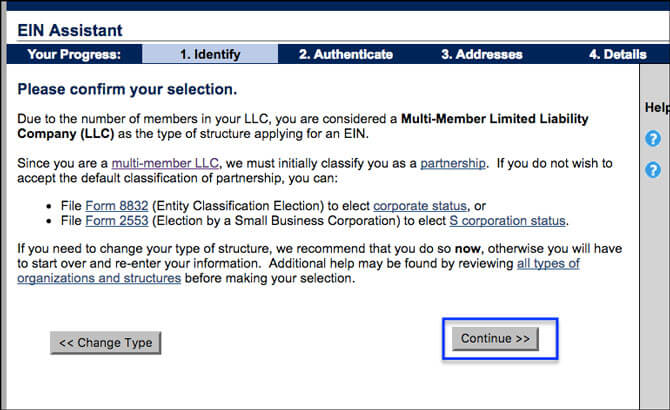

If you have a Multi-Member LLC, the IRS will tax your LLC like a Partnership. Keep in mind, this has nothing to do with your liability protection. You are still operating as an LLC and have its full personal liability protection. The IRS is just taxing it like a Partnership.

Your LLC’s income will “pass through” to your personal tax return (on Form 1040), but you’ll also need to file a 1065 Partnership Return and issue a K-1 to each LLC Member. You’ll see the following message:

Note:

You’ll see a message stating that if you do not want to accept the LLC’s default tax classification, you can file Form 8832 and have your LLC taxed as a C-Corporation, or, more popularly, you can file Form 2553 and have your LLC taxed as an S-Corporation. Please note, that even if you plan on filing either of these forms, you’ll need to continue through the process of the online EIN application, and after your EIN is approved, you can then file Form 8832 or Form 2553. But make sure you speak to an accountant regarding which method of taxation is best for your LLC. For people starting out (earning less than $50,000 per year), it usually won’t make sense to have your LLC taxed as an S-Corporation or a C-Corporation, however, as mentioned, please speak with an accountant.

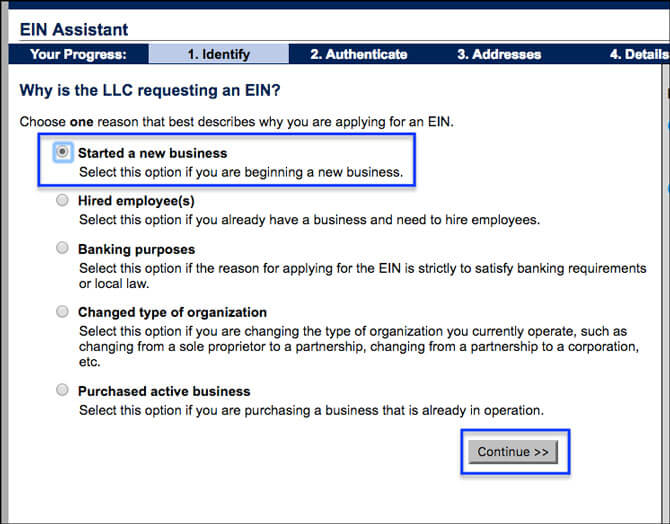

Why is the LLC requesting an EIN?

Most people select “Started a new business” and then click “Continue”.

2. Authenticate (EIN Responsible Party)

The EIN Responsible Party is a person that goes on file with the IRS when you apply for an EIN for your LLC.

Think of the Responsible Party as the LLC “contact person”. The IRS will send mail about your LLC’s taxes to this person.

The Responsible Party must have an SSN or ITIN, if you’re applying for an EIN online.

Tip: If you’re non-US resident and don’t have an SSN or ITIN, you can still get an EIN for your LLC. Please see this page: How to get an EIN without SSN.

If you have a Single-Member LLC: You will be the EIN Responsible Party.

If you have a Multi-Member LLC: One of the LLC Members will be the EIN Responsible Party.

The IRS just wants one person as the EIN Responsible Party. They don’t want all the LLC Members’ information. The IRS gets the other Members’ information when you file your 1065 Partnership return.

Although any LLC Member can be listed, you should list the LLC Member that will take on the responsibility of making sure the LLC taxes are handled properly.

Note: If you need to change your EIN Responsible Party later, please see this page: Change EIN Responsible Party for LLC.

What if my LLC is owned by another company?

The IRS rules changed in 2018 to say that the EIN Responsible Party cannot be another company. The EIN Responsible Party must be an individual person.

If your LLC is owned by another company, list an owner of the parent company.

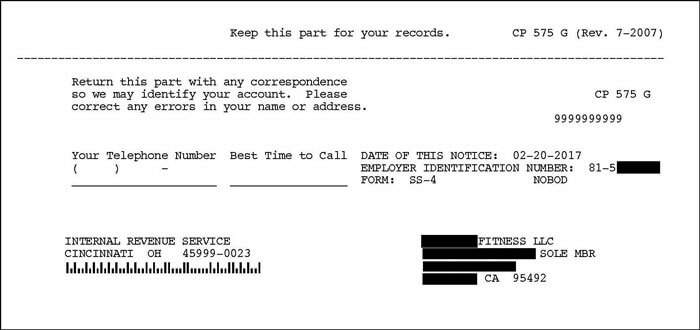

Note: If your EIN Confirmation Letter says “[YOUR NAME], SOLE MBR” at the top, don’t worry. The system prints “SOLE MBR” automatically. The IRS is only looking for a Responsible Party, and doesn’t care whether your LLC is owned by another company. The “SOLE MBR” on the letter doesn’t make you a member of the LLC, and doesn’t change the fact that the LLC is owned by another company. This is just a system bug, and the IRS doesn’t actually think you’re the owner.

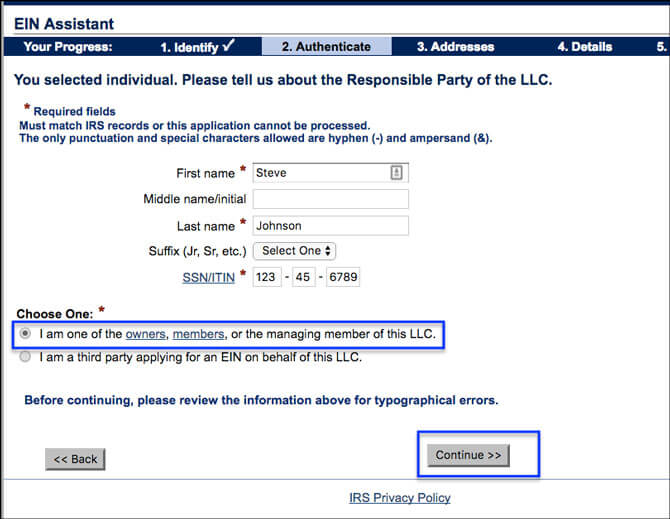

Please tell us about the Responsible Party of the LLC:

Enter your full name and your SSN or ITIN. Then select “I am one of the owners, members, or the managing member of this LLC“. Then click Continue to proceed.

ITIN Number: If you are entering your ITIN number, please note, that there is a 30-40% chance you will receive an error message (called a reference number) at the end of the EIN Application. There are many reasons this might happen. For example, your ITIN may not be established in the IRS system yet. If you receive an error message at the end, don’t worry, you can still get an EIN for your LLC. You just need to mail or fax in Form SS-4 instead. You can find instructions here: apply for EIN with Form SS-4.

3. Addresses

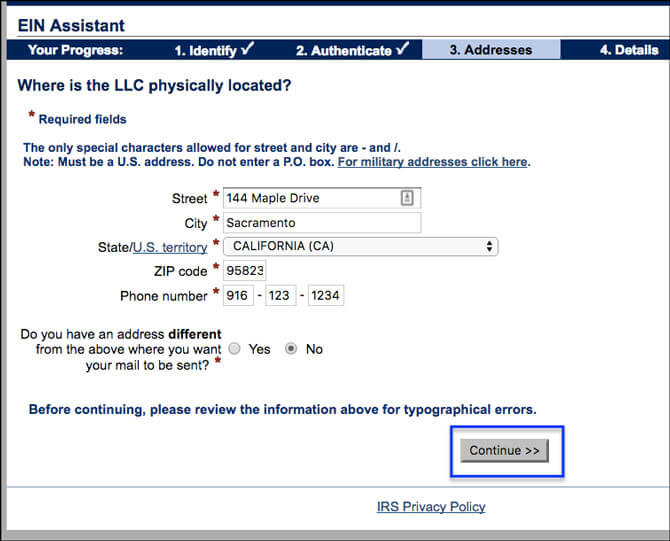

Where is the LLC physically located?

Enter your LLC’s physical address and your U.S. phone number.

The IRS will use this address to send your LLC any mail or correspondence.

The IRS rarely calls people, but in case they need to, use a reliable phone number where you can be reached. The number must be a U.S. telephone number. It can be a cell, home, or office number.

A P.O. Box address is not allowed. A physical street address must be entered.

Most filers list their home if they work from home or an office address if they work from an office. You can also can use a PMB (Private Mailbox Service) or a CMRA (Commercial Mail Receiving Agency) address if you have one.

Note: If you need to change your address later, we have instructions here: Change your LLC address with the IRS.

Non-US residents:

If you formed an LLC in the U.S., but you don’t actually have a physical location in the U.S., you can use the address of your Registered Agent (if they allow it). One such company that is “foreigner-friendly” and will let you use their address is Northwest Registered Agent.

Special characters:

The only special characters that are allowed in the address fields are a hyphen (-) and a forward slash (/). You can’t use the number sign (#), a comma, or a period.

For example, if your address is “123 Main Street, Apt. #3”, you’ll need to enter it as: “123 Main Street – Apt 3” or “123 Main Street Apt 3“.

Different Mailing Address:

If you want mail from the IRS to be sent to a different address than you entered, select “Yes” and enter that address on the next page. The IRS will use this address as your mailing address instead of the LLC’s physical location.

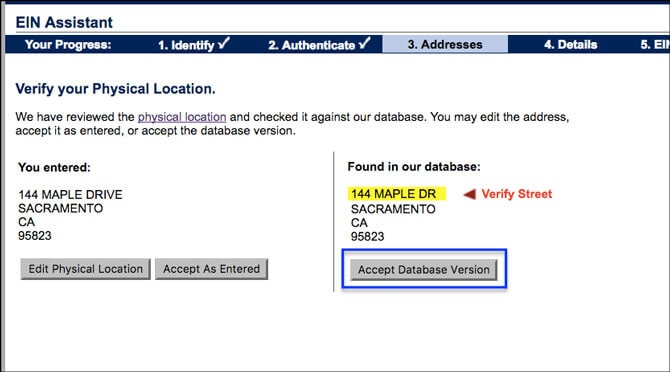

Verify your Physical Location:

If the following page appears, it just means the IRS is formatting your address to match up with the “standardized format” from the United States Postal Service. You can click “Accept Database Version” and then click Continue.

4. Details

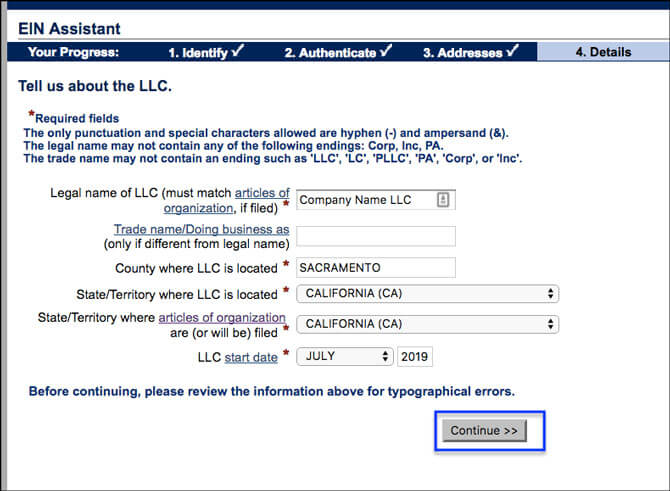

Tell us about the LLC:

Legal name of LLC:

Enter the full name of your LLC, but don’t use any periods or commas.

Even if your LLC was filed with the state using a comma, a period, or some other symbol, the IRS will only allow the use of a hyphen (-) and the ampersand symbol (&) in the name field.

Keep in mind, this doesn’t affect the legality of how your LLC filed with the state. It’s simply the IRS “normalizing” their records for their database. Again, it won’t impact the legal name of your LLC.

For example: If your LLC was formed with the name “ABC Widgets, LLC“, it must be entered as “ABC Widgets LLC“.

Symbols in your LLC name:

The IRS doesn’t allow most special characters in the name field. If your LLC name includes any of the symbols below, they will need to be replaced.

For example:

- replace “.” with “dot”

- replace “.com” with “dot com” (ex: MySite.com LLC becomes MySite dot com LLC)

- replace “+” with “plus”

- replace “@” with “at”

- replace a “/” or “” with “-“

- remove $ and related symbols

- remove the apostrophe (‘) and don’t use

Trade name/Doing business as:

This field can be left blank, unless your LLC has also filed a DBA (doing business as) name. Most filers leave this blank since their LLC will just operate using the legal name it was filed under.

If you previously had a Sole Proprietorship with a DBA, don’t enter that name here. That is not the same thing. Only enter a DBA if the DBA was filed after the LLC was formed and the DBA is owned by the LLC.

- Related article: For more information on whether or not a DBA is needed for your LLC, please see: Do I need to file a DBA for my LLC?

County where LLC is located:

A lot of people read this too fast and think it says “country” (like the USA). It doesn’t. It’s the county. Each U.S. state is divided into counties.

Enter the county where your LLC is located. If you’re not sure which county your address is in, you can use this tool.

State/Territory where LLC is located:

Enter the state where your LLC was formed.

State/Territory where Articles of Organization are (or will be) filed:

Enter the state where you filed your Articles of Organization, Certificate of Organization, or Certificate of Formation.

For most filers, this field and the one above will be the same state.

Note: If you’re getting an EIN for a Foreign LLC the state names will be different.

LLC start date:

Enter the month and year that your LLC was approved. You can find this date on your LLC’s approved Articles of Organization, Certification of Organization, or Certification of Formation.

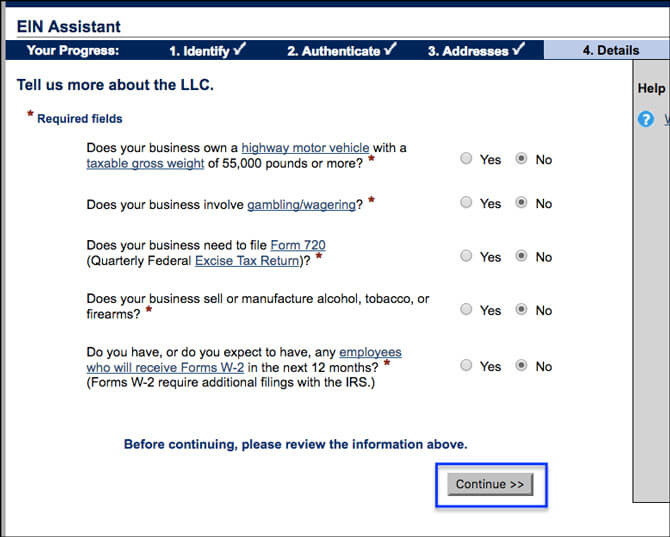

Tells us more about the LLC:

Read the questions carefully and select either “Yes” or “No“, then click Continue.

(Click the links below for explanations from the IRS)

- Does your business own a highway motor vehicle with a taxable gross weight of 55,000 pounds or more?

- Does your business involve gambling/wagering?

- Does your business need to file Form 720 (Quarterly Federal Excise Tax Return)?

- Does your business sell or manufacture alcohol, tobacco, or firearms?

- Do you have, or do you expect to have, any employees who will receive Forms W-2 in the next 12 months? (Forms W-2 require additional filings with the IRS.)

What does your business or organization do?

On the next page, select your LLC’s primary business purpose from the list of given choices.

If it does not fall in any of the choices provided, you can select “Other” and then specify your LLC’s business purpose on the next page. Once you’re done, click Continue.

5. EIN Confirmation

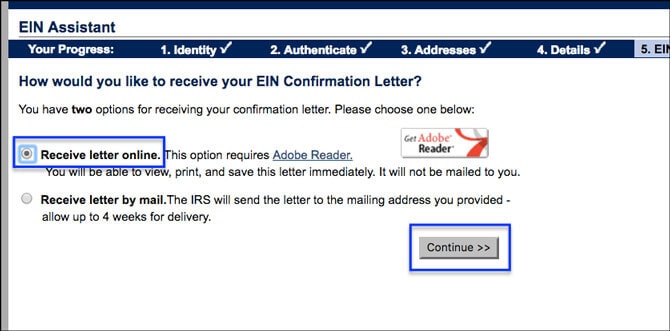

How would you like to receive your EIN Confirmation Letter?

We recommend selecting “Receive letter online” as this is the fastest way to receive your EIN Confirmation Letter.

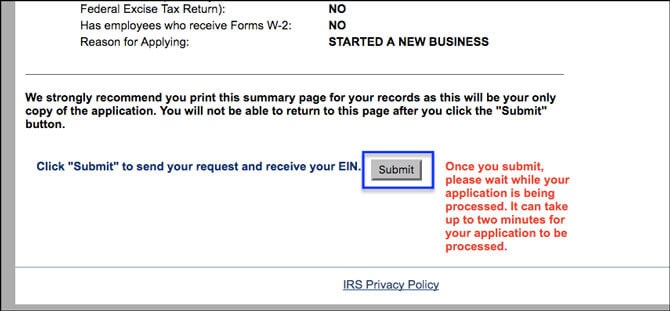

Summary of your information

Review the information you entered, then click “Submit” to finalize your application.

Congratulations, the EIN for your LLC has been successfully assigned!

You’ll see a message confirming that an EIN has been successfully assigned to your LLC.

Important (make sure to download your EIN Confirmation Letter):

Click the blue download link to save and print a PDF copy of your EIN Confirmation Letter. Then click Continue twice to end your online application.

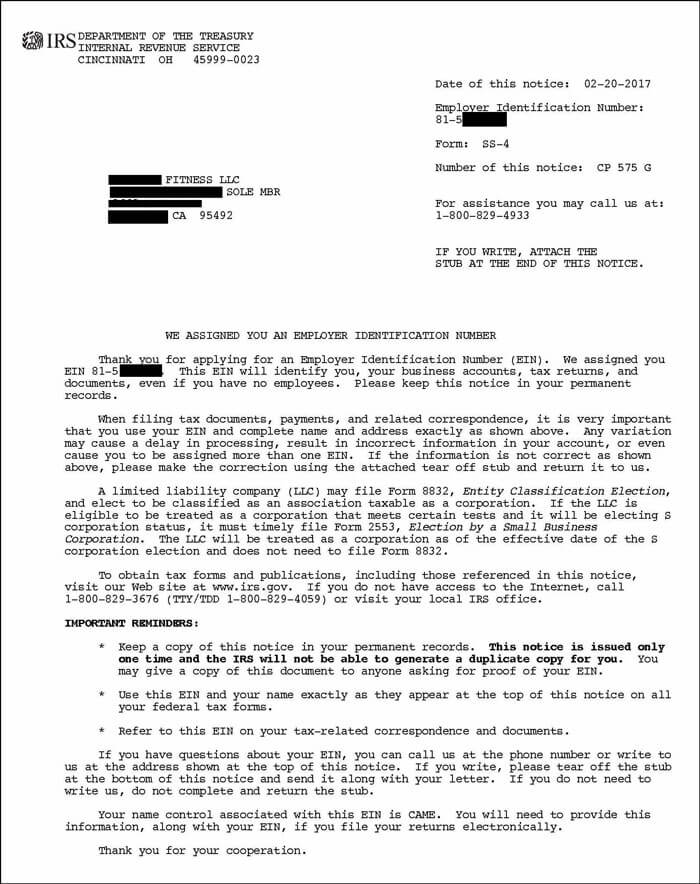

CP-575:

The technical name for your EIN Confirmation Letter for an LLC is the CP 575.

Again, make sure you download and save a few copies of this form.

The IRS will also mail you a duplicate copy, which will arrive in 4-5 weeks.

If you misplace the EIN Confirmation Letter, you can always call the IRS (1-800-829-4933) and request another letter. The IRS won’t be able to issue another CP 575, but that’s okay; they’ll issue another type of EIN letter called the EIN Verification Letter (147C).

The EIN Confirmation Letter is 2 pages. Here is what page 1 looks like:

Page 2 has a “cut out”, but you don’t have to mail this into the IRS unless you are sending in a letter and making changes to your LLC’s EIN (which you might do at some point in the future).

Here is what the bottom of page 2 looks like:

EIN Reference Numbers/Error Messages

There are a number of different error messages (called “EIN reference numbers”) that you may receive at the end of the application.

There are many reasons why an online EIN Application may be rejected.

Please reference this page (What do these EIN reference numbers mean?) for more information.

And if you need to file Form SS-4 instead of the online application, you’ll find those instructions here: how to apply for EIN with Form SS-4.

LLC Business Bank Account

Once you get an EIN for your LLC, you’ll be able to open an LLC business bank account.

You’ll need the following items in order to open an LLC bank account:

- EIN Confirmation Letter

- LLC approval (Articles of Organization, Certificate of Organization, or Certificate of Formation)

- LLC Operating Agreement

- Your driver’s license and/or passport

IRS Phone Number & Contact Information

If you have any questions while going through the online EIN Application (or you receive any EIN reference numbers), you can call the IRS at 1-800-829-4933.

The IRS hours are Monday through Friday between 7am and 7pm. The earlier you call, the shorter the wait times.

References

IRS – EIN FAQs

IRS – About Form SS-4

IRS – About Name Control

IRS – Do you need an EIN?

IRS – How to apply for an EIN

IRS – Do you need a New EIN?

IRS – How are EINs assigned?

IRS – Understanding Your EIN

IRS – Instructions for Form SS-4

IRS – Form SS-4 (EIN Application)

IRS – What is a responsible party?

IRS – How long will it take to get an EIN?

IRS – Limited Liability Company Information

IRS – LLC Filing as Corporation or Filing as Partnership

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi. This info is all so great!

When I filed the Articles of Organization of my LLC, I did it under my first and last name (no middle initial). When I did the EIN, the middle initial was not starred as a required field, but the text on screen said “Must match IRS records or this application cannot be processed.” Since my IRS records includes my middle initial, I used that. It that difference going to be a problem?

Thanks for the info. ~ Pam

You’re welcome Pam! You have nothing to worry about. No problem at all with that difference.

Hi, I made application (free) online for EIN #, they gave me one. Then I requested letter confirmation online but I couldn’t print/save the PDF. And I submitted it. Now they are sending me emails requesting payment to finish (a lot) ????? How can I go again and review it using my EIN# so as to print it so as to open a bank account? Or How can I cancel it to start again?

Hi Janitzia, if a company is asking you for money, then it’s not the IRS. If you have an EIN from the IRS, you can get a copy of your EIN by calling them. Please see: How to get an EIN Verification Letter 147C.

Hi Matt, I formed a LLC company without individual member. Do I have to include an individual member as the responsible party, or this natural person can be the responsible party as a third party?

Hi Alan, is this your LLC? What do you mean by formed the LLC without an individual member? Do you mean there are zero Members, or do you mean the Member is another company?

Hi! I was reading the information about getting EIN in Nevada, and when I completed the form, it was asking for payment of $379 for expedited EIN processing and $239 for Standard processing. I thought it was free? Am I doing it wrong?

That means you were not on the IRS official website, but instead a “look-alike” website. We have the correct IRS links above on this page.

Hello, i was trying to apply online and i have itin number, on the identity check I put my name and last name and number but it dint recognize, i wanted to know if you know why, my last name is G… da S…. , it has spaces and usually last names here has no spaces and only one name, i was wondering if you know what i can do, my itin number is already done and paid two years of taxes so everything is right, and on the irs website my name is with spaces.

I’m not sure about this. I would try a few times and then call the IRS for assistance, or mail a letter.

HI Matt

I have 2 member LLC in MN and recently changes LLC name, Do i need to apply new EIN? Can I edit the LLC name on the IRS?

Hi Gaid, I apologize for our slow reply. No, you don’t apply for a new EIN. You just update the IRS with the new LLC name. We have instructions here: how to change your LLC name with the IRS.

This was AMAZING!! You answered every question I had and I just got my EIN number! Thanks for providing this video!! You should get paid for this… although I am glad it was free. haha.

Thanks Alisha! So happy to hear that! You’re very welcome :)

Hi Matt, I am applying for my EIN online and used Northwest as my registered agent to file my LLC which has been completed. The EIN application ask “where is your LLC physically located” and you have to put in a complete address. It then asks if you “have an address different from the physical where you want the mail to be sent.”

The first time I applied, I put my physical mailing address as my home address since I thought it would be associated with my SSN. The system said “unable to process at this time.” I tried it again and put in Northwest’s address since that is how the LLC was filed under their address and I got the same same message. “Unable to process at this time.”

Do you know what address I should be using or should I call the IRS help line? I am trying to figure out if it is something that I am entering incorrectly or if it may be a website issue. Thank you!

Hi Tanya, the EIN application wouldn’t get rejected due to an address. The IRS treats the address entered as a mailing address. It’s better to use your home address and not Northwest’s address. Did you get an EIN reference number?

Yes, I did Error/reference 101. I am really bummed out about this. I spoke to a rep at Northwest about this error message and she told me to mail in my application which will take up to 12 weeks! So I called and stayed on hold for over 1 hour to speak to the IRS directly about it. The IRS rep put me on hold did a search with my LLC info (w/Registered Agent info) and my name and SSN and could not figure out why I was unable to submit online successfully. She then told me my only choice now (since the system would not let me process successfully) is to do it be fax (and I should get a response by mid April) or by mail (and get a response my mid June). I paid the expedited fee with Northwest for my LLC formation/filing. I chose not to pay the $50 for them to submit my EIN for me since it was free and appeared to be a simple procedure. Now I am dealing with being at least 8 weeks out to get an EIN and I still need to get my state license and re-sellers permit before I can officially conduct business. Any insight or suggestions will be really appreciated. Thank you!

Hi Tanya, it’s a really bummer scenario for those that need to file SS-4 by mail or fax. The IRS is backed up because of the pandemic. Even if Northwest applied for the EIN for you, the same thing would have happened. I don’t know any way around it at this time.

Hi Matt

In the section to list your state located and state filed would the state located be the address I used on my LLC paperwork? (Filed in Wyoming. Used Tennessee address.)

What would I do in the case where it is a multiple member LLC and all members are in different, plus there is no physical location as it is a company operated online? Thinking we just use Tennessee as that member is the contact person for the LLC. Thank you for the great site!

Hi Jen, you’re welcome! The “state located” is where the LLC is physically located, where the primary business activities take place, or where the LLC records and paperwork are kept (I know, everyone will have copies). In your case, using Tennessee is fine. Hope that helps.

Hi Matt, Thanks loads for the tremendous amount of information you provide in the university and in the posts that you reply, this is A major tribute to the society, I personally think that the site is a must for every accountant.

My question is, I recently changed the members of my NJ LLC, that means I sold my ownership and interest in the LLC to another individual, the new owners tried to apply for an EIN but received an error message stating that the LLC already has an EIN, he therefore filled out an SS-4 form and outlined in paragraph 18 that this LLC received an EIN in the past.

for some reason I keep on redoing this but not receiving any response from them, what is the official route in such A matter.

Thank you I really appreciate it.

Hi Yes, thank you so much for your amazing comment. It’s truly appreciated! Since the LLC didn’t change (just the ownership did), the LLC doesn’t need a new EIN. The owner simply needs to change the EIN Responsible Party for LLC with IRS. Hope that helps :)

Attorney is trying to submit application for EIN, however submit button doesn’t display

Hi Marsha, we recommend exiting the application and trying again using a different web browser (example: Chrome, Firefox, or Safari). Hope that helps.

Hi Matt;

When I filled out form it asked if I owned a truck. I have an LLC for a trucking company. My question is : I said NO to owning a truck for my trucking company because I have not bought one yet, is this going to need to be changed when I purchase a truck ?

thanks

Hi Marcus, this only comes into affect if it’s a heavy truck. You can find more information here: IRS: Trucking Tax Center. If you do have to file Form 2290, we recommend working with an accountant. Hope that helps.

Hello,

I am filling out my IRS EIN application now and the system keeps removing the word “the” out of my LLC company name. My LLC was filed with Texas under The Virtual Advocate. Shouldn’t the IRS application retain the word “The?”

Thank you,

Karen Davia

Hi Karen, that’s totally okay. The IRS does this to “normalize” their records and for a thing called IRS Name Control. Your LLC’s legal name is still The Virtual Advocate LLC (or The Virtual Advocate, LLC). You can find more information here: IRS: How Your Name Control is Assigned. Hope that helps.

Do you have or hope to have any employees to file w2 in the next 12 months?

The answer is yes but i have no projected time. should i say no.

This is a partnership, not husband and wife.

Please advise

Hi Grace, it’s okay if you don’t know exactly when. If you’re pretty sure you’ll have employees (those you’ll pay a W-2 salary, not 1099 independent contractors) working for your LLC, then you can check off yes. This just gives the IRS a heads up to know you’ll be withholding payroll taxes for employees. If you don’t think you’ll hire W-2 employees within the next 12 months, you can select no.

This is What is Stated in the Notes

Due Date

Your Massachusetts Annual Report is due every year before your LLC’s anniversary date. You can find your LLC’s anniversary date by looking at the date your Certificate of Organization was approved.

Your first LLC Annual Report isn’t due until the year after your LLC is formed

So does this mean we have to do our Annual report 11/18/21(Birthd)date or 4/18/21 as advised

Please clarity

Grace

Hi Grace, if your Massachusetts LLC was approved on November 18, 2020, the first LLC Annual Report (filed with the Massachusetts Secretary of the Commonwealth) is due by November 18, 2021. Then it’s due every year going forward by November 18th. This is completely different than your LLC’s 1065 Partnership Return (filed with the IRS) that is due every year by March 15th. The first 1065 Partnership Return for your LLC needs to be filed by March 15, 2021.

Thanks, Matt. Well articulated. Thank You, Grace W.

You’re welcome Grace :)

I decided to move forward and put all addresses in Texas since that is where I will be receiving the mail and operating the actual business. However, I am afraid I made a mistake with the name. Because the trade name was not supposed to include the words LLC I got confused and I didn’t include it under the Legal name. So now is Heflin MH Park without LLC at the end. Is this very important do I need to cancel my request?

Hi Maqui, that part definitely confuses people. If the LLC doesn’t have a Trade Name (aka DBA, Doing Business As, Assumed Name, Fictitious Name) then nothing should be entered for the Trade Name.

However, in the “Legal name of LLC” field you want your LLC’s designator to be listed (LLC, L.L.C., etc). While you can change the name of your LLC with the IRS, it can take 2 months right now before you get a reply. It’s easier to just apply for a new EIN. And cancel the first EIN. Hope that helps :)

It helps a lot. I will be canceling the first EIN and I already applied for a new one. Thank you so much!

You’re welcome Maqui!

Hi Matt, It’s amazing how you continue to respond to everyone.

I have created an LLC with 4 other partners in Texas. We live here and receive mail in Texas. But the actual business is located in Alabama. Do I have to include the real business address even though we do not recieve any mail there?

Hi Maqui, thank you! When you say include the real business address, on which form are you referring to? What kind of business is the LLC doing in Alabama?

i Got this question and need help

I was applying for my EIN, Started a new LLC Business NOVEMBER 2020

I got this alert- The closing month of accounting year: DECEMBER (The closing month of the accounting year is defaulted to December due to your organization type. To change your closing month of the accounting year, complete Form 1128.)

Should i wait to apply for EIN until January 2021?

Please Advise

Hi Grace, the closing month of the accounting year is for taxes and bookkeeping. It doesn’t effect the date your LLC doesn’t into existence. Did you already form your LLC? If yes, is it a Single-Member LLC or Multi-Member LLC?

Thanks, Matt for the response

I already formed it, its a Multi-Member LLC

What was confusing me in the question above is if i get the EIN if i will be requested to File for December 2020 instead of 2021.

So i guess the meaning here is instead of filing in November 2021, i will be doing that in December 2021.

Is this correct?

Thank you in advance

Grace W

Hi Grace, you’re welcome :) No, that date is not about when to file, but rather the date the “tax year” ends. So the tax year will end on 12/31. Then, your LLC must file a 1065 Partnership Return (since your LLC is a Multi-Member LLC, it files federal taxes as if it were a Partnership) by March 15th, 2021 (and then every March going forward). Then you file your personal taxes (Form 1040) by April 15th, 2021 (and then every April going forward). Hope that helps.

Thank You Matt. I thought i file for the first time on the Birthday of the LLC.

It is not operational yet. So filing in March 2021 will be just months since registration. We registered Nov,18,2020.

Does March 18, 2020 still apply?

Please help clarify

Grace

Hi Grace, I believe you are confusing the annual federal tax filing requirements (with the IRS) with the LLC Annual Report (with the Massachusetts Secretary of the Commonwealth). They are separate filings.

You’ve answered a lot of questions that I initially had, but I’m still unclear on one question.

I am buying an existing business and changing the name, but it will be a few more months before everything is closed on and I actually move into the space to officially take over as owner. When I apply for my EIN for my LLC, do I use my physical address to register the new LLC name or the current address the existing business is operating from?

Hi Renee, you can use either address you’d like. The IRS isn’t very picky about the address used on the EIN application as it’s just considered a mailing address. Hope that helps.

Matt,

The Articles of Organization that I printed from the KS Secretary of State have a stamp indicating that they are a non-certified web copy. Do I need to get a certified copy from the State in order to open a bank account for the LLC I am creating?

Thanks

Hi Ty, you shouldn’t need a certified copy of your Articles of Organization in order to open an LLC bank account. A regular stamped and approved Articles of Organization is usually fine. Having said that, it’s a good idea to call the bank and double-check. Most banks don’t require a certified copy, however, there could be a few that do. When you call, ask to speak to the branch manager. Often, not everyone is familiar with all the LLC paperwork details. Hope that helps.

Hey Matt,

My LLC name is “MPR Enterprises, LLC” but the form says not to put LLC at the end, so I registered it as “MPR Enterprises” should I cancel?

also,

My address has a unit number, i entered it as –

Street / unit and number with “/” inbetween. Think this will cause issues?

thanks in advance,

regards

Hi Matthew, it sounds like you’re referring to the “Tell us about the LLC” step, where the IRS is asking for the legal name of LLC, trade name/DBA (if applicable), county, state, etc. It sounds like you just misread the instructions. It states “The trade name may not contain an ending such as ‘LLC’, ‘LC’, ‘PLLC’, ‘PA’, ‘Corp’, or ‘Inc’.” In the “Legal name of LLC” field, you should enter the full name of your LLC, including the ending (LLC, L.L.C., etc). The Trade name field should be left blank unless your LLC is also doing business under a fictitious name (aka DBA or Trade name). I don’t think the “/” will cause any issues, however, it’s not necessary. You can just enter the address like this: 123 Main Street Unit 12, for example. If the EIN was already issued, we recommend cancelling the EIN and applying for a new EIN. You can apply for a new EIN right away. You don’t have to wait for the initial EIN to be cancelled. Hope that helps.

Hi Matt. Just applied for a new EIN for my LLC and forgot to add LLC to the name. Is this a big deal and what can I do?

Hi Adriana, you’ll want the EIN to properly reflect the LLC and its full legal name. It’s an easy fix though. Just cancel the EIN and apply for another EIN. You can do them both at the same time. You don’t have to wait for the EIN cancellation to be processed. Hope that helps.

Hey Matt,

Thanks for all this info you’ve provided. Super super helpful.

I have a parent LLC in WY that owns a subsidiary in CA. There are two members. Two questions:

1) Do I need an EIN for both LLCs? (everything will flow to CA)

2) When applying for an EIN for the CA subsidiary, do I need to say there are one or two members since this entity is technically owned by one member (the WY LLC)? Meaning, in actuality there are two people in the company, but we operate through this structure for anonymity.

Hi Josh, you’re very welcome. Yes, each LLC needs its own EIN as they are separate legal entities. When applying for the EIN for the California LLC, you will enter 1 Member (owner) since it’s owned by the Wyoming LLC.

Okay good to know. I went ahead and did that. And when it asked for a responsible party I put my name as a “member/owner” rather than designated party. I’m guessing that’s correct? Even though my partner and I are not listed in the CA LLC docs as owners.

Hi Josh, that is correct. Either you or your partner will be the EIN Responsible Party for the LLC.

Thank you so much for making this step so easy! Great website and instructions. I just filed for my LLC in the state of Texas and am awaiting my certificate before proceeding with the EIN. THANKS!

Hi Christine, you’re very welcome! That’s fantastic to hear. Best wishes with your new business!

Hi Matt,

Excellent website! Very well written and loaded with a ton of detailed information.

We recently established a Multi-Member LLC in Ohio and have decided to elect to be taxed as a S-Corp. When completing the EIN request we should follow the steps to register as a Multi-Member LLC and upon receiving our EIN we then complete IRS Form 2553 to elect the S-Corp status. From what I gathered from your lessons is that establishing an EIN and electing to have the MMLLC taxed as a S-Corp are two separate processes. Am I understanding the process correctly?

Thank you in advance,

Dan

Hi Dan, thank you very much :) You are absolutely correct! You’ll first get an EIN for your LLC and after the EIN has been issued, you’ll separately submit a Form 2553 to request for your LLC to be taxed as an S-Corp. Hope that helps!

Hi Matt,

Thanks for such a quick response! Would you mind giving a brief explanation for when I would utilize Form 8832? The form instructions aren’t always clear and I just want to ensure I have a clear picture.

Thanks again,

Dan

You’re welcome Dan. It’s challenging to list out all the use cases, because there are many, but it’s a fairly open-ended question with not a lot of context. In short, it depends. There is some confusing in the LLC/S-Corp space because of this: back many years ago (not sure exactly how many) many accountants used to first have an LLC file an 8832 to elect for an LLC to be taxed as a Corporation. And then they’d file the 2553 to elect for that Corporation to be taxed as an S-Corporation. However, as per 26 CFR 301.7701-3, filing 2553 has the same effect as filing 8832 + 2553. Not sure if that helps at all. But in summary, there is still misinformation online about the need for the 8832 for an LLC electing to be taxed as an S-Corp (answer: it’s not needed). However, if an LLC revokes its S-Corp election, Form 8832 would be used. Hope that helps.

Hello Matt,

I’m trying to get an EIN and running into an error after submitting. The LLC was formed in Delaware and business is in California. Wondering if this is causing the issue. On the page where county and state of business and state of LLC formation info is entered it has California for business state and Delaware for LLC. IS this how it should be?

Thanks,

Matt

Hi Matt, that is likely not what is causing the error. Please see EIN Reference Numbers. That should help you troubleshoot the error message you are receiving. Hope that helps.

Thanks For the quick reply Matt!

It is a 109 error so will try again tomorrow. For the “Identity” question when it asks for where is the LLC physically located would I say Delaware (where it was formed) or California where the business address is?

Thanks again,

Matt

You’re welcome Matt! Yes, Error 109 is a “wait 24 hour” one and it’s fairly generic. If you do need to call the IRS, make sure to do so early in the morning (for shorter hold times) as we’re now entering peak filing season. For the “Identify” question, you can select California. Having said that, it wouldn’t have a material impact if you selected Delaware (unless this was a Qualified Joint Venture LLC). Later on in the EIN application, they’ll ask for state where the Articles of Organization, or equivalent (in your case the Certificate of Formation) was filed. Overall, the IRS is looking at the federal tax treatment of the LLC and from an address standpoint, they just want the most reliable address where they can send correspondence. Is your Delaware LLC registered as a foreign LLC in California? If not, it should be since it’s doing business in California. Your LLC will also need to file California Franchise Tax, Form 568, and may be responsible for other California filings as well. Hope that helps.

Matt. Great Q&A board. My wife and I created a LLC and obtained an EIN for it (online). I had intended on making this new LLC the sole member/owner/proprietor of a larger “ownership” LLC that will eventually be made up of our LLC and other smaller LLCs. Because the LLC I first created was online, I cannot apply for the “ownership” LLC’s EIN online. Both our LLC as well as the “ownership” LLC have been approved by the secretary of state’s website and have articles of incorporation. According to IRS instructions on filling out the SS-4 (to be faxed), 7-A and 7-B must be completed by an individual and not an entity. How do I properly complete the SS-4 for the “ownership” LLC when it’s sole member is also a LLC? Thank you.

Hi Matthew, thanks! The IRS did make some changes regarding the EIN responsible party. We have that info here: EIN responsible party for LLC. And we have instructions on SS-4 by mail or fax here: applying for LLC EIN with Form SS-4. Hope that helps!

Hi,

I just want to thank you for this site. This site is so cool and helpful. It’s made starting an LLC fun and uncumbersome.

John

Hey John, that’s so great to hear. Thank you! And you’re very welcome :)

Hi Matt,

I should have found this awesome site earlier. I made a mistake when applying for an EIN number online. I didn’t enter LLC in the legal name.

What is the best solution to add LLC in the legal name?

1. Applying for another EIN number again? (Is that okay to have 2 EIN numbers without using one of them?)

2. or Submitting Form to amend the legal name which takes for weeks?

3. Is there any way to cancel/remove the previous wrong legal name without LLC?

Sorry for the too many questions. but please help me fix this issue. If I had known this site, I wouldn’t have made any mistakes..

Thank you for your awesome site and help.

Warm regards,

Charlie

Hey Charlie, thanks for the kind words :) When you applied for your LLC’s EIN Number, on the first question (“What type of legal structure is applying for an EIN?“), did you select LLC or Sole Proprietor? If you selected LLC, and then later on the “Tell us about the LLC” page, you forgot to enter “LLC” in the “Legal name of LLC” box, then you can just send a letter to the IRS getting the name updated. Please see this page: how to change LLC name with IRS. You can mail that letter, adding “LLC” to your LLC’s name. Also, include a note that you forgot to enter “LLC” in the EIN Online Application. Also include a copy of your approved LLC’s state filing. Hope that helps!

thank you for the reply I can now comfortably get my EIN now

You’re welcome Lee!

Great content! Thanks so much for putting all of this together!

I have a question about my LLC. I jumped the gun on the first few steps on my small business as I was hoping to grow from a part-time to a full-time business. I got busy with my actual job and life, and never got around to getting my EIN or anything afterwards. I also haven’t actually done any business/performed any services since filing with my state to become an LLC.

I guess my question is: for tax purposes does the IRS expect me to pay taxes from the moment my state approved my LLC, from the moment I file my EIN, the moment I make money, something else?

Hey Steve, you’re welcome! No, the IRS doesn’t expect taxes just because there’s an EIN in place for an LLC. As the LLC owner, it’s your responsibility to report any income. Or, if there’s no income and you want to write off expenses, then you could also file in that case. But if there’s no income or expenses, credits, or deductions you want to take, you don’t have to file with the IRS until there is an obligation to do so. Aka, there is income to report. So there’s no harm in obtaining an EIN for your LLC. Hope that helps.

Oh My Goodness….this was AWESOME! Thank you….you could not have made this more simple…I really appreciate the STEP-BY-STEP instructions. So helpful and such a savings!!

I do have a question….not your fault! I left a letter out of the business name when filing for the EIN, however EIN was issued. I have the name correct in the Articles of Organization that I filed.

How to do I make the correction for my EIN?

Thanks again, Matt!

Hi Jerri, you’re very welcome :) Thank you for the awesome comment! Check out change LLC name with IRS. You can mail a letter to the IRS changing the name. I’d also include a note (or a second page) just letting them know you entered your LLC name incorrectly the first time and that’s why you’re changing the LLC name. Make sure to include a copy of your approved state forms. Hope that helps!

Hi Matt – while applying for LLC, It was just 1 member (myself). But now I am planning to include additional 2 members on operating agreement. Do I need to apply for new EIN or can continue to use an existing EIN and just need to make election during tax time?

Hi Sumeet, you don’t need to a new EIN, but you will need to file Form 8832 and change your tax election to Partnership. Unless you want the LLC to be taxed as an S-Corp or C-Corp. But if you’re just starting out, I’m guessing you meant Partnership taxation. You’ll also want to amend your state filing if Members are listed. Hope that helps.

I just wanted to say THANK YOU! You guys have helped me understand LLC world, making it easy to understand, well organized and helping us make it as affordable as possible. May God bless your good work!

A new LLC co-owner!

Hey Ana, that is lovely to hear! Congratulations! And you’re very welcome :)

I’m starting an LLC but currently, don’t own a physical address/ building for the business yet. Do I have to get a building before applying for my E.I.N.

Hi Lee, no, you don’t. You can use any mailing address you’d like when applying for an EIN for your LLC. Hope that helps.

Hi Matt,

I used Northwestern as company’s registered agent. For the part of the online EIN application that asks for the company’s physical address, should I put my home address (where I work from), or the registered agent’s address? I’m planning on moving soon this year. But I also normally use my home as a place of business and use it as a deduction on my taxes the last few years before the LLC formed.

Thanks for your help!

Alex

Hi Alex, for physical location, you can use where the business is actually located. After you move, you can update your address with the IRS using Form 8822-B. We have instructions here: how to change LLC address with IRS. Hope that’s helpful!

Hi Matt,

First of all I have to thank you for helping me to file my Certificate of Organization! The step by step guide is just Phenomenal!!!

On the other hand; I see that in the Certificate of Organization ther is an Entity Identification Number, so is that the same as EIN? So sorry if the question is silly; I just want to make sure that I am doing everything right.

Also; I have had my business as a sole propietor for a couple of years and now I just form my LLC, so at the time of completing the EIN application it asks “Why is the LLC requesting an EIN? Should I answer: “Change type of organization”.

Thank you so much!

Adriana

Hi Adriana, you’re very welcome :) No, the Entity Identification Number is a state-issued number. It’s different than the Employer Identification Number. Although I see now they both have the same abbreviation. Yea, that could be confusing lol! No, you’ll want to select “Limited Liability Company (LLC)” on the first step of the EIN Application, then “Started a new business” a few steps later. Hope that helps.

Hello.

I filled out an SS-4 to obtain an EIN for an LLC. On the application I mistakenly listed the LLC as 2 members and it should only be a 1 member LLC. In October I submitted, in writing, a request to the IRS to change the LLC to 1 member but have not had a response. Is making this change critical or not a big deal?

The IRS should respond to written requests within 30-45 days. Yes, you’ll want this updated since their systems are going expect a 1065 Partnership return to be filed. I’d call them this week and ask them to look into it. You want to get it squared away. 800-829-8933. They open at 7am. Call early for very quick response time. Hope that helps.

We have formed a 2 member LLC, I understand that we will be taxed as a partnership. When I go to the screen to apply as a partnership I noticed that we cannot add LLC to the name of the business. Will that be a problem when going to the bank to open an account as the LLC?

Hi Linda, you shouldn’t check off Partnership at that step. You should check off LLC. Then later it’ll ask for the number of members. That’s how the IRS knows to tax your LLC like a Partnership. If you applying incorrectly, you can apply for a new EIN then cancel the first EIN.

Hi Matt,

If I use a regesitered agent and I put my home address for LLC physical location, for county LLC located should I put the county of the registered agent or the county where I live?

Thank you!

Hi Melissa, I believe you’re filing in New York. You can put the county where you live in the EIN application. Hope that helps.

Hi Matt,

I assume this goes the other way: if I opt to put my registered agent as my mailing address, I should put the county of the registered agent?

I’ve also seen your comments about preferring to put home address for the “physical location” field. Given I am using Northwest Registered Agent, who can receive and scan my mail for me, is there any downside to me using their address for both physical location and mailing address when signing up for an EIN? I feel like using their address is better for a few reasons:

1. They are listed as my company’s entity address with the state I am registered in, so it would be consistent with my company’s registration and incorporation papers

2. I currently rent my house and am likely to move in the next year or 2. Using my registered agent’s address would also allow me to move freely without having to change my address with the IRS

3. I’d prefer not to receive any type of business correspondence at home.

Thanks!

Hi Mike, yes, you can use their county location. Typically, Northwest doesn’t want IRS mail, however, they will still scan and send it to you. So your point #2 and #3 are valid. Point #1 doesn’t matter too much. An LLC can have multiple addresses. And the IRS just treats the address as a mailing address. Hope that helps.

Hello! I just filed article of organization and now applying an EIN number. But when I finished all the detailed questions, it is shown:“DECEMBER (The closing month of the accounting year is defaulted to December due to your organization type. To change your closing month of accounting year, complete Form 1128.)” Since I started my LLC legally in December, but not any action yet. Should I fill the form1128? or since there is not any activities in my LLC, should I just ignore it?

Hi Holly, for accounting and tax purposes, having an LLC run on the calendar year (Jan – Dec) is the most common setup. You may be confusing this and the LLC effective date, but I can’t tell exactly by your question. You don’t need to file Form 1128 unless you want your LLC to run on a fiscal year (instead of a calendar year). Hope that helps.

Sorry I didn’t follow directions properly. I omitted the LLC at the end of my business name. Is there a way to correct that? Thank you.

Hi Monique, while you can change an LLC name with the IRS, it’ll take months before you get a response (delays are due to the pandemic). It’s much easier to apply for another EIN. And you can cancel/deactivate the first EIN. You can apply for the new EIN before the cancellation is filed. Hope that helps.

Hey Matt;

I was walking thought he UTAH business registration site and it says I need the EIN before I can complete my LLC registration. In your video you recommend completing the state process 1st. I know you have not done a UTAH tutorial yet, but any thoughts on this. Considering my fairly unique LLC naming, I’m pretty confident I can take the chance on timing but wanted to get your thoughts.

Thanks again for all the great info!

Hi Todd, looks like Utah’s LLC filing is a “one-stop” process. We haven’t done a deep dive yet, but they usually form your LLC and register it with other state agencies. In the case of the Utah, that’s the Utah State Tax Commission, the Utah Labor Commission, the Utah Department of Commerce, the Utah Department of Workforce Services, and the Utah Department of Environmental Quality (if applicable). This is why they may be asking for the EIN (but I’m not sure if it’s required). You can do as you suggest… apply for the EIN first and hope the LLC goes through later. If there’s an issue, just cancel the EIN and then get another one. Hope that helps!

Thanks Matt…all good!

Hello Matt!

I filed an LLC in my state of Colorado with the a period “.” in the name. I see that this punctuation is not accepted by the IRS when applying for the EIN #. Will it be a problem that my LLC in Colorado has the period “.” in the name, but the EIN does not?

Thanks in advance for your help!

Jason

Hey Jason, short answer is no, it won’t be a problem. It’s not the IRS doesn’t accept them. More technically, they “normalize” they records by ignoring/disregarding/removing it. Most of my LLCs have the comma on the state filing, but my EIN Confirmation Letters don’t show them. It’s super common. Hope that helps!

I have an LLC and using a Commercial Registered Agent’s address. When completing my application for my EIN do I use the address for the Registered Agent or my actual home address? I would much rather use the Registered Agent address, but I don’t want to complete the application wrong.

Hi Su, you’ll want to use the best mailing address for your LLC. For many people, that is likely their home address. Some Commercial Registered Agents, like Northwest Registered Agent, will let you use their address here and then they’ll scan your mail. If you’re using a different Commercial Registered Agent, you’ll want to check with them ahead of time. Hope that helps.

Can I add a DBA later on to my LLC after getting an EIN to the EIN? Or is it just attached to my LLC so it won’t matter?

Hi Umar, correct, it doesn’t matter since the DBA is a “nickname” for your LLC. If your LLC had 20 DBAs, all taxes “flow” to the LLC since all those DBAs are again, just “nicknames” for the LLC. You can create a DBA owned by your LLC at anytime in the future. Hope that helps.

Matt,

Thank you for providing this great content. I am a software developer, and I have just branched out on my own as a private contractor. Your site has been an invaluable resource.

I had a question about my application for EIN that you might be able to answer:

On the question,“Do you provide operating advice and assistance to businesses and other organizations?” I selected, “Yes.” But, after further reading, I believe I should have selected, “No.” Is this something that I can ammend? Is there any reason to do so?

Hey Tiffany, you’re very welcome! It’s not a big deal. There isn’t really an easy way to amend the EIN application. Instead, you could cancel the EIN and then apply for another one. Hope that helps.

Thank you so much for your help. Really appreciate your effort.

You’re very welcome David :)

Hi Matt, the newly registered LLC company has the same member just my wife and I and everything stays the same. It has the same name, same members, and everything else is the same. The only difference I can see is the registered date. I just want to get a second opinion. Thank you very much

Hi Dave, we researched this further and also spoke to the IRS. First, did you file ‘final’ Partnership 1065 returns for years after the LLC was dissolved (I’m assuming 2016 and 2017)? If not, make sure you get that done (even if “zeroed out” returns) since the IRS will be looking for them. The IRS’s rule is this: since you filed a new Articles of Organization you should obtain a new EIN. However, if you use the online EIN application, you’ll get an error/reference number (it won’t work) since the identical LLC name is already linked to your SSN as the Responsible Party. So you’ll need to apply for your EIN with Form SS-4. However, if you don’t property notify the IRS, they’re just going to send you confirmation of your existing EIN (since they won’t recognize that the LLC is new). So, in addition to the SS-4, also send the IRS a copy of your new LLC’s stamped and approved Articles of Organization as well as letter explaining the situation. You can fax it to 855-641-6935 or mail it to: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999. The IRS will then send you a new EIN by mail or fax. Fax is about 4-7 business days. By mail is about 4-5 weeks. Hope that helps.

Hello Matt, I formed a LLC company several years ago in Hawaii. It was dissolved less than 2 years ago. And now I was able to re-register the LLC with the same name again recently and got approved. So my question is that do I need a new tax ID or can I use the same tax ID from before when I first form the LLC company ? Any advise will be very much appreciated. Thank you in advance.

Hi David, this is an interesting question. I’m not immediately sure about the answer to this. My guess it comes down to is this the same company or is this a new company with the same name? Also is the ownership of the company different now? I believe that’s what the IRS would be most concerned about. Has the business purpose changed? I also recommend running this question by a few accountants.

At the step of EIN applying process Where is the LLC physically located? There is a note says: Must be a U.S. address. As an LLC formed by a foreigner, how could the fields be filled?

Hey Frank, what state did you form your LLC in? Where is your Registered Agent address? Did you hire a Commercial Registered Agent? If so, which company? And do you have an ITIN? If not, you won’t be able to submit the EIN application online, but instead will need to mail or fax Form SS-4 to the IRS. You don’t need an SSN or ITIN to get an EIN for your LLC. We have instructions here for foreigners: how to get an EIN as a foreigner (no SSN). Hope that helps!

Hi Matt, I formed an LLC in Delaware and I hired HBS did the job. I’m going to apply an ITIN online. When I took a look at your video, I found there is a need for information of Where is the LLC physically located. In my case, what should I fill that field? Thanks

Hey Frank, thanks for the info. What address is listed as your registered office (“Second”) in your Delaware LLC Certificate of Formation?

Hi Matt, it’s an address in Delaware. It says like this, is located at xxxxxx Coastal Highway, Lewes, Delaware 199xx.

Hi Frank, if you’re able to go through the EIN application online (many filers with ITINs get an EIN error message) you’ll use this address for where the LLC is physically located, but check off that your LLC has a different mailing address and enter your address in your country of residence. If filing SS-4 by mail or fax, you can just enter your mailing address located in your country of residence in 4a and 4b, and then for 6, enter “Sussex County, Delaware”. Hope that helps.

Hi Matt, thank you for your prompt reply. I’d like to go along with your instructions to get ITINs and EIN. I’ll post here about what I come with.

Sounds good. You’re welcome Frank :)

Hi Matt, I have just received the fax with EIN on it from IRS. Since I have no SSN or ITINs as a foreigner I have to fill SS-4 form and then faxed it to IRS according to your instructions. IRS has a statement on its web site says you can receive your EIN by fax generally within 4 business days but it’s not true, I received mine at seventh day. It’s not too bad though.

Thanks again for your helpful information.

Hi Frank, thanks for your helpful comment. Yes, often when submitting an EIN as a foreigner, approval times can take longer. We’ll make sure to update this page with more details about that. Also, we’ll be making a separate instructional page just for foreigners, so we’ll make sure to include it there as well. Thanks again! *UPDATE* Here’s the new instructions for anyone else reading: how to get an EIN for your LLC without an SSN or ITIN.

What is the importance of waiting for the LLC approval before applying for the EIN? Is it just in case there is an issue with the filing?

Btw, I have a tip for you in regards to filing in Iowa. You can receive an expedited filing (currently standard wait time is over 3 weeks for filings made by fax/mail/online). if you file in person AND request that the filing be expedited it can be expedited which is 2-3 days currently.

Great site – thanks for having it!

Nevermind, I actually watched the video and I now understand why the advice is to wait on the filing before applying.

Awesome, glad to hear! Thanks for notes on Iowa! Sometimes we leave out the in-person expedited information so we don’t make our content too long and confusing (since not everyone is close enough to file in person and we don’t get asked that much)… however, we’ll think about adding it back in. Thanks for the feedback JD!

The information entered in a articles of incorporation form is public, you can pull up an entity’s completed forms on a secretary of state website. In that same way, can you pull up a copy of a completed EIN form for a given entity?

Hey Jake, great question. No, the information you submit to the IRS is private. It does not go on public record.