Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Kansas Articles of Organization

In this lesson, we will walk you through filing your Articles of Organization with the state. This is the document that officially forms your Kansas LLC.

In this lesson, we will walk you through filing your Articles of Organization with the state. This is the document that officially forms your Kansas LLC.

You can file your Kansas Articles of Organization by mail or online, and we have step-by-step instructions below for both.

If you file by mail, the state filing fee is $165 and the approval time is 2-3 business days (plus mail time).

If you file online, the state filing fee is $160 and filings are approved immediately.

We recommend filing online because it’s cheaper and the approval time is much faster.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Kansas.

(Kansas Secretary of State, Business Filing Center Building)

Or, you can hire a company to form your LLC instead. We’ve compared the best in the industry for you in Best LLC Services in Kansas, and our favorite is Northwest Registered Agent.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

How to file Kansas Articles of Organization by Mail

Form: Download the Articles of Organization form: Kansas LLC Articles of Organization (DL 51-09).

Payment: Prepare a check or money order for $165, made payable to “Secretary of State”.

Mail: Send your completed Articles of Organization and $165 filing fee to:

Secretary of State

Memorial Hall, 1st Floor

120 SW 10th Avenue

Topeka, KS 66612-1594

Approval: The Kansas Secretary of State will process and approve your LLC within 2-3 business days (plus mail time).

You’ll receive the following documents by mail:

- a Welcome Letter

- a Certified Copy of your Articles of Organization

How to file Kansas Articles of Organization Online

Tip: The state’s online filing system doesn’t have a back button. Make sure any information you enter is correct. If you make an error, you’ll have to start at the beginning again.

Register for KanAccess & get started

- Go to KanAccess: Sign In and click the “Sign Up” button.

- Enter your contact information and create a password. Then click “Sign Up“.

- The state will send you an email with an activation link. Check your email. Then click the activation link. You will be redirected to a KanAccess success page.

- Click “the next step” link to proceed.

You can ignore the “Kansas.gov subscriber” check box (unless you have an account already).

Note: If “the next step” link doesn’t appear, click this link: KanAccess Sign-in

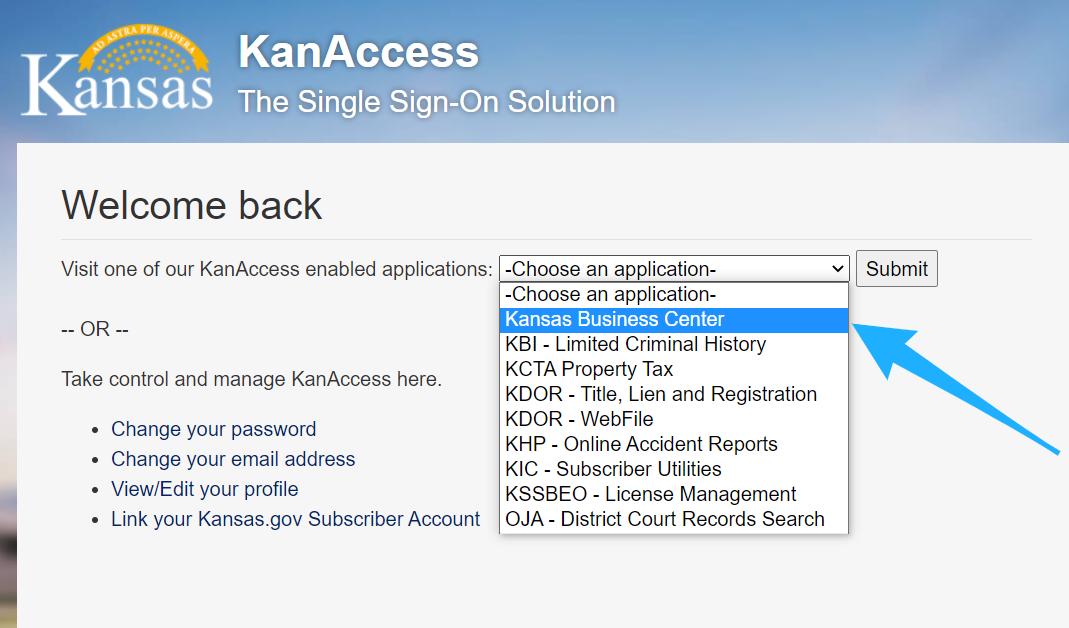

You’ll see a drop down menu in the center of the page. Select “Kansas Business Center” and click “Submit“.

Complete your Articles of Organization Online

On the left, click “Kansas Business Entity Formation“.

At the bottom of the page, select “Kansas limited liability company“.

LLC Name

The next page’s layout is a little confusing. The system is asking whether or not you reserved a business name ahead of time (which isn’t required, so don’t worry!).

Most of our readers have not reserved an LLC name ahead of time.

If that’s the case, under the “Name not reserved?” box (on the left), enter your LLC name exactly as you would like it, including your preferred capitalization, as well as the designator “LLC” or “L.L.C.” and then click “Continue“.

Note: You can use a comma in your LLC name or you can leave it out. Ex: “ABC Widgets, LLC” and “ABC Widgets LLC” are both acceptable.

On the next page you should see a message that your name “is available.” Click “Continue” to proceed.

Tip: If the “not available” message appears, it means your LLC name is not distinguishable or unique enough from other to be approved. You’ll need to come up with a variation or a new LLC name.

If you receive a “not available” message or you haven’t read our LLC name lesson, please check out this important information about searching your Kansas LLC name.

Select a Resident Agent

- Related reading:

- What is a Kansas LLC Registered Agent?

- Is a Registered Agent a Member of an LLC?

In the drop down list, choose your LLC’s Resident Agent (aka Registered Agent) type.

If your LLC’s Registered Agent is an individual, select “An individual in Kansas” from the drop down and click “Continue”.

Use this option if you, one of your business partners, or a friend or family member will be the Registered Agent. On the next page, enter their first and last name, then click “Continue” again.

If your LLC’s Registered Agent is your LLC itself, select “The business entity you are currently forming” from the drop down and click “Continue”. On the next page, click “Continue” again.

If you hired a Commercial Registered Agent, select “Registered business entity” from the drop down list and click “Continue”.

On the next page, enter the exact name of the Commercial Registered Agent you hired, and click “Continue”.

Then on the next page, select your Commercial Registered Agent from the list and click “Continue” again.

Tip: If you’re not sure of the full business name of your Commercial Registered Agent, go to this Business Entity Search page. Click “By resident agent name.” Enter your Commercial Registered Agent’s name in the box and then click “Search”. Use the full name you see under the “Resident Agent” column.

If you hired Northwest Registered Agent, their official name in Kansas is Northwest Registered Agent LLC.

Registered Office in Kansas

Enter the street address (must be located in Kansas) of your LLC’s Resident Agent and then click “Continue”. PO boxes aren’t allowed.

Official Mail

Tip: This address will be used by the Kansas Secretary of State to send you reminders about filing deadlines and other state notices. It does not have to be an address in Kansas, and it could be a PO Box.

Select the first option if you want your LLC’s official mail sent to your Registered Agent’s address. This is a good option to choose if the Registered Agent’s address was your address or the address of one of your business partners.

Select the second option if you want your LLC’s official mail sent to an address other than the address of your Registered Agent. Then enter the alternative address on the next page.

Select Organizer

Note: The LLC Organizer is the person, or company, submitting the Articles of Organization to the state. To learn more, check out: LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer.

Select whether your LLC’s Organizer is an individual or a business from the drop down menu, then click “Continue“.

If you’re forming your own LLC you should select “Individual.”

On the next page, enter the Organizer’s name and click “Continue“. You are only required to enter 1 Organizer.

That said, you can click “Add Additional” if you want to add more than one Organizer.

When you’re finished, click “Continue” to proceed.

Review, Edit, and Confirm

Click the “Show Preview” button to see the information you entered. Review everything for accuracy and check for typos.

If you need to make any changes, click on the information that needs to be updated (it should appear as clickable links).

If no changes are needed, click the “Continue” button.

Notification Emails

Enter at least 1 email address. You can enter up to 4 email addresses of those you want to be notified of any notices related to your LLC (you are only required to list 1 email).

Then enter your full name in the “Signature” box and click “I Agree“. Then on the next page, click “Continue to Checkout“.

Signature Page

If you are the Organizer for your LLC, electronically sign your name by entering it in the box. Then click “I agree“.

Additional Information

There is nothing to enter on this page. The state is just letting you know which documents you can save in the next step. Click “Continue to Checkout“.

Shopping Cart

Click the “Pay by Credit Card” button.

Check Out

Enter your contact and billing information on the next page, and submit your filing to the state.

Congratulations, your Kansas LLC has been filed for processing! Now you just need to wait for the Secretary of State to approve your LLC.

Approval

Wait a few minutes for the Kansas Secretary of State to process and approve your LLC.

Once approved, the state will email you a Welcome Letter and a Certified Copy of your Articles of Organization.

You’ll use your Certified Copy of your Articles of Organization and your Federal Tax ID Number to open a business bank account for your LLC (we’ll discuss this in a later lesson).

Kansas Secretary of State Contact Info

If you have any questions, you can contact the Kansas Secretary of State at 785-296-4564.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Kansas LLC Articles of Organization FAQs

How much does an LLC cost in Kansas?

Kansas LLC Costs include:

$160 to form your Kansas LLC (to file your LLC Articles of Organization).

$50 in annual fees (to file your LLC Annual Report).

Is an LLC a Business License?

No, an LLC isn’t a business license. They are two completely different things.

An LLC is a type of business structure created by filing a document with the state government.

And a business license is a document that gives a person, or a company, the right to transact business. It doesn’t create a business structure.

Does Kansas require a Business License?

Kansas doesn’t have a state-level general business license.

That said your LLC may need local Kansas Business Licenses and Permits depending on your industry and where your LLC is located.

References

Kansas.gov: FAQs

Kansas LLC Act: Chapter 17 Article 76

Kansas Business Center: Business Entity Filing

Kansas LLC Act: 17-7673 Articles of Organization

Kansas LLC Act: 17-7668 Nature of Business Permitted

Kansas LLC Act: 17-7904 Filings Related to Limited Liability Companies

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

What about when you are looking to withdraw from an LLC that doesn’t have an operating agreement? (We never came to an agreement on an OA but one of the members wants to keep the business name)

Hi Rob, we’d recommend speaking to an attorney to properly document the transfer of your LLC membership interest and you withdrawing as a member. Hope that helps.

To add a member to existing LLC in the state of Kansas do I have to file with the state secretaries office or is this just a simple amendment I can do

Hi Jason, you don’t have to amend the Articles of Organization with the state, since it doesn’t ask for LLC Member info. However, you would need to amend the Operating Agreement and you may want to create an Assignment of Membership Interest Agreement. You may also need to update the Department of Revenue. And if adding an LLC Member changes the tax classification of the LLC, then the IRS will need to be updated too. Hope that helps.