Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

To start an LLC in Kansas, file Articles of Organization with the Kansas Secretary of State. This costs $160 and takes 1 day for approval.

There are 5 steps to follow:

There are 5 steps to follow:

- Choose an LLC Name

- Select a Registered Agent

- File Articles of Organization

- Create an Operating Agreement

- Get an EIN

If you want to form your LLC yourself, follow our free guide below.

If you want someone to take care of it for you, we recommend hiring Northwest Registered Agent

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(We recommend Northwest. We've reviewed all the top companies in the industry. And Northwest is our #1 pick for prices, customer support, and address privacy. Check out Northwest vs LegalZoom to learn more.)

How much does it cost to start an LLC in Kansas?

It costs $160 to start an LLC. And then it costs $50 per year.

What are these fees for?

- The $160 is to file the Articles of Organization – the document that creates an LLC.

- The $50 per year is for your Annual Report – a mandatory filing that keeps your LLC in good standing.

To learn more about LLC Costs, see LLC Costs in Kansas.

How long does it take to get an LLC in Kansas?

If you file your LLC by mail, it will be approved in 2-3 business days (plus mail time).

But if you file online, your LLC will be approved immediately.

Please see How long does it take to get an LLC in Kansas to check for any delays.

Here are the steps to forming an LLC

1. Search your LLC Name

Search your LLC Name to make sure it’s available in the state.

Search your LLC Name to make sure it’s available in the state.

You need to do this because two businesses in the state can’t have the same name.

First, search your business name and compare it to existing businesses in the state. You can make sure the LLC Name you want is unique from existing businesses using the Kansas Business Center: Name Availability Status.

Second, familiarize yourself with the state’s naming rules (so your LLC gets approved).

We’ll explain both in more detail here: Kansas LLC Name.

2. Choose a Registered Agent

The next step is to choose a Registered Agent.

A Kansas LLC Registered Agent is a person or company who accepts legal mail and state notices on behalf of your Limited Liability Company.

A Kansas LLC Registered Agent is a person or company who accepts legal mail and state notices on behalf of your Limited Liability Company.

Note: In Kansas, a Registered Agent is also called a Resident Agent. We may use either term.

Who can be an LLC Resident Agent?

You have 3 options for who can be the Resident Agent:

- You

- A friend or family member

- A Registered Agent Service

The Resident Agent for your LLC must have a physical street address in Kansas. PO Boxes aren’t allowed.

And the Resident Agent’s name and address will be listed on public records.

If you don’t have an address in Kansas, or you want more privacy, you can hire a Registered Agent Service for your LLC.

We recommend Northwest Registered Agent

Our favorite feature about Northwest is they’ll let you use their office address throughout your LLC filing. This way, you can keep your address off public records.

They’ll also scan any mail sent to your LLC and upload it to your online account.

Northwest has excellent customer service, and they’re who we trust to be our own Registered Agent.

Special offer: Hire Northwest to form your LLC ($39 + state fee), and you'll get a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

3. File Articles of Organization

To start an LLC, you need to file Articles of Organization with the Kansas Secretary of State.

To start an LLC, you need to file Articles of Organization with the Kansas Secretary of State.

The Articles of Organization costs $160 if you file online.

This is a one-time fee to create your LLC.

If you want to file this yourself, see our step-by-step guide: Kansas Articles of Organization.

Or, you can hire a company to do it for you.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

4. Create an Operating Agreement

An Operating Agreement serves as a “companion” document to the Articles of Organization.

An Operating Agreement serves as a “companion” document to the Articles of Organization.

The Articles of Organization creates your LLC, and the Operating Agreement shows who owns the LLC.

Additionally, some banks require an Operating Agreement when you open an LLC bank account.

And having an Operating Agreement will be very helpful if you ever end up in court. Reason being, it helps prove that your LLC is being run properly.

That’s why we recommend that all LLCs have an Operating Agreement – including Single-Member LLCs.

Furthermore, an Operating Agreement is an “internal document“. Meaning, you don’t need to file it with the state or the IRS (Internal Revenue Service). Just keep a copy with your business records.

You can download a free template below.

Then, learn how to fill it out by watching our step-by-step Kansas Operating Agreement video.

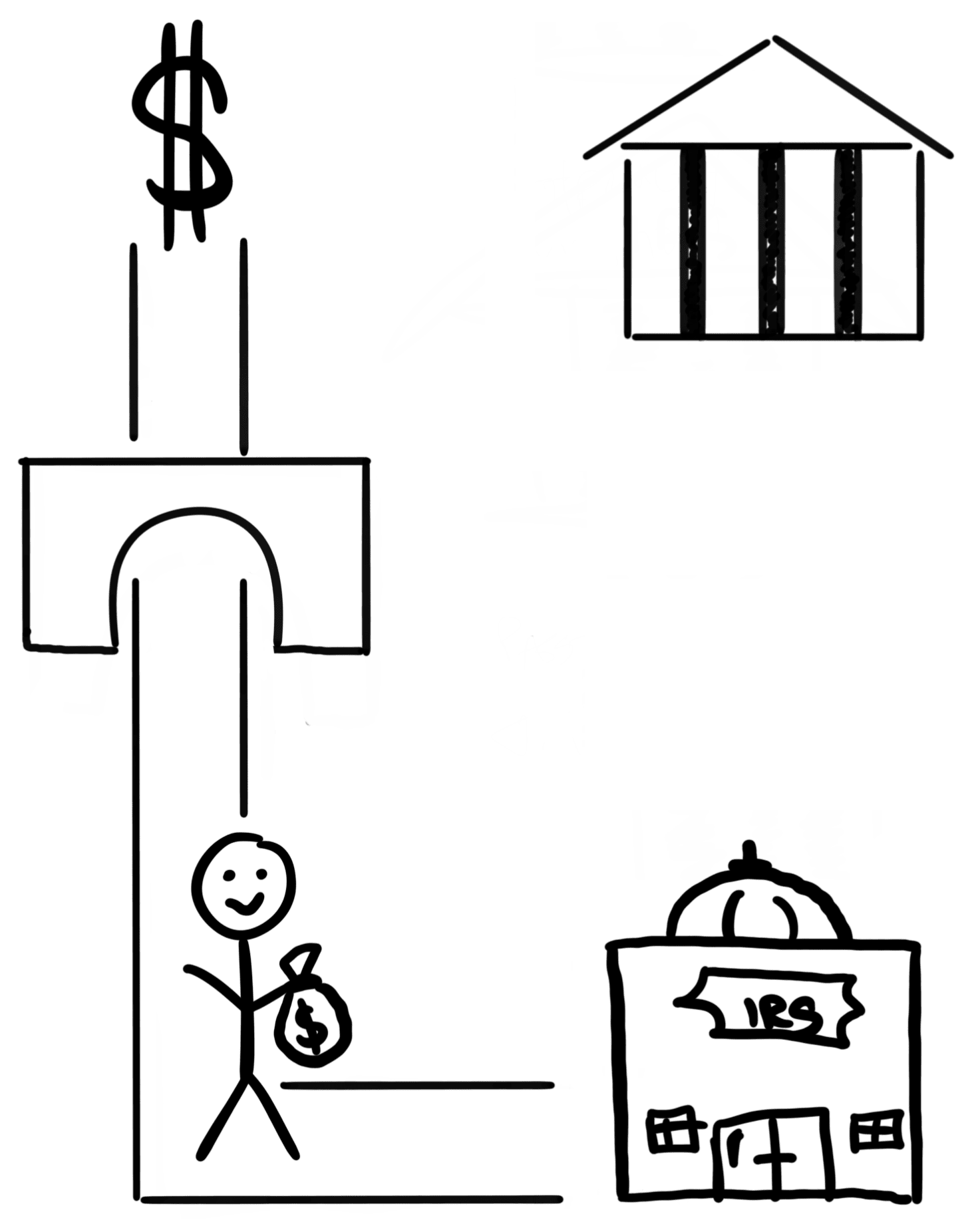

5. Get an EIN for your LLC

The next step is to get a Kansas EIN Number from the IRS for your LLC.

Note: An EIN Number is also called a Federal Tax ID Number or Federal Employer Identification Number.

An EIN Number is used to:

An EIN Number is used to:

- identify your LLC for tax purposes

- open a business bank account

- apply for business licenses and permits

How much does an EIN cost?

Getting an EIN Number from the IRS is completely free.

How long does it take to get an EIN?

If you apply online, it takes 15 minutes.

If you apply by mail or fax, it can take 1-3 months.

How can I get an EIN?

US Citizens/US Residents: If you have an SSN or ITIN, you can apply for an EIN online. Follow these instructions: Apply for an EIN online.

Non-US Residents: You can’t get an EIN online, but you can still get one by fax or by mail. Follow these instructions: How to get an EIN without an SSN or ITIN.

What do I do after my LLC is approved?

After your LLC is approved, there are some additional steps.

Open an LLC business bank account

You’ll want to open a business bank account for your LLC.

This makes accounting and record-keeping much easier for your business finances.

Having a separate business bank account also maintains your personal liability protection. This is because it keeps your business entity finances separate from your personal finances.

Get business licenses and permits

Good news, Kansas doesn’t have a state general business license.

Good news, Kansas doesn’t have a state general business license.

However, depending on where your LLC is located, you may need a local business license or permit.

For example, if you want to start a daycare, you may need a business license from the city or county.

You can learn more on our Kansas Business License page.

File your LLC Annual Report

All Kansas LLCs must file an Annual Report every year.

All Kansas LLCs must file an Annual Report every year.

The Annual Report keeps your LLC in good standing with the state.

How much does a Kansas Annual Report cost?

The LLC Annual Report filing fee is $50 per year.

When is the Annual Report due?

Annual Reports are due every year on the 15th day of the 4th month following the tax closing month.

For example, if your 2025 tax closing month is December (which it is for most people), then your Annual Report due date is April 15th, 2026.

When is my first Annual Report due?

Your first Annual Report is due the year after your LLC was approved.

For example, if your LLC is approved on February 2, 2025, your first Annual Report is due by April 15, 2026.

How do I file my LLC Annual Report?

You can file your LLC’s Annual Report online or by mail. We recommend the online filing because it’s easier to complete.

Follow our step-by-step guide here: Kansas LLC Annual Report.

File and pay taxes

LLCs don’t pay federal taxes. Instead, the LLC Members pay the taxes for the LLC.

Said another way, the owners pay taxes for the LLC as a part of their personal tax return.

How will my LLC be taxed?

By default, an LLC is taxed by the IRS based on the number of owners your LLC has:

- A Single-Member LLC is taxed like a Sole Proprietorship.

- A Multi-Member LLC is taxed like a Partnership.

Alternatively, you can ask the IRS to tax your LLC like a C-Corporation or S-Corporation.

Besides federal taxes, there are also state and local income taxes – and sales tax. Learn more in Kansas LLC Taxes.

How to Start an LLC in Kansas FAQs

Can I start an LLC online in Kansas?

Yes, you can file your LLC online. The Articles of Organization filing fee is $160.

When you start your LLC online, it will be approved immediately.

What are the benefits of an LLC?

The first benefit of an LLC is protecting your personal assets. Meaning, if your business is sued, your personal assets – like your home, cars, and bank accounts – are protected.

This protection applies to every LLC owner (called an LLC Member). It doesn’t matter if you have a Single-Member LLC or Multi-Member LLC. All of the LLC owners are protected from the business debts and liabilities.

This type of protection wouldn’t apply if you operate as a Sole Proprietorship or Partnership. With these types of informal business structures, the owners aren’t protected in the event of a lawsuit. For that reason, Limited Liability Companies (LLCs) are a much more popular business structure.

Another benefit is LLC pass-through taxation. This means the LLC itself doesn’t pay federal income taxes. Instead, the profits “pass through” to the LLC Members. And the Members pay the taxes on their personal tax return.

Another benefit is LLC pass-through taxation. This means the LLC itself doesn’t pay federal income taxes. Instead, the profits “pass through” to the LLC Members. And the Members pay the taxes on their personal tax return.

And state income taxes are very similar. This is because the Kansas Department of Revenue honors the federal tax treatment of your LLC.

To learn more, please see How are LLCs taxed.

Is Kansas a good state to start an LLC?

Whether Kansas is a good state to start an LLC depends on where you live – and where you’re doing business.

Meaning, if you live in or do business in Kansas, then you should start your LLC there. While many websites talk about tax rates and advantages of certain states, none of that applies if it’s not the state where you live and do business.

For example, if you form an LLC in Wyoming, but live in and conduct business in Kansas, you’ll also need to register your Wyoming LLC in Kansas (and pay extra fees). And you’ll end up paying Kansas taxes anyway. This ends up leading to more costs and more headaches with no advantages.

In summary, if you live in and conduct business in Kansas, then yes, it’s a good state to start a business. If you don’t live in and do business in Kansas, then no, it isn’t a good state to start a business.

Real estate exception: If you’re purchasing real estate outside of Kansas, you should form your LLC in the state where the property is located.

For more information, please see Best State to Form an LLC.

References

Kansas.gov: FAQs

Kansas Secretary of State: Business Services

Kansas Business One Stop: Business Starter Kit

Kansas Secretary of State: Business Entity Search

Kansas Dept. of Revenue: Business Registration FAQs

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi. I have a house in a LLC. I am the only agent of the LLC and the house is the only reason I have the LLC. I would like to transfer to house to my name and then terminate the LLC. Is it as easy as a Quit Claim deed from the LLC to me? One time I filed a TOD to someone (he has since died) and my lawyer said nope, that wouldn’t have worked. Thank you for your assistance.

Hi Belinda, yes, you can transfer the house from your LLC to yourself (using a Warranty Deed or Quit Claim Deed). You can work with a local title company and/or real estate attorney for assistance. Hope that helps.

Hi Matt,

Im forming an LLC in Kansas and one in Missouri. Do you have instructions or a sample package of what documents are needed to keep both LLCs in compliance? to keep the corporate veil in compliance. Thanks.

Hi Mac, you can keep the Kansas LLC in compliance with the Secretary of State by filing the Kansas LLC Annual Report. Missouri LLCs don’t have an Annual Report with the Secretary of State. It’s a good idea to work with an accountant to file your taxes properly, however, that doesn’t really impact the corporate veil. The corporate veil remains in tact by not committing fraud or doing anything illegal. Additionally, make sure to open an LLC bank account for each LLC and treat the LLCs as separate entities (ex: don’t commingle money).

I’m trying to start a small business and I got my Kansas tax ID number and I want to be LLC what steps do I need to take and I already have my company name and I still be able to use that

Hi Joshua, if you follow the “Detailed Lessons” links at the top of this page, it’ll walk you through how to form an LLC in Kansas. After your LLC is approved, you’ll apply for an EIN from the IRS. Then you’ll need a new Kansas Tax ID Number. The one you have now is attached to you personally as a Sole Proprietorship (please see Sole Proprietorship vs LLC). If by company name you mean a DBA (Doing Business As), yes, you’ll be able to use that same name for your LLC (with “LLC” at the end). Hope that helps.

My Son in law and I are starting a snow removal and lawn mowing business. I went on line and got an EIN Number. I think i got the cart before the horse. We want to form an LLC, and I did not put LLC in the name of the business. What do I need to do next?

Hey Kent, just cancel the EIN, then form an LLC and wait for it to be approved. After your Kansas LLC is approved, then apply for an EIN using the instructions we’ve provided in our lesson. I recommend following our Kansas LLC lessons in order. Hope that helps!