Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through starting a Montana LLC by filing your Montana Articles of Organization with the Secretary of State.

This is the document that officially forms your Montana LLC, and it can only be filed online.

100% digital: The Montana Secretary of State has gone completely digital to make the LLC formation process easier. Everything is filed online.

If you don’t want to file your LLC paperwork online, your other option is to hire a company to form your LLC. To learn more about this option, check out Best LLC Services in Montana for our recommendations.

How much does it cost to get an LLC in Montana?

The Montana LLC filing fee is $35. This is a one-time payment.

How much is an LLC in Montana explains all of the fees you’ll pay, including the Articles of Organization filing fee.

How long does it take to get an LLC in Montana?

Your Montana LLC will be approved in 5-6 business days.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Montana.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Expedited processing: You also have the option to pay for a faster LLC review time. There are two options:

- If you pay an extra $20, the state will process your filing in 24 hours.

- If you pay an extra $100, the state will process your filing in 1 hour.

And once your LLC is approved, the state will email you back:

- Articles of Organization (stamped and approved)

- Articles of Filing

Instructions for Montana LLC Articles of Organization Online Filing

In 2022, the Montana Secretary of State started using a new online filing system. The old system was called ePass. It was replaced by the SOS Enterprise Online Filing Portal.

Our instructions are up-to-date and will guide you through the current process. Please leave us a comment if you encounter any issues with our lesson.

Create a Montana SOS Enterprise Account

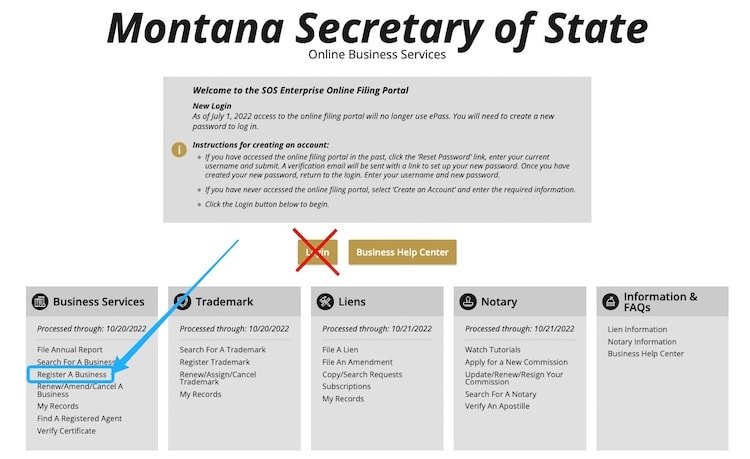

1. Go to the Secretary of State’s Enterprise Online Filing Portal.

2. Click the “Login” button.

3. On the left, click the “Create an Account” button.

Note: If you already had an ePass Montana account, you can follow the steps on the right side of the screen to convert your ePass account to the new SOS Enterprise system.

4. Enter your first name, last name, and email address. Create a username and password.

After you submit your account information, you will get a verification email in a few minutes. Click the link in the email to Verify your account. Then you can login to the SOS Enterprise Portal.

Start your Montana Articles of Organization Online Filing

Go to the SOS Enterprise Online Filing Portal dashboard. Click “Login“, and enter your new username and password.

(Note: You’ll be returned to the dashboard page. You probably won’t need to click “Login” again. To check if you’re logged in, look in the upper right. If you see your username, you’re logged in. If you see “Login” in the upper right, you’ll need to click it to login.)

If you used the link above, the system should automatically take you to the Domestic LLC Articles of Organization form.

If not, follow these steps:

In the Business Services box, click “Register a Business“.

Under the Limited Liability Companies heading, click Articles of Organization for Domestic Limited Liability Company. This is the form that creates a Montana LLC.

In the popup, click “FILE ONLINE” to begin the application process.

Filing Information

Filing Fees & Processing Options

First, you’ll tell the system how quickly you want to get your LLC approved.

Choose “Standard Processing” for no additional charge and you will get your LLC approved in 5-6 business days. With Standard Processing, you only pay the $35 Articles of Organization fee.

You also have the option to choose “24 Hour Processing” (for an extra $20), or “1 Hour Processing” (for an extra $100).

Filing Effective Date

In the Filing Effective Date section, you can choose the date your LLC becomes effective.

The first option is “The entity will be effective when filed with the Secretary of State.” This means your LLC will go into existence on the date it is approved by the Montana Secretary of State.

If you need your LLC to go into existence at a later date, instead select the option for “The entity will be effective on a specific future date.” Then select that date and time using the calendar (it can’t be more than 90 days out).

Pro tip: If you’re forming your LLC in October, November, or December, and you don’t need your business open during those months, forward date your filing to January 1st. This will save you the hassle of filing any taxes for those 1-3 months. For more information, please read LLC effective date.

Click Next Step to continue.

Entity Name

Limited Liability Company Type

If you are forming a regular LLC, click the button for “Limited Liability Company“. (This is the case for most of our readers.)

If you are forming a professional LLC (PLLC), check “Professional Limited Liability Company”.

A Professional LLC is required if your business provides services that require a license from the state.

Examples include, but are not limited to: accountants, attorneys, chiropractors, dentists, nurses, optometrists, osteopathic physicians, physicians and surgeons, physician assistants, podiatrists, registered nurses, and veterinarians.

Make sure you searched your Montana LLC Name before continuing.

Limited Liability Company Name

The system first asks whether you will “File Using a Reserved Name”. You don’t have to reserve your entity name in Montana. So most people don’t bother with this extra step.

- If you reserved your LLC name ahead of time, click “Yes” and select the name from the dropdown list.

- If you didn’t reserve a name, click the button for “No.”

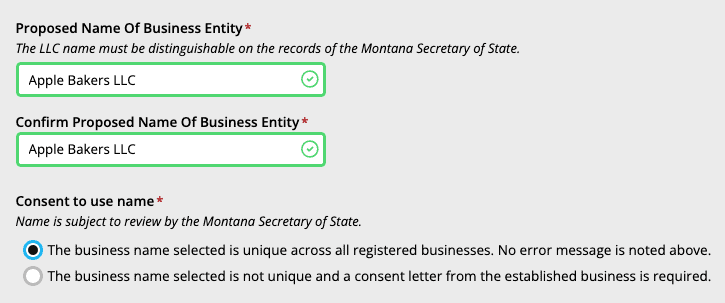

Enter your LLC name exactly as you would like it in both name fields. Use your preferred capitalization, and make sure to include the designator (“LLC” or another allowable suffix).

You can use a comma in your Montana LLC name or you can leave it out.

For example: “ABC Widgets, LLC” and “ABC Widgets LLC” are both acceptable.

After you enter the name in both fields, the system will do a quick check to see if your LLC name is available. If it is available, the fields will have a green border and green checkmark logo:

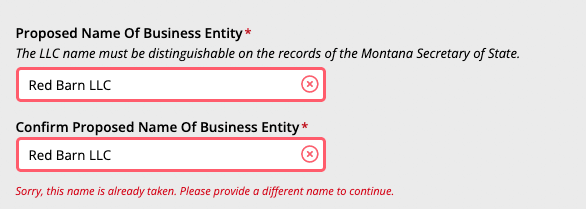

If the name is not available, the fields will turn red with a red “x” logo:

Consent to Use Name

If your LLC name has a green box and checkmark, you can click the first button. This tells the system that your business name is unique and available to use.

If your business name is already taken (you saw a red “x” in the name boxes), you must come up with a new, unique name for your company.

Note: Some people have permission from the existing business to use their name. In that case, you would select the second button and upload a consent letter from the other business. This is not very common.

Click Next Step to continue.

Entity Details

Term

In this section, you need to let the Montana Secretary of State know about the duration of your LLC (how long it will remain in existence).

If you prefer for your LLC to be “open-ended” with no set closure date, select “Perpetual/Ongoing“.

Most people choose this option as this gives them the freedom to close their LLC at any time in the future (by filing dissolution paperwork).

If you prefer for your LLC to be automatically shut down on a specific date in the future, select “Future Date“, and then select that specific date from the calendar. This is not very common.

Purpose (optional)

You can leave this section blank if you’d like, as it’s not a requirement. Or, if you prefer, you can list the general purpose of your business. It doesn’t have to be extremely specific and detailed, and you are not going to be forced to do this forever. You can always change the purpose of your business at any time (and you won’t have to update the state).

You can enter just a few words (ex: “pizza shop”, “real estate investing”, “landscaping”, etc.), or if you prefer to keep things open-ended, you can use this default language instead:

- “Any lawful business for which a limited liability company may be organized under the laws of the State of Montana.”

Business Mailing Address of Principal Office

Enter your LLC’s mailing address. This address can be a home address or an office address. It can be located in any state. It can also be a PO Box, if needed.

Business Physical Address of Principal Office

If you’d like to enter your LLC’s physical address (especially if it’s different from your LLC’s mailing address), then click the “Add Physical Address” box and enter your LLC’s physical address. This section is optional, so you can also leave it blank if you’d like.

Click Next Step to continue.

Registered Agent in Montana

- Related article: If you’re not sure who can serve as your Montana LLC’s Registered Agent, please refer back to this lesson: Montana Registered Agent. Also explore our article on Is a Registered Agent a Member of an LLC?

How to enter a Registered Agent Service:

If you hired a Commercial Registered Agent (aka Registered Agent Service), type their name in the Registered Agent Search box. Then select the correct entity from the popup window.

(Note: If you hired Northwest Registered Agent, you will see two options in the popup. Select the one that says “Commercial Registered Agent” and has “E053995” as the Agent Number.)

The search box will now be replaced by your Registered Agent’s information. Next, check off the box at the bottom stating that this person or company has agreed to be your Registered Agent.

How to enter Yourself, a Friend or Family Member:

If you (or a friend or family member) will be the Registered Agent for your Montana LLC, click “+ Add a New Agent“. Then enter their contact information in the popup window. Click Save.

Next, check off the box at the bottom stating that this person or company has agreed to be your Registered Agent.

Click Next Step to continue.

Principals

LLC Management

In this step, you’ll select your LLC’s management structure.

Note: Most LLCs are Member-managed, where all the owners run the business and day-to-day operations.

An LLC can also be Manager-managed, where one, or a few designated people, run the business and day-to-day operations (while the Members play more of a passive/investor role).

Learn more about Member-managed vs. Manager-managed LLCs.

Under LLC Managed By, select either “Managers” or “Members“.

Manager-managed Montana LLC

If you selected “Managers” (for a Manager-managed LLC), you must enter the information for at least 1 Manager. Click the Add button and select “Individual“. Enter the Manager’s name and address, and then click Save. You don’t have to enter the Manager’s email address (it’s optional).

Click the Add button again to add additional Managers (if you want), or click Next Step to continue.

Member-managed Montana LLC

If you selected “Members” (for a Member-managed LLC), you must answer the additional liability question. Most people click the button for No, the Members are not liable for the LLC’s debts (this ensures your Limited Liability Company retains its LLC asset protection.)

Now you must enter the information for at least 1 Member.

Click the Add button and select “Individual” (unless the Member is another business entity). Enter the Member’s name and address, and then click Save. You don’t have to enter the Member’s email address (it’s optional).

Click the Add button again to add additional Members (if you want), or click Next Step to continue.

Documents

This section is used to upload any additional documents to your LLC filing. Anything you upload will be public record. For example, if your LLC has additional provisions or amendments, those could be uploaded here.

Most people select “No” and don’t upload anything, unless they’ve been instructed to do so by their attorney.

Review

Review your information for accuracy and check for typos. If you need to make any changes, click the appropriate step in the list on the left where you need to make changes.

If you see a red warning symbol, it means some information is missing/incorrect and you need to go back and change it.

If everything looks good, click the Next Step button (at the bottom) to proceed.

Sign & Submit

Declarations

Check the 3 authorization boxes at the top.

Signature

In the Signer’s Capacity drop down menu, select “Self” (you will be the LLC Organizer).

To learn more about the Organizer’s role and who can be an LLC Organizer, check out these articles: LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer.

Type your full name in the Signature box. Either click the button for “Today” or select the date from the calendar.

Enter your phone number and email address, in case the Secretary of State has questions about your filing. Your phone and email address will not be made public.

Note: You only need one Organizer (even if your LLC has multiple Members). You’ll declare and list all LLC members in your Montana LLC Operating Agreement, which we’ll discuss in the next lesson.

Pay Domestic Limited Liability Company Filing Fee

Click Add New Payment Method and enter your contact information. Then enter your debit or credit card information to submit your payment.

Congratulations, your Montana LLC has been filed for processing!

At this point, your LLC filing has been successfully sent to the Secretary of State for review.

Now you just need to patiently wait for approval.

Montana LLC Approval

Your Montana LLC will be approved in 5-6 business days (unless you paid extra for expedited filing).

Once your LLC is approved, the state will email you back:

- Articles of Organization (stamped and approved)

- Articles of Filing

Note: You’ll use your stamped and approved Montana Articles of Organization and your Montana EIN Number to open a business bank account for LLC.

Montana Secretary of State Contact Info

If you have any questions, you can contact the Montana Secretary of State at 406-444-3665. Their hours are Monday through Friday, 8am to 5pm Mountain Time.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Montana Articles of Organization FAQs

What are the Articles of Organization for an LLC in Montana?

The Articles of Organization are a form that tells the Montana Secretary of State important information about your LLC. Once the Secretary of State approves your Articles of Organization, your company officially exists.

The Articles of Organization asks for your LLC name, business address, Registered Agent, and other information.

How do I get Articles of Organization in Montana?

You can get the Montana LLC Articles of Organization from the state’s website.

Montana uses an online filing system to file LLC Articles of Organization. There’s no PDF to download or print.

If you’re looking for a copy of a Articles of Organization that you already filed for your LLC:

Search your LLC name on the Montana Business Search page.

Click your company’s name, then click the “Request Information” button. Fill out the form to request a copy of your Articles of Organization.

Do you have to put LLC in your business name in Montana?

Yes, you have to put “LLC” (or another allowable ending) in your LLC name. For example, Montana allows the following endings:

- LLC

- L.L.C.

- Limited Liability Company

- LC

- L.C.

- Limited Company

- Ltd. Liability Company

- Ltd. Liability Co.

- Limited Liability Company

- Limited Liability Co.

Tip: Most people choose “LLC”.

Your complete LLC name is listed in your Montana Articles of Organization.

How much does it cost to file a Articles of Organization in Montana?

It costs $35 to file the Montana LLC Articles of Organization. This is a one-time fee paid to the Montana Secretary of State.

Does my LLC need any Montana business licenses?

It depends on what your business does.

Montana doesn’t have a state-wide general business license requirement. However, the Montana Department of Revenue requires certain types of businesses to have a license. You should check with your city about any local business license requirements for your LLC.

Can I use the instructions above for filing a Foreign LLC?

No, the instructions on this page are specifically for filing a Domestic LLC in Montana.

If you want to register a Foreign LLC, you can find the forms and fees in Foreign LLC Fees by State.

How to start an LLC in Montana

Here are the steps to starting an LLC in Montana:

- Select a business name for your Montana LLC

- Choose your Registered Agent

- File the LLC Articles of Organization with the state

- Complete and sign an LLC Operating Agreement

- Get a Employer Identification Number (EIN) from the Internal Revenue Service (IRS)

- Open an LLC bank account

- Check whether you need a business or sales tax license in Montana

References

Montana LLC Act, Section 35-8-201

Montana LLC Act, Section 35-8-202

Montana LLC Act, Section 35-8-204

Montana LLC Act, Section 35-8-206

Montana LLC Act, Section 35-8-212

Montana Secretary of State: How do I Register a Business?

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.