Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

New Hampshire LLC Annual Report: 2026 Requirements & Filing Guide

Every LLC that does business in New Hampshire must file an Annual Report every year.

Every LLC that does business in New Hampshire must file an Annual Report every year.

The Annual Report filing keeps your New Hampshire LLC in compliance and in good standing with the state.

You must complete your New Hampshire Annual Report online (using the New Hampshire QuickStart filing system).

Then, you can either submit the report online, or print it and submit it by mail.

How much is the annual filing fee for an LLC in NH?

It costs $100 per year to file the New Hampshire LLC Annual Report with the New Hampshire Secretary of State.

How long does it take to process the New Hampshire LLC Annual Report?

If you submit your Annual Report by mail, it will be processed in 1-3 weeks.

If you submit your Annual Report online, it will be processed instantly.

We recommend submitting your Annual Report online.

When is the LLC Annual Report due?

Your New Hampshire LLC’s Annual Report is due between January 1st and April 1st, every year.

Your first Annual Report is due the year after you form your LLC.

For example:

- If your New Hampshire LLC was formed on February 5th 2026, your first Annual Report will be due between January 1st and April 1st of 2027.

- If your New Hampshire LLC was formed on November 22nd 2026, your first Annual Report will be due between January 1st and April 1st of 2027.

How early can an Annual Report be filed?

Your LLC Annual Report can be filed as early as January 1st each year.

What happens if I forget to file a NH Annual Report?

Your New Hampshire LLC’s Annual Report will be late if not filed by April 1st.

If you’re late, your LLC enters a “Not in Good Standing” status. It will also be charged a $50 penalty on top of the filing fee ($150 total).

After late-filing and paying the penalty, your LLC will go back into “Good Standing” status.

If you fail to file an Annual Report for 2 consecutive years, the state will administratively dissolve (shut down) your LLC.

LLC Annual Report Reminders

The New Hampshire Secretary of State will send one courtesy reminder shortly after January 1st. Depending on what was selected in your New Hampshire LLC Certificate of Formation, the state will send the reminder by mail or email.

However, this reminder is a “courtesy” reminder. Meaning, even if you don’t receive it, it’s still your responsibility to file your Annual Report on time every year.

For that reason, we recommend putting a repeating reminder on your phone, computer, and/or calendar.

Here’s a video on how to use Google Calendar to create free Annual Report reminders:

Completing your New Hampshire LLC Annual Report

Get started

Visit New Hampshire QuickStart.

Click “Login” in the upper right and login to your account.

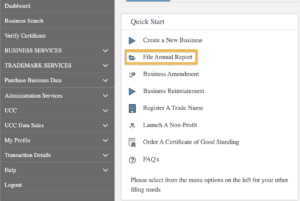

In your account dashboard, click “File Annual Report” in the Quick Start menu.

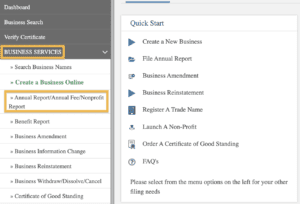

If you don’t see that, look to the menu on the left. Find “BUSINESS SERVICES“, and click “Annual Report/Annual Fee/Nonprofit Report“.

Search your LLC by name (just enter the first couple words and leave out “LLC”) or by its Business ID.

Select your LLC from the list and click “Continue“.

On the next page, you should see your LLC name with the current year selected. Click “File an Annual Report/Annual Fee/Nonprofit Report“.

Principal Purposes

You’ll see the following message in red:

“Please review your current Principal Purpose(s) in the table below. If you need to make changes to your Principal Purpose(s) please contact our office at (603) 271-3246 or corporate@sos.nh.gov.”

You can’t make any changes to your LLC’s purpose via the Annual Report. Instead, the state wants you to file Form LLC-3 (Certificate of Amendment) and pay a $35 filing fee.

We recommend just leaving the purpose as-is, even if it’s completely changed. You’re not restricted from engaging in any legal business activity, so filing a Certificate of Amendment is just a way for the state to unnecessarily charge you $35. You aren’t forced to do what you listed as the original purpose of your LLC.

Registered Agent

- Related article: New Hampshire LLC Registered Agent

Review your LLC’s Registered Agent information.

If nothing has changed, then you can skip this section.

If you’d like to change or update your Registered Agent, you can’t do it using the Annual Report. Instead, you have to submit a separate filing (Statement of Change of Registered Agent) by mail or online.

Principal Office Information

Review your LLC’s Principal Office Address and Mailing Address.

If you don’t need to change an address, then you can skip this section.

If you do need to change an address, just click the “Edit” icon to the right. Then change your address details and click “Save Selection“.

Email Address

You can enter an email address if you’d like, but it’s optional.

Click “Continue” to proceed.

Member/Manager Information

The fields you immediately see with red asterisks don’t necessarily need to be filled out.

First, look below the fields for the current Member/Manager information.

If you need to remove a Member/Manager, click the “Remove” icon.

If you need to add a Member/Manager, enter their information at the top, then click “Save Selection“.

Certify

Check off the “Certify” box agreeing to the terms and conditions of filing the Annual Report, then click “Continue“.

A few additional fields will appear below.

Effective Date

Your effective filing date will be automatically set to today’s date (you won’t be able to change it).

There is nothing you need to do here. Technically, it just means your LLC’s Annual Report is filed with the state on today’s date.

Name & Title

Enter your name and select your title from the drop down list.

- If you’re a Member of the LLC, you can use the title “Authorized Signer“.

- If you’re a Manager of the LLC, you can use the title “Manager” or “Authorized Signer“.

(Learn more about these options here: LLC Management and Officer Titles.)

Click “Continue“.

Review

Review the information you entered in your LLC’s Annual Report and check for any typos or mistakes.

If you need to make any changes, click the “Edit” buttons to the right of any section.

When everything looks good, choose how you’d like to file your Annual Report. You can file your New Hampshire Annual Report online or by mail.

We recommend filing online because it’s faster and easier.

To File by Mail:

Click the “Mail with Check” button.

Prepare a check or money order for $100 payable to “State of New Hampshire”. Then print out the Annual Report form, and send it with the check to:

Corporation Division

NH Department of State

107 North Main Street, Room 204

Concord, NH 03301-4989

To File Online:

Click the “Add to Shopping Cart and Checkout” button.

You’ll see a pop-up asking if you’d like to order a Certificate of Good Standing for an additional $5.

What is it? A Certificate of Good Standing is a letter from the state that says your LLC is in a “Good Standing” status. This just means it’s up-to-date on all of its Annual Report filings.

This document isn’t required. It’s optional.

Select “Yes” or “No“.

On the next page, click “Proceed to Checkout“.

I would like to pay using…

Select “Credit Card” and your total charges will appear below. Then click “Pay Securely using Credit Card“.

A popup message will appear stating that you’ll be redirected to a payment gateway. Click “Ok“.

Billing Information

Enter your billing information and then click “Pay“.

Verification/Approval of a filed LLC Annual Report (online):

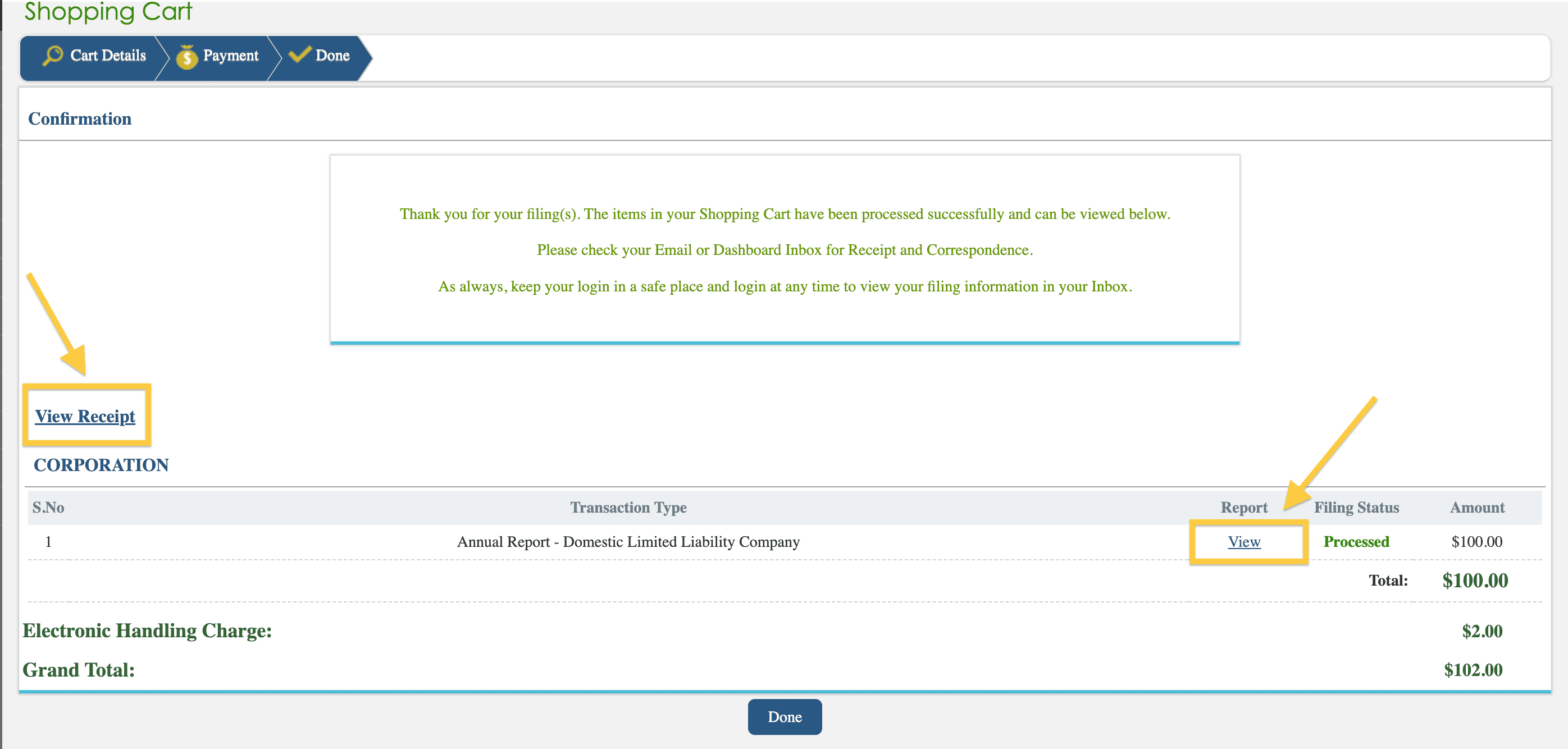

Your Annual Report is processed immediately during the online filing. After a successful filing, you’ll be taken to a confirmation page that will look like this:

On the left, click “View Receipt” to download your receipt.

On the right, click “View” to download a copy of your filed Annual Report.

Then click “Done” at the bottom. Congratulations, your New Hampshire LLC Annual Report has been successfully filed.

If you accidentally close the browser tab:

Don’t worry, you can still download your filed Annual Report. Search your LLC online (New Hampshire Secretary of State: Business Search).

Note: New Hampshire’s Business Name Search doesn’t always work well in Google Chrome. Instead, we recommend using Firefox or Microsoft Edge to access the Business Name Search.

Click on your LLC name and then click “Filing History” at the bottom. Then look for your recent Annual Report in the list.

Note: You’ll also get an email from the state with a copy of your filed Annual Report. They won’t include the receipt, however, the receipt isn’t really important.

New Hampshire Secretary of State Contact Info

If you have any questions, you can contact the New Hampshire Secretary of State at 603-271-3246.

Their hours are Monday through Friday, from 8am to 4:30pm Eastern Time.

Frequently Asked Questions

How do I change my New Hampshire Registered Agent?

You can change your New Hampshire Registered Agent online or by mail.

There’s a small catch though: If you file the change of Registered Agent online, you have to pay a $15 fee. If you file the change of Registered Agent by mail and you file the change between January 1st and April 1st, you don’t have to pay the $15 fee.

Change your Registered Agent online:

In your QuickStart dashboard, hover over “BUSINESS SERVICES” on the left. There are three options to choose from:

- Registered Agent Address Change:

- Select this option if your Registered Agent is not a Commercial Registered Agent and you are just changing the Registered Agent’s address (but not the actual Registered Agent)

- Registered Agent Address Change – Commercial Agent:

- Select this option if your Registered Agent is a Commercial Registered Agent and you are just changing the Registered Agent’s address (but not the actual Registered Agent)

- Registered Agent Change:

- Select this option if you’re changing who the Registered Agent is, regardless of what type of Registered Agent it is.

Change your Registered Agent by mail:

Complete a Statement of Change of Registered Office or Registered Agent. If you file this with the state between January 1st and April 1st, there is no fee. If you file outside of that timeframe, there is a $15 fee.

What happens if I made an error in my Annual Report?

If there are any errors or problems with your LLC’s Annual Report, the state will send you back a notification letting you know.

They will also give you 30 days to correct the issue and re-file the Annual Report.

References

New Hampshire Secretary of State: Filing Fees

New Hampshire Statutes: Section: 304-C:194 (Annual Reports to Secretary of State)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

New Hampshire LLC Guide

Looking for an overview? See New Hampshire LLC

Please send me an email with the annual reports that are due. I know this LLC is not in good standing and would like to pay so that it is in good standing

Thank you,

Jackie Burby

Hi Jackie, we are not the New Hampshire Secretary of State. You will need to get in touch with them directly. Thank you.