Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through filing your Certificate of Formation with the New Hampshire Secretary of State. This is the document that officially forms your LLC in New Hampshire.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in New Hampshire.

After filling out your Certificate of Formation, you can submit it to the New Hampshire Secretary of State in 1 of 3 ways:

After filling out your Certificate of Formation, you can submit it to the New Hampshire Secretary of State in 1 of 3 ways:

1. By mail: the LLC filing fee is $100 and your LLC will be approved in 7-10 business days (plus mail time).

2. Online: the LLC filing fee is $102 and your LLC will be approved in 7-10 business days.

3. Walk-in: the LLC filing fee is $125 and your LLC will be approved in 15 minutes to 2 hours.

How much is an LLC in New Hampshire will explain all the fees you’ll pay, including the Certificate of Formation filing fee.

Note: The “LLC filing fee” (the fee to create a New Hampshire LLC) is the same thing as the “Certificate of Formation fee”. The Certificate of Formation is the document, that once approved by the Secretary of State’s office, creates your New Hampshire LLC.

So how do you know which filing method is best? Here’s our recommendation: if you don’t need your LLC approved the same-day (via the walk-in filing), we recommend filing online because the approval time is much faster than filing by mail.

If you need your LLC filing same-day, we recommend the walk-in filing (if you live near, or are willing to drive to Concord, NH 03301).

In this lesson, you will find detailed instructions for all 3 filing methods.

Alternatively, you can hire a company to form your LLC. Check out Best LLC Services in New Hampshire for more information about this option.

Before you continue: Make sure you have searched your LLC name and selected your LLC’s New Hampshire Registered Agent.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Instructions for Filing New Hampshire Certificate of Formation by Mail

Important: Licensed professionals in New Hampshire (doctors, lawyers, architects, engineers, nurses, etc.), cannot form regular LLCs. Instead, they must file a Professional LLC (PLLC). If you are a licensed professional, please follow this lesson instead: Forming a PLLC in New Hampshire.

Download Certificate of Formation (Form LLC-1):

New Hampshire Secretary of State: Form LLC-1 Certificate of Formation

You can print the form, fill it out by hand (use a black pen), then sign; or, you can type in the form on your computer, then print and sign. When printing, use regular white paper (8.5″ x 11″).

Please read the helpful instructions on the 1st page (“Nine Steps to Avoid Rejection”) before filling out your Certificate of Formation.

FIRST: The name of the limited liability company is:

Enter your LLC name exactly as you would like it, including your preferred capitalization, as well as the designator “LLC” or “L.L.C.” (the abbreviation “LLC” is the most common).

You can use a comma in your New Hampshire LLC name or you can leave it out. Ex: “ABC Widgets, LLC” and “ABC Widgets LLC” are both acceptable.

Principal Office Address:

Enter the “location” of your LLC here. This can be your home address, a friend or family member’s address, or an actual office address.

Principal Mailing Address (if different):

If you’d like to receive mail at an address different than your Principal Office Address, enter that address here. If not, just leave this line blank.

Business Phone:

Enter your phone number here. It doesn’t have to be an “official” business phone number. It can be your home, your cell, or an office phone.

Business Email:

Same thing here. This doesn’t have to be an “official” business email address. Just enter your primary email address.

Please check if you would prefer to receive the courtesy Annual Report Reminder by email:

We recommend checking this box off in order to receive your New Hampshire Annual Report reminder notices via email. If you prefer to get your reminder notices by mail, leave this box unchecked.

SECOND: Describe the nature of the primary business or purposes (and if known, list the NAICS Code and Sub Code):

Enter a few words or a sentence about what your business does. It doesn’t have to be extremely specific, and you are not going to be forced to do this forever. You can always change the purpose of your business at any time. You can enter just a few words, (ex: “pizza shop”, “real estate investing”, “landscaping”, etc.), or a short sentence (ex: “restoration of old cars”, “life coaching services and products”, etc.).

The state also asks for your NAICS Code if you know it. It’s optional to enter your NAICS Code, so you can enter it if you’d like, or skip it and just list your business activity. If you do list your NAICS Code, you also need a brief description of what your business does.

An NAICS Code (North American Industry Classification System) is used by government agencies to identify your LLC’s line of business and activities. It’s mostly used for statistical purposes. Here is the link to the NAICS Code search.

You can either search by keyword or browse by industry. To search by keyword, in the “NAICS Keyword Search” box, enter the first word of your business industry (ex: “restaurant”, “landscape”, “retail”, “real estate”, etc.) and then click “Submit”. Scroll through the list until you find your industry and its NAICS Code. On the other hand, to browse by industry, just scroll underneath the search box and you’ll see a list of industries which you can click on.

THIRD: The name of the limited liability company’s registered agent is:

Enter the individual’s or company name of your LLC’s Registered Agent.

Note: If you’re not sure who can serve as your New Hampshire LLC’s Registered Agent, please refer back to this lesson: New Hampshire Registered Agent. Make sure to also explore our article on Is a Registered Agent a Member of an LLC?

The complete address of its registered office (agent’s business address) is:

Enter your Registered Agent’s full street address. The address cannot be a PO Box. It must be a street address located in New Hampshire.

FOURTH: The management of the limited liability company ___ vested in a manager or managers:

If your LLC is Member-managed, enter “is not” on the blank line.

If your LLC is Manager-managed, enter “is” on the blank line.

Note: Most LLCs are Member-managed, where all the owners run the business and day-to-day operations. An LLC can also be Manager-managed, where one, or a few designated people, run the business and day-to-day operations (while the members play more of a passive/investor role).

To learn more about Member-managed vs. Manager-managed LLCs, read this short article.

Manager/Member Information (optional)

If you’d like to list the LLC Members and/or Managers in your Certificate of Formation, you can enter them here. This is optional though, so you can leave it blank if you’d rather not disclose this information on public record.

Signature block on Page 2

After you print this form, sign your name to the right of “Signature”. Print your full name on the 2nd line. For title, enter “Member” or “Manager”. Then enter today’s date to the right of “Date signed”.

Prepare Payment:

Prepare a check or money order for $100 and make it payable to “State of New Hampshire”.

Mail Documents:

Mail your completed Certificate of Formation and $100 filing fee to:

Corporation Division

NH Dept. of State

107 N Main Street, Room 204

Concord, NH 03301-4989

You can send your Certificate of Formation and check or money order via USPS regular mail (plain envelope + stamp), or you can send via UPS or FedEx if you need to save a day or two on arrival time.

LLC Approval by mail:

When filing by mail, your LLC will be approved in 7-10 business days (plus mail time). Your approval documents will be returned via regular mail. You’ll receive a stamped and approved copy of your Certificate of Formation and a Certificate of Good Standing.

Note: You’ll use these documents and your Federal Tax ID Number to open a business bank account for your LLC.

Instructions for Filing New Hampshire Certificate of Formation Online

Create a New Hampshire QuickStart Account

To form an LLC online in New Hampshire, you need to create a “QuickStart” account. QuickStart is the online filing system for the New Hampshire Secretary of State.

1. Go to the New Hampshire QuickStart homepage.

2. Click the “Create Account” button in the upper right.

3. Enter your name, mailing address, zip code (your city, county, state, and country will automatically appear once you enter it). Enter your mobile number to receive text message notifications when your filing is approved. Enter your contact number (which might be the same as your mobile number). Then enter your email address and click the “Continue” button.

4. Create a User ID, password, and security question, then click the “Create My Account” button.

5. The next page will tell you that your registration has been successful. Before logging in, we recommend you print your login details by clicking the “Print the Login Details” button. A PDF file containing your account information will automatically download to your computer.

The system will bring you back to the homepage. Click “Login” in the upper right to begin.

6. In your QuickStart dashboard, hover over “Business Services” (on the left) and then click “Create a Business Online.”

7. On the next page, click “I am creating a new Domestic Business/Trade Name (D/B/A)“.

From the “Business Type” drop down menu, select “Limited Liability Company“.

Important: Licensed professionals in New Hampshire (doctors, lawyers, architects, engineers, nurses, etc.), cannot form regular LLCs. Instead, they must file a Professional LLC (PLLC). If you are a licensed professional, please follow this lesson instead: Forming a PLLC in New Hampshire.

Complete your New Hampshire LLC Certificate of Formation Online

Article First: Business Name:

Enter your LLC name exactly as you would like it, including your preferred capitalization, as well as the designator “LLC” or “L.L.C.” (the abbreviation “LLC” is the most common).

You can use a comma in your New Hampshire LLC name or you can leave it out. Ex: “ABC Widgets, LLC” and “ABC Widgets LLC” are both acceptable.

Business Name Reservation:

A business name reservation is when you file a form called “Application for Reservation of Name” and pay a $15 filing fee to reserve an LLC name ahead of time.

Note: An LLC Name Reservation is not a requirement when forming an LLC in New Hampshire, so if you don’t have one, there is no need to stress out.

Select “No” if you don’t have a Name Reservation filed.

Select “Yes” if you have a Name Reservation that’s already been filed. Then search your LLC name reservation, find it, and click “Select“.

Article Second: Principal Purpose:

An NAICS Code (North American Industry Classification System) is used by government agencies to identify your LLC’s line of business and activities. It’s mostly used for statistical purposes.

Select the NAICS Code number from the drop down menu which most closely represents the purpose of your business. Then select the NAICS sub code from the drop down menu in the right box. Then click the “Save Selection” button.

If you’re having a hard time locating an NAICS Code, don’t sweat it. It’s not a requirement to provide one. Instead, select “Other” from the drop down, enter a few words about your business, then click the “Save Selection” button.

What you enter doesn’t have to be extremely specific, and you are not going to be forced to do this forever. You can always change the purpose of your business at any time. You can enter just a few words, (ex: “pizza shop”, “real estate investing”, “landscaping”, etc.), or a short sentence (ex: “restoration of old cars”, “life coaching services and products”, etc.).

Article Third: Registered Agent:

If you’re not sure who can serve as your New Hampshire LLC’s Registered Agent, please refer back to this lesson: New Hampshire Registered Agent.

If your Registered Agent is an individual (such as you, a friend, or family member), click the “Create Agent” button.

From the “Agent Type” drop down, select “Individual”. Then enter their first name, last name, and email address. Next, enter their street address on the left, under “Registered Office Address”. Remember, PO Boxes are not allowed and the street address must be located in New Hampshire.

To the right, under “Registered Mailing Address”, most people check off the box at the top for “Same As Office Address”. On some occasions, the individual serving as your LLC’s Registered Agent may prefer to get mail at a location different from what you entered on the left. If that’s the case, enter that additional address on the right.

Once finished, click the “Create Agent” button at the bottom.

If you hired a Commercial Registered Agent, select “Business“, enter their company name in the “Search Agent Name” box and then click the “Search” button.

Once you find your Commercial Registered Agent’s name in the list, just click the “Select” circle once and the information will be automatically saved.

If you hired Northwest Registered Agent as your Commercial Registered Agent, their full name in New Hampshire is “Northwest Registered Agent LLC”.

Article Fourth: Manager/Member Information:

Select “Member-Managed” from the drop down menu if your LLC is managed by all of the members (owners). This is what most people select.

Select “Manager-Managed” from the drop down menu if your LLC is managed by one (or more) designated managers.

Once finished, click the “Continue” button at the bottom to proceed to the next page.

Note: Most LLCs are Member-managed, where all the owners run the business and day-to-day operations. An LLC can also be Manager-managed, where one, or a few designated people, run the business and day-to-day operations (while the members play more of a passive/investor role).

- Related article: To learn more about Member-managed LLCs vs. Manager-managed LLCs, read this short article.

Duration:

In this section, you need to let the New Hampshire Secretary of State know about the duration of your LLC (how long it will remain in existence).

If you prefer for your LLC to be “open-ended” with no set closure date, select “Perpetual“. Most people choose this option as it gives them the freedom to close their LLC at any time in the future if necessary (by filing dissolution paperwork).

If you prefer for your LLC to be automatically shut down on a specific date in the future, select “Term Date“, and then select that specific date using the calendar to the right.

Business Email Information:

Enter your email address in the box provided. It doesn’t have to be an official “business” email address; you can just use your personal email address if you’d like.

Notification Email:

If you would like email reminders about when your LLC Annual Report is due, either enter your business email address again or enter a different email address (if you prefer that reminders get sent to a different email). This section is optional.

Phone Number:

This section is optional, so you can enter a phone if you’d like the state to have one, or you can leave it blank.

Tip: Since the information listed in your New Hampshire Certificate of Formation becomes public record, we recommend leaving your phone number off the filing in order to prevent telemarketing and spam phone calls.

Manager/Member Information:

If your LLC is Member-managed, you need to add at least one Member. If your LLC is Manager-managed, you need to add at least one Manager.

General Upload:

You can leave this section blank as this is optional. However, if you are forming a Professional LLC (PLLC) in NH, you’d use this section to upload any licenses or necessary certificates. Most people who are forming a regular LLC don’t need to upload any additional documents and just leave this section blank.

Principal Office Information:

In the “Business Address” section, enter the LLC’s “office” location. This can be your home address, a friend or family member’s address, or an actual office address. You should keep copies of your LLC documents at this “office” address. This address doesn’t have to be located in New Hampshire (although it can be). This address can be located in any state.

Mailing Address (if different than Principal Office address):

If you’d like to receive mail at an address different than your Principal Office Address, enter that address here. If not, check off “Same as Business Address”. This address also doesn’t have to be located in New Hampshire (although it can be). This address can also be located in any state.

Certify:

Check off the box to certify that you’ve read the terms and conditions. Once you check off the box, 2 new sections will appear below.

Effective Date:

Select the first option if you want your LLC to be effective upon filing. This means your LLC will go into existence on the date it is filed with the New Hampshire Secretary of State.

If you need your LLC to go into existence at a later date, select the second option and enter that date in the box provided (it can’t be more than 90 days out).

Pro tip: If you’re forming your New Hampshire LLC in October, November, or December, and you don’t need your business open during those months, forward date your filing to January 1st. This will save you the hassle of filing any taxes for those 1-3 months. For more information, please read LLC effective date.

Signature:

If you’re signing your own LLC filing, for “Type”, select “Individual“. Then select your title from the “Title” drop down menu. Most people select “Member” if they are signing their own LLC filing.

- Related article: Who can be an LLC Member?

- Information about LLC Organizers: LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer

Then enter your first and last name and click “Continue” at the bottom.

Review:

Review your information for accuracy and check for typos. If you need to make any changes, click the “Edit” button to the right of any section.

If you see a red warning symbol, it means some information is missing or incorrect and you need to click “Edit” to change it.

Once you review the page and everything looks good, click the “Add to Shopping Cart and Checkout” button at the bottom.

On the next page, click “Proceed to Checkout“. Then click “Pay securely using Credit Card“.

Payment:

A popup message will appear telling you that you will be redirected to the Global Gateway payment system. Click the “Ok” button to proceed.

Enter all of your billing information, then click the “Pay With Your Credit Card” button to submit your filing and payment.

Congratulations, your New Hampshire LLC has been filed for processing!

LLC Approval when filing online:

When filing online, your LLC will be approved in 7-10 business days. Your approval documents will be returned via email. You’ll receive a stamped and approved copy of your Certificate of Formation and a Certificate of Good Standing.

Note: You’ll use these documents and your Federal Tax ID Number to open a business bank account for your LLC.

Instructions for Walk-in Filing of New Hampshire Certificate of Formation

Note: This is New Hampshire’s only expedited option.

Please see the section above titled “Instructions for Filing New Hampshire Certificate of Formation by Mail”. Follow the steps in that section to complete your Certificate of Formation, and then come back here. The only difference between these filing methods is how you submit the documents to the state. Instead of submitting your documents to the state via mail, you’re going to drive to their office and hand deliver them.

Filing Fee: $125 ($100 filing fee + $25 expedited fee)

Payment Method: Check, money order, or debit/credit card

Make Payable To: “State of New Hampshire”

Walk-in Instructions:

Bring your completed Certificate of Formation and $125 filing fee to:

25 Capitol Street

3rd Floor

Concord, NH 03301

The building is to the left of the State House. The office is in the Annex, on the 3rd floor. Take the elevator up to 3rd floor, then head left to room 317.

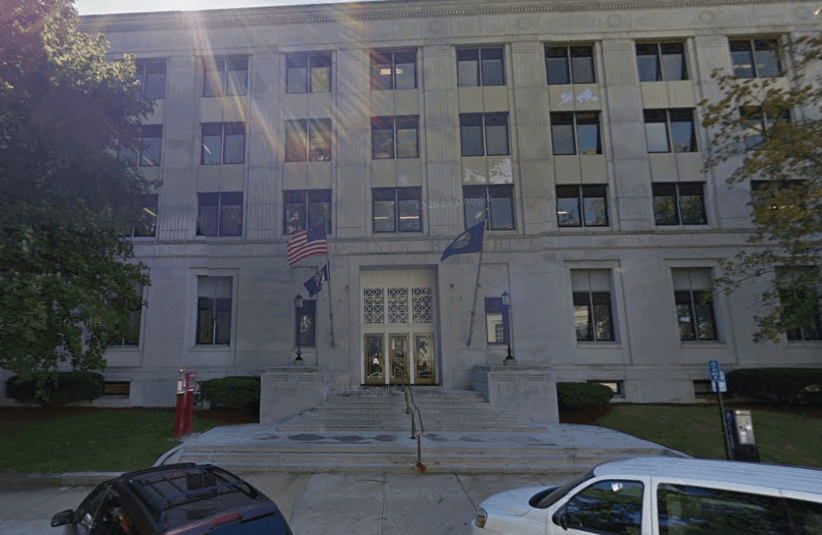

Here is a photo of the entrance:

Hours:

You can do a walk-in filing Monday – Friday: 8:30am – 4pm.

Best Time of Arrival:

It’s best to arrive at (or shortly after) 8:30am for the quickest approval time.

If you arrive around 8:30am – 9:30am, your LLC will be processed on the spot and will take approximately 15-20 minutes to be approved.

If you arrive later in the afternoon, your LLC could go “into a small line”. You’ll need to wait about ½ hour to 2 hours for your LLC to be approved.

LLC Approval for walk-in filing:

If you do the walk-in filing, your LLC will be approved either right away or within 2 hours (it depends on how early you arrive). Your approval documents will be given to you on the spot. You’ll receive a stamped and approved copy of your Certificate of Formation and a Certificate of Good Standing.

Note: You’ll use these documents and your Federal Tax ID Number to open a business bank account for your LLC.

New Hampshire Secretary of State Contact Info

If you have any questions, you can contact the New Hampshire Secretary of State at 603-271-3246 (Monday – Friday: 8am – 4:30pm).

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

References

New Hampshire LLC Act

New Hampshire Secretary of State: Domestic LLC Forms

New Hampshire Secretary of State: Certificate of Formation

New Hampshire LLC Act: Definition of Certificate of Formation

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

New Hampshire LLC Guide

Looking for an overview? See New Hampshire LLC

Hi Matt,

Thank you! This is an excellent and much needed resource. If we have a registered LLC with three members and one member resigns, what is the process for the removal of the member? Do we need to file an amendment to change the LLC?

Hi Stephanie, you’re welcome! Since LLC Members are not listed in the Certificate of Formation in New Hampshire, you don’t need to file an amendment with the Secretary of State. Instead, you’ll either want to amend your Operating Agreement or create a new one. Hope that helps.

Hi Matt,

Since I will need a business address for my LLC (not my home address), it seems like I have to go to UPS or someplace that will give me a “real street address” before I can form the LLC because it asks for your business address on the formation document/application.

Conversely, when you go to get a business address set up, they will want to know the name of your LLC (which you haven’t formed yet).

Which comes first? Form the LLC without a business (non-home) address, or get a business address listing the LLC name you hope will be approved? (If it helps answer, I’m talking NH)

Thanks,

Mike

Hey Mike, great question. Usually the mailbox is opened first. Most places will just accept the name of the LLC and don’t check documentation. Some do though, so in that case, you can check to see if you can open the mailbox in your name and then later switch to or add your LLC. Also, as an alternative to the mailbox rental is using Northwest Registered Agent. They’ll serve as your LLC’s Registered Agent and let you use their office address as your business address too. Any mail that is sent to your LLC will be scanned by them and uploaded to your online account. Although, the mailbox may be better if you want to physically go into a place and pickup mail and for package delivery. Hope that helps.

Can we file our annual LLC report via email?

Hi Jerry, no, New Hampshire LLC Annual Reports can’t be filed by email. They can only be filed by regular mail, online, or in-person. Hope that helps!

Just an FYI – the form does not have the duration Fourth article. The Fourth article is now the Manager/Member Information. In person you can pay with credit/debit card. Also, you do not have to fill in Principal Office address.

Thank you so much for all the help and information :)

Hi Beechy, thank you for your very help comment. We’ve since update the lesson to address the state moving some sections around. And we’ve also added credit/debit card as a method of payment for walk-in filings. We’re still researching the Principal Office Address part. Well, we actually already researched it and are chewing on how best to explain things. New Hampshire has a few quirks. One of them being that the Principal Office Address is required for the online LLC filing, but not required for the mail filing of an LLC. We’ll be pushing those updates live soon though. Thanks for helping improve our lessons. As a result, people will have a better LLC formation experience because of your feedback… so thank you! :)

This was AWESOME!!!! Thank you so much for sharing your wisdom!! I will admit I was a little overwhelmed this would be outta my league and you made it all easy & saved me SO much $$$ from being concerned enough to go pay someone else ($500 was fee I was told)

Thank YOU

from all of us at Outlaw Ridge sled Dogs ( who will be real soon, thanks to you!!)

Becki, thank you so much for the lovely comment!! I’m so happy we were able to help you save money and that you were able to do it all yourself. I wish you and Outlaw Ridge Sled Dogs nothing but success :-)

What if your LLC paperwork never arrives by mail? I searched in on the data base and we are in good standing but we never got the certificate.

Hi Marissa, if your filed your LLC by mail, approval takes 1-3 weeks. There is a slight chance there is a delay that is longer than usual, but I imagine it’s on its way. Please call the Secretary of State’s office on Monday and check the status of your LLC. Just let them know what you told me. Their number is 603-271-3246 and their hours are 8am – 4:30pm. Let me know what you come up with. Hope that helps.