Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

How to file Articles of Organization for a New Mexico LLC

In this lesson, we will walk you through filing your Articles of Organization with the New Mexico Secretary of State.

In this lesson, we will walk you through filing your Articles of Organization with the New Mexico Secretary of State.

This is the document that officially forms your New Mexico LLC.

And you must submit the Articles of Organization online. The state doesn’t accept mail filings.

Note: If you don’t want to file your LLC yourself, you can hire a company to form your LLC instead. Check out Best LLC Services in New Mexico for our recommendations.

How much does it cost to get a New Mexico LLC?

Forming a New Mexico LLC costs $50. And this is a one-time filing fee that is paid to the state.

Note: The “LLC filing fee” (the fee to create a New Mexico LLC) is the same thing as the “Articles of Organization fee”. How much is an LLC in New Mexico explains all the fees you’ll pay, including the Articles of Organization filing fee.

How long does it take to get an LLC in New Mexico?

It takes 1-3 business days for your New Mexico LLC to be approved. And once approved, the state will send you an email.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in New Mexico.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

How to form your New Mexico LLC online (filing the Articles of Organization)

If you don’t have an account with the New Mexico Secretary of State, you’ll first need to create one:

- Visit the New Mexico Secretary of State Online Portal.

- Click “Login” in the upper right corner, then click “Create an Account“.

- Enter your name, phone number, and email. Then click “Create Account“. (This information is private and won’t go on public record. It’s just used to create the account).

Note: If you have an old login (one created before December 2024), that login no longer works. And you’ll need to create a new account.

Get Started

Log in to the Online Portal.

Scroll down to the “Business Filing Help & Resources” section. Then click “Register a Business“.

Then select “Domestic LLC Articles of Organization“, and click “File Online“.

Limited Liability Company Name

- Recommended article: We recommend reading the New Mexico LLC Name lesson before proceeding with your online filing. This will help make sure your LLC name is available.

Business Sub Type

Select “Domestic LLC” from the dropdown.

“A previously filed reserved name will be used for this filing.”

If you’ve reserved a business name with the state, choose “Yes”. If not, choose “No”.

Most people choose “No”. Because you don’t need to reserve a business name with the state in order to start an LLC, and we don’t recommend it.

Limited Liability Company Name

Enter your desired LLC name exactly as you would like it. And confirm it (by entering it again) in the second box.

Make sure to include the designator (ending). As per Section 53-19-3 of the New Mexico LLC Act, the following designators are allowed:

- LLC (most common)

- L.L.C.

- LC

- L.C.

- Ltd. Co.

- Limited Co.

- Ltd. Company

- Limited Liability

- Limited Liability Co.

- Limited Liability Company

Consent to use name

Check off the 1st box, “It is not known if consent to use the name is needed from a business registered in New Mexico.”

(Why? Consent to use an existing name is not common, and we rarely recommend doing this.)

“Is the name proposed to do business in New Mexico different than the registered LLC name?” (DBA, aka Doing Business As)

The state is asking if you’ll be using an Alternative Business Name (aka DBA).

Pro Tip: Most people get quite confused when it comes to LLC and DBA names. You can think of a DBA as a “nickname” for your LLC. This means, your LLC can do business under its true and legal name, as well as its DBA name. However, DBAs aren’t required, and for many people, DBAs aren’t necessary. I recommend checking out Do I need a DBA for my LLC for more info.

If you won’t be using a DBA for your LLC:

- Click “No“.

If you will be using a DBA for your LLC:

- Click “Yes“.

- Then click “Add“.

- Enter the name of your DBA.

- Then click “Save“.

Note: DBA names in New Mexico aren’t required to be filed on a separate registration form. Instead, just pick your DBA name and enter it here.

Click “Next Step“.

Business Contact Information

Principal Place of Business Address

Enter the physical street address where most of your business activities take place.

This must be a physical address (no PO boxes allowed). And while it’s called an “office” address, it doesn’t have to be an actual office address.

This address can be a:

- home address

- office address

- virtual office address

- mailbox rental address

- address of your Registered Agent (check with your Registered Agent first for permission)

Additionally, this address doesn’t have to be in New Mexico. It can be in any state.

Business Mailing Address

If your Business Mailing Address is the same as your LLC’s Principal Place of Business Address:

- Click the box next to “Address” to copy the information.

- Then click on the address to select it.

If your Business Mailing Address is different:

- Manually enter that address below.

Business Phone Number (optional)

This field is optional and we don’t recommend filling it out. The Secretary of State wants it in case they ever need to get in touch with you, which is unlikely to happen.

If you do choose to list a phone number here, it won’t be put on public record.

Business Email Address

This field is required and the Secretary of State will use it to send your LLC business notices.

This email address won’t be put on public record.

Click “Next Step“.

Registered Agent and Registered Office Information

In this section, you will tell the Secretary of State who your New Mexico Registered Agent is.

Tip: If you haven’t chosen a Registered Agent yet (or you aren’t sure what the best option is), we recommend reading New Mexico Registered Agent.

If you’re going to be the Registered Agent (or you’ll use a friend or family member):

Click the “+Add New Agent” button.

Select “Individual“.

Enter their name and address. And then click “Save“.

Registered Agent Certification:

- Check the box agreeing to the terms.

- Complete (and sign) the Statement of Acceptance of Appointment by Registered Agent.

- (This just says that you agree to be your own Registered Agent.)

- Scan and save this file as a PDF on your computer.

- Then upload the PDF file.

- And click “Next Step” to proceed.

If you hired Northwest Registered Agent:

If you hired Northwest Registered Agent, enter “Northwest Registered Agent” and then click “Search“.

- Choose this result: “Northwest Registered Agent, Inc. (4221701BA)“.

- And in the section below, you’ll need the Registered Agent Consent Form.

Pro Tip: Login to your Northwest dashboard and look in your “Forms Library”. In here, you’ll find a signed Registered Agent Consent Form. Download this and upload it in the next section below.

Registered Agent Certification:

- Check off the box.

- Upload the signed Registered Agent Consent Form.

- And click “Next Step” to proceed.

If you hired a different Registered Agent Service:

If you hire a different Registered Agent Service, first, login to their dashboard and confirm your Registered Agent address. And see if they have a “Registered Agent Consent Form” that you can download. If you don’t see it, you’ll need to call or email them to get it.

Next, search their name at the top of the page (just enter the first few words of the company name). And choose the correct result.

Registered Agent Certification:

- Then check off the box.

- Upload the Registered Agent Consent Form.

- And click “Next Step” to proceed.

Duration and Purpose

This section lets the state know how long your LLC will remain in existence (the Duration of your LLC).

- If you want your LLC to be “open-ended” with no set end date, select “Perpetual“.

- If you want your LLC to be automatically shut down after a certain period of time, select “Limited/Future Date”. Then enter your desired LLC end date.

Pro Tip: We recommend choosing “Perpetual“. This is the best option for everyone.

Purpose Statement

In this section, you’ll state your LLC’s business purpose.

You can choose either a general purpose or specific purpose.

If you leave the box blank (which is totally okay), then your LLC will have a general purpose. This means it can engage in “any and all lawful activities”.

If you prefer to use a specific purpose, you can enter a few words (like “pizza shop”, “real estate investing”, “landscaping”, “old car restoration”, etc.).

Note: If you do list a specific purpose, you won’t be forced to do this forever. You can change your LLC’s purpose at any time.

Pro Tip: We recommend just leaving the box blank for general purpose (this gives you the most flexibility.)

Click “Next Step”.

Optional Articles

Statement of Management Status

The Limited Liability Company is managed or under the authority of a Manager(s):

- Check this box if your LLC will be Manager-Managed.

- Leave this unchecked if your LLC will be Member-Managed.

- For more information, please see Member-managed vs Manager-managed LLC.

The Limited Liability Company is a single-member limited liability company:

- Check this box if your LLC will have 1 owner (a Single-Member LLC)

- Leave this unchecked if your LLC will have 2 or more owners (a Multi-Member LLC)

I would like to include my members of the Limited Liability Company:

- If you’d like to publicly list the owners (Members) of your LLC, check off this box, click “Add“, and enter their name (address is optional).

- If you prefer to keep this information private (it’s not required by the state), then you can leave this box unchecked.

Additional Articles

This section doesn’t apply to 99% of people, so you can just leave it on the default selection of “Not Applicable“.

Act Information – For SOS Use Only

Note: There is nothing to choose or select in this step. It’s just stating that your LLC will be organized under the laws of the New Mexico LLC Act.

Filing Effective Date

This section lets the state know when your LLC will go into existence (the LLC Effective Date).

- If you want your LLC to go into existence on the date it’s approved by the state, select “When filed by the Secretary of State” (this is what most people do).

- If you want your LLC to go into existence on a future date, select “On a specific future date (within 1 year)“. Please enter the date you want your LLC to go into existence

Note: If you choose a date in the future, it can’t be more than 1 year ahead. You also can’t back-date your filing at all.

Click “Next Step“.

Application Fee

This section is letting you know that you’re about to pay a filing fee of $50, and that it’s not refundable.

Click “Next Step“.

Confirm

This section will show you all of the information you’ve entered in the previous sections. Review the information for completeness and accuracy.

If you’d like to edit anything, you can do so by clicking the heading for that section from the left-hand navigation menu. You can also hit “Previous Step” and “Next Step” to cycle through them.

Once everything looks good, click “Next Step”.

Signature

Check off the boxes at the top, agreeing to the terms.

Organizer(s)

What is an LLC Organizer?

- An LLC Organizer is simply the person who signs the Articles of Organization.

- An Organizer can be an LLC Member, but they don’t have to be.

- Additionally, being an Organizer doesn’t automatically make a non-Member of an LLC become a Member of your LLC.

- And your LLC only needs to list 1 Organizer.

- For more information, please see LLC Organizer vs LLC Member.

Add your LLC Organizer:

- Click “Add“.

- Enter their first and last name.

- You can also enter their address, but it’s optional.

- Click “Save“.

Then you will see a signature pop-up appear:

- Signer’s Capacity: Select “Self” from the dropdown.

- Signature: Enter the first and last name of the LLC Organizer again.

- Date: Just click “Today” (don’t use the calendar button).

Then click “File Online” to proceed.

Cart (Payment)

The fee for a New Mexico LLC is $50.

Select your payment type:

- Credit or Debit Card

- Personal ACH

- Business ACH

Billing Information & Payment Details

Enter your billing and payment information in the next steps.

And then submit your filing to the state.

Congratulations!

Your LLC has been submitted to the state. Now you just need to wait for approval.

New Mexico LLC Approval Time

When you file your LLC online, it will be approved in 1-3 business days.

Once approved, you will receive an email letting you know to check your Dashboard.

Login to your Online Portal, click “My Records“, and download your LLC approval documents.

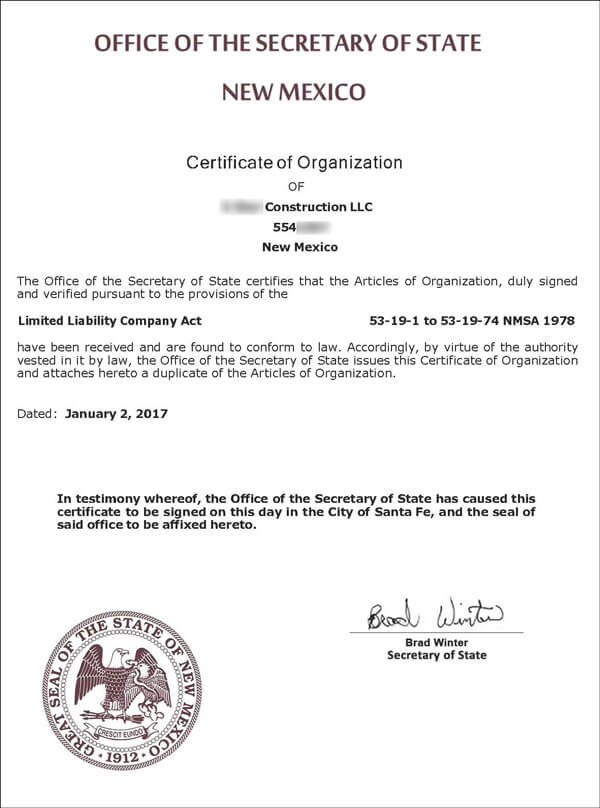

You’ll find a Certificate of Organization. And you’ll find a stamped and approved copy of your Articles of Organization.

Here’s what the New Mexico Certificate of Organization looks like:

New Mexico Secretary of State Contact Info

If you have any questions, you can contact the New Mexico Secretary of State at 505-827-3600.

Their hours are Monday through Friday from 8am to 5pm (Mountain Time).

(New Mexico Secretary of State, Corporations Bureau Building)

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

References

New Mexico LLC Act

New Mexico Secretary of State: Domestic LLC

New Mexico Secretary of State: Start a Business

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

New Mexico LLC Guide

Looking for an overview? See New Mexico LLC

Matt,

If the work is not going to be conducted within the US, and clients will not be from the US, would you agree it is best not to set the principal place of business to be an address within the US – how convenient it may be – to comply with regulations for a disregarded entity?

Hi Feisal, we recommend using the address where most of the business activities will be taking place.

Are the organizer name and information public record or known only from the SoS?

Hi Nick, the LLC Organizer name and address is on public record.

Thanks, that’s a great info! So if you want privacy…

You’re welcome. If you want privacy, it’s best hire a filing company to form the LLC for you (so they sign as the Organizer). You’ll also want to hire a Commercial Registered Agent. Ideally, one that will let you use the Registered Agent address for the Principal Place of Business and the Mailing Address (of course they’d also list their name and address in the Registered Agent section). If you want to hire a company, we recommend Northwest Registered Agent. They offer address privacy as I’ve mentioned here. Alternatively, you can just hire a Commercial Registered Agent (for Registered Agent + addresses) and have a friend sign as the LLC Organizer. Then your friend can sign a Statement of LLC Organizer.

WOW! Your LLC lessons were awesome! I followed your online lessons and

“demonstration videos” and was able to apply for my LLC without a glitch. I actually had approval and my Articles of Organization from the state within 12 HOURS of applying!

THANK YOU!

Jake, that is freakin’ awesome! And fast! We’re so glad we were able to help make things easy for you :)