Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Every Utah LLC needs to file an Annual Report each year to keep their business in good standing with the Utah Department of Commerce.

This requirement begins the year after you start an LLC.

If you just started your Limited Liability Company, you won’t have to file this until next year (just bookmark this page for later).

If it’s time to file your Utah Annual Report now, this page will walk you through the filing instructions.

Important: If you don’t file your Utah Annual Report within 60 days of the due date, the state will shut down your LLC. This page will show you how to file your Annual Report, and what to do if it’s late.

What is an Annual Report for an LLC?

The Annual Report is a business filing that keeps your LLC in Good Standing with the state.

This filing includes basic business details, like your principal office address and your Registered Agent information.

Like most states, Utah requires that LLCs stay in Good Standing to be legally compliant. And LLCs remain in Good Standing by keeping the LLC’s basic information current on state records.

The Utah Division of Corporations gathers this information every year using the LLC Annual Report form.

Note: The Utah Annual Report may also be referred to as the Business Renewal or Annual Renewal. We will use these terms interchangeably.

Does Utah require Annual Renewals?

Yes, Utah requires every LLC to file an Annual Report every year.

How much does it cost to file a Utah Annual Report?

The Utah Annual Report costs $18 each year. This filing fee is paid every year for the life of your LLC.

When is a Utah Annual Report Due?

Utah Annual Reports are due by the last day of your LLC’s anniversary month.

Your LLC’s anniversary month is the month it was approved by the Utah Division of Corporations. You can find this date on your approved Certificate of Organization or by searching for your LLC on the Utah Business Registration Search.

For example, let’s say the Division of Corporations approved your LLC on August 12, 2025. This means that August 12 is your LLC anniversary date, and August is your LLC anniversary month. Therefore, your Annual Report will be due by August 31 every year after that.

When is my first Utah Annual Report due?

Your first Annual Report is due the year after your LLC was approved.

For example, let’s say your LLC was approved on August 12, 2025. Your first Annual Report is due by August 31, 2026. Then your Annual Reports are due by August 31 every year after that.

How early can I file my Annual Report?

You can file your Annual Report up to 60 days before the due date.

For example, if your Annual Report due date is August 31, you can file your Annual Report as early as July 1.

What if my Annual Report is late?

The state gives you a 30-day Grace Period to file your Annual Report late. Meaning, you can file your Annual Report up to 30 days late with no penalty and no late fee.

For example, if your Annual Report due date is August 31, your Grace Period is September 1 to September 30. As long as you file before September 30, there is no penalty and no late fee.

If you don’t file your Annual Report within the Grace Period, you have 30 more days to file your Annual Report late. This is called the Delinquency Period. If you file your Annual Report during this Delinquency Period, you will have to pay a $10 late fee ($28 total). Then your LLC will be renewed and ready to go.

For example, if your due date is August 31, your Delinquency Period is October 1 to October 31. If you file between October 1 and October 31, you’ll need to pay the $10 late fee ($28 total).

If you don’t file your Annual Report by the end of the Delinquency Period, the state will dissolve (shut down) your LLC.

For example, if your due date is August 31, and you don’t file by October 31, then the state will dissolve your LLC.

This means that the state cancels your business’s registration. And technically, you shouldn’t operate an Expired LLC.

Instead, you need to Reinstate your LLC, which we explain in the FAQs below.

How do I file my Annual Report in Utah?

You can file your Annual Report online or by mail.

We recommend the online filing because you get an immediate confirmation of the filing. And you’re also able to update your Registered Agent, LLC Members, and business address online.

How to file an Annual Report online (step-by-step)

First, go to the Utah Division of Corporations Business Registration System, and login with your Utah ID.

(Note: If you don’t already have a UtahID account, you can follow the instructions on the UtahID Account Creation page.)

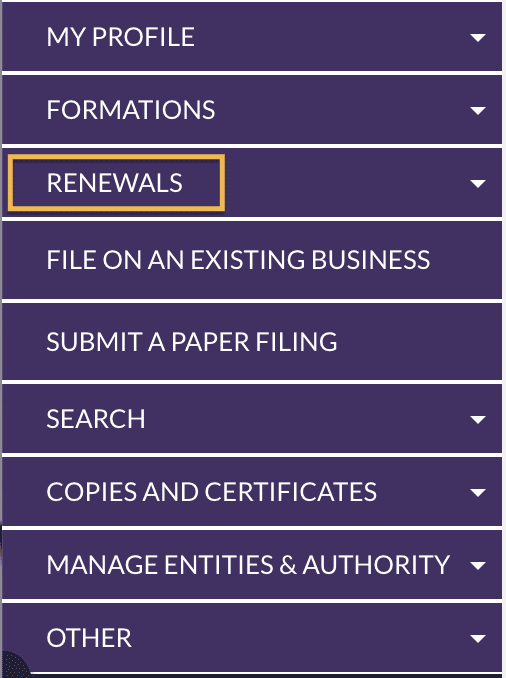

Once you’re logged in, click “Renewals”.

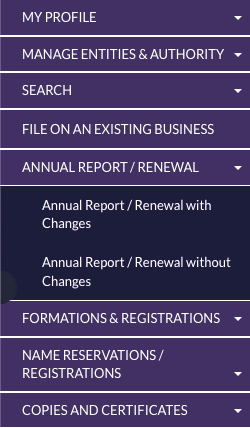

Then you’ll see 2 options for your Annual Report filing.

Select “Annual Report/Renewal with Changes“.

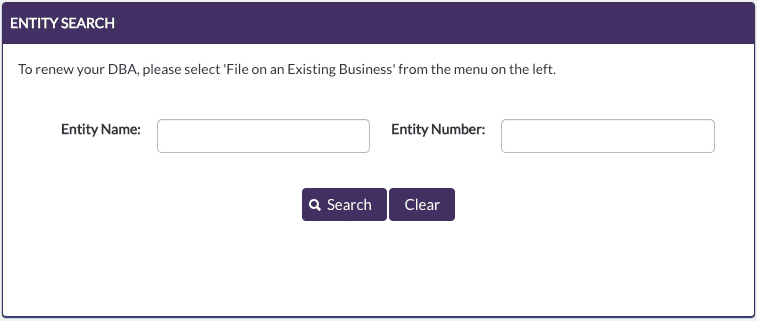

Entity Search

Enter your LLC’s name in the Entity Name field and click “Search”.

Scroll down and find your business in the search results. Click the button next to your LLC name, and then click “Select”.

Next you’ll see basic details about your LLC. At the bottom of the screen, click “Next”.

Note: To edit each of the following sections, check the box at the top that says “Select checkbox to update/provide information below”.

Filing Details (Purpose Statement)

This section is asking for your LLC statement of purpose.

You can either:

- leave this section blank, which gives your LLC a general purpose (meaning it can engage in any legal business activities)

- or you can choose a specific purpose (by entering a few words, or sentences, about what your LLC does)

Tip: We recommend leaving this blank to provide your LLC the most flexibility.

Principal Office Address

Review your Principal Office Address, Mailing Address, and email, and make any changes if necessary.

Important: If you don’t have an email on file, we recommend adding one. This will be used to send you Annual Report reminder notices in the future.

Then click “Next”.

Registered Agent

Look under the “Update Selected Registered Agent” section (the 2nd box). This shows your current Utah Registered Agent‘s information.

If you don’t need to change or update your Registered Agent:

Simply click “Next” to proceed.

How to change or update your Registered Agent

If your new Registered Agent is a person (like you, a friend, or a family member):

- In the “Registered Agent Search” section, enter their name in the “Agent Name” box. Then click “Search“.

- Next click the “Create Agent” button.

- Enter their first name, last name, and address. Then click “Save“.

- Under the “Search Results” section, click the “Select” button to the left and then click “Select Registered Agent” (you’ll see their information populate below).

- Then click “Next” to proceed.

If you hired a Commercial Registered Agent:

- In the “Registered Agent Search” section, enter the company’s name in the “Agent Name” box (leave out the ending, like “LLC” or “Inc”). Then click “Search“.

- Select your Registered Agent’s information from the search results and click “Select Registered Agent“.

- Then click “Next” to proceed.

Principal Information

All Utah LLCs are required to have at least 1 Principal on file with the Division of Corporations, beginning with their first Annual Report.

A Principal should be an LLC Member (owner) or LLC Manager.

Pro Tip: Don’t use the titles “Organizer” or “Governing Person” here. Instead, use “Member” or “Manager”. If these terms are confusing or unfamiliar, check out Member-managed vs Manager-managed LLC.

Titles: Select your Principal’s title (Member or Manager) from the dropdown.

Start Date: You can leave this blank. It’s not important.

Name Type: Select whether the LLC Principal is an Individual or an Entity.

Name: Enter either the person’s name or the entity’s name.

Address: This isn’t required, so you can leave it blank if you want.

Then click “Add Principal“.

If you’d like to add more Principals to your LLC, repeat these steps.

When you’re finished with this section, click “Next”.

Supporting Documentation (optional)

This section is not relevant to Annual Reports, so you can just leave it blank and click “Next“.

Signature (LLC Organizer)

An LLC Organizer is the person or company who signs and submits your Certificate of Organization to the state. An LLC Organizer isn’t automatically made a Member of your LLC, however, an LLC Member can also sign as the Organizer.

Check the boxes agreeing to the terms.

Signature: Enter your name.

Title: Select the title “Authorized Person“.

Then click “Next”.

Review

Review all of the information you’ve entered to make sure everything is correct.

If you need to edit any information, click the “Edit” button for that section.

When everything looks correct, click “Add to Shopping Cart”.

Note: If the system logs you out at this point, login again with your Utah-ID. You can reopen your Annual Report filing by going to your Dashboard and, clicking “Filings in Progress”. Then click the green pencil icon next to your Annual Report.

Click “Next” all the way through to the Review page again. Confirm that all of your information is correct and up-to-date. Then click “Add to Shopping Cart” again.

Shopping Cart (payment)

Next, you’ll see your Annual Report listed next to the $18 filing fee.

Click “Make Payment”.

Enter your payment information and click “Complete”.

Approval

Congratulations, you’ve successfully filed your Utah Annual Report, and it will be processed within a few minutes.

Once your Annual Report is processed, you will receive an email confirmation from the state.

Set a calendar reminder to file your Annual Report every year

To make sure you file your Annual Report on time (and so you don’t have to worry about late fees or filing a Reinstatement), we recommend putting a repeating reminder on your phone, computer, and/or calendar.

Here’s a video on how to use Google Calendar to create reminders for Annual Reports:

Utah Department of Commerce: Division of Corporations Contact Info

If you have any questions about your LLC Annual Report, you can contact the Division of Corporations and Commercial Code within the Utah Department of Commerce.

Their phone number is 801-530-4849. Their hours are Monday through Friday, from 8am to 5pm Mountain Time.

Utah Annual Report Filing FAQs

What is a Renewal for an LLC?

The Annual Business Renewal is the same thing as the LLC Annual Report in Utah.

It’s the filing that is due every year in order to keep your LLC active.

You can do this yourself, or you can hire somebody to file the Utah Business Renewal for an LLC. Most LLC Filing Companies offer a Utah Annual Report Service in their packages.

Do I have to file an Annual Renewal for my LLC every year?

Yes, you have to file a Utah Annual Report (LLC Renewal) every year. It is a state requirement in order to keep your Utah LLC active and in good standing.

This is required regardless of business activity or income. Meaning, even if your LLC does nothing and makes no money, you still have to file an Annual Report every year.

How much does it cost to renew an LLC in Utah?

The filing fee for an Annual Business Renewal in Utah is $18 per year.

If you file your LLC Renewal online, you can pay by credit or debit card.

If you file your LLC Renewal by mail, make your check payable to the “State of Utah”.

How often do you have to renew your LLC in Utah?

All Utah LLCs must be renewed every year.

If you don’t renew your LLC, it will “Expire” and you’ll then have to Reinstate it or file a new LLC altogether.

If you don’t want to go through the Annual Report filing process every year, you can hire an Annual Report service.

Most LLC Filing Companies and Registered Agent Services offer a Utah Annual Report Service in their packages.

What is the processing time for a Utah Annual Report?

If you file online, it’s processed immediately.

If you file by mail, it may take up to two weeks with mail time.

What happens when an LLC expires in Utah?

If your LLC expires, the state shuts down your LLC (or cancels your business registration).

If your LLC expires, you have 2 years to Reinstate it. If you fail to Reinstate the LLC within that 2 years, you must form a new LLC by filing another Certificate of Organization.

How to Reinstate an LLC: Follow the instructions on the Division of Corporations page: Reinstate your LLC. You will file the Reinstatement online and pay $59 in filing fees.

How to start a new LLC: If it’s been more than 2 years since your LLC expired, you must form a new Utah LLC. The filing fees for new LLCs are $59.

Will I be charged a late fee if I don’t file a Utah Annual Report on time?

If you file within the 30-day Grace Period after the Report due date, there is no late fee.

However, there is a late fee if you file after the 30-day Grace Period. This is called the Delinquency Period and it lasts for an additional 30 days.

The late fee to file during the Delinquency Period is $10, so your total Annual Report filing fees are $28.

Note: If you don’t file an Annual Report within 60 days of the Annual Report deadline, you will have to pay $59 to Reinstate your LLC.

How do I know if my LLC is Expired?

The state will send an Expiration Notice to your LLC’s Principal Business Address, your Registered Agent, and to an LLC Member. You can also check the status of your LLC by using Utah’s Business Search tool.

If the LLC is Expired, the “Status” field will say “Expired”.

What should I do if my LLC Expires?

If you (and any other LLC Members) are ready to shut down your business, you can let your LLC Expire. There’s no penalty for doing this and you don’t need to file anything else with the Division of Corporations. You can then file a final tax return and close the LLC bank account.

If you want to keep using your LLC, you need to “bring it back to life” by filing a Reinstatement.

How do I Reinstate an LLC?

If you need to file a Reinstatement, it will cost $59. You can file it online (see Online Business Reinstatement) or by mail (Application for Reinstatement).

You can only Reinstate your LLC within 2 years from the date your LLC was marked “Expired”. After 2 years have passed, you can’t file a Reinstatement. Instead, you must start over by forming a new Utah LLC.

For example, if your LLC expired on July 1, 2024, you can file your Application for Reinstatement any time before July 1, 2026. To find the date your LLC expired, you can use the Business Entity Search tool.

Tip: Make sure you still have a valid Registered Agent before Reinstating. If a friend or family member is the Registered Agent, confirm they’re still willing to do it. If you hired a Registered Agent Service, check that your subscription is still active.

What is an LLC Expiration Date?

Because Utah law requires an LLC to be “renewed” every year, you will see mention of an “expiration date”. In Utah, your LLC will “expire” unless you renew it.

Your LLC’s anniversary date is the date it was approved by the Division of Corporations. Your LLC’s Annual Report is due by the last day of your anniversary month (not the exact anniversary date). This due date is sometimes called the expiration date, because unless you Renew the LLC, it “expires”.

The actual change of status to Expired doesn’t happen until 60 days after the expiration date (the due date of the Annual Report). The Division of Corporations calls that the “Date of Status Change”.

Can I file my Utah Annual Report by mail?

Yes, you can file the Renewal Application by mail (instead of online).

First, download the Annual Report/Renewal Form.

Enter:

- Your LLC’s Entity Number (find it using the Business Entity Search tool)

- Entity type: Enter “Domestic Limited Liability Company“

- Expiration Date: Last day of your LLC’s anniversary month (written in MM/DD/YYYY format)

- Entity Name: Enter your LLC name (including “LLC” or other designator)

Prepare a check payable to the “State of Utah” for the $18 filing fee. Mail to:

Division of Corporations

PO Box 146705

Salt Lake City, UT 84114

Note: If you need to make changes to your LLC’s Registered Agent, Primary Business Address, or the names of your LLC Members or Managers, you will also need to complete a Registration Information Change Form (download it here). There’s no additional charge to file this form with your Annual Report.

Can I file my Annual Report online if I filed my LLC by mail?

Yes, you can file your Annual Report online even if you filed the LLC by mail.

You’ll just need to make a Utah ID and use it to log in to the Utah Business Registration System. Then follow the instructions above.

How do I get a copy of my filed Annual Report?

Unfortunately you can’t get a copy of your filed Annual Report, but you can download a copy of any changes that were made.

You can confirm that your Report was filed (and get a copy of any changes) by searching for your LLC in the Business Entity Search. It takes 10-12 business days for your Report filing to become available in the system after you submit it online.

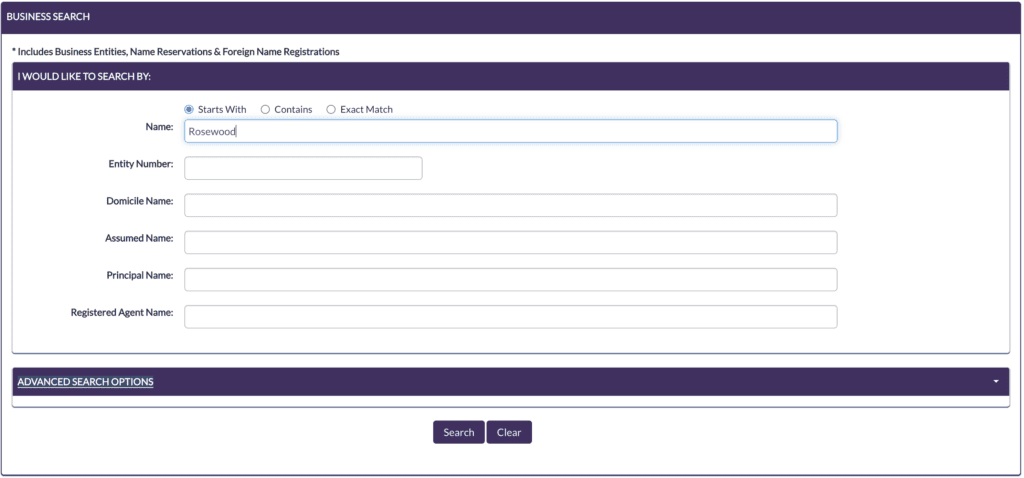

After 10-12 business days have passed, search your LLC using the Utah Division of Corporations: Business Search tool.

Enter your LLC Name and click “Search”.

Click on your LLC Name from the business entity search results.

Next, in the Entity Information section, check the “Last Renewed Date” to confirm the most recent filing date.

Scroll down to the bottom of the screen and click “Filing History” to see the list of filings you’ve submitted to the Utah Division of Corporations.

Look for the document labeled “Annual Report”, and click the blue magnifying glass under the “View” column. This will automatically download the changes you made in that Annual Report filing.

Remember: The document only lists the changes that were made in that specific Annual Report. It isn’t a copy of your entire Annual Report.

References

Utah LLC Act: Section 48-3a-212

Utah LLC Act: Section 48-3a-102

Utah Business Renewal: Instructions

Utah Business Renewal Online Filing

Utah Division of Corporations: Renewal Process

Utah Division of Corporations: About the Postcards

Utah Division of Corporations: How to Reinstate a Business

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.