Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through filing your Utah Certificate of Organization with the Division of Corporations.

In this lesson, we will walk you through filing your Utah Certificate of Organization with the Division of Corporations.

What is the Utah Certificate of Organization?

This is the document that officially forms your Utah LLC.

The form asks for basic information like your business name, your LLC address, and your company’s Registered Agent information.

You can file the Utah LLC Certificate of Organization online or by mail.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

How much does the Utah Certificate of Organization cost?

The filing fee for an LLC in Utah is $59. This is a one-time fee, and it’s the same amount whether you file online or by mail.

Note: The “LLC filing fee” is the same thing as the “Certificate of Organization fee”. They are different names for the same fee to create your Utah LLC. How much is an LLC in Utah explains all the fees you’ll pay, including the Certificate of Organization filing fee.

How long does it take to get an LLC approved in Utah?

The approval time for an LLC in Utah is 3-4 business days (plus mail time) if you file by mail, and immediately if you file online.

We recommend filing online because it’s faster and you get your approval documents emailed to you. On the other hand, if you file by mail, the state doesn’t send you the approval documents (and you have to retrieve it manually). If you still want to file by mail, we have instructions below.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Utah.

Expedited Utah LLC Filing

The Utah Division of Corporations also offers Expedited Filing for mail or online filings.

The Division of Corporations will process an expedited filing the next business day for an additional $75 (a total filing fee of $134).

Utah Department of Commerce, Division of Corporations and Commercial Code Building

How to File a Utah LLC Online (step-by-step)

In September 2024, the Utah Division of Corporations changed where and how business registrations are submitted online. The new system requires you to create an account with UtahID to file your Certificate of Organization.

We’ll explain the new Certificate of Organization filing process step-by-step.

First, visit the Utah Division of Corporations Business Registration System, and login with your UtahID username and password.

(Note: If you don’t already have a UtahID account, you can follow the step-by-step instructions on UtahID Account Creation provided by the Utah Division of Technology Services.)

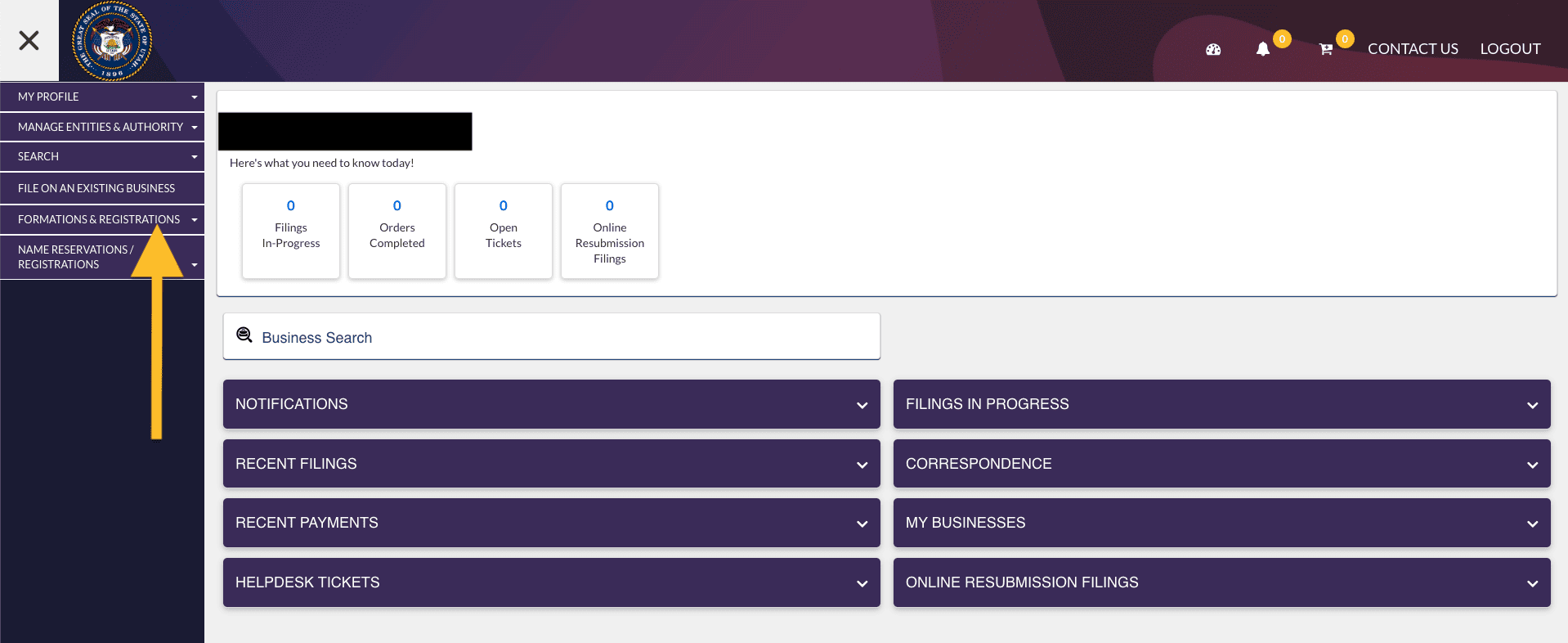

Once you’re logged in, click on “Formations & Registrations” in the left-hand menu.

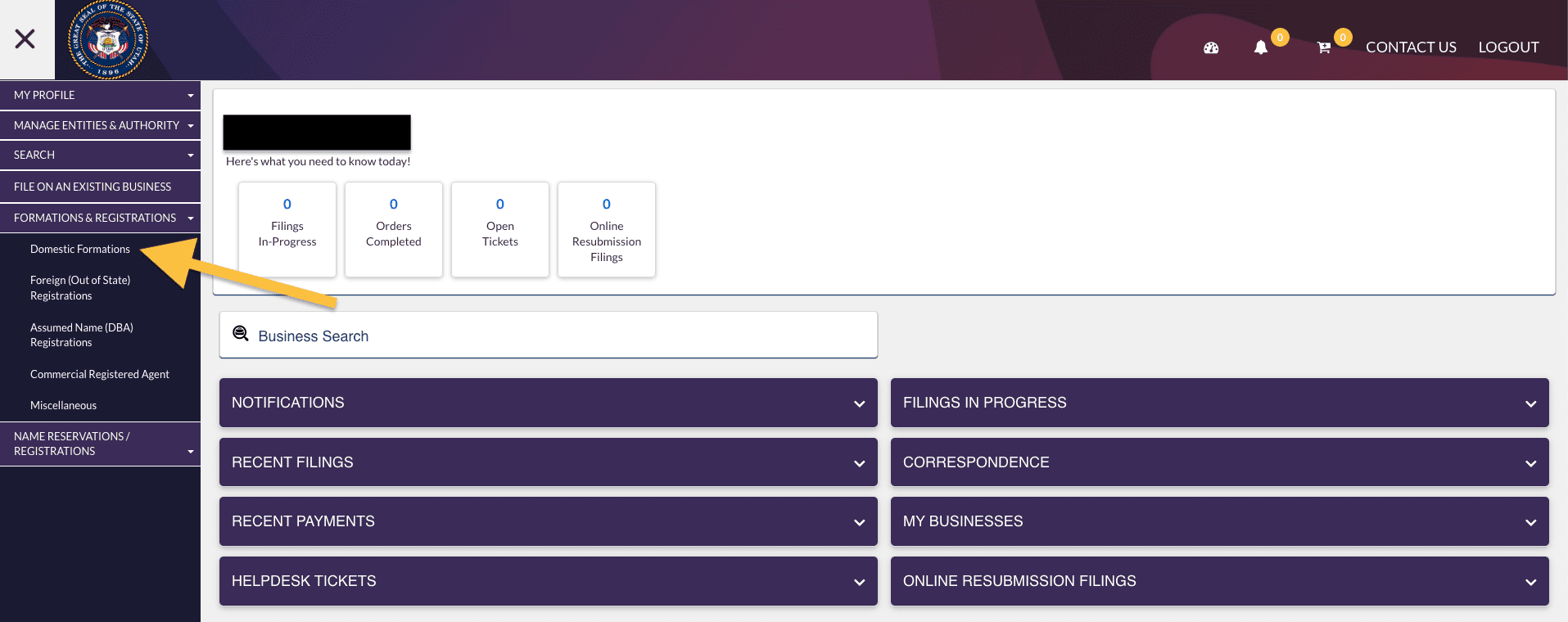

Click “Domestic Formations“.

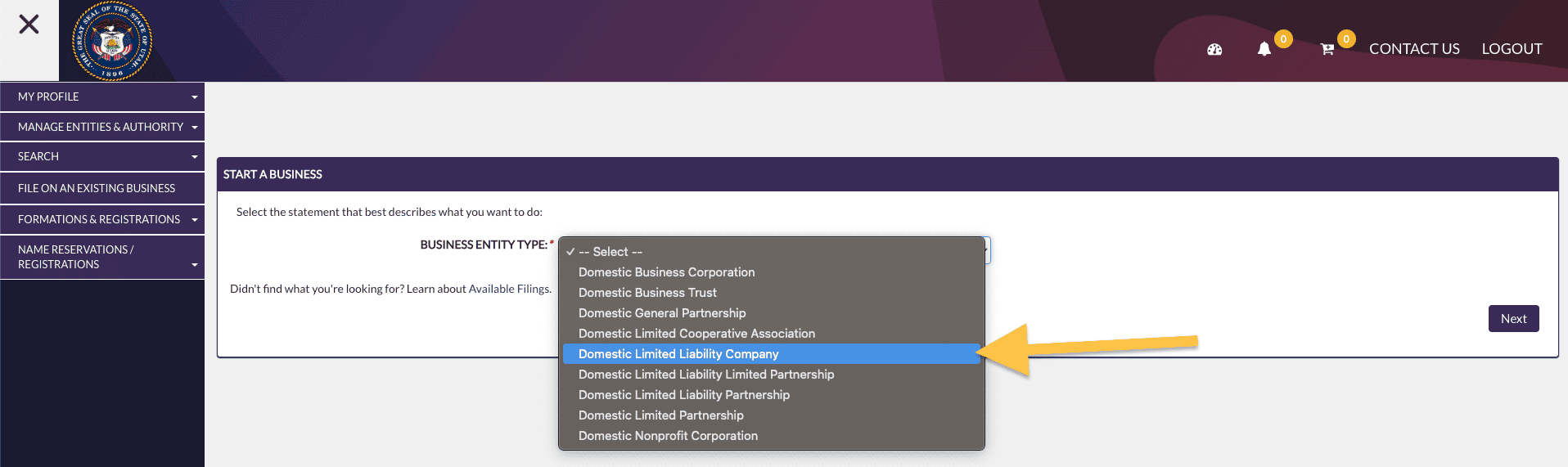

On the next page, select “Domestic Limited Liability Company” from the “Business Entity Type” menu and click “Next”.

Business Classification

Select the type of LLC you want to form.

Most people select “A Limited Liability Company”. This is the standard type of LLC and what we recommend.

Note: The other types of LLCs on this list have special rules and extra requirements. We recommend speaking to a business attorney before starting the other LLC types. You can also learn more about these LLC Types from the Utah Division of Corporations: Business Entities page.

Once you’ve selected your LLC type, click “Next”.

Name Availability Search

In this step, you’ll enter your LLC name to make sure it’s available.

Have you reserved a name for this business?

If you’ve reserved a business name with the state, choose “Yes”. If not, choose “No”.

Most people choose “No”. You don’t need to reserve a business name with the state in order to start an LLC, and we don’t recommend it.

Enter your desired entity name

Enter the name that you want to use for your business, and click “Verify Name”.

Note: If you did reserve a business name with the state, enter the release code in this box. The release code is the number the state gave you when you finished your name reservation request.

If your desired business name is available, you’ll see a success message. Click “Next“.

Filing Details (Purpose Statement)

In this section, you’ll state your LLC’s business purpose. You can choose either a general purpose or specific purpose.

If you leave the box blank (which is totally okay), then your LLC will have a general purpose. This means it can engage in “any and all lawful activities”.

If you prefer to use a specific purpose, you can enter a few words (like “pizza shop”, “real estate investing”, “landscaping”, “old car restoration”, etc.).

Note: If you do list a specific purpose, you won’t be forced to do this forever. You can change your LLC’s purpose at any time.

Recommendation: We recommend just leaving the box blank (for the most flexibility.)

Click “Next”.

Effective Date and Duration (optional)

This section lets the state know when your LLC will go into existence (the Effective Date), and how long your LLC will remain in existence (the Duration of your LLC).

If you want your LLC to go into existence on the date it’s approved by the state, leave both “Effective Date” and “Effective Time” blank (this is what most people do).

If you want your LLC to go into existence on a future date, please enter the date you want your LLC to go into existence (and leave the “Effective Time” blank; this is not important).

Note: If you choose a date in the future, it can’t be more than 90 days ahead. You also can’t back-date your filing at all.

Pro Tip: If you’re forming your LLC later in the year (October through December) and you don’t need your LLC open right away, you can forward date your filing to January 1st of next year. This can save you the hassle of filing taxes for those few months.

However, if you need your LLC bank account opened before January 1st, we recommend not using a future Effective Date.

Duration Type

This section lets the state know the duration of your LLC (how long it will remain in existence).

- If you prefer for your LLC to be “open-ended” with no set end date, select “Perpetual“.

- If you prefer for your LLC to be automatically shut down after a certain period of time, select “Set Duration”. Then enter your desired LLC end date.

Recommendation: We recommend choosing “Perpertual”. This is the best option (and you can always shut down/close your LLC at any time in the future.

Click “Next”.

Principal Office Address

In this section, you’ll enter your LLC’s Principal Office Address and your LLC’s Mailing Address.

Principal Office Address

Enter your LLC’s Principal Office Address here.

This must be a physical address (no PO boxes). And while it’s called an “office” address, it doesn’t have to be an actual office address. This address can be a:

- home address

- office address

- mailbox rental address

- address of your Registered Agent (check with your Registered Agent)

Additionally, this address can be in Utah or in any other state.

Tip: Enter the zip code first. This will turn the city field into a dropdown menu.

Mailing Address

If your Mailing Address is the same as your LLC’s Principal Office Address, check the box next to “Mailing Address Same as Principal Office Address”.

If not, enter your LLC’s Mailing Address here.

Note: Unlike the Principal Office Address, if needed, this address can be PO Box.

Correspondence Email Address Entry

Enter your email address so that the state can send you Annual Report reminders and other communications.

Pro Tip: I recommend adding your email address here. If you do, the state will email you a stamped copy of your LLC documents once they’re approved.

Click “Next”.

Registered Agent

In this section, you’ll enter your Registered Agent’s name and address.

The Registered Agent is a person or company who agrees to accept legal documents and state notices on behalf of your LLC.

Note: If you haven’t chosen a Registered Agent yet (or you aren’t sure what the best option is), we recommend reading Utah LLC Registered Agent.

Registered Agent Search

If you hired a Commercial Registered Agent (aka Registered Agent Service):

- Select “Entity” and check the box next to “Commercial Registered Agent”. Then enter the company’s name and click “Search”.

- Select your Registered Agent’s name from the results and click “Select Registered Agent”. Now your Registered Agent’s name, address, and entity number will auto-fill below. Click “Next” to proceed.

- Note: It’s a good idea to confirm the address is correct (by double-checking the address inside your Registered Agent dashboard).

If you’ve chosen to be your own Registered Agent (or use a friend or family member):

- Select “Individual”.

- (Don’t select “Commercial Registered Agent”.)

- Then enter the person’s first and last name, and click “Create Agent”.

- Enter that person’s first and last name, and their Utah address.

- The address can’t be a PO Box. The Utah Registered Agent must have a physical street address located in Utah.

- Click “Save” to return to the main Registered Agent section, and then click “Next”.

For more information on being your own Registered Agent, check out Can I be my own Registered Agent in Utah.

Principal Information

In Utah, you don’t have to list the LLC Members (owners) or LLC Managers in the Certificate of Organization (it’s optional). LLC Members are listed in the LLC Operating Agreement.

For this reason, we recommend that you just leave this entire section blank and click “Next”.

However, if you prefer to list your LLC’s Members or Managers, then select the appropriate title from the dropdown. Enter their first and last name, then click “Add Principal”.

You can ignore the “Governing Person” and “Organizer” titles in the dropdown. They aren’t relevant or needed at this step.

Note: LLCs in Utah may seem “private” because Members and Managers aren’t required to be listed in the Certificate of Organization. But please know that at least one Principal (an LLC Member, LLC Manager, or Governing Person) will be listed publicly on the Utah Annual Report.

Click “Next”.

Supporting Documentation with Other Provisions

You can use this section to add or upload “custom rules” to your LLC (for example, if your attorney recommended it).

That said, most people leave this entire section blank because it’s not relevant.

Click “Next”.

Signature

Note: At the top, you’ll see a reminder about your Annual Report being due every year, starting the year after your LLC’s Effective Date (the date it’s approved).

You don’t need to worry about this right now. We explain everything you need to know about the Utah Annual Report, including when and how to file it step-by-step in our Utah LLC Annual Report guide. For now, you can just bookmark that page and read it after you’ve finished forming your LLC.

First, check off the two boxes agreeing to the terms.

Electronic Signature:

Enter the first name and last name of the LLC Organizer and then click “Add”.

Pro Tip:

It’ll look like the “Electronic Signature” and “Title” fields get duplicated. It’s a weird thing that Utah does. However, this is correct. It means it’s been saved. Once the box is duplicated, click “Next”.

What is an LLC Organizer? An LLC Organizer is simply the person who signs the Certificate of Organization.

Note: An Organizer can be an LLC Member, but signing this form doesn’t automatically make someone an LLC Member. To learn more, please see LLC Organizer vs LLC Member.

Additional Orders (Expedited filing)

In this section, you have the option to expedite your filing for an extra $75, however, we don’t recommend this.

Why? The state has recently updated their online filing system, so online filings are now processed immediately. So if you file online, there’s no point in expediting your filing. And if you file by mail, expedited filing only knocks a day or 2 off of your processing time.

Just click “Next” to proceed.

Review

This section will show you all of the information you’ve entered in the previous sections on one page. Review the information for completeness and accuracy.

If you’d like to edit anything, you can do so by clicking “Edit”.

Once everything looks correct, click “Add to Shopping Cart”. This will take you to a checkout page.

Pro Tip: If instead, you get kicked out and see the Utah ID login, then just log back in, click “Filings In-Progress” at the top, and click the green pencil icon. Once you get back to the review page, then click “Add to Shopping Cart” again.

Shopping Cart & Check Out

Click “Checkout”.

Then click “Make Payment” and enter your payment details.

Then click “Complete”.

Approval

Congratulations, your LLC has been filed with the Utah Division of Corporations. Now you just need to wait for approval.

When you file your LLC online, it will be approved in immediately.

Once the state reviews and approves your LLC filing, you will receive an email with your stamped and approved Certificate of Organization.

Congratulations! Your LLC is now approved.

Utah Division of Corporations Contact Info

If you have any questions, you can contact the Utah Department of Commerce, Division of Corporations and Commercial Code.

Their phone number is 801-530-4849. Their hours are 8am – 5pm Mountain Time, Monday – Friday.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Utah LLC Certificate of Organization FAQs

How to File a Utah LLC by Mail

If you want to file by mail (instead of online), you need to download and complete the Utah LLC Certificate of Organization form.

Note: The state doesn’t accept handwritten forms. Complete the form on your computer, then print and sign.

Regular filings (3-4 business days (plus mail time)):

- Prepare a check or money order for $59 (made payable to “State of Utah“).

- Put your LLC Name on the memo line.

- Mail payment and Certificate of Organization to: Utah Division of Corporations, PO Box 146705, Salt Lake City, UT 84114-6705

Expedited filing (2-3 business days approval time):

- Prepare a check or money order for $134, made payable to “State of Utah“.

- Put your LLC Name on the memo line.

- Put a sticky note on your form and write “Expedited Filing”.

- Mail payment and Certificate of Organization to: Utah Division of Corporations, 160 East 300 South, Salt Lake City, UT 84114

What is a Certificate of Organization in Utah?

The Certificate of Organization is the document that officially forms your LLC in Utah. You can file the Utah LLC Certificate of Organization online or by mail.

The form asks for basic information like your business name, your LLC address, and your company’s Registered Agent information.

This document may also be called the Utah LLC Articles of Organization.

Does Utah require Articles of Organization for LLC?

Technically, no. However, Utah uses a Certificate of Organization for LLC filings. And this is the form you need to file to create an LLC in Utah.

What is the difference between a Certificate of Organization and Articles of Organization?

They are in essence the same thing (the document you file with the state to create your LLC), however, different states use different names.

Most states call this form the Articles of Organization, however, Utah uses the term Certificate of Organization.

(And a few other states call this form the Certificate of Formation.)

How do I get a Certificate of Organization in Utah?

You can get the Utah LLC Certificate of Organization from the state’s website.

The Corporations Division provides a Utah LLC Certificate of Organization template form for you to use. You can download the PDF for free.

If you’re looking for a copy of a Certificate of Organization that you already filed for your LLC:

Search your LLC name using the Utah Division of Corporations: Business Search tool.

Click “Filing History” once you’ve opened your LLC’s entity page. Then select the Certificate of Organization to download a free copy.

How much does it cost to file a Certificate of Organization in Utah?

It costs $59 to file the Utah LLC Certificate of Organization. This is a one-time fee paid to the Utah Division of Corporations.

You can download a stamped and approved copy of your Certificate of Organization for free, using the state’s Business Search tool.

How much does an LLC cost per year in Utah?

Your Utah LLC must file an Annual Report (aka Annual Renewal) and pay the $18 fee every year.

This fee is paid to the Utah Division of Corporations. Filing the Annual Report keeps your LLC in good standing.

Can I use the instructions above for filing a Foreign LLC?

No, the instructions on this page are specifically for filing a Domestic LLC in Utah.

If you want to register a Foreign LLC, you can find the forms and fees in Foreign LLC Fees by State.

References

Utah LLC Act

Utah LLC Act: Section 201

Utah Division of Corporations: Fee Schedule

Utah Division of Corporations: Domestic Limited Liability Company

Utah Division of Corporations: LLC Certificate of Organization Form

Utah Division of Corporations: LLC Certificate of Organization Instructions

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Utah LLC Guide

Looking for an overview? See Utah LLC

Matt,

Probably wouldn’t advise people to not list, “the LLC Members (owners) or Managers in the Certificate of Organization (it’s optional). LLC Members are listed in the LLC Operating Agreement. For this reason, we recommend that you just leave this entire section blank and click “Next”.

I followed this advise and my credit union will not let me have a business account without me being listed as the manager on the articles of organization. Even if you go back and attach supporting documents like an operating agreement, this is going to cost another $37 to amend it.

Thanks anyway. Have a good day.

Hey TJ, so sorry for the inconvenience! This is pretty rare that a bank or credit union doesn’t accept the Operating Agreement. Thanks for letting us know, and thank you again.

The links on this page for the Certificate of Organization form are broken. I believe this is the new link for the same form:

https://corporations.utah.gov/wp-content/uploads/2023/04/llcdomestic-1.pdf

Thank you again for the assist JJ! And you are correct. I just updated the page with the updated Certificate of Organization links.

Sadly, when following the Shopping Cart links above, I get this message:

Shopping Cart

has been shut down and replaced

Please delete any Shopping Cart bookmarks you may have.

Please reach out to the appropriate agency for payment instructions.

Hi JJ, thanks for your message. We will get this fixed and updated this week. Please check back in a few days. Thank you :)

I sent in the form for Certificate of Organization and was wondering if i had the paper work filled out correctly. I did not have a signature on the paper. If I need that i can get it done and fax the paper in.

Hi Dusty, it’s best to wait for the state to respond and then you can correct the filing. Hope that helps.