Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

How much is the Virginia LLC Annual Fee?

After you start a Virginia LLC, you must pay the Annual Fee every year for the life of your LLC.

The Annual Fee is $50. This fee is due even if your LLC didn’t make any money or do any business activity during the year.

What is the Virginia LLC Annual Fee?

Every Virginia LLC (Limited Liability Company) has to pay an Annual Fee every year.

This is due regardless of business income or activity. Said another way, you have to pay this fee even if your LLC does nothing or makes no money.

The $50 Annual Fee must be paid to the Virginia State Corporation Commission (SCC). It needs to be paid every year in order to keep your LLC in good standing.

Note: In Virginia, the official name for this filing is the Annual Registration Fee, however, it’s also commonly referred to as the Annual Fee. You may also see this called an Annual Report, but that is inaccurate.

In Virginia, only Corporations file an Annual Report. LLCs don’t file an Annual Report. Virginia LLCs only need to pay the Annual Registration Fee.

When is my Virginia LLC Annual Registration Fee due?

It’s due by the last day of your LLC’s “anniversary month”. The anniversary month is the month your LLC was approved.

It’s due by the last day of your LLC’s “anniversary month”. The anniversary month is the month your LLC was approved.

(If you’re not sure when your LLC was approved, you can search your LLC name in the Business Entity Search, and then look for “Formation Date”.)

Your first Annual Registration Fee is due the year after your Virginia LLC was approved.

Example 1: If your LLC was approved on July 15, 2024, then your first Annual Registration Fee is due by July 31, 2025. And it will be due by July 31st every year after that.

Example 2: If your LLC was approved on January 17, 2025, then your first Annual Registration Fee is due by January 31, 2026. And it will be due by January 31st every year after that.

How early can I pay the Annual Registration Fee?

You can pay your Annual Registration Fee 2 months before the due date. That is when the SCC assesses the fee.

Do I get a reminder?

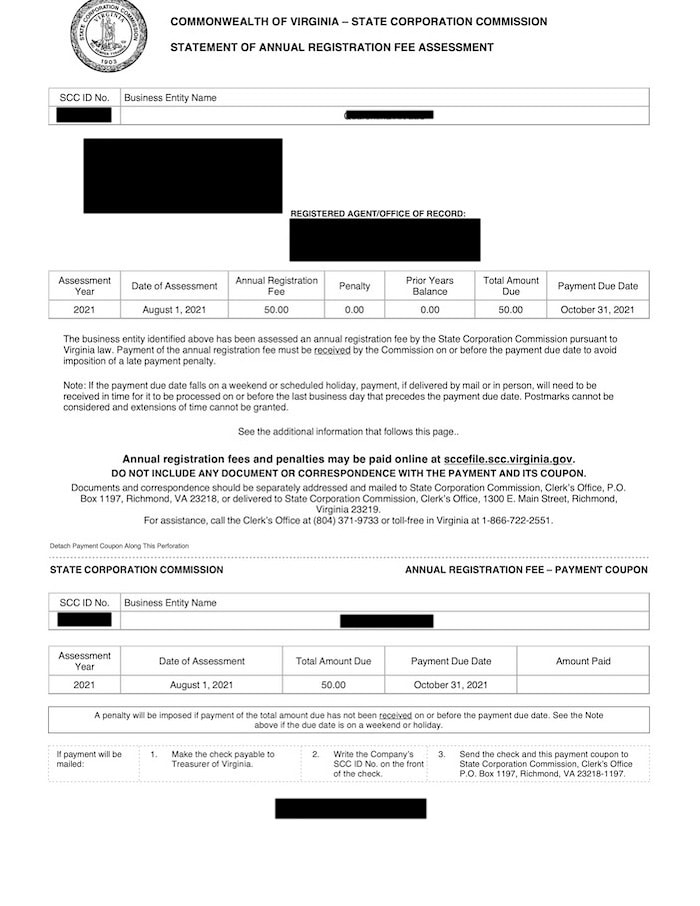

Yes, your LLC will receive a “Notice of Assessment of Annual Registration Fee” 2-3 months before your Annual Registration Fee is due.

The state sends the Notice of Assessment to your LLC Registered Agent by mail.

Here’s what it will look like:

Is there a penalty for not paying the Annual Registration Fee?

Your Virginia LLC will have to pay a $25 penalty if it doesn’t pay the Annual Registration Fee on time. The $25 will be in addition to the $50 fee, so you will have to pay $75 total.

You have a 3-month window from the original deadline (a “grace period”) to pay the $75.

For example: Let’s say your Virginia LLC Annual Registration Fee is due January 31. If you don’t pay it on time, then you have until April 30 to pay the $75.

If you still haven’t paid after the 3-month grace period, then your Virginia LLC will be automatically cancelled. In other words, the state shuts down your LLC.

Virginia LLC Annual Registration Fee Timeline

First, find your Virginia LLC’s anniversary month. Then look at the table below to determine the timeline for your Annual Registration Fee.

Virginia LLC Annual Registration Fee due dates:

| LLC Formation Month | How early can I pay? | When is the due date? | Grace period for late payment | LLC shut down (if not paid by) |

|---|---|---|---|---|

| January | November 1 (prior year) | January 31 | February 1 - April 30 | May 1 |

| February | December 1 (prior year) | February 28 | March 1 - May 31 | June 1 |

| March | January 1 | March 31 | April 1 - June 30 | July 1 |

| April | February 1 | April 30 | May 1 - July 31 | August 1 |

| May | March 1 | May 31 | June 1 - August 31 | September 1 |

| June | April 1 | June 30 | July 1 - September 30 | October 1 |

| July | May 1 | July 31 | August 1 - October 31 | November 1 |

| August | June 1 | August 31 | September 1 - November 30 | December 1 |

| September | July 1 | September 30 | October 1 - December 31 | January 1 (next year) |

| October | August 1 | October 31 | November 1 - January 31 | February 1 (next year) |

| November | September 1 | November 30 | December 1 - February 28 | March 1 (next year) |

| December | October 1 | December 31 | January 1 - March 31 | April 1 (next year) |

How can I pay my Annual Registration Fee?

You can pay the Annual Registration Fee online or by mail. Either way, the fee is still $50.

We have instructions for both methods below.

Which is better: Online or mail?

We recommend paying online as it’s easier to complete. However, if you’re not tech-comfortable, you can still pay by mail.

Virginia LLC Annual Registration Fee (online filing)

- Go the Virginia State Corporation Commission: Clerk’s Information System (CIS)

- In the “Sign In” field, enter your username and password

- Click “Pay Registration Fees” from the options on the top of the screen

Note: If you don’t have a CIS account, you can create one here: CIS Account Creation.

How to pay the Virginia LLC Annual Registration Fee online:

- Search your LLC by name (or Entity ID number)

- Select your LLC from the list

- You can skip entering an email address and phone number (they’re optional)

- Click “Add to shopping cart” and then “Checkout”

- Complete your payment

Congratulations! You’ve successfully paid your Virginia LLC Annual Registration Fee.

Virginia LLC Annual Registration Fee (mail filing)

About 2-3 months before your LLC’s Annual Registration Fee is due, the state will mail a reminder notice to your Registered Agent.

The reminder notice is sometimes called:

- Assessment Letter

- Notice of Assessment

- Notice of Assessment of Annual Registration Fee

- Statement of Annual Registration Fee Assessment

However, the Notice of Assessment is a courtesy reminder. Meaning, even if you don’t receive it from the state, it is still your responsibility to pay the Annual Registration Fee on time every year.

Note: If you didn’t get a Notice of Assessment from the state, you can request one be emailed to you (Forms Request) or mailed to you (call 804-371-9967).

How to Pay the Virginia LLC Annual Registration Fee by mail:

- Prepare a check or money order for $50, made payable to “Treasurer of Virginia”

- Write the SCC ID Number for your LLC anywhere on the front of the check or money order

- You can find this number on the Notice of Assessment

- Mail your Notice of Assessment along with your payment to:

State Corporation Commission

Clerk’s Office

PO Box 1197

Richmond, VA 23218-1197

Note: The SCC ID Number on your Assessment paperwork is the same thing as your Entity ID Number.

Postmark date vs date received: The state must receive your payment in the mail by the due date (they ignore the postmark date). So we recommend mailing your payment at least two weeks before the due date to make sure it’s on time.

Calendar reminder for next year

We recommend putting a repeating reminder on your phone, computer, and/or calendar for your Virginia Annual Registration Fee.

Here’s a video on how to use Google Calendar to create free Annual Registration Fee reminders:

Contact Info: Virginia State Corporation Commission

If you have any questions, you can contact the Virginia State Corporation Commission (SCC) at 804-371-9733.

Their hours are Monday through Friday from 8:15am to 5pm, Eastern Time.

References

Virginia LLC Act: Section 13.1-1061

Virginia LLC Act: Section 13.1-1062

Virginia LLC Act: Section 13.1-1064

Virginia SCC: CIS Filing System Help

Virginia SCC: Annual Registration Fees

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Virginia LLC Guide

Looking for an overview? See Virginia LLC

Estoy entrando para pagar mi Anual Fee registration me sale toda la información de la LLC pero no tengo el check del lado izquierdo del nombre de la LLC para activar darle continue y seleccionar pago y en la fecha de pago me sale N/A?

deberia salir 06/30/2025 cierto?

Entity Status: Active

Series LLC: No

Reason for Status: Active

Formation Date: 06/12/2023

Status Date: xxxxxxxxx

VA Qualification Date:xxxxxxxxxxxx

Period of Duration: Perpetual

Industry Code: 0 – General

Annual Report Due Date: N/A

Hola Fani, en general sí. Es posible que alguien ya haya pagado el Annual Registration Fee de este año. Te recomiendo llamar a la Virginia State Corporation Commission al 804-371-9733 y preguntar.