Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

After your LLC is approved and before you start doing business in West Virginia, you must apply for a West Virginia Business Registration Certificate (aka Business License).

You need to get your Business Registration Certificate for your West Virginia LLC before you conduct any business in the state.

West Virginia Business Registration Certificate

The fee for a West Virginia Business Registration Certificate is $30. This is a one-time fee.

You can get your Business Registration Certificate online or by mail, depending on how you formed your LLC.

If you formed your LLC online using One Stop, the Certificate may or may not have been included with your filing. The state actually has two versions of One Stop:

- Multi-Agency, which forms your LLC and registers it with multiple state agencies

- SOS-Only, which only forms your LLC and doesn’t do anything else

Because of this, it’s often quite confusing for people to figure out whether or not they have their Business License.

Pro Tip: If you haven’t received your Business Registration Certificate after one month – or aren’t sure if you filed for one – you can call the West Virginia State Tax Department at 304-558-3333 and they will tell you whether your business is registered.

If you formed your LLC via One Stop and it included the West Virginia Business Registration Certificate filing, you should receive your Certificate by mail in 2 to 4 weeks. You’ll just need to check on additional business license requirements, like a city business license, or local government permit.

If you formed your LLC in any other way (ex: you filed by mail or you hired a company), you must apply for a West Virginia Business Registration Certificate by mail using the BUS-APP form. Follow the step-by-step instructions below.

How to get a West Virginia Business Registration Certificate by Mail

First, download the New Business Registration Application Form (BUS-APP).

We have step-by-step instructions for completing this form below.

Tip: Make sure you have an EIN Number (Employer Identification Number) before submitting the BUS-APP form by mail.

Step-by-Step Instructions: BUS-APP Form

Part 1 (Business Tax Registration)

Section A: Reason for Submitting this Application

Check the box for “New Business“.

Note: This page’s instructions are specifically for new West Virginia Limited Liability Companies. If you’re applying for a Business License for another business type, these steps can serve as a guide but may not be exactly the same.

Section B: Business Identification

1. Legal Name of Entity

Enter your LLC’s full legal name, including the designator (LLC, Limited Liability Company, etc.).

FEIN

Enter your LLC’s FEIN (EIN Number).

2. DBA

Note: A DBA Name is also called a Trade Name in West Virginia.

If you don’t have a DBA Name for your LLC, leave this blank. And go to question #3.

If you do have a DBA Name for your LLC, you might just need one West Virginia Business Registration Certificate. Or you may need to apply for two (or more) Certificates. It depends on how each DBA is used.

Here’s how to tell:

- If your DBA is just a nickname for your LLC and it will operate at the same location as your LLC, you don’t need a second Business Registration Certificate. Just list the DBA in Question #4 on your LLC’s Business Registration.

- If your DBA is used to operate a different business than your LLC’s primary activity, you do need a second Certificate.

- If your DBA is used to operate a business at a different location from your LLC (regardless of what type of business it is), you do need a second Certificate.

If you’re still confused, our FAQs have examples that can help.

(If you have more than 1 DBA Name (that all operate the same business from the same location as the LLC) enter them on Schedule DBA and attach it to the BUS-APP filing.)

3. Physical Address of Business Named Above

This address must be a physical street address. It can’t be a PO Box.

The address can be in West Virginia, or in any other state.

If the address is in West Virginia, also answer the question about whether the address is within city limits.

4. Mailing Address

This field is optional. Enter your mailing address if you want your mail to go somewhere other than the Physical Address above.

This address can be a:

- home address

- office address

- PO Box address

- mailbox rental address

- virtual office address

This address can be in West Virginia or in any state.

5. Email address

This field is optional. Enter your email address if you want notices from the Tax Department emailed to you.

Website

This is also optional, and most people leave it blank.

6. Will you have West Virginia Employees?

Answer Yes or No.

- If you answer “Yes“, you must also answer questions 6A and 6B.

- If you answer “No“, skip ahead to question 7.

If you are an LLC Member (Owner) you are just an owner, not an employee. The only time an LLC Member is also an employee is if your LLC elects to be taxed as an S-Corporation.

6A. Date you will begin withholding WV Income (MMDDYYYY)

Enter the date that you will start withholding state income taxes from your employees’ wages. Said another way, enter the date you start paying your West Virginia employee(s).

If you’re not sure, check with your payroll administrator, bookkeeper, or accountant.

Enter the date in the format MMDDYYYY. For example: If the date is June 1, 2025, enter “06012025“.

6B. Number of Employees Subject to WV Income Tax

Enter the number of West Virginia employees you have. This number gets updated every year when you file your withholding return with the Tax Department, so it’s okay if you guess.

For example, let’s say your LLC currently has 2 employees in West Virginia to get the business started. If things go well, you plan to hire 3 more people in the next few months. You should enter “2” in question 6B. When you (or your accountant) files the Income Tax Withholding information next year, that form will tell the Tax Department that you now have 5 employees.

You don’t need to update or change your Business Registration Certificate if you hire more employees.

7. Date Beginning Business in WV (MMDDYYYY)

Enter the date you started, or will start, doing business in West Virginia.

Enter it in MMDDYYYY format. For example, write 08152025 for August 15, 2025.

If you formed your LLC within the past few days or weeks, you can enter today’s date. Or you can enter a date in the future if you haven’t started doing business yet. However, this date can’t be more than 90 days ahead.

If you’ve had an LLC for a while and just learned about the Business License requirement, you should enter the date you started doing business. In this case, we also recommend speaking with an accountant as you will have some back taxes to file.

8. Taxable Year End for Federal Tax Purposes (MM)

Enter the number of the month in which your business’s tax year ends. Most businesses enter “12” here for December.

That’s because most small business owners operate their business on a calendar year basis (the same as their personal income tax). So their LLC’s taxable year end is in December.

9. Estimated Annual Gross Income

Enter your LLC’s estimated annual gross income. This doesn’t need to be exact.

10. Business Phone

Enter a good phone number for the person completing the Business Registration Form. The Tax Department uses this to contact you with any questions or problems with the application.

Section C: Business Activity

11. Description of Business Activity

Describe what your business will do or is doing. The state wants you to enter a few sentences about what your business does and they prefer details.

12. NAICS Codes (6 digits preferred)

An NAICS Code for an LLC is used to describe your business activity.

If your business will engage in one primary activity, then enter that NAICS Code in the “Primary NAICS” field.

If your business engages in two primary activities, complete the “Primary NAICS” and “Secondary NAICS” fields.

If your business engages in three primary activities, complete all three fields.

If you need help finding your NAICS Code(s), you can watch this video we made for the online LLC filing process. While the interface is a little different, the methods will still be helpful:

Tip: If you can’t find your exact type of business, don’t worry. That’s pretty normal. Just pick something that generally describes your business activity.

13. General Activity

If your business engages in any of the regulated activities listed on this page, check the boxes that apply. You can check more than one box if applicable, but you must check at least one.

However, most of our readers aren’t engaged in these regulated activities and they just check “Other/Activity Not Listed” at the bottom.

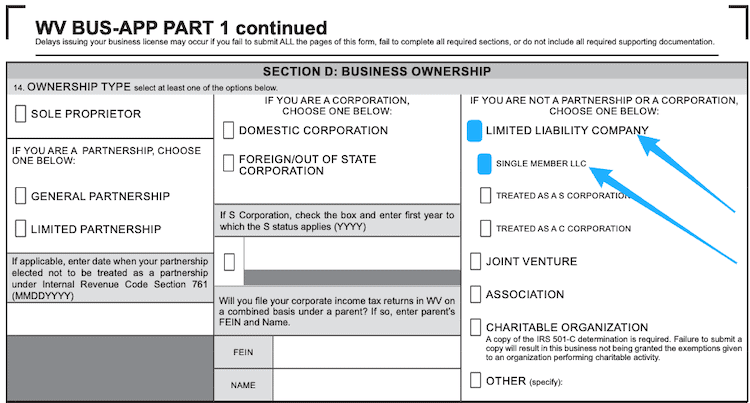

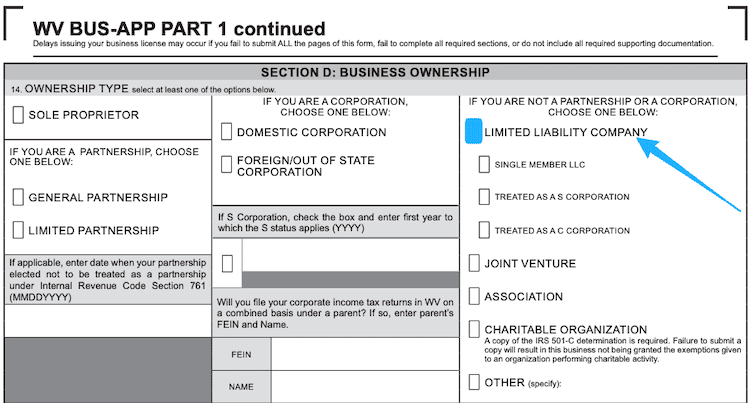

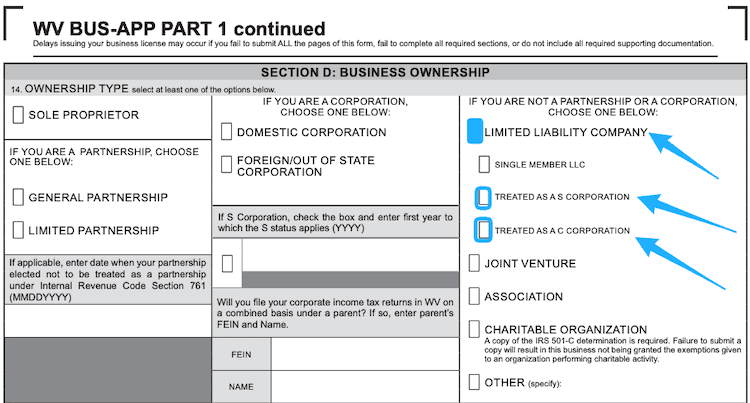

Identify your LLC’s ownership type.

If you are a West Virginia LLC with only one Member, check the box in the far right column for Limited Liability Company and the box immediately underneath it for Single Member LLC.

If you are an LLC with more than one Member (a Multi-Member LLC), just check the box in the far right column for Limited Liability Company (and don’t select any of the other boxes below).

If you are an LLC that has chosen to be taxed as a Corporation, check the box in the far right column for Limited Liability Company. And then check the box for either Treated as an S Corporation or Treated as a C Corporation, as appropriate.

Section E: Responsible Party

You must list at least one of the LLC Members here.

Anyone who you list here will be allowed to speak and act on behalf of the company for state tax purposes.

Complete the fields in row 15 with the person’s name, Social Security Number, email address, and phone number. For Title, write “Member“. And for Effective Date, use the date your LLC was formed (LLC Effective Date) because that’s when the person’s authority as a Responsible Party began.

If you want to list other Members, do the same thing for rows 16, 17, and 18.

Section F: Signature

One of the Responsible Parties listed in Section E must sign the Registration Form.

Sign, print the Member’s name, write “Member” for Title, and enter the date.

Important: Don’t stop here. Turn to the next page to finish the business license application form.

All West Virginia businesses must complete an Unemployment Compensation registration regardless of whether they have employees in West Virginia.

Part 2: Unemployment Compensation / Section G: Unemployment Compensation

Depending on whether or not you have employees will determine how you complete this page.

If you don’t have employees:

- Under “Reason for Applying” check the last box for “West Virginia business, with No employees“.

- Enter your contact information in #2

- Under “Name” enter your LLC name

- Under “Contact Person” enter your name

- Skip #3.

- Enter a “0” on each line of #4.

- Skip #5 – #11.

- All LLC Members must sign in #12.

If you have employees:

- Under “Reason for Applying”, check the first box for “New Business“.

- Enter your contact information in #2

- Under “Name” enter your LLC name

- Under “Contact Person” enter your name

- Answer questions #3, 4, and 5.

- Skip #6.

- Answer questions #7 and 8.

- Answer #9 and 10, only if applicable. If not, leave it blank.

- Answer #11.

- All LLC Members must sign in #12.

If you have any questions about the Unemployment Compensation section, you can call WorkForce West Virginia at 304-558-2677. They are friendly and knowledgeable and will help you if you get stuck.

Submit your Business Tax Registration

After you’ve completed and signed the Business Registration Form, prepare a check or money order for $30. Make it payable to “West Virginia State Tax Department”. Then mail the BUS-APP Form and your payment to:

West Virginia Tax Department

Tax Account Administration Division

PO Box 2666

Charleston, WV 25330-2666

Make a photocopy of your completed and signed form. And keep it with your business records until your official Certificate arrives.

West Virginia Business Registration Certificate Approval

After you submit your Business Registration Application, it will be approved in 2-4 weeks.

Once approved, the Tax Department will mail you your official Certificate.

As per West Virginia requirements, you must post your Certificate on the wall at your place of business.

Additional West Virginia Business Licenses

Besides the Business Registration Certificate, your LLC will also need to get a City Business License – and possibly other regulatory licenses and permits.

Please see Additional West Virginia business licenses for more information.

Business Registration Certificate FAQs

Is there a West Virginia business license search?

No. There isn’t a database that displays whether a business has a Business License.

If you’re not sure whether you have a Business License for your LLC already, call the West Virginia State Tax Department at 304-558-3333. And they will tell you whether your business is registered.

Note: The State Tax Department is sometimes called the West Virginia Department of Taxation.

Do all businesses in West Virginia need a business license?

Yes. Every business in West Virginia must obtain a Business Registration Certificate regardless of business structure. This includes Sole Proprietorship, Partnerships, LLCs, Corporations, etc.

Depending on local licensing requirements, your LLC may also need regulatory licenses or local licenses and permits.

Note: If you need to collect sales tax, your Business License application will register you for sale tax with the state.

Do I need to renew my Business Registration Certificate?

No. The Business Registration Certificate from the Tax Department is valid forever, or until:

- the business location changes

- the business name changes

- or the Tax Department cancels it

If you close your LLC, you must file a BUS-FIN form to return the Business Registration Certificate to the state.

How many Business Registration Certificates does my LLC need?

Most people just need one Business Registration Certificate for their LLC. This is because their LLC has one primary business activity that takes place at one location.

For example:

Linda owns Summit LLC and operates the business from home. She offers life coaching services and meets with her clients online. Linda only needs 1 Business Registration Certificate because she is only engaging in one type of business activity at one location.

However, you will need an additional Business Registration Certificate if your LLC is doing business at an additional location or has an additional activity.

For example:

Carl and Marvin own a landscaping business called CM Yards LLC. Carl runs one location of CM Yards LLC in Charleston. Marvin runs the second location of CM Yards LLC in Morgantown. That means CM Yards LLC needs to get 2 Business Registration Certificates: one for the Charleston office and another for the Morgantown office.

Mark and Jen (husband and wife) own Jolly Math LLC. Jolly Math LLC operates out of a single location in Wheeling. They each run separate businesses under the LLC, but work in the same office. Mark runs his accounting business and Jen is a financial consultant. Jen and Mark need to get 2 Business Registration Certificates: one for the accounting business and another one for the consulting business, even though they are both at the same address.

Do I need a separate Business Registration Certificate for my DBA?

Maybe. It depends on how the DBA is used.

DBA as a nickname: 1 Application

If your DBA is just a nickname for your LLC, you don’t need to apply for a second Business Registration Certificate (aka state-level general business license).

For example, Fred owns Fred’s Cars LLC. He operates a car repair shop under the DBA “Fred’s Repair Shop”.

Because Fred’s Cars LLC and Fred’s Repair Shop operate in the same location doing the same activity, Fred only needs one Business License.

DBA for Different Business Activity: 2 Applications

If your DBA is used to operate a different business activity than your LLC’s primary activity, then you’ll need to apply for two business licenses.

For example, Bart owns Bart Buck LLC. He operates a car repair shop under the DBA “Bucky Repairs”. And he operates a videography business under the DBA “Bucky Films”.

Because these are two different business activities, Bart must apply for two business licenses:

- Bart Buck LLC with the DBA “Bucky Repairs”, the car repair shop, and

- Bart Buck LLC with the DBA “Bucky Films”, the videography company

DBA for Different Business Locations: 2 Applications

If your DBA is used to operate a business at a different location from your LLC (regardless of what type of business it is), then you’ll need to apply for two business licenses.

For example, Sophia owns Sophia Saturn LLC. She operates a car repair shop in Morgantown under the DBA “Saturn Mechanics”. And she operates a 2nd car repair shop in Brookhaven, under the DBA “Sophia’s Car Shop”.

Because each DBA operates at a different location, Sophia must apply for two business licenses:

- Sophia Saturn LLC with the DBA “Saturn Mechanics” for the Morgantown location and

- Sophia Saturn LLC with the DBA “Sophia’s Car Shop” for the Brookhaven location

Do I have to post my Business Registration Certificate?

Yes. West Virginia Code Section 11-12-7, requires you to post your Business Registration Certificate in a visible place.

Some people choose to frame their West Virginia Business License, but simply taping the paper to the wall is fine.

How long does it take to get a Business Registration Certificate?

You should receive your Certificate by mail in 2-4 weeks. The Business License processing time is the same whether you submitted your application by mail or online through the West Virginia website – the One Stop Business Portal.

Do WV business licenses expire?

No. Your West Virginia Business License is valid forever.

The only time you need to re-apply for a Certificate is if your business changes locations, business activities, or its business name.

There is no Business License renewal process. As long as you keep filing your tax returns on time, your business license is valid for use.

How to start an LLC in West Virginia

Here are the steps to starting an LLC in West Virginia:

- Choose an LLC name and make sure it’s available

- Choose who will be your West Virginia Registered Agent

- Get an Employer Identification Number from the federal government (IRS)

- File the West Virginia LLC Articles of Organization

- Get your Business Registration Certificate

- Complete and sign an LLC Operating Agreement

- Open an LLC bank account

References

West Virginia Code: Business Registration Tax

West Virginia State Tax Department: Business Registration

West Virginia Business Registration Application (Form BUS-APP

West Virginia Reissuance of Business Registration (Form BUS-RBL

West Virginia State Tax Department: Information & Instructions for Business Registration

West Virginia State Tax Department: Permanent Business Registration Certificate Information (Special Notice 10-01)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

West Virginia LLC Guide

Looking for an overview? See West Virginia LLC