Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

All LLCs doing business in Colorado must file a document called the LLC Periodic Report with the Colorado Secretary of State, every year.

What is the Colorado LLC Periodic Report?

The Colorado Periodic Report is an annual filing that keeps your LLC in Good Standing with the Colorado Secretary of State.

Like most states, Colorado requires that LLCs stay in Good Standing to legally do business in the state. And LLCs remain in Good Standing by keeping the LLC’s basic information current on state records.

This information is submitted every year by filing your LLC Periodic Report with the Colorado Secretary of State.

It costs $10 to file the Periodic Report each year, starting the year after you start a Colorado LLC.

Note: Most states call this filing the LLC Annual Report. That said, Colorado calls it the LLC “Periodic Report”. These terms refer to the same thing and we may use them interchangeably.

What is the purpose of the Periodic Report in Colorado?

The purpose of the Periodic Report filing is to keep the Colorado Secretary of State up-to-date about any changes in your LLC’s basic information (like your Registered Agent’s contact information).

When you file this document each year, the state marks your business as being in Good Standing.

Are Periodic Reports required in Colorado?

Yes, all LLCs formed in Colorado are required to file the Colorado Periodic Report and pay the $10 filing fee every year.

Additionally, foreign LLCs registered to do business in Colorado must also file the Colorado Periodic Report.

Periodic Reports in Colorado are required every year for the life of your LLC – regardless of business income or activity. Said another way, your Periodic Report still needs to be filed even if your Colorado LLC made $0 or did nothing.

Colorado Periodic Report Table of Information

| Filing fee: | $10 (per year) |

| Filing method: | Online filing only (no mail filings) |

| Filing office: | Business Organizations Department, Colorado Secretary of State |

| Due date: | Due within a 5-month window: 2 months before the anniversary month, the anniversary month, and 2 months after the anniversary month (explained below). |

| Late fee: | $50 late fee. You have 60 days (after the 5-month window) to late-file before your LLC becomes Delinquent. |

| Penalty: | If you miss the 60 days to late-file, your LLC becomes Delinquent. Your LLC must file a Statement Curing Delinquency and pay $100. This resets the anniversary month. |

| Instructions: | Colorado Secretary of State: Instructions for Periodic Report and see the step-by-step instructions below on this page. |

| Statute: | Section 7-90-501 of the Colorado Revised Statutes |

When is the Colorado Periodic Report due?

Each Colorado Periodic Report due date is set during a 5-month window that is based on the LLC Effective Date.

Note: The LLC Effective Date is the date your LLC went into existence. You can think of it as your LLC’s Anniversary Date, and you may also see it called a Formation Date.

That said, the Colorado Secretary of State allows reports to be filed online up to 2 months before the LLC’s Anniversary Month, and 2 months after the Anniversary Month.

This means that each year, you have a total of 5 months for your Annual Report to be filed online and considered on-time.

A Colorado Periodic Report is considered to be on time if it’s filed within the following 5-month window:

- during your LLC’s Anniversary Month,

- up to 2 months before the Anniversary Month,

- and 2 months after the Anniversary Month.

So once you have your Effective Date, you can figure out your LLC’s 5-month filing window.

How to find a Colorado LLC Effective Date

You can find your LLC Effective Date by looking at your approved Colorado LLC Articles of Organization. Or, you can search for your LLC in the state’s business database:

- Visit Colorado Secretary of State: Business Database Search

- Search your LLC name (don’t include “LLC”)

- Look for “Formation Date”

How to count the Colorado Periodic Report 5-month filing window

Now that you have your LLC’s Anniversary Month, you can determine the 5-month filing window for your Colorado Periodic Report.

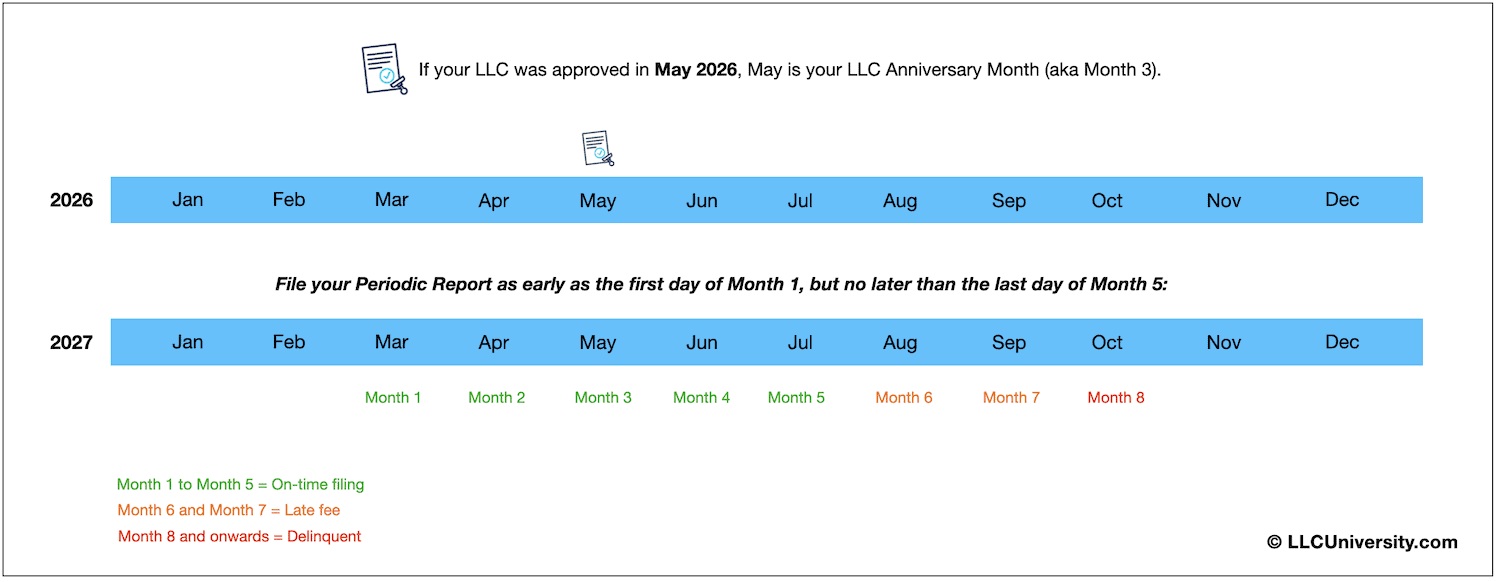

Let’s look at a few Colorado Periodic Report examples:

Example 1: If your LLC Formation Date is May 10th, 2024, then May is your LLC’s Anniversary Month.

And the 5-month filing window for your 1st Periodic Report would be March – July 2025:

- March 2025 (Month 1)

- April 2025 (Month 2)

- May 2025 (Month 3, aka Anniversary Month)

- June 2025 (Month 4)

- July 2025 (Month 5)

Said another way, a Colorado LLC with a Formation Date of May 10th can be filed on-time:

- as early as March 1 (Month 1),

- during the month of May (Month 3), and

- as late as July 31 (Month 5).

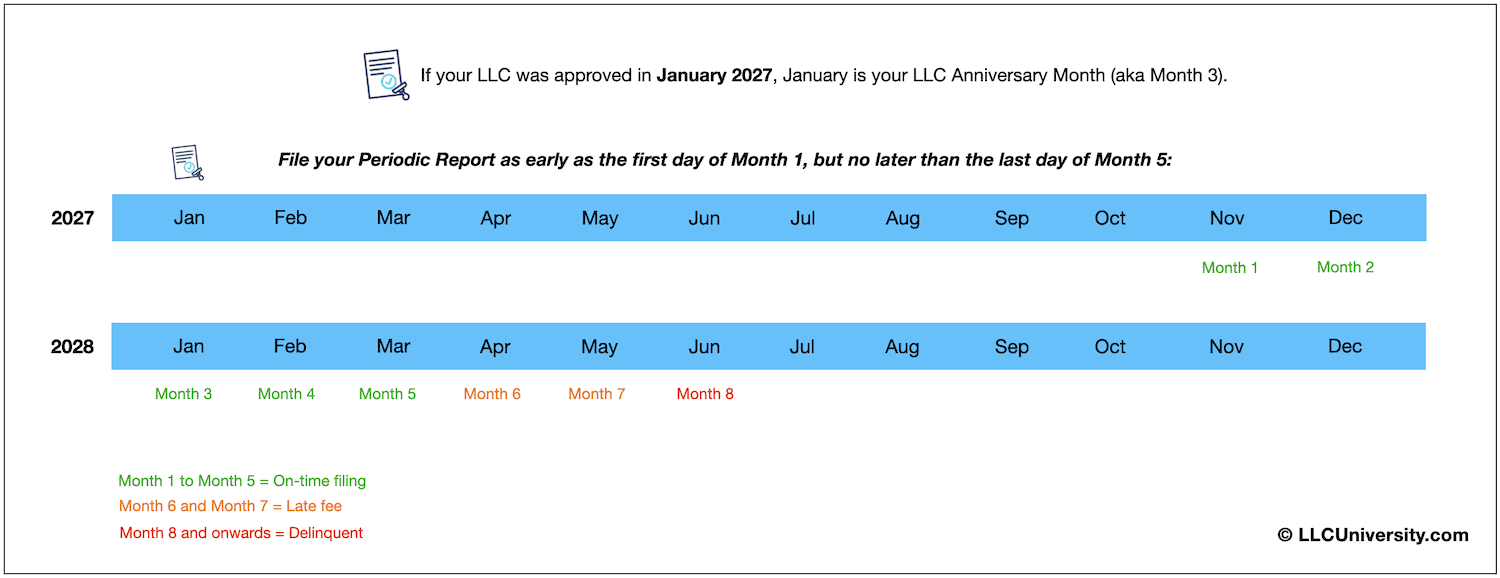

Example 2: If your LLC’s Formation Date is January 30th, 2024, then January is your LLC’s Anniversary Month.

And the 5-month filing window for your 1st Periodic Report would be November 2025 – July 2026:

- November 2025 (Month 1)

- December 2025 (Month 2)

- January 2026 (Month 3, aka Anniversary Month)

- February 2026 (Month 4)

- March 2026 (Month 5)

(click to enlarge)

Said another way, a Colorado LLC with a Formation Date of January 30th, 2024 can be filed on-time:

- as early as November 1 2024 (Month 1),

- during the month of January 2025 (Month 3), and

- as late as March 2025 (Month 5).

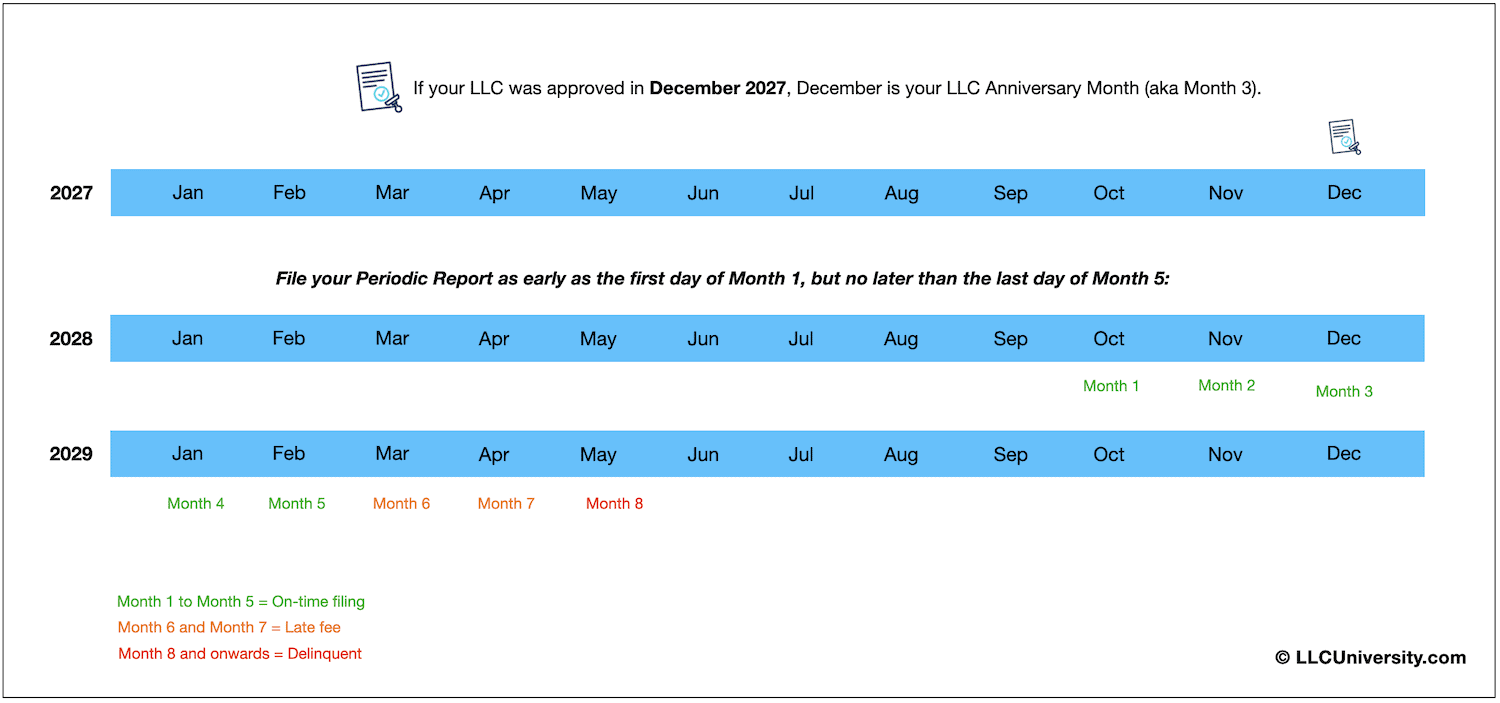

Example 3: If your LLC’s Formation Date is December 5th, 2024, then December would be your LLC’s Anniversary Month.

And the 5-month filing window for your 1st Periodic Report would be October 2025 – February 2026:

- October 2025 (Month 1)

- November 2025 (Month 2)

- December 2025 (Month 3, aka Anniversary Month)

- January 2026 (Month 4)

- February 2026 (Month 5)

(click to enlarge)

Said another way, a Colorado LLC with a Formation Date of January 30th, 2025 can be filed on-time:

- as early as October 1, 2025 (Month 1),

- during the Anniversary Month of January 2026 (Month 3), and

- as late as March 31, 2026 (Month 5).

How early can I file the Colorado Periodic Report?

No matter which Anniversary Month your LLC has, the earliest you can submit the report filing is the 1st day of Month 1. And the latest you can file (for an on-time filing) is the last day of Month 5.

When is my first Periodic Report due?

Your LLC’s first Annual Report is due 1 year after your LLC is formed.

Then your LLC Periodic Report will be due during this same 5-month window every year going forward.

Colorado Periodic Reports: Online filing process

Remember, Annual Reports can only be filed online in Colorado.

If your LLC’s report is due now, you can follow our step-by-step instructions on how to file a Colorado Periodic Report online:

Search

Search for your Colorado LLC on the state’s website:

- Visit Colorado Secretary of State: Record Identification or ID Search

- Search your LLC name (don’t include “LLC”)

- Click on your LLC name

- Confirm that you are authorized to make changes

Overview

Next, you’ll see an overview page with a few FAQs. You can check them out if you’d like, or click “Next” to proceed.

Principal Office Address

Your Colorado LLC’s Principal Office Address is auto-filled.

If nothing has changed, leave it as-is.

If the address has changed, you can update it here.

Note: The Street Address and Mailing Address can be the same address, but they don’t have to be.

Registered Agent

Your Colorado LLC Registered Agent address is auto-filled.

If nothing has changed, leave it as-is.

If your LLC’s Registered Agent – or Registered Agent address – has changed, you can update that information here.

If you’re going to use a Registered Agent Service, you must hire them first before entering their information in the Periodic Report.

You can read more here about who can be the Registered Agent for a Colorado LLC.

Note: The Street Address and Mailing Address for the Registered Agent can be the same, but they don’t have to be.

Filer information

Check the box agreeing to the terms. Then enter your name and address.

Notifications

The Colorado Secretary of State doesn’t send out reminders about Annual Reports by mail, so we recommend signing up for their email notifications here. (You can also sign up for text message notifications if you’d like.)

If you subscribe to the Colorado Secretary of State’s Email Notification Service, you’ll get email reminders when it’s time for your Annual Reports to be filed online.

You can expect the email notification to arrive during your LLC’s Periodic Report Month 1.

Note: The information you provide on the state’s email notifications sign-up page will not be given to third parties or be put on public record.

Or, you can create your own annual reminder using Google Calendar.

How to create a calendar reminder for next year (using Google Calendar)

Follow our video on how to use Google Calendar to create free annual reminders for your LLC Periodic Reports.

Review Filing

Review the information you entered. If you need to make any changes, click the “Edit” buttons.

Payment

- Select “Credit or debit” (fields will appear below)

- Enter your name, address, email, and click “Pay Now”

- Enter your card information and click “Pay Now”

Congratulations! Your Colorado Periodic Report has been submitted to the Colorado Secretary of State, and it was approved instantly! But don’t close the browser tab just yet.

We recommend saving a copy of your receipt and Periodic Report Filing:

- Enter your email address in the “Email my receipt” box. Then go to the next page.

- At the top of the next page, click “Print a copy of your document (PDF)” to download a copy of your filed Periodic Report.

Colorado Secretary of State Contact Info

If you have any questions, you can contact the Colorado Secretary of State at 303-894-2200.

Their hours are Monday through Friday, from 8am – 5pm Mountain Time.

Colorado Periodic Report FAQs

How much does it cost to file a Periodic Report in Colorado?

It costs $10 per year to file the Colorado Periodic Report, and it must be filed every year for the life of your LLC.

What happens if you don’t file the Periodic Report in Colorado?

If your LLC misses the 5-month filing window, you can still late-file in Month 6 and Month 7. However, there is a $50 late fee if you file in Month 6 or Month 7.

As per Section 7-90-902 of the Colorado Statutes, if you miss the late filing window, your LLC becomes Delinquent on the 1st day of Month 8.

What happens if I file my Colorado Periodic Report late?

If you submit your filing during Periodic Report Month 1-5 for your LLC every year, then your LLC’s Annual Report filing will be considered on-time.

However, if you don’t file your Periodic Report within the filing window, your LLC will be charged late fees and become Delinquent.

If this happens, you’ll have to pay the state to get your LLC back in Good Standing. And your Periodic Reports going forward will get a new 5-month due date based on the month your LLC is reinstated.

How do I get my LLC out of Delinquent status in Colorado?

In order to bring your LLC out of a Delinquent status (and back into a Good Standing status), you need to:

- file a Statement Curing Delinquency, and

- pay the $100 filing fee.

What is the Colorado Statement Curing Delinquency for an LLC?

The Colorado Statement Curing Delinquency is a business filing that gets your LLC out of Delinquent status and back into Good Standing with the state.

Once a Colorado LLC is Delinquent, it can no longer file Periodic Reports.

Instead, the LLC must file a Statement Curing Delinquency with the Colorado Secretary of State, and pay the $100 filing fee.

This means that if your LLC needs to file a Statement Curing Delinquency, it doesn’t also need to file any backlogged Annual Reports (no matter how many years the LLC is Delinquent).

Simply filing the Statement Curing Delinquency and paying the $100 filing fee brings the LLC back into Good Standing. This is because the Statement Curing Delinquency and the Colorado Periodic Report confirm similar contact information about Colorado businesses. The state only cares that your business information is current.

Important: Filing a Statement Curing Delinquency (SCD) will change your LLC’s Anniversary Month. Your LLC’s new Anniversary Month will be the month your SCD is filed.

References

Colorado Revised Statutes: Section 7-80-301

Colorado Revised Statutes: Section 7-90-501

Colorado Revised Statutes: Section 7-90-901

Colorado Revised Statutes: Section 7-90-902

Colorado Revised Statutes: Section 7-90-903

Colorado Revised Statutes: Section 7-90-904

Colorado Revised Statutes: Section 7-90-905

Colorado Revised Statutes: Section 7-90-906

Colorado Secretary of State: Fee Schedule Colorado Secretary of State: Periodic Report Instructions Colorado Secretary of State: Business FAQs (Delinquency) Colorado Secretary of State: Business FAQs (Noncompliance) Colorado Secretary of State: Business FAQs (Periodic Reports)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hello Matt,

The representative of a company is replaced, how should I do it?

It seems that need a Statement of Change to Add an Attachment. Where should I find the attachment form?

And the Amount Paid is $65?

Hi JC, do you mean the Registered Agent? I don’t fully understand what you’re trying to do. Thanks.

our LLI/HOA art. of incorp. show June. 1994 as the creation date. So if our periodic report is due 2 months before June or any time from April. Our HOA just filed it in Jan. Is it considered accepted by the SOS even though it has been filed early.

Hi Mary Ann, we recommend calling the Colorado Secretary of State (303-894-2200) to first check if your entity is in good standing. You shouldn’t have been able to file, so I’m not sure what you did.

Do I file the same form with the Dept of real Estate. We are a small self managed HOA and just beginning that process. Want to make sure we follow all the requirement

Hi Mary Ann, we are not familiar with HOA requirements so you’ll want to contact the Department of Real Estate to check. Thanks for your understanding.

Have changed the name for Registered Agent of Carr Creek Cattle, LLC from Joan Hyland to McCade McDonald PO Box 757, Fruita, CO 81521. I have paid $110.00 in doing so, also received the notice to file a periodic report for Carr Creek (20091051080). Do I need to file for Carr Creek again and do I need to pay the $10.00 yearly fee? Please let me know on this please.

Ho Joan, yes, you still need to file the Colorado LLC Periodic Report even though you recently filed a Statement of Change. The LLC Periodic Report is due each year. Also, the fee to file a Statement of Change is only $10. It’s not $110. Hope that helps.

I just received a letter in the mail stating it has to be completed by the 24th of January. I started my LLC in june and it also states the fee is $110.

Hi Val, it sounds like spam mail. Who is the sender? If it’s not the Colorado Secretary of State, it’s likely junk. Also, look on the back of the letter. If it’s spam, it’ll say something like “this is a solicitation”, “this is not a bill”, and “we are not a government entity” (or something along those lines). Hope that helps.

What if I missed date for periodic report. Can I still use the LLC?

Hi Todd, when is your due date? If you’re LLC is not in good standing, you’ll want to bring it into good standing.

Hi,

I received in the mail a form for my 2019- Periodic Report (Colorado LLCs)

From Workplace Compliance Services wanting a fee of $85.00.

I have never received anything like this before as I do everything online through the state site.

Have you heard of this company and are they legit? Just seems like a scam to me. Why would I pay them $85.00 when it’s only $10.00 through the state??

Hi Penny, mail like this is borderline illegal. If you look on the back, it’ll say something like “this is a solicitation” and “we are not a government agency”. You can toss it in the trash. Hope that helps.

Hi Matt,

any chance you could add a lesson on “How to Close an LLC”?

thank you

Hi Peter, thanks for your recommendation. We won’t be adding dissolution lessons at this time, but it’s on our list. We just have a lot of other content in front of it. Thank you for your understanding.

Hey Matt! First off thank you so much for these lessons. It made it so much easier. I was trying to do my periodic report but it when i search it just takes me to available documents. Would this be because I just set up my llc this week?

Hi Toni, you’re very welcome! Yes, that is correct. Your first Periodic Report is not due until next year. Hope that helps!

Great thank you!!

Hi, When I try to find the periodic report filing form for LLC , I get this error:

“The document you requested ( Periodic Report ) is not available for this entity. Below is a list of documents that are available”

Hi Ashwin, you’re likely outside of the filing window to file the Periodic Report for your LLC. If that’s not the case, I would call the Colorado Secretary of State’s office in case there is an error. Hope that helps.

Hello how do you pay delinquent

Hi Mari, you want to call the Colorado Secretary of State and check on the details of your LLC. You may need to file a Colorado LLC Reinstatement. Apologies for the slow reply. Hope that helps.