Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Once you’ve chosen a Colorado LLC name, you need to compare it against existing businesses in the state.

This is done using the Colorado Business Entity Search tool.

And this is necessary because business names in the same state:

- can’t be the same

- can’t be too similar

If you file your LLC paperwork with a name that’s not available, your LLC filing will be rejected.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

How do I search the Colorado business entity name database?

You can use the business entity search to compare your business name against the existing business entities registered in Colorado.

Visit the Colorado Business Name Search pages:

Colorado has two different business entity search tools for checking a potential business name: The Business Database Search and the Name Availability Search. We explain how to use both tools below.

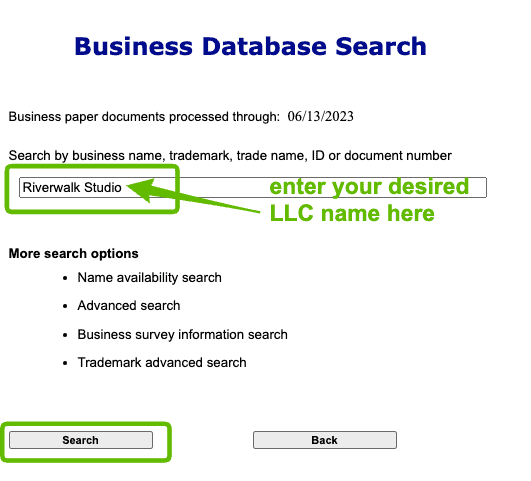

Business Database Search

We recommend starting with this tool so you can see other businesses with similar names.

Colorado Business Database Search

Simply enter your desired LLC name in the box and click Search.

- This database searches all business entities registered in Colorado. It shows you all similar names.

- Don’t enter a designator (like “LLC”) during the search.

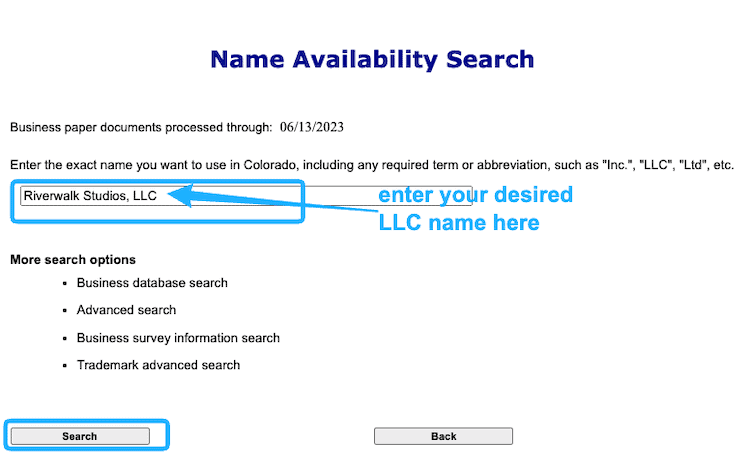

Name Availability Search

We recommend using this in addition to the Business Database Search to double-check that your Colorado LLC name is unique.

Simply enter your desired LLC name (including the designator (like “LLC”)) in the box and click Search.

- You’ll get an “available” or “not available” response.

- This tool doesn’t show you similar names already in use.

Search tips:

- Leave out any commas, periods, apostrophes, etc.

- You can search using uppercase or lowercase letters.

Tip: It’s best to enter only the main part of your desired Colorado LLC name in the search bar. For example, if your desired LLC name is Riverwalk Studios LLC, first do a search for the words “Riverwalk Studio”. And then do a search for “Riverwalk”. This helps make sure that you see everything that is potentially similar.

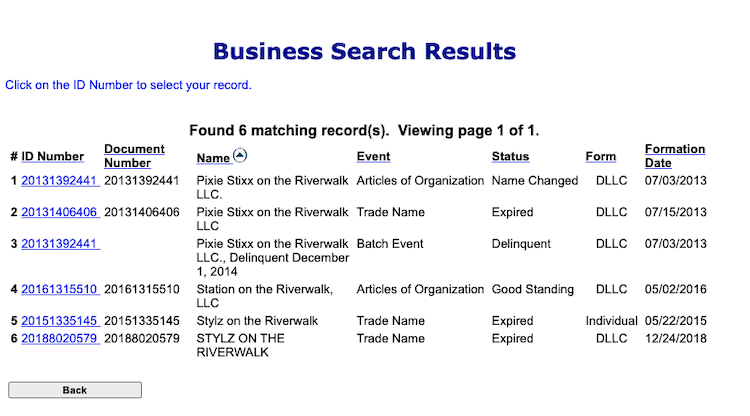

How to interpret the Colorado LLC search results

If the Business Database Search results show names that are not too similar to yours (meaning yours is distinguishable), then your Limited Liability Company name is available for use.

- Let’s keep using the example above. If your desired name is Riverwalk Studios LLC, and the only similar names you saw were “Riverwalk Rentals” and “Riverwalk Studio Starters”, then your name should be available.

If no results show up, that means your LLC name is unique and it should be available for use. To be safe, run your search again using only part of your LLC name (to double-check that there are no similar names).

- For example, search just the word “Riverwalk” instead of Riverwalk Studios.

If your exact LLC name appears in the list of search records, your LLC name is not available for use because another Colorado business entity is already using it.

If the results show a name that is very similar to yours, your LLC name may not be available for use.

- If your desired name is Riverwalk Studios LLC, and the search results show a “Riverwalk Studio”, then your name is not available.

Once you have a name that appears to be unique, check again using the Name Availability Search tool. If you get a message that the Name is Available, you should be good to go!

What if my desired LLC name isn’t available?

If your name is not unique, you’ll need to come up with a variation or a different name for your LLC.

Tip: Wait until your LLC is approved before you apply for your LLC EIN Number or purchase any other marketing materials. This way you don’t spend money on business supplies you can’t use because your business name isn’t available.

Colorado Secretary of State Contact Information

You can call the Colorado Secretary of State to ask questions about whether your LLC name is available.

Representatives at the Colorado Secretary of State can help you use the Colorado Business Database Search and Name Availability Search. They can’t guarantee that your LLC name will be available when you file, however.

The Business Organizations Department phone number is 303-894-2200. Their hours are 8am to 5pm Mountain Time, Monday through Friday.

Colorado Limited Liability Company Name Requirements

There are a few rules and requirements for naming a Colorado business entity that you need to know.

Do I have to use a comma in my LLC name?

No, you don’t have to. You can file your LLC name with or without a comma. Both versions are accepted by the Secretary of State.

For example: If your desired business name is Queen Bakery LLC, you can file it as:

- Queen Bakery, LLC

- Queen Bakery LLC

Or, instead of having “LLC” as your designator (ending), there are a few other options in Colorado.

What designators (endings) can I use in my LLC name?

Your Colorado LLC name must contain one of the following designators at the end:

- Ltd.

- LLC

- L.L.C.

- Limited

- Ltd. Liability Co.

- Limited Liability Co.

- Ltd. Liability Company

- Limited Liability Company

Note: Most people choose “LLC”.

The following designators are not allowed

Your Colorado LLC can’t make itself sound like a Colorado Corporation or any other business entity besides an LLC.

The following words and designators can’t be used anywhere in your LLC name:

- Inc.

- Corp.

- Incorporated

- Corporation

- Cooperative

What words are not allowed in my Colorado LLC name?

Your Colorado LLC name can’t contain words and abbreviations that are restricted by law.

For example, you can’t make your LLC name sound like it’s a bank, part of the government or a government agency, or anything else that misleads the public.

You also can’t use words that are reserved for licensed professionals. These vary by state, but some common examples are accountants, architects, attorneys, dentists, and engineers.

Your Colorado business name must be distinguishable (unique)

When you use the Colorado Secretary of State Business Database Search, you will compare your desired LLC name to existing businesses in the state. (If you use the Name Availability Search instead, the tool compares the names for you.)

If your name is not unique, you’ll need to come up with a variation or a different business name. That’s because Colorado Revised Statutes Section 7-90-601 requires business names to be distinguishable.

Below are rules and examples of LLC names that are not distinguishable.

Not distinguishable: Punctuation

Adding punctuation to the business name doesn’t create distinguishability.

If your desired LLC name is Bighorn Sheep LLC, it’s not available to use if any of the following are found in the Colorado Business Search results:

- Big.horn.sheep LLC

- Big’horn Sheep LLC

- Big_Horn Sheep LLC

Not distinguishable: Capitalization

Changing the capitalization of the business name doesn’t create distinguishability.

If your desired LLC name is Lark Letters LLC, it’s not available to use if any of the following are found:

- LARK Letters LLC

- LaRk LeTTeRs LLC

- lark letters LLC

How to create distinguishability

Colorado is pretty lenient with distinguishability (compared to other states). Here are some easy ways of making your desired business name distinguishable from other similarly named businesses in the state.

Designators

Differences in designators (endings) create distinguishability in Colorado.

If your desired LLC name is Jovial Brownies LLC, you can use that name even if you find any of these names in the search results:

- Jovial Brownies, Inc.

- Jovial Brownies Corp.

- Jovial Brownies Ltd.

- Jovial Brownies, Limited Liability Company

Adding Articles (Filler Words)

Adding non-meaningful or filler words (the, a, an, and, &) creates distinguishability in Colorado.

If your desired LLC name is Apple Orange LLC, you can use that name even if any of the following are found:

- An Apple Orange LLC

- The Apple, the Orange, LLC

- Apple & Orange LLC

Want to watch a video tutorial instead?

The video below shows you how to search LLC names in Colorado.

The video starts with LLC name rules in Colorado. Then at the 7:30 minute mark, you can see LLC searches being completed.

What if my Colorado business name is rejected?

If you file your Colorado Articles of Organization (the document that creates your Colorado LLC) and the business name is not available, don’t panic. The state will notify you and tell you why your filing was rejected.

You will just need to file again with a variation of your LLC name or a different LLC name.

Colorado Business Name FAQs

Do I need a name reservation in Colorado?

No, a name reservation isn’t required to form an LLC in Colorado. It’s an unnecessary step and a waste of money.

You can just file your LLC’s Articles of Organization with your desired LLC name.

Does Colorado require LLC in the name?

Yes. Your Colorado LLC name must contain one of the allowable designators at the end. The most commonly used designators are:

- LLC

- Limited Liability Company

- Ltd. Liability Co.

Does my Colorado LLC need a DBA?

No, you’re not required to file a DBA (“Doing Business As”) for your business entity in Colorado.

A DBA (known as a Trade Name in Colorado) lets your LLC conduct business under a name which is different from its true and legal name (the name on your Articles of Organization).

If you want your LLC to do business under a name that’s different from its true and legal name, you have to file a Statement of Trade Name and pay an additional fee of $1 to the Secretary of State. Check out the Secretary of State Trade Name FAQ for more information on this process.

There is no limit to the number of Trade Names an LLC can have.

For more information, please see Does my LLC need a DBA?

When would my LLC use a DBA?

Let’s say you form an LLC called Aquamarine Tour Groups LLC, but you also want to use a friendlier, catchy name, like Aquamarine Tours. In this case, your LLC would need to file a Statement of Trade Name to use the name Aquamarine Tours.

If you don’t file a Statement of Trade Name for a different name, you can only use your legal entity name of Aquamarine Tour Groups LLC.

Similarly, if you want to do business under the name Aquamarine Tour Groups, just without the letters “LLC” in the name, you will need to file a Trade Name Statement for Aquamarine Tour Groups.

How do I get a business domain name?

Once you’ve found a business name that you like, it’s a good idea to check if your domain name is available before forming your LLC.

You can search for available domain names with GoDaddy:

Find a domain name

What does “distinguishability” mean?

Each business entity name must be “distinguishable upon the records” of the Secretary of State.

This means that no two businesses can operate with the same exact name. Said another way, if a business already exists with your desired LLC name, you can’t register your LLC with that name.

For example, let’s say you want to form an LLC called Lisa’s Landscapers LLC. But there is already a business in another town called Lisa’s Landscapers, LLC. Because your desired LLC name is the same as that existing Colorado business, it is not distinguishable. You can’t use it and must choose another name.

How do I come up with a business name?

Business names are important for branding and recognition. The name of your Colorado LLC can be your company’s brand name, but it doesn’t have to be (please see the FAQ about DBAs above). Either way, picking a good LLC name is an important decision.

Here are some quick tips for coming up with business names:

- First, write down the features of your company and things that you want to be associated with.

- Then list out as many business names as you can think of. Don’t edit or analyze them. Just get as many names on the page as you can.

- Now go back and read through them. Write down any variations that come to mind.

- Next, set the list aside. Do something else, like go for a walk or get groceries, or sleep on it for the night. Then come back and review the list of names. As you go through it, write down additional ideas and variations.

- Read the whole list out loud. If you want, get input from friends, business partners, and family.

- Repeat the process: sleep on the ideas, write down new variations, read them out loud again.

- The best business name will often “rise off the page” and present itself. If it doesn’t, you can try this trick: Close your eyes and count to 10. When you get to 10, you must choose a name. When you open your eyes, force yourself to make a decision. Sometimes we know the best name deep in our subconscious, and this trick can help it come out. Trust yourself and go with what feels best.

For more tips, please see How to Choose an LLC Name.

Can I use the name of another Colorado entity?

No. You can’t use the same name as another Colorado business.

And it doesn’t matter what entity type it is – your LLC can’t have the same entity name as another corporation, LLC, or any other entity type.

In Colorado, the Secretary of State sometimes adds the words “Delinquent”, “Dissolved”, “Withdrawn”, or “Colorado Authority Terminated” to a business’s name. This trick makes it easy to tell if the business’s name has become available for use again (since the business has been closed).

For example: Let’s say your desired LLC name is Rocky Roads LLC. There’s a company that was dissolved a few years ago, and their name shows up as Rocky Roads LLC Dissolved. That means when you file your Colorado Articles of Organization for Rocky Roads LLC, your new name is distinguishable from “Rocky Roads LLC Dissolved”.

How do I change my LLC name?

You can change your LLC’s name later by filing an Amendment form with the Secretary of State.

We have step-by-step instructions on how to change an LLC name in Colorado.

How to start an LLC in Colorado?

Here are the steps to starting an LLC in Colorado:

- Choose an LLC name and make sure it’s available

- Choose who will be your Colorado Registered Agent

- File the Colorado LLC Articles of Organization

- Complete and sign an LLC Operating Agreement

- Get a Tax ID Number (EIN) from the IRS

- Open an LLC bank account

- Check whether you need a business or sales tax license in Colorado

References

Colorado Secretary of State: Designators

Colorado Revised Statutes: Business Name Rules

Colorado Secretary of State: Business Name FAQs

Colorado Secretary of State: How to use business entity search

Colorado Secretary of State: Name Distinguishability Slideshow

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Wow, what a find your site and videos are Matt! Thank you so much and well done

Thanks Mark! You’re very welcome :)

Hi, thank you for all the information here,

I was wondering, I registered for the EIN before the LLC, It says that its required to inculde one of the LLC abbreviation, so that what I did for the LLC registeration, However I didnt do the same for the EIN, should I change the EIN ?

thank you

Hi Sanaa, you’re very welcome :) So you obtained an EIN for your LLC (“Big Ski Lodge LLC”, as an example) before your LLC was approved. You told the IRS you have an LLC in the “What type of legal structure is applying for an EIN?” section of the EIN application, however, when it came to entering your LLC name, you entered “Big Ski Lodge” and forget to add “LLC”.

In that case, yes, you want the full legal name or your LLC appearing on your EIN Confirmation Letter. While you can change the business name associated with the EIN, you have to mail or fax a letter to the IRS. And because of all their delays right now, you won’t get a response back for at least 2 months.

Here’s an easier solution: Apply for a new EIN for your LLC using “Big Ski Lodge LLC”. And for the original EIN, you can file an EIN Cancellation Letter with the IRS. You can apply for the new EIN right away. You don’t have to wait for the first EIN’s cancellation to be processed. Hope that helps!

Hi I was wondering if I needed to file a DBA with my LLC if they are very similar? Like for example lets say I filed my LLC as Southwest Bakery LLC, would I need a DBA if I refer to my business as Southwest Bakery with No “LLC” at the end?

Hi Minh, yes, you do. Anytime you want the LLC to represent itself without using its true and legal name, you will need to file a DBA. Hope that helps.

Cool, thanks for the help Matt!

This was great and very helpful. Thank You

You’re welcome Dale!