Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Biennial Report Requirements for Washington DC LLCs

After you form a DC LLC, you must regularly file an informational report in order to keep your LLC in compliance and in good standing.

This report is filed with the District of Columbia Department of Licensing and Consumer Protection (DLCP).

Unlike most states where LLCs file a report every year (known as “LLC Annual Reports”), LLCs in the District of Columbia file a report every 2 years. This report is called the DC LLC Biennial Report.

You might still see other websites that refer to the District of Columbia Biennial Report as a District of Columbia Annual Report, but don’t worry, there is no Annual Report in DC. You only have to file the Biennial Report every 2 years.

DC Biennial Report penalty

If your DC LLC Biennial Report is late, as per DC Code 29-106.01, you will be charged a $100 late fee. If you pay these late fees (a total filing fee of $400), you can file your Biennial Report any time before September.

If you continue to ignore this requirement past September, the DLCP can administratively dissolve (shut down) your LLC.

District of Columbia Biennial Report fee

$300, due every 2 years.

DC Biennial Report due date

The DC Biennial Report is due by April 1st, due every 2 years.

The DC Biennial Report is due by April 1st, due every 2 years.

Your LLC’s first Biennial Report is due by April 1st of the year following your LLC’s registration date. Then, it’s due every 2 years after that.

For example:

- If your LLC is approved on October 10th 2024, your first DC Biennial Report is due by April 1st 2025. The following Biennial Reports are due by April 1st 2027, April 1st 2029, and so on.

- If your LLC is approved on January 10th 2025, your first DC Biennial Report is due by April 1st 2026. The following Biennial Reports are due by April 1st 2028, April 1st 2030, and so on.

To clarify these due dates:

- If your LLC is formed between April and December, your first DC Biennial Report is due by April 1st of the following year.

- If your LLC is formed in January, February, or March, your first DC Biennial Report is not due 1-3 months later in April of the same year. It’s due the following April, one whole year later.

Reminders

The DLCP sends a courtesy reminder (by email) to your LLC’s DC Registered Agent. The DLCP sends these notices in February of any year in which your LLC must file a Biennial Report.

The DLCP doesn’t send any mail reminders. If your Registered Agent (whether that’s you, a friend or family member, or a company) doesn’t have an email address listed, the DLCP can’t send a reminder.

What if I don’t get a reminder by email?

Even if you don’t receive a courtesy reminder from the DLCP, it is still your responsibility to file your DC LLC Biennial Report on time every 2 years. So we recommend creating a repeating reminder in your calendar, and on your phone or computer.

#1 reason LLCs get administratively dissolved:

The #1 reason LLCs in DC get shut down by the DLCP is for failure to file their Biennial Report.

Biennial Report filing methods & processing times

You can file your LLC Biennial Report by mail or online. In both cases, the filing fee is $300.

- If you file online, it’s processed and approved immediately.

- If you file your Biennial Report by mail, it will take 15 business days to process and approve.

We recommend filing online as it’s easier and the processing time is much faster.

The DCRA also prefers to receive Biennial Report filings online instead of by mail. And there are no in-person filings for DC Biennial Reports.

Online filing instructions only

The instructions below are for how to file a Biennial Report online.

If you prefer to file your Biennial Report by mail, the instructions will be similar. But instead of filing online, you’ll need to mail in a completed Form BRA-25 to the DLCP. And you’ll need original signatures from all LLC Members to file the Report by mail.

The DLCP mailing address is:

Department of Licensing and Consumer Protection

Corporations Division

PO Box 92300

Washington, DC 20090

Send a check or money order for $300 payable to the “DC Treasurer”.

District of Columbia LLC Biennial Report Online Filing

(Access DC & CorpOnline)

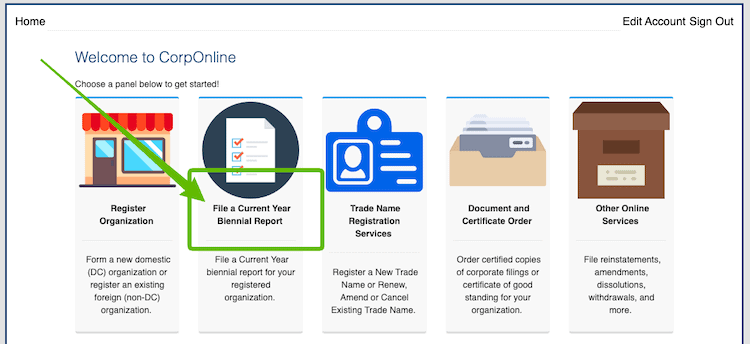

If you haven’t done so already, you need to create an Access DC login. After that’s complete, then you need to create a CorpOnline account.

If you already have these, you can just login to CorpOnline.

Get Started: Click “File a Current Year Biennial Report“.

The next page contains instructions and tips about what information you’ll need in order to complete the Biennial Report filing. After reviewing this checklist, scroll to the bottom and click “Continue”.

Select Your Organization

Search for your LLC using either its name or its File Number. Then click on your LLC name.

Report Year

Enter the year that you’re filing your Biennial Report.

Business Address

Review your LLC’s business address. Leave it as-is or update it if your address has changed.

This address can be a home address, an office address, a friend or family member’s address, or the address of your Commercial Registered Agent.

This address can be within the District of Columbia or it can be in another state. The address can also be outside of the United States, if applicable.

Note: If you hired Northwest Registered Agent to be your Registered Agent, they’ll allow you to use their address here for privacy. This will keep your address off of public records.

Registered Agent

Review your LLC’s Registered Agent. Leave the information as-is or update it if your Registered Agent has changed.

Note: Remember that the DLCP sends Biennial Report reminders by email. If your Registered Agent doesn’t have an email address listed, this is a good time to add that information.

In the District of Columbia, you have multiple options for who can be your DC LLC Registered Agent: yourself, a friend or family member, or a Registered Agent Service.

“Are you using a non-commercial registered agent?”

This question on the Biennial Report online filing can be confusing.

- Choose “Yes” if you are your own Registered Agent, or if another person (friend or family member, or business partner) is the Registered Agent. Then, complete the contact information fields.

- Choose “No” if you hired a Registered Agent Service. Then, select the name of the Registered Agent Service from the drop down menu.

Organization Purpose

Purpose Type: From the drop down menu, select the industry your LLC is involved in (if it’s listed). If it’s not listed, select “Other”.

Description: Enter a few words or a sentence or two about what your LLC does. The DCRA doesn’t allow for a general purpose/”any lawful activity” statement to be made. The statement must be specific.

For examples of specific LLC statements, please see LLC statement of purpose.

Beneficial Owners

A Beneficial Owner is an LLC Member. In DC, Beneficial Owners are sometimes also called Governors.

Note: An LLC Manager that is not an LLC Member (meaning, the Manager doesn’t own any part of the company) is not a Beneficial Owner. Learn more here: LLC Member vs LLC Manager.

If you’re submitting the Biennial Report for your own LLC, then you can enter your last name, first name, and address. Then check off “Executing Officer” (that tells the DLCP that you are signing the filing), and click “Add Governor”.

If you already have LLC Beneficial Owner (aka LLC Governor) information in your Biennial Report, you can either keep it, remove it, or add more LLC Governors (if applicable).

Beneficial Owner Document Upload

Most people ignore this section. However, if needed, you can upload a list of all Beneficial Owners if there are too many to enter in the section above.

Validation

Review the information you entered in your LLC’s Biennial Report. Check for any errors or typos.

If you need to make any changes, click the “Previous” button at the bottom.

If everything looks good, click the “Continue” button to proceed.

Payment

Select “Credit Card” from the first drop down menu. Enter your name, billing address, and phone number. Then enter your credit card information below, click “Next”, and finalize your payment of filing fees ($300) to the DLCP.

Note: All information on this last page is private. Your name, address and phone number entered here don’t become public record.

Congratulations! Your District of Columbia LLC Biennial Report has been submitted to the DLCP.

Now you just need to wait for your Biennial Report to be processed and the verification form to be uploaded to your DLCP CorpOnline account.

DC LLC Biennial Report Approval

If you file your DC LLC Biennial Report online, it will be approved instantly.

The DLCP will:

- Send you an email confirmation, and

- Upload a filed copy of your Biennial Report in CorpOnline dashboard

We recommend keeping a copy of your filed Biennial Reports with your LLC’s records.

And don’t forget: You have another Biennial Report coming due in 2 years, due by April 1st. Remember to set a calendar reminder for yourself.

DLCP Contact Info

If you have any questions, you can contact the Department of Licensing and Consumer Protection at 202-671-4500 (Press 1 for Corporations Division). Or you can use their interactive chat feature on the DLCP website.

Their hours are 8:30am to 4:30pm, Monday through Friday (except Thursday, when the hours are 9:30am to 4:30pm).

Note: In 2022, the District of Columbia government reorganized some of their departments. This created the Department of Licensing and Consumer Protection, which took over handling business filings from the Department of Consumer and Regulatory Affairs. The DCRA no longer exists, so any questions about the Biennial Report should go to the DLCP.

References

DLCP: Biennial Report Form (BRA-25)

D.C. Business Center: File a Biennial Report

DLCP: Domestic Limited Liability Company

D.C. Code, Section 29-102.11 – Biennial Report

D.C. Regs, Section 17-703 – Deadline for Filing Biennial Report

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

District of Columbia LLC Guide

Looking for an overview? See District of Columbia LLC