Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Washington DC LLC Formation

In this lesson, we will walk you through starting a DC LLC by filing your Articles of Organization with Washington D.C. Department of Licensing and Consumer Protection (DLCP).

In this lesson, we will walk you through starting a DC LLC by filing your Articles of Organization with Washington D.C. Department of Licensing and Consumer Protection (DLCP).

The Articles of Organization is the form that officially creates your LLC in the District of Columbia.

District of Columbia LLC Filing Fee:

The District of Columbia LLC filing is $99. This is a one-time filing fee.

How much is an LLC in DC explains all the fees you’ll pay.

Note: The “LLC filing fee” (the fee to create a District of Columbia LLC) is the same thing as the “Articles of Organization fee”. The Articles of Organization is the document, that once approved by the Corporations Division, creates your District of Columbia LLC.

LLC approval times

- If you form your District of Columbia LLC online, your LLC will be approved in 5 business days.

- If you form your District of Columbia LLC by mail, your LLC will be approved in 2-4 weeks (plus mail time).

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in the District of Columbia.

Our Recommendation

We recommend filing your DC LLC online. The filing is much easier and your LLC will be approved within 5 business days (as opposed to 2-4 weeks (plus mail time) for a mail-in filing).

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Online filing instructions only

The instructions below are for how to form an LLC in the District of Columbia online.

If you prefer to file your LLC by mail, the instructions will be similar, but instead of filing online, you’ll need to mail in a completed Articles of Organization to the DLCP Corporations Division. Their mailing address is:

Department of Licensing and Consumer Protection

PO Box 92300

Washington, D.C. 20090

Send a check or money order for $99 payable to the “DC Treasurer”.

Or, you can hire a company to form your LLC instead. If you want to find the right LLC formation service for your business, check out Best LLC Services in the District of Columbia.

Prior LLC University® lessons

Before forming an LLC in the District of Columbia, make sure you have read the two prior lessons:

DC LLC Online Filing

(Access DC + CorpOnline)

In order to form an LLC online in the District of Columbia, you’ll need to create an Access DC login and then a CorpOnline account.

Create an account with Access DC and CorpOnline

- Visit the Access DC login page and click “Sign up”.

- Create a login and click the verification email. Now you can login to Access DC.

- Next, go to CorpOnline and click “Sign in with Access DC”

- Enter your address and finish the registration. You can now access the CorpOnline dashboard.

Let’s get Started

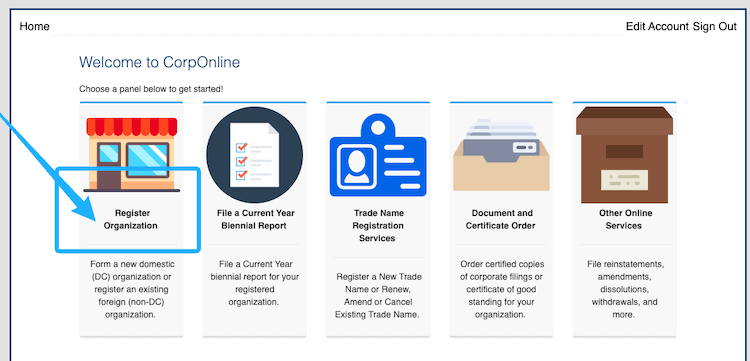

On the left, click “Register Organization“.

Do you already have a registered organization, in DC or any other jurisdiction, that you use to do business?

- Related article: Domestic LLC vs Foreign LLC

If you are forming a new domestic LLC in DC, click “No”. If you are registering your out-of-district LLC as a foreign LLC in DC, click “Yes”.

(Note: The instructions below are for domestic LLC formation)

Click “Limited Liability Company (LLC)“. Then click “Continue” at the bottom of the next page.

Business Information

- Prior lesson: Make sure you read the DC LLC name search lesson before proceeding.

Enter your desired DC LLC name, but leave out the suffix, aka the designator (ex: “LLC”).

Select your desired designator. As per section 29-103.02 of the DC Business Organizations Code, the following are allowed:

- LC

- L.C.

- LLC

- L.L.C.

- Ltd. Co.

- Ltd. Company

- Limited Co.

- Limited Company

- Limited Liability Company

Tip: If you’re not sure which suffix to use, the ending “LLC” is the most common. It’s also the most recognizable and easy to remember.

LLC Effective Date

The LLC effective date is the date your DC LLC officially goes into existence.

Most filers choose today’s date.

Pro tip: If you’re forming your DC LLC later in the year, such as October, November, or December, it may be a good idea to forward-date your filing to January 1st of next year. This will save you the hassle of filing taxes for those few months.

Note: Your LLC effective date can’t be more than 90 days ahead.

LLC Business Address

Enter your LLC’s office address or place of business.

This address can be a home address, an office address, a friend or family member’s address, or the address of your Commercial Registered Agent.

This address can be within the District or it can be in another state. The address can also be outside of the United States, if applicable.

Note: If you hired Northwest Registered Agent as your DC Registered Agent, they allow you to use their address as your LLC’s business address.

Registered Agent

- Prior lesson: Make sure you’ve read District of Columbia Registered Agent and Is a Registered Agent a Member of an LLC? before proceeding.

If you or someone you know will be the Registered Agent for your LLC:

- Are you using a non-Commercial Registered Agent? Select “Yes”

- Enter the person’s name, email, and DC address

If you hired a Commercial Registered Agent:

- Are you using a non-Commercial Registered Agent? Select “No”

- Select your Commercial Registered Agent from the list

Note: If you hired Northwest Registered Agent, you’ll notice their name is in the list twice. It doesn’t matter which one you select. They are both the same.

Series LLC

Note: We don’t provide information about Series LLCs. We only cover a subject matter if we can thoroughly research and document it for our readers. At this time, we don’t feel that there are enough established case law and tax decisions made for us to recommend or explain Series LLCs. If you do decide to form a Series LLC in DC, we recommend working with a tax attorney in the District.

If you are forming a Series LLC in DC (as per section 29-802.06), click the checkbox to the right of “Has Series?“.

If you’re forming a regular LLC, just click “Continue”.

LLC Members

- Related article: Who can be LLC Members?

There isn’t much to do on this page. It’s just in place because the District needs to know that your LLC has at least 1 Member.

For the date, most people choose today’s date. However, if you’re using an LLC effective date in the future, then you can use that same date here.

Note: You’ll enter the LLC Members information later.

LLC Organizer

- Related articles: LLC Organizer vs Member and Registered Agent vs LLC Organizer

Most people forming their own LLC are also the LLC Organizer. If that’s the case, select “Individual”, enter your contact information, and then click “Continue”.

Your LLC only needs one Organizer. Whoever is the Organizer for your LLC can later sign a Statement of LLC Organizer.

Miscellaneous Provisions (Members must be added)

- Related article: Member-managed vs Manager-managed LLC

As per Section 29-102.01(6) of the Code of DC, you need to list the Members (or Managers, if applicable) of your LLC.

If your LLC is Member-managed:

- you must list every Member that owns more than 10% of the LLC

If your LLC is Manager-managed:

- you must list every Manager

- and you must list every Member that owns more than 10% of the LLC

For every person listed, you must include their:

- First and last name,

- Residential address,

- and Business address

Here’s an example for someone who has a residence address and separate a business address:

Bob Jones

701 Pennsylvania Ave #7012, Washington, DC 20004 (residence)

201 F St NE, Washington, DC 20002 (business)

Here’s an example for someone who doesn’t have a dedicated business address:

Sally Smith

1350 Maryland Ave NE, Washington, DC 20002 (residence and business)

Professional LLC

If you are forming a Professional LLC, you must also describe the type of professional services your LLC will offer. This applies to attorneys, architects, certified public accountants, professional engineers, dentists, optometrists, podiatrists, or other health professionals (as per section 3-1201.01).

Upload Documents

Like the Miscellaneous Provisions field, this section is used to add additional provisions, articles, or rules to your DC LLC filing. You can upload multiple pages or multiple addenda to your LLC filing.

Tip: Most filers don’t upload any additional documents if they could fit everything under Miscellaneous Provisions.

Expedite Order

Normal approval time for filing a DC LLC online is 5 business days (at no additional cost).

If you’d like to speed up your LLC approval time, you can expedite the review of your filing:

- $50 extra for 3 business days

- $100 extra for 1 business day

From the drop down, select whether or not you want to expedite your LLC filing and then click “Next” to proceed.

Validation (review)

Review the information you entered in your LLC Articles of Organization. Check for any errors or typos.

If you need to make any changes, click the “Previous button at the bottom.

If everything looks good, click “Continue”.

Payment

Select “Credit Card” from the first drop down menu, enter your billing information, and submit your filing and payment to the DLCP.

Congratulations, your District of Columbia LLC filing has been submitted to the DLCP!

Now you just need to wait for your LLC to be approved.

District of Columbia LLC Approval

After submitting your District of Columbia LLC Articles of Organization online, the DLCP will approve your LLC in 5 business days (unless you’ve paid extra for an expedited review).

Once your DC LLC is approved, you’ll receive an email notification and you’ll then be able to download your LLC approval documents from you CorpOnline account.

There are 3 documents that make up your District of Columbia LLC approval:

- Certificate of Organization (with the DLCP seal)

- Articles of Organization (stamped and approved)

- Invoice

DLCP Contact Info

If you have any questions, you can contact the Department of Licensing and Consumer Protection at 202-671-4500 (Press 1 for Corporations Division). Or you can use their interactive chat feature on the DLCP website.

Their hours are 8:30am to 4:30pm, Monday through Friday (except Thursday, where the hours are 9:30am to 4:30pm).

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

References

DLCP: Business Registration FAQs

DLCP: Limited Liability Company Forms

DC Municipal Regulations: Section 17-708

DLCP: Domestic Limited Liability Company

DLCP: Domestic LLC Articles of Organization

DLCP: Fees for Corporate Registration Services

Code of DC: Chapter 8 (Limited Liability Companies)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

District of Columbia LLC Guide

Looking for an overview? See District of Columbia LLC

Hi Matt! Thanks for this great site – you have saved a lot of lives! Just one question: I have already registered one LLC in DC, and now I’m trying to register another LLC in DC, too. But at the first step “Do you already have a registered organization, in DC or any other jurisdiction, that you use to do business?”, I think I should click “Yes” because I do have a registered LLC in DC already. Then, they just turned me to file my annual report for my existing LLC and there is no option for registering a new one. So, does it mean that for people who want to register multiple LLCs in DC, we actually should click “No” for “Do you already have a registered organization, in DC or any other jurisdiction, that you use to do business?”?

Hey Travis! You’re very welcome! Thanks for the kind words. Yeah, that’s pretty annoying/confusing lol. Yes, you can just click “No”, and the proceed to set up your 2nd LLC. Hope that helps.