Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Getting a Business License for your DC LLC

Every Washington DC LLC must get a Business License (aka Basic Business License) in order to operate in DC.

This is mandatory and is required for all LLCs, regardless of income or activity.

Note: A Business License and a Basic Business License mean the same thing. We may use these terms interchangeably.

Before you can get a Basic Business License for your LLC, you must:

- get your LLC approval from the DLCP

- get an EIN Number from the IRS

- register your LLC with the Office of Tax & Revenue

- get a Home Occupation Permit or a Certificate of Occupancy

(each one of the links above will take you to a prior lesson)

You must get your Basic Business License before you start operating your business in the District.

What’s the purpose of the Basic Business License?

The purpose of the Basic Business License is to ensure the safety of the residents and the visitors of DC with regard to certain business activities.

Different types of Basic Business Licenses

Your business activities will determine the type of Basic Business License you need.

Each type of business activity falls under a specific category. The Business License Categories are specific to various industries.

So it may be more helpful to think of a Basic Business License as:

A Basic Business License AND its Business License Category “lumped” together.

How much does a Basic Business License cost?

If you’re curious about all the costs for starting a DC LLC, check out District of Columbia LLC cost to learn more.

The total cost for a business license will depend on which Business License Category is right for your business.

To determine the price of your Basic Business License:

- Visit the DLCP Business License Category page (scroll down for the categories)

- Look for your industry, and click the + symbol to expand.

- Click the Category link to access the page for that industry, including the fees.

Note: All costs shown for business licenses are for 2 years.

Let’s look at a few examples:

- an Auto Wash License costs $190 for 2 years

- a Caterer License costs $349 for 2 years

- a General Business License costs $99 for 2 years

- a One Family Rental License costs $198 for 2 years

General Business License (GBL)

The General Business License (GBL) is the most common type of business license issued in the District of Columbia.

The reason why is that a lot of businesses don’t fall within a specific Business License Category.

Having said that, it’s easier to think of the General Business License as a Business License Category, but the category itself is labeled “General”.

In order to determine if your DC LLC will need a General Business License, both of these statements must be true:

- Your business doesn’t fall within any other business license category.

- The business owners aren’t required to maintain professional licenses issued or regulated by a local, state, or national certification board/body (ex: architects, attorneys, doctors, engineers, etc.).

Said another way, your LLC gets a General BBL if there’s no other applicable license.

Need help? If you’re not sure what type of Business License Category you need for your Basic Business License, you can call the Business License Center at 202-671-4500. Their staff will ask you a few questions about what your business will do and then tell you if it falls under a General Business License or a different Business License Category.

What if my business does multiple things?

If your business is engaged in different types of activities and they fall within multiple Business License Categories, then you need to select (and pay for) multiple Business License Categories.

If you apply online, you’ll be able to select multiple Business License Categories. And if you apply in-person, a Business License Representative will help you select all applicable Business License Categories.

How to apply for a Basic Business License

You can apply for a Basic Business License online. (There are no paper forms; you can’t file by mail.)

However, if you don’t have access to a computer or need help completing the application, you can go to the Business Licensing Center. You can complete the online filing there using the kiosks.

We recommend the online filing. It’s convenient, free, and if you get stuck you can call the DLCP and ask questions.

The walk-in filing is useful if you have a lot of questions, or you don’t have access to a computer.

We have instructions below for both the online filing and walk-in filing.

Applying for a Basic Business License in-person (walk-in filing)

Go to the Business Licensing Center at 1100 4th Street SW, 2nd Floor, Washington, DC 20024.

The Business Licensing Center is open 8:30am to 4:30pm on Monday, Tuesday, Wednesday, and Friday. On Thursday their hours are 9:30am to 4:30pm.

You will need to make your payment with a credit card or debit card. Cash, check and money order aren’t accepted.

Applying for a Basic Business License online

Create an account with My DC Business Center.

Then login.

Get started:

- In the middle of the page, click the “My BBLs” button

- Click “Apply For A New License“

- Click the green “Next” button to begin

Step 1. Pre-Application Questions:

- Select one Primary Business Activity

- Select one Primary Business License Category

- Select all Secondary Business License Categories that apply

- Click “None” if none apply

- Select one General Business Sub-Category

Corporation Registration:

This page will ask you a series of questions about your DC LLC:

Is this business already registered with DLCP Corporations Division?

Select “Yes”. (Remember, you must have already filed your DC Articles of Organization and had it approved by the DLCP before you apply for the BBL.)

What is your business structure?

Select “Limited Liability Company (LLC)“.

What is the Trade Name?

If you filed a Trade Name (aka DBA) for your LLC, then enter your LLC’s Trade Name here. If not, leave this field blank.

A Trade Name is used if your LLC will do business under a name besides its full legal name. For more information, please see Do I need a DBA for my LLC?

Would you like a two (2) or four (4) year license?

Choose whether you want to pay for 2 years or 4 years.

Most filers pick 2 years. You’ll renew the BBL every 2 years.

Will this business be located in the District of Columbia?

Select whether or not your LLC is located in DC. For most readers, this will be “Yes”.

Will this business be Home based?

Select whether or not your LLC will be a home-based business.

Do you have a Home Occupancy Permit (HOP) from Office of Zoning?

If you followed our prior lesson (Home Occupation Permit) then you should select “Yes”. You’ll enter your Home Occupation Number in a few steps.

Which Tax Identification Number is associated with your business: Federal Employer Identification Number (FEIN) or Social Security Number (SSN)?

Select “FEIN”. Remember you should already have gotten your FEIN from our prior lesson: EIN Number for DC LLC.

License Category and Fee Confirmation:

Based on your pre-application questions, the system should determine what type of business license your LLC needs. You should also see the total amount that will be due on this page.

Click “Next” to proceed. And click “Confirm” in the pop-up box.

Step 2. Application Checklist:

Click the “Enter Information about Your Business (Here)” link to get started.

Home Occupancy Permit Number

Enter your Home Occupancy Permit Number and click “Search”. Then select your Home Occupation Permit and click “Next”.

Corporate Registration

Enter your LLC’s File Number and click “Search Corp Online“. Your LLC’s info should appear below. Denote that it’s correct by selecting “Correct” twice and then clicking “Next”.

Note: You can find your LLC’s File Number by looking at your Certificate of Organization or by searching your LLC name.

Registered Agent Address

Review your DC Registered Agent address. Denote that it’s correct by selecting “Correct” twice and then clicking “Next”.

Mailing Address

Enter your LLC name, your first and last name, your email address, your LLC’s mailing address, and your phone number.

You should now be taken back to the Application Checklist overview page.

Click the “Enter Tax and Revenue Information (Here)” link.

Clean Hands Self Certification and Legal Attestation:

Enter your LLC’s Notice Number. This can be found in the upper-right hand corner of your Notice of Business Tax Registration letter that you received from the Office of Tax and Revenue when you registered your LLC for taxes.

Then enter your name, select “Owner” from the drop down menu, enter your LLC’s FEIN (aka EIN Number), check off the box at the bottom, enter your name again to electronically sign the form, and then click “Next”.

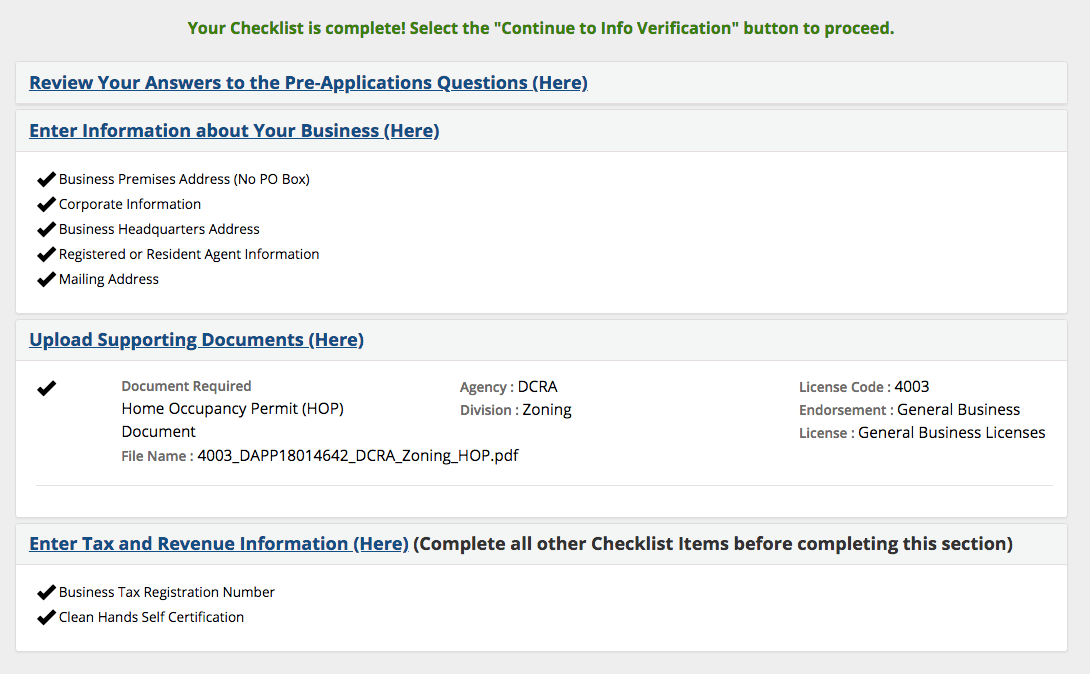

You’ll be taken back to the Application Checklist overview page one last time. You should see check marks in all sections. Here’s an example of what your page may look like:

Click “Next”.

On the next page you should see the total amount due as well as all the information you entered in your application. Review all the info. Look for any errors or typos. If you need to make any corrections, click the “Return to Checklist” button. If all looks good, click “Next” to proceed. And then click “Confirm” in the pop-up box.

Payment & Approval

Enter your credit card information, your email address, check off the box, and enter your name at the bottom to electronically sign. Click “Submit” at the bottom and then finalize your payment.

Congratulations! Your LLC’s Basic Business License Application has been submitted to the District. Now you just need to wait for approval.

The most common types of Basic Business Licenses will be approved immediately and you’ll be able to download your business license. Make sure to save and print a copy too.

Other types of business licenses can take up to one week for the Business Licensing Center to review and approve.

Either way, the online filing system will let you know if your license is immediately available for download or if you need to wait.

Once your Basic Business License is ready to download, you will receive an email.

Basic Business License Renewals

All Basic Business Licenses must be renewed every 2 years (unless you paid for a 4-year license; then it’s renewed every 4 years).

You can renew your Basic Business License online.

Note: In the past, the DCRA sent reminders through the mail that contained a PIN number to access the renewal. But the DLCP started using a new system in August 2021.

Now all you need to do is login to the DC Business Center, and use the last 4 digits of your LLC’s EIN number to file the Renewal.

Reminders:

You will get an email through the Access DC system reminding you that your BBL is eligible for renewal.

However, even if you don’t receive your renewal reminder (or it gets sent to Spam), it is still your responsibility to renew your business license every 2 years (or every 4 years). For this reason, we strongly recommend putting a repeating reminder on your phone, your computer, and/or your calendar.

Approval:

After the DLCP reviews your renewal application (which takes 3-5 business days), you can access the new Basic Business License by logging into the DC Business Center.

Fines and penalties:

As per section 47-2851.10 of the DC Code, the District takes Basic Business License renewals very seriously.

Lapsed: If you fail to renew your Basic Business License before its expiration date, it will be considered “lapsed”. You can then renew it within 30 days from the date of expiration by paying the filing fee plus a $250 penalty.

Expired: If your Basic Business License stays “lapsed” past 30 days (but for less than 6 months from expiration), your license then becomes “expired”. You can renew it within that 6 months timeframe by paying the filing fee plus a $500 penalty.

Revoked: If you fail to renew your Basic Business License within 6 months of expiration, your license is then revoked. If you continue doing business, you’ll then be operating your business illegally without a license and you’ll be fully liable for all fines and penalties that may be imposed.

If you want to continue operating your business in the District, you must pay all fines and penalties and then apply for a new business license (you can no longer renew). You won’t be able to apply for a new business license until all the fines and penalties have been paid.

Frequently Asked Questions

Do I need to have a Certificate of Occupancy or Home Occupation Permit?

Yes, if your LLC is located in the District, you’re required to have one or the other. Please see this page: Certificate of Occupancy or Home Occupation Permit.

If your LLC is not located in the District (and the only DC address you have is your Registered Agent address; all other addresses are in another state), then you don’t need a Certificate of Occupancy or Home Occupation Permit.

What’s the difference between a Business License, a Basic Business License, and a General Business License?

A Business License and Basic Business License (BBL) are the same thing.

Basic Business License (BBL) is the official name in DC.

A General Business License is an Business License Category which a business falls within if:

- the business doesn’t fall within another Business License Category and

- the business owners aren’t required to maintain professional licenses issued or regulated by a local, state, or national certification board/body (ex: accountants, doctors, lawyers, engineers, etc.)

How do I set up an LLC in the District of Columbia?

Here are the steps to starting an LLC in Washington DC:

- Choose an LLC business name and make sure it’s available

- Choose who will be your DC Registered Agent

- File the District of Columbia LLC Articles of Organization

- Complete and sign an Operating Agreement

- Get a Tax ID Number (EIN) from the IRS

- File your DC LLC Tax Registration

- Obtain a Certificate of Occupancy or Home Occupation Permit

- Get the DC Basic Business License

- Open an LLC bank account

Contact Info: Business Licensing

If you have any questions about your LLC’s Basic Business License and/or Business License Category, you can contact the Business License Center at 202-671-4500 (press 2 for Licensing).

Their hours are 8:30am to 4:30pm, Monday through Friday, except Thursday; when their hours are 9:30am to 4:30pm.

References

DLCP: Business Licensing FAQs

Basic Business License User Guide

DLCP: Business Licensing Division

DLCP: Basic Business License Renewal

D.C. Code: Chapter 28, General License Law

DLCP: Basic Business License Renewal Overview

DLCP: Steps to Obtaining a Basic Business License

D.C. Code: Section 2851.05, Business License Center

D.C. Code: Section 2851.03(d), General Business License

D.C. Code: Section 2851.09, Business License Expiration

DC Office of Tax and Revenue: New Business Registration

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

District of Columbia LLC Guide

Looking for an overview? See District of Columbia LLC