Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through filing your Certificate of Organization with the state. This is the document that officially forms your Iowa LLC.

In this lesson, we will walk you through filing your Certificate of Organization with the state. This is the document that officially forms your Iowa LLC.

Unlike most states, the State of Iowa doesn’t provide an official Certificate of Organization. Instead, they accept any Certificate of Organization as long as it meets the requirements of the Iowa LLC Act Chapter 489, Section 201.

We’ve provided a Certificate of Organization (PDF) form you can use that meets these requirements. And we’ll walk you through the process step-by-step below.

After completing your Certificate of Organization, you can submit it to the Iowa Secretary of State by mail or online.

Alternatively, you can hire a company to form your LLC instead. If you’d like to learn more about this option, check out Best LLC Services in Iowa.

How much does it cost to start an LLC in Iowa?

The cost to form an LLC in Iowa is $50.

This one-time fee is the same for both mail and online filings. And you pay it to the state for filing your LLC Certificate of Organization.

Note: The Certificate of Organization filing fee is commonly referred to as the “LLC filing fee”. They are the same thing.

How much is an LLC in Iowa explains all of the fees you’ll pay to start and maintain your LLC.

How long does it take to get an LLC in Iowa?

By mail: If you submit your Certificate of Organization by mail, it will take 7-10 business days (plus mail time) to be approved and returned to you.

Online: If you submit your Certificate of Organization online, it will be approved in 1 business day.

We recommend the online filing because it has a faster approval time.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Iowa.

Before proceeding with this lesson, make sure you’ve read Iowa LLC name search and Iowa Registered Agent.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Certificate of Organization Iowa (Step-by-step)

Overview:

- Regardless of whether you file by mail or online, you’ll need to complete the Certificate of Organization paper form.

- You can complete the form by hand or on your computer.

- Once the form is complete, you can either mail it to the state, or scan it and upload it online.

Download our free Iowa Certificate of Organization form:

Iowa LLC Certificate of Organization (PDF)

Iowa LLC Certificate of Organization (Word)

Effective date

The LLC Effective Date is the date your LLC officially goes into existence. Think of this as the day your LLC is “born”.

- If you want your LLC to go into existence on the date it’s approved by the Secretary of State, leave this blank.

- If you want your LLC to go into existence on a future date, enter that date here. This date can’t be more than 90 days ahead. And you can’t back-date your filing at all.

Most people leave this section blank unless they are forming their LLC at the end of the year.

Pro tip: If you’re forming your LLC later in the year (October, November, or December) and you don’t need your LLC open right away, we recommend using January 1st of next year as your effective date.

This can save you money on taxes and your first Iowa LLC Biennial Report (by delaying its due date).

Expiration date (Perpetual)

If you want your Iowa LLC to automatically shut down (dissolve) on a future date, enter that date here.

Otherwise, leave this blank to give your LLC a Perpetual existence. This means that your LLC won’t automatically shut down on a future date. Instead, it will remain open until you file paperwork to dissolve it.

Tip: Most people prefer for their LLC to have a perpetual existence and they leave this section blank.

Article 1. LLC Name

- Prior lesson: Make sure you read Iowa LLC Name Search before proceeding.

Enter your Iowa LLC name exactly as you would like it. Include your preferred capitalization, punctuation (commas, periods, etc.), and the designator (the ending).

Remember, Iowa allows the following designators at the end of your LLC name:

- LC

- L.C.

- LLC (most common)

- L.L.C.

- Ltd. Liability Co.

- Ltd. Liability Company

- Limited Liability Co.

- Limited Liability Company

Tip: Your LLC name can use a comma or you can leave it out. For example, “Alice’s Wonderful Landscapes LLC” and “Alice’s Wonderful Landscapes, LLC” are both acceptable.

Important: Make sure your LLC name appears twice. Once in Article 1 and again at the top of the form.

Article 2. Registered Agent and Registered Office

- Prior lesson: Make sure you have read the Iowa Registered Agent lesson and explored our article about Is a Registered Agent a Member of an LLC?

In this section, enter your Registered Agent’s name and address.

Article 3. Principal Business Office

Enter your Iowa LLC’s Principal Office Address.

What is a Principal Office Address?

It’s where the primary business activities take place and/or where your LLC records are kept. This address must be a street address. It can’t be a PO Box.

Your Iowa LLC’s Principal Office Address can be:

- located in Iowa

- located in any state

- located in any country

- a home address

- an office address

- a virtual office address or mailbox rental

- the address of your Iowa Registered Agent (if your Registered Agent allows it)

Note: If you hire Northwest Registered Agent, you can use their address for your LLC’s Principal Office Address.

Signature of LLC Organizer

- Related articles: LLC Organizer vs Member and Registered Agent vs LLC Organizer

The LLC Organizer is the person who signs and submits your filing to the state.

Most people filing their own LLC are also the Organizer. If this is the case:

- Enter today’s date

- Sign and print your name

- Enter the title “Organizer” after your printed name

For example, the Name and Title line would read “Boris Badenov, Organizer”.

Submit your Certificate of Organization to the State

You can submit your Certificate of Organization to the state by mail or online.

We provide step-by-step instructions for both methods below.

Tip: If you need your LLC approved faster, we recommend the online filing (approval time is 1 business day). However, if you’re not tech-comfortable, you can file by mail.

Submit Certificate of Organization by Mail

Prepare Payment: Prepare a check or money order for $50, made payable to the “Secretary of State”.

Mail Documents: Mail your completed Certificate of Organization along with your $50 filing fee to:

Secretary of State

Lucas Building, 1st Floor

321 E. 12th Street

Des Moines, IA 50319

Submit Certificate of Organization Online (using FastTrack)

Before you begin, scan your signed and completed Certificate of Organization onto your computer and save in PDF format.

For the most part, you will be entering the same information from your completed Certificate of Organization.

Create a “FastTrack” Account

- Visit the FastTrack Account Creation page.

- Enter your contact information and click “Sign up”.

- Username/Email: Just enter your email address. This will be used as your username.

- Open your email inbox, and click the link from the state to confirm your account.

- You can now sign in to FastTrack.

(Tip: We use 1Password to save all of our passwords. You might like it, too.)

Login and get started:

- Go to Welcome to FastTrack Filing.

- Enter your username and password, then click “Login”.

- Your username is your email address.

- Click “Business Filings” at the top of the screen.

- Click “File a document“.

- Click “Form an Iowa Limited Liability Company“.

Chapter:

From the drop down menu, select “Code 489 Domestic Limited Liability Company“.

Name of Entity:

Enter your LLC name exactly as you have it on your Certificate of Organization.

If you enter a name that is not available, you’ll need to come up with a variation or a new LLC name altogether. And then you will need to change the name on your printed Certificate of Organization.

Effective Date & Time:

If this section is blank in your Certificate of Organization, then you will need to choose today’s date. This means your LLC will go into existence on the date it’s approved by the Secretary of State.

If you entered a future date in your Certificate of Organization, then select the same date from the calendar.

The time doesn’t matter, but you need to select something. Just choose any time you’d like.

Remember, you can’t back date your filing at all (even if the calendar looks like you can).

Expiration:

If you didn’t enter an expiration date on your Certificate of Organization, check the box for “Perpetual” here. Otherwise, select your LLC expiration date using the calendar.

Certificate of Organization upload:

Upload your signed and completed Certificate of Organization. Make sure it’s in PDF format.

Does the LLC hold an interest in agricultural land in Iowa?

If your LLC will own land used for agricultural purposes, select “Yes“.

If not, select “No“.

Registered Agent:

In this section, you’ll enter your Registered Agent information again.

- If you, a friend, or family member will be your Registered Agent, enter the name, address, and email for that person.

- If you hired a Commercial Registered Agent, type the name of the company. Then, you can select them from the dropdown list and it will autofill the contact information.

Payment & Review:

Click “Review and Pay“. Review your filing for accuracy and check for any typos. If all looks good, click “Submit to File“. If you need to make any changes, click the “Back to Form” button.

Next, click “Setup Payment Method” and enter your payment information. Then submit your filing to the state.

Congratulations! Your Iowa LLC has been filed for processing.

Iowa LLC Approval and Processing Time

Mail filings: Your LLC will be approved in 7-10 business days (plus mail time). This accounts for processing time at the Secretary of State, plus the transit time to and from the state. Your approval documents will be mailed (via USPS) to your Registered Agent’s address.

Online filings: After you submit your filing online, it will be approved in 1 business day. Then you’ll get an email from the state when your LLC approval documents are ready for download.

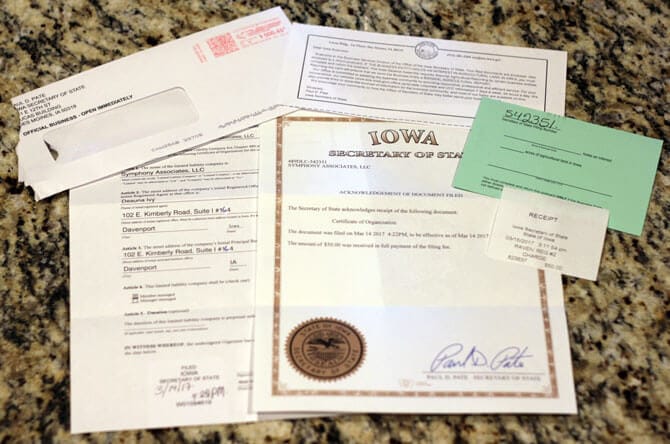

Iowa LLC approval documents:

After your Iowa LLC is approved, you will receive a:

- Receipt

- Acknowledgment Letter

- Certificate of Organization (stamped and approved)

Here is what your LLC approval will look like:

Note: You’ll use your approved Certificate of Organization, Acknowledgment Letter, and Federal Tax ID Number to open a business bank account for LLC.

Iowa Secretary of State Contact Info

If you have any questions, you can contact the Iowa Secretary of State at 515-281-5204.

Tip: Don’t call around lunch time. There are longer hold times.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

References

Iowa Uniform LLC Act: Chapter 489

Iowa Secretary of State: FastTrack Filing System

Iowa Uniform LLC Act: Chapter 489 Section 201

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi Matt, thanks for your help and great informnation. Could you add how to proceed if the owner of the LLC in Iowa is a Corp registered in a different state? How to specify that the owner is a Corp? Does it need to apply for a foreign entity license or as it creates the LLC in Iowa it is already able to operate business in Iowa? Thanks,

Ferran

Hi Fram, since Members aren’t listed on the Iowa Certificate of Organization, you’d simply list the Corporation as the owner (Member) in the Iowa LLC Operating Agreement. And no, the Corporation doesn’t need to register as a Foreign Corporation in Iowa just because it owns an LLC in Iowa. Hope that helps!

Hi Matt,

I just submitted my completed and signed application for Certificate of Organization for my Transport LLC business in the State of Iowa as a member. If I want to add members (Owners), when/how do I go about that? Or should the other members have signed the Certificate of Organization as well?

Sincerely,

Scott

Hi Scott, you’d need to amend the Operating Agreement. If you’ve obtained an EIN for your LLC with one member, the IRS is taxing your LLC like a Sole Proprietorship. If you add more members, you’ll need to change your tax classification to Partnership. We recommend hiring an attorney to add or remove LLC members. Hope that helps.

Hi Matt,

Thank you so much for the advice and the very quick response!

You are a fantastic resource!

Sincerely,

Scott

You’re welcome Scott :) Thank you!

Hello Matt,

Thank you so much for this website. I still have a question about Submit your Certificate of Organization Online. When I click “File Type”, there are no one is “Certificate of Organization”. I just saw “Registered agent change”, “Fictitious name filing”, “Amendment”, “Name reservation” and “Other”. Which one should I select?

Thank you

Can you and a family member both be listed as registered agents?

Hi Julie, no. Only one person’s name (or company name) can be used for the Registered Agent. Hope that helps.

Is it faster if I actually go down to the SOS? I want to buy a house in the LLC’s name and i need it to be quicker than the 3-4 weeks :(

Hi Jennifer, yes, walk-in filings are always faster. I believe they can be same-day in Iowa, however, we don’t cover walk-in filings since most of our readers do not file this way. I recommend calling the Secretary of State just to check on instructions and location for drop off. Hope that helps.

Legal says that I have to be at address during business hours. What if I want to transport cars to auctions with DOT registration. I cannot be in two places at one time. How about independent truckers, how is this handled?

Ed

Hey Ed, owner operators will either use a friend or family member (who resides in the state) or hire an Iowa Registered Agent company. Hope that helps.

Very helpful website with easy to follow instructions,thanks a ton for making this process easier for me.

You’re very welcome Jane! Thanks for your nice comment :)

Thanks so much for this step by step. I was wondering when you start an LLC with two corporations who signs the certificate of organization?

Hi Lalisa, when you “start an LLC with” do you mean that the 2 existing Corporations are members of the LLC? If so, you’ll have an authorized representative sign on behalf of both Corporations in the LLC’s Operating Agreement. Anyone person or company can be the Organizer of the LLC. Once the LLC is approved, have the Organizer sign a Statement of LLC Organizer, which will appoint (“hand off”) the LLC to the 2 Corporations.

Thank you for this amazing free step-by-step guide on how to form a LLC. It was very easy to follow and navigate. I will definitely share this with my clients.

You’re very welcome Jared. Thanks for the awesome comment and helping us reach more people :)

Amazing work and perfectly thorough. Thank you so much for all you’ve done. It was perfect.

Thanks so much for the comment Steven. Much appreciated!

Thank you so much for this! The amount of useful information you provide is awesome!

Thank you for the kind words Megan. You are welcome!

I cannot believe you provide this start-up guide for free. It’s exactly what I needed. I’m trying to get my business up and running as I recently lost my job. I cannot afford to pay someone else. But when I’m in a position, I will pay you forward!!!! Thank you.

Hey Tricia!! Thank you so much for the kind words! Comments like this make my day! Thank you for paying us forward, and we’re here if you need anything else. Best wishes with your business!