Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

A Maine business license gives your Limited Liability Company (LLC) permission to operate in a certain location or within a specific industry.

We can’t walk you through any applicable license applications step-by-step, because every business is unique. But we do provide helpful resources like:

- information about state licensing rules

- instructions for researching municipal licenses

And if you want to just hire a company to do the research for you, we have a recommendation below.

Maine Business License Requirements

After you form a Maine LLC, you may need to obtain a business license or permit.

Your requirements are determined by the industry you are in and where your Maine Limited Liability Company is located.

Because of the large number of industries and all of the municipalities in Maine, it’s not possible for us to explain them all. However, you can use the search tools below, call your local municipality, or hire a company for help.

Need to save time? We recommend hiring MyCompanyWorks (for $99) to handle the business license research for you.

How to get a Business License in Maine

You can obtain a business license in Maine by applying with the relevant licensing or regulatory agency. The agency you apply with will depend on where your business is located and what business activities it engages in.

The business license application typically requires basic information, such as your LLC name, EIN Number, business address, and contact information. Many also include a questionnaire that asks about your business activity.

There are three main licensing jurisdictions:

- State licensing

- Local licensing, such as county, city, township, etc.

- Federal licensing

Does Maine Require a Business License?

That depends on where your business is located, and what it does.

There are two types of state-level business licenses:

- a general business license

- and an occupational license

Maine General Business License

Some states have a general license requirement, which means all businesses operating in those states must have the license, regardless of what they do.

But good news: Maine doesn’t require a general license to do business in the state.

Meaning, your Maine LLC doesn’t need a general state business license. But depending on what type of business you run, your LLC might need an occupational license (aka “industry-specific” license).

Maine Occupational License

Most states have occupational business license requirements. This means a license or permit may be required depending on what your business does or what your occupation is. For example, if you sell used cars, or run a hair salon, you may need an occupational business license. But a license may not be required for other types of businesses.

The How to Get a Business License page can help you determine if your Maine business needs an occupational license or permit, and which agency to contact about applying for the license.

You can look through this list of resources by profession to see if your industry or occupation needs a business license in Maine.

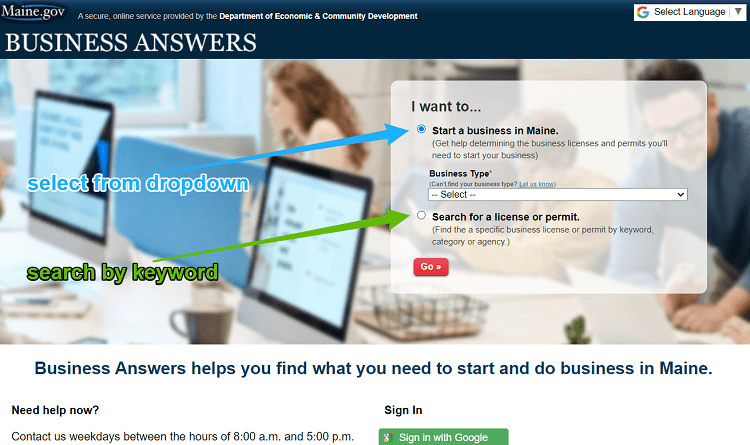

The Maine Department of Economics and Community Development created a service called Business Answers to help people start businesses in Maine. Their website has two ways to search for business license requirements: by selecting your business type from a list, or searching by keyword.

You can also contact the Business Answers service with questions.

Note: Maine business licenses are not issued by the Secretary of State or the Division of Corporations. The Secretary of State is responsible for business entity administration, for example Limited Liability Company formation.

How much is a Maine Business License?

Maine doesn’t have a general business license at the state level, so there are no fees there.

However, your business may need a state-level occupational license or municipal-level license or permit to operate. The filing fee for these licenses will vary depending on where you’re doing business and what industry you’re in. To be honest, we can’t predict your specific Maine business license cost.

For example, licenses issued by a county that contains a large city are usually more expensive than licenses in less populated, rural counties. And licenses for regulated industries, like child care facilities, are usually more expensive than generic business licenses.

But your LLC might not need a license or permit at all. So your Maine business license cost could be $0.

See LLC Cost in Maine to learn about all the possible LLC fees.

Municipal Business License

Municipal business licenses can be issued by the city, town, county, parish, township, borough, etc. We refer to all of these as a “municipality” to keep things simple.

There are two types of municipal business licenses:

- general business license

- industry-specific license

For example, if a municipality has a general business license requirement, all businesses operating in that municipality must have the license, regardless of what they do.

And if a municipality has industry-specific business licenses, a license or permit may be required depending on what your business does. For example, if you operate a food truck, or run a daycare, you may need an industry-specific municipal business license. Or if you’re purchasing or leasing real estate, you may need a zoning permit.

But a license may not be required for other types of businesses, like making wedding invitation templates or offering marketing consulting.

You can contact your municipality to check on their local licensing requirements:

- Maine Counties

- Search on Google for your town or city’s website

Maine Sales Tax License

If you sell products to consumers in Maine, you may need to collect sales tax and file a Sales Use and Service Provider Tax Return.

If your business activities are subject to sales, use and service provider tax, your LLC must register with the Department of Revenue.

Note: This requirement will apply whether you sell products online or in a physical location in Maine.

You can register for business tax with the Department of Revenue online.

For additional information about the Sales Tax License, check out:

Tip: Save time by hiring an expert. We recommend using TaxJar. They'll help you register for, collect, and pay sales tax.

Do I need any federal business licenses?

Most businesses in Maine don’t need a federal business license. However, certain industries do need federal licenses:

| If your business… | Contact this agency about business licenses |

|---|---|

| Transports animals, plants or biotechnology over state lines | Department of Agriculture |

| Imports or exports animal products, wildlife, or products derived from wildlife (including fish) | Fish and Wildlife Service |

| Fishes commercially | Fish and Wildlife Service |

| Broadcasts on radio or TV | Federal Communications Commission |

| Makes alcohol and sells it at a retail store | Tobacco Tax and Trade Bureau |

| Makes or sells firearms, ammunition or explosives | Bureau of Alcohol Tobacco Firearms and Explosives |

| Transports cargo by sea | Federal Maritime Commission |

| Transports goods or people by air | Federal Aviation Administration |

Check out the Small Business Administration’s Licenses and Permits page for a full list of industries with federal license requirements.

If your business isn’t one of these special cases, then the only federal requirements are that your LLC get an Maine EIN Number (aka Federal Employer Identification Number) and that you file taxes.

Maine Business License FAQs

How much does a business license cost in Maine?

Maine doesn’t have a general business license for LLCs, so there are no fees there.

If your business has to get an occupational license or municipal (city or county) permit, the fees are hard to predict. Depending on your LLC’s location, and what type of business or industry you’re in, the fee varies.

And you might not need a business license at all!

Unfortunately, we can’t say what your LLC’s business license costs would be, because it depends on several factors and the cost of Maine licenses varies.

Is an LLC considered a business license?

No, an LLC is not a business license. They are two completely different things.

An LLC is a type of business structure created by filing a document with the state government.

And a business license is a document that gives a person, or a company, the right to transact business. It doesn’t create an LLC.

Does a Sole Proprietor need a business license in Maine?

Sometimes a new business owner chooses to operate as a Sole Proprietorship in Maine instead of an LLC.

Even if you’re just trying out a business idea as a Sole Proprietorship, you may still be subject to license requirements at the state and municipal levels. It just depends on what you will be doing, and where you will be operating your business.

Does the Maine Secretary of State provide a business license?

No, the Maine Secretary of State doesn’t handle licensing requirements. Instead, they manage business entity formation and registration. For example, depending on business entity type, business owners file different paperwork with the Secretary of State to create their business entity.

For more information, or to determine if there is a Maine business license cost for your business, we recommend contacting the specific licensing board or department and/or your local government agency. For example, your local county or city government will have information about any local licenses.

How to start an LLC in Maine

Here are the steps to starting an LLC in Maine:

- Select a business name for your Maine LLC

- Choose your Registered Agent

- File the LLC Certificate of Formation with the state

- Complete and sign an LLC Operating Agreement

- Get a Tax ID Number (EIN) from the Internal Revenue Service (IRS)

- Open an LLC bank account

- Check whether you need a business license or tax permits in Maine

References

Maine Business Licensing

Maine Licensing Resources by Profession

Maine Office of Business Development: Start a Business

Maine Small Business Development Centers: Starting a Small Business

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.