Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through filing your Certificate of Organization with the state.

This is the document that officially forms your Massachusetts LLC.

You can file your Massachusetts Certificate of Organization by mail or online.

If you file by mail, the filing fee is $500.

If you file online, the filing fee is $520.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

The “LLC filing fee” (the fee to create a Massachusetts LLC) is the same thing as the “Certificate of Organization fee”. The Certificate of Organization is the document that, once approved by the Secretary of State’s office, creates your Massachusetts LLC.

How much is an LLC in Massachusetts explains all the fees you’ll pay, including the Certificate of Organization filing fee.

(Massachusetts Secretary of the Commonwealth, Corporations Division Building)

Regardless of how you file your Certificate of Organization, the state will process and approve your LLC within 1-2 business days.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Massachusetts.

Online filing vs mail filing

Below, you will find instructions for the online filing. We recommend filing online as it’s faster and easier than the mail filing.

Alternatively, if you want to hire someone to form your LLC for you, check out Best LLC Services in Massachusetts.

Prefer to file by mail instead?

If you prefer to file by mail, the instructions on this page still apply to the paper form.

Here are the steps to forming an LLC by mail:

- Download the Certificate of Organization (Form D)

- Fill the form out on your computer or by hand (using a blue or black pen)

- Print it on regular white paper (8.5″ x 11″)

- Sign the form

- Prepare a check or money order for $500 (made payable to “Commonwealth of Massachusetts”)

- Mail your signed Certificate of Organization and payment to: Secretary of the Commonwealth, One Ashburton Place, Room 1717, Boston, Massachusetts 02108-1512

Approval:

When filing by mail, the Commonwealth of Massachusetts will not mail anything back once your LLC is approved. Instead, you’ll need to wait 1-2 business days (plus allow a few days for mail time).

Then, search for your LLC online (via the Business Entity Search). Click on your LLC name, and scroll down to the “View filings for this business entity” section. Then click “Certificate of Organization”, and then click the “View Filings” button.

Notes:

- If you cannot find your LLC filing online, or do not receive a rejection letter within about a week, you can call the Massachusetts Secretary of the Commonwealth at 617-727-9640.

- We recommend saving/printing a few copies of your Certificate of Organization (both physical and digital) and keeping them with your business records.

- If your LLC is rejected for any reason, the state will mail you a letter letting you know what needs to be changed.

Massachusetts Certificate of Organization (Online filing instructions)

Before you continue: Make sure you have searched your LLC name and selected your Massachusetts Registered Agent.

Get Started

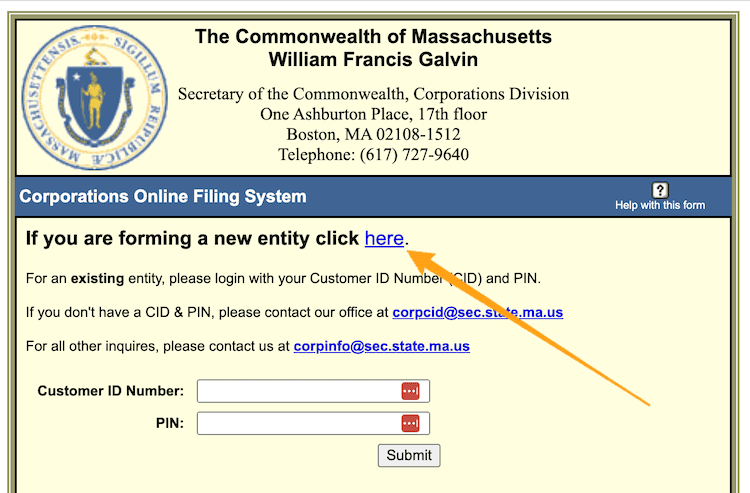

Visit the Corporations Division Online Filing System.

To the right of “If you are forming a new entity“, click the “here” link.

Then underneath “Domestic Limited Liability Company (LLC)”, click “Certificate of Organization“.

1. Name of your LLC

Enter your LLC name exactly as you would like it.

Include your preferred capitalization, as well as the designator “LLC” or “L.L.C.” (the abbreviation “LLC” is the most common).

Note: You can use a comma in your Massachusetts LLC name or you can leave it out. Ex: “ABC Widgets, LLC” and “ABC Widgets LLC” are both acceptable.

2a. Principal Office Address

Enter your LLC’s Principal Office Address.

This can be a home address, an office address, or the address of your LLC’s Resident Agent (aka Registered Agent).

Note: Make sure to enter “USA” in the “Country” field.

2b. Address where your LLC’s Records will be Maintained

I know this sounds a bit repetitive, but a few businesses might have a different address where official records are kept.

For most people though, this address will be the same thing you entered in 2a above. If that’s the case, select “Principal Office” from the drop down menu.

3. General Character of your Business

Enter the purpose of your LLC.

It doesn’t have to be extremely specific (unless you want it to be), and you are not going to be forced to do this forever. You can change the purpose of your business as it grows.

You can enter just a few words (ex: “pizza shop”, “real estate investing”, “landscaping”, etc.) or a few sentences.

Note: Massachusetts doesn’t allow for a “general use” clause (ex: “Any and all purposes for which an LLC can be formed”). If you use this, your LLC will be rejected. Instead, you must enter something specific.

4. Dissolution

In this section, you need to let the Massachusetts Secretary of the Commonwealth know about the duration of your LLC (how long it will remain in existence).

If you prefer for your LLC to be “open-ended” with no set closure date, leave #4 blank.

Most people leave #4 blank as this gives them the freedom to close their LLC at any time in the future (by filing dissolution paperwork).

If you prefer for your LLC to be automatically shut down on a specific date in the future, enter that specific date here.

5. Name and Street Address of Resident Agent (aka Registered Agent)

- Related article: If you’re not sure who can serve as your Massachusetts Registered Agent, please refer to this page: Massachusetts Registered Agent.

Notes

- Resident Agent is the same thing as Registered Agent. Massachusetts just uses the term Resident Agent.

- You can learn more about the role of a Registered Agent here: Registered Agent vs LLC Organizer.

Enter the exact name of your Resident Agent in the first box and their street address in the second box (PO boxes are not allowed).

If your Resident Agent is an individual, they must be a resident of Massachusetts. If your Resident Agent is a company, they need to be authorized to do business in Massachusetts.

Resident Agent Consent

To the right of “I,” enter the exact name of your Resident Agent again.

6. Name and Address of Managers (if your LLC is Manager-Managed)

If your LLC is Manager-managed, enter the name and address of the manager(s) and then click “add”.

If your LLC is Member-managed, you can leave this section blank.

Note: Most LLCs are Member-managed, where all the owners run the business and day-to-day operations. An LLC can also be Manager-managed, where one, or a few designated people, run the business and day-to-day operations (while the Members play more of a passive/investor role).

To learn more about Member-managed LLCs vs. Manager-managed LLCs, please see Member managed LLC vs Manager managed.

7. Name and Address of Authorized Signer(s) (if your LLC is Member-Managed)

If your LLC is Member-managed, enter the name and address of each person authorized to sign documents on behalf of the LLC and then click “add”. This will most likely be you and any additional Members.

If your LLC is Manager-managed, you can leave this section blank, or enter any additional authorized signer’s name and address (in addition to those listed in #6).

8. Name and Address of Authorized Signer(s) (for Real Estate)

If your LLC is involved in real estate transactions, enter the name and address of all members/managers who are authorized to sign real estate documents and then click “add”.

If your LLC is not involved in real estate transactions, you can leave #8 blank.

9. Additional Matters

This section is used to add additional rules and regulations to your Massachusetts LLC.

This section is not required, and most people leave it blank.

Filer’s Contact Information

Enter your name in the “Contact Name” box.

Leave “Business Name” blank.

Enter your street address (if different from the Principal Office Address listed in 2a). If your address is the same as the Principal Office Address listed in 2a, select that same address from the drop down menu on the right.

Enter your phone number and email address.

Signature

Type your full name under the signature box.

Then select “Accept“.

Then click the “Click HERE to submit this information” button.

Summary and Review

On the next page, review the information for accuracy and check for typos.

If you need to make any changes, click the “Make Corrections” button at the lower left of the page.

If no changes are needed, click the “Accept” button at the lower right of the page to proceed.

Payment Method

Click the “Enter Payment Details” button.

On the next page, click the “PAY” button.

Enter your credit card and billing information.

Then submit your payment to the state.

Congratulations! Your Massachusetts LLC has been filed for processing.

Now you just need to wait for approval.

Massachusetts LLC Approval

Approval:

When filing by mail, the Commonwealth of Massachusetts will not mail anything back once your LLC is approved. Instead, you’ll need to wait 1-2 business days.

Then, search for your LLC online (via the Business Entity Search). Click on your LLC name, and scroll down to the “View filings for this business entity” section. Then click “Certificate of Organization”, and then click the “View Filings” button.

Notes:

- If you can’t find your LLC filing online, or don’t receive a rejection letter within about a week, you can call the Massachusetts Secretary of the Commonwealth at 617-727-9640.

- We recommend saving/printing a few copies of your Certificate of Organization (both physical and digital) and keeping them with your business records.

- If your LLC is rejected for any reason, the state will mail you a letter letting you know what needs to be changed.

Massachusetts LLC bank account

You’ll use your Certificate of Organization and your Federal Tax ID Number to open a business bank account for your LLC.

Massachusetts Secretary of the Commonwealth Contact Info

If you have any questions, you can contact the Massachusetts Secretary of the Commonwealth at 617-727-9640. Their hours are Monday through Friday from 8:45am to 5:00pm, Eastern Time.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

References

Massachusetts LLC Act

Massachusetts LLC Laws and Regulations

Mass.gov: Limited Liability Companies

Massachusetts Secretary of State: LLC Information

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Massachusetts LLC Guide

Looking for an overview? See Massachusetts LLC

The articles you have provided was very helpful. I especially like the video you made on the operating agreement. Made completing mine super easy. Keep up the wonderful work.

Hi Susan, thank you very much! I appreciate the kind words. You are very welcome :)

I just wanted to say thank you! This article made the filing process very smooth. I would leave a tip if you had a tip jar!

Haha, thanks Vee! So glad we could help :)

Hi Matt,

This is a fantastic article. I have 1 area I would like to clarify:

Once I can see my Certificate of Organization, that means my LLC is approved? I ask because even though your article is clear, I could see my certificate very quickly (the first time I checked was ~12 hours after applying and it was there.)

Thank you,

Michael

Thanks Michael! Yes, correct. Once you can access the stamped and approved Certificate of Organization, your LLC exists. And sometimes that approval time is faster than 24-36 hours. Congrats on your new LLC!

Great article firstly. Took me years to figure out the exact steps for filing.

Is the contact information porton for my personal contact info, like my personal number and personal contact email correct? As I wouldn’t have a number or biz email set up yet exactly.

Hi Christine, thank you. Your phone number and email address can be personal. You aren’t required to use a dedicated “business” phone number or email address. Hope that helps.

My question is , can you use anyone for a reference for the LLC application ?

Hi Matthew, what do you mean by “reference”? Which specific role are you referring to for your Massachusetts LLC?

I just filed for LLC and it’s in the system, so I went ahead and got my EIN online – I have the number. The State has it with the “,LLC” extension as it was guided in the article above, but the EIN application said that legal name cannot have a “corp, inc. etc extension, and the Trademark name cannot have LLC extention, so I left it out of the EIN application. Is this inconsistency going to cause issues? Is there a recommended approach or benefits whether to include or exclude the LLC extension in the name, or is it personal preferance? Am I required to include the LLC ext in my name in Massachusetts if I am one? Thank you!

Hi Suzy, you’ll want the “LLC” in your LLC name for the EIN application. It sounds like you got confused about a certain section of the EIN online application (which is common). In the “Tell us about the LLC” step, where the IRS is asking for the legal name of LLC, trade name/DBA (if applicable), county, state, etc., it states “The trade name may not contain an ending such as ‘LLC’, ‘LC’, ‘PLLC’, ‘PA’, ‘Corp’, or ‘Inc’.” In the “Legal name of LLC” field, you should enter the full name of your LLC, including the ending (LLC, L.L.C., etc). The Trade name field should be left blank unless your LLC is also doing business under a fictitious name (aka DBA or Trade name).

We recommend applying for a new EIN Number and then cancelling the first. You can apply for a new EIN right away. You don’t have to wait for the initial EIN to be cancelled. Hope that helps!

Hi Matt,

Thanks so much for your thorough response – yes, I was definitely confused there.

I had called the support number for the EIN application the same day and they said I an just call them back if I want to add the LLC in the name officially, so I’ll try that before cancelling and reapplying for new.

Would you be able to explain what the benefit(s) is to including the LLC in the EIN name if it’s not legally required? I’m obviously so new to this, I just want to foresee any potential obstacles and be as prepared as possible. Thanks so much for all your help!

Hey Suzy, you’re very welcome! You can change the name with the IRS, but that has to be done by mail or fax and will take months (usually weeks, but now about 2 months because of covid) before you get an updated approval letter (EIN Verification Letter, aka 147C). It’s actually much faster to apply for a new EIN (since it’s approved instantly via the online application). You definitely want the correct designator in your EIN Confirmation Letter (CP 575). The IRS system doesn’t catch the error, but that doesn’t mean it’s correct. There’s no reason to have an inaccurate entity name in your EIN Confirmation Letter. In fact, it can cause issues/confusion with certain organizations, like banks, as one example. We strongly recommend applying for a new EIN using the full/legal name of your LLC. Hope that helps clear things up :)

If I am a single member LLC, can I aslo leave the contribution as $1,000? Also this operating agreement is just for myself to fill out and keep correct? No parts of the operating agreement has to be filled out with the Secretary of State’s Officers?

Hi Etania, yes, you can use $1,000 as the capital contribution. To be more precise, you can make your capital contribution match the amount of your initial deposit when you open/opened your LLC business bank account. And correct, the Operating Agreement is just for you to keep with your LLC’s records. You don’t send it to the Secretary of the Commonwealth. Hope that helps!

This article was super helpful, thank you! For the top of Page 2: Filing Fee, Today’s Date, and Effective Date – it looks like that part is to be filled out by the Secretary of State’s office, correct? That’s the only part I wasn’t clear on based on the instructions above.

Also, just FYI, it seems that Massachusetts is one of the states that does require you to have your EIN/TIN number before you file your articles or organization.

*of not or

Hi Sheryl, apologies for any confusion. “Page 2” has since been fixed and changed to “Page 3”. You’ll leave the top part of page 3 blank (fee, date, effective date) – the Secretary of State Office will complete this part. Just enter your contact information in the 2nd half of page 3. Regarding the EIN, no, this is not required to be listed here. It’s best to get the EIN after your LLC is approved. We recommend leaving this blank. Hope that helps!

I can understand why you need to have your LLC established before you get your. Once you have the EIN, do you have to provide an update to the State with your EIN or will they just get it when you file taxes as the LLC the following year?

Hi David, you don’t have to update the Secretary of State with the LLC’s EIN (it’s not a requirement). And yes, when you file your state taxes, you’ll use the EIN with the Department of Revenue. Hope that helps.

8. Name and Address of Authorized Signer(s) (for Real Estate) — Hi! I have a question on this section. If I’m purchasing a property from a different state, do I put my name and home address (different state from property) in this section? Thanks!

Hi Diana, yes, in theory, this would be your address listed in #8, however, if you’re purchasing property in another state, you should be forming the LLC in the state where the property is located, since this is where you will legally be doing business. Forming an LLC in Massachusetts and then investing in real estate in another state will require you to register your Massachusetts LLC as a “Foreign LLC” in the state where the property is located (thus increasing your fees).