Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

What is an Annual Report for an LLC?

The Michigan LLC Annual Report is a required filing (and $25 fee) that is due every year.

The Michigan LLC Annual Report is a required filing (and $25 fee) that is due every year.

It keeps your LLC’s contact information up to date with the Michigan Department of Licensing and Regulatory Affairs (LARA).

It can be filed online or by mail and it keeps your LLC in compliance and in good standing.

Note: In Michigan, the official name for an Annual Report is actually the Annual Statement. They both mean the same thing, so we will keep it simple and call it the “Annual Report”.

How much does it cost to file an Annual Report in Michigan?

The Michigan Annual Report costs $25 each year.

This filing fee is paid every year for the life of your LLC.

Veterans: You can file your Annual Report for free. You’ll just need to submit an Affidavit and proof of your Veteran status. We’ll discuss this below.

Do I have to file an Annual Report for my LLC every year?

Yes, must file an Annual Report for your Michigan LLC every year. It is a state requirement in order to keep your LLC in good standing.

This is required regardless of business activity or income. Meaning, even if your LLC does nothing and makes no money, you still have to file the Annual Report every year.

Having said that, it’s okay if your Annual Report is late in Michigan. The penalty is not that serious.

Michigan LLC Annual Report due date

The due date of the Michigan Annual Report is February 15th every year.

However, your first Annual Report may not be due right away.

When is my 1st Annual Report due?

Michigan uses your LLC’s Date of Organization to determine when your first Annual Report is due.

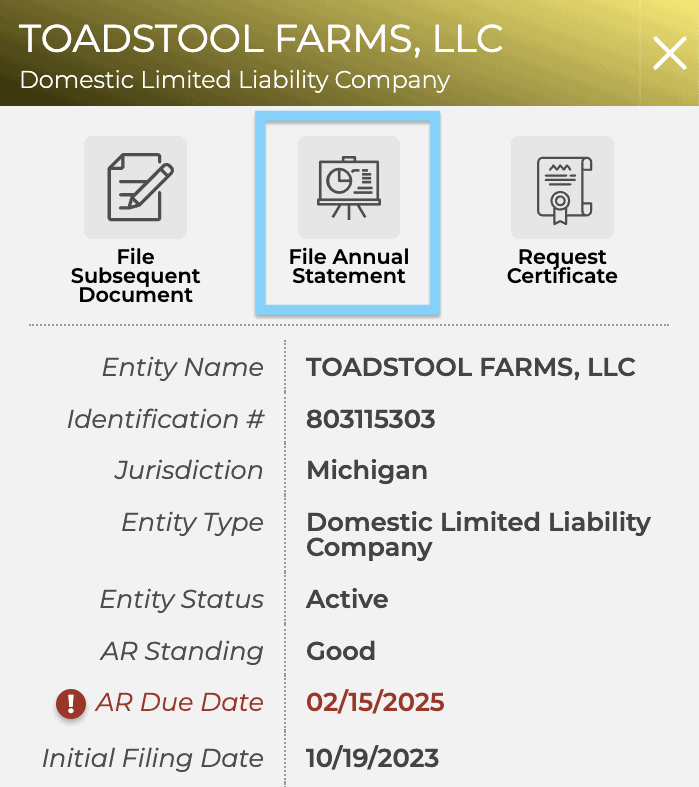

Note: If you don’t remember your Date of Organization, you can look it up in the online portal:

- Visit the MiBusiness Registry Portal.

- Click “Search” and search for your LLC name.

- Select your LLC from the search results.

- Your Date of Organization will be listed next to “Initial Filing Date“.

If your Date of Organization is between January 1st and September 30th, your first Annual Report will be due by February 15th of the following year.

For example: If your Date of Organization is August 4 2026, then your first Annual Report will be due by February 15th, 2027.

If your Date of Organization is between October 1st and December 31st, your first Annual Report will be due by February 15th two years later.

For example: If your Date of Organization is November 4 2026, then your first Annual Report will be due by February 15th, 2028.

Michigan Annual Reports due dates:

| Date of Organization | 1st Annual Report Due | 2nd Annual Report Due |

|---|---|---|

| January 1 - September 30, 2026 | February 15, 2027 | February 15, 2028 |

| October 1 - December 31, 2026 | February 15, 2028 | February 15, 2029 |

| January 1 - September 30, 2027 | February 15, 2028 | February 15, 2029 |

| October 1 - December 31, 2027 | February 15, 2029 | February 15, 2030 |

Penalty for failure to file Annual Reports

There is a 2-year “grace period” for filing your Michigan Annual Report. If you file within 2 years of the due date, there are no late fees or penalties.

However, if you don’t file within 2 years of the due date, your LLC will lose its “good standing” status (and other people can use your LLC name).

If this happens, you’ll need to Restore your LLC. This is done by filing a Certificate of Restoration ($50) and all your late Annual Reports ($25 for each report). If someone has taken your LLC’s name in the meantime, you will have to select a new name.

How do I file my Annual Report in Michigan?

You can file online or by mail.

We recommend filing your Michigan Annual Report online because it’s faster and easier.

Important: Michigan’s old filing system was called the Corporations Online Filing System (COFS) and it required a Customer ID (CID) and PIN to login.

However, Michigan replaced this filing system and login in 2025.

The new online filing system is called MiBusiness Registry Portal, and you’ll login using MiLogin for Business.

If you don’t have a MiLogin for Business account, you’ll need to create one before you can file your Annual Report.

How to create a Michigan MiLogin for Business account

Go to the MiLogin for Business account creation page.

Email address and Name:

Enter your email address and click “Next Step“.

Retrieve the passcode from your email and enter the passcode on the MiLogin page. Then click “Next Step“.

Enter your name and check the box agreeing to the MiLogin Terms and Conditions. Then click “Next Step“.

Work phone:

Enter your preferred work number (most people just use their cell phone). Then click “Next Step“. You’ll receive a phone call with the code. Enter the code and click “Confirm Passcode“.

Mobile phone:

Enter your cell phone number (it’s okay if you entered this as your “work phone” too) and click “Next Step“. Choose your verification method, enter the code given, and then click “Confirm Passcode“.

Create your User ID:

Important: Your User ID must start with your last name followed by your first initial, and then 4 numbers.

Tip: Look at the “info box” for your username example.

For example: If your name is Susan Binkowski, your username must start with “BinkowskiS“, followed by any 4 numbers. So “BinkowskiS4455” would be acceptable.

Enter your desired User ID and click “Next Step“.

Create your password:

Enter your desired password twice. Then click “Create Account“.

Once your MiLogin for Business account is created, you can close this tab.

You’re now ready to file the Annual Report for your Michigan LLC.

Get started:

- Visit the MiBusiness Registry Portal.

- Click the “Login” button.

- Under “MiBusiness Registry Portal“, click “Launch service“.

- This automatically logs you in if you just created your account.

- Click “Launch service” to return to the MiBusiness Registry Portal.

If this is your first Annual Report, you’ll need to request access to your LLC in order to complete your filing:

- Click “Search“.

- Enter your LLC’s name in the search tool, and select your LLC from the search results.

- Click “Request Access“.

- Enter your LLC’s Identification Number and Initial Filing Date.

- You’ll find these items on your LLC’s information pop-out.

- Then click “Request Access“.

- Now you can access your LLC filing in the “My Records” page.

Click “My Records” in the left-hand navigation.

Then click on your LLC’s name.

Click “File Annual Statement” to begin your filing.

Tip: If you don’t see the “File Annual Statement” button, we recommend calling the Corporations Division (517-241-6470) for guidance.

Processing Information

Select your processing speed.

We recommend choosing Standard Review. This will get your LLC Annual Report processed in 7-10 business days.

If you would like your Annual Report approved faster, you can pay more money to expedite your filing. That said, most people don’t need to expedite their filing. And we don’t recommend it.

Veteran Exemption

If you’re a Veteran and qualify for a free Annual Report filing, check the box marked “I qualify for a veteran fee exemption“. Then upload your Proof of Veteran’s Status and a Fee Waiver Request form. For more information, please see Michigan Veteran LLC.

If you aren’t a Veteran, leave the box unchecked.

Then click “Next Step“.

Limited Liability Company Information

There’s nothing to do on this page. Your LLC’s name will already be in this field. And you can’t make changes to the LLC name here.

If you want to change the name of your Michigan LLC, follow the steps on Change LLC Name in Michigan.

Just click “Next Step“.

Resident Agent and Registered Office Address

Review your Michigan LLC Registered Agent information and make sure it’s up to date.

If you don’t need to change your Registered Agent information:

- Select “No” under “Do you wish to change the resident agent…”

- Select the delivery method.

- Then click “Next Step“.

If you want to make changes to your Registered Agent:

- Select “Yes” under “Do you wish to change the resident agent…”

- Select the Agent Type:

- If you – or someone you know – will be the Registered Agent, select “Individual” (and enter their name and address).

- If you hired a Registered Agent Service, select “Resident Agent Company“, search their name, and then select them from the results.

- Check the “I Certify” box.

- Select the delivery method:

- Most people choose “Email” if they are the Registered Agent.

- Or check “Mail” if they hired a Registered Agent Service.

- Click “Next Step“.

Signature

Check all 3 boxes agreeing that:

- you know your Annual Report information is public record,

- you are authorized to file this document, and

- the information you’re submitting is true.

At least 1 person must sign your Annual Report:

- Click “Add“.

- Enter the name of the signer.

- Click “Save“.

- Signer’s Capacity: Select “Authorized Agent” or “Self“.

- Signature: Enter your name.

- Date: Click the box labeled “Today“.

Then click “Next Step“.

Review

Review your information for accuracy and check for typos.

If you need to make any changes, click the section in the left navigation and edit the information.

When everything looks good, click “File Online” at the bottom.

Payment

Select “Pay Now with Credit Card“.

There’s nothing to do on the next page. Just click “Next“.

Enter your billing and payment details.

Then click “Next” to submit the $25 fee using a debit or credit card.

Note: You’ll receive an email with a receipt (sent to the email you just entered during the payment step).

Approval

Congratulations! Your Annual Report was filed online and will be processed within 7-10 business days.

Michigan doesn’t send an email confirmation when your Annual Report is approved.

Instead, you can check on the status of your filing by searching for your LLC in the MiBusiness Registry Portal:

- Click “Search” and run a search for your LLC name.

- Select your LLC from the search results.

- Click “View History & Filings“.

When your Annual Report has been approved, you’ll see “Annual Statement” with the current year listed in the filing history.

We recommend waiting the full 7-10 business days before checking on your Annual Report’s filing status.

Calendar Reminder

Make sure you set a calendar reminder for next year.

Even if you don’t receive a reminder notice, it’s still your responsibility to file your Michigan Annual Report on time every year.

For that reason, we recommend putting a repeating reminder on your phone, computer, and/or calendar.

Here’s a video on how to use Google Calendar to create reminders:

Michigan Department of Licensing and Regulatory Affairs Contact Info

If you have any questions about your LLC Annual Report, you can contact the Corporations Division at the Michigan Department of Licensing and Regulatory Affairs (LARA).

Their phone number is 517-241-6470. And their hours are Monday through Friday, from 8am to 5pm Eastern Time.

Michigan Annual Report Filing FAQs

What is the processing time for a Michigan Annual Report?

How long it takes for a Michigan Annual Report to be processed depends on how it was filed:

- If you file online, it can take up to 7-10 business days.

- If you file by mail, it may take 7-10 business days, plus mail time.

Will I be charged a late fee if I don’t file a Michigan Annual Report?

No, there is no late fee.

However, if you file the Annual Report more than 2 years late, the state can shut down your LLC. Then you’ll have to pay a fee in order to restore your LLC.

What is an Annual Statement for an LLC?

The LLC Annual Statement is the same thing as the LLC Annual Report.

It’s the filing (and annual fee) that is due every year in order to keep your LLC in good standing.

Can I file a Michigan Annual Report by mail?

Yes, you can file by mail (instead of online).

The Michigan Department of Licensing and Regulatory Affairs will send an Annual Report form every year to your Registered Agent.

- Make sure the details on your pre-printed Michigan LLC Annual Report are correct.

- If applicable, report any changes to your Registered Agent and their address.

- Sign and date the form.

- Include a check for the $25 filing fee.

- Send your payment and the form to: Michigan Corporations Division, PO Box 30054, Lansing, MI 48909-7554

References

Michigan LLC Act: Section 450.4909

Michigan LLC Act: Section 450.4207(3)

Michigan Secretary of State: Annual Filings

Michigan Secretary of State: Restore My LLC

Michigan Secretary of State: Limited Liability Company Filing Information

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Michigan LLC Guide

Looking for an overview? See Michigan LLC

Impossible!! all I want to do is file a LLC annual report.

As a new LLC, it was very helpful to me.

Thank you Johnny, that’s wonderful to hear!