Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

What is an Annual Report for an LLC?

The Michigan LLC Annual Report is a filing that keeps your LLC’s contact information up to date with the Michigan Department of Licensing and Regulatory Affairs (LARA).

The Michigan LLC Annual Report is a filing that keeps your LLC’s contact information up to date with the Michigan Department of Licensing and Regulatory Affairs (LARA).

It can be filed online or by mail and it keeps your LLC in compliance and in good standing.

Does Michigan require an Annual Report?

Yes. Every Michigan LLC (Limited Liability Company) must file an Annual Report every year.

Note: In Michigan, the official name for an Annual Report is actually the Annual Statement. They both mean the same thing, so we will keep it simple and call it the “Annual Report”.

How much does it cost to file an Annual Report in Michigan?

The Michigan Annual Report costs $25 each year. This filing fee is paid every year for the life of your LLC.

Veterans: Thank you for your service! You can file your Annual Report for free. You’ll need to call the Michigan Secretary of State (517-241-6470) and request that it be mailed to you. You’ll also need to submit an Affidavit and proof of your Veteran status. We provide the form and instructions here: Michigan Veteran LLC.

Do I have to file an Annual Report for my LLC every year?

Yes, you have to file an Annual Report for your Michigan LLC every year. It is a state requirement in order to keep your LLC in good standing.

This is required regardless of business activity or income. Meaning, even if your LLC does nothing and makes no money, you still have to file the Annual Report every year.

Having said that, it’s okay if your Annual Report is late in Michigan. The penalty is not that serious.

Michigan LLC Annual Report due date

The due date of the Michigan Annual Report is February 15th every year.

However, your first Annual Report may not be due right away.

When is my 1st Annual Report due?

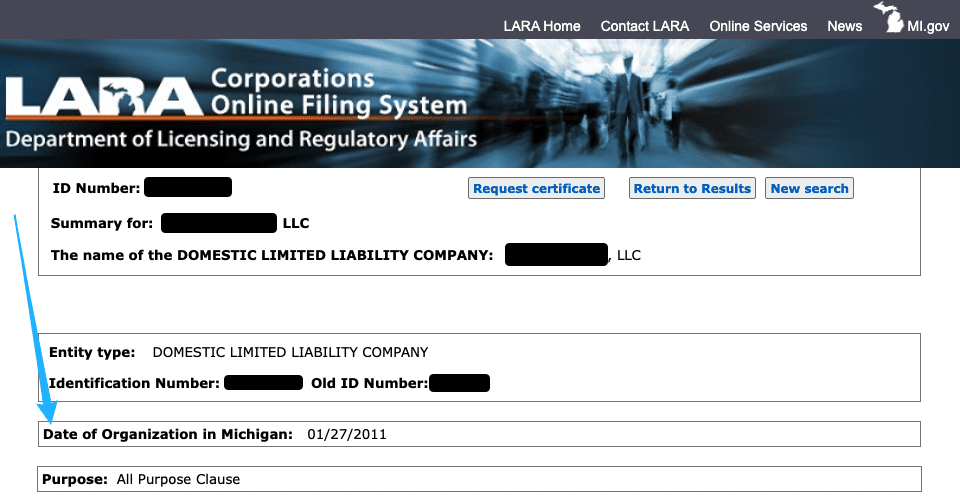

Michigan uses your LLC’s Date of Organization to determine when your first Annual Report is due.

Action: Visit the Business Entity Search page and search for your LLC name. On the business entity page, look for the “Date of Organization in Michigan”.

If your LLC’s Date of Organization is between January 1st and September 30th, your first Annual Report will be due by February 15th of the following year.

If your LLC’s Date of Organization is between October 1st and December 31st, your first Annual Report will be due by February 15th two years later.

Michigan Annual Reports due dates:

| Date of Organization | First Annual Report Due Date | Second Annual Report Due Date |

|---|---|---|

| January 1 - September 30, 2024 | February 15, 2025 | February 15, 2026 |

| October 1 - December 31, 2024 | February 15, 2026 | February 15, 2027 |

| January 1 - September 30, 2025 | February 15, 2026 | February 15, 2027 |

| October 1 - December 31, 2025 | February 15, 2027 | February 15, 2028 |

Penalty for failure to file Annual Reports

There is a 2 year “grace period” for filing your Michigan Annual Report. If you file within 2 years of the due date, there are no late fees or penalties.

If you don’t file within 2 years of the due date, your LLC will lose its “good standing” status (and other people are able to use your LLC name).

If this happens, you’ll need to Restore your LLC. This is done by filing a Certificate of Restoration ($50) and all your late Annual Reports ($25 x each report). If someone has taken your LLC’s name in the meantime, you will have to select a new name.

Michigan LLC Annual Report Reminders

Michigan doesn’t have a reliable system for sending Annual Reports reminders.

Sometimes they are sent by email, sometimes a pre printed form is sent by mail, and sometimes they are sent to your Registered Agent (aka Resident Agent).

For that reason, we recommend putting a repeating reminder on your phone, computer, and/or calendar.

Here’s a video on how to use Google Calendar to create reminders:

How do I file my Annual Report in Michigan?

You can file online or by mail. We recommend filing your Michigan Annual Report online, because you get an immediate confirmation of the filing.

Things to have ready:

- Your CID and PIN

- LLC name

- Resident Agent name (aka Registered Agent) and address

- Credit or debit card

CID and PIN

In order to access the online filing, you will need your LLC’s CID (Customer ID Number) and PIN (Password).

If you formed your LLC yourself, you should already have your CID and PIN.

If you don’t have a CID and PIN (or can’t find them), you can “recover” them here: Michigan LARA: CID/PIN Recovery. You’ll need your LLC’s Entity ID Number. This can be found by searching your LLC name on the Business Entity Search page.

Login to online filing

Get started:

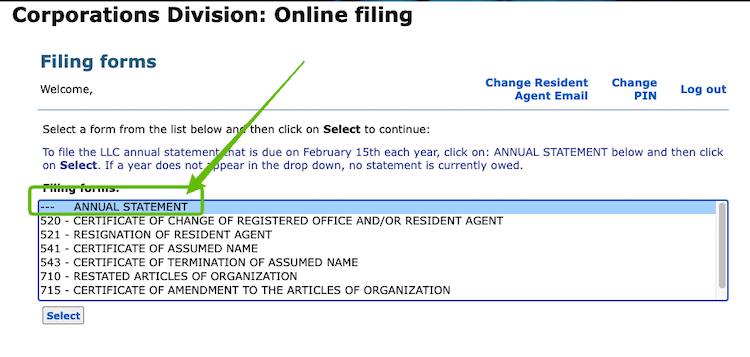

- Go to the Michigan Corporations Division: Online Filing page

- Login using your CID and PIN

- Look for the Annual Statement (aka Annual Report) and click Select to begin your filing

Annual Statement for Domestic Limited Liability Company

Your LLC’s Entity ID Number should already be in the Identification Number field. (If not, you can find it by searching your LLC name on the Business Entity Search page.)

Annual Statement Filing Year

Select the year you’re filing an Annual Report for. (Most people will enter 2024. If you’re filing a late report for last year, enter 2023, etc.)

1. Limited Liability Company Name

Your LLC’s name will already be in this field.

You can’t make changes to the LLC name here.

If you want to change the name of your Michigan LLC, follow the steps on Change LLC Name in Michigan.

2. Registered Office and Resident Agent

- Prior lesson: Please read Michigan Registered Agent before proceeding.

Review your LLC’s Registered Agent information and make sure it’s up to date.

If you need to make any changes, you can do so here.

Signature

Click “Add new entry to this list”. Enter your name and select the applicable title.

- If your LLC is Member-managed, select the title “Member”.

- If your LLC is Manager-managed (and you’re a Manager), select the title “Manager”.

- If you’re not a Member or a Manager but have been authorized to file the Annual Report for the LLC, use the title “Authorized Agent”.

If these terms are confusing or you’re not sure which applies, check out Member-managed LLC vs Manager-managed LLC for more information.

Click the button to Accept that you’re signing and filing an accurate Annual Report.

Then click Add to finalize the signature.

Submitter’s information

The Submitter is the “point of contact” for your LLC Annual Report. The state will contact the Submitter if they have any questions about your filing.

- Enter your name.

- You can leave the Business Name blank (you don’t have to enter your LLC name).

- Enter your mailing address and phone number.

- Enter your best email address. This can be a personal or business email. Your Michigan Annual Report filing confirmation will be sent to this email address.

Notices from the state sent to your LLC (“delivery method for statutory notices”)

If the form asks for a “delivery method for statutory notices”, this is just the email where the state can send future notices to your LLC.

And even though the explanation mentions “Resident Agent”, we recommend entering your own email address so the notices go right to you.

Tip: Most people enter the same email address that they used for the Submitter’s contact email.

Level of Service

You can choose to expedite your filing, but we don’t recommend it. Even if you submit your Annual Report on February 15th and it doesn’t get reviewed for a week or two, it will still be considered “on time”. You don’t need to pay for faster review.

Click the button for Standard Review – only fee applicable to the document.

You’ll only pay the filing fee ($25), no extra charges.

Click Submit Filing.

Payment

Complete the payment process to submit the $25 fee using a debit or credit card.

Congratulations

Your Annual Report was filed online and will be processed within a few minutes.

Action item: Make sure you set a calendar reminder for next year.

Michigan LLC Annual Report Approval

You’ll receive a confirmation email with a copy of your filed Annual Report.

However, if you don’t get that email, don’t worry. You can still download a copy online:

- Go to the Business Entity Search page

- Search for your LLC name

- Click on “View filings” (at the bottom)

- Download your Annual Report

Michigan Department of Licensing and Regulatory Affairs Contact Info

If you have any questions about your LLC Annual Report, you can contact the Corporations Division at the Michigan Department of Licensing and Regulatory Affairs.

Their phone number is 517-241-6470. Their hours are Monday through Friday, from 8am to 5pm Eastern Time.

Michigan Annual Report Filing FAQs

What is the processing time for a Michigan Annual Report?

If you file online, it’s processed immediately. If you file by mail, it may take up to two weeks with mail time.

Will I be charged a late fee if I don’t file a Michigan Annual Report?

No, there is no late fee. However, if you file the report more than two years late, the state can shut down your LLC. Then you’ll have to pay a fee in order to restore your LLC.

What is an Annual Statement for an LLC?

The LLC Annual Statement is the same thing as the LLC Annual Report.

It’s the filing that is due every year in order to keep your LLC in good standing.

Can I file Michigan Annual Reports by mail?

Yes, you can file by mail (instead of online).

The Michigan Department of Licensing and Regulatory Affairs will send an Annual Report form every year to your Registered Agent.

- Make sure the details on your pre-printed form Michigan LLC Annual Report are correct.

- Report any changes in your Registered Agent or Registered Office (your Registered Agent’s address).

- Sign and date the form.

- Include a check for $25 filing fees.

- Send your payment and the form to: Michigan Corporations Division, PO Box 30054, Lansing, MI 48909-7554

Or, you can ignore the pre printed form that the Corporations Division mails to you and just file online.

References

Michigan LLC Act: Section 450.4909

Michigan LLC Act: Section 450.4207(3)

Michigan Secretary of State: Annual Filings

Michigan Secretary of State: Restore my LLC

Michigan Secretary of State: Entrepreneur’s Guide

Michigan Secretary of State: Limited Liability Company Filing Information

Michigan Secretary of State: Information for completing an online submission

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Michigan LLC Guide

Looking for an overview? See Michigan LLC

Leave a comment or questionComments are temporarily disabled.