Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

File your Articles of Organization to form an LLC in Michigan

In this lesson, we will walk you through filing your LLC Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs (LARA).

In this lesson, we will walk you through filing your LLC Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs (LARA).

This is the document that officially forms your Michigan LLC.

You can file the Michigan Articles of Organization online or by mail.

The form asks for basic information like your business name, your LLC address, and your Registered Agent information.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Michigan LLC Articles of Organization filing fee

The filing fee for an LLC in Michigan is $50. This is a one-time fee, and it’s the same amount whether you file online or by mail.

How much is an LLC in Michigan explains all the fees you’ll pay.

Veterans: You can form an LLC for free in Michigan. Please read Michigan Veteran LLC for instructions.

Note: The “LLC filing fee” is the same thing as the “Articles of Organization fee”. They are different names for the same fee to create your Michigan LLC.

Michigan LLC approval times

The approval time for a Michigan LLC is 10 business days.

This is the same for both online filings and mail filings. However, allow a few extra days for mail filings.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Michigan.

LLC University® recommendation: We recommend the online filing as it’s easier to complete. Instructions are below.

However, if you aren’t very tech-comfortable, you can still file by mail.

Or, alternatively, you can hire an LLC formation company to file the paperwork for you. If you want to hire a company to form your LLC, check out Best LLC Services in Michigan for our recommendations.

Filing your Articles of Organization by Mail

If you want to file by mail (instead of online), you need to:

- Download the Michigan LLC Articles of Organization (Form CD-700)

- Prepare a check or money order for $50

- Make payable to “The State of Michigan”

- Put your LLC Name on the memo line

- Send your payment and the completed Articles of Organization to: Michigan Corporations Division, PO Box 30054, Lansing, MI 48909-7554

Mail filing video instructions (see 8min 50s):

Filing your Articles of Organization Online

Tip: Don’t use your browser’s back button. This will clear all the data entered. Use the navigation buttons on the bottom of the screen instead.

Get started:

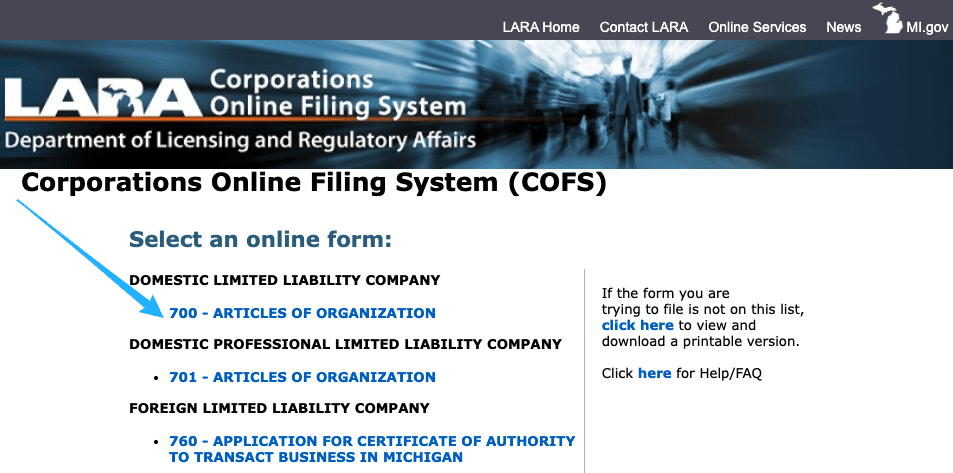

- Visit the Michigan Corporation Online Filing System (aka COFS)

- Look under “Domestic Limited Liability Company” and click on “Form 700 – Articles of Organization“

- Fill out the form using the step-by-step instructions below

Article I – Name

- Prior lesson: Make sure you’ve read the Michigan LLC Name Search lesson before proceeding.

Enter your desired LLC name, including its designator (ending).

As per Section 450.4204 of the Michigan LLC Act, your LLC name must have one of the following designators at the end:

- LLC

- L.L.C.

- LC

- L.C.

- Limited Liability Company

Tip: Most people choose “LLC”.

Article II – Purpose

- Related lesson: LLC statement of purpose

If you would like to list a specific purpose for your LLC, you can enter that in this box.

However, if you leave the box blank, it means your LLC will use the “all purpose clause” (aka a general purpose). This means your LLC can engage in any legal business activities.

Recommendation: We recommend using an “all purpose clause” as it gives your LLC the most flexibility.

What do most filers do? Most filers leave Article II blank.

Exception: If you’re forming a Professional LLC or an Educational purpose LLC, you cannot use the “all purpose clause”. You must specifically state the purpose of your LLC. Additionally, Professional LLCs and Educational purpose LLCs have different filing requirements, which are not covered in this lesson.

Article III – Duration

In this section, you’ll tell Michigan how long you want your LLC to exist.

We recommend leaving this section blank as this gives your LLC a perpetual duration. This means your LLC will exist forever, until you choose to dissolve it.

Note: It’s very rare to specify an end date in your Articles of Organization filing (a date on which your LLC would automatically shut down). You can always dissolve your LLC by filing a simple form later.

Article IV – Registered Agent & Registered Office

- Prior lesson: Make sure you’ve read the Michigan Registered Agent lesson before proceeding. Also explore our article: Is a Registered Agent a Member of an LLC?

In #1 and #2, enter the name and address of your Michigan Registered Agent.

You can leave #3 blank, unless your Registered Agent receives mail at a different address.

Tip: If you hired a Commercial Registered Agent, contact them for how to complete this section.

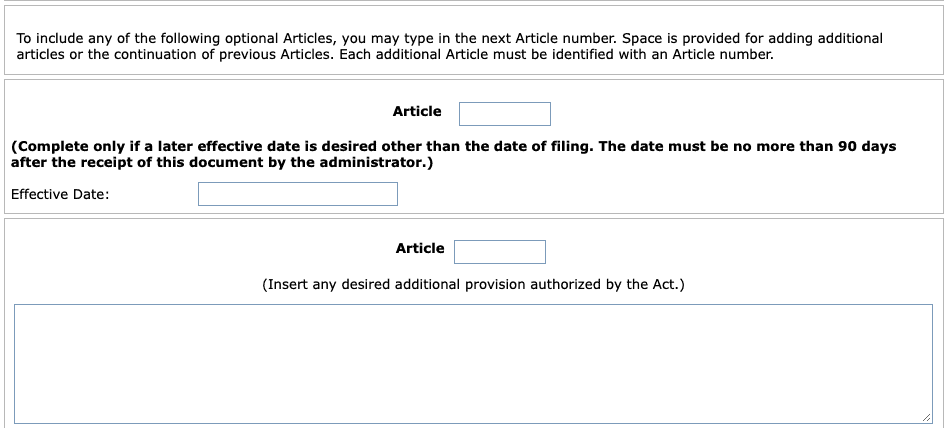

Optional Article (used for Effective Date)

The LLC Effective Date is the date your Michigan LLC goes into existence (is “born”).

You have two options:

- Your LLC can go into existence on the date it’s approved by the state

- or your LLC can go into existence on a future date

If you choose a future date, it can’t be more than 90 days ahead. You also can’t back-date your filing at all.

If you want your LLC to go into existence on the date it’s approved by the state:

Don’t enter anything here. Leave the entire section blank.

If you want your LLC to go into existence on a future date:

Enter the capital letter “V” (for Article ‘5’) in the box. Then enter your desired Effective Date.

Why would I change the Effective Date?

If you’re forming your LLC later in the year (October through December) and you don’t need your LLC open right away, you can forward date your filing to January 1st of next year. This can save you the hassle of filing taxes for those few months.

However, if you need your LLC bank account to be opened before January 1st, we recommend leaving this section blank (and not changing the Effective Date).

Optional Article (used for Additional Rules)

- Recommended reading: Please read Member-managed vs Manager-managed LLC before proceeding. Remember, LLC owners are called Members.

Typically, this section is used for “additional rules”. For example, your attorney might give you specific instructions to include here. But that isn’t very common.

However, because of Section 450.4401 of the Michigan LLC Act, if you want your LLC to be Manager-managed, you need to state that in your Articles of Organization.

If you want your LLC to be Member-managed:

Leave this section blank. Because by default, all Michigan LLCs are Member-managed.

If you want your LLC to be Manager-managed:

Enter the following text: “This LLC shall be managed by 1 or more Managers, as provided by the Operating Agreement.” This is all you need to write here. The details of who the Manager(s) are will be spelled out in your Michigan LLC Operating Agreement.

What roman numeral should I use for this section?

- If you entered a delayed Effective Date in Article V above, then this will be Article VI.

- If you left the Effective Date blank, then this will be Article V.

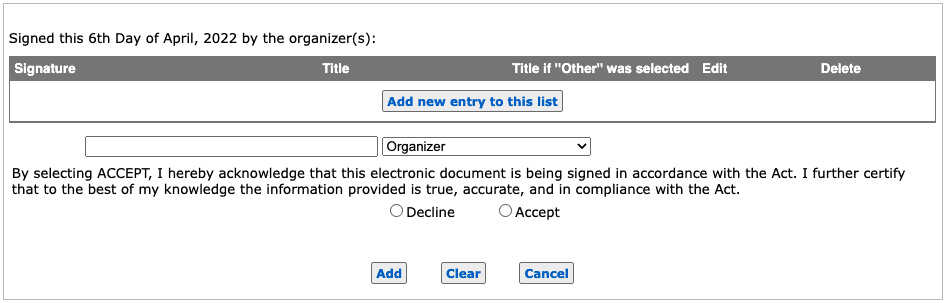

Signatures (Organizer)

- Recommended reading: Please read LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer before proceeding.

At least 1 Organizer must sign your Articles of Organization:

- Click “Add new entry to this list” and enter the name of the Organizer

- Leave the drop down menu on “Organizer”

- Click “Accept”

- Then click “Add”

Tip: We recommend that your LLC Organizer(s) signs an LLC Statement of Organizer.

Special Instructions (Optional)

Leave this blank.

Submitter’s Contact Information

The Submitter is the “point of contact” for your Michigan Articles of Organization filing.

If the state has any questions, they’ll contact this person. Additionally, the LLC approval documents will be sent to the Submitter. The information listed in this section is private and doesn’t go on public record.

Contact Name: Enter your first and last name.

Business Name: Leave this blank. Don’t enter your LLC name.

Mailing address: Enter your preferred mailing address. This address can be:

- an address that’s already on the Articles of Organization

- a PO Box or Mailbox Rental Facility

- in Michigan or in any state

- in the United States or in any country

Contact phone number: Enter your best phone number. It can be a cell phone, home phone, or business phone number.

Contact email: Enter your best email address. This can be a personal or business email. Your LLC approval documents will be sent to this email address.

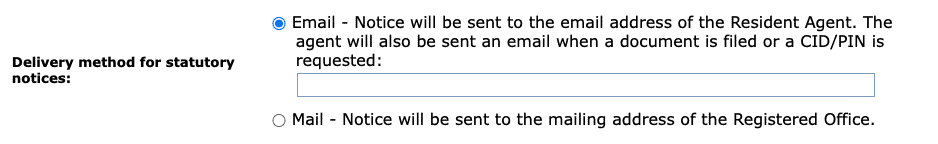

Delivery method for statutory notices

We recommend leaving “Email” checked. Then enter your email address in the field.

The state is simply asking for an email address where they can send future notices to your LLC. And even though the explanations mentions “Resident Agent”, we recommend using your own email address so the notices go right to you.

Expedited service

By default, your LLC will be approved in 10 business days.

If you would like your LLC approved faster, you can pay more money for expedited filing.

Most people don’t choose to expedite their filing. However, if you do, we recommend choosing the “24 Hour Review” for $50 extra. It’s the most cost effective.

Review

Click “Review” to proceed to the next step.

You might not notice it, but the page will refresh. Review your information for accuracy and check for any typos.

If everything looks good, click “Submit filing” at the bottom.

If you need to make any changes, click “Make corrections”.

Payment

Michigan LLC fee: $50

Click “Enter credit card details”. You can pay with a credit or debit card.

Finalize and submit your payment to the state.

Congratulations! Your Michigan LLC has been submitted for approval.

Michigan LLC approval time (online filing)

Your Michigan LLC will be approved within 10 business days of submitting your Articles of Organization.

Then the state will send an email to the Submitter’s email address.

Attached to that email will be your LLC approval documents:

- Filing Endorsement

- Stamped and approved Articles of Organization

Additionally, that email will include information about your LLC’s CID (Customer ID Number) and PIN.

CID and PIN for a Michigan LLC

Important: Every Michigan LLC is assigned a CID (Customer ID Number) and PIN (password).

These are used to file your Michigan LLC Annual Statement each year.

Please make a few copies of your CID and PIN and keep them in a safe location.

Note: If you lose your CID and PIN, you can recover them here: Michigan Secretary of State: CID/PIN Recovery. You must provide your LLC’s Entity ID Number. This can be found by searching your LLC name on the Business Entity Search page.

Michigan Secretary of State Contact Info

If you have any questions, you can contact the Michigan Department of Licensing and Regulatory Affairs Corporations Division.

Their phone number is 517-241-6470. Their hours are Monday through Friday, from 8am to 5pm Eastern Time.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Michigan Articles of Organization FAQs

How do I get Articles of Organization in Michigan?

You can get the Michigan Articles of Organization from the state’s website.

The Corporations Division provides an Articles of Organization form for you to use. You can download the PDF or complete the form online.

If you’re looking for a copy of Articles of Organization that you already filed for your LLC:

Search your LLC name on the Michigan Business Entity Search page. Click the button “View Fillings” and select the Articles of Organization.

What are Articles of Organization for an LLC in Michigan?

The Articles of Organization are a form that tells the Michigan Department of Licensing and Regulatory Affairs important information about your LLC. Once LARA approves your LLC, your company officially exists.

The Articles of Organization ask for your LLC name, business address, Registered Agent, and other information.

Do you have to put LLC in your business name in Michigan?

Yes, you have to put “LLC” (or another allowable ending) in your LLC name. Michigan allows the following endings:

- LLC

- L.L.C.

- LC

- L.C.

- Limited Liability Company

Tip: Most people choose “LLC”.

Your complete LLC name gets listed in your Michigan Articles of Organization.

How much does it cost to file Articles of Organization in Michigan?

It costs $50 to file the Michigan Articles of Organization.

This is a one-time fee paid to the Michigan Department of Licensing and Regulatory Affairs.

What should be included in Article 2 of Articles of Organization?

Article 2 of the Michigan Articles of Organization asks for your business’s purpose.

You’re not required to list anything specific here. In fact, you can leave this section blank.

Doing so will give your LLC a “general purpose”. This means you can use your LLC for any legal purpose. This is a good choice to give your LLC the most flexibility.

Does my LLC need any Michigan business licenses?

It depends on what your business does.

Michigan doesn’t have a state-wide general business license requirement. However, the Michigan Commercial Licensing Bureau requires certain types of businesses to have a license.

You should check with your city or county about any local business license requirements for your LLC.

And you may need to register with the Michigan Department of Revenue in order to collect sales tax or register for other taxes.

Can I use these instructions for filing a Foreign LLC?

No, the instructions on this page are specifically for filing a Domestic LLC in Michigan.

If you want to file a Foreign Limited Liability Company, you can find the forms and fees in Foreign LLC Fees by State.

How to start an LLC in Michigan

Here are the steps to starting an LLC in Michigan:

- Select a business name for your Michigan LLC

- Choose your Registered Agent

- File the LLC Articles of Organization with the state

- Complete and sign an LLC Operating Agreement

- Get a Tax ID Number (EIN) from the Internal Revenue Service (IRS)

- Open an LLC bank account

- Check whether you need a business or sales tax license in Michigan

References

Michigan LLC Act: Section 450.4104 (filing rules)

State of Michigan: Entrepreneur’s Guide (PDF)

Michigan LARA: FAQs and Instructions

Michigan LARA: Form CD-700 Articles of Organization

Michigan LARA: Limited Liability Company Filing Information

Michigan LARA: Policy Statement C-53 on Educational-Purpose LLCs

Michigan LARA: Policy Statement C-38 on Preclearance of Documents

Michigan LARA: FAQ – Information for completing an online submission

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Michigan LLC Guide

Looking for an overview? See Michigan LLC

I have a business that the articles of incorporation for a non profit that was formed in 1971. What do I have to do in order to be able to get an updated articles of incorporation done. Everyone on the original has moved on, and all the positions are still filled but w/ different people. I just want everything updated. Please advise, and thank you.

Hi David, you’d first want to review the Bylaws for any internal procedures. Then I believe the form you’d file with the state is the Certificate of Amendment.

i did not see anything about members, so how does that work for three members that want to open a LLC?

Hi Carlos, Members are not listed in the Michigan Articles of Organization. They are listed in the Michigan LLC Operating Agreement.

Hi I have my EIN number and I chose sole proprietor instead of LLC for a group home I’m working on opening up do I need a LLC or can I just stay sole proprietor? I also am a non profit organization

Hi Rochelle, I don’t fully understand your question. Were you originally trying to apply for an EIN for an LLC that already exists… or did you think you were forming an LLC by applying for an EIN? By non-profit organization, do you mean a Non-profit Corporation? If so, things are very different. Have you applied for tax-exempt status with the IRS and have your formed a Corporation with the state? An LLC cannot be a non-profit LLC unless the LLC is owned by a Corporation which has already been granted non-profit status by the IRS.

Hello. Just reading through your advice to everyone, and I have one that I didn’t see an answer for..I just paid $25 for Reservation of Name-LLC. I was given a CID, ID, and a pin #. My question to you, should I fill out the DOMESTIC PROFESSIONAL LIMITED LIABILITY COMPANY

701 – ARTICLES OF ORGANIZATION forms as my next step? Or does the Reservation of Name take its place? I am a truck driver looking to start up a trucking company. Thanks for you time and advice/suggestions.

Hi Laron, you’ll just be forming a “regular” LLC, not a Professional LLC (PLLC). Form 701 is for Professional LLCs. You want Form 700. Form 700 is linked above on this page. The Name Reservation doesn’t take the place of the Articles of Organization (Form 700). You can enter the LLC name you reserved in the Articles of Organization (Form 700) and when you send Form 700 to the state, include a copy of your Name Reservation approval. Hope that helps.

Thanks

Hi Matt

I was told the first-year LLC is $50. then every year it is $25. Do I need to fill the same form to pay $25 even though I am not into business e any more?

Thanks for your help!

Hi Bonnie, yes, the fee to form an LLC in Michigan is $50 (one-time fee). This $50 is sent along with the Articles of Organization (the document that creates your LLC).

Then every year an Annual Statement ($25) must be filed with the Michigan Corporations Division regardless of business activity and/or profit. If your LLC goes into existence in November or December 2020, your first Annual Statement isn’t due until February 15th, 2022 (no need to file anything in 2021). After that, the Annual Statement (and its $25 fee) must be filed every year by April 15th. The purpose of the Annual Statement is to keep your LLC’s contact information up to date with the Michigan Corporations Division. Hope that helps :)

Hi Matt,

Oh wow I didn’t expect that you replied this fast. Thank you so much for help.

What about if I still have keep my EIN. Do I still need to fill LLC. If I do, it is still the same form to fill it out?

Thanks.

You’re very welcome Bonnie. Can you rephrase your questions about the EIN and filing the LLC please? Which form are you referring to? The Articles of Organization? And is this existing EIN for an existing business entity or for yourself personally as a Sole Proprietorship?

Hi is an Articles of Organization form sufficient for all forms? I was told I would also need an Articles of Incorporation for an LLC is that correct? Also, I already applied for the EIN prior to submitting the Articles of Organization form because I didn’t know. Please advise. Thanks!

Hi Chloe, no, that is incorrect. Curious where you got that information from? An LLC doesn’t use an Articles of Incorporation. That form is for Corporations. LLCs in Michigan use an Articles of Organization. When you applied for your EIN and entered your LLC name, is that LLC name ultimately the one that was approved from the state? If so, you’re good to go. The IRS doesn’t check to see if the entity exists, so if the names match, you’re fine. If the LLC names don’t match, you can cancel the EIN, then just re-apply for a new one. Hope that helps!

I just received my articles of organization back all it has is a stamp that says filed is that the approval stamp?

Any help would greatly be appreciated.

Also this website is a god send very well put together.thank you

Hi Coby, you’re very welcome! Glad to hear we could help :) Yes, that “filed stamp” means your LLC was approved. Hope that helps.

Do you have recommendations or advice for what kind of liability insurance an LLC should carry?

Hi Denise, there is certainly general liability insurance, but the other types of business insurance vary depending on the type of business and the business’ needs. Can I ask what the business is?

Does anything change on this form if you want your wife on the llc with you. Does here name go with your on it or do you have to put it somewhere else?

Hi Justin, no, nothing has to change on the Articles of Organization, since Michigan does not ask for Member information. You and your wife will simply sign an Operating Agreement, which makes you Members (owners) of the LLC. For better documentation to help “connect” the dots, you as the LLC Organizer could also sign a Statement of LLC Organizer, which states that you organized the LLC (filed the documents with the state), then stepped down as Organizer and appointed you and your wife as Members. Hope that helps!

Well done team. I will be recommending this website to friends and family!

Thank you very much Amir :) We appreciate you!

Hello, Matt.

I have my name on a sole proprietor LLC and I want to give someone else the company. Can I just complete a operating agreement and a statement of organization? The company isn’t worthy anything. I’ll dissovle the EIN and they can just get a new one. Will doing all this clear me of the company and complete the transfer. Thanks for your time.

Hi Laquice, no, the sale of an LLC is not as simple as that. You’ll want more documentation showing the sale. Then you’ll need to file an Amendment with the state as well as update the IRS (in addition to other steps). If the company isn’t worth anything, it’s often much better to just have your friend form a new LLC and you dissolve your LLC (instead of hiring a lawyer to sell an LLC that’s not worth anything). Hope that helps.