Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

State Business License vs Other Licenses

We’ve already discussed the required Nevada State Business License (the privilege of doing business in the state) in our Articles of Organization lesson. Every Nevada LLC must get this Business License and renew it every year.

But there may be other licenses that you need to get for your LLC.

The information in this lesson is not about the State Business License. Instead, it’s about two other types of business licenses that your Nevada LLC might need:

- a municipal/county license

- a regulatory license or permit

Municipal/County Licenses

These types of business licenses are administered by local governments and municipalities, namely, the county and/or city where your Nevada LLC will do business.

Regulatory Licenses and Permits

A regulatory license may be needed if you personally hold a state license (such as if you are a doctor, engineer, or architect).

Additionally, there are also regulatory licenses (and permits) depending on the industry of your business. For example, restaurants are regulated by the Nevada Board of Health and require a special permit to operate.

How to determine license requirements for your Nevada LLC

The easiest way to figure out your LLC’s municipal and county licensing requirements is through SilverFlume, using the Common Business Registration.

Nevada Common Business Registration

Prior LLC University® lessons: Make sure you have formed a Nevada LLC (filed your Articles of Organization) and obtained an EIN Number before completing the Common Business Registration.

The Common Business Registration is a statewide initiative to make it easier for businesses to register across multiple state agencies.

You’ll enter information about your LLC and then the Common Business Registration will help you:

- determine any regulatory and municipal license requirements

- register for sales and use tax (if applicable)

- obtain a workers’ compensation affirmation (if you have employees)

- and register for taxes with the Department of Taxation

Note: Unlike your Articles of Organization filing, the information entered in your Common Business Registration is not public record.

Get Started

- Login to your SilverFlume account

- Click on your Dashboard

- Select your LLC from the “My Businesses” section

- In your “My Business Checklist” you should see Common Business Registration

- Click the “Start” button to begin

Step 1: Business Information

Click the “Search/Add” button to find the NAICS Code most closely related to your LLC’s business purpose/activities.

An NAICS Code (North American Industry Classification System) is used by the Nevada Secretary of State to classify your LLC’s line of business.

Then answer the rest of the questions about your business location and whether or not you intend to sell goods outside of Nevada.

Step 2: Physical Locations

Click the “Add a new location” button and begin answering questions about your Nevada LLC’s primary physical location. You must list a primary physical location.

Note: Based on the primary physical location of your Nevada LLC, SilverFlume will help you determine what municipal/county business license may be needed. You’ll see these requirements after you complete the Common Business Registration.

Date you opened this location:

For the “Date you opened this location”, if you’re using your home address (or your Registered Agent address or a friend/family member’s address), you can just enter your LLC effective date found in your Articles of Organization.

Complete the rest of the information about your Nevada LLC’s location, phone number, and whether or not you’ll have employees.

Do you want to add a Fictitious Firm Name/”Doing Business As” (DBA) name?

If your LLC will be doing business under it’s actual legal name (the full LLC name), then you can select “No” as you won’t need a Fictitious Firm Name (FFN).

If you would like for your LLC to do business under a name other than it’s full legal name, then you’ll select “Yes” and enter your Fictitious Firm Name/DBA.

Important: This doesn’t actually register your LLC’s Fictitious Firm Name/DBA. Instead, you must register your FFN/DBA with the County Clerk where you will be doing business. You can find that information here: SilverFlume FAQ: How do I register a Fictitious Name

If you’re not sure whether or not you should register an FFN/DBA for your Nevada LLC, please read the following article: Do I need a Fictitious Name for my LLC?

Step 3: Non Brick and Mortar Location

If your Nevada LLC will conduct business in another county, but it doesn’t have a physical location (called a “brick and mortar” store) there, then you’ll need to select the applicable counties on this page.

An example would be a construction company with a primary physical location (its office) in Washoe County, but they build homes in Storey County. Storey County would be a Non Brick and Mortar Location and would need to be added here.

If you have a home-based business, online business, or have a brick and mortar location that only operates in one county, then you can skip Step 3 – since it’s not applicable – and just click “Next“.

Step 4: Applicable Regulatory Information

For the majority of filers, the filing system will skip over Step 4 since it only applies to a small number of businesses. Most filers will be automatically sent over to Step 5 (and you won’t be able to click on Step 4).

If you need to complete Step 4, just answer the questions applicable to your LLC’s business activities.

Step 5: Owner Info

Click “Add a new owner” and add the 1st owner (aka LLC Member). Enter their name, title (Member, Manager, or Managing Member), how much of the LLC they own, their address and phone number, and then click “Save“.

- Related article: LLC Officer Titles

Click “Add a new owner” if there are additional LLC Members. If not, just click “Next” to proceed.

Step 6: Labor Laws

If you entered 0 employees in Step 2, the system will skip over Step 6 and take you right to Step 7.

If your business will have employees, you have a requirement to hang labor law posters in your place of business. Make sure you understand the requirement, check off the box agreeing to comply, and then click “Next“.

Step 7: Declaration & Signature

Check off the two boxes agreeing to the terms. Then enter your first and last name, select today’s date, and click “Next“.

Step 8: Review

Review the information you entered and check for any errors or typos.

If you need to make any changes, click any of the “Edit” buttons. If not, click “Next” to proceed.

Back to “My Business Checklist”

Once you complete the Common Business Registration (CBR), you will then be taken back to your “My Business Checklist” page.

Based on how you answered the CBR, your Checklist will have additional steps (for example, sales and use tax registration).

Please review any new information that was added to your Checklist and complete any additional registration steps. The process will be very similar to the CBR; it’ll be a series of questions that you must answer about your Nevada LLC and its business activities.

Municipal/County Business License & Regulatory License

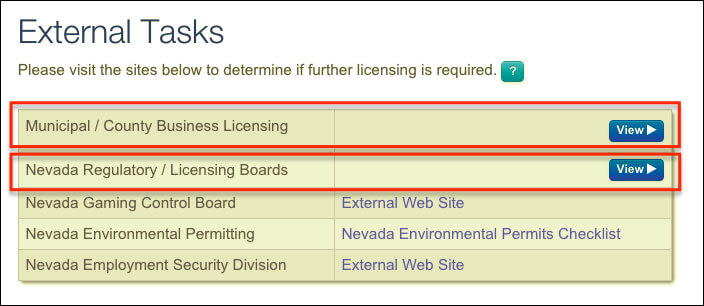

Now that you’ve completed the Common Business Registration, you will see a “View” button in your “External Tasks” table of SilverFlume (towards the bottom of the page).

It will look like this:

When you click the “View” buttons the system will show you both the relevant county/municipal jurisdiction that you’ll need to call to determine what license (if any) will be required for your Nevada LLC as well as what license (if any) is required by a regulatory board (for example: doctors, architects, engineers, etc.)

Resources & Contact Information

You can also view the contact information for the cities, counties, and state agencies below.

Cities & Counties:

Nevada Association of Counties Directory

Nevada State Agencies:

State of Nevada: Nevada Department List

Licensing & Permits

Nevada Department of Business & Industry: Licensing and permits

How much does a business license cost in Nevada?

The required Nevada State Business License costs $200.

And if your business has to get an occupational (aka regulatory) license or municipal (city or county) permit, the fees are hard to predict. Depending on your LLC’s location, and what type of business or industry you’re in, the fee varies.

And you might not need these other business licenses at all! So you might only have to pay the $200 State Business License fee, which is part of the Articles of Organization filing and LLC filing costs.

Unfortunately, we can’t say what your LLC’s total business license costs would be, because it depends on several factors and the cost of Nevada licenses varies.

Check out Nevada LLC Cost to learn about other fees you’ll pay when starting an LLC in Nevada.

Need Help?

If you want help making sure your Nevada LLC’s licenses requirements are correct, we recommend hiring IncFile.

References

Nevada SilverFlume: Help > Manage a business

Nevada Department of Business & Industry: FAQs

Nevada Revised Statutes: Chapter 76 (State Business License)

Nevada Department of Business & Industry: Business certifications

Nevada Department of Business & Industry: Licensing and permits

Nevada Department of Business & Industry: Business resource center

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

my nv business licecse expira last week. i am fine it difficult to renew it online, please i need help,

Hi Newton, please see this page: Nevada LLC Annual Fees. It discusses the Annual List & State Business License renewal.