Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

If you don’t live in Nevada, or do business in Nevada, please see Why You Shouldn’t Form an LLC in Nevada.

Nevada LLC Articles of Organization, Initial List, & State Business License

In this lesson, we will walk you through how to form your Nevada LLC. In most states, you just have to file an Articles of Organization with the Secretary of State.

In this lesson, we will walk you through how to form your Nevada LLC. In most states, you just have to file an Articles of Organization with the Secretary of State.

However, in Nevada you actually have to file 3 documents in order to form an LLC:

- Articles of Organization

- Initial List of Managers or Managing Members (aka “Initial List”)

- State Business License

The Articles of Organization is the form that officially creates your LLC in Nevada, and the other 2 forms are additional (and mandatory) requirements for Nevada LLCs.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Nevada LLC Filing Fee

The total state fees for forming an LLC in Nevada are $425. The breakdown is as follows:

- $75 – Articles of Organization

- $150 – Initial List of Managers or Managing Members

- $200 – State Business License

These are one-time fees in order to create the LLC.

Note: The “LLC filing fee” (the fee to create a Nevada LLC) is the same thing as the “Articles of Organization fee”. The Articles of Organization is the document, that once approved by the Secretary of State’s office, creates your Nevada LLC.

However, it’s important to note that all Nevada LLCs must also file an Annual List (of Managers or Managing Members) and renew their State Business License every year. We’ll discuss this in a later lesson, but wanted to give you a heads up. The Annual List is $150 and the renewal for the State Business License is $200 (so that’s $350 per year).

How much is an LLC in Nevada explains all the costs for starting a Limited Liability Company.

Should you form an LLC in Nevada?

Nevada is a state that used to have a lot of “hype” and was thought of as a “magical state” to form an LLC. However, if you don’t live in Nevada or do business in Nevada, it’s best to form your LLC in your home state.

If you live or do business outside of Nevada, but form your LLC in Nevada, you’ll be required to register your Nevada LLC as a Foreign LLC in your home state.

However, if you do business in Nevada or reside in Nevada and do business from home, then you should form an LLC in Nevada.

Before proceeding, we recommend reading the following articles:

Nevada LLC approval times & methods of filing

If you form your Nevada LLC online, your LLC will be approved within 1 business day.

If you form your Nevada LLC by mail, your LLC will be approved in 3-4 weeks (plus mail time).

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Nevada.

Recommendation

We recommend filing your Nevada LLC online. The filing is much easier and your LLC will be approved faster.

If this process sounds too complicated, you can hire a company to form your LLC instead. Check out Best LLC Services in Nevada for our suggestions.

Online filing instructions only

The instructions below are for how to form a Nevada LLC online. If you prefer to file by mail, the instructions will be somewhat similar, however, you’ll need to mail the complete Articles of Organization packet to the state instead.

Prior LLC University® lessons

Before forming and registering your Nevada LLC, make sure you have read the prior lessons:

Nevada LLC Online Filing (SilverFlume)

In order to form your Nevada LLC online, you’ll need to create a SilverFlume account with the Nevada Secretary of State.

SilverFlume will be your “one stop shop” where you’ll:

- form your Nevada LLC

- file your Initial List

- get your State Business License

- apply for sales tax (if applicable)

- and more

Fun fact: A flume is a small channel in which water flows, originally used as an easier way to transport timber and minerals. Nevada kicked off the silver-mining industry in the mid-1800s and is currently the 2nd largest producer of Silver in the United States. That’s why the official state nickname is “The Silver State”. SilverFlume is meant to represent the flow of information, allowing small business owners to easily form their business and take care of multiple registrations in a “one-stop-shop” fashion.

Create a SilverFlume Account

Click here to register for a SilverFlume account:

SilverFlume: Register

Enter your email, name, phone number, and create a password. Then enter your address and answer two security questions.

Activation email:

The state will send you an activation email which you must open and click the link to finalize your SilverFlume account creation. The link in the email should say something like “Activate my account”. Just click that and it’ll redirect back to the site where you’ll need to login. After you login, you’ll be redirected to your SilverFlume dashboard.

Let’s Get Started!

- Click “Start Your Business” on the left

- Then click “Start Your Business (Online Wizard)” at the top and center

- Select “Start a for-profit Nevada business“

- Select “Domestic Limited Liability Company (NRS Ch 86)“

Is the entity claiming a 001-Government or 006-Insurance exemption from the state business license?

Answer “Yes” or “No” accordingly. Certain types of businesses in Nevada don’t have to get a State Business License. In this case, if the LLC you’re forming is a government entity or an insurance company, you actually won’t be able to file online and instead need to complete your filing by mail.

What do most filers do? This is not applicable to most of our readers. Most readers select “No“.

My Business Checklist

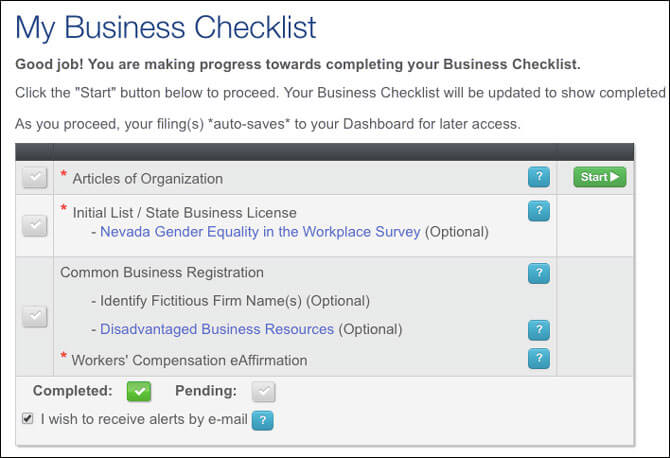

You’ll now be on the “My Business Checklist” page. It will look like this:

Before you get started, we recommend checking the “I wish to receive alerts by email” box at the bottom. This will keep you alert for any filings made for your LLC.

Then click the “Start” button to begin your Nevada LLC filing.

Note: Although it looks like you’ll be filing just your Articles of Organization by clicking “Start“, you’ll actually be completing the Articles of Organization, Initial List, and State Business License (they are all grouped together).

Step 1: Name of Nevada LLC

Prior LLC University® lesson: Did you search your LLC name to see if it’s available? Make sure you read our Nevada LLC Name Search lesson before proceeding.

I already have a reserved name:

You can leave this box unchecked, unless you’ve filed an LLC name reservation ahead of time. An LLC name reservation is not required (and often not even needed) when forming an LLC.

Name:

Enter your desired Nevada LLC name, but leave out the designator (ex: “LLC”). You’ll select your designator from the drop down below.

Entity Suffix:

Select the desired “ending” (designator) for your Nevada LLC from the drop down menu.

As per section 86.171 of the Nevada Revised Statutes, an LLC must include one of the following designators at the end of its name:

- LLC

- L.L.C.

- LC

- Ltd.

- LTD.

- Limited

- Limited Co.

- Limited Company

- Limited Liability Co.

- Limited Liability Company

Note: “LLC” is the most commonly used designator.

English Translation:

Most filers will have their desired Nevada LLC names in English so this section doesn’t apply to most. If your LLC name is in English, you can leave this section blank.

Series:

Check this box if you are forming a Nevada Series LLC.

A Nevada Series LLC is like a “cluster” all LLCs, each with its own owners, operations, and assets, however each LLC (called a “unit”) is owned by a Parent LLC, more commonly referred to as the “Master LLC” or “Umbrella LLC”.

To think about it another way, it’s one Articles of Organization filing, but it creates a large holding/subsidiary organization. It’s 1 Master/Umbrella LLC at the top and multiple LLC Units underneath (there’s no limit).

There is not a lot of clear case law regarding the liability protection and taxation of Series LLCs, so if this is the direction you are thinking of heading, make sure that you’ve spoken with your attorney and/or accountant and you fully understand the details.

Most of our readers are not forming a Series LLC and they leave this box unchecked. Furthermore, we do not provide instructions or information on Series LLCs at this time. Thank you for your understanding.

Restricted:

Check this box if you are forming a Nevada Restricted LLC.

A Nevada Restricted LLC is an LLC, which generally speaking, cannot distribute any money to its owners for at least 10 years.

Most of our readers are not forming a Restricted LLC and they leave this box unchecked.

Latest Date of Dissolution:

As per section 86.155 of the Nevada Revised Statutes, by default, all LLCs formed in Nevada have a perpetual duration. This means the LLC remains open until you choose to close it (by filing dissolution paperwork) instead of the LLC automatically shutting down on a specific date.

If you would like your LLC to have a perpetual existence, then leave this field blank.

If you would like your Nevada LLC to automatically shut down (dissolve/dissolution) on a specific date in the future, you can enter that date here.

Most of our readers prefer their Nevada LLC to have a perpetual existence and they leave this field blank.

Review your Nevada LLC name:

You’ll see your complete LLC name on the next page. Make sure the spelling is correct before proceeding.

You’ll see a note that the Nevada Secretary of State converts your LLC name to ALL CAPITAL LETTERS. This is just so they can “normalize” their records. However, after your LLC is approved, you can use any capitalization format you’d like (lowercase words, CAPITAL LETTERS, or Capitalized Text).

Step 2: Registered Agent

Prior LLC University® lesson: Remember, you have multiple options for who can be your Nevada LLC Registered Agent. Some options offer more privacy than others. Make sure you’ve read our Nevada Registered Agent lesson before proceeding, and explored our article on Is a Registered Agent a Member of an LLC?

Commercial Registered Agent:

If you hired a Commercial Registered Agent (like Northwest Registered Agent), search for their name, select it from the list, and click “Next“. On the next page, select “I am NOT the Registered Agent stated above“. Click the “choose file” button and upload the Registered Agent Acceptance Form that you received after signing up (it’ll be filled out and signed by them). Here is a blank acceptance form if you’re curious what it looks like.

You, friend, or family:

If you, a friend, or family member will be your LLC’s Registered Agent, you have to do a “fake search” first and then enter the contact information. For example, enter “bob”, click “Search“, then click “My Registered Agent not found“. Enter the person’s name, select “Noncommercial Registered Agent“, and enter the street address in Nevada. If the Registered Agent has a mailing address different from their street address, select the box at the bottom and enter it. If not, leave the box unchecked.

Your LLC:

If your LLC will serve as its own Registered Agent, follow the same instructions as listed one paragraph above, but just enter your LLC’s name in the “Registered Agent Name” box.

Office/position:

If you’re going to list an office or position (ex: Office Manager, President, Member, Manager, Owner, etc.) as your LLC’s Registered Agent, follow the same instructions as listed in the paragraph above, but just enter the office/position in the “Registered Agent Name” box and check off “Office or Position with Entity“.

Step 3: Managers/Members

Related LLC University® article: We recommend reading our Member-managed vs Manager-managed LLC article before proceeding with this section.

Member-managed LLC:

If your LLC will be Member-managed, select “Member(s)“, click “Next“, click “Add a New Managing Member“, add that Managing Member’s name and address, then click “Save“.

You can click “Add a New Managing Member” to add another Member or you can click “Next” if there is just one Managing Member.

Manager-managed LLC:

If your LLC will be Manager-managed, select “Manager(s)“, click “Next“, click “Add a New Manager“, add that Manager’s name and address, then click “Save“.

You can click “Add a New Manager” to add another Manager or you can click “Next” if there is just one Manager.

As per Section 86.161 of the Nevada Revised Statutes, all the initial Managing Members (or Managers) must be listed in your Articles of Organization.

Step 4: Organizers

Related LLC University® article: We recommend reading these articles before completing this section: LLC Organizer vs LLC Member and Registered Agent vs Organizer.

Click the “Add New Organizer” button, add the Organizer’s name and address, then click “Save“.

You can click “Add New Organizer” to add another Organizer or you can click “Next” to go to the next step.

Note: Only 1 LLC Organizer needs to be listed in your Nevada Articles of Organization.

Step 5: Attachments

This section is used to add additional provisions, articles, or rules to your Nevada LLC filing.

Most filers don’t add additional provisions unless they’ve been instructed by their attorney.

Step 6: Initial List (and State Business License)

Note: Although it only says “Initial List of Officers” at the top, this step includes the Initial List of Officers and it also takes care of the required State Business License as well. Additionally, if you are claiming a business license exemption, you cannot complete your LLC filing online. It must be completed by mail.

Click the “Next” button to start filing your Initial List.

You should see the Managing Member(s) or Manager(s) you listed in Step 3.

If there are additional Managing Members or Managers that were not listed in Step 3, you need to add them by clicking the “Add” button.

As per Section 86.263 of the Nevada Revised Statutes, all Managing Members (in a Member-managed LLC) or all Managers (in a Manager-managed LLC) must be listed in your LLC’s Initial List of Officers.

Step 7: Declaration & Signature

Agree to the terms by checking the 2 boxes, enter your title (ex: Organizer, Managing Member, or Manager), and enter your first and last name then click “Next“.

Step 8: Review

Review the information you entered in your Nevada LLC online filing. Look for any errors or typos.

If you need to make any changes, click the “Edit” button. If all looks good, click “Next“.

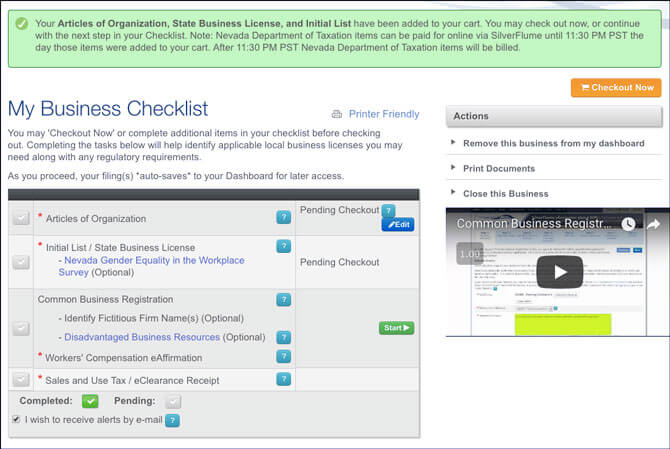

You’ll then be redirected back to your SilverFlume Dashboard and you’ll see your My Business Checklist, but now, you’ll see a “Pending Checkout” note to the right of Articles of Organization and Initial List/State Business License.

You’ll also see a message at the top that says, “Your Articles of Organization, State Business License, and Initial List have been added to your cart. You may check out now, or continue with the next step in your Checklist.”

Your SilverFlume Dashboard will look something like this:

Checkout & Pay

Click the “Checkout Now” button to go to the payment step.

You should see the name of your LLC and a total of $425 in your Cart. The Articles of Organization is $75, the Initial List is $150, and the Business License is $200.

Click “Proceed to Checkout“. Then select “Credit Card” in the middle of the page (it’s a little hard to see).

Enter your credit or debit card info, click “Review Order“, and then finalize your payment to the Secretary of State.

Congratulations! Your Nevada LLC filing has been submitted to the Secretary of State and will be approved within 1 business day

Nevada LLC Approval

Once your Nevada LLC filing is approved, it may take a few minutes for your stamped and approved documents to become available for download.

If you were not redirected to the downloads page, click the “DOCUMENTS” tab at the top of SilverFlume.

You should see the following approval documents:

- Articles of Organization

- Initial List of Managers or Managing Members

- State Business License

Your Articles of Organization and Initial List will have your LLC’s Entity ID Number listed.

Your State Business License will have your LLC’s Nevada Business Identification Number listed.

It’s a good idea to save these ID numbers as you may need them for future filings and/or if you have to call the Nevada Secretary of State.

Tip: Your Nevada LLC approval documents are only available for free download for 60 days. After 60 days, you’ll need to pay for copies. For this reason, we recommend saving a few copies, both digitally and physically. If your LLC has other Members, send them copies. We also recommend giving your PDF documents good file names so they are easier to find in the future. For example, “Articles of Organization”, “Initial List”, and “State Business License”.

Common Business Registration, Sales & Use Tax, and Workers’ Compensation

In your Business Checklist you will see the Common Business Registration and other items below. These additional registrations may be needed based on what type of business you’re in and where your business is located.

Completing the Common Business Registration for your Nevada LLC will register your business with the Nevada Division of Taxation (including sales and use tax). It will also assist you in determining your local business license requirements with your city and/or town.

We will discuss the details in a future lesson, but for now, we recommend continuing through our LLC lessons in order. Reason why is that you’ll need your EIN (Federal Tax ID Number) first in order to complete certain registrations above.

Nevada Secretary of State Contact Info

If you have any questions about your LLC, you can contact the Nevada Secretary of State at 775-684-5708. Their hours are 8am to 5pm Pacific.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

References

Nevada SOS: LLC fees

Nevada Revised Statutes: Chapter 679A

Nevada Revised Statutes: Section 76.020

Nevada Secretary of State: Business forms

Nevada Secretary of State: Processing dates

Nevada Legislature: 2017 Assembly Bill 123

Nevada Secretary of State: Registered Agents

Nevada Secretary of State: Business > Resources

Nevada Secretary of State: Commercial recordings

Nevada Secretary of State: Start a business > LLC

Nevada Secretary of State: Notice of 2017 Legislative Impacts

Nevada Secretary of State: State Business License Exemption – FAQ

Nevada Secretary of State: Complete Articles of Organization Packet

SilverFlume FAQ: What Is The State Business License And Who Is Required To File

SilverFlume FAQ: What Businesses Are Exempt From Needing A State Business License

Nevada Secretary of State: Declaration of Eligibility for State Business License Exemption

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.