Thanks to Act 135 of 2016, which became effective on January 2nd, 2017, Veterans and Reservists don’t have to pay the $125 filing fee for forming an LLC in Pennsylvania.

For Veterans or Reservists, we’ll show you how to form an LLC in PA for free in this short article.

And by the way, we thank you for your service!

What Defines a Veteran or Reservist?

Under PA’s Military and Veterans Code, a Veteran is defined as “an individual who has served in the armed forces of the United States, including a reserve component and National Guard, and who has been discharged or released from the service under conditions other than dishonorable.”

Under the same Code, a Reservist is defined as “a member of a United States Armed Forces reserve component or National Guard.”

Along with the Pennsylvania Certificate of Organization and Docketing Statement (which we’ll discuss shortly), you’ll need to provide proof of your status when submitting your documents to the state.

How to Provide Proof

There are 4 different ways you can show to the PA Bureau of Corporations that you are a US Veteran or Reservist:

- Federal DD-214 Form

- Federal NGB-22 Form

- A valid Federal Veterans’ Administration Card

- A valid Department of Defense-issued Military Identification Card

You must upload one of these documents with your LLC filing. Please see our Pennsylvania LLC Certificate of Organization page for instructions on how to file online.

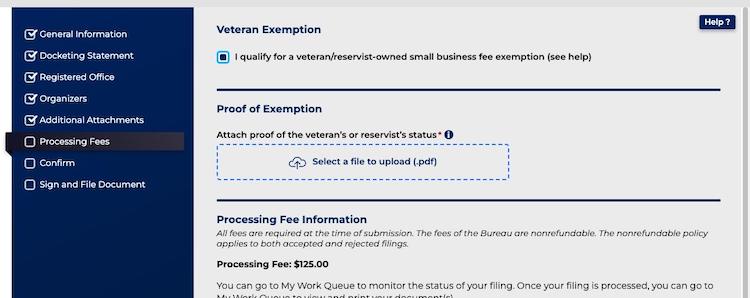

When you reach the Processing Fees screen, check the box to indicate you qualify for the Veteran Exemption. Then upload one of the documents above as proof of your veteran status.

If you want to file your LLC by mail, you can instead send a photocopy of one of these documents to the Department of State with your filing.

Warning: You will be held liable for third-degree misdemeanor if you commit any of the following:

- Fraudulently obtain the Veteran/Reservist filing fee exemption.

- Assign, transfer, or attempt to assign or transfer a business filing fee exemption.

- Use or attempt to use a business filing fee exemption in any manner contrary to this Act.

Let’s now discuss the steps to forming an LLC in PA.

Note: The steps below are a brief overview and are not extremely detailed. We recommend reading through these first to get the “big picture”, then once finished, please see our complete PA LLC Course, which offers much more step-by-step details.

1. LLC Name Search

Search your desired LLC name in the Pennsylvania Business Entity Database.

Your LLC name must be “distinguishable upon the record” (unique) and must include the designator “LLC”, “L.L.C.”, “Limited Liability Company”, or any abbreviation, at the end of your name.

2. Choose a Registered Office

A Registered Office is a street address (PO Boxes are not allowed) located in Pennsylvania where legal documents (called Service of Process) can be delivered if your LLC is sued. You can use your home address, an office address, or the address of a friend or family member. This Registered Office address will be listed in your Certificate of Organization, discussed in Step 3 below.

If you don’t want to use any of those addresses (because of privacy; the addresses will appear on public records), you can hire a Commercial Registered Office Provider (CROP) in PA. We recommend Northwest Registered Agent. They have excellent customer service and their yearly fee is just $125 (most companies charge $200 – $300 per year).

3. Mail your Certificate of Organization, Docketing Statement, and Proof

Mail a completed Certificate of Organization, Docketing Statement, and proof that you are a Veteran or Reservist to:

PA Department of State

Bureau of Corporations

PO Box 8722

Harrisburg, PA 17105-8722

LLC Approval:

The PA Bureau of Corporations will approve your LLC after they review it. Once approved, you will receive a stamped and approved copy of your Certificate of Organization in the mail as proof your LLC is now in existence. To learn how long this will take, please see how long does it take to get an LLC in PA.

Tip: If you want a slightly faster approval time, you can send these documents through UPS or FedEx, instead of regular USPS mail.

4. Complete and Sign an LLC Operating Agreement

Your Pennsylvania LLC’s Operating Agreement spells out who the owners (called Members) of the LLC are, how profits are distributed, how taxes are paid, and more.

You can download a free 6-page Operating Agreement from our website: Pennsylvania LLC Operating Agreement.

5. Obtain a Federal Tax ID Number (EIN) from the IRS

Apply for your Federal Tax ID Number (also known as EIN, or Employer Identification Number) only after your LLC is approved.

The EIN is free from the IRS and it can be obtained online via the EIN Online Application. We have instructions here: Pennsylvania LLC EIN Number.

6. Open an LLC Business Checking Account

Take your approved PA Certificate of Organization, Federal Tax ID Number, and Driver’s License to the bank to open a business checking account in the name of the LLC.

It’s strongly recommended to create a separate bank account for the LLC to keep business and personal finances apart; an important part of running a legitimate company.

You can learn more about LLC banking here: LLC bank account.

7. Obtain any Required Business Licenses and/or Permits

Depending on what type of business you are in and where your business is located, you may need to obtain certain business licenses and/or permits.

You’ll need to get in contact with your city, county, township or borough to find out the requirements for your Pennsylvania LLC, or you can hire IncFile for help.

8. File Your Taxes

Your LLC will not pay federal income taxes directly to the IRS, but instead, taxes will “flow through” to your personal income return (US 1040).

However, you’ll need to file PA-40 with the Pennsylvania Department of Revenue, as well as additional returns, depending on your type of business.

And further, you also likely need to file local taxes with your county, city or township.

We strongly recommend getting assistance from a local accountant as taxes can be quite complicated and making mistakes can lead to penalties and fines.

You can find an accountant via Thumbtack, or you can use our “how to find a great accountant” strategy here.

Congratulations, those are the steps to setting up a Free Pennsylvania LLC for Veterans and Reservists!

Pennsylvania Department of State Contact Info

If you have any questions, you can contact the Pennsylvania Bureau of Corporations at 717-787-1057 (Monday through Friday, 8am – 4:45pm).

References

Statutes of Pennsylvania: Act 135 of 2016

PA Department of State: Business Fee Exemption for Veterans and Reservists

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Pennsylvania LLC Guide

Looking for an overview? See Pennsylvania LLC

How long does it take for a LLC to get approved?

Hi Fraz, you can find those details here: How long does it take to get an LLC in PA.

Thank you Matt.

As a veteran are these the steps?

1) Fill out the Certificate of Organization?

2) Then we should hear back in roughly 5-6 weeks?

3) Then apply for a EIN number?

4) Bring EIN and LLC approval letter to bank for account set up?

Question:

*How do we keep our personal name off the LLC in public registry? Is there a way to keep our personal name away from the public view?

Thanks for your help on the steps to open up a LLC for a veteran.

Hi Fraz, to keep your name off the LLC, you’ll want to hire an LLC filing company. This way, they’ll be (and sign as) the LLC Organizer and not you. If you don’t want your address on the LLC, you should also hire a Registered Agent company. Note: most LLC filing companies also offer Registered Agent service (and vice versa).

Yes, you need the LLC approval (stamped and approved Certificate of Organization) and EIN Letter to open an LLC business bank account. It’s also a good idea to bring your Pennsylvania LLC Operating Agreement. And if you hire a company to form your LLC, also bring the Statement of LLC Organizer.

And no, you need more than just the Certificate of Organization to form the LLC. The instructions are above on this page. You also need to submit a Docketing Statement.

Hello,

I was able to set up my business and since I am a veteran it was free. But I made a mistake. In the state of PA, you are not allowed to use the word realty in your name.

The exact wording I received was, “As per the Commission Laws, a Qualified Association cannot hold itself to the public as providing real estate or real estate-related services. Unfortunately, due to that guideline, you will not be able to use the name “TJMT Realty LLC” for your Qualified Association because you are not permitted to use real estate-related words such as “reality”, “real estate” or “realtor(s)”, etc.”

Now I am trying to take the Realty out of my name but can not seem to find anyone to help me figure out how to do this. I printed out a certificate of Amendment form but not sure how I change the name or what to even do with it once I have it filled out. I put on line 4 to change the name from TJMT Realy LLC to TJMT LLC but not sure if that is all I need to do. Can anyone recommend to me what to do?

Hi Jeramie, if you want a PA Qualified Association LLC, you can use your desired name. You just need to register with the State Real Estate Commission. If you don’t, then just submit another Certificate of Organization form along with a copy of your rejection letter. You don’t have to pay again. The state will use the rejection letter as proof for a credit.

Thank you for the information. I think Im too late I went through the pa portal and it walked me through changing the name and they charged me 70.00 :( Thanks for the info though. Next time I know.

Hey, at least you got it done! You’re welcome :)

Hello Matt

Am I clear in understanding that the LLC applicant needs to acquire a FEIN to submit the required docketing statement, then once approved for the LLC you apply for the state EIN?

Hi Tom, your Federal Tax ID Number (FEIN) in not required on the Docketing Statement. You can enter “applied for”. It’s better to wait for your LLC to be approved, and then apply for your FEIN with the IRS. After the LLC is approved and you have your FEIN, you can register with the Pennsylvania Department of Revenue (PA-100). After that, you’ll get your PA state tax account number. Note, the PA-100 is going fully digital after January 22, 2019. Hope that helps.

Hi I literally just registered for an EIN and then found this article which specifically stated to not register for an EIN until After the LLC is approved- is it too late to register my LLC for free if I already have an EIN?

Hi Angela, the IRS doesn’t validate the LLC’s approval. So no, it’s not too late to register your LLC. If your LLC is approved, and that’s the same name on your EIN Confirmation Letter, then you’re good to go. If not, just get a new EIN for the LLC and then cancel the old one. See how to cancel an EIN. Hope that helps!

Hello Matt, I want to thank you for the terrific information you are providing. Had I not ventured to your site, I would not have known that filing an LLC in PA for a veteran is free in PA. My question is: how many LLCs can a veteran file in PA for free? I didn’t know if it is limited to one or more. Thank you in advance

Hi Rick…I have 2, but a friend of mine actually has 7. Hope this helps.

Hey Rick, you are very welcome! There is no limit to how many PA LLCs a veteran can have. Hope that helps.