Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

If you googled how to form an LLC in Pennsylvania, and are feeling confused, don’t worry! At LLC University®, we specialize in researching the LLC formation process and turning it into step-by-step instructions.

If you googled how to form an LLC in Pennsylvania, and are feeling confused, don’t worry! At LLC University®, we specialize in researching the LLC formation process and turning it into step-by-step instructions.

File Certificate of Organization an LLC PA

In this lesson, you will learn how to start your Pennsylvania LLC with the Pennsylvania Bureau of Corporations and Charitable Organizations.

The Pennsylvania LLC filing consists of two documents:

- Certificate of Organization

- Docketing Statement

Once approved, these two documents officially create your PA LLC.

Note: In most states the form to create an LLC is called the Articles of Organization. However, in PA the form is called the Certificate of Organization. So technically, both Pennsylvania Certificate of Organization and Pennsylvania Articles of Organization mean the same thing.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Pennsylvania LLC Certificate of Organization filing fee

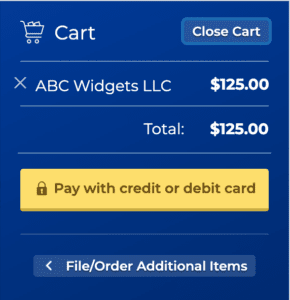

The fee to create an LLC in Pennsylvania is $125.

The fee is the same whether you file online or by mail.

How much is an LLC in Pennsylvania explains all the fees you’ll pay, including the Certificate of Organization fee.

LLC approval times

If you file online, your LLC will be approved in 5-7 days.

If you file by mail, your LLC will be approved in 5-7 days (plus mail time).

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Pennsylvania.

Tip: We recommend filing online. It’s easier to complete and you’ll get your LLC documents back faster. US mail is often delayed, so it’ll probably take an extra week if you file by mail.

However, if you aren’t very tech-comfortable, you can still file by mail.

Alternatively, you can hire a company to form your LLC instead. Check out Best LLC Services in Pennsylvania for our suggestions.

How to File a Pennsylvania LLC by Mail

If you want to file by mail (instead of online), you need to:

- Download and complete the Certificate of Organization and Docketing Statement

- Prepare a check or money order for $125

- Make payable to “Department of State”

- Make sure your check has a pre-printed name and address in the upper left

- Send your payment and the completed form to:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

PO Box 8722

Harrisburg, PA 17105-8722

How to File a Pennsylvania LLC Online

What happened to PENN File? In October 2022, Pennsylvania changed their systems. They replaced PENN File with Business Filing Services. You’ll need a Keystone Login to access the Business Filing Services. The instructions on this page show the latest updates.

To file your Pennsylvania LLC Certificate of Organization online, you need to create a Keystone Login.

If you already have a Keystone Login simply login.

Note: While you’ll no longer see the “Manage Business Filings” that PENN File used to have, you’ll still be able to do everything you need inside your Business Filing Services (BFS) account.

Create a Keystone Login

If you don’t have a Keystone Login, visit PA Business One-Stop Hub and click “Register”.

After registering, you’ll see a success message at the top (in a small green bar).

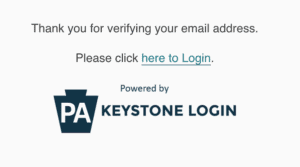

Next, you’ll need to go to your email and click the verification link.

After doing that, you should see this success message:

Click the “here to Login” link and then login.

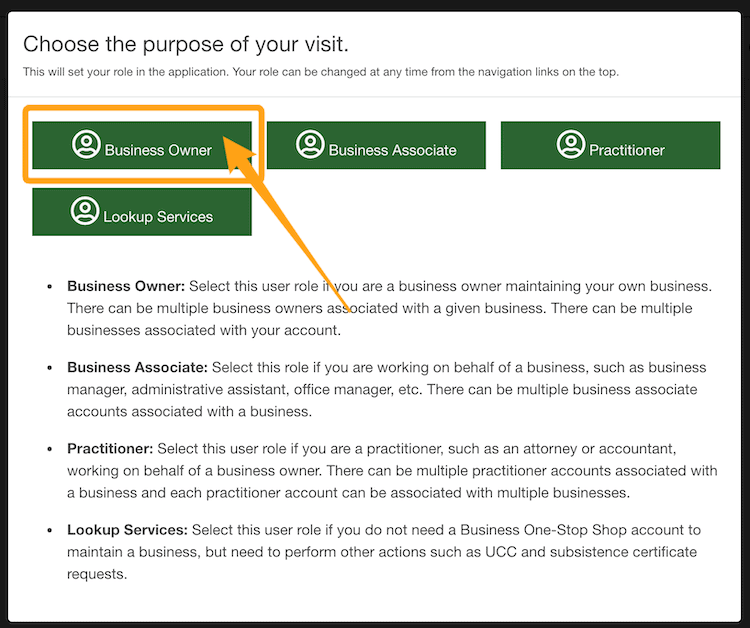

Choose the purpose of your visit

You’ll see a pop-up with several buttons to choose what type of filer you are. Select Business Owner.

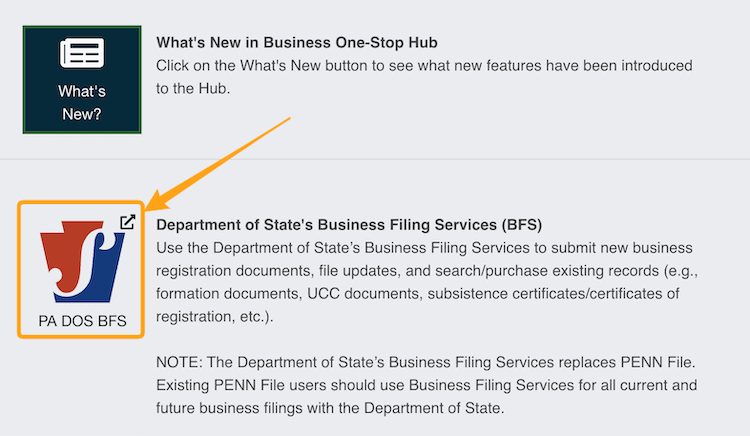

Go to the PA Business Filing Services

You will now see the Welcome page for PA Business One-Stop Shop.

Scroll down and click Department of State’s Business Filing Services (aka PA DOS BFS):

You will now be on the main dashboard for your Business Filings Services account. From here, you can manage your business filings.

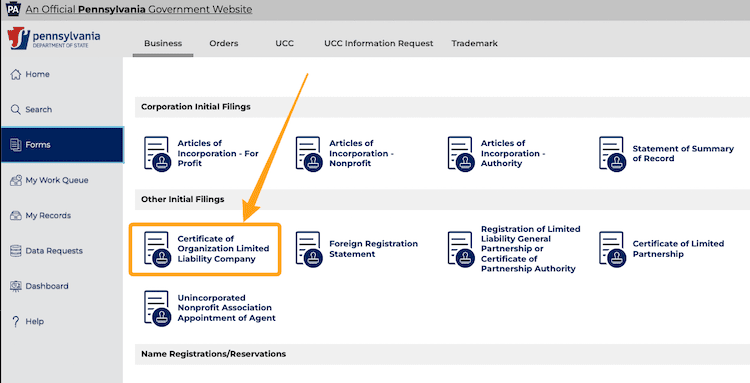

On the left, click “Forms“.

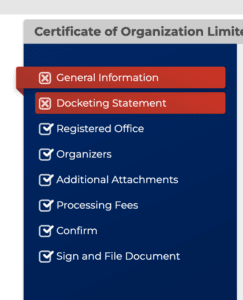

Look under “Other Initial Filings” and click “Certificate of Organization Limited Liability Company“.

Then click “File Online“.

General Information

You’re now ready to begin forming your Pennsylvania LLC Certificate of Organization!

Limited Liability Company Type

- Prior Lesson: We recommend reading Pennsylvania LLC Name before proceeding. You’ll need to make sure your LLC name is unique when compared to existing business names in the state.

From the “Subtype” drop down, select “Limited Liability Company“.

(Note: This lesson doesn’t tell you how to file a Professional Services LLC for Restricted Professional Companies. You can still form a Restricted Professional Service LLC – aka Professional LLC – online, though. You just need to upload proof of state licensure.)

LLC Name

The system first asks if you filed a business Name Reservation ahead of time.

Note: You don’t have to reserve your LLC name in order to form an LLC in Pennsylvania. It’s often a waste of money.

If you don’t have a name reservation:

If you don’t have a name reservation certificate, don’t worry. Just click “No” and enter your LLC name twice. Then select “Consent to use the name is not required because the name is available for use in Pennsylvania.”

Make sure to include the designator in your LLC name. As per Section 15-204, Pennsylvania law allows the following designators:

- LLC (or L.L.C.)

- Ltd (or Ltd.)

- LTD (or LTD.)

- Limited Liability Co.

- Limited Liability Company

- Ltd. Liability Co.

- Ltd. Liability Company

Tip: Most people choose “LLC”.

If you have a name reservation:

If you filed a Name Reservation, click “Yes” and then select your reserved name from the dropdown menu.

LLC’s Effective Date

- Related article: What Effective Date Should I Use for my LLC?

If you’d like your LLC to go into existence on the date it is approved by the state, select “when filed with the Department of State“.

If you’d like your LLC to go into existence on a future date, select “on a future specific date“. Then choose the date using the calendar button to the right. Don’t worry about what time you choose; it’s not important.

Note: There is no limit on how far into the future you make the date, but you can’t back-date your filing.

Pro tip: If you’re forming your PA LLC later in the year (October, November, December) and you don’t need your LLC open right away, you can give your LLC an effective date of January 1st of the following year. This can save you the hassle of filing taxes for those few months with no business activity. Keep in mind though, you won’t be able to open an LLC bank account until your LLC goes into existence.

Email Address for Notifications

We recommend enabling email notifications. This way, when it comes time to file your Pennsylvania LLC Annual Report, you’ll be notified.

Choose the option that starts with “I would like to receive email notifications…“.

Then click “Add” and enter your email address.

Click Next Step to proceed.

Docketing Statement

Note: The information entered in your Docketing Statement gets sent to the Pennsylvania Department of Revenue. They will create an account for your LLC (which will include a PA Revenue ID Number).

The Department of Revenue will mail you a Welcome Letter with information within 3-4 weeks of your LLC being approved. All information entered here is private and won’t go on public record.

Description of Business Activity

Enter a detailed description about your LLC’s business activity.

Don’t worry, you aren’t going to be forced to do the activity you list forever. You don’t need to update the state if this changes in the future.

However, you have to be specific for this initial purpose.

If you list a general statement (ex: “any lawful purpose” or “general purpose”) or something really vague, the state will reject your LLC filing.

Here are some examples of descriptive business purposes:

- Real estate investing

- Coffee shop and cafe

- Online retail and eCommerce

- To offer online coaching and digital products

- To operate and manage a food truck in Pittsburgh

- Technology company offering IT and web development services

Tax responsible party

This person is the one who will be responsible for the initial tax reports. For most people forming their LLC, they will list themselves.

Enter your first name, last name, and a good mailing address.

EIN/FEIN (aka Employer Identification Number)

You can leave this blank. It’s not required.

Really, you shouldn’t get your Pennsylvania EIN Number until your LLC is approved.

(It’s silly that the state is even asking for it here. Don’t worry, we have a lesson that will show you how to get your EIN from the IRS website later.)

Tax Year or Fiscal Year End

For accounting and tax purposes, most small businesses run on the “calendar year”, which is January 1st to December 31st. That’s the same as your personal income taxes.

If that’s what you will be doing for your LLC, you can enter “12” in the first box and “31” in the second box for December 31. (This is what most people do).

If your business runs on a different fiscal year, please enter that fiscal year end date instead.

Click Next Step to proceed.

Registered Office

- Prior lesson: Make sure you read Pennsylvania Registered Agent. You can also explore Is a Registered Agent a Member of an LLC?

Note: The terms Registered Agent Address, Registered Office, and Registered Office Address all refer to the same thing in Pennsylvania.

You or someone you know will be the LLC’s Registered Agent:

If you will be your own Registered Agent, or someone you know will be the Registered Agent for your LLC, select the 1st option (“The address of this limited liability company’s proposed registered office in this Commonwealth is”).

Then enter the address and county information.

You hired a Registered Agent Service:

If you hired a Registered Agent Service (aka Commercial Registered Office Provider or CROP), select the 2nd option (“The name of the commercial registered office provider and the county of venue is”).

Search for Commercial Registered Office Provider (CROP):

Search for the Registered Agent company you hired and select them from the list.

Venue and Publication County:

You’ll need to contact the Registered Agent company (or check inside your account) and ask what county their address is located in. Then select it from the dropdown menu.

Tip: If you hired Northwest Registered Agent, select Erie from the county list.

Note: Don’t worry about the word “publication”. LLCs in Pennsylvania don’t have to publish anything in the newspapers. Only 3 states have LLC publication requirements and Pennsylvania isn’t one of them.

Click Next Step to proceed.

Organizers

- Related articles: LLC Organizer vs LLC Member and Registered Agent vs LLC Organizer

Add an LLC Organizer to your filing by clicking the “Add” button. Enter their first and last name in the pop-up and then click save. The address is optional, so you can leave it blank.

Tip: Most people forming their own LLC are also the LLC Organizer.

Note: You’re required to list 1 Organizer, but you could list more than 1. However, you don’t need to make every LLC Member an Organizer of the LLC. They are not the same things. The LLC Members will be listed in your LLC Operating Agreement (we’ll cover this in another lesson).

Click Next Step to proceed.

Additional Attachments

This section is used to upload any additional documents to your LLC filing, such as additional rules or provisions.

Most people don’t upload anything unless they’ve been instructed to do so by their attorney.

Click Next Step to proceed.

Processing Fees

This page is letting you know that the fee to form an LLC in Pennsylvania is $125.

However, if you are a Veteran, you can form a free LLC in PA. If you qualify for a free Pennsylvania Veteran LLC, check the box and upload proof of your veteran status.

Note: The $125 LLC fee is the same whether you are forming a regular LLC (aka Domestic Limited Liability Company) or a Foreign LLC.

Click Next Step to proceed.

Confirm

Review your information for accuracy and check for typos.

If you need to make any changes, click the appropriate step in the list on the left where you need to make changes.

If everything looks good, click Next Step to proceed.

Sign and File Document

Enter your full time in the “Signature” field and click “Today” to enter today’s date.

Below that, make sure “File Online” is selected.

Then click “File Online” again in the lower right.

Note: If you’re getting an error message, it usually means some information needs to be updated. Look at the left navigation. Anything that needs attention will be highlighted in red:

Payment

After clicking “File Online” you’ll see a pop-up on the right.

Click the button to pay by credit or debit card.

Enter your billing information and submit your payment to the state.

Congratulations! Your Pennsylvania LLC has been submitted to the state for processing.

Now you just need to wait for your LLC to be approved.

Pennsylvania Certificate of Organization Approval Time

After filing your Pennsylvania LLC online, the state will approve it in 5-7 days.

After your LLC is approved, you will get the following documents via email:

- Acknowledgement Letter

- Certificate of Organization (stamped and approved)

And in a few weeks, you’ll receive the Welcome Letter from the Pennsylvania Department of Revenue.

Pennsylvania Department of State Contact Info

If you have any questions, you can contact the Pennsylvania Bureau of Corporations at 717-787-1057. Their hours are Monday through Friday, from 8am – 4:45pm.

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

PA Certificate of Organization FAQs

What’s the difference between the Certificate of Organization and the LLC Operating Agreement?

The Certificate of Organization is the document that – once approved by the Pennsylvania Department of State – creates your LLC.

However, the LLC owners (called Members) don’t get publicly listed in the Certificate of Organization.

Instead, you’ll list the LLC Members in your LLC’s Operating Agreement. The Operating Agreement is a document that spells out who owns the LLC and how much they own. Additionally, it sets out other rules like how the LLC is managed and how disputes are resolved.

The Operating Agreement is an “internal” document. Meaning, it doesn’t get filed with any government agency. You’ll just keep it with your business records.

How much does it cost to open an LLC in Pennsylvania?

The filing fee for the LLC Certificate of Organization is a one-time fee paid to the Pennsylvania Department of State.

It costs $125 to file by online using Pennsylvania’s Business Filing System.

Your LLC might also need to pay for a business license or permit, depending on what your company does.

How do I get a copy of my Pennsylvania Certificate of Organization?

If you’re looking for a copy of the Pennsylvania Certificate of Organization that you already filed for your LLC, you can use the Business Filing Services system:

- Go to the Department of State Business Filing System

- Click Search on the left, and enter your LLC name

- Click on your LLC in the results, and then click the button to “Request Certificate.”

- Select “Copy Request” from the dropdown menu for Request Type. Then choose whether you want a regular copy or a certified copy of the Certificate of Organization.

- Click the Search button to display all the documents, and select the “Initial Filing“. Click Save & Close.

- Pay for your order and Submit the request.

What should I do if my LLC is rejected?

If your LLC is rejected, there’s no need to panic. You can correct the issue and re-submit your Certificate of Organization to the state.

If you have questions about why your filing was rejected, you can call the Pennsylvania Bureau of Corporations at 717-787-1057.

Does my LLC need a Pennsylvania business license?

It depends on what your business does.

Pennsylvania doesn’t have a state-wide general business license requirement.

However, the Pennsylvania Department of State requires certain types of businesses to have a license. You should also check with your city or county about any local business license requirements for your LLC.

And you may need to register with the Pennsylvania Department of Revenue in order to collect sales tax or register for other taxes.

How do I get a Certificate of Good Standing?

If you need a Certificate of Good Standing (aka Subsistence Certificate) for your PA LLC, you can order it online or by mail. This document isn’t required when forming an LLC, however, some lenders and title companies may need one in order to facilitate a real estate closing.

How do I set up an LLC in Pennsylvania?

Here are the steps on how to start an LLC in Pennsylvania:

- Choose an LLC name and make sure it’s available

- Choose who will be your Pennsylvania Registered Agent

- File the Pennsylvania Certificate of Organization

- Get a Tax ID Number (EIN) from the IRS

- Check whether you need business permits

- Complete and sign an LLC Operating Agreement

- Open an LLC bank account

References

PA General Assembly: LLC Act

PA Department of State: Fees and Payments

PA Department of State: A Guide to Business Registration

PA Department of State: Commercial Registered Office Providers

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Pennsylvania LLC Guide

Looking for an overview? See Pennsylvania LLC

Hey Matt, we actually went to high school together! Had a question that was asked a few times here regarding an official certificate organization from PA that the LLC was created. We got a very small form from PA but it does not have a stamp with “date filed” etc that our bank needs to open a business checking account. Just a very simple plain form on the PA business hub website . Think it’s best just to call them to see if we can get a more official form? Take care and thanks !

Hey Matt, great to hear from you! Hope you’re doing well man. It sounds like you might just have the Acknowledgement Letter. The approval in the upper right of your Certificate of Organization will look something like this. You can login to PA Business One-Stop Hub, then click on “PA Business Filing Services (BFS)”. Once there, look on the left nav and check out “My Work Queue” or “My Records”. You should find your Certificate of Organization there. If you don’t see it, or have any issues, then I’d call the Bureau of Corporations on Tuesday at 717-757-1057. Hope that helps! Let me know if you need anything else.

Hi Matt,

First, I want to thank you for creating this awesome website. It’s very well laid-out and helped put many of my concerns at ease.

My questions are about the docketing statement form. For “Tax Responsible Party,” it asks to list an address. Am I able to list my registered agent for this part? Or will I need another business address?

I’m hesitant to put my personal address down because I don’t want it to become public record, but I’d also prefer that the tax forms get mailed to me. My business is going to be online and I won’t have a physical address. If I can’t use the registered agent’s address, I was planning to get a UPS mailbox local to my area. (Do UPS mailboxes count for a business address in Pennsylvania? I’ve found conflicting answers)

Thank you in advance!

Hey Alex, thank you very much! I appreciate the kind words. The Docketing Statement gets sent to the PA Department of Revenue. For this, I’d use your home address (or the address you’ll use for your tax returns). It’s not on public record (all information with the Department of Revenue is private; it’s the Secretary of State info on the Certificate of Organization that is public). And yes, you could technically use a mailbox rental address (aka CMRA; Commercial Mail Receiving Agency) on the Docketing Statement (the DOR doesn’t care). However, I’d personally use a home address here, since they are usually easier and more reliable. Hope that helps!

I filed for my LLC in Pennsylvania online and it got approved. I received my acknowledgement letter via email and on the business filing services it indicated my company is active. However, I have not received my certificate of organization (stamped & approved). I attempted to request/pay for a copy on the business filing services site, however, there does not seem to be an option to get a copy of the actual certificate of organization.

Hi Mir, the state’s online system is a little “wonky” when it comes to getting your approval documents emailed/downloaded. If this is still an open issue, I recommend calling the PA Bureau of Corporations and seeing what they recommend.

Hi, I filed my LLC online, and I recieved an email about the approval of LLC but they didn’t send me the certificate of LLC and I couldn’t find it on PAgov officail website where I filed LLC. Where can I find the certificate of organization?

Thanks

Hi Maig, there’s a chance it’s in that email. The approved Certificate of Organization is pretty unassuming and simple looking in PA. Let me know if you find it or still need a hand.

I submitted my LLC online. Is there a place I can review the “Status” of approval? I’d really like to move forward with Bank account, Logo Design, etc but figured waiting until the LLC is approved would be the best course of acction.

Hi John, no, unfortunately, there’s place to check the status. You just have to wait for it to be approved. Hope things went over well!

Hi again Matt,

So I filed my LLC and it got returned (sad face). It says:

The enclosed filing is being returned for the following reason(s):

103 – Your filing lacks the specific brief statement of business. Refer to the proper paragraph on the

Docketing Statement. BE MORE SPECIFIC/ DETAIL.

161 – Your payment has been received. Please return this notice along with your corrected filing.

Failure to do so may result in further rejections and penalties, if applicable.

Please return this letter or a copy thereof with the attached, date-stamped and corrected document

within 30 days of the date of this notice in order to retain the date of delivery to the Department as the

file date, if a filing is required. Rejection of a document does not constitute a name reservation.

In accordance with 19 PA Code §3.2(a)(2) and §11.12(d)(2), the dates on any missing documents or

certificates, which are needed to support this submittal, must be operative or effective on or as of the

original date of the submission in order for the original submission date to be retained.

The fees of the Bureau are nonrefundable pursuant to 15 Pa.C.S. §153(a). The nonrefundable policy

applies to both accepted and rejected filings.

What does this mean? Did I not fill out the Business Activity section correctly? I put “Any lawful business activity for which a Limited Liability Company may be organized in Pennsylvania.” Was this the issue? I was unsure as to what to put for this section. My business is making handmade decor items and selling them online. What should I have put here instead? Please help I don’t know where to go to get this correct. Do I have to pay the $125 again or it will be fine as long as I file again within the 30 days?

Hi Sasha, don’t worry. This isn’t as scary as the letter sounds (those “penalties” don’t apply). And it’s a quick fix ;)

Your LLC was rejected because you used the “any lawful business” description. The state rejects filings which use this clause (even though it’s allowed in the Pennsylvania LLC Act). Please see above on this page. Look for the “Description of Business Activity:” section for more details.

All you need to do is complete a new Certificate of Organization and mail it to the state with a copy of your rejection letter. The rejection letter will serve as your $125 “credit”, so you don’t have to pay twice (as long as the new Certificate of Formation is filed within 30 days). For your description, you could say something like “handmade crafts and online sales”. Hope that helps!

Thank you so much Matt! You’ve helped so much with this process!

You’re very welcome Sasha :)

Hi Matt,

Quick question I am forming an LLC and I filed for my EIN before registering my Certificate of Organization and I read online that LLC needs to be added to my name (ex. ABC Help LLC) is this correct? Do I have to correct this by mail to the IRS to add LLC to my name once I file and are approved for my Business Entity/Certificate of Organization?

Also How do I know how to correctly fill out my PA-100 form to fit my business. For Section 8 do I fill out just the County I live in and conducting taxable sales or is this for every county I may conduct sales within PA For? For Section 9 Do I have to fill out Establishment Employment Information for myself being that I will be paying my self a percentage and are technically my own employee? Also Section 11. Does an LLC need to fill out this section? Section 7 and 17 if I am selling decor items on Etsy that I am making do I choose manufacturing, retail trade, and wholesale trade being that I will buy some of my products from wholesalers?

Thank you for this website filled with all the Instructions and steps in this confusing process. This website has truly helped me stay organized and take most of the stress away from what could have been a more stressful process. Thanks a bunch!!!!

Hey Sasha, have you used the EIN for anything yet? If not, it’s easier to just get another EIN and cancel the first EIN. You can apply for a new EIN right away (you don’t have to wait for the cancellation of the old EIN to be processed first).

If you want to keep the EIN, you can file a name change form by mail, but it can take 2-3 months before you hear anything back. It’s typically much faster, but the IRS is very backed up right now. We have information here: Change LLC name with IRS. Regarding the PA-100 form, we recommend working with an accountant to get this properly filled out. Thank you for your understanding and I hope that helps :) And thank you so much for your kind words. We’re so happy the site has been helpful!!

Hello Matt just want to say this is very helpful. I have a quick question about the expedited service request form in PA, it ask for entity number but I don’t have one yet can I leave that blank? Thanks

Hi William, you’re very welcome. Which form/line are you referring to re: the entity number?

Matt I just finished the last page on the Pa state site which reads “certificate of organization domestic limited liability company” and it asks if I want to upload anything which I don’t. So then I click save and it just stays on that page? I thought it would lead me to a check out for payment? does all the info I just filled out about my company stay saved on the site? Whats my next step thanks Jerrell

Hi Jerrell, were you able to get it submitted? You likely just needed to hit save and continue… or manually click on the “Declaration & Signature” tab. What web browser were you using?

Matt. I am planning to create an LLC with my three brothers to take over ownership of our parents lake house. This is not going to be a business for profit as we are not planning to rent the property out but are doing it more for protection of our personal assets. Would this be something an LLC is used for?

Hi Jodi, yes, this is a common setup. However, it may also be a good idea to speak a real estate attorney about other options. Hope that helps.

Hi Matt! My husband and I have been impressed with your website as we start an LLC. We also submitted these forms online and received approval within one business day! We were very excited since we were debating about driving to Harrisburg and paying for expedited approval.

Hey Carolyn! We’re happy to hear we were able to help. Yea, that drive is a pain! Congratulations on your LLC filing and good luck with your business!

Hi Matt, Thank you so much for posting valuable information to form llc. We are forming LLC in PA and we did not find section to specify manager managed LLC in Certificate of Organization.

We are really confused, as all the members wants to have passive role because of most of members are on work visa (H1B) and would like to have LLC managed by Manager.

Where should we fill in this information so thats its evident its manager managed?

Hi VJ, you’re welcome :) The Pennsylvania LLC Certificate of Organization doesn’t ask about management. The state doesn’t really care. It’s an “internal” affair and that would be set by your Operating Agreement. I just emailed you a Manager-managed LLC Operating Agreement template. Hope that helps.

Hi Matt, I want to change by sole proprietorship printing business to an LLC in Pennsylvania. I am keeping my same name for the business and just want to add the LLC after it. Do I need to register for a fictitious name since when I searched, my name is available and I’m keeping the same name? Once the state approves the LLC, do I need to do anything else for sales tax purposes or will this convert automatically. I imagine I need to contact all my vendors to let them know I’m operating as an LLC and do I need to contact my customers too? Do I need to advertise this in the newspaper? I have read that I don’t have to since my name will be the same. I want to get a new EIN so once the state approves my LLC, I would file to get a new EIN, then contact Pennsylvania with the new EIN?

Hi Ron, no, you won’t need to register a Fictitious Name or advertise. You’ll just be forming an LLC and then getting an EIN for the LLC. Yes, you’ll need to update your sales tax account and the PA Dept. of Revenue. And yes, vendors and customers as well. Hope that helps.

Thanks for all of your help Matt. I was able to form my LLC and update everything pretty easy.

Fantastic! You’re very welcome Ron!

Thank you so very much for increasing my knowledge re. LLC’s, but now I think I filled in my paperwork incorrectly! I checked the restricted box and psychology, but now I see this applies only if the psychologist is licensed by the state. I am a certified school psychologist (PA Dept of Ed), not a licensed psychologist. Do I need to change this somehow? Thank you so much in advance!

Hi Maureen, you’re very welcome :) Happy to hear! I’m not 100% sure since we don’t have all professions (for all states) documented… things vary widely re: PLLCs state by state. I recommend calling the Department of Education to clarify. You could also try the Bureau of Corporations. Thanks for your understanding.

Thank you! I will call them!

Hi,

I filed for my PA LLC online and received the emailed copy of my certificate of organization with the welcome letter in 7 days; however, I don’t see an official stamped approved date. The only date is the date I submitted the form online. What should be used as an approval date for my operating agreement and EIN- is it the date I filed or the date I received my emailed copy back?

Thank you so much for freely sharing this very helpful information!

Hey Sam, you’re very welcome! You should have a date on your Welcome Letter as well is in the upper right of page 1 of your Certificate of Organization. That’ll be your LLC’s effective date. Hope that helps :)

I just wanted to say THANK YOU!! I had filed my LLC paperwork, sent it in and waited… Imagine my surprise when I got a notice stating the Docketing Statement Form DSCB:15-134A was missing (along with a copy to fill out and return)! When I downloaded and filled out the paperwork nothing was there about this form (or I missed it)… I wasn’t sure what to do about the FEIN, or what to put for Description of Business Activity, so I Googled it and found your website! What a blessing! I now have you bookmarked, and will be passing your info on in any business groups I’m in! I second what Michael said in the above comment!

Hi Susan, THANK YOU for such a lovely comment! So glad you found our site and were able to get your LLC successfully filed! Thanks for spreading the word too… it really means a lot!!

where is the docketing Statement link

Hi Will, it’s above on this page. Please look for “Download the Docketing Statement”. Hope that helps.

I just wanted to thank you. I am starting my own (first) business, and while I know my craft, I know nothing about forming a business. Your website has been an invaluable resource in the formation process. Every link has been active and accurate, every instruction written clearly and simplified for anyone to understand, even someone like me who has no knowledge in these matters. I’d been researching for days and still felt lost before I came across your website. Now I’ve filed and am awaiting approval. Thank you so much.

Michael, your comment is so wonderful to receive! Thank you so much for the kind words :) We’re so happy to hear that we’ve not only been able to help you start your business, but have made the process easy and enjoyable to learn. That’s our goal! Congratulations on your first business! Wishing you nothing but success and meaningful growth!

I am starting a new LLC, I have gone through the steps of creating LLC:

1. Name Search

2. Registered Agent

3. Filing Forms

4. Operating Agreement

When I go to checkout it says my cost is $70.00. It clearly states that creating an LLC is $125.

Am I missing something?

Hi Cari, you likely selected a Fictitious Name registration ($70) instead of an LLC filing, which is $125. In lesson 3 (Filing Forms), please look for the text “after you login” and make sure you are selecting the proper filing. Here are the steps:

– login

– scroll down to “Start or Manage Business Filings”

– click “Domestic Limited Liability Company”

– click “Certificate of Organization – Domestic Limited Liability Company (8821)”

Hope that helps!

Hey Matt,

I filed a cert of organization with the name “Biz, limited liability company” and fictitious name as “Biz, LLC.” Both has the same address. Now i received a letter saying that there’s a name conflict and another letter saying welcome with the Cert of Org attached. I called the Bureau of PA but was told that I should not worry about the conflict and that the business exits under my name as the filer. It’s been like 4 months now. I haven’t received any docketing paper from PA or PA EIN. I need your advise. Please respond through email, thanks.

Hi Hope, hopefully I can help straighten things out. It seems like you’re confused on a few different points. You cannot register a Fictitious Name with the letters “LLC” in it (or the words spelled out). That’s why your Fictitious Name was rejected. Further, “Biz, limited liability company” and “Biz, LLC” have the same root (“Biz”). Having LLC spelled out or abbreviated technically mean the same thing (that the entity is an LLC). So “Biz, limited liability company” and “Biz, LLC” are the same thing. You’ll need to call the PA Department of Revenue to see if an account was created for you. The account should have been created shortly after the Bureau approved your LLC. The EIN is issued federally by the IRS, not from the state of Pennsylvania. You need to apply for an EIN with the IRS. We have a video lesson for EIN (also known as Federal Tax ID Number) on the website. Hope that helps!

Hello Matt,

I am currently registered and operating in PA as one-person sole proprietorship (fictitious name) since 2002 and I have an EIN number. I would now like to change the business category from a sole proprietorship into a one-member LLC. But I would also like to chance the business name (ex. ABC to XYZ) and retain the EIN. I understand that I need to write/notify IRS of the name change.

I found your university website in my search. I have a PENN File account but I’m not sure how to proceed.

1) Should I amend the fictitious name to change the name of the business (ABC->XYZ) first; and then create a new LLC using the same name (XYZ), and dissolve fictitious name.

2) Or Should I create a new LLC using the old name (ABC) with “Consent to Appropriation Name”, amend the ABC LLC to XYZ LLC, and dissolve the fictitious name (ABC)

I understand that it would have been easier to just create XYZ LLC and dissolve ABC but I need to retain the history of my company since I am trying to apply for an MBE status.

I would really appreciate your advice. Thank you very much in advance.

Max

Hi Max, no, you should not amend the Fictitious Name filing as a Fictitious Name cannot be “changed to” an LLC. You simply form an LLC and then file a Cancellation of Fictitious Name. You don’t need a Consent to Appropriation of Name as Fictitious Names do not hold rights to their name, so the LLC will be approved regardless. In terms of the EIN, you’ll need a new one. We have details here: Do I need a new EIN if I change from Sole Proprietorship to LLC. Hope that helps.

Hi Matt,

This is extremely helpful and resourceful! Thank you! I do have a quick question. I want to form a LLC in the Education field. I wonder if there is any impact if I choose “Not applicable” to the question “This limited liability company shall have the purpose of creating general public benefit”? Is it required for ALL education related company to choose Applicable to this question?

Thank you Millions!

-Ashlee

Hey Ashlee! Thank you for the lovely comment. No, this is not a requirement for all education companies. In fact, it’s not a requirement for any company. It’s instead for those who specifically know they want to form a Benefit LLC. Think of a Benefit LLC as hybrid between a for-profit and a non-profit company that has a positive social impact and usually a charitable component. Now, this doesn’t mean you can’t have fundraisers or can’t raise money without making this election. Hopefully that helps clear things up. People forming Benefit companies usually know at the onset and have spoken with their accountant about any pros and cons.

Thank you very much Matt! You are being really helpful!!! So does this website!

Thank you Ashlee. You’re very welcome!

Hi Matt! Thank you so much for this great source of information! it’s by far the best step by step guide to form LLC in the internet!

you said above “After filing your PA LLC online, the state will approve it in 7-10 business days. The state will email you a stamped and approved copy of your Certificate of Organization along with a Welcome Letter.”

I just received a copy of the Certificate of Organization along with a Welcome Letter within less than 24h! but the certificate of organization is not stamped! is my LLC approved now? can I apply for EIN?

Hey Jamal! Thanks for the nice comment :) Did you file by mail or file online? If you file online, yes, approval times are much faster. If not, wow, that was fast. We’ll chat with the state and see if approval times have gotten faster.

Hi Matt! I am forming an LLC in anticipation of making some real estate investments. Give the fact that my business has not actually completed any transactions, does the “effective date” have any meaning? For example, If I wanted to arbitrarily choose an effective date of July 23, 2016, can I do so? Thank you, this is an amazing source of information!

Hey Brandon! Glad you are finding the course helpful, and thanks for the kind words. The effective date is the date your LLC officially goes into existence with the state.

You can’t back-date it, but you can forward date (up to 90 days). Here’s a reason you might need to forward date:

If you’re forming your LLC in October, November, or December, and you don’t need your business open during those months, forward date your filing to January 1st. This will save you the hassle of having to file an RCT-101 w/ PA Department of Revenue for the year the LLC was open (but not really active). It’s not a major thing though, just an FYI as it might help paint some context.

Also, great to hear about the upcoming purchases! Let me know if you need anything else.