Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Annual Reports for Vermont LLCs

After you form an LLC in Vermont, you must file an Annual Report every year.

What is the Vermont LLC Annual Report?

The Vermont Annual Report is an annual filing that keeps your LLC in Good Standing with the state.

It contains basic information about your LLC. And it gets filed every year with the Vermont Secretary of State.

You can file your Annual Report online or by mail.

We recommend filing online because it’s faster and easier.

How much does the Vermont LLC Annual Report cost?

The Vermont LLC Annual Report costs $45.

When is the Vermont LLC Annual Report due?

For most people, your Vermont LLC Annual Report will be due between January 1st and March 31st every year.

For most people, your Vermont LLC Annual Report will be due between January 1st and March 31st every year.

Details: Technically, the due date is a 3-month “filing window” following the close of your LLC’s fiscal year. But since most LLCs run on the calendar year (January 1 to December 31), their due date is between January 1st and March 31st. If your LLC runs on a different fiscal year (not very common), then your due date will be different.

When is my first Annual Report due?

Your LLC’s first Annual Report is due the year after your LLC is approved.

For example, if your LLC is approved anytime in 2026, then your first Annual Report will be due between January 1st and March 31st of 2027.

Then going forward, your Annual Report will be due at the same time each year.

Penalties for not filing the Vermont Annual Report

For most people, if you don’t file your Vermont Annual Report by June 30th, then the Secretary of State will revoke your LLC’s Good Standing status.

Note for fiscal year filers: If you have a fiscal year that is different from the calendar year (again, uncommon), then your deadline will be 3 months after the last day of your filing period.

What happens if I miss the deadline?

If you don’t file your Annual Report by the deadline (June 30th for most people), the state will mark your LLC as “Terminated“. This means your LLC will not legally be able to do business in the state.

If you want to reinstate your LLC (“bring it back to life“), then you must file an LLC Reinstatement. (Online Dashboard > Filings > Business > Reinstatement). The cost to reinstate an LLC is $80 for every year you failed to file an Annual Report. For more info on Reinstatement, please see Vermont Secretary of State: Reinstatements or call the Secretary of State for guidance.

How to file the Vermont LLC Annual Report online

Note: In 2025, the Vermont Secretary of State replaced their old online portal with their new Online Business Filing System. This means that your old login information won’t work with the new system. You’ll need to create a new account. We have instructions for you below.

How to create an account with the Online Business Filing System

Visit the Vermont Secretary of State’s Online Services Login.

If you need to create a new account, scroll down and click “Register Here“.

Account Information:

- Enter your first and last name.

- Then enter your email address and click “Verify“.

- Go to your email inbox and click on the email from the state. Get the code in the email message and enter it in on the account information page.

- Then click “Authenticate“.

You can enter a cell phone number if you’d like, but it isn’t required.

Then enter a password and click “Continue“.

Mailing Address:

- Enter your street address. This address can be in any state.

- Then click “Continue“.

Account Preferences:

You have 3 options for logging into Vermont’s Online Business Filing System.

You can login using:

- a one-time password sent to email

- a one-time password sent to phone

- a regular password that you remember and type into the box

Select your preferred login method and click “Register“.

Now you’re ready to begin your online filing.

Vermont LLC Annual Report online filing instructions

Get started:

Visit the Vermont Secretary of State’s Online Services Login page.

Login to your account, and then click “Continue“.

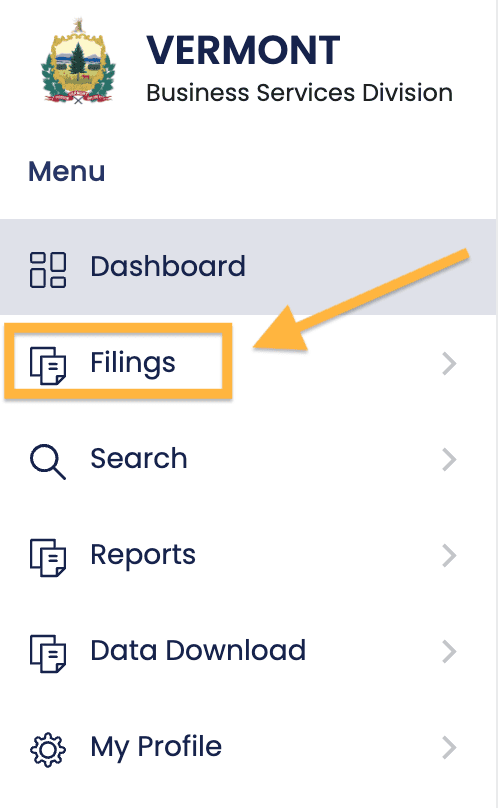

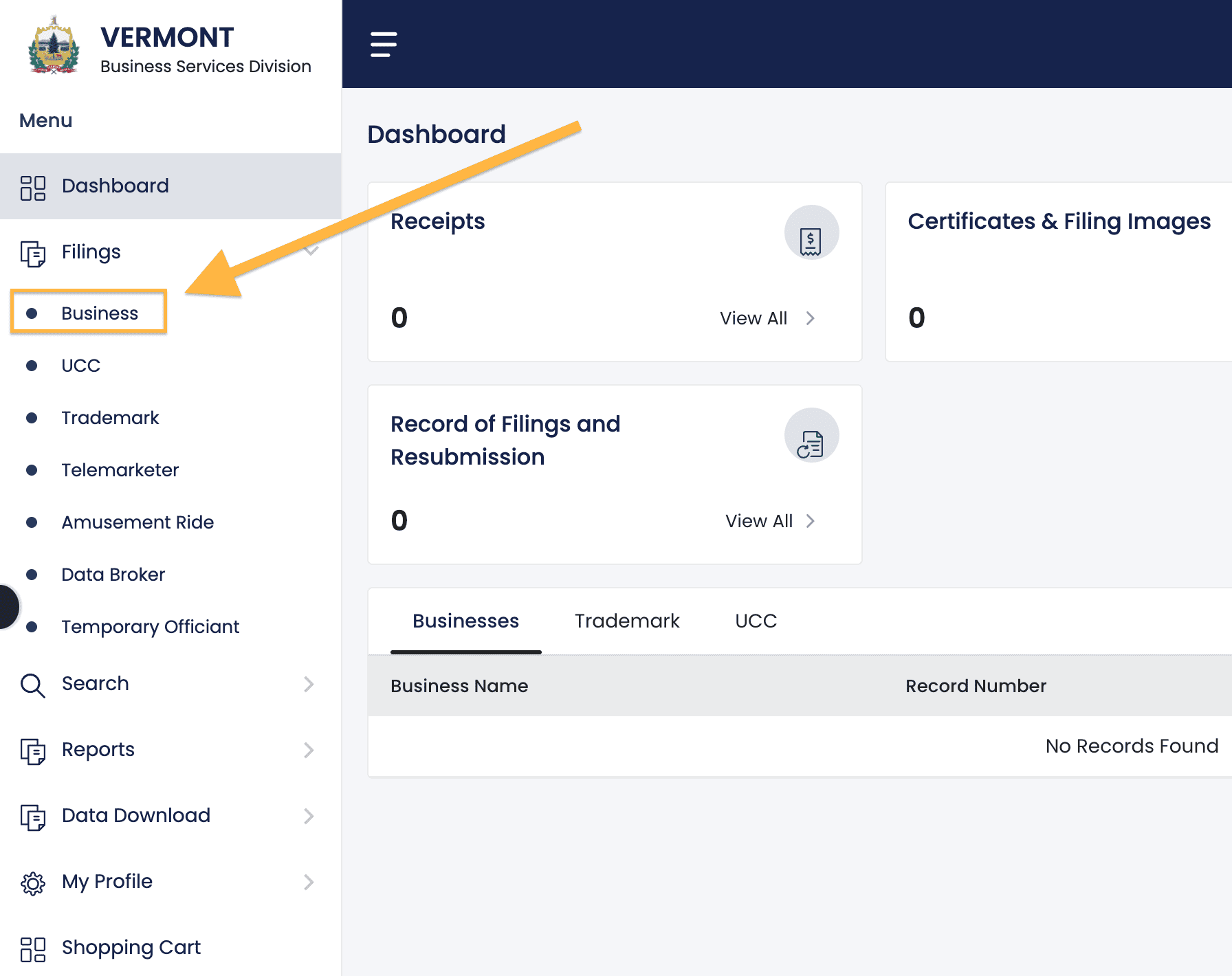

In your Vermont Business Services Division Dashboard, click “Filings“.

Then click “Business“.

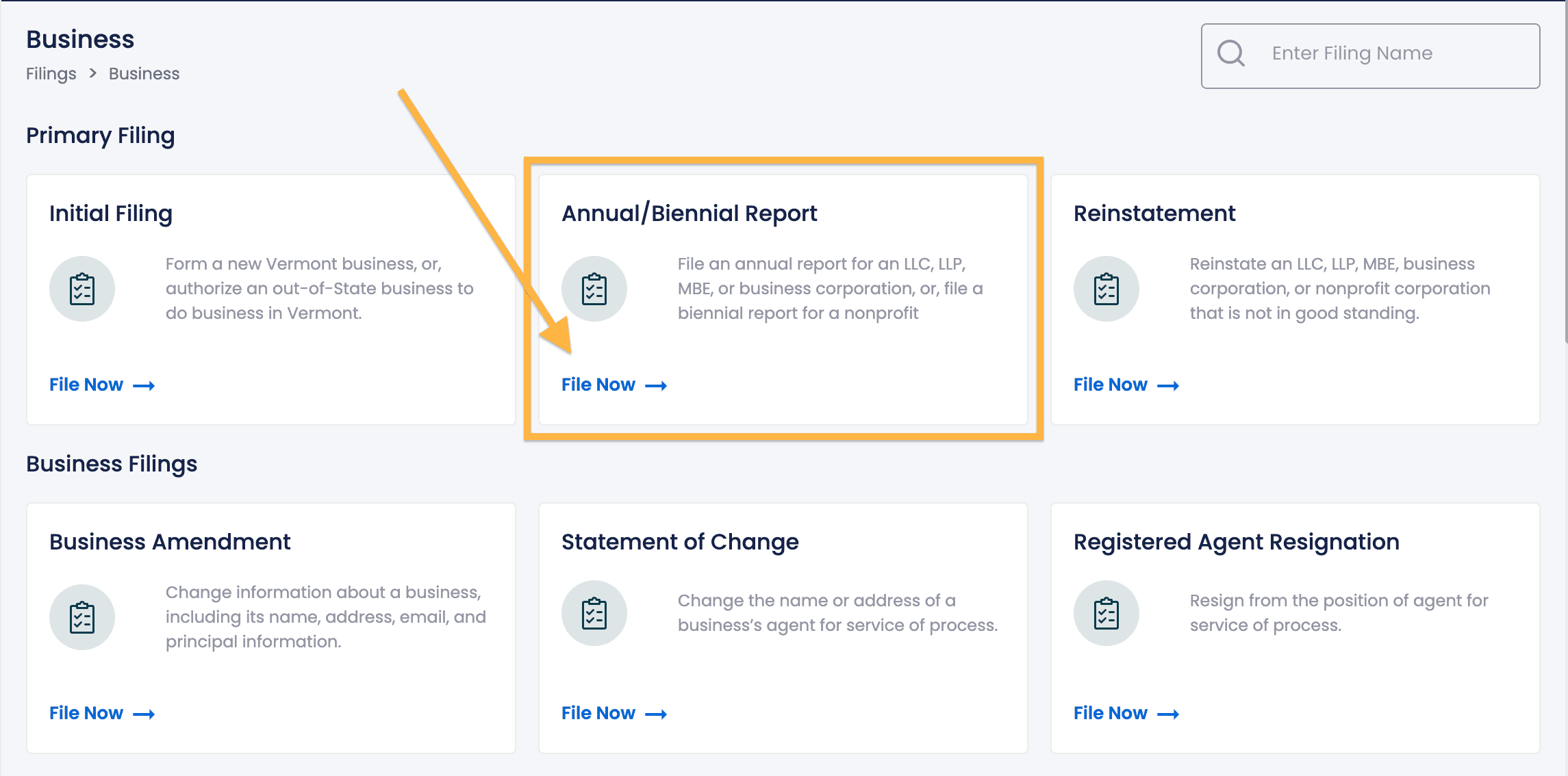

Then under “Annual/Biennial Report“, click “File Now“.

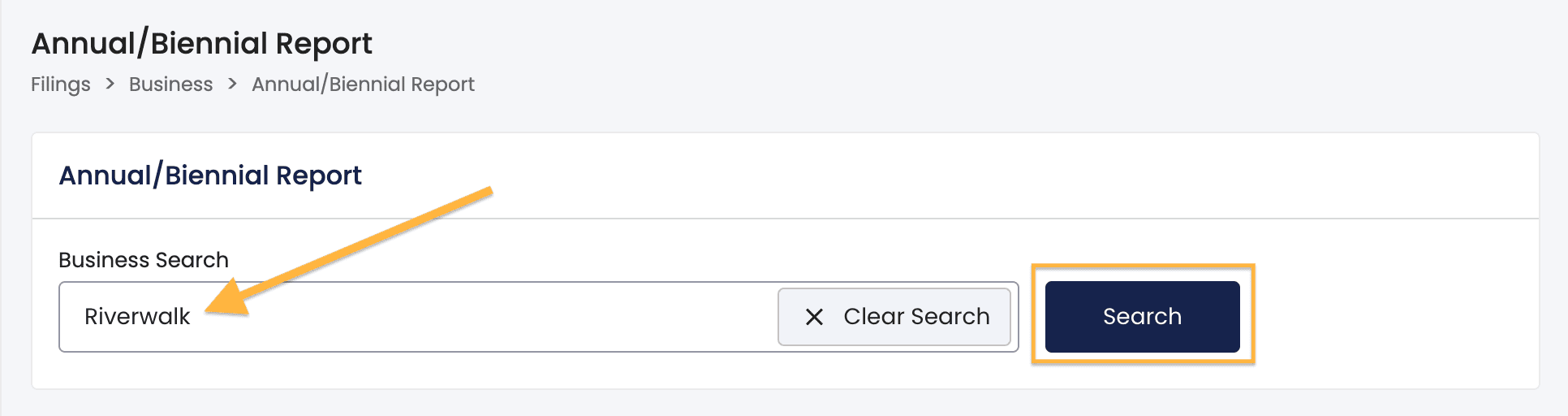

Enter your LLC’s name in the Business Search box and click “Search“.

Find your LLC in the search results and click “Select“.

On the next page, you’ll see your LLC’s information as well as your total Annual Report cost.

There’s nothing to do on this page.

Note: If you missed any Annual Reports from prior years, you’ll see the fee for all of those reports at the bottom. And by submitting this one Annual Report filing, you will file, pay for, and update all prior years.

Click “Next” to proceed.

Business Email

Enter your email address. This can be a business or personal email address.

If you would like to use the same email address you used during registration, check the box next to “Same as Submitter Email“.

Note: The Submitter is simply the person who completes and files the Vermont Annual Report.

Designated Office (Street Address)

If your Designated Office Address has changed, you can update that information here.

Otherwise, you can leave this as-is.

What is a Designated Office Address? This is where your primary business activities take place and/or where you keep your business records.

Your Designated Office Address must be a street address (it can’t be a PO Box address).

This address can be in any state, or in any country.

Designated Office Mailing Address (Optional)

This section is optional.

If you would like to update your LLC’s Mailing Address, you can do that here. Or leave it as-is.

Then click “Next“.

Note: You can’t change your Registered Agent

You can’t change your Vermont Registered Agent during your Annual Report filing.

Instead, this must be done using a separate filing.

Note: If you’d like to update or change your Registered Agent, first, submit your Annual Report filing. Then go back to the Dashboard and click “Filings” on the left. Then click “Business” and look for “Statement of Change“.

Principal Information

- Related article: Member-managed LLC vs Manager-managed LLC

In this section, you’ll see a list of Principals for your LLC.

What is a Principal? A Principal is an LLC Member or LLC Manager.

If there are no changes to be made:

- Leave this section as-is.

If you’d like to make changes, you can add, edit, or remove Members or Managers from your LLC here:

- To add a Principal, click the “Add” button.

- Type: Choose “Individual” or “Business“

- Capacity: Select “Member” or “Manager“

- Name: Enter their first and last name (or business name)

- Address: Enter their street address (the mailing address is optional)

- To edit a Principal, click the paper and pencil icon.

- To delete a Principal, click the trashcan icon.

When you’re finished with the Principal Information section, click “Next“.

Review

Review the information you entered.

If you need to make any changes, click the pencil and paper icons to return to that section.

Affirmation

Check the box to certify that the information you entered is true.

Then enter your name and capacity.

You can use the title “Member” or “Manager“. Or you use the title “Authorized Signer“.

Then click “Add“.

And click “Add to Cart“.

Shopping Cart

There’s nothing to do here. This section just shows you your filing fee total.

Click “Proceed to Pay“.

Payment Details

Select “Credit Card“.

Enter your payment information and billing address. Then click “Pay Now“.

Approval

Congratulations! Your LLC Annual Report has been submitted to the Vermont Secretary of State.

It will be processed and approved in 24 hours. And once completed, you’ll receive an email notification from the state.

Calendar reminder for next year

Note: The #1 reason that LLCs are shut down by the Secretary of State is for failure to file an Annual Report.

Even if you don’t receive an Annual Report reminder, it’s still your responsibility to file on time every year.

For that reason, we recommend putting a repeating reminder on your phone and/or computer.

Here’s how to use Google Calendar to create reminders:

Vermont Secretary of State Contact Info

If you have any questions, you can contact the Vermont Secretary of State at 802-828-2386.

Their hours are Monday – Friday from 7:45am – 4:30pm, Eastern Time.

Vermont Annual Report FAQs

Does the Vermont Secretary of State send Annual Report reminders?

Yes, the Vermont Secretary of State will send a reminder notice to your LLC’s Registered Agent.

If you listed an email address for your Registered Agent in your Articles of Organization filing, then the reminder will be emailed to your Registered Agent.

If you didn’t provide an email address, then the reminder will be mailed to the Registered Agent.

If you hired a Registered Agent Service, they will most likely forward the Annual Report reminder to you by email.

References

Vermont Secretary of State: Annual/Biennial Reports

Vermont Statutes Annotated: Title 11, Chapter 25, Section 4033

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Vermont LLC Guide

Looking for an overview? See Vermont LLC