Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Vermont LLC Articles of Organization Instructions

In this lesson, we’ll walk you through forming a Vermont LLC.

In this lesson, we’ll walk you through forming a Vermont LLC.

This is done by filing the Articles of Organization with the Vermont Secretary of State.

Vermont LLC filing fee

It costs $155 to form an LLC in Vermont.

This is a one-time fee paid when you submit your Articles of Organization.

Note: The “LLC filing fee” is the same thing as the “Articles of Organization fee”. The Articles of Organization is the document that, once approved by the Secretary of State, creates your Vermont LLC.

How much is an LLC in Vermont explains all the LLC costs, including the Articles of Organization filing fee.

(Vermont Secretary of State, Business Services Building)

Methods of LLC filing in Vermont

The state prefers that you file your LLC Articles of Organization online (instead of filing by mail).

We also recommend the online filing because the filing process is easier. And the approval time is faster.

(If you prefer to file by mail, you’ll need to submit a “form request” to get the paper Articles of Organization. For mail filing instructions, please see the FAQs towards the bottom of this page.)

Note: If you don’t want to file yourself, you can hire a company to form your LLC for you. Check out Best LLC Services in Vermont for our recommendations.

How long does it take to get an LLC in Vermont?

Mailing filing: The approval time for mail filing is 5-7 business days (plus mail time).

Online filing: The approval time for online filing is 1 business day.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Vermont.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

How to File Articles of Organization Online in Vermont

First, visit the Vermont Business Services Division: Login page.

(If you already have an account with the Vermont Business Service Center, you can login.)

If you don’t have an account, you’ll need to create one.

Note: In 2025, the Vermont Secretary of State replaced their old online portal with their new Online Business Filing System. This means that your old login information won’t work with the new system. You’ll need to create a new account. We have instructions for you below.

How to create an account with the Online Business Filing System

Visit the Vermont Secretary of State’s Online Services Login.

Click “Register Here“.

Account Information:

- Enter your first and last name.

- Then enter your email address and click “Verify“.

- Go to your email inbox and click on the email from the state. Get the code in the email message and enter it in on the account information page.

- Then click “Authenticate“.

You can enter a cell phone number if you’d like, but it’s not required.

Then enter a password and click “Continue“.

Mailing Address:

- Enter your street address. This address can be in any state.

- Then click “Continue“.

Account Preferences:

You have 3 options for logging into Vermont’s Online Business Filing System.

You can login using:

- a one-time password sent to email

- a one-time password sent to phone

- a regular password that you remember and type into the box

Select your preferred login method and click “Register“.

Now you’re ready to begin your online filing.

Get started:

Visit the Vermont Secretary of State’s Online Services Login page, and login to your account.

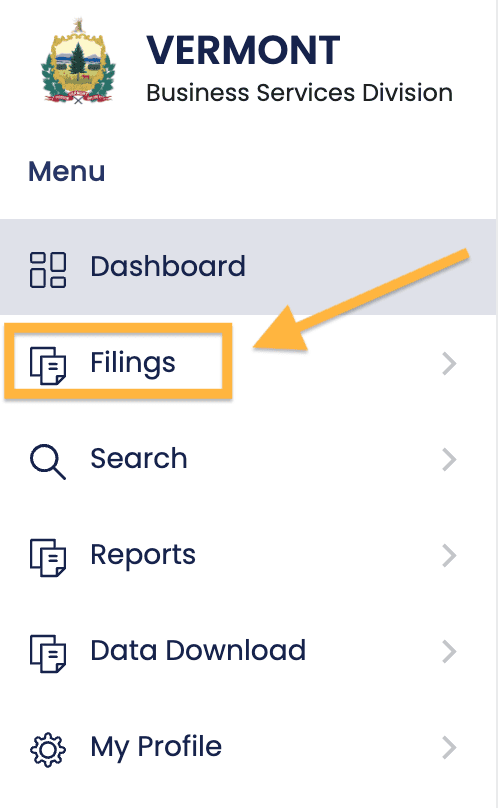

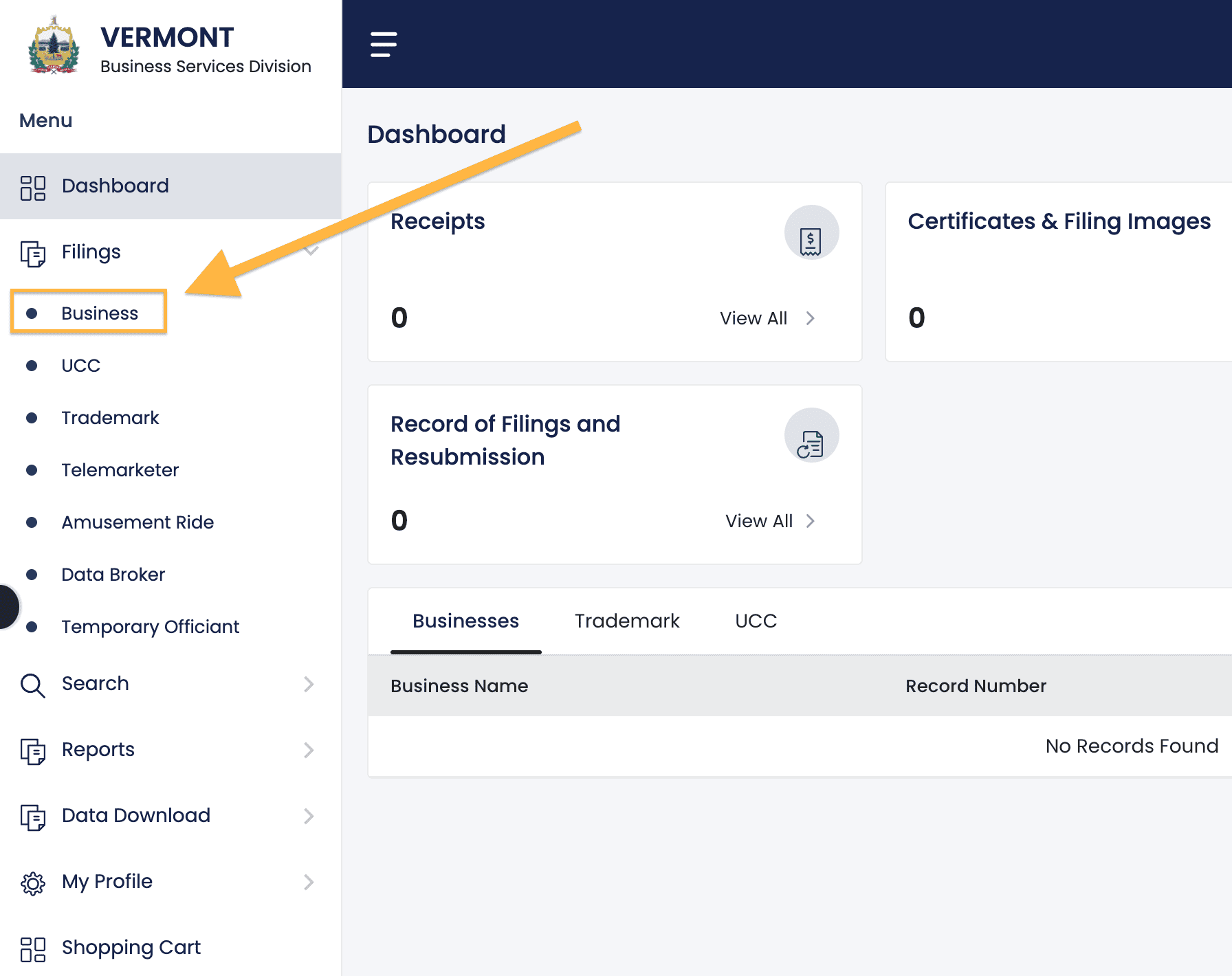

In your Dashboard, click “Filings“.

Then click “Business“.

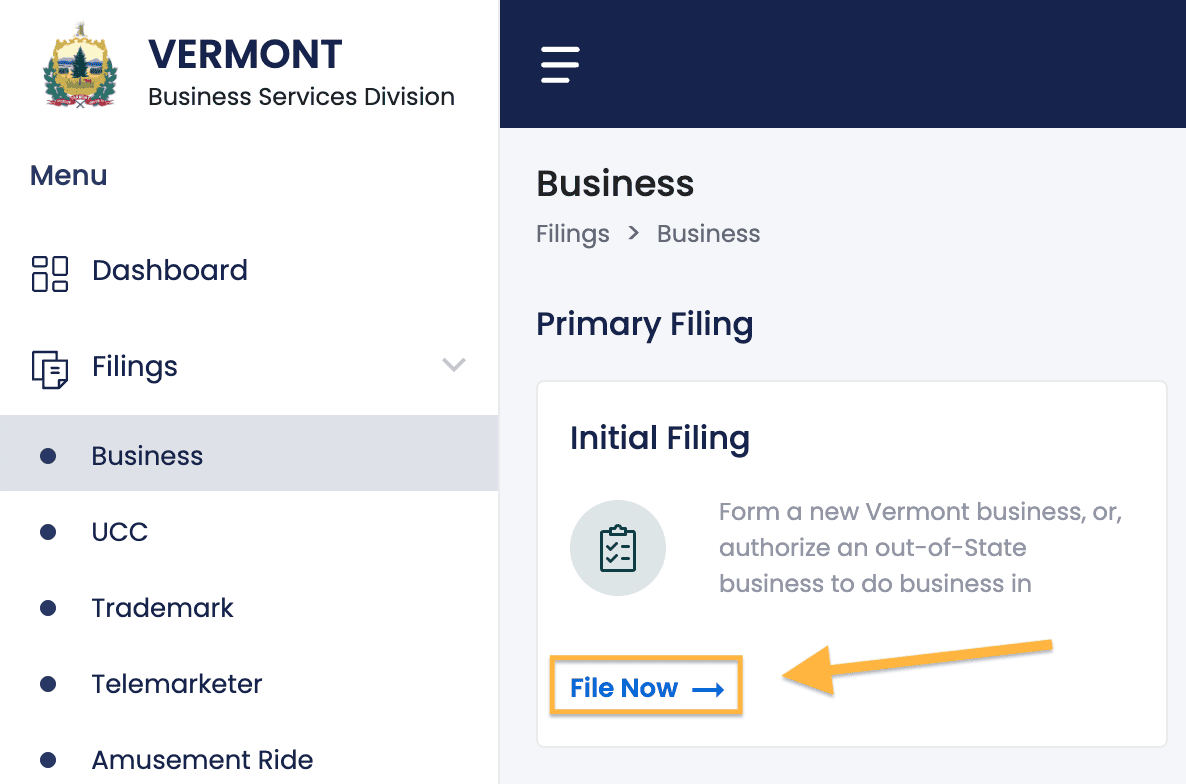

Under “Initial Filing”, click “File Now →“.

Business Type

Select “Domestic” as your business type. Then click “Next“.

Legal Structure

Select “Domestic Limited Liability Company“.

Click “Next“.

Business Name

- Prior lesson: Please see Vermont LLC name before proceeding.

Next to “Do you have a Name Reservation,” select “No“.

Tip: We don’t recommend getting a Name Reservation because it’s not required and it’s usually a waste of money.

Election Types (Optional)

Most people don’t check any boxes for this section.

Business Name

First, enter your LLC name, but leave out the ending (ex: “LLC”)

For example, if your desired LLC name is Riverwalk Studios LLC, enter “Riverwalk Studios” in the Business Name box.

Then, add your LLC designator (ending) by clicking on it from the buttons above.

The available designators are:

- LLC (most common)

- L.L.C.

- Limited Liability Company

- Ltd. Liability Company

- Limited Liability Co.

- Ltd. Liability Co.

- Limited Company

- Ltd. Company

- Limited Co.

- Ltd. Co.

- L.C.

- LC

Then click “Check Availability“.

If you see a message in green, it means your LLC name is likely available. You can continue with your LLC filing.

If you see a message in red, it means your LLC name isn’t available. You’ll need to pick a new LLC name.

When you’ve selected an LLC name that’s available, click “Next“.

Business Email

To use the same email you used during registration, leave the box marked “Same as Submitter Email” checked.

If you’d like to use a different email address, uncheck the box and enter your preferred email instead.

Effective Date

The LLC Effective Date is the date your LLC goes into existence. Think of it like the day your LLC is “born”.

If you leave the current date in the Effective Date field, your LLC will go into existence as soon as it’s approved by the Vermont Secretary of State.

If you want your LLC to go into existence on a future date, click the calendar icon and select your LLC’s Effective Date.

Note: This date can’t be more than 90 days ahead. And you can’t back-date your filing.

Pro Tip: If you’re forming your Vermont LLC later in the year (October, November, December) and you don’t need your LLC open right away, you can give your LLC an effective date of January 1 of the following year. This can save you the hassle of filing taxes for those few months with no business activity.

Fiscal Year End Month

Most people select “December“.

Why? For accounting and tax purposes, most small businesses run on the “calendar year“, which is January 1 to December 31. This is just like how your personal taxes work.

Note: While uncommon, if your business runs on a different fiscal year, please enter that fiscal year end month instead.

Business Purpose

Vermont requires that you list at least 1 NAICS code to tell the state about your business purpose.

An NAICS Code is used by government agencies to gather statistical information about businesses.

Note: If your LLC’s activities change in the future, you can update this code on your LLC Annual Report.

You can search using keywords (like “restaurant” or “car wash”), or you can browse through the categories.

If you can’t find an NAICS Code for your business, just choose one that is similar or kind of related.

Tip: If your LLC will run multiple businesses, you just need to enter one NAICS Code. The state doesn’t investigate or enforce NAICS Codes. Again, they are just used for statistics. Also, if you’re having trouble finding an NAICS Code, asking ChatGPT can be really helpful.

When you’re finished with this section, click “Next“.

Designated Office (Street Address)

Enter your LLC’s Designated Office Address.

This is the address where your primary business activities take place and/or where you keep your business records.

This address can be any state.

Mailing Address (optional)

If your LLC uses a Mailing Address that is different from your Principal Office Address, you can enter it here.

This address can be in any state.

When you’re finished adding your LLC’s addresses, click “Next“.

Agent for Service of Process Information

Note: An Agent for Service of Process is more commonly known as a Registered Agent. We usually call it a Registered Agent to keep things simple.

Important: You have a few options for who can be your Registered Agent in Vermont. We recommend reading Who can be my Registered Agent in Vermont before proceeding.

Regardless of who you pick as your Registered Agent, their address must be located in Vermont. And PO Box addresses aren’t allowed.

If your Registered Agent will be a person (you, friend, family member, etc.):

- Select “Create New“.

- Under Type, select “Individual”.

- Enter their name, address, and email.

Important: Although you can select any state from the drop down, this is actually not correct. Both the Registered Agent’s Street Address and Mailing Address must be located in Vermont.

If you’ll be using the same location for both addresses, check the box in the Mailing Address section labeled “Same as Street Address“.

Then click “Save Agent for Service of Process“.

Check the box confirming that the person you listed consents to be your Registered Agent.

Then click “Next“.

If you hired a Registered Agent Service:

- Click “Select from Existing List“.

- Enter the name of the company and click “Search“.

- Select the company from the search results.

- Check the box confirming that the Registered Agent accepts (if you hired them, they gave their consent)

Then click “Next“.

Members

Do you have members at the time of filing?

Select “Yes“.

Principal Information (optional)

- Related article: Member-managed LLC vs Manager-Manged LLC

If you’d like to add LLC Members (or Managers), you can do so in this section.

If you prefer to keep this information private (and off of public records), you can instead leave it blank. You’re not required to list Members (or Mangers) in your Vermont LLC filing.

Click “Next“.

Organizer Information

You must list at least 1 Organizer.

What is an LLC Organizer? An LLC Organizer is simply the person who signs and submits the Articles of Organization to the state.

Note: An Organizer can be an LLC Member, but signing this form doesn’t automatically make someone an LLC Member. To learn more, please see LLC Organizer vs LLC Member.

Click “Add Organizer“.

Enter the Organizer’s name and Physical Address.

If they have a Mailing Address that is different from the Physical Address, you can enter that here. But the Mailing Address isn’t required if it’s not applicable.

Note: The address(es) can be in any state.

When you’re finished with this section, click “Save Organizer“.

Then click “Next“.

Other Provisions

We recommend leaving this section blank. You don’t need to upload anything here.

Note: Most people don’t need to add Other Provisions, unless they’ve been instructed to do so by their attorney.

Click “Next“.

Review

Review all of the information you entered and check for any typos.

If you need to make any changes, please do so now.

Affirmation

Check the box to confirm the information you entered is accurate.

- Name: Enter the Organizer’s first and last name.

- Capacity: You can use the title “Organizer” or “Authorized Person“.

Then click “Add“.

If all looks good, click “Add to Cart” to proceed.

Shopping Cart

There’s nothing to do here. The state is just letting you know how much your filing will cost.

Click “Proceed to Pay“.

Payment

Enter your credit card or debit card details and click “Pay Now” to submit your payment to the state.

Congratulations! Your Vermont LLC has been filed with the Secretary of State.

Vermont LLC Approval (Online Filing):

When filing online, your Vermont LLC will be processed and approved in 1 business day.

Once approved, you’ll receive an email with a stamped and approved copy of your Articles of Organization.

We recommend keeping a copy of your approved Articles of Organization with your other LLC documents.

Vermont Secretary of State Contact Info

If you have any questions, you can contact the Vermont Secretary of State at 802-828-2386.

Their hours are 7:45am to 4:30pm (Monday – Friday).

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Vermont Articles of Organization FAQs

How to file Articles of Organization by mail in Vermont?

If you prefer to file by mail (instead of filing online), you’ll need to submit a Forms Request

in order to get a copy of the Articles of Organization.

The approval time for mail filing is 5-7 business days (plus mail time).

If you’re filing by mail, the instructions above on this page will be similar to the paper form.

Once your Articles of Organization is complete, you’ll need to sign it and send payment to the state.

In an envelope, place:

- 2 copies of your Articles of Organization

- check or money order (made payable to “Vermont Secretary of State”)

- self-addressed and stamped envelope

Then mail to:

Vermont Secretary of State

Business Services Division

128 State Street

Montpelier, VT 05633-1104

References

Vermont Secretary of State: Limited Liability Company (LLC)

Vermont Statutes Annotated: Title 11, Chapter 25, Section 4022

Vermont Statutes Annotated: Title 11, Chapter 25, Section 4023

Vermont Statutes Annotated: Title 11, Chapter 25, Section 4024

Vermont Statutes Annotated: Title 11, Chapter 25, Section 4025

Vermont Statutes Annotated: Title 11, Chapter 25, Section 4026

Vermont Statutes Annotated: Title 11, Chapter 25, Section 4027

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.